false

0001798270

0001798270

2024-07-18

2024-07-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of report (Date of

earliest event reported): July 18, 2024

Assure Holdings Corp.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-40785 |

|

82-2726719 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

7887 East Belleview Avenue, Suite 240

Denver, CO |

|

80111 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: 720-287-3093

_____________________________________________

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

IONM |

|

NASDAQ Capital Market |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01. Entry into

a Material Definitive Agreement.

Memorandum of Understanding

– Settlement of Debenture and Security Documents

On July 18, 2024, Assure

Holdings Corp. (the “Company” or “Assure”) entered into a binding memorandum of understanding (the “MOU”)

with Centurion Financial Trust, an investment trust formed by Centurion Asset Management Inc. (“Centurion”) pursuant to which

the Company and Centurion agreed to the settlement of the Company’s obligations under that certain debenture issued on June 9, 2021

(the “Debenture”) to Centurion, acting on behalf of the lenders thereunder, from time to time (the “Lender”),

with a maturity date of June 9, 2025 (the “Maturity Date”), in the principal amount of $11 million related to a credit facility

comprised of a $6 million senior term loan (the “Senior Term Loan”), a $2 million senior revolving loan (the “Senior

Revolving Loan”) and a $3 million senior term acquisition line (the “Senior Term Acquisition Line” and together with

the Senior Term Loan and the Senior Revolving Loan, the “Credit Facility”). The Debenture and the Credit Facility issued pursuant

to the terms of a commitment letter dated March 8, 2021 (the “Commitment Letter”).

The Debenture is secured

by Centurion’s security interests under that certain General Security Agreement dated June 9, 2021 (the “Security Agreement”)

with Centurion, pursuant to which, among other things, the Company and the subsidiaries named therein granted Centurion, in its capacity

as agent and nominee to the Lender, a first priority security interest (the “Security Interest”) on all of the assets of the

Company and the subsidiaries, respectively, defined as “Collateral” under the Security Agreement (the “Collateral”)

and to all “Intellectual Property” (as defined in the Security Agreement, the “Intellectual Property”) of the

Company and the subsidiaries. As a further security for the repayment of the Company’s obligations, the subsidiaries of the Company

entered into a Guarantee and Indemnity Agreement dated June 9, 2021 (the “Guarantee”, together with the Security Agreement,

the “) with the Agent, as lender and as agent and nominee for certain lenders pursuant to the Debenture, pursuant to which the Subsidiaries

irrevocably and unconditionally guaranteed to the Agent, as a continuing obligation, the full and punctual payment and performance of

the Obligations when due, whether at stated maturity, by acceleration, declaration, demand, or otherwise

Under the MOU, the Company

and Centurion agreed to settle the Company’s obligations under the Debenture in accordance with (i) the assignment of certain assets

of the Company to Centurion, as set forth below (the “Assigned Assets”), (ii) the exchange of the remaining amount of obligation

under the Debenture into shares of common stock, par value $0.001 (the “Exchange Common Stock”) at a price of $4.11 per share,

and (iii) the payment of an accommodation fee of $750,000 to Centurion by the Company to be paid in shares of common stock the same price

as the Exchange Common Stock, as set forth in (ii) above (the “Additional Stock”)(the Exchange Common Stock and the Additional

Stock are the “Settlement Common Stock”).

The Company also agreed

to pay to Centurion a cash payment as follows: If between the date of the MOU and July 22, 2024, the Company closed a public or private

offering of the Company’s equity securities for cash, with aggregate gross proceeds to the Company of at least $8.0 million, then

within 5 business days of the closing of such offering, the Company would pay to Centurion fifty percent of the net proceeds in excess

of $8 million in cash and reduce the Settlement Common Stock by the equal dollar amount (the “Cash Payment”). The Company

did not close an offering through July 22, 2023 and no Cash Payment was due or paid.

The Assigned Assets under

the MOU are as follows:

| (a) | $2.5 million of the Company’s federal and state settlements and IDR Awards under the “No Suprises

Act” (the “IDR Accounts Receivable”), which the parties agreed have a stated value of $2.5 million. Centurion shall

be entitled to cash receipts from the assigned IDR Accounts Receivable equal to an aggregate of $2.5 million and the Company will retain

rights to all cash receipts from the assigned IDR Accounts Receivable in excess of $2.5 million. |

| (b) | $3.0 million of the Company’s Employee Retention Tax Credit refund from the Internal Revenue Service

from the tax years 2020 through 2021, which the parties agreed will have a stated value of $3.0 million. |

At the closing under

the MOU, the Company will issue the Additional Stock (as disclosed above) and, following the reduction of the obligations for any Cash

Payment and the value of the Assigned Assets, the portion of the obligations under the Debenture that remain outstanding (the “Conversion

Amount”), will be exchanged into the number of Exchange Shares equal to the quotient of (A) the Conversion Amount divided by $4.11

(the “Exchange”). The number of shares of Settlement Common Stock is subject to being held in abeyance if the percentage ownership

of the Company held by Centurion would exceed 9.99% of the issued and outstanding shares then outstanding. In lieu of such shares of Settlement

Common Stock, Centurion will receive a right to abeyance shares, which right will remain subject to the same ownership restriction, and

the shares issuable thereunder will be issued from time to time to Centurion to the extent that such shares will not result in Centurion,

at any time, owning over 9.99% of the Company’s issued and outstanding shares of common stock.

Under the MOU, Centurion

has agreed that the assignment of the Assigned Assets and the issuance of the Settlement Common Stock constitutes complete satisfaction

of the obligations under the Debenture and that at the closing, the obligations shall be deemed to have been paid in full and indefeasibly

discharged by the assignment and stock issuance with no further obligations existing under the Debenture and the Debenture shall be extinguished

and canceled in its entirety and Centurion will then release and forever discharge the Company and the subsidiaries of the Company, of

and from any and all past, present or future claims, demands, obligations, actions, causes of action, rights, damages, costs, loss of

services, expenses and compensation which Centurion now has, or which may hereafter accrue or otherwise be acquired, on account of, or

in any way growing out of the Debenture, the Security Agreement and the Guarantee (the “Settlement”).

Upon the closing under

the MOU, Centurion will issue to the Company a release and cancellation of the Debenture, the Security Documents and Centurion’s

Security Interests and guarantee under the Security Documents.

Under the MOU, the Company

acknowledged that it may be in default under certain of the covenants and provisions of the Debenture and the Security Documents (collectively,

the “Loan Documents”), pursuant to which the Lender has the right to accelerate its obligations under the Loan Documents.

In consideration of the settlement terms in the MOU, from the date of the MOU until July 23, 2024, the Lender agreed to forbear in the

exercise of any rights or remedies, whether granted in Loan Documents or under law, with respect to the Company or any of its assets (the

“Forbearance Period”), other than the exercise of the Permitted Remedies. As used in the MOU, the “Permitted Remedies”

shall be limited solely to (i) enforce the terms of the MOU and (ii) to obtain the benefits of the continuing indemnification obligations

of the Company to Lenders in the Loan Documents. The Forbearance Period terminated automatically upon the occurrence of any of the following

events: (i) the commencement by the Company or any its subsidiaries of a voluntary proceeding seeking relief with respect to itself or

its debts under any bankruptcy, insolvency or similar law, or seeking appointment of a trustee, receiver, liquidator or other similar

official for it or any substantial part of its assets; or its consent to any of the foregoing in any involuntary proceeding against it;

or makes an assignment for the benefit of, or the offering to or entering into by. The Company or any of its Subsidiaries of any reorganization

with its creditors, (ii) commencement of an involuntary proceeding against the Company or any of its subsidiaries of the kind described

in clause (i) above.

Centurion also agreed

to the cancellation of all of its common stock purchase warrants of the Company.

The above is a summary

of the material terms of the MOU is qualified in its entirety by the full terms and conditions of the MOU, which is filed as Exhibit 10.1

to this Current Report on Form 8-K, and which is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

SIGNATURE

Pursuant to the requirement of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

ASSURE HOLDINGS CORP. |

| |

|

|

| Date: July 24, 2024 |

By: |

/s/ John Farlinger |

| |

Name: |

John Farlinger |

| |

Title: |

Chief Executive Officer |

Exhibit 10.1

Memorandum

of Understanding for Exchange Agreement

This Binding Memorandum of Understanding

(“Agreement”) is entered into by and between Assure Holdings Corp. (the “Company”) and Centurion Financial Trust

(the “Holder” and in its capacity as agent and nominee, the “Agent”) as of July 18, 2024.

WHEREAS, on June 10, 2021, the Company

entered into definitive agreements to secure a credit facility under the terms of a commitment letter dated March 8, 2021 (the “Commitment

Letter”) with the Holder, an investment trust formed by Centurion Asset Management Inc. (“Centurion”). Under the terms

of the Commitment Letter, the Company issued a debenture to Centurion, dated June 9, 2021 (the “Debenture”), acting on behalf

of the lenders thereunder, from time to time (the “Lender”), with a maturity date of June 9, 2025 (the “Maturity Date”),

in the principal amount of $11 million related to a credit facility comprised of a $6 million senior term loan (the “Senior Term

Loan”), a $2 million senior revolving loan (the “Senior Revolving Loan”) and a $3 million senior term acquisition line

(the “Senior Term Acquisition Line” and together with the Senior Term Loan and the Senior Revolving Loan, the “Credit

Facility”).

WHEREAS, as of the date hereof there is

$10,881,276.23 of principal amount outstanding, due and payable, under the Debenture plus $ 1,013,870.53 in accrued and unpaid interest

and penalties.

WHEREAS, as security for the repayment

of the Company’s Obligations (as defined under the Debenture, the “Obligations”), the Company and certain subsidiaries

of the Company named therein (the “Subsidiaries”), entered into a General Security Agreement dated June 9, 2021 (the “Security

Agreement”) with the Agent, pursuant to which, among other things, the Company and the Subsidiaries granted the Agent, in its capacity

as agent and nominee to the Lender, a first priority security interest (the “Security Interest”) on all of the assets of

the Company and the Subsidiaries, respectively, defined as “Collateral” under the Security Agreement (the “Collateral”)

and to all “Intellectual Property” (as defined in the Security Agreement, the “Intellectual Property”) of the

Company and the Subsidiaries.

WHEREAS, as a further security for the

repayment of the Corporation’s Obligations, the Subsidiaries entered into a Guarantee and Indemnity Agreement dated June 9, 2021

(the “Guarantee”) with the Agent, as lender and as agent and nominee for certain lenders pursuant to the Debenture, pursuant

to which the Subsidiaries irrevocably and unconditionally guaranteed to the Agent, as a continuing obligation, the full and punctual

payment and performance of the Obligations when due, whether at stated maturity, by acceleration, declaration, demand, or otherwise.

WHEREAS, the parties desire to settle

the Company’s Obligations under the Debenture in accordance with (i) the assignment of certain assets of the Company to the Agent,

as set forth herein (the “Assigned Assets”), (ii) the exchange of the remaining Obligation into shares of common stock, par

value $0.001 (the “Exchange Common Stock”), of the Company at the Nasdaq “Minimum Price” as defined in Nasdaq

Listing Rule 5635(d) as the date and time of the execution of this Agreement, and (iii) the payment of an accommodation fee of $750,000

to the Agent by the Company to be paid in Common Shares at the same price as the Exchange Common Stock, as set forth in (ii) above (the

“Additional Stock”)(the Exchange Common Stock and the Additional Stock are the “Common Stock”). Upon the closing

of the Company’s contemplated public offering of equity with a minimum aggregate raise amount of $8 million, (the “Offering’),

the Company will pay fifty percent of the net proceeds in excess of $8 million in cash and reduce the remaining Obligation to be exchanged

into Common Stock as per (ii) above by the commensurate amount. Further, the Holder hereby agress to the cancellation of all common stock

purchase warrants issued by the Company to the Holder.

NOW, THEREFORE, in consideration of the

promises, covenants and agreements set forth in this Agreement and other good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, the parties hereto hereby agree as follows:

1.

Settlement and Release. The Parties are entering into this Agreement to agree upon the binding terms of settlement of

the Obligations. Pursuant to, and upon complete satisfaction of the Settlement Terms (as set forth below), at the Closing (as defined

below) (i) the Agent acting on its own behalf as the Holder and on behalf of the Lender, hereby agrees that the satisfaction of the Settlement

Terms constitutes complete satisfaction of the Obligations under the Debenture and that at the Closing, upon satisfaction of the Settlement

Terms, the Obligations shall be deemed to have been paid in full and indefeasibly discharged by the assignment and stock issuance with

no further Obligations existing under the Debenture and the Debenture shall be extinguished and canceled in its entirety and the Agent

on its own behalf as the Holder and as agent for the Lender will then release and forever discharges the Company and the Subsidiaries,

of and from any and all past, present or future claims, demands, obligations, actions, causes of action, rights, damages, costs, loss

of services, expenses and compensation which the Agent or the Lender now has, or which may hereafter accrue or otherwise be acquired,

on account of, or in any way growing out of the Debenture, the Security Agreement and the Guarantee (the “Settlement”) and

(ii) pursuant to one or more written releases in form and substance acceptable to the Company and the Agent, the Agent agrees to release

all of its security interest in and to all the Collateral and Intellectual Property of the Company and the Subsidiaries under Security

Agreement and terminates the Security Agreement and releases the Subsidiaries from the Guarantee and terminates the Guarantee (collectively,

the “Release”) where upon the right and interest of the Agent will consist of the rights under the Exchange Agreement, the

issued Common Stock and Additional Stock and the Assigned Assets.

2. The Settlement Terms.

2.1

Cash Payment. If between the date hereof and July 22, 2024, the Company closes the Offering, or any similar public

or private offering of the Company’s equity securities for cash, with aggregate gross proceeds to the Company of at least $8.0 million,

then within 5 business days of the Closing of the Offering, the Company shall pay to the Agent, on behalf of the Lenders, fifty percent

of the net proceeds in excess of $8 million in cash and reduce the Common Stock by the equal dollar amount. These incremental payments

are subject to final approval by the investors of the Offering.

2.2

Assignment of Assets. At the Closing, the Company will deliver to the Agent an assignment, in form and substance reasonably

acceptable to the Agent and the Company, of the Assigned Assets which consist of the following assets of the Company which the parties

hereto agree have the stated value set forth below, which stated values will be applied to the Obligations as follows: first payment of

any penalties due and owing, second to payment of any accrued and unpaid interest and finally to paying down the principal amount of the

Debenture (the “Assignment Payment”). The assignments in the Assignment payment shall be as follows:

2.2.1

Federal and State Settlements and IDR Awards Under the “No Suprises Act” as Managed and Reported by Halo (IDR Accounts

Receivable). At the Closing, the Company will assign to the Agent on behalf of the Lenders $2.5M of the Company’s IDR Accounts

Receivable, which the parties hereto agree will have a stated value of $2.5M. The Agent shall be entitled to cash receipts from the assigned

IDR Accounts Receivable equal to an aggregate of $2.5M and the Company will retain rights to all cash receipts from the assigned IDR Accounts

Receivable in excess of $2.5M.

2.2.2

ERTC. At the Closing, the Company will assign to the Agent on behalf of the Lenders $3.0M of the Company’s Employee

Retention Tax Credit refund from the Internal Revenue Service from the tax years 2020 through 2021, which the parties hereto agree will

have a stated value of $3.0M.

2.3 Exchange.

At the Closing, the Company will issue the Additional Stock and following the reduction of the Obligations for any Cash Payment and

the Assignment Payment, if any portion of the Obligations under the Debenture remains outstanding (the “Conversion

Amount”), the Agent, acting on its own behalf as Holder and as Agent to the Lender, agrees to exchange the remaining

Conversion Amount into such aggregate number of shares of common stock (the “Exchange Shares”) equal to the quotient of

(A) the Conversion Amount divided by the Nasdaq Minimum Price as of the date and time of this

Agreement (the “Exchange”); provided, however, that in all cases, to the extent that any issuance of

Exchange Shares to the Agent at the Closing Date or otherwise in accordance herewith would result in a Lender and its other

Attribution Parties (as defined below) exceeding the Maximum Percentage (as defined below) (as calculated in accordance with

procedures set forth below, a “Maximum Percentage Event”), then such Lender shall not be entitled to receive such

aggregate number of Exchange Shares in excess of the Maximum Percentage (and shall not have beneficial ownership of such Exchange

Shares (or other equivalent security) as a result of the Closing (and beneficial ownership) to such extent of any such excess) (such

remaining portion of such Exchange Shares that would have otherwise been issued to the Lender at the Closing, the “Abeyance

Shares”), such portion of the Obligations under the Debenture in relation to the Abeyance Shares shall alternatively be

exchanged for the irrevocable, unconditional right to receive such Abeyance Shares on the price and basis herein (with a beneficial

ownership and issuance limitation as set forth below in this Section 2.3), at such time or times as its right thereto would not

result in such Lender and the other Attribution Parties exceeding the Maximum Percentage, at which time or times, if any, such

Lender shall be granted such remaining portion of such Abeyance Shares in accordance herewith. The Company shall not effect the

issuance of any Abeyance Shares pursuant to the Lender’s right to Abeyance Shares hereunder, and the Lender shall not have the

right to request any Abeyance Shares pursuant to the terms and conditions of this Agreement, and any such issuance or request shall

be null and void and treated as if never made, to the extent that after giving effect to such issuance or request, as the case may

be, the Lender together with the other Attribution Parties collectively would beneficially own in excess of 9.99% (the

“Maximum Percentage”) of the shares of common stock of the Company outstanding immediately after giving effect to such

issuance or request. For purposes of the foregoing sentence, the aggregate number of shares of common stock beneficially owned by

the Lender and the other Attribution Parties shall include the number of shares of common stock held by the Lender and all other

Attribution Parties plus the number of shares of common stock to be issued pursuant to the right to Abeyance Shares with respect to

which the determination is being made, but shall exclude shares of common stock which would be issuable (A) pursuant to the right to

Abeyance Shares under this Agreement that is not being issued to the Lender or any of the other Attribution Parties at the time of

determination and (B) exercise or conversion of the unexercised or nonconverted portion of any other securities of the Company

(including, without limitation, any convertible notes or convertible preferred stock or warrants) beneficially owned by the Lender

or any other Attribution Party subject to a limitation on conversion or exercise analogous to the limitation contained in this

Section 2.3. For purposes of this Section 2.3, beneficial ownership shall be calculated in accordance with Section 13(d) of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”). The term of the agreement for issuance of Abeyance

Shares shall be no less that 10 years and the Lender at any time may request issuance of the Abeyance Shares, subject at all time

the limitations set forth in this Section 2.3. If the Company receives a request for Abeyance Shares from the Lender, the Company

shall notify the Lender in writing of the number of shares of common stock then outstanding and, to the extent that such request for

Abeyance Shares would otherwise cause the Lender’s beneficial ownership, as determined pursuant to this Section 2.3, to exceed

the Maximum Percentage, Abeyance Shares shall not be issued and shall remain subject to the Abeyance Share terms set forth in this

Section 2.3. Abeyance Shares shall issue to the permitted level but the balance of Abeyance Shares will continue to be subject to

the terms set forth in this Section 2.3 for re-issue upon the request for Abeyance Shares to issue when and as often as it desires

until all are issued. For any reason at any time, upon the written or oral request of the Lender, the Company shall within three (3)

business days confirm orally and in writing or by electronic mail to the Lender the number of shares of common stock then

outstanding. In the event that the issuance of Abeyance Shares to the Lender pursuant to the right to Abeyance Shares under this

Agreement results in the Lender and the other Attribution Parties being deemed to beneficially own, in the aggregate, more than the

Maximum Percentage of the number of outstanding shares of common stock (as determined under Section 13(d) of the Exchange Act), the

number of shares so issued to the Lender by which the Lender’s and the other Attribution Parties’ aggregate beneficial

ownership exceeds the Maximum Percentage (the “Excess Shares”) shall be deemed null and void and shall be cancelled ab

initio, and the Lender shall not have the power to vote or to transfer the Excess Shares but the Lender’s right to unissued

Abeyance Shares shall not be diminished by the amount of Excess Shares so cancelled. Upon delivery of a written notice to the

Company, the Lender may from time to time increase (with such increase not effective until the sixty-first (61st) day after delivery

of such notice) or decrease the Maximum Percentage to any other percentage not in excess of 19.9% as specified in such notice;

provided that any such increase in the Maximum Percentage will not be effective until the sixty-first (61st) day after such notice

is delivered to the Company. For purposes of clarity, the Abeyance Shares issuable pursuant to the terms of this Agreement in excess

of the Maximum Percentage shall not be deemed to be beneficially owned by the Lender for any purpose including for purposes of

Section 13(d) or Rule 16a-1(a)(1) of the Exchange Act. The provisions of this paragraph shall be construed and implemented in a

manner otherwise than in strict conformity with the terms of this Section 2.3 to the extent necessary to correct this paragraph (or

any portion of this paragraph) which may be defective or inconsistent with the intended beneficial ownership limitation contained in

this Section 2.3 or to make changes or supplements necessary or desirable to properly give effect to such limitation. The limitation

contained in this paragraph may not be waived. As used herein, “Attribution Parties” means, collectively, the following

persons and entities: (i) any investment vehicle, including, any funds, feeder funds or managed accounts, currently, or from time to

time after the date hereof, directly or indirectly managed or advised by the Subscriber or any of its Affiliates or principals, (ii)

any direct or indirect Affiliates of the Subscriber or any of the foregoing, (iii) any person acting or who could be deemed to be

acting as a Group together with the Subscriber or any of the foregoing and (iv) any other persons whose beneficial ownership of the

Company’s common stock would or could be aggregated with the Lender’s and the other Attribution Parties for purposes of

Section 13(d) of the Exchange Act or for the purpose of exercising control over the Company. For clarity, the purpose of the

foregoing is to subject collectively the Lender and all other Attribution Parties to the Maximum Percentage. As used herein,

“Affiliate” means, with respect to any person, any other person that directly or indirectly controls, is controlled by,

or is under common control with, such person, it being understood for purposes of this definition that “control” of a

person means the power directly or indirectly either to vote 10% or more of the stock having ordinary voting power for the election

of directors of such person or direct or cause the direction of the management and policies of such person whether by contract or

otherwise. As used herein, “Group” means a “group” as that term is used in Section 13(d) of the Exchange Act

and as defined in Rule 13d-5 thereunder.

3.

Forbearance. The Company may at the date hereof be in default under certain of the covenants and provisions of the Debenture,

the Security Agreement or the Guarantee (collectively, the “Loan Documents”), pursuant to which the Lender may have the right

to accelerate its Obligations under the Loan Documents. From the date hereof until July 23, 2024,

the Lender will forbear in the exercise of any rights or remedies, whether granted in Loan Documents or under law, with respect

to the Company or any of its assets (the “Forbearance Period”), other than the exercise of the Permitted Remedies. As used

herein, the “Permitted Remedies” shall be limited solely to (i) enforce the terms of this Agreement and (ii) to obtain the

benefits of the continuing indemnification obligations of the Company to Lenders in the Loan Documents. The Forbearance Period shall terminate

automatically upon the occurrence of any of the following events: (i) the commencement by the Company or any its Subsidiaries of a voluntary

proceeding seeking relief with respect to itself or its debts under any bankruptcy, insolvency or similar law, or seeking appointment

of a trustee, receiver, liquidator or other similar official for it or any substantial part of its assets; or its consent to any of the

foregoing in any involuntary proceeding against it; or makes an assignment for the benefit of, or the offering to or entering into by.

the Company or any of its Subsidiaries of any reorganization with its creditors, (ii) commencement of an involuntary proceeding against

the Company or any of its Subsidiaries of the kind described in clause (i) above.

4. Securities to be

Issued. The Exchange is being made in reliance upon the exemption from registration requirements of the Securities Act of

1933, as amended (the “1933 Act”), provided by Section 3(a)(9) promulgated thereunder. The Agent represents to

the Company that it and each Lender is an “accredited investor” as defined in Rule 501(a) of Regulation D under the 1933

Act and understands and acknowledges that the Common Shares have not been and will not be registered under the 1933 Act or any

applicable securities laws of any state of the United States and may not be offered or sold except pursuant to registration under

such laws or pursuant to an available exemption thereunder. The Common Shares will be “restricted securities” under the

1933 Act, may bear a restrictive legend to such effect and will be subject to certain restrictions on resale under the 1933 Act

which may prevent the holder thereof from offering, selling or otherwise transferring such securities. The Company acknowledges that

the holding period of the Common Shares, if any, shall be tacked onto the holding period of the Debenture, and, in each case, the

Company agrees not to take a position contrary. The Agent, acting on behalf of the Lender, has had access to such information

regarding the Company, its business and its securities as it has deemed necessary to make its decision to invest in the Exchange

Shares pursuant to the Exchange.

5. Closing

and Closing Conditions. Subject to the conditions set forth herein, the closing of the Assignment Payment and the Exchange

shall take place via the electronic exchange of documents, securities and signatures, at such time and place as the Company and the

Agent mutually agree (the “Closing” and the “Closing Date”), but in any event the Closing Date shall be no

later than 2:00 p.m. (New York City Time) on July 22, 2024. The Company’s obligation to close will be conditioned upon

the Lender having delivered to the Company executed, written releases as contemplated in Section 1 hereof and the Lender’s

obligation to close will be conditioned upon the Company having (i) made the Cash Payment, if applicable, (ii) delivered executed

assignments as contemplated in Section 2.2 hereof and (iii) having provided for review by the Agent the treasury order for the

Exchange Shares to be delivered to the transfer agent for the Company at the Closing.

6. Miscellaneous.

6.1

Further Assurances. The parties hereto agree to execute and deliver, without further consideration, all such further

and other documents or assurances as may be required in order to carry out this Agreement according to its intent.

6.2

Assignment. This Agreement is not assignable by either party without the prior written consent of the other party. This

Agreement will ensure to the benefit of and be binding on the parties hereto and their respective legal representatives, successors and

permitted assigns.

6.3

Applicable Law. All questions concerning the construction, validity, enforcement and interpretation of this Agreement

shall be governed by the internal laws of the State of Nevada, without giving effect to any choice of law or conflict of law provision

or rule (whether of the State of Nevada or any other jurisdictions) that would cause the application of the laws of any jurisdictions

other than the State of Nevada.

6.4

Amendments and Waivers. Any term of this Agreement may be amended and the observance of any term of this Agreement may

be waived (either generally or in a particular instance and either retroactively or prospectively), only with the written consent of the

Company, and the Agent, or successor and assignee as provided under this Agreement.

6.5 Severability.

If one or more provisions of this Agreement are held to be unenforceable under applicable law, such provision shall be excluded from

this Agreement and the balance of the Agreement shall be interpreted as if such provision were so excluded and shall be enforceable

in accordance with its terms so long as this Agreement as so modified continues to express, without material change, the original

intentions of the parties as to the subject matter hereof and the prohibited nature, invalidity or unenforceability of the

provision(s) in question does not substantially impair the respective expectations or reciprocal obligations of the parties or the

practical realization of the benefits that would otherwise be conferred upon the parties. The parties will endeavor in good faith

negotiations to replace the prohibited, invalid or unenforceable provision(s) with a valid provision(s), the effect of which comes

as close as possible to that of the prohibited, invalid or unenforceable provision(s).

6.6

Entire Agreement. This Agreement represents the entire agreement and understandings between the parties concerning the

transactions hereunder and the other matters described herein and supersedes and replaces any and all prior agreements and understandings

solely with respect to the subject matter hereof and thereof.

6.7

Specific Performance. It is recognized and acknowledged that a breach by any party of any material obligations contained

in this Agreement will cause the other parties to sustain injury for which it would not have an adequate remedy at law for money damages.

Accordingly, in the event of any such breach, any aggrieved party shall be entitled to the remedy of specific performance of such obligations

and interlocutory, preliminary and permanent injunctive and other equitable relief in addition to any other remedy to which it may be

entitled, at law or in equity, and each party will waive, in any action for specific performance, interlocutory, preliminary and permanent

injunctive relief and/or any other equitable relief, the defense of adequacy of a remedy at law and any requirement for the securing or

posting of any bond in connection with the obtaining of any such relief.

6.8

Counterparts. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original,

but all of which together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the Company and

the Agent, on its own behalf as the Holder and as agent for the Lender, have each executed this Agreement as of the date set forth on

the first page of this Agreement.

| Assure Holdings Corp. |

|

| |

|

| By: |

/s/ John Farlinger |

|

| Name: John Farlinger |

|

| Title: John Farlinger |

|

| |

|

| Centurion Financial Trust |

|

| |

|

| By: |

/s/ Daryl W. Boyce |

|

| Name: Daryl W. Boyce |

|

| Title: EVP, Corporate Finance |

|

[SIGNATURE PAGE TO MEMORANDUM

OF UNDERSTANDING]

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

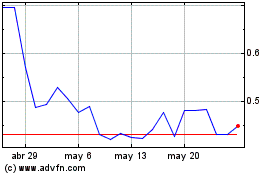

Assure (NASDAQ:IONM)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Assure (NASDAQ:IONM)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024