Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

12 Septiembre 2024 - 3:15PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2024

Commission File Number 001-34738

Luokung Technology Corp.

(Translation of registrant’s name into English)

B9-8, Block B, SOHO Phase II, No. 9, Guanghua Road,

Chaoyang District,

Beijing People’s Republic of China 100020

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F þ

Form 40-F ☐

Luokung Technology Corp, a British Virgin Islands company (the “Company”),

furnishes under the cover of Form 6-K the following:

Financial Statements and Exhibits

Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Luokung Technology Corp. |

| |

|

|

| Date: September 12, 2024 |

By |

/s/ Xuesong Song |

| |

|

Xuesong Song |

| |

|

Chief Executive Officer |

| |

|

(Principal Executive Officer) |

2

Exhibit 99.1

Luokung Announces 8-to-1 Share Combination

BEIJING, Sept. 12, 2024 (GLOBE NEWSWIRE) --

Luokung Technology Corp. (NASDAQ: LKCO) (“Luokung,” “we,” “our” or the “Company”), a

British Virgin Islands company, reported that it expects to implement a 8-to-1 share combination on its ordinary shares effective

Tuesday, September 17, 2024, with trading to begin on a split-adjusted basis at the market open on that day. Trading in the ordinary

shares will continue on the Nasdaq Capital Market under the symbol “LKCO”. The new CUSIP number for the ordinary shares

following the share combination is G56981 114.

Upon the effectiveness of the share combination,

every 8 shares of the Company’s issued and outstanding ordinary shares will automatically be combined into one issued and outstanding

ordinary share. No fractional shares will be issued as a result of the share combination. Instead, any fractional shares that would have

resulted from the split will be rounded up to the next whole number. The share combination affects all shareholders uniformly and will

not alter any shareholder’s percentage interest in the Company’s outstanding ordinary shares, except for adjustments that

may result from the treatment of fractional shares. The par value per share after the share combination will be $0.0001 while the total

authorized ordinary shares of the Company will remain at 1 billion shares, as per the separate resolutions approved by the Company’s

board of directors at the same time.

The share combination

at a ratio of 8-to-1 shares was approved by the Company’s board of directors. No approval from its members is required pursuant

to the Company’s Amended and Restated Memorandum and Articles of Association (the “M&A”). The Company is to file

a further restated and amended M&A with the British Virgin Islands Registry of Corporate Affairs to reflect the share combination.

About Luokung Technology Corp.

Luokung Technology Corp.

is a leading spatial-temporal intelligent big data services company, as well as a leading provider of LBS for various industries in China.

Backed by its proprietary technologies and expertise in multi-sourced intelligent spatial-temporal big data, Luokung has established city-level

and industry-level holographic spatial-temporal digital twin systems and actively serves industries including smart transportation (autonomous

driving, smart highway and vehicle-road collaboration), natural resource asset management (carbon neutral and environmental protection

remote sensing data service), and LBS smart industry applications (mobile Internet LBS, smart travel, smart logistics, new infrastructure,

smart cities, emergency rescue, among others). The Company routinely provides important updates on its website: https://www.luokung.com.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This press release contains

certain forward-looking statements. Forward-looking statements include, but are not limited to, statements regarding our or our management’s

expectations, hopes, beliefs, intentions or strategies regarding the future and other statements that are other than statements of historical

fact. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including

any underlying assumptions, are forward-looking statements. The words “anticipate”, “believe”, “continue”,

“could”, “estimate”, “expect”, “intend”, “may”, “might”, “plan”,

“probable”, “potential”, “should”, “would” and similar expressions may identify forward-looking

statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements

in this press release are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without

limitation, management’s examination and analysis of the existing law, rules and regulations and other data available from third

parties. Although we believe that these assumptions were reasonable when made, because these assumptions are inherently subject to significant

uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, we cannot assure you the statement

herein will be accurate. As a result, you are cautioned not to rely on any forward-looking statements.

CONTACT:

The Company:

Mr. Jian Zhang

Chief Financial Officer

Tel: +86-10-6506-5217

Email: ir@luokung.com

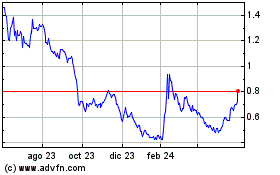

Luokung Technology (NASDAQ:LKCO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

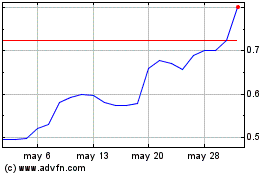

Luokung Technology (NASDAQ:LKCO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025