LeMaitre Q4 2023 Financial Results

27 Febrero 2024 - 3:05PM

LeMaitre (Nasdaq:LMAT), a provider of vascular devices, implants

and services, today reported Q4 2023 results, announced a

$0.16/share quarterly dividend and provided guidance.

Q4 2023 Financial Results

- Sales $48.9mm, +19% (+14% organic) vs. Q4 2022

- Gross margin 68.1%, +450 bps

- Op. income $10.2mm, +46%

- Op. margin 21%

- Net income $8.5mm, +50%

- Earnings per diluted share $0.38, +49%

- Cash up $8.1mm sequentially to $105.1mm

Bovine patches (+18%), allografts (+52%), valvulotomes (+12%),

carotid shunts (+16%) and distributed porcine patches drove Q4

sales. EMEA sales increased 21%, the Americas 20% and APAC 11%.

The gross margin increased to 68.1% in Q4 (vs. 63.6% in Q4 2022)

driven primarily by average selling price increases, as well as

manufacturing efficiencies.

Operating income of $10.2mm was up 46% vs. Q4 2022. Operating

expenses grew 21% year-over-year due to increased sales

commissions, other compensation and CE-related regulatory

costs.

Chairman/CEO George LeMaitre said, “Our 19% sales growth and

gross margin recovery produced 46% op. income growth in Q4. Full

year 2024 guidance implies an operating margin of 21%, up from 19%

in 2023.”

Business Outlook

|

|

Q1 2024 Guidance |

Full Year 2024 Guidance |

|

Sales |

$50.5mm - $52.9mm(Mid: $51.7mm, +10%, +7% Org.) |

$209.7mm - $214.3mm(Mid: $212.0mm, +10%, +9% Org.) |

|

Gross Margin |

68.5% |

68.0% |

|

Op. Income |

$9.7mm - $11.3mm(Mid: $10.5mm, +33%)(Mid: $10.5mm, +28%

Ex-Special)* |

$43.4mm - $46.5mm(Mid $45.0mm, +22%)(Mid: $45.0mm, +21%,

Ex-Special)* |

|

EPS |

$0.36 - $0.41(Mid: $0.39, +42%)(Mid: $0.39, +37%, Ex-Special)* |

$1.60 - $1.71(Mid: $1.65, +23%)(Mid: 1.65, +22%, Ex-Special)* |

*Special charges in 2023 are related to the St. Etienne factory

closure.

Quarterly Dividend

On February 21, 2024, the Company's Board of Directors

approved a quarterly dividend of $0.16/share of common stock.

The dividend will be paid on March 28, 2024 to

shareholders of record on March 14, 2024.

Share Repurchase Program

On February 21, 2024, the Company's Board of Directors

authorized the repurchase of up to $50.0mm of the Company’s common

stock. The repurchase program may be suspended or discontinued at

any time and will conclude on February 21, 2025, unless extended by

the Board.

Conference Call Reminder

Management will conduct a conference call at 5:00pm

ET today. The conference call will be broadcast live over the

Internet. Individuals interested in listening to the webcast can

log on to the Company's website at www.lemaitre.com/investor.

Access to the live call is available by registering online here.

All registrants will receive dial-in information and a PIN allowing

them to access the live call. The audio webcast can also be

accessed live or via replay through a webcast at

www.lemaitre.com/investor. For individuals unable to join the live

conference call, a replay will be available on the Company's

website. A reconciliation of GAAP to non-GAAP results is

included in the tables attached to this release.

About LeMaitre

LeMaitre is a provider of devices, implants and services

for the treatment of peripheral vascular disease, a condition that

affects more than 200 million people worldwide. The Company

develops, manufactures and markets disposable and implantable

vascular devices to address the needs of its core customer, the

vascular surgeon.

LeMaitre is a registered trademark of LeMaitre Vascular,

Inc. This press release may include other trademarks and trade

names of the Company.

For more information about the Company, please

visit www.lemaitre.com.

Use of Non-GAAP Financial Measures

LeMaitre management believes that in order to better

understand the Company's short- and long-term financial trends,

investors may wish to consider certain non-GAAP financial measures

as a supplement to financial performance measures prepared in

accordance with GAAP. Non-GAAP financial measures are not based on

a comprehensive set of accounting rules or principles and do not

have standardized meanings. These non-GAAP measures result from

facts and circumstances that may vary in frequency and/or impact on

continuing operations. Non-GAAP measures should be considered in

addition to, and not as a substitute for, financial performance

measures in accordance with GAAP. In addition to the description

provided below, reconciliation of GAAP to non-GAAP results is

provided in the financial statement tables included in this press

release.

In this press release, the Company has reported non-GAAP sales

growth percentages after adjusting for the impact of foreign

currency exchange, business development transactions, and/or other

events, including EBITDA. This press release also provides guidance

for operating income and EPS excluding the special charge relating

to the closure of our St. Etienne factory and revenue related the

Aziyo distribution agreement. The Company refers to the calculation

of non-GAAP sales growth percentages as "organic." The Company

analyzes non-GAAP sales on a constant currency basis, net of

acquisitions and other non-recurring events, and the aforementioned

non-GAAP profitability measures to better measure the comparability

of results between periods. Because changes in foreign currency

exchange rates have a non-operating impact on net sales, and

acquisitions, divestitures, product discontinuations, factory

closures, and other strategic transactions are episodic in nature

and are highly variable to the reported sales results, the Company

believes that evaluating growth in sales on a constant currency

basis net of such transactions provides an additional and

meaningful assessment of sales to management. The Company believes

that the presentation of guidance described above for operating

income and EPS provides an alternative and meaningful view of the

Company’s profitability.

Forward-Looking Statements

The Company's current financial results, as discussed in this

release, are preliminary and unaudited, and subject to adjustment.

This press release contains forward-looking statements within the

meaning of the U.S. Private Securities Litigation Reform Act of

1995. Statements in this press release regarding the Company's

business that are not historical facts may be "forward-looking

statements" that involve risks and uncertainties. Forward-looking

statements are based on management's current, preliminary

expectations and are subject to risks and uncertainties that could

cause actual results to differ from the results expected,

including, but not limited to, the status of our global regulatory

approvals and compliance with regulatory requirements to market and

sell our products both in the U.S. and outside of the U.S.; risks

from implementing a new enterprise resource planning system; the

risks from competition from other companies; the risk of

significant fluctuations in our quarterly and annual results due to

numerous factors; the risk that assumptions about the market for

the Company’s products and the productivity of the Company’s direct

sales force and distributors may not be correct; the risk that we

may not be able to maintain our recent levels of profitability; the

risk that the Company may not realize the anticipated benefits of

its strategic activities; risks related to the integration of

acquisition targets; the acceleration or deceleration of product

growth rates; risks related to product demand and market acceptance

of the Company’s products and pricing; the risk that a recall of

our products could result in significant costs or negative

publicity; the risk that the Company is not successful in

transitioning to a direct-selling model in new territories and

other risks and uncertainties included under the heading "Risk

Factors" in our most recent Annual Report on Form 10-K, as updated

by our subsequent filings with the SEC, which are all

available on the Company's investor relations website

at http://www.lemaitre.com and on

the SEC's website at https://www.sec.gov. Undue

reliance should not be placed on forward-looking statements, which

speak only as of the date they are made. The Company undertakes no

obligation to update publicly any forward-looking statements to

reflect new information, events, or circumstances after the date

they were made, or to reflect the occurrence of unanticipated

events.

|

|

|

|

|

|

|

LEMAITRE VASCULAR, INC. (NASDAQ: LMAT) |

|

|

|

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

|

|

|

(amounts in thousands) |

|

|

|

|

| |

|

|

|

|

|

| |

|

|

December 31, 2023 |

|

December 31, 2022 |

| |

|

|

(unaudited) |

|

|

|

Assets |

|

|

|

|

| |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

24,269 |

|

|

$ |

19,134 |

|

| |

Short-term

marketable securities |

|

|

80,805 |

|

|

|

63,557 |

|

| |

Accounts

receivable, net |

|

|

25,064 |

|

|

|

22,040 |

|

| |

Inventory

and other deferred costs |

|

|

58,080 |

|

|

|

50,271 |

|

| |

Prepaid

expenses and other current assets |

|

|

6,380 |

|

|

|

6,731 |

|

|

Total current assets |

|

|

194,598 |

|

|

|

161,733 |

|

| |

|

|

|

|

|

|

Property and equipment, net |

|

|

21,754 |

|

|

|

17,901 |

|

|

Right-of-use leased assets |

|

|

18,027 |

|

|

|

15,634 |

|

|

Goodwill |

|

|

65,945 |

|

|

|

65,945 |

|

|

Other intangibles, net |

|

|

41,711 |

|

|

|

46,527 |

|

|

Deferred tax assets |

|

|

1,003 |

|

|

|

1,745 |

|

|

Other assets |

|

|

3,740 |

|

|

|

991 |

|

| |

|

|

|

|

|

|

Total assets |

|

$ |

346,778 |

|

|

$ |

310,476 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

Liabilities and stockholders' equity |

|

|

|

|

| |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

| |

Accounts

payable |

|

$ |

3,734 |

|

|

$ |

2,903 |

|

| |

Accrued

expenses |

|

|

23,650 |

|

|

|

19,967 |

|

| |

Acquisition-related obligations |

|

|

24 |

|

|

|

573 |

|

| |

Lease

liabilities - short-term |

|

|

2,471 |

|

|

|

1,886 |

|

|

Total current liabilities |

|

|

29,879 |

|

|

|

25,329 |

|

| |

|

|

|

|

|

|

Lease liabilities - long-term |

|

|

16,624 |

|

|

|

14,710 |

|

|

Deferred tax liabilities |

|

|

107 |

|

|

|

69 |

|

|

Other long-term liabilities |

|

|

2,268 |

|

|

|

2,167 |

|

|

Total liabilities |

|

|

48,878 |

|

|

|

42,275 |

|

| |

|

|

|

|

|

|

Stockholders' equity |

|

|

|

|

| |

Common

stock |

|

|

239 |

|

|

|

237 |

|

| |

Additional

paid-in capital |

|

|

200,755 |

|

|

|

189,268 |

|

| |

Retained

earnings |

|

|

115,430 |

|

|

|

97,773 |

|

| |

Accumulated

other comprehensive loss |

|

|

(4,625 |

) |

|

|

(6,031 |

) |

| |

Treasury

stock |

|

|

(13,899 |

) |

|

|

(13,046 |

) |

|

Total stockholders' equity |

|

|

297,900 |

|

|

|

268,201 |

|

| |

|

|

|

|

|

|

Total liabilities and stockholders' equity |

|

$ |

346,778 |

|

|

$ |

310,476 |

|

| |

|

|

|

|

|

| LEMAITRE

VASCULAR, INC. (NASDAQ: LMAT) |

| CONDENSED

CONSOLIDATED STATEMENT OF OPERATIONS |

| (amounts in thousands,

except per share

amounts) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

|

| |

|

For the three months ended |

|

For the year ended |

| |

|

December 31, 2023 |

|

December 31, 2022 |

|

December 31, 2023 |

|

December 31, 2022 |

| |

|

|

|

|

|

|

|

|

|

Net sales |

$ |

48,883 |

|

$ |

40,954 |

|

$ |

193,484 |

|

|

$ |

161,651 |

|

|

Cost of sales |

|

15,618 |

|

|

14,900 |

|

|

66,435 |

|

|

|

56,755 |

|

| |

|

|

|

|

|

|

|

|

|

Gross profit |

|

33,265 |

|

|

26,054 |

|

|

127,049 |

|

|

|

104,896 |

|

| |

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

10,268 |

|

|

8,600 |

|

|

41,054 |

|

|

|

32,921 |

|

| |

General and

administrative |

|

8,440 |

|

|

6,933 |

|

|

31,832 |

|

|

|

28,745 |

|

| |

Research and

development |

|

4,351 |

|

|

3,554 |

|

|

16,966 |

|

|

|

13,294 |

|

| |

Restructuring |

|

- |

|

|

- |

|

|

485 |

|

|

|

3,107 |

|

|

Total operating expenses |

|

23,059 |

|

|

19,087 |

|

|

90,337 |

|

|

|

78,067 |

|

| |

|

|

|

|

|

|

|

|

|

Income from operations |

|

10,206 |

|

|

6,967 |

|

|

36,712 |

|

|

|

26,829 |

|

| |

|

|

|

|

|

|

|

|

|

Other income (expense), net |

|

|

|

|

|

|

|

| |

Interest

income |

|

992 |

|

|

447 |

|

|

3,077 |

|

|

|

986 |

|

| |

Other income

(loss), net |

|

115 |

|

|

384 |

|

|

(314 |

) |

|

|

(325 |

) |

| |

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

11,313 |

|

|

7,798 |

|

|

39,475 |

|

|

|

27,490 |

|

| |

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

2,848 |

|

|

2,171 |

|

|

9,370 |

|

|

|

6,854 |

|

| |

|

|

|

|

|

|

|

|

|

Net income |

$ |

8,465 |

|

$ |

5,627 |

|

$ |

30,105 |

|

|

$ |

20,636 |

|

| |

|

|

|

|

|

|

|

|

|

Earnings per share of common stock |

|

|

|

|

|

|

|

| |

Basic |

$ |

0.38 |

|

$ |

0.26 |

|

$ |

1.36 |

|

|

$ |

0.94 |

|

| |

Diluted |

$ |

0.38 |

|

$ |

0.25 |

|

$ |

1.34 |

|

|

$ |

0.93 |

|

| |

|

|

|

|

|

|

|

|

|

Weighted - average shares outstanding: |

|

|

|

|

|

|

|

| |

Basic |

|

22,278 |

|

|

22,023 |

|

|

22,217 |

|

|

|

21,975 |

|

| |

Diluted |

|

22,459 |

|

|

22,238 |

|

|

22,423 |

|

|

|

22,171 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Cash dividends declared per common share |

$ |

0.140 |

|

$ |

0.125 |

|

$ |

0.560 |

|

|

$ |

0.500 |

|

| |

|

|

|

|

|

|

|

|

| LEMAITRE

VASCULAR, INC. (NASDAQ: LMAT) |

| SELECTED NET

SALES INFORMATION |

| (amounts in

thousands) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three months ended |

|

For the year ended |

| |

|

December 31, 2023 |

|

December 31, 2022 |

|

December 31, 2023 |

|

December 31, 2022 |

| |

|

$ |

|

% |

|

$ |

|

% |

|

$ |

|

% |

|

$ |

|

% |

|

Net Sales by Geography |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Americas |

$ |

32,812 |

|

67 |

% |

|

$ |

27,415 |

|

67 |

% |

|

$ |

130,308 |

|

67 |

% |

|

$ |

109,439 |

|

68 |

% |

| |

Europe, Middle East and Africa |

|

12,920 |

|

26 |

% |

|

|

10,689 |

|

26 |

% |

|

|

51,099 |

|

27 |

% |

|

|

41,854 |

|

26 |

% |

| |

Asia

Pacific |

|

3,151 |

|

7 |

% |

|

|

2,850 |

|

7 |

% |

|

|

12,077 |

|

6 |

% |

|

|

10,358 |

|

6 |

% |

|

Total Net Sales |

$ |

48,883 |

|

100 |

% |

|

$ |

40,954 |

|

100 |

% |

|

$ |

193,484 |

|

100 |

% |

|

$ |

161,651 |

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LEMAITRE

VASCULAR, INC. (NASDAQ: LMAT) |

| NON-GAAP

FINANCIAL MEASURES |

| (amounts in

thousands) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

For the three months ended |

|

For the year ended |

| |

|

|

|

December 31, 2023 |

|

December 31, 2022 |

|

December 31, 2023 |

|

December 31, 2022 |

|

Reconciliation between GAAP and Non-GAAP EBITDA |

|

|

|

|

|

|

|

|

| |

Net income as reported |

|

$ |

8,465 |

|

|

$ |

5,627 |

|

|

$ |

30,105 |

|

|

$ |

20,636 |

|

| |

Interest (income) expense, net |

|

|

(992 |

) |

|

|

(447 |

) |

|

|

(3,077 |

) |

|

|

(986 |

) |

| |

Amortization and depreciation expense |

|

|

2,443 |

|

|

|

2,288 |

|

|

|

9,515 |

|

|

|

9,433 |

|

| |

Provision for income taxes |

|

|

2,848 |

|

|

|

2,171 |

|

|

|

9,370 |

|

|

|

6,854 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

EBITDA |

|

$ |

12,764 |

|

|

$ |

9,639 |

|

|

$ |

45,913 |

|

|

$ |

35,937 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

EBITDA percentage increase (decrease) |

|

|

|

|

32 |

% |

|

|

|

|

28 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| LEMAITRE

VASCULAR, INC. (NASDAQ: LMAT) |

| NON-GAAP

FINANCIAL MEASURES |

| (amounts in

thousands) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

Reconciliation between GAAP and Non-GAAP sales growth: |

|

|

|

|

|

|

|

| |

For the three months ended December 31, 2023 |

|

|

|

|

|

|

|

|

|

|

Net sales as reported |

|

$ |

48,883 |

|

|

|

|

|

|

| |

|

Net

distribution sales |

|

|

(1,479 |

) |

|

|

|

|

|

| |

|

Impact of

currency exchange rate fluctuations |

|

|

(556 |

) |

|

|

|

|

|

| |

|

Adjusted net sales |

|

|

|

$ |

46,848 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

For the three months ended December 31, 2022 |

|

|

|

|

|

|

|

| |

|

Net sales as

reported |

|

$ |

40,954 |

|

|

|

|

|

|

| |

|

Adjusted net sales |

|

|

|

$ |

40,954 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Adjusted net sales increase for the three months ended December 31,

2023 |

|

$ |

5,894 |

|

14 |

% |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Reconciliation between GAAP and Non-GAAP projected sales

growth: |

|

|

|

|

|

|

|

| |

For the three months ending March 31, 2024 |

|

|

|

|

|

|

|

| |

|

Net sales

per guidance (midpoint) |

|

$ |

51,722 |

|

|

|

|

|

|

| |

|

Net

distribution sales |

|

|

(1,247 |

) |

|

|

|

|

|

| |

|

Impact of

currency exchange rate fluctuations |

|

|

(35 |

) |

|

|

|

|

|

| |

|

Adjusted projected net sales |

|

|

|

$ |

50,440 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

For the three months ended March 31, 2023 |

|

|

|

|

|

|

|

| |

|

Net sales as

reported |

|

$ |

47,075 |

|

|

|

|

|

|

| |

|

Adjusted net sales |

|

|

|

$ |

47,075 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Adjusted projected net sales increase for the three months ending

March 31, 2024 |

|

$ |

3,365 |

|

7 |

% |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Reconciliation between GAAP and Non-GAAP projected sales

growth: |

|

|

|

|

|

|

|

| |

For the year ending December 31, 2024 |

|

|

|

|

|

|

|

| |

|

Net sales

per guidance (midpoint) |

|

$ |

212,000 |

|

|

|

|

|

|

| |

|

Net

distribution sales |

|

|

(1,574 |

) |

|

|

|

|

|

| |

|

Impact of

currency exchange rate fluctuations |

|

|

133 |

|

|

|

|

|

|

| |

|

Adjusted projected net sales |

|

|

|

$ |

210,559 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

For the year ended December 31, 2023 |

|

|

|

|

|

|

|

| |

|

Net sales as

reported |

|

$ |

193,484 |

|

|

|

|

|

|

| |

|

Adjusted net sales |

|

|

|

$ |

193,484 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Adjusted projected net sales increase for the year ending December

31, 2024 |

|

$ |

17,075 |

|

9 |

% |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Reconciliation between GAAP and Non-GAAP projected operating

income: |

|

|

|

|

|

|

| |

For the three months ending March 31, 2024 |

|

|

|

|

|

|

|

| |

|

Operating

income per guidance (midpoint) |

|

$ |

10,490 |

|

|

|

|

|

|

| |

|

Adjusted projected operating income |

|

|

|

$ |

10,490 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

For the three months ended March 31, 2023 |

|

|

|

|

|

|

|

| |

|

Operating

income as reported |

|

$ |

7,874 |

|

|

|

|

|

|

| |

|

Impact of

special charge |

|

|

305 |

|

|

|

|

|

|

| |

|

Adjusted operating income |

|

|

|

$ |

8,179 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Adjusted projected operating income increase for the three months

ending March 31, 2024 |

|

$ |

2,311 |

|

28 |

% |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Reconciliation between GAAP and Non-GAAP projected operating

income: |

|

|

|

|

|

|

| |

For the year ending December, 2024 |

|

|

|

|

|

|

|

| |

|

Operating

income per guidance (midpoint) |

|

$ |

44,955 |

|

|

|

|

|

|

| |

|

Adjusted projected operating income |

|

|

|

$ |

44,955 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

For the year ended December 31, 2023 |

|

|

|

|

|

|

|

| |

|

Operating

income as reported |

|

$ |

36,712 |

|

|

|

|

|

|

| |

|

Impact of

special charge |

|

|

485 |

|

|

|

|

|

|

| |

|

Adjusted operating income |

|

|

|

$ |

37,197 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Adjusted projected operating income increase for the year ending

December 31, 2024 |

|

$ |

7,758 |

|

21 |

% |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Reconciliation between GAAP and Non-GAAP projected EPS: |

|

|

|

|

|

|

|

| |

For the three months ending March 31, 2024 |

|

|

|

|

|

|

|

| |

|

EPS per

guidance (midpoint) |

|

$ |

0.39 |

|

|

|

|

|

|

| |

|

Adjusted EPS |

|

|

|

$ |

0.39 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

For the three months ended March 31, 2023 |

|

|

|

|

|

|

|

| |

|

EPS as

reported |

|

$ |

0.27 |

|

|

|

|

|

|

| |

|

Impact of

special charge, including tax |

|

|

0.01 |

|

|

|

|

|

|

| |

|

Adjusted EPS |

|

|

|

$ |

0.28 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Adjusted projected EPS increase for the three months ending March

31, 2024 |

|

$ |

0.11 |

|

37 |

% |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Reconciliation between GAAP and Non-GAAP projected EPS: |

|

|

|

|

|

|

|

| |

For the year ending December 31, 2024 |

|

|

|

|

|

|

|

| |

|

EPS per

guidance (midpoint) |

|

$ |

1.65 |

|

|

|

|

|

|

| |

|

Adjusted EPS |

|

|

|

$ |

1.65 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

For the year ended December 31, 2023 |

|

|

|

|

|

|

|

| |

|

EPS as

reported |

|

$ |

1.34 |

|

|

|

|

|

|

| |

|

Impact of

special charge, including tax |

|

|

0.01 |

|

|

|

|

|

|

| |

|

Adjusted EPS |

|

|

|

$ |

1.35 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Adjusted projected EPS increase for the year ending December 31,

2024 |

|

$ |

0.30 |

|

22 |

% |

| |

|

|

|

|

|

|

|

|

|

CONTACT:

J.J. Pellegrino, CFO, LeMaitre

781-425-1691

jjpellegrino@lemaitre.com

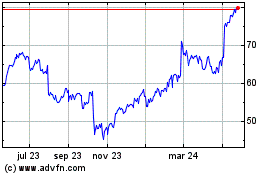

LeMaitre Vascular (NASDAQ:LMAT)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

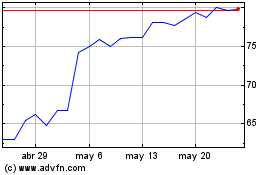

LeMaitre Vascular (NASDAQ:LMAT)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025