UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive

Proxy Statement |

| ☒ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material under §240.14a-12 |

INVO

Bioscience, Inc.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

| ☒ |

No

fee required |

| |

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and 0-11 |

Payment

of Filing Fee (Check the appropriate box):

INVO

Bioscience, Inc.

Amendment

and Supplement to the Proxy Statement

For

the Special Meeting of Stockholders

To

be Held on October 13, 2023 (adjourned on September 29, 2023)

EXPLANATORY

NOTE

On

September 1, 2023, INVO Bioscience, Inc. (“INVO” or the “Company”) filed its definitive proxy statement (the

“Proxy Statement”) for its special meeting of shareholders to be held on September 29, 2023 (the “Special Meeting”),

which was adjourned until October 13, 2023 to provide its shareholders additional time within which

to vote on the proposals as described in the Proxy Statement

On

September 29, 2023, following the adjournment of the Special Meeting, the Company retained Alliance Advisors as its strategic shareholder

advisor and proxy solicitation agent in connection with the solicitation of proxies for the Special Meeting.

The

Company is voluntarily amending and supplementing the Proxy Statement with the information provided in this amendment and supplement

to the Proxy Statement (the “Amendment and Supplement”) to disclose the retainment of strategic shareholder advisor and proxy

solicitation agent and to also supplement the reasons the Company is seeking approval of the Authorized Share Increase proposal in the

Proxy Statement.

Any

proxies submitted by shareholders before the date of this Amendment and Supplement will be voted as instructed on those proxies, unless

a shareholder changes his or her vote by submitting a later dated proxy. Shareholders should follow the instructions described in the

Proxy Statement regarding how to submit proxies or vote at the Special Meeting.

THIS

AMENDMENT AND SUPPLEMENT SHOULD BE READ IN CONJUNCTION WITH THE PROXY STATEMENT.

This

supplemental information should be read in conjunction with the Proxy Statement, which should be read in its entirety. Section references

in the below disclosures are to sections in the Proxy Statement, and defined terms used but not defined herein have the meanings set

forth in the Proxy Statement. To the extent the following information differs from or conflicts with the information contained in the

Proxy Statement, the information set forth below shall be deemed to supersede the respective information in the Proxy Statement.

Amendments

and Supplemental Disclosure

Notice

of Special Meeting of Shareholders

Immediately

above “By the Order of the Board of Directors” in the Notice of Special Meeting of Shareholders included in the Proxy

Statement, the following will be inserted:

“If

you have any questions or need assistance voting your shares, please call Alliance Advisors at:

Strategic

Shareholder Advisor and Proxy Solicitation Agent

200

Broadacres Drive

Bloomfield,

NJ 07003

North

American Toll Free Phone:

1-833-501-4702

Email:

INVO@allianceadvisors.com

Call

Collect Outside North America: 1-352-623-6148”

Proxy

Statement

The

text under the heading “Frequently Asked Questions— Q: Do the directors and officers of the Company have an

interest in the outcome of the matters to be voted on?” is amended and restated as follows (new text in bold and underline):

| “A: |

Our

directors and officers may have an interest in Proposal 1, the Authorized Share

Increase should any related party notes held by our chief executive officer or chief

financial officer be converted into common stock. Our directors and officers do not have

any interest in Proposal 2, the Warrant Exercise Price Reduction.” |

The

text under the heading “Frequently Asked Questions— Q: Are there any expenses associated with collecting the

shareholder votes? Who is paying for this proxy solicitation?” is amended and restated as follows (new text in bold and underline):

| “A: |

The

Company will pay for the entire cost of soliciting proxies. We will reimburse brokerage firms and other custodians, nominees and

fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and other materials to our shareholders. In addition,

we have retained Alliance Advisors as our strategic shareholder advisor and proxy solicitation agent in connection

with the solicitation of proxies for the Special Meeting at an approximate cost of $15,000, plus reimbursement of expenses. If

you have any questions or require any assistance with completing your proxy, please contact Alliance Advisors by telephone (toll-free

within North America) at 1-833-501-4702 or (call collect outside North America) at 1-352-623-6148 or by email at INVO@allianceadvisors.com. Our

officers and other employees may solicit proxies in person or by telephone but will receive no special compensation for doing so.” |

The

text under the heading “PROPOSAL 1: AUTHORIZED SHARE INCREASE—Reasons for the Increase in Authorized Common Stock Amendment”

is amended and restated as follows (new text in bold and underline):

“Reasons

for the Increase in Authorized Common Stock Amendment

Our

Board determined that the Authorized Share Increase amendment to our Articles of Incorporation is in the best interests of the Company

and unanimously recommends approval by shareholders. The Board believes that the availability of additional authorized shares of common

stock is required for several reasons including, but not limited to, the additional flexibility to issue common stock for a variety of

general corporate purposes as the Board may determine to be desirable including, without limitation, future financings, investment opportunities,

acquisitions, or other distributions and stock splits (including splits effected through the declaration of stock dividends). In addition,

certain of our securities are exercisable for shares of our common stock. In addition, we may use the additional available shares

of commons stock to convert up to $200,000 of related party indebtedness held by our chief executive office and chief financial

officer into shares of our common stock. Such related parties have offered to convert such indebtedness into shares of our common

stock at $2.85 per share, which was the price for securities sold in our August 2023 offering. Therefore, we must maintain a

sufficient amount of authorized, but unissued shares of common stock adequate to issue shares of common stock upon the exercise of such

securities.

As

of the Record Date, there were 2,467,256 shares of our common stock issued out of the 6,250,000 shares of common stock that we are authorized

to issue. In addition, as of the Record Date, an aggregate of approximately 3,672,801 shares of common stock have been reserved for future

issuance, including: (i) an aggregate of 10,425 shares reserved for issuance under our 2019 Equity Incentive Plan; (ii) 3,601,266 shares

of common stock reserved for issuance upon the exercise of outstanding warrants; (iii) 40,768 shares of common stock reserved for issuance

upon the conversion of notes payable; and (iv) 113,457 shares of common stock reserved for issuance upon the exercise of outstanding

options. Thus, we have approximately 34,422 shares of common stock available for future issuance at this time. Our working capital requirements

are significant and may require us to raise additional capital through additional equity financings in the future.

On

November 23, 2022, we received notice (the “Stockholders’ Equity Notice”) from The Nasdaq Stock Market LLC (“Nasdaq”)

advising us that we were not in compliance with the minimum stockholders’ equity requirement for continued listing on The Nasdaq

Capital Market. Nasdaq Listing Rule 5550(b)(1) requires companies listed on The Nasdaq Capital Market to maintain stockholders’

equity of at least $2,500,000 (the “Stockholders’ Equity Requirement). On May 23, 2023, we were notified by the Listing Qualifications

department (the “Staff”) of Nasdaq that, based upon the Company’s non-compliance with the $2.5 million stockholders’

equity requirement for continued listing on The Nasdaq Global Market, as set forth in Nasdaq Listing Rule 5550(b)(1) (the “Rule”),

as of May 22, 2023, the Company’s common stock was subject to delisting from Nasdaq unless the Company timely requests a hearing

before the Nasdaq Hearings Panel (the “Panel”). On July 6, 2023, we had our hearing before the Panel at which time we provided

the Panel of our plan to regain compliance under the Rule referred to above. On July 27, 2023, we received formal notice from Nasdaq

that the Panel granted our request for continued listing on Nasdaq subject to our compliance with all applicable criteria for continued

listing on The Nasdaq Capital Market, by September 29, 2023. On September 27, 2023, we requested an extension of the compliance period

to November 20, 2023, which Nasdaq granted on September 27, 2023. No additional extensions for compliance under the Rule may be granted

by the Panel. We believe that approval of the Authorized Share Increase proposal resulting in additional shares of our common

stock available for issuance will allow us to complete a transaction to satisfy the Stockholders’ Equity Requirement

under the Rule and thus allow us to continue our listing on Nasdaq.”

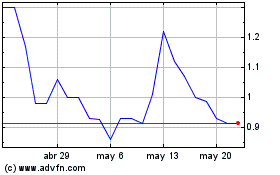

INVO BioScience (NASDAQ:INVO)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

INVO BioScience (NASDAQ:INVO)

Gráfica de Acción Histórica

De May 2023 a May 2024