Interstate Power and Light Company Prices Debt Offering

05 Septiembre 2024 - 8:08AM

Business Wire

$350 million in senior debentures will be due in 2034 and

$300 million in senior debentures will be due in 2054

Interstate Power and Light Company (“IPL”), a wholly owned

subsidiary of Alliant Energy Corporation (NASDAQ: LNT), announced

the pricing of its public offering of $350 million aggregate

principal amount of 4.950% senior debentures due 2034 and $300

million aggregate principal amount of 5.450% senior debentures due

2054. The 2034 senior debentures will be due on September 30, 2034.

The 2054 senior debentures will be due on September 30, 2054. IPL

intends to use the net proceeds from this offering to retire its

$500 million aggregate principal amount of 3.25% senior debentures

maturing on December 1, 2024 at or prior to maturity and for

general corporate purposes. The closing of the offering is expected

to occur on September 6, 2024, subject to the satisfaction of

customary closing conditions.

The offering was marketed through a group of underwriters

consisting of Barclays Capital Inc., Goldman Sachs & Co. LLC,

J.P. Morgan Securities LLC, and MUFG Securities Americas Inc., as

joint book-running managers, and Academy Securities, Inc., Comerica

Securities, Inc., KeyBanc Capital Markets Inc. and U.S. Bancorp

Investments, Inc. as co-managers.

The offering is being made only by means of a prospectus

supplement and accompanying prospectus which are part of a shelf

registration statement IPL filed with the Securities and Exchange

Commission (the “Commission”). Copies may be obtained by calling

Barclays Capital Inc. toll free at (888) 603-5847, Goldman Sachs

& Co. LLC toll free at 1-866-471-2526, J.P. Morgan Securities

LLC collect at 1-212-834-4533, or MUFG Securities Americas Inc.

toll free at 1-877-649-6848. Electronic copies of these documents

will be available from the Commission’s website at www.sec.gov.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy these securities, nor will there be

any sale of these securities in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Alliant Energy

Alliant Energy Corporation’s Iowa utility subsidiary, Interstate

Power and Light Company (IPL), utilizes the trade name of Alliant

Energy (NASDAQ:LNT). The Iowa utility is based in Cedar Rapids,

Iowa.

Forward-Looking Statements

This press release includes forward-looking statements. These

statements involve inherent risks and uncertainties that could

cause actual results to differ materially from those projected or

anticipated, including risks related to the proposed offering, the

anticipated use of proceeds from the sale of the senior debentures

and other risks outlined in IPL’s public filings with the

Commission, including IPL’s most recent annual report on Form 10-K

and subsequent Quarterly Reports on Form 10-Q. All information

provided in this news release speaks as of the date hereof. Except

as otherwise required by law, IPL undertakes no obligation to

update or revise its forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240905329147/en/

Media Hotline: (608) 458-4040 Investor Relations:

Susan Gille: (608) 458-3956

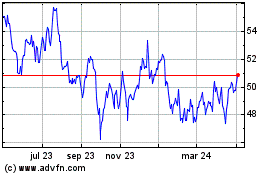

Alliant Energy (NASDAQ:LNT)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

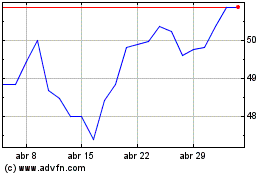

Alliant Energy (NASDAQ:LNT)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025