As filed with the Securities

and Exchange Commission on November 16, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER THE SECURITIES

ACT OF 1933

LION GROUP HOLDING LTD.

(Exact name of registrant as specified in its charter)

| Cayman Islands | |

Not Applicable |

| (State or other jurisdiction of | |

(I.R.S. Employer |

| incorporation or organization) | |

Identification Number) |

3 Phillip Street, #15-04 Royal Group Building

Singapore 048693

(Address of Principal Executive Offices and Zip

Code)

2023 Share Incentive Plan

(Full title of the plan)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

+1 212-947-7200

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Lawrence Venick, Esq.

Loeb & Loeb LLP

2206-19 Jardine House

1 Connaught Place, Central

Hong Kong SAR

Tel: +852.3923.1111

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | |

Accelerated filer ☐ |

| Non-accelerated filer ☒ | |

Smaller reporting company ☐ |

| | |

Emerging growth company ☒ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item 1. Plan Information*

Item 2. Registrant Information and Employee Plan Annual Information*

| * | Information required by Part I to be contained in the Section

10(a) prospectus is omitted from this registration statement in accordance with Rule 428 under the Securities Act and the Note to Part

I of Form S-8. The documents containing information specified in this Part I will be separately provided to the participants covered

by the 2023 Share Incentive Plan (the “Plan”), as specified by Rule 428(b)(1) under the Securities Act. |

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference

The following documents previously filed by Lion

Group Holding Ltd. (the “Registrant”) with the Securities and Exchange Commission (the “Commission”) are incorporated

by reference herein:

(a) Our annual report on Form 20-F for the fiscal year ended

December 31, 2022 filed with the SEC on April 28, 2023 (File No. 001-39301), or the 2022 Form 20-F;

(b) Our reports of foreign private issuer on Form 6-K filed

with the SEC on January 19, 2023,

February 14, 2023, April

11, 2023, September 1, 2023,

September 5, 2023, September

6, 2023, September 11, 2023,

September 27, 2023, October

2, 2023, October 6, 2023,

and November 3, 2023;

(c) The description of the securities contained in our registration

statement on Form 8-A filed on May 28, 2020 pursuant to Section 12 of the Exchange Act, together with all amendments and reports filed

for the purpose of updating that description.

All documents subsequently filed by the Registrant

pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), after

the date of this registration statement and prior to the filing of a post-effective amendment to this registration statement which indicates

that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated

by reference in this registration statement and to be part hereof from the date of filing of such documents. Any statement in a document

incorporated or deemed to be incorporated by reference in this registration statement will be deemed to be modified or superseded to the

extent that a statement contained in this registration statement or in any other later filed document that also is or is deemed to be

incorporated by reference modifies or supersedes such statement. Any such statement so modified or superseded will not be deemed, except

as so modified or superseded, to be a part of this registration statement.

Item 4. Description of Securities

Description of Class B Ordinary Shares

The Registrant has two classes of ordinary shares,

the Class A ordinary shares and the Class B ordinary shares. The Class A ordinary shares are registered under Section 12 of the Exchange

Act and the American depositary shares representing Class A ordinary shares are listed on the Nasdaq Capital Market under the symbol “LGHL.”

The Class B ordinary shares are not publicly traded

and are not registered under Section 12 of the Exchange Act. The Class A ordinary shares and Class B ordinary shares differ only with

respect to voting rights and conversion rights, which are discussed below. The following is a description of the Class B ordinary shares.

Voting Rights

Holders of Class A ordinary shares and Class B

ordinary shares will at all times vote together as one class on all resolutions submitted to a vote by the shareholders. Each Class A

ordinary share is entitled to one vote on all matters subject to vote at general meetings of the Registrant, and each Class B ordinary

share is entitled to one hundred votes on all matters subject to vote at general meetings of the Registrant.

An ordinary resolution to be passed by the shareholders

requires the affirmative vote of a simple majority of votes attached to the ordinary shares cast in a general meeting, while a special

resolution requires the affirmative vote of no less than two-thirds of votes cast attached to the ordinary shares. Both ordinary resolutions

and special resolutions may also be passed by a unanimous written resolution signed by all the shareholders of the Registrant, as permitted

by the Companies Law (As Revised) of the Cayman Islands, or the Companies Law, and the amended and restated memorandum and articles of

association of the Registrant, as amended, or the M&AA. A special resolution will be required for important matters such as a change

of name or making changes to the M&AA.

Dividend Rights

The holders of both Class A ordinary shares and

Class B ordinary shares are entitled to such dividends as may be declared by the board of directors (provided always that dividends may

be declared and paid only out of funds legally available therefor, namely out of either profit or the share premium account).

Conversion Rights

Class B ordinary shares may be converted into

the same number of Class A ordinary shares by the holders thereof at any time, while Class A ordinary shares cannot be converted into

Class B ordinary shares under any circumstances.

Upon any sale, transfer, assignment or disposition

of any Class B ordinary share by a shareholder of the Registrant (a) to any person who is not an affiliate of such shareholder, or (b)

to any person who is a competitor of the Registrant (as determined in accordance with the M&AA) in one or more privately negotiated

transactions, such Class B ordinary share will be automatically and immediately converted into one Class A ordinary share.

However, the following will not be deemed to be

a sale, transfer, assignment or disposition of Class B ordinary shares: the creation of any pledge, charge, encumbrance or other third

party right on any Class B ordinary shares to secure a holder’s contractual or legal obligations, unless and until any such pledge,

charge, encumbrance or third party right is enforced and results in the third party holding fee simple ownership interest to the related

Class B ordinary shares, in which case all the related Class B ordinary shares will be automatically converted into the same number of

Class A ordinary shares.

Liquidation Rights

On a winding up of the Registrant, assets available

for distribution among the holders of ordinary shares will be distributed among the holders of the Class A and Class B ordinary shares

on a pro rata basis. If the assets available for distribution are insufficient to repay all of the paid-up capital, the assets will be

distributed so that the losses are borne by the shareholders proportionately. The Registrant is a “limited liability” company

incorporated under the Companies Law, and under the Companies Law, the liability of the shareholders is limited to the amount, if any,

unpaid on the shares respectively held by them. The M&AA contains a declaration that the liability of its shareholders is so limited.

Miscellaneous

Holders of Class A ordinary shares and Class B

ordinary shares do not have any pre-emptive rights, other subscription rights, redemption rights or sinking fund rights.

There is no classification of the board of directors,

and there is no cumulative voting by shareholders of any class or series in the election of directors of the Registrant.

Provisions of M&AA Affecting Changes in

Control

Dual Class Structure

The Registrant has two classes of ordinary shares,

Class A ordinary shares and Class B ordinary shares. Each Class B ordinary share entitles the holder of record to one hundred votes for

each share held, while each Class A ordinary share entitles the record holder to only one vote per share.

The Registrant’s dual class share structure

has essentially prevented, or made highly unlikely, any action requiring shareholder approval that certain holders of Class B ordinary

shares do not support, including actions that may have effected a change in control of the Registrant.

Foreign Restrictions on Holding of Class B

Ordinary Shares

The Registrant is an exempted company limited

by shares incorporated under the laws of the Cayman Islands. The Cayman Islands currently levies no taxes on individuals or corporations

based upon profits, income, gains or appreciation and there is no taxation in the nature of inheritance tax or estate duty. There are

no other taxes likely to be material to the Registrant levied by the government of the Cayman Islands except for stamp duties which may

be applicable on instruments executed in, or after execution brought within the jurisdiction of, the Cayman Islands. There are no exchange

control regulations or currency restrictions in the Cayman Islands. Additionally, upon payments of dividends by the Registrant to its

shareholders, no Cayman Islands withholding tax will be imposed.

There are no limitations on the right of non-resident

or foreign owners to hold or vote Class B ordinary shares imposed by the laws of the Cayman Islands or by the M&AA of the Registrant.

The Cayman Islands is not a party to any double

tax treaties which are applicable to any payments made by or to the Registrant.

Item 5. Interests of Named Experts and Counsel

Not applicable.

Item 6. Indemnification of Directors and Officers

Cayman Islands law does not limit the extent to

which a company’s articles of association may provide for indemnification of directors and officers, except to the extent any such

provision may be held by the Cayman Islands courts to be contrary to public policy, such as to provide indemnification against civil fraud

or the consequences of committing a crime. The M&AA provide that the Registrant shall indemnify each of its directors and officers

against all actions, proceedings, costs, charges, expenses, losses, damages or liabilities incurred or sustained by such director or officer,

other than by reason of such person’s own dishonesty, wilful default or fraud, in or about the conduct of the Registrant’s

business or affairs (including as a result of any mistake of judgment) or in the execution or discharge of his duties, powers, authorities

or discretions, including without prejudice to the generality of the foregoing, any costs, expenses, losses or liabilities incurred by

such director or officer in defending (whether successfully or otherwise) any civil proceedings concerning the Registrant or its affairs

in any court whether in the Cayman Islands or elsewhere.

Pursuant to the indemnification agreement, the

form of which was filed as Exhibit 10.26 to the Registrant’s Amendment No. 3 to Form F-4, as amended (File No. 333-237336), the

Registrant has agreed to indemnify its directors and officers against certain liabilities and expenses incurred by such persons in connection

with claims made by reason of their being directors or officers of the Registrant.

Insofar as indemnification for liabilities arising

under the Securities Act may be permitted to directors, officers or persons controlling the Registrant pursuant to the foregoing provisions,

the Registrant has been informed that in the opinion of the Commission such indemnification is against public policy as expressed in the

Securities Act and is therefore unenforceable.

The Registrant also maintains a directors and

officers liability insurance policy for its directors and officers.

Item 7. Exemption from Registration Claimed

Not applicable.

Item 8. Exhibits

See the Index to Exhibits attached hereto.

Item 9. Undertakings

| (a) | The undersigned Registrant hereby undertakes: |

| (1) | To file, during any period in which offers or sales are being

made, a post-effective amendment to this registration statement: |

| (i) | to include any prospectus required by Section 10(a)(3) of the

Securities Act; |

| (ii) | to reflect in the prospectus any facts or events arising after

the effective date of this registration statement (or the most recent post-effective amendment thereof) which, individually or in the

aggregate, represent a fundamental change in the information set forth in this registration statement; and |

| (iii) | to include any material information with respect to the plan

of distribution not previously disclosed in the registration statement or any material change to such information in the registration

statement; |

provided, however, that paragraphs (a)(1)(i)

and (a)(1)(ii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained

in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that

are incorporated by reference in this registration statement;

| (2) | That, for the purpose of determining any liability under the

Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered

therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| (3) | To remove from registration by means of a post-effective amendment

any of the securities being registered which remain unsold at the termination of the offering. |

| (b) | The undersigned Registrant hereby undertakes that, for purposes

of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a)

or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section

15(d) of the Exchange Act) that is incorporated by reference in this registration statement shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof. |

| (c) | Insofar as indemnification for liabilities arising under the

Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions,

or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as

expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities

(other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant

in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection

with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling

precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as

expressed in the Securities Act and will be governed by the final adjudication of such issue. |

EXHIBIT INDEX

| Exhibit Number | |

Description |

| | |

|

| 2.1 | |

Specimen Ordinary Share Certificate of the Registrant (incorporated by reference to Exhibit 4.5 of the Registrant’s Amendment No. 1 to Form F-4 (File No. 237336), filed with the SEC on April 24, 2020) |

| | |

|

| 2.2 | |

Form of Deposit Agreement, by and among Lion Group Holding Ltd., Deutsche Bank Trust Company Americas, as depositary, and all holders and beneficial owners from time to time of ADSs issued thereunder (incorporated by reference to Exhibit (a) of the Registrant’s Registration on Form F-6 (File No. 238516) filed with the SEC on May 20, 2020) |

| | |

|

| 2.3 | |

Amendment No. 1 to the Deposit Agreement dated July 13, 2023 among the Registrant, the depositary and owners and holders of the American depositary shares (incorporated by reference to Exhibit (a)(ii) of the Registrant’s Registration on Form F-6 (File No. 333-273223) filed with the SEC on July 13, 2023) |

| | |

|

| 4.1 | |

Fourth Amended and Restated Memorandum of Association of the Registrant (incorporated by reference to Exhibit 99.1 to the Form 6-K (file no. 001-39301) filed with the Commission on October 6, 2023) |

| | |

|

| 4.2 | |

Third Amended and Restated Articles of Association (incorporated by reference to Exhibit 3.1 of the Registrant’s 6-K, filed with the SEC on January 19, 2023) |

| | |

|

| 5.1* | |

Opinion of Ogier, Cayman Islands counsel to the Registrant, regarding the legality of the Ordinary Shares being registered |

| | |

|

| 10.1 | |

2023 Share Incentive Plan (incorporated by reference to Exhibit 99.1 to the Form 6-K (file no. 001-39301) filed with the Commission on September 11, 2023) |

| | |

|

| 23.1* | |

Consent of UHY LLP |

| | |

|

| 23.3* | |

Consent of Ogier (included in Exhibit 5.1) |

| | |

|

| 24.1* | |

Power of Attorney (included on signature page hereto) |

| | |

|

| 107* | |

Filing Fee Table |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant

certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this

registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Singapore, on November 16, 2023.

| |

Lion Group Holding Ltd. |

| |

|

|

| |

By: |

/s/ Chunning Wang |

| |

|

Name: |

Chunning Wang |

| |

|

Title: |

Director and Chief Executive Officer |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each

person whose signature appears below constitutes and appoints each of Jian Wang and Chunning Wang, his or her true and lawful attorney-in-fact

and agent, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all

capacities, to sign any or all amendments (including post-effective amendments) to this registration statement and any and all related

registration statements pursuant to Rule 462(b) of the Securities Act and to file the same, with all exhibits thereto, and other documents

in connection therewith, with the Securities and Exchange Commission, hereby ratifying and confirming all that said attorneys-in-fact

and agents, or any of them, or their substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended,

this registration statement has been signed by the following persons in the capacities on November 16, 2023.

| Signature |

|

Title |

| |

|

|

| /s/ Jian Wang |

|

Chairman of the Board |

| Name: Jian Wang |

|

|

| |

|

|

| /s/ Chunning Wang |

|

Director and Chief Executive Officer |

| Name: Chunning Wang |

|

(principal executive officer) |

| |

|

|

| /s/ Sze Hau Lee |

|

Chief Financial Officer |

| Name: Sze Hau Lee |

|

(principal financial and accounting officer) |

| |

|

|

| /s/ Yan Zhang |

|

Director and President |

| Name: Yan Zhang |

|

|

| |

|

|

| /s/ Hua Luo |

|

Director and Chief Operating Officer |

| Name: Hua Luo |

|

|

| |

|

|

| /s/ Zhixiang Zhang |

|

Director |

| Name: Zhixiang Zhang |

|

|

| |

|

|

| /s/ Chi Fai Choi |

|

Director |

| Name: Chi Fai Choi |

|

|

| |

|

|

| /s/ Rahul Mewawalla |

|

Director |

| Name: Rahul Mewawalla |

|

|

| |

|

|

| /s/ Tak Wing Lo |

|

Director |

| Name: Tak Wing Lo |

|

|

SIGNATURE OF AUTHORIZED REPRESENTATIVE IN THE

UNITED STATES

Pursuant to the Securities Act of 1933, the undersigned, the duly authorized

representative in the United States of Lion Group Holding Ltd. has signed this registration statement or amendment thereto in New York,

New York on November 16, 2023.

| |

Authorized U.S. Representative |

| |

Cogency Global Inc. |

| |

|

|

| |

By: |

/s/ Collen A. De Vries |

| |

|

Name: Collen A. De Vries |

| |

|

Title: Senior Vice President |

II-8

Exhibit 5.1

| LION GROUP HOLDING LTD. |

D +852 3656 6011 |

| c/o Ogier Global (Cayman) Limited |

E: lin.han@ogier.com |

89 Nexus Way, Camana Bay

Grand Cayman KY1-9009 |

|

| Cayman Islands |

Reference: LHJ/172158.00008 |

| |

|

| |

16 November 2023 |

Dear Sirs

LION GROUP HOLDING LTD. (the

Company)

We have acted as Cayman Islands

counsel to the Company in connection with the Company’s registration statement on Form S-8, including all amendments or supplements

thereto (the Form S- 8), as filed with the United States Securities

and Exchange Commission (the Commission) under the United States

Securities Act of 1933 (as amended, the Act) on or about the date

hereof. The Form S-8 relates to the registration under the Act of 33,818,770 ordinary shares (comprising Class A ordinary shares and/or

Class B ordinary shares), issuable pursuant to the Company’s 2023 Share Incentive Plan as approved by the board of directors of the Company

on October 5, 2023, and by the shareholders of the Company at the annual general meeting of the Company held on October 6, 2023 (the 2023

Share Incentive Plan).

Unless a contrary intention appears,

all capitalised terms used in this opinion have the respective meanings set forth in the Documents (as defined below). A reference to

a Schedule is a reference to a schedule to this opinion and the headings herein are for convenience only and do not affect the construction

of this opinion.

For the purposes of giving this opinion, we have examined

originals, copies, or drafts of the following documents (the Documents):

| (a) | the certificate of incorporation of the Company dated 11 February 2020 issued by the

Registrar of Companies of the Cayman Islands (the Registrar); |

| (b) | the fourth amended and restated memorandum of association of the Company and the third

amended and restated articles of association of the Company adopted by special resolutions dated 6 October 2023 and 21 January 2023, respectively

(respectively, the Memorandum and the Articles); |

| (c) | a certificate of good standing of the Company dated 20 January 2023 (the Good

Standing Certificate) issued by the Registrar in respect of the Company; |

| (d) | a copy of the register of directors of the Company (the ROD); |

| Ogier |

|

|

|

| British Virgin Islands, Cayman Islands, |

|

|

|

| Guernsey, Jersey and Luxembourg practitioners |

|

|

|

| |

|

|

|

| Floor 11 Central Tower |

Partners |

|

|

| 28 Queen’s Road Central |

Nicholas Plowman |

|

|

| Central |

Nathan Powell |

Florence Chan |

|

| Hong Kong |

Anthony Oakes |

Lin Han |

|

| |

Oliver Payne |

Cecilia Li |

|

| T +852 3656 6000 |

Kate Hodson |

Rachel Huang |

|

| F +852 3656 6001 |

David Nelson |

Richard Bennett |

|

| ogier.com |

Michael Snape |

James Bergstrom |

|

| |

Justin Davis |

Marcus Leese |

|

Page 2 of 4

| (f) | a copy of the written resolutions of all the directors of the Company dated October

5, 2023 approving, among other things, the Company’s adoption of 2023 Share Incentive Plan (the Board

Resolutions); |

| (g) | a copy of the minutes of the annual general meeting of the Company held on October

6, 2023 (the AGM) approving, among other things, the Company’s

adoption of 2023 Share Incentive Plan (the Minutes of the AGM,

and together with the Board Resolutions, the Resolutions); |

| (h) | a certificate from a director of the Company dated on or around the date of this opinion

as to certain matters of fact (the Director’s Certificate); and |

| (i) | a copy of the 2023 Share Incentive Plan. |

In giving this opinion we have relied

upon the assumptions set forth in this paragraph 2 without having carried out any independent investigation or verification in respect

of those assumptions:

| (a) | all original documents examined by us are authentic and complete; |

| (b) | all copy documents examined by us (whether in facsimile, electronic or other form)

conform to the originals and those originals are authentic and complete; |

| (c) | all signatures, seals, dates, stamps and markings (whether on original or copy documents)

are genuine; |

| (d) | each of the Good Standing Certificate, the ROD, the Director’s Certificate and the

2023 Share Incentive Plan is accurate, complete and up-to-date (as the case may be) as at the date of this opinion; |

| (e) | the Memorandum and Articles provided to us are in full force and effect and have not

been amended, varied, supplemented or revoked in any respect; |

| (f) | all copies of the Form S-8 are true and correct copies and the Form S-8 conforms in

every material respect to the latest drafts of the same produced to us and, where the Form S-8 has been provided to us in successive drafts

marked to show changes from a previous draft, all such changes have been accurately marked; |

| (g) | the Board Resolutions have been duly passed in accordance with the Company’s articles

of association then in effect and remains in full force and effect; |

| (h) | the resolutions passed at the AGM as documented in the Minutes of the AGM remain in

full force and effect and the AGM referred to in the Minutes of the AGM was properly convened and held in accordance with the Company’s

articles of association then in effect, a quorum was present throughout the AGM and the Minutes of the AGM provided a complete and accurate

record of the proceedings descried therein; |

Page 3 of 4

| (i) | each of the directors of the Company has acted in good faith with a view to the

best interests of the Company and has exercised the standard of care, diligence and skill that is required of him or her in approving

the 2023 Share Incentive Plan and no director has a financial interest in or other relationship to a party of the transactions contemplated

by the 2023 Share Incentive Plan which has not been properly disclosed in the Board Resolutions; |

| (j) | neither the directors and shareholders of the Company have taken any steps to wind

up the Company or to appoint a liquidator of the Company and no receiver has been appointed over any of the Company’s property or

assets; |

| (k) | the maximum number of shares (i.e. 33,818,770 Class A or Class B shares) which the

Company is required to issue under the 2023 Share Incentive Plan to fulfil its obligation (the ESOP

Shares), together with the outstanding and issued shares of the Company, will not exceed the Company’s authorised share capital

then in place and the consideration payable for each ESOP Share shall be no less than the par value of US$0.0001 each; and |

| (l) | there is nothing under any law (other than the laws of the Cayman Islands), that would

or might affect the opinions herein. |

On the basis of the examination

of the Documents and assumptions referred to above and subject to the limitations and qualifications set forth in paragraph 4 below, we

are of the opinion that:

Valid Issuance of ESOP Shares

| (a) | The ESOP Shares to be issued under the 2023 Share Incentive Plan have been duly authorised

by all necessary corporate actions of the Company under the Memorandum and Articles and when: |

| (i) | issued and delivered in accordance with the Memorandum and Articles, the Resolutions

and the terms of the 2023 Share Incentive Plan; and |

| (ii) | the register of members of the Company has been duly updated to reflect the issuance

of the ESOP Shares as fully paid shares, |

will be validly issued, fully paid and non-assessable.

| 4 | Limitations and Qualifications |

| (a) | as to any laws other than the laws of the Cayman Islands, and we have not, for the

purposes of this opinion, made any investigation of the laws of any other jurisdiction, and we express no opinion as to the meaning, validity,

or effect of references in the 2023 Share Incentive Plan to statutes, rules, regulations, codes or judicial authority of any jurisdiction

other than the Cayman Islands; or |

Page 4 of 4

| (b) | except to the extent that this opinion expressly provides otherwise, as to the

commercial terms of, or the validity, enforceability or effect of the Form S-8, the accuracy of representations, the fulfilment of warranties

or conditions, the occurrence of events of default or terminating events or the existence of any conflicts or inconsistencies among the

Form S-8 and any other agreements into which the Company may have entered or any other documents. |

| 4.2 | Under the Companies Act (Revised) (Companies

Act) of the Cayman Islands annual returns in respect of the Company must be filed with the Registrar of Companies in the Cayman

Islands, together with payment of annual filing fees. A failure to file annual returns and pay annual filing fees may result in the Company

being struck off the Register of Companies, following which its assets will vest in the Financial Secretary of the Cayman Islands and

will be subject to disposition or retention for the benefit of the public of the Cayman Islands. |

| 4.3 | In good standing means only that as of the date of the Good Standing Certificate the

Company is up-to-date with the filing of its annual returns and payment of annual fees with the Registrar of Companies. We have made no

enquiries into the Company’s good standing with respect to any filings or payment of fees, or both, that it may be required to make under

the laws of the Cayman Islands other than the Companies Act. |

| 4.4 | In this opinion letter, the phrase “non-assessable” means, with respect

to the issuance of ESOP Shares, that a shareholder shall not, in respect of the relevant ESOP Shares and in the absence of a contractual

arrangement, or an obligation pursuant to the Memorandum and Articles, to the contrary, have any obligation to make further contributions

to the Company’s assets (except in exceptional circumstances, such as involving fraud, the establishment of an agency relationship or

an illegal or improper purpose or other circumstances in which a court may be prepared to pierce or lift the corporate veil). |

| 5 | Governing law of this opinion |

| (a) | governed by, and shall be construed in accordance with, the laws of the Cayman Islands; |

| (b) | limited to the matters expressly stated in it; and |

| (c) | confined to, and given on the basis of, the laws and practice in the Cayman Islands

at the date of this opinion. |

| 5.2 | Unless otherwise indicated, a reference to any specific Cayman Islands legislation

is a reference to that legislation as amended to, and as in force at, the date of this opinion. |

We hereby consent to the filing of this opinion as an exhibit

to the Form S-8.

This opinion may be used only in connection with the Form

S-8 while the 2023 Share Incentive Plan is effective.

Yours faithfully

Exhibit 23.1

Consent of Independent Registered Public Accounting

Firm

We consent to the incorporation by reference in this

Registration Statement on Form S-8 of our report dated April 28, 2023, with respect to our audits of Lion Group Holding Ltd. and its subsidiaries’

consolidated financial statements as of December 31, 2022 and 2021, and for each of the years in the three-year period ended December

31, 2022, which appears in the Annual Report on Form 20-F of the Company for the year ended December 31, 2022.

/s/ UHY LLP

New York, New York

November 16, 2023

Exhibit 107

Calculation of Filing Fee Table

FORM S-8

(Form Type)

Lion Group Holding Ltd.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| Security Type | |

Security Class

Title(1) | |

Fee

Calculation

Rule | |

Amount Registered(2) | |

Proposed Maximum Offering Price Per Unit | | |

Maximum Aggregate Offering Price | | |

Fee Rate | | |

Amount of Registration Fee | |

| Equity | |

Ordinary Shares | |

Rule 457(c) and (h) | |

33,818,770 | (3) |

$ | 1.085 | (3) | |

$ | 36,693,365.45 | | |

$ | 0.00014760 | | |

$ | 5,416 | |

| Total Offering Amounts | |

| | | |

| | | |

| | | |

$ | 5,416 | |

| Total Fees Offsets | |

| | | |

| | | |

| | | |

| — | |

| Net Fee Due | |

| | | |

| | | |

| | | |

$ | 5,416 | |

| (1) | The Class A ordinary shares of Lion Group Holding Ltd. (the

“Registrant”) may be represented by the Registrant’s American depositary shares (“ADSs”), each representing

fifty Class A ordinary shares, par value $0.0001 per share (“Class A Ordinary Shares”). The registrant’s ADSs issuable

upon deposit of the Class A Ordinary Shares have been registered under a separate registration statement on Form F-6 (333- 273223) and/or

Form F-6EF (333-273223). There is no trading market for the Class B ordinary shares, par value $0.0001 per share (“Class B Ordinary

Shares” and, together with the Class A Ordinary Shares, the “Ordinary Shares”). The Class B Ordinary Shares may be

converted into Class A Ordinary Shares according to the terms and provisions of the Registrant’s memorandum and articles of association. |

| (2) | This registration statement covers a maximum aggregate of 33,818,770

shares of Class A Ordinary Shares and Class B Ordinary Shares of the Registrant which are issuable upon exercise of options and pursuant

to other awards granted under the 2023 Share Incentive Plan of the Registrant (the “Plan”). Pursuant to Rule 416(a) under

the Securities Act of 1933, as amended (the “Securities Act”), this registration statement is deemed to cover an indeterminate

number of additional shares which may be offered and issued to prevent dilution resulting from share splits, share dividends or similar

transactions as provided in the Plan. Any Ordinary Shares covered by an award granted under the Plan that lapses for any reason will

be deemed not to have been issued for purposes of determining the maximum aggregate number of Ordinary Shares that may be issued under

the Plan. |

| (3) | Represents Ordinary Shares to be issued pursuant to the Plan. As there is no established public trading

market for the Registrant’s Class B Ordinary Shares, and, in order to trade Class B Ordinary Shares, the shares must be

converted into Class A Ordinary Shares on a one-for-one basis, the Registrant computed the offering price per share for the Ordinary

Shares to be issued pursuant to the Plan by assuming that all such shares will be Class A Ordinary Shares. The proposed maximum

offering price per share, which is estimated solely for the purposes of calculating the registration fee under Rule 457(h) and Rule

457(c) under the Securities Act, is based on US$1.085 per ADS, the average of the high and low prices for the Registrant’s

ADSs as quoted on the Nasdaq Capital Market on October 14, 2023, adjusted for ADS to Class A ordinary share ratio. |

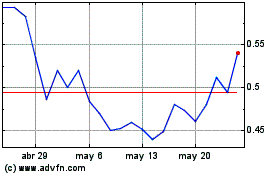

Lion (NASDAQ:LGHL)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Lion (NASDAQ:LGHL)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024