UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE TO

(Amendment No. 4)

TENDER OFFER

STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

VECTIVBIO HOLDING AG

(Name of Subject

Company (Issuer))

Ironwood

Pharmaceuticals, Inc.

(Name of Filing Person—Offeror)

Ordinary Shares, CHF 0.05 nominal value per

share

(Title of Class of Securities)

H9060V 101

(CUSIP Number of Class of Securities)

John Minardo

Ironwood Pharmaceuticals, Inc.

Senior Vice President, Chief Legal Officer

and Secretary

100 Summer Street, Suite 2300

Boston, Massachusetts 02110

(617) 621-7722

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications on Behalf of Filing Persons)

Copies to:

Charles K. Ruck, Esq.

Daniel E. Rees, Esq.

Andrew Clark, Esq.

Ian Nussbaum, Esq.

Latham & Watkins LLP

1271 Avenue of the Americas

New York,

NY 10020

(212) 906-1200

| ¨ | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below

to designate any transactions to which the statement relates:

| x | Third-party offer subject to Rule 14d-1. |

| ¨ | Issuer tender offer subject to Rule 13e-4. |

| ¨ | Going-private transaction subject to Rule 13e-3. |

| ¨ | Amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing

is a final amendment reporting the results of the tender offer: x

If applicable, check the appropriate

box(es) below to designate the appropriate rule provision(s) relied upon:

| ¨ | Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ¨ | Rule 14d-1(d) (Cross-Border Third Party Tender Offer) |

This

Amendment No. 4 (this “Amendment”) amends and supplements the Tender Offer Statement on Schedule TO filed by Ironwood

Pharmaceuticals, Inc., a Delaware corporation (“Ironwood”), with the U.S. Securities and Exchange Commission on

May 31, 2023 (as amended and together with any subsequent amendments or supplements thereto, the “Schedule TO”).

The Schedule TO relates to the offer by Ironwood to purchase all of the outstanding registered ordinary shares, nominal value of CHF 0.05

per share (the “Shares”), of VectivBio Holding AG, a Swiss stock corporation (Aktiengesellschaft) organized

under the laws of Switzerland (“VectivBio”), for $17.00 per Share, net to the shareholders of VectivBio in cash, without

interest and subject to any applicable withholding taxes, on the terms and subject to the conditions set forth in the offer to purchase,

dated May 31, 2023 (together with any amendments or supplements thereto, the “Offer to Purchase”), and in the

related letter of transmittal (the “Letter of Transmittal”), copies of which are attached to the Schedule TO as Exhibits

(a)(1)(A) and (a)(1)(B), respectively, which Offer to Purchase and Letter of Transmittal collectively constitute the “Offer”.

Except

as otherwise set forth in this Amendment, the information set forth in the Schedule TO remains unchanged. Capitalized terms used

but not defined herein have the meanings ascribed to them in the Schedule TO.

Items 1 through 9 and Item 11.

The information contained in the Offer to Purchase

and Items 1 through 9 and Item 11 of the Schedule TO, to the extent such Items incorporate by reference the information contained in the

Offer to Purchase, are hereby amended and supplemented by adding the following text thereto:

“The

Offer and withdrawal rights expired one minute after 11:59 P.M., Eastern Time, on June 28, 2023 (the “Expiration

Time”). The Depositary has advised Ironwood that, as of the Expiration Time, 59,287,753 Shares have been validly tendered and

not validly withdrawn pursuant to the Offer, representing approximately 94.40% of the Shares outstanding (not including 2,007,310

Shares delivered through Notices of Guaranteed Delivery, representing approximately 3.20% of the outstanding Shares). The

number of Shares validly tendered and not validly withdrawn pursuant to the Offer satisfied the Minimum Condition. As all conditions

to the Offer have been satisfied or waived, Ironwood has accepted for payment and will promptly pay for all Shares that were

validly tendered and not validly withdrawn in accordance with the terms of the Offer.

As a result

of its acceptance for payment of all Shares that were validly tendered and not validly withdrawn in accordance with the terms of the Offer, Ironwood

owns at least the percentage of Shares that would be required to consummate the Merger in accordance with the laws of Switzerland and

a merger agreement to be entered into by Merger Sub and VectivBio, pursuant to which VectivBio will be merged with and into Merger Sub,

and Merger Sub will continue as the surviving entity of the Merger, and each Share (other than the Excluded Shares) that is not validly

tendered and accepted pursuant to the Offer or acquired by Ironwood after the Acceptance Time will thereupon be cancelled and converted

into the right to receive the Offer Price.

Following the

completion of the Offer, to the extent permitted under applicable law and stock exchange regulations, Ironwood intends to delist

the Shares from Nasdaq. Following delisting of the Shares from Nasdaq and provided that the criteria for deregistration are met, Ironwood

intends to cause VectivBio to make a filing with the SEC requesting that VectivBio’s reporting obligations under the Exchange Act

be terminated.

On June 29,

2023, Ironwood and VectivBio issued a joint press release announcing the expiration and results of the Offer. The full text of the

press release issued by Ironwood and VectivBio is attached as Exhibit (a)(5)(L) to the Schedule TO and is incorporated herein

by reference.”

Item 12. Exhibits

* Filed herewith.

SIGNATURES

After due inquiry and to the best knowledge

and belief of the undersigned, each of the undersigned certifies that the information set forth in this statement is true, complete and

correct.

| |

Ironwood Pharmaceuticals, Inc. |

| |

|

|

| |

By: |

/s/ Thomas McCourt |

| |

Name: |

Thomas McCourt |

| |

Title: |

Chief Executive Officer |

Date:

June 29, 2023

Exhibit (a)(5)(L)

Ironwood and VectivBio Announce the Completion

of the Tender Offer for VectivBio Shares

BOSTON

and BASEL, Switzerland – June 29, 2023 – Ironwood Pharmaceuticals, Inc. (“Ironwood”) (Nasdaq:

IRWD), a GI-focused healthcare company, and VectivBio Holding AG (“VectivBio”) (Nasdaq: VECT), a global clinical-stage biopharmaceutical

company pioneering novel, transformational treatments for severe rare gastrointestinal conditions, today announced the successful completion

of the tender offer to purchase the outstanding ordinary shares of VectivBio (the “Shares”) for $17.00 per share in cash

(the “Tender Offer”).

The Depositary for the Tender Offer has

advised Ironwood and VectivBio that at the end of the offering period, 59,287,753 Shares had been tendered and not withdrawn

pursuant to the Tender Offer and it has received commitments to tender 2,007,310 additional Shares under the guaranteed delivery

procedures described in the offer, representing in the aggregate approximately 97.60 percent of the outstanding Shares. Ironwood has

accepted for payment and will promptly pay for all Shares that have been validly tendered and not validly withdrawn in accordance

with the terms of the Tender Offer Statement on Schedule TO filed with the U.S. Securities and Exchange Commission (the

“SEC”) on May 31, 2023, as amended. Effective immediately following the completion of the Tender Offer, the current

directors of VectivBio were replaced with those Ironwood appointed directors as approved by the VectivBio shareholders at the

extraordinary general meeting of shareholders held on June 26, 2023.

As previously announced, Ironwood intends

to cause VectivBio to voluntarily delist its shares from Nasdaq and intends to effect a squeeze-out merger under Swiss law to acquire

all remaining outstanding Shares.

The Depositary & Paying Agent for the

Tender Offer is Computershare Trust Company, N.A. The Information Agent for the Tender Offer is Innisfree M&A Incorporated. The Tender

Offer materials may be obtained at no charge by directing a request by mail to Innisfree M&A Incorporated or by calling toll free

at (877) 750-0537 and may also be obtained at no charge at the website maintained by the SEC at www.sec.gov.

For further information, contact:

Ironwood:

Media:

Beth Calitri, 978-417-2031

bcalitri@ironwoodpharma.com

Investors:

Greg Martini, 617-374-5230

gmartini@ironwoodpharma.com

Matt Roache, 617-621-8395

mroache@ironwoodpharma.com

VectivBio:

Investors:

Patrick Malloy, 847-987-4878

Patrick.Malloy@VectivBio.com

About Ironwood

Ironwood Pharmaceuticals (Nasdaq: IRWD), an S&P

SmallCap 600® company, is a leading gastrointestinal (GI) healthcare company on a mission to advance the treatment of GI diseases

and redefine the standard of care for GI patients. We are pioneers in the development of LINZESS® (linaclotide), the U.S. branded

prescription market leader for adults with irritable bowel syndrome with constipation (IBS-C) or chronic idiopathic constipation (CIC).

In June 2023, the U.S. Food and Drug Administration also approved LINZESS for the treatment of functional constipation in pediatric

patients ages 6-17 years-old. Under the guidance of our seasoned industry leaders, we continue to build upon our history of GI innovation

and challenge what has been done before to shape what the future holds. We keep patients at the heart of our R&D and commercialization

efforts to reduce the burden of GI diseases and address significant unmet needs.

Founded in 1998, Ironwood Pharmaceuticals

is headquartered in Boston, Massachusetts.

We

routinely post information that may be important to investors on our website at www.ironwoodpharma.com. In addition, follow

us on Twitter and on LinkedIn.

About VectivBio

VectivBio is a global clinical-stage biotechnology company focused

on transforming and improving the lives of patients with severe rare conditions. Lead product candidate apraglutide is a next-generation,

long-acting synthetic GLP-2 analog being developed for a range of rare gastrointestinal diseases where GLP-2 can play a central role

in addressing disease pathophysiology, including short bowel syndrome with intestinal failure (SBS-IF) and Acute Graft-Versus-Host Disease

(aGVHD).

VectivBio is also advancing its modular, small molecule CoMET platform

to address a broad range of previously undruggable Inherited Metabolic Diseases (IMDs). CoMET leverages innovative chemistry, based on

a proprietary stabilized pantetheine backbone, to restore fundamental cellular metabolism in pediatric populations with IMDs characterized

by a deficit of energy metabolism caused by the depletion of functional Coenzyme A (CoA). Candidates from the CoMET platform are initially

being evaluated in methylmalonic acidemia (MMA), propionic acidemia (PA), and other organic acidemias.

Cautionary Statement Regarding Forward-Looking Statements

Certain statements in this press release may

constitute “forward-looking statements”. Forward-looking statements may be typically identified by such words as “may,”

“will,” “could,” “should,” “expect,” “anticipate,” “plan,” “likely,”

“believe,” “estimate,” “project,” “intend,” and other similar expressions. These forward-looking

statements are subject to known and unknown risks and uncertainties that could cause our actual results to differ materially from the

expectations expressed in the forward-looking statements. Although Ironwood and VectivBio believe that the expectations reflected in

the forward-looking statements are reasonable, any or all of such forward-looking statements may prove to be incorrect. Consequently,

no forward-looking statements may be guaranteed and there can be no assurance that the actual results or developments anticipated by

such forward looking statements will be realized or, even if substantially realized, that they will have the expected consequences to,

or effects on, Ironwood, VectivBio or their respective businesses or operations.

Factors which could cause actual results to differ

from those projected or contemplated in any such forward-looking statements include, but are not limited to, the following factors: (1) litigation

relating to the transaction; (2) uncertainties as to the timing of the consummation of the squeeze out transaction and the ability

of each of VectivBio and Ironwood to consummate the squeeze out transaction; (3) risks that the completion of the Tender Offer or

the squeeze-out transaction disrupts the current plans and operations of VectivBio or Ironwood; (4) the ability of Ironwood and/or

VectivBio to retain and hire key personnel; (5) competitive responses to the completion of the Tender Offer and/or the squeeze-out

transaction; (6) unexpected costs, charges or expenses resulting from the completion of the Tender Offer or the squeeze-out transaction;

(7) potential adverse reactions or changes to business relationships resulting from the completion of the Tender Offer and/or the

squeeze-out transaction; (8) the prospects, including clinical development, regulatory approvals, and commercial potential of apraglutide;

(9) Ironwood’s ability to achieve the growth prospects and synergies expected from the transaction, as well as delays, challenges

and expenses associated with integrating VectivBio with its existing businesses; and (10) legislative, regulatory and economic developments.

The foregoing review of important factors that could cause actual events to differ from expectations should not be construed as exhaustive

and should be read in conjunction with statements that are included herein and elsewhere, including the risk factors included in VectivBio’s

Annual Report on Form 20-F for the year ended December 31, 2022, the risk factors included in Ironwood’s Annual Report

on Form 10-K for the year ended December 31, 2022 and Ironwood’s other filings with the SEC (which may be obtained for

free at the SEC’s website at http://www.sec.gov). VectivBio and Ironwood can give no assurance that the conditions to the transaction

will be satisfied. Neither VectivBio nor Ironwood undertakes any intent or obligation to publicly update or revise any of these forward-looking

statements, whether as a result of new information, future events or otherwise, except as required by law.

###

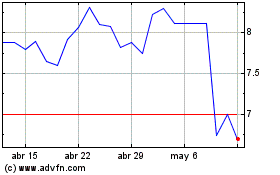

Ironwood Pharmaceuticals (NASDAQ:IRWD)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Ironwood Pharmaceuticals (NASDAQ:IRWD)

Gráfica de Acción Histórica

De May 2023 a May 2024