UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting Material under §240.14a-12 |

IDENTIV, INC.

(Name of

Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11 |

Script for first quarter 2024 earnings call first used on May 8, 2024

Q1 2024 Earnings Call Prepared Remarks

Operator

Good afternoon. Welcome to Identiv’s

Presentation of its First Quarter 2024 Earnings Call. My name is [name], and I will be your operator this afternoon. Joining us for today’s presentation are the company’s CEO, Steven Humphreys; CFO, Justin Scarpulla; and President, IoT

Solutions Kirsten Newquist. Following management’s remarks, we will open the call for questions.

Before we begin, please note that during this call,

management may be making references to non-GAAP financial measures or guidance, including non-GAAP adjusted EBITDA, non-GAAP

gross margin, and non-GAAP operating expenses.

In addition, during the call, management will be making

forward-looking statements. Any statement that refers to expectations, projections, or other characteristics of future events, including the pending asset sale transaction, future business and market conditions and opportunities, and future plans

and prospects, including with respect to the transaction and Identiv’s post-closing business, is a forward-looking statement.

Actual results may

differ materially from those expressed in these forward-looking statements. For more information, please refer to the risk factors discussed in documents filed from time to time with the SEC, including the company’s latest Annual Report on Form

10-K and Quarterly Report on Form 10-Q. In addition, risks related to the asset sale are included in the preliminary proxy statement filed with the SEC April30, 2024 and

our first quarter 10-Q once filed, and will be included in the definitive proxy statement, once filed. Identiv assumes no obligation to update these forward-looking statements, which speak as of today.

I will now turn the call over to CEO Steven Humphreys for his comments.

Sir, please proceed.

Section 1 – CEO Steven Humphreys

Thanks

operator and thank you all for joining us. The first quarter of 2024 was one of the most important in our company’s history. We completed an extensive, year-long strategic review and took actions that we think serve all our stakeholders very

well. We’re divesting assets relating to our security and logical reader products for a cash price of $145 million, generating capital to invest in our IoT business. We also completed a thorough search for a new leader for our IoT

business, who will take over as CEO of the remaining Identiv business when the transaction closes. We believe we’ve put Identiv on a path to realize its opportunity to create major value by investing in the growth of a key business that’s

increasingly central to the digital transformation of some of the world’s largest industries. That’s a big statement but we believe it’s accurate for three reasons: the scope of the market opportunity; our competitive advantages; and

soon, our access to the capital and the focus and leadership to deliver on the opportunity.

We’ll go into details throughout the call, but first let

me outline specifically what steps culminated in and around Q1:

We undertook a strategic review of our business starting early last year. We looked at

every combination of our business assets, including market opportunities and our competitive positioning, with one criterion: What is the highest expected value creation opportunity available to us to deliver to our investors? We looked at divesting

each part of our business, including divesting all of the business. We looked at each path for capital formation, value creation and ROI. We went in-market to assess current values and competitive dynamics. We

evaluated competitive companies, both to assess their strategic directions and the effect on our value creation opportunity, and to assess our opportunity to realize near-term value for our assets. In consultation with our largest investor and with

our financial advisor, Imperial Capital, we ultimately focused on the actions we announced last month: raise the maximum capital possible to invest in and focus on our specialty IoT business, ensure a strong balance sheet for that business, and

bring on highly experienced leadership to direct this investment and navigate the company’s future growth trajectory. We believe this transaction positions us to build an enduring, leading IoT company that’s core to enabling the digital

transformation taking place, in particular across healthcare, pharmaceuticals, and medical devices, but also a critical enabler in other industries’ digital transformations.

In order to secure the investment for the IoT business, one of the requirements was that I join the buyer, so last year we launched an executive search

process to find a world-class leader for our specialty IoT business, to take over as CEO when the transaction closes. We needed the best possible leader to take advantage of our unique opportunity to be a lynchpin technology provider in the digital

transformation we’re targeting.

We found that leader in Kirsten Newquist. Kirsten has the ideal profile to lead the business to maximize our

value creation opportunity. She spent 17 years at Avery-Dennison, leading their medical business as well as in their Smartrac RFID business, one of the strongest companies in the space. She deeply understands the key customers and influencers across

the digital transformation of healthcare, while also knowing intimately the operations of RFID businesses. She’s a pragmatic and disciplined businessperson who also sees strategic opportunities to transform industries. She has the rare ability

to define a vision and then to build and execute plans to make the vision happen. We’re convinced she’s the right leader for the business and to realize Identiv’s market opportunity. Kirsten will be speaking more about her background

and why she chose to join Identiv after the financial review.

In the interest of time, we won’t go through the details of our strategic assessments,

executive recruiting, and everything else, so for more details please review the preliminary proxy statement we filed last week. We’ve put a lot of information into it, including a thorough description of the IoT business going forward as well

as the timeline and alternatives we assessed and the basis for the Board’s decision to proceed on this path to maximize shareholder value.

Today

we’ll focus on Q1 and subsequent events as they relate to our business’ future. Investors need clear visibility on the likelihood to close of the transaction and of the post-close business going forward, so we’ll focus on those

topics.

I’ll go through relevant business results in Q1 and the status and outlook for the transaction, and then after Justin’s comments

I’ll turn the call over to Kirsten to discuss the IoT business, her near term priorities and long-term vision for the business.

For Q1, our

businesses continued on a solid footing, but there was some effect due to the ramp in activity on the transaction and recruiting our future CEO. We managed both activities, which involved key management in diligence meetings as well as in CEO

interviews and on-boarding. We couldn’t disclose it at the time, but of course this was going on in Q4 as well as Q1.

Our overall business performance was consistent despite these distractions, with total revenues within our guidance range at $22.5 million, and solid

gross margins. Our GAAP gross margin was 37% and non-GAAP gross margin was 40%, our highest non-GAAP gross margin since Q3 2020, reflecting margin strength in our

Premises segment as well as within identity readers.

In Premises we also had to contend with the federal government’s continuing resolution budgetary

uncertainty. We’ve been pleased with the Premises business’ strength, which we think puts us in a good position to continue strongly into Q2 and for the rest of 2024. Notably, software, services, and recurring revenues grew to 27% of

Premises revenues in the first quarter. This reflects three other trends we saw in Q1: strong interest in our Primis product line; cloud as an interest area in nearly all of our new business opportunities; and high interest levels in video in the

federal space, as we deployed demo platforms of Velocity Vision across three more federal agencies. We also continue to see growth from our newest integrators, from our smaller geographic regions and in particular across K-12 schools, utilities and transportation, especially in airports.

Our Identity business, which includes our access

card and identity readers in addition to IoT, continued to perform consistently overall even with the internal activities of a new IoT leader being recruited, much of our executive team spending time on transaction due diligence and other process

steps.

Our IoT team continued to build our position as a specialty IoT leader with another successful presence at RFID Journal. We also joined the Axia

Institute at Michigan State, and we continued our webinar series, with sessions shared with ST Micro, and another with NXP and Axia Institute next week. We secured a new 2-year customer contract for a smart

home application and we also shipped another 5 million units to Wiliot in Q1. As we said on our Q4 earnings call, we expect these to be the last Wiliot units for at least a few quarters, as they work on producing their Gen 3 chip. This last

batch for Wiliot was produced in our new Thailand facility. It demonstrated our ability to rapidly ramp-up even very complicated products in Thailand, to take advantage of our lower costs there for nearly all

of our production over time.

Competitively, as we’ve expected due to the large capacity build-ups by some

companies that we described on prior calls, we’ve seen a couple of companies become aggressive on pricing. This capacity was added mostly for UHF products, but some of it can be applied to HF applications. This affects some of our standard,

lower-margin products but doesn’t affect our more complex, specialty IoT devices.

Lastly, our logical access readers within our Identity segment

performed well. Our FIDO dual-factor security keys expanded sales and pipeline opportunities, especially in Europe. In the Americas, our contactless readers are our main growth drivers, including our deployment company-wide across one of the

world’s largest online retailers in Q1 and Q2 and could continue into 2024 with further follow-on orders.

So, returning to our strategic transaction, in terms of timeline to close we believe we’re moving the

process on the shortest possible timeline given the statutory requirements for a shareholder vote and the other regulatory processes. In terms of certainty to close: clearance of these approvals, and of course the stockholder vote, are the only

major terms needed to proceed. We believe we’re on a good path both in terms of timing and certainty. We’re on track for the Q3 close estimate we’d provided, and should things progress smoothly, have a decent shot at an early Q3 close

date. That forms the foundation for our IoT business going forward, so after Justin’s comments on our financial results, I’ll turn the call over to Kirsten so you can hear directly from her the path and opportunity we’ll be focused

on.

Justin, over to you.

Section 2 – CFO Justin Scarpulla

Thanks, Steve.

As Steve mentioned, in the first

quarter of 2024 we were able to deliver revenue in line with our guidance range, increased company margins, and continued control over our operating expenses.

We achieved these results while focusing on both our Identity and Premises businesses including our cutting-edge Premises products, as well as the continued

buildout of our operational Thailand facility.

First quarter 2024 revenue was $22.5 million, a decrease of $3.5 million vs Q1 2023.

$1.7 million of this decrease was from our Premises segment and was primarily related to the federal government continuing resolution that wasn’t resolved until March; the remaining $1.8 million decrease in our Identity segment was

related to our RFID-enabled IoT products, primarily from Wiliot, offset in part by an increase in our Identity Reader products.

First quarter 2024 GAAP

and non-GAAP adjusted gross margins were 37% and 40%, respectively as compared to 35% and 37% in Q1 2023, which included increases in both our Premises and Identity segments margins.

Our Q1 2024 GAAP and Non-GAAP adjusted gross margin reflect our continued focus on our margin profile, while

continuing to increase our investments in technology, and manufacturing processes and equipment.

GAAP and non-GAAP adjusted operating expenses for the first quarter

2024, which include research and development, sales and marketing, and general and administrative costs, totaled $12.6 million, and $10.4 million, respectively, as compared to $11.9 million and $10.6 million in Q1 2023. First

quarter 2024 GAAP operating expenses include $1.0 million in strategic review-related costs.

First quarter 2024 GAAP net loss attributable to common

shareholders was $4.8 million, or $0.21 cents per share, compared to GAAP net loss of $3.0 million in Q1 2023.

Non-GAAP adjusted EBITDA for Q1 2024 was negative $1.4 million, compared to negative $0.9 million in the

prior year period. This change in non-GAAP adjusted EBITDA is primarily a result of our lower year-over-year Identity revenues, which impacted the utilization of our Singapore and Thailand operations.

In the appendix of today’s presentation, we have provided a full reconciliation of GAAP to non-GAAP financial

information, which is also included in our earnings release.

Our next slide further analyzes trends by segment. Beginning with Identity, in Q1 2024

revenue from our Identity products totaled $12.8 million, or 57% of the company’s net revenue, compared to $14.7 million, or 56% of net revenue in Q1 2023.

Identity segment GAAP and non-GAAP adjusted gross margins for Q1 2024 were 22% and 26%, respectively, as compared to

21% and 23%, respectively in Q1 2023. The year-over-year increase in gross margin was primarily attributable to an increase in Identity Reader revenues and margins, offset in part by increased overhead expenses for our Thailand operations that came

online in Q3 2023.

Now turning to the Premises segment. In Q1 2024, revenue from our Premises products and services accounted for $9.7 million, or

43% of the company’s net revenue, compared to $11.3 million, or 44% of net revenue in Q1 2023.

Premises segment GAAP gross margin for Q1 2024

was 58%, an increase of 4% compared to Q1 2023. Premises segment non-GAAP adjusted gross margin for Q1 2024 was 59%, compared to 55% in Q1 2023. The increase in our Premises segment related to decreases in

inventory, freight, and logistics costs.

Moving now to our operating expense management. Our GAAP operating expenses in the first quarter of 2024 as a %

of revenue was 56%, compared to 46% in Q1 2023. The increase in GAAP operating expenses as a percentage of revenue is primarily related to our strategic review costs. Non-GAAP operating expenses in the first

quarter of 2024, adjusted to exclude restructuring, strategic review and severance costs and certain non-cash charges consisting of stock-based compensation and depreciation and amortization, was 46% of

revenue, compared to 41% in Q1 2023. The increase in non-GAAP operating expenses as a % of revenue is primarily related to the year-over-year decrease in revenue, as operating expenses were relatively flat.

Now, turning to the balance sheet. We exited Q1 2024 with $22.4 million in cash and cash equivalents

and restricted cash, a decrease of $2.0 million from Q4 2023. In Q4, the decrease in cash was the result of $1.4 million from operating activities, $0.2 million from investing activities, and $0.4 million from financing

activities. Our working capital exiting Q1 was $45.6 million, a decrease of $3.1 million from Q4 2023. As noted previously, our cumulative strategic review costs are $1.4 million exiting Q1.

In our 10-K filing we will be providing a full reconciliation of the year-to-date cash flows. For completeness, we have included the full balance sheet in the appendix of today’s earnings release.

This leads us to an expected Q2 2024 revenue range of $23 to $25 million.

This concludes the financial discussion. I’ll now pass the call back to Steve.

Section 3 – CEO Steven Humphreys and

President, IoT Solutions Kirsten Newquist

Steven Humphreys:

Thanks, Justin. As I mentioned in our opening comments, we believe we’re on track to close our strategic transaction. Once closed, the infusion of capital

will fortify our balance sheet to support the growth of our specialty IoT business into what we expect to be a key player in the healthcare industry and other high-value end markets. With Kirsten Newquist’s leadership and a singularly focused

team, we’re very confident in our opportunity to transform major industries and the value creation that’ll come from establishing that business position under her leadership. To be clear, transforming industries takes time, particularly a

regulated industry like healthcare, and requires a clear go-to-market strategic plan, laser-focused execution, and investment with a deliberate allocation of resources.

Kirsten’s been on board all of 3 1⁄2 weeks, and she’s been diving deeply into our IoT business. She is bringing in the resources to build out a detailed

plan, but as you’ll hear, she already has a vision for strategic value creation and the path to get there from our current business position. Kirsten, welcome!

Kirsten Newquist:

Thank you, Steve, and good afternoon, everyone. I’m very happy to be with all of you today and speak with you about the opportunity we have in front of us

for the IoT business. But first, I’d like to take a moment to provide some background about myself and why I joined Identiv at this pivotal moment in the company’s history.

As Steve mentioned, I came to Identiv after nearly 17 years with Avery Dennison, where I started out in Corporate Strategy analyzing new growth platforms,

including RFID. I ultimately joined the Avery Dennison Medical division, first as VP, Business Development and ultimately as VP/GM, which I led for six years with a focused and disciplined approach. During my tenure, I was able to double the sales

and significantly increase the EBITDA of the business. I led the launch of many new, innovative products, including wound dressings and surgical films containing active ingredients, and skin adhesive components for wearable devices such as

continuous glucose monitors, all utilizing complex coating, converting and finishing capabilities under the strict quality and regulatory standards required to produce finished medical devices. My last year at Avery Dennison was spent within the

RFID division, Avery Dennison Smartrac, where I led the healthcare strategy and market development efforts and provided leadership to the product management team.

I was familiar with Identiv from my involvement in the RFID industry. My decision to join the Company was driven by the opportunity to lead an

entrepreneurially-oriented public company with a strong portfolio of products and solutions in an exciting and growing IoT industry. Its primary focus on specialty IoT technologies utilizing HF/NFC, DF (Dual Frequency), specialty UHF, and BLE, along

with its multi-component manufacturing capabilities, sets it apart from competitors who primarily serve high-volume UHF-based applications. Its focus and initial traction in the healthcare sector was

particularly compelling, given my background in this space. Having worked for many years with the major players involved in the medical device and healthcare industry, I understood and appreciated the position that Identiv has built up to this

point. It is an area where there are large unmet needs – ranging from medication non-adherence, to drug mix-ups, to pharmaceutical counterfeiting – in which

RFID can play an important role. The IMS Institute of Healthcare Informatics estimates that medication non-adherence alone costs at least $105 billion in avoidable healthcare costs in the U.S.

There are further compelling trends in healthcare, such as the shift of care from hospital to the home, the growth in personalized medicine, and the rise in

large molecule drugs requiring careful temperature, moisture, and location monitoring that, collectively, create a growing opportunity space. As the healthcare industry embarks on its digital transformation journey, we see many opportunities for

RFID-enabled solutions to become a critical asset in this transformation, including medication authentication and adherence, diagnostic test authentication, blood bag and sample tracking, smart labels for auto-

injectors, and condition monitoring of critical drugs. Incorporating RFID into these products and processes

provides a persuasive value proposition by reducing errors, enhancing patient engagement, and ultimately increasing patient safety. Let me give you two metrics to give you an order of magnitude on the opportunity space – there are over

5 billion prescriptions filled annually in the US today and over 16B syringes used worldwide each year. Initial penetration in these areas represents a substantial opportunity for Identiv. We have already experienced much interest from the

industry and have built up an impressive pipeline of customer driven NRE projects across these applications. Furthermore, these specialty solutions command higher gross margins, often in excess of 35%.

While the opportunities in healthcare are vast and compelling, they tend to be longer term given the regulated nature of the healthcare industry. In fact, the

industry is relatively nascent when it comes to RFID, most of these customers are at the beginning of their digital journeys and need to go through several design iterations and run multiple pilots to optimize the technology and fully understand the

benefits and ROI. Once the technology is proven out, it takes time to integrate the solution into their manufacturing processes due to the regulatory and quality requirements, and then typically would be launched with a phased rollout. That said,

once launched, it is often very sticky business, as the switching costs are high. We see this industry as a long-term sustainable driver of Identiv’s growth.

In parallel, we will also be evaluating the opportunities in three other high value segments, specialty retail, smart packaging, and smart home devices. As

these industries do not have the same regulatory and quality hurdles, we expect their ability to adopt new solutions will be quicker than those we see in the healthcare segment. Many of the technical requirements and design features that we develop

for the healthcare applications can be leveraged in these markets (and vice versa), and also require custom design, rapid prototyping and often complex manufacturing processes. We are seeing growing interest for products that we have already

developed for these segments. These include our embedded and highly secure authentication tags of consumables for smart home devices, our Life of Garment tags that withstand the stringent wash and dry cycles requirements for garments and footwear,

and our NFC-enabled smart labels for packaging to enhance the consumer experience.

In summary, we will

proactively go after specific applications and use cases where we know there is strong volume potential and a realistic opportunity for sustainable, and predictable, higher margin recurring revenue.

At the same time, we will continue to support the customers and industries that are at the core of our

business today and where we see opportunities to optimize our cost structure, and sustainable growth and margin profile. One of our most critical short-term initiatives is to accelerate the transition of the majority of our RFID production to our

Thailand facility, to capitalize on its much lower cost structure, and we expect that effort to be largely complete by the end of Q1 2025. After that, our primary manufacturing will occur in Thailand with a smaller R&D and engineering focused

operation in Singapore to support new product development and any customers who require more time to requalify in Thailand.

As part of this process, we

have begun to exit some of our very low margin business that doesn’t justify the expense of relocating to Thailand, nor makes financial sense to sustain once we’ve transitioned. The overhead incurred by maintaining dual manufacturing sites

during this transition, coupled with exiting this low-margin business, has and will continue to impact our revenue and margins into the first half of next year. However, we’re confident that our move to

Thailand and the reduction of this low-margin business will ultimately result in a more streamlined and efficient operation, with significantly improved direct margins.

I am now in my fourth week with Identiv. I’ve enjoyed getting to know the team, delving into the Company’s product portfolio, and absorbing the

team’s perspectives on the business’s potential. The reasons why I joined Identiv are true – strong technology and engineering capabilities, a strategic position within the specialty IoT sphere, and an array of compelling products in

development. It’s evident to me that we have a dedicated team, fueled by a passion for the business. I also see an opportunity to streamline a very wide breadth of business opportunities with the disciplined processes and strategic clarity that

are necessary to drive the business towards long term, sustainable, high margin growth. This will be crucial in realizing our long-term goals. To date, the business has struggled to fully capitalize on its potential, both in terms of revenue

and profitability. That said, what this team has been able to accomplish in developing its specialized products and building its opportunity pipeline with limited resources, is commendable.

Over the next several months, my priorities are to complete my onboarding and business deep dive and address two important topics – build a plan to drive

to operational excellence and develop strategic clarity and focus along with a detailed growth and go to market plan. It is imperative that our core business is focused, disciplined, and resourced appropriately so it can provide a solid foundation

to build upon the longer-term opportunities we will be pursuing. To start, I am bringing in industry specific resources with whom I have worked extensively in the past to bring in an outside perspective and complement our internal talent to drive

the operational excellence initiatives and strategic process. These consultants are standouts in their respective industries.

In addition, our Board advisor Manfred Rietzler, the founder of Smartrac, one of the trailblazing companies

in the RFID space, will be participating in our strategic growth process as will our two Board Members, Dr. Rick Kuntz, a Harvard trained and faculty cardiologist who was previously Chief Medical and Scientific Officer for Medtronic, and Laura

Angelini, who was previously a senior MedTech executive with Baxter Healthcare and Johnson & Johnson. I look forward to providing you with timely updates on the development of these plans and the key milestones as we execute against them.

And finally, I want to emphasize that at present, we have no immediate plans to pursue M&A. Our primary objective is to gain strategic clarity and

driving towards operational excellence so any future M&A will be built upon a strong business foundation and aligned closely with our strategic objectives.

In closing, I am looking forward to the opportunities ahead to fully immerse myself in the business and my role and to meet with the Wall Street community in

the coming months. With that, I’ll turn the call back over to Steve.

Steven Humphreys:

Thanks, Kirsten. As you all heard, Kirsten has a very clear vision for the business and firm understanding of our operations. With this clear vision after just

a few weeks on the job, you can appreciate why we’re so excited to have her leading Identiv going forward. I’m personally very thankful to have found such an excellent leader to take our business forward and realize the tremendous

opportunity we have.

Now before opening the call for discussion, I’d like to make a couple of personal comments. If we meet the schedule we aspire

to, this’ll be my last earnings call for Identiv. I’d like to thank all of you, our investors, for your support of the business. I’d also like to thank all of our people, and our customers and partners for everything we’ve built

together. I’m confident that we’ve created a path for both of our businesses to thrive and grow, with very exciting futures. Both businesses needed capital and focus to achieve their potential, and I believe we found the best path forward

to reach that goal. In the case of the Physical Security business, we’ve found terrific partners with Vitaprotech and Seven2, who’re aligned with our vision, our values and culture, and our commitment to invest and grow the business.

I’m very excited to work with them after the closing, and especially looking forward to continue to work with and expand our amazing Identiv Physical and Logical Security team to build a truly world-leading security business. I’ll miss

being part of the IoT business and working with our great people there, but Kirsten’s an exceptional business leader. With her vision, passion and disciplined business approach, and with the expected capital resources on the balance sheet to

make it happen, I’m confident we’ll realize our vision for Identiv IoT.

With that, I’d like to open the call for your questions. Operator, please open the question queue.

Q&A

Closing Comments – CEO Steven Humphreys

Thanks,

Operator.

We’ll continue to update you all on the business progress and KPI’s as Kirsten described, and on our progress and timeline for

closure of our transaction and the next exciting phase for Identiv IoT and for our investors. For the details of our transaction and business going forward, please do review our preliminary proxy on file with the SEC. We expect to file our

definitive proxy in the coming weeks, at which point we’ll announce the date for our annual meeting and stockholder vote on the transaction.

In

terms of investor outreach, we’ll be attending the B. Riley Conference on May 22nd, Craig-Hallum will be arranging a fireside chat session in early June, and we’ll share business updates following our shareholder vote and AGM. If you have

any questions, please don’t hesitate to reach out to our Investor Relations at IR@identiv.com.

Thank you all again and have a very good

evening.

Forward-Looking Statements

This communication

contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are those involving future events and future results that are based on current expectations as well as the

current beliefs and assumptions of management of Identiv and can be identified by words such as “anticipate,” “believe,” “continue,” “plan,” “will,” “intend,” “expect,”

“outlook,” and similar references to the future. Any statement that is not a historical fact is

a forward-looking statement, including statements regarding: Identiv’s expectations regarding future

operating and financial outlook and performance; Identiv’s strategy, opportunities, focus and goals, including plans for its IoT business; opportunities in the markets and industry in which Identiv operates, including healthcare, specialty

retail, smart packaging, and smart home devices; beliefs regarding the strengths of Identiv’s business, including the belief that its design, development, and production capabilities are well-suited across a wide range of segments; the timing

of the closing of the asset sale transaction; Identiv’s expectations regarding seasonality; Identiv’s plans to expand the production capacity of its Thailand facility, including the expected timing and benefits thereof; expectations with

respect to management and management following the completion of the proposed transaction, including the belief that Ms. Newquist’s background creates value creation opportunities and is ideal to drive the growth of Identiv’s

business; Identiv’s expectations with respect to the use of proceeds from the proposed transaction; Identiv’s beliefs regarding access to future capital; Identiv’s expectations relating to the growth of its IoT business; and

Identiv’s expectations with respect to demand and customer orders. Forward-looking statements are only predictions and are subject to a number of risks and uncertainties, many of which are outside Identiv’s control, which could cause

actual results to differ materially and adversely from those expressed in any forward-looking statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to: the

failure of the proposed transaction to close for any reason; risks that the proposed transaction disrupts current business, plans and operations of Identiv or its business prospects; diversion of management’s attention from Identiv’s

ongoing business; the ability of Identiv to retain and hire key personnel; the effect of the change in management following the completion of the proposed transaction; competitive responses to the proposed transaction; potential adverse reactions or

changes to business relationships resulting from the announcement or completion of the proposed transaction; Identiv’s ability to continue the momentum in its business; Identiv’s ability to successfully execute its business strategy,

including with respect to its IoT business; Identiv’s ability to capitalize on trends in its business and penetrate the healthcare and other specialty markets; the effect of competition on Identiv’s business; Identiv’s ability to

satisfy customer demand and expectations; the level and timing of customer orders and changes/cancellations; the loss of customers, suppliers or partners; the success of Identiv’s products and strategic partnerships; industry trends and

seasonality; the impact of macroeconomic conditions and customer demand, inflation and increases in prices; and the other factors discussed in its periodic reports, including its Annual Report on Form 10-K for

the year ended December 31, 2023, preliminary proxy statement filed with the U.S. Securities and Exchange Commission (the “SEC”) on April 30, 2024 and subsequent reports filed with the SEC. All forward-looking statements are

based on information available to Identiv on the date hereof, and Identiv assumes no obligation to update such statements.

Additional Information and Where to Find It

On April 2, 2024, Identiv entered into a Stock and Asset Purchase Agreement with Hawk Acquisition, Inc. (“Buyer”), whereby Identiv agreed to

sell its physical security business to Buyer (the “Transaction”). Identiv has filed a preliminary proxy statement on Schedule 14A with the SEC, in connection with its solicitation of proxies for approval of the Transaction (the “Proxy

Statement”). The Proxy Statement is in preliminary form and Identiv intends to file a definitive proxy statement. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO)

FILED BY IDENTIV AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ANY SOLICITATION. Investors and security holders may obtain copies

of these documents and other documents filed with the SEC by Identiv free of charge through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by Identiv are also available free of charge in the

“Investors—Financials” section of Identiv’s website at identiv.com/investors/financials.

Participants in the

Solicitation

Identiv, its directors, director nominees, certain of its officers, and other members of management and employees (as set forth

below) are or may be deemed to be “participants” (each a “Participant” and collectively, the “Participants”) in the solicitation of proxies from stockholders of Identiv in connection with the Transaction. Information

about Identiv’s executive officers and directors, including compensation, is set forth in the sections entitled “Directors,” “Executive Officers,” “Compensation of Directors,” and “Executive

Compensation,” of Identiv’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2023, as amended by Amendment No. 1 to the Annual Report on Form 10-K/A filed with the SEC on April 29,

2024 (as amended, the “Annual Report”), as well as Item

5.02 of its Current Reports on Form 8-K filed with the SEC on April

3, 2024 and April 18, 2024. Information about the ownership of common stock by Identiv’s executive officers and directors is set forth

in the section entitled “Security Ownership of Certain Beneficial Owners and Management” of the Annual Report. To the extent holdings

by the

directors and executive officers of Identiv securities reported in the Annual Report change, such changes

will be reflected in Forms 3, 4 or 5 to be filed with the SEC, as well as the section entitled “Security Ownership of Certain Beneficial Owners and Management” of Identiv’s definitive proxy statement, and other materials to be filed

with the SEC. All of these documents are or will be available free of charge at the SEC’s website at www.sec.gov and in the “Investors—Financials” section of Identiv’s website at

identiv.com/investors/financials. Each of Hawk Acquisition, Inc. and Seven2 SAS (together, Vitaprotech) is or may be deemed to be a Participant in the solicitation of proxies from stockholders of Identiv in connection with the Transaction.

Information about the ownership of securities of Vitaprotech is set forth in the Schedule 13D filed by Vitaprotech on April 12, 2024. In

addition, each of Bleichroeder LP and Bleichroeder Holdings LLC (together, “Bleichroeder”) is or may be deemed to be a Participant in the solicitation of proxies from stockholders of Identiv in connection with the Transaction. Information

about the ownership of securities of Bleichroeder is set forth in the section entitled “Security Ownership of Certain Beneficial Owners and Management

” of the Annual Report and Amendment No. 2 to the Schedule 13D filed by Bleichroeder on April 4, 2024. Any further

changes will be reflected in the section entitled “Security Ownership of Certain Beneficial Owners and Management” of Identiv’s definitive proxy statement, and other materials to be filed with the SEC.

Presentation materials for first quarter 2024 earnings call first used on

May 8, 2024 Q1 2024 Earnings Conference Call Wednesday, May 8, 2024, at 5:00PM EDT © 2024 Identiv, Inc. | All Rights Reserved | NASDAQ: INVE

Safe Harbor Note Regarding Forward-Looking Information This presentation

contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are those involving future events and future results that are based on current expectations as well as the

current beliefs and assumptions of management of Identiv and can be identified by words such as “anticipate,” “believe,” “continue,” “plan,” “will,” “intend,”

“expect,” “outlook,” and similar references to the future. Any statement that is not a historical fact is a forward-looking statement, including statements regarding: Identiv’s expectations regarding future operating

and financial outlook and performance; Identiv’s strategy, opportunities, focus and goals, including plans for its IoT business; opportunities in the markets and industry in which Identiv operates, including healthcare, specialty retail, smart

packaging, and smart home devices; beliefs regarding the strengths of Identiv’s business, including the belief that its design, development, and production capabilities are well-suited across a wide range of segments; the timing of the closing

of the asset sale transaction; Identiv’s expectations regarding seasonality; Identiv’s plans to expand the production capacity of its Thailand facility, including the expected timing and benefits thereof; expectations with respect to

management and management following the completion of the proposed transaction, including the belief that Ms. Newquist’s background creates value creation opportunities and is ideal to drive the growth of Identiv’s business;

Identiv’s expectations with respect to the use of proceeds from the proposed transaction; Identiv’s beliefs regarding access to future capital; Identiv’s expectations relating to the growth of its IoT business; and Identiv’s

expectations with respect to demand and customer orders. Forward-looking statements are only predictions and are subject to a number of risks and uncertainties, many of which are outside Identiv’s control, which could cause actual results to

differ materially and adversely from those expressed in any forward-looking statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to: the failure of the

proposed transaction to close for any reason; risks that the proposed transaction disrupts current business, plans and operations of Identiv or its business prospects; diversion of management’s attention from Identiv’s ongoing business;

the ability of Identiv to retain and hire key personnel; the effect of the change in management following the completion of the proposed transaction; competitive responses to the proposed transaction; potential adverse reactions or changes to

business relationships resulting from the announcement or completion of the proposed transaction; Identiv’s ability to continue the momentum in its business; Identiv’s ability to successfully execute its business strategy, including with

respect to its IoT business; Identiv’s ability to capitalize on trends in its business and penetrate the healthcare and other specialty markets; the effect of competition on Identiv’s business; Identiv’s ability to satisfy customer

demand and expectations; the level and timing of customer orders and changes/cancellations; the loss of customers, suppliers or partners; the success of Identiv’s products and strategic partnerships; industry trends and seasonality; the impact

of macroeconomic conditions and customer demand, inflation and increases in prices; and the other factors discussed in its periodic reports, including its Annual Report on Form 10-K for the year ended December 31, 2023, preliminary proxy statement

filed with the U.S. Securities and Exchange Commission (the “SEC”) on April 30, 2024 and subsequent reports filed with the SEC. All forward-looking statements are based on information available to Identiv on the date hereof, and Identiv

assumes no obligation to update such statements. Non-GAAP Financial Measures (Unaudited) This presentation includes financial information that has not been prepared in accordance with GAAP, including non-GAAP adjusted EBITDA, non-GAAP adjusted

EBITDA margin, non-GAAP gross margin, and non-GAAP operating expenses. Identiv uses non-GAAP financial measures internally in analyzing its financial results and believes they are useful to investors, as a supplement to GAAP measures, in evaluating

its ongoing operational performance. Identiv believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends. The non-GAAP measures discussed above

exclude items that are included in GAAP net income (loss), GAAP operating expenses and GAAP gross margin. For historical periods, the exclusions are detailed in the reconciliation table included in this presentation. Non-GAAP financial measures

should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Investors are encouraged to review the reconciliation of the non-GAAP measures to their most directly comparable GAAP

financial measures as detailed in this presentation. Trademarks This presentation contains trademarks, service marks, trade names and copyrights of Identiv and other companies, and are the property of their respective owners. © 2024 Identiv,

Inc. | All Rights Reserved | NASDAQ: INVE 2

Safe Harbor Additional Information and Where to Find It On April 2, 2024,

Identiv entered into a Stock and Asset Purchase Agreement with Hawk Acquisition, Inc. (“Buyer”), whereby Identiv agreed to sell its physical security business to Buyer (the “Transaction”). Identiv has filed a preliminary

proxy statement on Schedule 14A with the SEC, in connection with its solicitation of proxies for approval of the Transaction (the “Proxy Statement”). The Proxy Statement is in preliminary form and Identiv intends to file a definitive

proxy statement. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED BY IDENTIV AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE

CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ANY SOLICITATION. Investors and security holders may obtain copies of these documents and other documents filed with the SEC by Identiv free of charge through the

website maintained by the SEC at www.sec.gov. Copies of the documents filed by Identiv are also available free of charge in the “Investors—Financials” section of Identiv’s website at identiv.com/investors/financials.

Participants in the Solicitation Identiv, its directors, director nominees, certain of its officers, and other members of management and employees (as set forth below) are or may be deemed to be “participants” (each a

“Participant” and collectively, the “Participants”) in the solicitation of proxies from stockholders of Identiv in connection with the Transaction. Information about Identiv’s executive officers and directors, including

compensation, is set forth in the sections entitled “Directors,” “Executive Officers,” “Compensation of Directors,” and “Executive Compensation,” of Identiv’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2023, as amended by Amendment No. 1 to the Annual Report on Form 10- K/A filed with the SEC on April 29, 2024 (as amended, the “Annual Report”), as well as Item 5.02 of its Current Reports on Form 8-K filed

with the SEC on April 3, 2024 and April 18, 2024. Information about the ownership of common stock by Identiv’s executive officers and directors is set forth in the section entitled “Security Ownership of Certain Beneficial Owners and

Management” of the Annual Report. To the extent holdings by the directors and executive officers of Identiv securities reported in the Annual Report change, such changes will be reflected in Forms 3, 4 or 5 to be filed with the SEC, as well as

the section entitled “Security Ownership of Certain Beneficial Owners and Management” of Identiv’s definitive proxy statement, and other materials to be filed with the SEC. All of these documents are or will be available free of

charge at the SEC’s website at www.sec.gov and in the “Investors—Financials” section of Identiv’s website at identiv.com/investors/financials. Each of Hawk Acquisition, Inc. and Seven2 SAS (together, Vitaprotech) is or

may be deemed to be a Participant in the solicitation of proxies from stockholders of Identiv in connection with the Transaction. Information about the ownership of securities of Vitaprotech is set forth in the Schedule 13D filed by Vitaprotech on

April 12, 2024. In addition, each of Bleichroeder LP and Bleichroeder Holdings LLC (together, “Bleichroeder”) is or may be deemed to be a Participant in the solicitation of proxies from stockholders of Identiv in connection with the

Transaction. Information about the ownership of securities of Bleichroeder is set forth in the section entitled “Security Ownership of Certain Beneficial Owners and Management” of the Annual Report and Amendment No. 2 to the Schedule 13D

filed by Bleichroeder on April 4, 2024. Any further changes will be reflected in the section entitled “Security Ownership of Certain Beneficial Owners and Management” of Identiv’s definitive proxy statement, and other materials to

be filed with the SEC. © 2024 Identiv, Inc. | All Rights Reserved | NASDAQ: INVE 3

Agenda I. Asset Sale Transaction Summary II. Kirsten Newquist Introduction

III. Recent Business Highlights IV. Q1 2024 Financial Review V. Post-Asset Sale Transaction Identiv IoT VI. Identiv IoT’s Opportunities VII. Identiv IoT’s Near-Term Priorities VIII. Q&A Session © 2024 Identiv, Inc. | All Rights

Reserved | NASDAQ: INVE 4

Asset Sale Transaction Summary • On April 2, Identiv entered into a

definitive asset purchase agreement to sell its physical security, access card, and identity reader operations and assets • Gross proceeds to Identiv are approx. $145 million* in cash • At closing, current CEO Steve Humphreys will join

Buyer and President, IoT Solutions Kirsten Newquist will assume the role of CEO • Goal of Transaction: • Raise as much capital as possible to invest in and focus on our specialty IoT business • Ensure a strong balance sheet for the

remaining business • Bring in highly experienced leadership to direct this investment and navigate the company’s future growth trajectory • Transaction expected to close in Q3 2024, subject to regulatory and stockholder approvals

and customary closing conditions *Purchase price subject to customary adjustments set forth in the Asset Purchase Agreement. © 2024 Identiv, Inc. | All Rights Reserved | NASDAQ: INVE 5

Introducing Kirsten Newquist, President, IoT Solutions • Ideal

profile to lead the IoT Solutions business • 25+ years’ experience in strategy, product management, business development, and global sales and marketing • 17 years at Avery-Dennison Corporation, most recently Global Vice President,

Avery Dennison Smartrac. Previously the VP/GM of Avery Dennison Medical • Joined Identiv on April 15, 2024 • To become CEO upon closing of Asset Sale transaction • Deeply understands the key customers and influencers Kirsten

Newquist across the digital transformation of healthcare as well as President, IoT Solutions RFID operations • Pragmatic and disciplined businessperson © 2024 Identiv, Inc. | All Rights Reserved | NASDAQ: INVE 6

Recent Business Highlights • Premises Segment Updates •

Software, services, and recurring revenues grew to 27% of Q1 Premises revenues • Strong interest in our Primis product line • Cloud an interest area in nearly all of our new business opportunities • Deployed demo platforms of

Velocity Vision across three more federal agencies; high interest levels of video in the federal space • Identity Segment Updates • Another successful presence at RFID Journal LIVE trade show • Joined the Axia Institute at Michigan

State University • Secured a new 2-year customer contract for a smart home application • Delivered 5 million units to Wiliot in Q1 2024, which were produced at our Thailand facility • Shipped the majority of a previously announced

$2 million reader application order for a global online retailer • Expanded sales and pipeline of FIDO security keys, especially in Europe © 2024 Identiv, Inc. | All Rights Reserved | NASDAQ: INVE 7

Q1 2024 Financial Review

Financial Overview Metric Q1’24 Q4’23 Q1’23 Revenue

$22.5M $29.0M $26.0M GAAP Gross Margin 37.3% 35.1% 35.4% Non-GAAP Gross Margin* 37.1% 39.9% 37.0% GAAP Operating Expenses $12.6M $11.8M $11.9M Non-GAAP Operating Expenses* $10.4M $9.8M $10.6M GAAP Net Loss** ($4.8M) ($1.9M) ($3.0M) EPS (GAAP)

Diluted ($0.21) ($0.08) ($0.13) Non-GAAP Adj. EBITDA* ($1.4M) $0.9M ($0.9M) Non-GAAP Adj. EBITDA Margin* -6% 3% -4% *Please refer to a reconciliation of Non-GAAP to GAAP later in this presentation or in the Q1 2024 earnings release dated May 8,

2024. May include rounding differences. © 2024 Identiv, Inc. | All Rights Reserved | NASDAQ: INVE 9 **GAAP Net Loss available to common stockholders

Segment Revenue and Non-GAAP Gross Margin* $31.8 $31.0 $29.6 $29.0 $29.0

$27.9 $26.0 $25.1 $22.5 $18.3 $19.2 $17.7 $16.8 $17.5 $17.0 $14.7 $14.6 $12.8 40% 39% 38% 38% 38% 37% 37% 37% 37% $13.6 $12.2 $11.8 $11.9 $11.5 $11.3 $10.9 $10.5 $9.7 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Note: Dollars in Millions

*Please refer to a reconciliation of Non-GAAP to GAAP later in this presentation or in © 2024 Identiv, Inc. | All Rights Reserved | NASDAQ: INVE 10 prior earnings releases. May include rounding differences.

Total Revenue and Non-GAAP Adjusted EBITDA and Non-GAAP Operating Expenses*

Revenue Non-GAAP Adj. EBITDA Non-GAAP Operating Expenses % $31.8 $31.0 $29.6 $29.0 $29.0 $27.9 $26.0 $25.1 $22.5 46% 41% 36% 36% 34% 33% 32% 32% 31% $2.2 $1.4 $2.0 $1.7 -$0.9 $0.2 $0.7 $0.9 -$1.4 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24

Note: Dollars in Millions *Please refer to a reconciliation of Non-GAAP to GAAP later in this presentation or in © 2024 Identiv, Inc. | All Rights Reserved | NASDAQ: INVE 11 prior earnings releases. May include rounding differences.

Q1 2024 Cash Flow and Balance Sheet (in $M) Cash Position Liabilities &

Equity Assets Q1'23 Q4'23 Q1'24 Q1'23 Q4'23 Q1'24 Cash Flow Q1'23 Q4'23 Q1'24 Cash & cash equivalents* Accounts payable From operations* 21.2 24.4 22.4 9.9 12.3 9.6 (4.7) 4.8 (1.3) Accounts receivable Financial liabilities From investing 21.1

22.0 17.8 9.9 9.9 9.9 (1.2) (1.1) (0.2) Inventory Other liabilities From financing 30.6 28.7 28.5 12.1 13.2 12.2 9.8 (0.4) (0.4) Other assets Total equity FX effect 32.6 34.7 33.1 73.6 74.3 70.2 0.2 0.2 (0.1) Total Total Total 105.6 109.7 101.8

105.6 109.7 101.8 4.0 3.5 (2.0) 12 © 2024 Identiv, Inc. | All Rights Reserved | NASDAQ: INVE * I nc lud es restricted cash May include rounding differences.

Identiv IoT Post-Close

Post-Asset Sale Transaction Identiv IoT • The infusion of capital

will fortify our balance sheet to support the growth of our specialty IoT business into what we expect to be a key player in the healthcare industry and other high-value end markets • Transforming industries takes time, particularly a

regulated industry such as healthcare, and requires a clear go-to-market strategic plan, laser-focused execution, and investment with a deliberate allocation of resources • Singularly focused team led by Kirsten Newquist, who has a vision for

strategic value creation and the path to get there from our current business position © 2024 Identiv, Inc. | All Rights Reserved | NASDAQ: INVE 14

Identiv IoT’s Opportunity in Healthcare • Why Kirsten Joined

Identiv • Familiar with Identiv from her RFID experience, driven to join by the opportunity to lead an entrepreneurially-oriented public company with a strong portfolio of products and solutions in an exciting and growing IoT industry •

Our focus and initial traction in the healthcare sector was particularly compelling, given her background working with the industry’s major players for many years • Compelling Trends in Healthcare • An area where there are large

unmet needs – ranging from medication non-adherence, to drug mix-ups, to pharmaceutical counterfeiting – in which RFID can play an important role • As the healthcare industry embarks on its digital transformation journey, we see

many opportunities for RFID-enabled solutions to become a critical asset in this transformation • Potential opportunities include medication authentication and adherence, diagnostic test authentication, blood bag and sample tracking, smart

labels for auto-injectors, and condition monitoring of critical drugs • Incorporating RFID into products and processes provides a persuasive value proposition • Healthcare is a targeted long-term sustainable driver of Identiv’s

growth • While the opportunities in healthcare are vast and compelling, they tend to be longer term given the regulated nature of the healthcare industry. Most of these customers are at the beginning of their digital journeys and need to go

through several design iterations and run multiple pilots to optimize the technology and fully understand the benefits and ROI • Once the technology is proven out, it takes time to integrate the solution into their manufacturing processes due

to the regulatory and quality requirements, and then typically would be launched with a phased rollout. Switching costs are high © 2024 Identiv, Inc. | All Rights Reserved | NASDAQ: INVE 15

Identiv IoT’s Opportunity in High-Value Segments and Thailand •

Evaluating opportunities in other high value segments • In parallel to healthcare, we will evaluate opportunities in specialty retail, smart packaging, and smart home devices • We expect their ability to adopt new solutions will be

quicker than the healthcare segment • Growing interest for products that we have already developed • Accelerating the transition of majority of RFID production to Thailand • One of our most critical short-term initiatives, to

capitalize on its much lower cost structure; expected to be largely complete by the end of Q1 2025 • Have begun exiting some very low margin business that doesn't justify the expense of relocating to Thailand, nor makes financial sense to

sustain • Overhead incurred by maintaining dual manufacturing sites during this transition, coupled with exiting this low-margin business, has and will continue to impact our revenue and margins into the first half of next year © 2024

Identiv, Inc. | All Rights Reserved | NASDAQ: INVE 16

Identiv IoT’s Near-Term Priorities • Building a plan to drive

to operational excellence • Imperative that our core business is focused, disciplined, and resourced appropriately so it can provide a solid foundation to build upon the longer-term opportunities we will be pursuing. • Developing

strategic clarity and focus along with a detailed growth and go-to- market plan • Clear, proactive view on where to drive the business for long term, sustainable success. • Bringing in industry-specific resources to support • No

immediate plans to pursue M&A • Our primary objectives are to gain strategic clarity and operational excellence © 2024 Identiv, Inc. | All Rights Reserved | NASDAQ: INVE 17

THANK YOU Q&A Session Visit identiv.com for more information

today.

Appendix

Income Statement (unaudited, in $’000) Identiv, Inc. Condensed

Consolidated Statements of Operations (in thousands, except per share data) (unaudited) Three Months Ended March 31, December 31, March 31, 2024 2023 2023 Net revenue $ 22,494 $ 28,985 $ 25,997 Cost of revenue 14,102 18,821 16,786 Gross profit 8,392

10,164 9,211 Operating expenses: Research and development 3,011 2,952 2,707 Selling and marketing 5,302 4,938 6,097 General and administrative 4,252 3,570 2,948 Restructuring and severance 22 338 191 Total operating expenses 12,587 11,798 11,943

Loss from operations (4,195) (1,634) (2,732) Non-operating income (expense): Interest expense, net (87) (76) (50) Foreign currency gains (losses), net ( 256) 209 89 Loss before income tax provision (4,538) (1,501) (2,693) Income tax provision (20)

(103) (26) Net loss (4,558) (1,604) (2,719) Cumulative dividends on Series B convertible preferred stock (248) (319) (313) Net loss available to common stockholders $ (4,806) $ (1,923) $ (3,032) Net loss per common share: Basic $ (0.21) $ (0.08) $

(0.13) Diluted $ (0.21) $ (0.08) $ (0.13) Weighted average shares used in computing net loss per common share: Basic 23,368 23,248 22,794 Diluted 23,368 23,248 22,794 © 2024 Identiv, Inc. | All Rights Reserved | NASDAQ: INVE 20

Balance Sheet (unaudited, in $’000) Identiv, Inc. Condensed

Consolidated Balance Sheets (in thousands) (unaudited) March 31, December 31, 2024 2023 ASSETS Current assets: Cash and cash equivalents $ 21,623 $ 23,312 Restricted cash 811 1,072 Accounts receivable, net of allowances 17,811 21,969 Inventories

28,460 28,712 Prepaid expenses and other current assets 4,159 4,421 Total current assets 72,864 79,486 Property and equipment, net 8,832 9,320 Operating lease right-of-use assets 4,756 5,214 Intangible assets, net 3,995 4,251 Goodwill 10,192 10,218

Other assets 1,150 1,234 Total assets $ 101,789 $ 109,723 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable $ 9,564 $ 12,250 Financial liabilities 9,894 9,949 Operating lease liabilities 1,655 1,714 Deferred revenue 1,744

2,341 Accrued compensation and related benefits 2,099 2,334 Other accrued expenses and liabilities 2,351 2,194 Total current liabilities 27,307 30,782 Long-term operating lease liabilities 3,309 3,716 Long-term deferred revenue 981 927 Other

long-term liabilities 26 26 Total liabilities 31,623 35,451 Total stockholders' equity 70,166 74,272 Total liabilities and stockholders' equity $ 101,789 $ 109,723 © 2024 Identiv, Inc. | All Rights Reserved | NASDAQ: INVE 21

GAAP to Non-GAAP Reconciliation (unaudited, in $M) Q1 Q2 Q3 Q4 FY Q1 Q2 Q3

Q4 FY Q1 2022 2022 2022 2022 2022 2023 2023 2023 2023 2023 2024 Reconciliation of GAAP gross margin to non-GAAP gross margin GAAP gross margin (%) 36% 37% 36% 36% 36% 35% 37% 37% 35% 36% 37% GAAP gross profit $9.0 $10.2 $11.2 $10.6 $41.0 $9.2 $10.8

$11.9 $10.2 $42.2 $8.4 Stock-based compensation $0.1 $0.0 $0.0 $0.1 $0.2 $0.0 $0.0 $0.0 $0.1 $0.2 $0.0 Amortization and depreciation $0.3 $0.3 $0.3 $0.3 $1.3 $0.4 $0.4 $0.5 $0.5 $1.7 $0.5 Total reconciling items included in GAAP gross profit $0.3

$0.4 $0.4 $0.4 $1.5 $0.4 $0.4 $0.5 $0.6 $1.9 $0.6 Non-GAAP gross profit $9.3 $10.6 $11.6 $11.0 $42.4 $9.6 $11.3 $12.4 $10.7 $44.1 $9.0 Non-GAAP gross margin (%) 37% 38% 37% 38% 38% 37% 38% 39% 37% 38% 40% Reconciliation of GAAP operating expenses to

non-GAAP operating expenses GAAP operating expenses $10.0 $10.5 $10.6 $10.2 $41.3 $11.9 $11.9 $11.6 $11.8 $47.2 $12.6 Stock-based compensation ($0.8) ($0.8) ($0.8) ($0.5) ($3.0) ($0.9) ($0.9) ($0.9) ($0.9) ($3.8) ($1.0) Amortization and depreciation

($0.2) ($0.2) ($0.3) ($0.2) ($1.0) ($0.2) ($0.2) ($0.3) ($0.2) ($1.0) ($0.2) Loss on disposal of property and equipment $0.0 $0.0 $0.0 ($0.1) ($0.1) $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 Strategic review-related costs $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0

($0.4) ($0.4) ($1.0) Restructuring and severance $0.1 ($0.2) ($0.0) ($0.1) ($0.2) ($0.2) ($0.1) ($0.1) ($0.3) ($0.7) ($0.0) Total reconciling items included in GAAP operating expenses ($0.9) ($1.2) ($1.1) ($0.9) ($4.2) ($1.4) ($1.3) ($1.3) ($2.0)

($5.9) ($2.2) Non-GAAP operating expenses $9.0 $9.2 $9.5 $9.3 $37.1 $10.6 $10.6 $10.3 $9.8 $41.3 $10.4 Reconciliation of GAAP net income (loss) to non-GAAP adjusted EBITDA GAAP net income (loss) ($1.0) ($0.3) $0.5 $0.3 ($0.4) ($2.7) ($1.1) ($0.0)

($1.6) ($5.5) ($4.6) Income tax provision (benefit) ($0.0) $0.1 ($0.0) $0.1 $0.1 $0.0 $0.0 $0.0 $0.1 $0.2 $0.0 Interest expense, net $0.0 $0.0 $0.0 $0.0 $0.1 $0.1 $0.1 $0.2 $0.1 $0.4 $0.1 Gain on forgiveness of Paycheck Protection Program note $0.0

$0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 Gain on sale of investment ($0.0) ($0.0) $0.0 $0.0 ($0.0) $0.0 $0.0 ($0.1) $0.0 ($0.1) $0.0 Foreign currency (gains) losses, net ($0.0) ($0.1) $0.0 ($0.0) ($0.2) ($0.1) $0.0 $0.3 ($0.2) ($0.0) $0.3

Stock-based compensation $0.9 $0.8 $0.9 $0.6 $3.2 $1.0 $1.0 $1.0 $1.0 $4.0 $1.0 Amortization and depreciation $0.5 $0.6 $0.6 $0.6 $2.3 $0.6 $0.6 $0.7 $0.7 $2.7 $0.8 Loss on disposal of property and equipment $0.0 $0.0 $0.0 $0.1 $0.1 $0.0 $0.0 $0.0

$0.0 $0.0 $0.0 Strategic review-related costs $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.4 $0.4 $1.0 Restructuring and severance ($0.1) $0.2 $0.0 $0.1 $0.2 $0.2 $0.1 $0.1 $0.3 $0.7 $0.0 Total reconciling items included in GAAP net income (loss) $1.2

$1.6 $1.5 $1.4 $5.8 $1.8 $1.8 $2.2 $2.5 $8.3 $3.1 Non-GAAP adjusted EBITDA $0.2 $1.4 $2.0 $1.7 $5.4 ($0.9) $0.7 $2.2 $0.9 $2.8 ($1.4) Non-GAAP adjusted EBITDA margin (%) 1% 5% 7% 6% 5% -4% 2% 7% 3% 2% -6% © 2024 Identiv, Inc. | All Rights

Reserved | NASDAQ: INVE 22

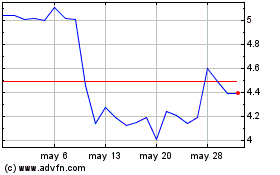

Identiv (NASDAQ:INVE)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Identiv (NASDAQ:INVE)

Gráfica de Acción Histórica

De May 2023 a May 2024