LeMaitre Vascular Announces Proposed Convertible Senior Notes Offering

16 Diciembre 2024 - 6:57AM

LeMaitre Vascular, Inc. (“LeMaitre”) (Nasdaq: LMAT) today announced

its intention to offer, subject to market and other conditions,

$150,000,000 aggregate principal amount of Convertible Senior Notes

due 2030 (the “notes”) in a private offering (the “offering”) to

qualified institutional buyers pursuant to Rule 144A under the

Securities Act of 1933, as amended (the “Securities Act”). LeMaitre

also expects to grant the initial purchasers of the notes an option

to purchase, for settlement within a period of 13 days from, and

including, the date the notes are first issued, up to an additional

$22,500,000 aggregate principal amount of notes.

The notes will be senior, unsecured obligations

of LeMaitre, will accrue interest payable semi-annually in arrears,

and will mature on February 1, 2030, unless earlier repurchased,

redeemed or converted. Noteholders will have the right to convert

their notes in certain circumstances and during specified periods

into cash, shares of LeMaitre’s common stock, or a combination of

cash and shares of LeMaitre’s common stock, at LeMaitre’s election.

The notes will be redeemable, in whole or in part (subject to

certain limitations on partial redemptions), for cash at LeMaitre’s

option at any time, and from time to time, on or after February 5,

2028 and on or before the 40th scheduled trading day immediately

before the maturity date, but only if the last reported sale price

per share of LeMaitre’s common stock exceeds 130% of the conversion

price for a specified period of time and certain other conditions

are satisfied. The redemption price will be equal to the principal

amount of the notes to be redeemed, plus accrued and unpaid

interest, if any, to, but excluding, the redemption date. If

certain corporate events that constitute a “fundamental change”

occur, then noteholders may require LeMaitre to repurchase their

notes for cash. The repurchase price will be equal to the principal

amount of the notes to be repurchased, plus accrued and unpaid

interest, if any, to, but excluding, the applicable repurchase

date. The final terms of the notes, including the initial

conversion price, interest rate and certain other terms of the

notes, will be determined at the time of pricing.

LeMaitre intends to use the net proceeds from

the offering, including the purchase of additional notes, for

working capital and other general purposes, which may include

acquisitions of or investments in complementary companies, product

lines, products or technologies.

The notes will be sold only to persons

reasonably believed to be qualified institutional buyers pursuant

to Rule 144A under the Securities Act. The offer and sale of the

notes and any shares of common stock issuable upon conversion of

the notes have not been, and will not be, registered under the

Securities Act or any other securities laws, and unless so

registered, the notes and any such shares cannot be offered or sold

except pursuant to an applicable exemption from, or in a

transaction not subject to, such registration requirements of the

Securities Act and any other applicable securities laws. This press

release does not constitute an offer to sell, or the solicitation

of an offer to buy, the notes or any shares of common stock

issuable upon conversion of the notes, nor will there be any offer

or sale of the notes or any such shares, in any state or other

jurisdiction in which such offer, sale or solicitation would be

unlawful.

About LeMaitre

LeMaitre (Nasdaq: LMAT) is a provider of

devices, implants and services for the treatment of peripheral

vascular disease, a condition that affects more than 200 million

people worldwide. LeMaitre develops, manufactures and markets

disposable and implantable vascular devices to address the needs of

its core customer, the vascular surgeon.

Cautionary Note Regarding

Forward-Looking Statements

This press release includes forward-looking

statements, including, among other things, statements regarding the

completion, timing and size of the proposed offering, the terms of

the notes and the expected use of proceeds. In addition, other

written or oral statements that constitute forward-looking

statements may be made by LeMaitre or on its behalf. Words such as

“expect,” “anticipate,” “intend,” “plan,” “believe,” “could,”

“estimate,” “may,” “target,” “project,” “is intended to,”

“project,” “guidance,” “likely,” “usually,” or variations of such

words and similar expressions are intended to identify such

forward-looking statements. Forward-looking statements represent

the current expectations of LeMaitre regarding future events and

are subject to known and unknown risks and uncertainties that could

cause actual results to differ materially from those implied by the

forward-looking statements. Among those risks and uncertainties are

(i) the risk that the offering will not be consummated, (ii)

changes as a result of market conditions, including market interest

rates, (iii) fluctuations in the trading price and volatility of

LeMaitre’s common stock, (iv) unanticipated uses of capital, (v)

the impact of general economic, industry or political conditions in

the United States or internationally, and (vi) risks relating to

LeMaitre’s business, including those described in LeMaitre’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2023 and

other filings with the U.S. Securities and Exchange Commission. The

forward-looking statements included in this press release speak

only as of the date of this press release, and LeMaitre does not

undertake to update the statements included in this press release

for subsequent developments, except as may be required by law.

Contact:

Gregory Manker

Director, Business Development & Investor Relations

LeMaitre Vascular, Inc.

+ 1-781-362-1260

gmanker@lemaitre.com

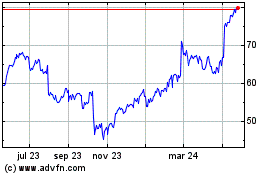

LeMaitre Vascular (NASDAQ:LMAT)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

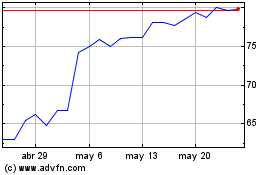

LeMaitre Vascular (NASDAQ:LMAT)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025