- CARVYKTI® (ciltacabtagene autoleucel; cilta-cel) net trade

sales of approximately $157 million

- EC and US FDA approved CARVYKTI® label expansion in earlier

lines of treatment for adult patients with relapsed and

lenalidomide-refractory multiple myeloma

- Legend and Johnson & Johnson enter into Master

Manufacturing and Supply Services Agreement with Novartis

Pharmaceuticals Corporation

- On April 5, Legend Biotech earned a milestone payment of $45

million in connection with FDA’s approval of CARVYKTI’s label

expansion to treat 2L+ MM, in accordance with the Janssen

Agreement*

- Cash and cash equivalents, deposits, and short-term investments

of $1.3 billion, as of March 31, 2024, which Legend believes will

provide financial runway into 2026, when Legend Biotech anticipates

achieving an operating profit

Legend Biotech Corporation (NASDAQ: LEGN) (Legend Biotech), a

global leader in cell therapy, today reported its first quarter

2024 unaudited financial results and key corporate highlights.

“Legend made great progress in the first quarter, culminating in

our exciting announcements in recent weeks. We received label

expansions for CARVYKTI in the U.S., Europe, and Brazil that have

changed the treatment paradigm for multiple myeloma and will enable

more patients to receive our transformative therapy earlier in the

course of their disease,” said Ying Huang, Ph.D., Chief Executive

Officer of Legend Biotech. “With more patients needing access to

CARVYKTI, we have increased our manufacturing capacity and have

scaled up our operations to reach our goal of 10,000 annual doses

by the end of 2025. The expansion of our partnership with Novartis

demonstrates our commitment to ensuring every patient who needs

CARVYKTI can access it.”

Regulatory Updates

- The U.S. Food and Drug Administration (FDA) approved CARVYKTI®

for the treatment of adult patients with relapsed or refractory

multiple myeloma who have received at least one prior line of

therapy including a proteasome inhibitor (PI) and an

immunomodulatory agent (IMiD) and are refractory to lenalidomide

following the Oncologic Drug Advisory Committee’s (ODAC) unanimous

(11 to 0) vote recommending the approval of CARVYKTI®.

- The European Commission (EC) granted approval for the label

expansion of CARVYKTI® for the treatment of adult patients with

relapsed and refractory multiple myeloma who have received at least

one prior therapy, including an immunomodulatory agent and a

proteasome inhibitor, have demonstrated disease progression on the

last therapy, and are refractory to lenalidomide.

- The Brazilian Health Regulatory Agency, ANVISA (Agência

Nacional de Vigilância Sanitária), approved CARVYKTI® for the

treatment of adult patients with multiple myeloma, who previously

received a proteasome inhibitor and are refractory to lenalidomide,

as well as adult patients with relapsed or refractory multiple

myeloma, who previously received a proteasome inhibitor, an

immunomodulatory agent and anti-CD38 antibody.

Key Business Developments

- Legend and Johnson & Johnson* entered into a Master

Manufacturing and Supply Services Agreement with Novartis

Pharmaceuticals Corporation to supplement our existing

manufacturing capabilities and increase commercial supply of

CARVYKTI®

- Published inaugural Environmental, Social & Governance

(ESG) report which aligns with the Sustainable Accounting Standards

Board (SASB) Biotechnology and Pharmaceutical sector standards,

shares ESG data collection and disclosure roadmap, and future

growth strategy for good corporate citizenship

* In December 2017, Legend Biotech entered into an exclusive

worldwide collaboration and license agreement with Janssen Biotech,

Inc., a Johnson & Johnson company, to develop and commercialize

cilta-cel (the Janssen Agreement).

First Quarter 2024 Financial Results

- License Revenue: License revenue was $12.2 million for

the first quarter of 2024 and consisted of the recognition of

deferred revenue in connection with the global license agreement

with Novartis Pharma AG to develop, manufacture, and commercialize

LB2102 and other potential CAR-T therapies selectively targeting

DLL3. Legend did not recognize any license revenue for the first

quarter of 2023.

- Collaboration Revenue: Collaboration revenue was $78.5

million for the first quarter of 2024 compared to $36.3 million for

the first quarter of 2023. The increase was primarily due to an

increase in revenue generated from sales of CARVYKTI® in connection

with the Janssen Agreement.

- Collaboration Cost of Revenue: Collaboration cost of

revenue was $49.1 million for the first quarter of 2024 compared to

$35.6 million for the first quarter of 2023. The increase was

primarily due to Legend Biotech’s share of the cost of sales in

connection with CARVYKTI® sales under the Janssen Agreement.

- Cost of License and Other Revenue: Cost of license and

other revenue for the three months ended March 31, 2024 was $5.6

million and consisted of costs in connection with the global

license agreement with Novartis Pharma AG to develop, manufacture,

and commercialize LB2102 and other potential CAR-T therapies

selectively targeting DLL3. The Company did not incur any cost of

license and other revenue for the three months ended March 31,

2023.

- Research and Development Expenses: Research and

development expenses were $101.0 million for the first quarter of

2024 compared to $84.9 million for the first quarter of 2023. The

increase was primarily driven by continuous research and

development activities in cilta-cel, including start up costs for

clinical production in Belgium and continued investment in Legend’s

solid tumor programs.

- Administrative Expenses: Administrative expenses were

$31.9 million for the first quarter of 2024 compared to $22.2

million for the first quarter of 2023. The increase was primarily

due to the expansion of administrative functions and infrastructure

to increase manufacturing capacity.

- Selling and Distribution Expenses: Selling and

distribution expenses were $24.2 million for the first quarter of

2024 compared to $18.0 million for the first quarter of 2023. The

increase was primarily driven by costs associated with commercial

activities for cilta-cel, including the expansion of the sales

force and second line indication launch preparation.

- Net Loss: Net loss was $59.8 million for the first

quarter of 2024, compared to a net loss of $112.1 million for the

first quarter of 2023.

- Cash Position: Cash and cash equivalents, time deposits,

and short-term investments were $1.3 billion as of March 31,

2024.

Webcast/Conference Call Details: Legend Biotech will host

its quarterly earnings call and webcast today at 8:00 am ET. To

access the webcast, please visit this weblink.

A replay of the webcast will be available on Legend Biotech’s

website at

https://investors.legendbiotech.com/events-and-presentations.

About Legend Biotech Legend Biotech is a global

biotechnology company dedicated to treating, and one day curing,

life-threatening diseases. Headquartered in Somerset, New Jersey,

we are developing advanced cell therapies across a diverse array of

technology platforms, including autologous and allogeneic chimeric

antigen receptor T-cell, gamma-delta T cell and natural killer (NK)

cell-based immunotherapy. From our three R&D sites around the

world, we apply these innovative technologies to pursue the

discovery of cutting-edge therapeutics for patients worldwide.

Learn more at https://legendbiotech.com and follow us on X

(formerly Twitter) and LinkedIn.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements in this press release about future expectations, plans,

and prospects, as well as any other statements regarding matters

that are not historical facts, constitute “forward-looking

statements” within the meaning of The Private Securities Litigation

Reform Act of 1995. These statements include, but are not limited

to, statements relating to Legend Biotech’s strategies and

objectives; statements relating to CARVYKTI®, including Legend

Biotech’s expectations for CARVYKTI® and its therapeutic potential;

statements relating to the potential approval of CARVYKTI® for

earlier lines of therapy; statements related to Legend Biotech

manufacturing expectations for CARVYKTI®; and the potential

benefits of Legend Biotech’s product candidates. The words

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intend,” “may,” “plan,” “potential,” “predict,” “project,”

“should,” “target,” “will,” “would” and similar expressions are

intended to identify forward-looking statements, although not all

forward-looking statements contain these identifying words. Actual

results may differ materially from those indicated by such

forward-looking statements as a result of various important

factors. Legend Biotech’s expectations could be affected by, among

other things, uncertainties involved in the development of new

pharmaceutical products; unexpected clinical trial results,

including as a result of additional analysis of existing clinical

data or unexpected new clinical data; unexpected regulatory actions

or delays, including requests for additional safety and/or efficacy

data or analysis of data, or government regulation generally;

unexpected delays as a result of actions undertaken, or failures to

act, by our third party partners; uncertainties arising from

challenges to Legend Biotech’s patent or other proprietary

intellectual property protection, including the uncertainties

involved in the U.S. litigation process; government, industry, and

general product pricing and other political pressures; as well as

the other factors discussed in the “Risk Factors” section of Legend

Biotech’s Annual Report on Form 20-F filed with the Securities and

Exchange Commission on March 19, 2024. Should one or more of these

risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those described in this press release as anticipated,

believed, estimated or expected. Any forward-looking statements

contained in this press release speak only as of the date of this

press release. Legend Biotech specifically disclaims any obligation

to update any forward-looking statement, whether as a result of new

information, future events or otherwise.

LEGEND BIOTECH

CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF PROFIT OR LOSS

Three Months Ended

March 31,

2024

2023

US$’000, except share and per share

data

(Unaudited)

(Unaudited)

REVENUE

License revenue

12,181

—

Collaboration revenue

78,481

36,280

Other revenue

3,329

56

Total revenue

93,991

36,336

Collaboration cost of revenue

(49,101

)

(35,613

)

Cost of license and other revenue

(5,638

)

—

Other income and gains

64,091

8,199

Research and development expenses

(100,964

)

(84,889

)

Administrative expenses

(31,929

)

(22,205

)

Selling and distribution expenses

(24,223

)

(17,954

)

Other expenses

(540

)

(10,734

)

Fair value gain of warrant liability

—

20,000

Finance costs

(5,475

)

(5,113

)

LOSS BEFORE TAX

(59,788

)

(111,973

)

Income tax expense

(5

)

(128

)

LOSS FOR THE PERIOD

(59,793

)

(112,101

)

Attributable to:

Ordinary equity holders of the parent

(59,793

)

(112,101

)

LOSS PER SHARE ATTRIBUTABLE TO ORDINARY

EQUITY HOLDERS OF THE PARENT

Basic

(0.16

)

(0.34

)

Diluted

(0.16

)

(0.34

)

ORDINARY SHARES USED IN LOSS PER SHARE

COMPUTATION

Basic

364,010,429

330,497,072

Diluted

364,010,429

330,497,072

LEGEND BIOTECH

CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF FINANCIAL POSITION

March 31, 2024

December 31, 2023

US$’000

US$’000

(Unaudited)

(Audited)

NON-CURRENT ASSETS

Property, plant and equipment

105,278

108,725

Advance payments for property, plant and

equipment

563

451

Right-of-use assets

80,179

80,502

Time deposits

4,387

4,362

Intangible assets

3,152

4,061

Collaboration prepaid leases

166,344

151,216

Other non-current assets

1,412

1,493

Total non-current assets

361,315

350,810

CURRENT ASSETS

Collaboration inventories

22,146

19,433

Trade receivables

3,307

100,041

Prepayments, other receivables and other

assets

85,603

69,251

Financial assets at fair value through

profit or loss

150,449

663

Pledged deposits

359

357

Time deposits

254,357

30,341

Cash and cash equivalents

897,571

1,277,713

Total current assets

1,413,792

1,497,799

Total assets

1,775,107

1,848,609

CURRENT LIABILITIES

Trade payables

39,485

20,160

Other payables and accruals

136,012

132,802

Government grants

538

68

Lease liabilities

3,116

3,175

Tax payable

7,273

7,203

Contract liabilities

63,251

53,010

Total current liabilities

249,675

216,418

NON-CURRENT LIABILITIES

Collaboration interest-bearing advanced

funding

286,396

281,328

Lease liabilities long term

45,174

44,169

Government grants

6,664

7,305

Contract liabilities

23,109

47,962

Other non-current liabilities

30

56

Total non-current liabilities

361,373

380,820

Total liabilities

611,048

597,238

EQUITY

Share capital

36

36

Reserves

1,164,023

1,251,335

Total ordinary shareholders’ equity

1,164,059

1,251,371

Total equity

1,164,059

1,251,371

Total liabilities and equity

1,775,107

1,848,609

LEGEND BIOTECH

CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOW

Three Months Ended March

31,

US$’000

2024

2023

(Unaudited)

(Unaudited)

LOSS BEFORE TAX

(59,788

)

(111,973

)

CASH FLOWS FROM/ (USED IN) OPERATING

ACTIVITIES

15,518

(139,215

)

CASH FLOWS FROM/ (USED IN) INVESTING

ACTIVITIES

(396,148

)

16,032

CASH FLOWS FROM/ (USED IN) FINANCING

ACTIVITIES

831

(444

)

NET DECREASE IN CASH AND CASH

EQUIVALENTS

(379,799

)

(123,627

)

Effect of foreign exchange rate changes,

net

(343

)

(2,354

)

Cash and cash equivalents at beginning of

the period

1,277,713

786,031

CASH AND CASH EQUIVALENTS AT END OF THE

YEAR

897,571

660,050

ANALYSIS OF BALANCES OF CASH AND CASH

EQUIVALENTS

Cash and bank balances

1,156,674

670,065

Less: Pledged deposits

359

1,283

Time deposits

258,744

8,732

Cash and cash equivalents as stated in the

statement of financial position

897,571

660,050

Cash and cash equivalents as stated in the

statement of cash flows

897,571

660,050

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240513104697/en/

INVESTORS: Jessie Yeung (732) 956-8271

jessie.yeung@legendbiotech.com

PRESS: MaryAnn Ondish (914) 552-4625

media@legendbiotech.com

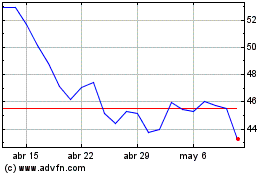

Legend Biotech (NASDAQ:LEGN)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Legend Biotech (NASDAQ:LEGN)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024