As

filed with the Securities and Exchange Commission on May 22, 2024

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

MANHATTAN

BRIDGE CAPITAL, INC.

(Exact

Name of Registrant as Specified in Its Charter)

| New

York |

|

11-3474831 |

(State

or other jurisdiction

of incorporation or organization) |

|

(I.R.S.

Employer

Identification No.) |

60

Cutter Mill Road, Suite 205

Great Neck, New York 11201

(516) 444-3400

(Address,

Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Mr.

Assaf Ran

Chief Executive Officer

Manhattan Bridge Capital, Inc.

60 Cutter Mill Road, Suite 205

Great Neck, New York 11201

(516) 444-3400

(Name, address, including zip code, and telephone number,

including

area code, of agent for service)

Copies

to:

Oded

Har-Even, Esq.

Howard

E. Berkenblit, Esq.

Ron

Ben-Bassat, Esq.

Sullivan

& Worcester LLP

1633

Broadway

New

York, NY 10019

Telephone:

(212) 660-3000

Facsimile:

(212) 660-3001

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement, as

determined by the registrant.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box: ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

|

| Non-accelerated

filer ☒ |

|

Smaller

reporting company ☒ |

| Emerging

growth company ☐ |

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

THE

REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE

REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE

IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE

AS THE COMMISSION ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The

information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject

to completion. dated May 22, 2024.

PROSPECTUS

$45,000,000

COMMON

SHARES

PREFERRED

SHARES

WARRANTS

DEBT

SECURITIES

UNITS

We

may from time to time sell common shares, preferred shares, warrants to purchase common shares or preferred shares, debt securities,

and units of such securities, in one or more offerings for an aggregate initial offering price of $45,000,000. We refer to the common

shares, preferred shares, the warrants to purchase common shares or preferred shares, debt securities and the units collectively as the

Securities. This prospectus describes the general manner in which our Securities may be offered using this prospectus. We may sell these

Securities to or through underwriters or dealers, directly to purchasers or through agents. We will set forth the names of any underwriters,

dealers or agents in an accompanying prospectus supplement. You should carefully read this prospectus and any accompanying supplements

before you decide to invest in any of these securities.

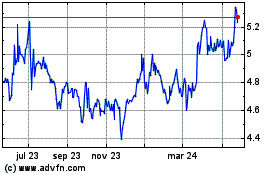

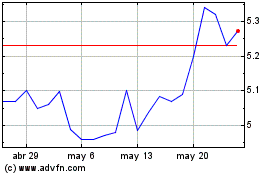

Our

common shares are traded on the Nasdaq Capital Market, or Nasdaq, under the symbol “LOAN.”

As

of May 21, 2024, the aggregate market value of our common shares held by non-affiliates was approximately $46,093,534 based

on a per share price of $5.34, the price at which our common shares were last sold on May 21, 2024. We have not offered

and sold any securities in a primary offering pursuant to Instruction I.B.6 of the General Instructions to Form S-3 during the period

of 12 calendar months immediately prior to and including the date of this prospectus.

Investing

in the securities involves risks. See “Risk Factors” beginning on page 1 of this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is

, 2024.

TABLE

OF CONTENTS

You

should rely only on the information contained in this prospectus, any prospectus supplement, and the documents incorporated by reference,

or to which we have referred you. We have not authorized anyone to provide you with different information. If anyone provides you with

different or inconsistent information, you should not rely on it. This prospectus and any prospectus supplement do not constitute an

offer to sell, or a solicitation of an offer to purchase, the securities offered by this prospectus and any prospectus supplement in

any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer or solicitation of an offer in such jurisdiction.

You should not assume that the information contained in this prospectus, any prospectus supplement or any document incorporated by reference

is accurate as of any date other than the date on the front cover of the applicable document.

Neither

the delivery of this prospectus nor any distribution of securities pursuant to this prospectus shall, under any circumstances, create

any implication that there has been no change in the information set forth or incorporated by reference into this prospectus or in our

affairs since the date of this prospectus. Our business, financial condition, results of operations and prospects may have changed since

such date.

As

used in this prospectus, the terms the “Company,” “we,” “us” and “our” mean Manhattan

Bridge Capital, Inc., unless otherwise indicated.

All

dollar amounts refer to U.S. dollars unless otherwise indicated.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf”

registration process. Under this shelf registration process, we may, from time to time, sell any combination of the Securities described

in this prospectus in one or more offerings up to a total dollar amount of $45,000,000. This prospectus describes the securities we may

offer and the general manner in which our Securities may be offered by this prospectus. Each time we sell securities, we will provide

a prospectus supplement that will contain specific information about the terms of that offering. We may also add, update or change in

the prospectus supplement any of the information contained in this prospectus. To the extent there is a conflict between the information

contained in this prospectus and the prospectus supplement, you should rely on the information in the prospectus supplement, provided

that if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example,

a document incorporated by reference in this prospectus or any prospectus supplement—the statement in the document having the later

date modifies or supersedes the earlier statement.

OUR

COMPANY

This

summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider

in making your investment decision. Before investing in our Securities, you should carefully read this entire prospectus, any prospectus

supplement relating to the offering of any specific Securities, information incorporated herein by reference, our historical financial

statements and the exhibits to the registration statement of which this prospectus is a part.

We

are a New York-based real estate finance company that specializes in originating, servicing and managing a portfolio of first mortgage

loans. We offer short-term, secured, non-banking loans (sometimes referred to as “hard money” loans), which we may renew

or extend on, before or after their initial term expires, to real estate investors to fund their acquisition, renovation, rehabilitation

or improvement of properties located in the New York metropolitan area, including New Jersey and Connecticut, and in Florida. We are

organized and conduct our operations to qualify as a real estate investment trust for federal income tax purposes, or REIT. We have qualified

for taxation as a REIT beginning with our taxable year ended December 31, 2014.

Our

principal executive offices are located at 60 Cutter Mill Road, Suite 205, Great Neck, New York 11021, and our telephone number is (516)

444-3400. The URL for our website is www.manhattanbridgecapital.com. The information contained on or connected to our website

is not incorporated by reference into, and you must not consider the information to be a part of, this prospectus.

RISK

FACTORS

An

investment in our securities involves significant risks. You should carefully consider the risk factors contained in any prospectus supplement

and in our filings with the SEC, including our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as well as all

of the information contained in this prospectus, any prospectus supplement and the documents incorporated by reference herein or therein,

before you decide to invest in our securities. Our business, prospects, financial condition and results of operations may be materially

and adversely affected as a result of any of such risks. The value of our securities could decline as a result of any of these risks.

You could lose all or part of your investment in our securities. Some of our statements in sections entitled “Risk Factors”

are forward-looking statements. The risks and uncertainties we have described are not the only ones we face. Additional risks and

uncertainties not presently known to us or that we currently deem immaterial may also affect our business, prospects, financial condition

and results of operations.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, any prospectus supplement and the documents we incorporate by reference contain forward-looking statements within the meaning

of the federal securities laws regarding our business, financial condition, expenditures, results of operations and prospects. Words

such as “expects,” “anticipates,” “intends,” “plans,” “planned expenditures,”

“believes,” “seeks,” “estimates,” “may,” “will,” “should” or

the negative thereof or other similar expressions or variations of such words are intended to identify forward-looking statements, but

are not deemed to represent an all-inclusive means of identifying forward-looking statements as denoted in this prospectus, any prospectus

supplement and the documents we incorporate by reference. Additionally, statements concerning future matters are forward-looking statements.

Although

forward-looking statements in this prospectus, any prospectus supplement and the documents we incorporate by reference reflect the good

faith judgment of our management, such statements can only be based on facts and factors known by us as of such date. Consequently, forward-looking

statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and

outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in

results and outcomes include, without limitation, those specifically addressed under the heading “Risk Factors” herein

and in the documents we incorporate by reference, as well as those discussed elsewhere in this prospectus and any prospectus supplement.

Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this prospectus,

any prospectus supplement or the respective documents incorporated by reference, as applicable. Except as required by law, we undertake

no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the

date of such forward-looking statements. Readers are urged to carefully review and consider the various disclosures made throughout the

entirety of this prospectus, any prospectus supplement and the documents incorporated by reference, which attempt to advise interested

parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

USE

OF PROCEEDS

Unless

otherwise specified in the applicable prospectus supplement, we intend to use the net proceeds from the sale of the Securities offered

hereby for general corporate purposes and working capital, which may include expanding our portfolio of real estate loans secured by

first mortgage liens, repayment of existing indebtedness and new investment opportunities as suitable opportunities arise. Further details

relating to the use of the net proceeds from any particular offering of Securities will be set forth in the applicable prospectus supplement.

THE

SECURITIES WE MAY OFFER

The

descriptions of the securities contained in this prospectus, together with any applicable prospectus supplement, summarize the material

terms and provisions of the various types of Securities that we may offer. We will describe in any applicable prospectus supplement relating

to any Securities the particular terms of the Securities offered by that prospectus supplement. If we so indicate in any applicable prospectus

supplement, the terms of the Securities may differ from the terms we have summarized below. We may also include in any prospectus supplement

information, where applicable, about material U.S. federal income tax consequences relating to the Securities, and the securities exchange

or market, if any, on which the Securities will be listed.

We

may sell from time to time, in one or more offerings, one or more of the following securities:

| |

● |

common

shares; |

| |

|

|

| |

● |

preferred

shares; |

| |

|

|

| |

● |

warrants

to purchase common shares or preferred shares; |

| |

|

|

| |

● |

debt

securities; or |

| |

|

|

| |

● |

units

of the securities mentioned above. |

The

total initial offering price of all securities that we may issue in these offerings will not exceed $45,000,000.

DESCRIPTION

OF CAPITAL STOCK

The

following description of our common shares is only a summary. This description and the description contained in any prospectus supplement

is subject to, and qualified in its entirety by reference to, our restated certificate of incorporation and bylaws, each as amended,

each of which has previously been filed with the SEC and which we incorporate by reference as exhibits to the registration statement

of which this prospectus is a part, and the New York Business Corporation Law, or the NYBCL. In addition, the specific terms of any series

of preferred shares will be described in the applicable prospectus supplement.

General

Our

authorized capital stock includes 25,000,000 common shares, par value $0.001 per share and 5,000,000 preferred shares, par value $0.01

per share. As of May 21, 2024, there are 11,757,058 common shares issued and 11,438,651

common shares outstanding and no preferred shares issued or outstanding.

Common

Shares

Except

as otherwise required by applicable law and subject to the preferential rights of any outstanding preferred stock, all voting rights

are vested in and exercised by the holders of common shares with each common share being entitled to one vote. In the event of liquidation,

holders of the common shares are entitled to share ratably in the distribution of assets remaining after payment of liabilities, if any.

Holders of the common shares have no cumulative voting rights and no preemptive or other rights to subscribe for shares. Holders of common

shares are entitled to such dividends as may be declared by the board of directors out of funds legally available therefor.

In

order to maintain our qualification for taxation as a REIT, we are required to distribute at least 90% of our REIT taxable income to

our shareholders each year. To the extent we distribute less than 100% of our taxable income to our shareholders (but more than 90%)

we will maintain our qualification for taxation as a REIT, but the undistributed portion will be subject to regular corporate income

taxes. As a REIT, we may also be subject to federal excise taxes and minimum state taxes. We also intend to operate our business in a

manner that will permit us to maintain our exemption from registration under the Investment Company Act of 1940, as amended. In addition,

in order for us to qualify for taxation as a REIT, not more than 50% in value of our outstanding common shares may be owned, directly

or indirectly, by five or fewer individuals (as defined in the Internal Revenue Code of 1986, as amended, or the IRC, to include certain

entities) at any time during the last half of each taxable year, and at least 100 persons must beneficially own our stock during at least

335 days of a taxable year of 12 months, or during a proportionate portion of a shorter taxable year. To help ensure that we meet the

tests, our restated certificate of incorporation restricts the acquisition and ownership of our capital stock. The ownership limitation

is fixed at 4.0% of our outstanding shares of capital stock, by value or number of shares, whichever is more restrictive. Assaf Ran,

our Chief Executive Officer and founder, is exempt from this restriction.

Authorized

but Unissued Capital Stock

New

York law does not require shareholder approval for any issuance of authorized shares, except in certain limited circumstances. However,

the listing requirements of Nasdaq, which would apply for so long as our common shares are listed on one of the Nasdaq exchanges, require

shareholder approval of certain issuances (other than a public offering) equal to or exceeding 20% of the then outstanding voting power

or then outstanding number of shares of common shares, as well as for certain issuances of stock in compensatory transactions. These

additional shares may be used for a variety of corporate purposes, including future public offerings, to raise additional capital or

to facilitate acquisitions. One of the effects of the existence of unissued and unreserved common shares may be to enable our board of

directors to sell shares to persons friendly to current management, for such consideration, in form and amount, as is acceptable to the

board of directors, which issuance could render more difficult or discourage an attempt to obtain control of our company by means of

a merger, tender offer, proxy contest or otherwise, and thereby protect the continuity of our management and possibly deprive shareholders

of opportunities to sell their common shares at prices higher than prevailing market prices.

Blank

Check Preferred Shares

Our

board of directors is empowered, without further action by stockholders, to issue from time to time one or more series of preferred shares,

with such designations, rights, preferences and limitations as the board of directors may determine by resolution. The rights, preferences

and limitations of separate series of preferred shares may differ with respect to such matters among such series as may be determined

by the board of directors, including, without limitation, the rate of dividends, method and nature of payment of dividends, terms of

redemption, amounts payable on liquidation, sinking fund provisions (if any), conversion rights (if any) and voting rights. Certain issuances

of preferred shares may have the effect of delaying or preventing a change in control of our company that some stockholders may believe

is not in their interest.

Transfer

Agent and Registrar

The

transfer agent and registrar for our common shares is American Stock Transfer & Trust Company, LLC.

Listing

Our

common shares are listed on Nasdaq under the symbol “LOAN.”

Anti-Takeover

Effects of Our Restated Certificate of Incorporation and Bylaws

Certain

provisions of our restated certificate of incorporation and bylaws could have the effect of delaying, deterring or preventing another

party from acquiring or seeking to acquire control of the Company. For example, our restated certificate of incorporation and bylaws

include provisions that:

| |

● |

require

the request of holders of a majority of the issued and outstanding shares of the capital stock of the Company entitled to vote at

a meeting, to call a special shareholders’ meeting; |

| |

|

|

| |

● |

allow

the board of directors, subject to a majority vote of the entire Board, to amend or repeal the Company’s bylaws and to adopt

new bylaws; |

| |

|

|

| |

● |

allow

the board of directors to increase or decrease the number of directors comprising the board of directors, as long as the number of

directors constituting the entire Board shall be not less than one nor more than nine directors, and to fill any vacancies on the

board of directors; |

| |

|

|

| |

● |

empower

our Board, without further action by stockholders, to issue from time to time one or more series of preferred shares, with such designations,

rights, preferences and limitations as the Board may determine by resolution. See “Description of Capital Stock – Blank

Check Preferred Shares”; and |

| |

|

|

| |

● |

restrict

persons and entities from beneficially owning more than 4.0%, by value or number of common shares, whichever is more restrictive,

of our aggregate outstanding capital stock, or such other percentage determined by our board of directors, subject to certain exclusions.

See “Restrictions on Ownership of Capital Stock.” |

DESCRIPTION

OF WARRANTS

The

following description, together with the additional information we may include in any applicable prospectus supplement, summarizes the

material terms and provisions of the warrants that we may offer under this prospectus and the related warrant agreements and warrant

certificates. While the terms summarized below will apply generally to any warrants that we may offer, we will describe the particular

terms of any series of warrants (and any securities issuable upon exercise of such warrants) in more detail in the applicable prospectus

supplement. If we so indicate in a prospectus supplement, the terms of any warrants offered under that prospectus supplement may differ

from the terms we describe below. Specific warrant agreements will contain additional important terms and provisions and will be incorporated

by reference as an exhibit to the registration statement.

General

We

may issue warrants for the purchase of common shares or preferred shares in one or more series. We may issue warrants independently or

together with common or preferred shares, and the warrants may be attached to or separate from the common or preferred shares.

We

will evidence each series of warrants by warrant certificates that we will issue under a separate agreement or by warrant agreements

that we will enter into directly with the purchasers of the warrants. If we evidence warrants by warrant certificates, we will enter

into a warrant agreement with a warrant agent. We will indicate the name and address of the warrant agent, if any, in the applicable

prospectus supplement relating to a particular series of warrants.

We

will describe in the applicable prospectus supplement the terms relating to warrants being offered including:

| |

● |

the

offering price and aggregate number of warrants offered; |

| |

|

|

| |

● |

if

applicable, the designation and terms of the securities with which the warrants are issued and the number of warrants issued with

each such security or each principal amount of such security; |

| |

|

|

| |

● |

if

applicable, the date on and after which the warrants and the related securities will be separately transferable; |

| |

|

|

| |

● |

in

the case of warrants to purchase common shares or preferred shares, the number of shares of common shares or preferred shares, as

the case may be, purchasable upon the exercise of one warrant and the price at which these shares may be purchased upon such exercise; |

| |

|

|

| |

● |

the

terms of any rights to redeem or call the warrants; |

| |

|

|

| |

● |

any

provisions for changes to or adjustments in the exercise price or number of securities issuable upon exercise of the warrants; |

| |

|

|

| |

● |

the

dates on which the right to exercise the warrants will commence and expire; |

| |

|

|

| |

● |

the

manner in which the warrant agreements and warrants may be modified; |

| |

|

|

| |

● |

federal

income tax consequences of holding or exercising the warrants, if material; |

| |

|

|

| |

● |

the

terms of the securities issuable upon exercise of the warrants; and |

| |

|

|

| |

● |

any

other specific terms, preferences, rights or limitations of or restrictions on the warrants. |

Before

exercising their warrants, holders of warrants will not have any of the rights of holders of the securities purchasable upon such exercise,

including, in the case of warrants to purchase common shares or preferred shares, the right to receive dividends, if any, or payments

upon our liquidation, dissolution or winding up of our affairs or to exercise voting rights, if any.

Exercise

of Warrants

Each

warrant will entitle the holder to purchase the securities that we specify in the applicable prospectus supplement at the exercise price

that we describe in the applicable prospectus supplement. Unless we otherwise specify in the applicable prospectus supplement, holders

of the warrants may exercise the warrants at any time, up to the specified time on the expiration date that we set forth in the applicable

prospectus supplement. After the close of business on the expiration date, unexercised warrants will become void.

Holders

of the warrants may exercise the warrants by delivering the warrant certificate representing the warrants to be exercised together with

specified information, and paying the required amount to the warrant agent in immediately available funds or such other consideration

as may be permitted, as provided in the applicable prospectus supplement. We intend to set forth in any warrant agreement and in the

applicable prospectus supplement the information that the holder of the warrant will be required to deliver to the warrant agent.

Upon

receipt of the required payment and any warrant certificate or other form required for exercise properly completed and duly executed

at the corporate trust office of the warrant agent or any other office indicated in the applicable prospectus supplement, we will issue

and deliver the securities purchasable upon such exercise. If fewer than all of the warrants represented by the warrant or warrant certificate

are exercised, then we will issue a new warrant or warrant certificate for the remaining amount of warrants. If we so indicate in the

applicable prospectus supplement, holders of the warrants may surrender securities as all or part of the exercise price for warrants.

Enforceability

of Rights by Holders of Warrants

If

we appoint a warrant agent, any warrant agent will act solely as our agent under the applicable warrant agreement and will not assume

any obligation or relationship of agency or trust with any holder of any warrant. A single bank or trust company may act as warrant agent

for more than one issue of warrants. A warrant agent will have no duty or responsibility in case of any default by us under the applicable

warrant agreement or warrant, including any duty or responsibility to initiate any proceedings at law or otherwise, or to make any demand

upon us. Any holder of a warrant may, without the consent of the related warrant agent or the holder of any other warrant, enforce by

appropriate legal action its right to exercise, and receive the securities purchasable upon exercise of, its warrants.

DESCRIPTION

OF DEBT SECURITIES

The

following description of the terms of debt securities that we may issue and the related indenture, if any, is only a summary. This description

and the description contained in any prospectus supplement are subject to and qualified in their entirety by reference to the applicable

indentures, which will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part.

We

may offer secured or unsecured debt securities in one or more series which may be senior, subordinated or junior subordinated, and which

may be convertible or exchangeable into another security. Unless otherwise specified in the applicable prospectus supplement, our debt

securities will be issued in one or more series under an indenture to be entered into by us and a bank or trust company.

The

following description briefly sets forth certain general terms and provisions of the debt securities. The particular terms of the debt

securities offered by any prospectus supplement and the extent, if any, to which these general provisions may apply to the debt securities,

will be described in the applicable prospectus supplement.

The

terms of the debt securities will include those set forth in the applicable indenture and those made a part of the applicable indenture

by the Trust Indenture Act of 1939, or the TIA, if any. You should read this summary, the applicable prospectus supplement and the provisions

of the applicable indenture or supplemental indenture, if any, in their entirety before investing in our debt securities.

The

aggregate principal amount of debt securities that may be issued under the respective indentures may be unlimited. The prospectus supplement

relating to any series of debt securities that we may offer will contain the specific terms of the debt securities. These terms may include

the following:

| |

● |

the

issuer or co-obligors of such debt securities; |

| |

|

|

| |

● |

the

guarantors of each series, if any, and the terms of the guarantees (including provisions relating to seniority, subordination and

release of the guarantees), if any; |

| |

|

|

| |

● |

the

title and aggregate principal amount of the debt securities and any limit on the aggregate principal amount; |

| |

|

|

| |

● |

the

relative ranking and preferences of the debt securities as to dividend rights or to the maintenance of any asset ratio or the creation

or maintenance of reserves; |

| |

|

|

| |

● |

whether

the debt securities will be senior, subordinated or junior subordinated; |

| |

|

|

| |

● |

whether

the debt securities will be secured or unsecured; |

| |

|

|

| |

● |

any

applicable subordination provisions; |

| |

|

|

| |

● |

the

maturity date(s) or method for determining same; |

| |

|

|

| |

● |

the

interest rate(s) or the method for determining same; |

| |

|

|

| |

● |

the

dates on which interest will accrue or the method for determining dates on which interest will accrue and dates on which interest

will be payable and whether interest shall be payable in cash or additional securities; |

| |

|

|

| |

● |

whether

the debt securities are convertible or exchangeable into other securities and any related terms and conditions; |

| |

|

|

| |

● |

redemption

or early repayment provisions; |

| |

|

|

| |

● |

authorized

denominations; |

| |

|

|

| |

● |

if

other than the principal amount, the principal amount of debt securities payable upon acceleration; |

| |

|

|

| |

● |

place(s)

where payment of principal and interest may be made, where debt securities may be presented and where notices or demands upon the

company may be made; |

| |

|

|

| |

● |

whether

such debt securities will be issued in whole or in part in the form of one or more global securities and the date as of which the

securities are dated if other than the date of original issuance; |

| |

|

|

| |

● |

the

amount of discount or premium, if any, with which such debt securities will be issued; |

| |

|

|

| |

● |

any

covenants applicable to the particular debt securities being issued; |

| |

|

|

| |

● |

any

defaults and events of default applicable to the particular debt securities being issued; |

| |

|

|

| |

● |

the

currency, currencies or currency units in which the purchase price for, the principal of and any premium and any interest on, such

debt securities will be payable; |

| |

|

|

| |

● |

the

time period within which, the manner in which and the terms and conditions upon which the holders of the debt securities or the issuer

or co-obligors, as the case may be, can select the payment currency; |

| |

● |

our

obligation or right to redeem, purchase or repay debt securities under a sinking fund, amortization or analogous provision; |

| |

|

|

| |

● |

any

restriction or conditions on the transferability of the debt securities; |

| |

|

|

| |

● |

the

securities exchange(s) on which the debt securities will be listed, if any; |

| |

|

|

| |

● |

whether

any underwriter(s) will act as a market maker(s) for the debt securities; |

| |

|

|

| |

● |

the

extent to which a secondary market for the debt securities is expected to develop; |

| |

|

|

| |

● |

provisions

granting special rights to holders of the debt securities upon occurrence of specified events; |

| |

|

|

| |

● |

compensation

payable to and/or reimbursement of expenses of the trustee of the series of debt securities; |

| |

|

|

| |

● |

provisions

for the defeasance of the debt securities or related to satisfaction and discharge of the indenture; |

| |

|

|

| |

● |

provisions

relating to the modification of the indenture both with and without the consent of holders of debt securities issued under the indenture

and the execution of supplemental indentures for such series; and |

| |

|

|

| |

● |

any

other terms of the debt securities (which terms shall not be inconsistent with the provisions of the TIA, but may modify, amend,

supplement or delete any of the terms of the indenture with respect to such series debt securities). |

General

We

may sell the debt securities, including original issue discount securities, at par or at a substantial discount below their stated principal

amount. Unless we inform you otherwise in a prospectus supplement, we may issue additional debt securities of a particular series without

the consent of the holders of the debt securities of such series or any other series outstanding at the time of issuance. Any such additional

debt securities, together with all other outstanding debt securities of that series, will constitute a single series of securities under

the applicable indenture.

We

will describe in the applicable prospectus supplement any other special considerations for any debt securities we sell which are denominated

in a currency or currency unit other than U.S. dollars. In addition, debt securities may be issued where the amount of principal and/or

interest payable is determined by reference to one or more currency exchange rates, commodity prices, equity indices or other factors.

Holders of such securities may receive a principal amount or a payment of interest that is greater than or less than the amount of principal

or interest otherwise payable on such dates, depending upon the value of the applicable currencies, commodities, equity indices or other

factors. Information as to the methods for determining the amount of principal or interest, if any, payable on any date, the currencies,

commodities, equity indices or other factors to which the amount payable on such date is linked.

United

States federal income tax consequences and special considerations, if any, applicable to any such series will be described in the applicable

prospectus supplement. Unless we inform you otherwise in the applicable prospectus supplement, the debt securities will not be listed

on any securities exchange.

We

expect most debt securities to be issued in fully registered form without coupons and in denominations of $2,000 and any integral multiples

of $1,000 in excess thereof. Subject to the limitations provided in the applicable indenture and in the prospectus supplement, debt securities

that are issued in registered form may be transferred or exchanged at the designated corporate trust office of the trustee, without the

payment of any service charge, other than any tax or other governmental charge payable in connection therewith.

Global

Securities

Unless

we inform you otherwise in the applicable prospectus supplement, the debt securities of a series may be issued in whole or in part in

the form of one or more global securities that will be deposited with, or on behalf of, a depositary identified in the applicable prospectus

supplement. Global securities will be issued in registered form and in either temporary or definitive form. Unless and until it is exchanged

in whole or in part for the individual debt securities, a global security may not be transferred except as a whole by the depositary

for such global security to a nominee of such depositary or by a nominee of such depositary to such depositary or another nominee of

such depositary or by such depositary or any such nominee to a successor of such depositary or a nominee of such successor. The specific

terms of the depositary arrangement with respect to any debt securities of a series and the rights of and limitations upon owners of

beneficial interests in a global security will be described in the applicable prospectus supplement.

Governing

Law

The

indentures and the corresponding debt securities shall be construed in accordance with and governed by the laws of the State of New York.

DESCRIPTION

OF UNITS

We

may issue, in one or more series, units consisting of common shares, preferred shares and/or warrants for the purchase of common shares

and/or preferred shares, in any combination. While the terms we have summarized below will apply generally to any units that we may offer

under this prospectus, we will describe the particular terms of any series of units in more detail in the applicable prospectus supplement.

The terms of any units offered under a prospectus supplement may differ from the terms described below. We will incorporate by reference

as exhibits to the registration statement the form of unit agreement that describes the terms of the series of units we are offering,

and any supplemental agreements, before the issuance of the related series of units. The following summaries of material terms and provisions

of the units are subject to, and qualified in their entirety by reference to, all the provisions of the unit agreement and any supplemental

agreements applicable to a particular series of units. We urge you to read the applicable prospectus supplement related to the particular

series of units that we may offer under this prospectus and the complete unit agreement and any supplemental agreements that contain

the terms of the units.

Each

unit will be issued so that the holder of the unit is also the holder of each security included in the unit. Thus, the holder of a unit

will have the rights and obligations of a holder of each included security. The unit agreement under which a unit is issued may provide

that the securities included in the unit may not be held or transferred separately, at any time or at any time before a specified date.

We

will describe in the applicable prospectus supplement the terms of the series of units, including:

| |

● |

the

designation and terms of the units, including whether and under what circumstances the securities comprising the units may be held

or transferred separately; and |

| |

|

|

| |

● |

any

provisions for the issuance, payment, settlement, transfer or exchange of the units or the securities comprising the units. |

The

provisions described in this section, as well as those described under “Description of Capital Stock,” “Description

of Warrants” and “Description of Debt Securities” will apply to each unit and to any common shares, preferred shares,

debt securities or warrant included in each unit, respectively.

We

may issue units in such amounts and in such distinct series as we determine.

CERTAIN

PROVISIONS OF NEW YORK LAW AND OF OUR RESTATED CERTIFICATE OF INCORPORATION AND BYLAWS

The

following summary of certain provisions of New York law, our restated certificate of incorporation, and our bylaws, as amended, does

not purport to be complete and is subject to and qualified in its entirety by reference to the NYBCL and to our certificate of incorporation

and bylaws. Copies of our certificate of incorporation and bylaws are filed as exhibits to the registration statement of which this prospectus

forms a part. See “Where You Can Find More Information.”

Our

Board of Directors

We

have one class of directors. Each director serves for a one-year term or until his or her successor is elected and qualified. Our bylaws

provide that our board of directors will consist of not less than one and not more than nine directors. At the present time our board

of directors consists of five members.

Election

of Directors; Removals; Vacancies

Directors

are elected by a plurality of all of the votes cast in the election of directors.

Under

our bylaws, a director may be removed for cause by the board of directors or by the shareholders acting by a simple majority.

Our

bylaws provide that vacancies on our board of directors may be filled by the remaining directors, even if the remaining directors do

not constitute a quorum. However, only shareholders can fill a vacancy on our board of directors that is caused by the removal of a director

by action of shareholders. Any director elected to fill a vacancy will serve for the remainder of the full term of the director he or

she is replacing or until his or her successor is duly elected and qualifies.

Meetings

of Shareholders

Our

bylaws provide that a meeting of our shareholders for the election of directors and the transaction of any business will be held annually

on such day during the period from May 1 through October 31, other than a legal holiday and at the time and place set by the board of

directors. Our bylaws provide that a special meeting of shareholders may be called at any time by the president and must be called by

the president at the request in writing of a majority of the directors then in office or at the request in writing filed with our secretary

by the holders of a majority of our issued and outstanding shares of capital stock entitled to vote at such a meeting.

Shareholder

Actions by Written Consent

Under

Section 615 of the NYBCL and our restated certificate of incorporation, shareholder action may be taken without a meeting if a written

consent, setting forth the action so taken, is given by the shareholders entitled to cast not less than the minimum number of votes that

would be necessary to authorize or take such action at a meeting of shareholders.

Amendment

of Certificate of Incorporation and Bylaws

Under

the NYBCL, a New York corporation may amend its certificate of incorporation if such action is declared advisable by the board of directors

and approved by the affirmative vote of shareholders entitled to cast a majority of all of the votes entitled to be cast on the matter.

Our bylaws provide that each of our board of directors and our shareholders has the power to adopt, alter or repeal any provision of

our bylaws and to make new bylaws.

Transactions

Outside the Ordinary Course of Business

Under

the NYBCL, a New York corporation generally may not dissolve, merge or consolidate with another entity, sell all or substantially all

of its assets or engage in a statutory share exchange unless the action is declared advisable by the board of directors and approved

by the affirmative vote of shareholders entitled to cast a majority of the votes entitled to be cast on the matter, unless a greater

percentage is specified in the corporation’s certificate of incorporation. Our restated certificate of incorporation does not provide

for a super majority vote on any matter.

Business

Combinations

Under

the NYBCL, certain “business combinations” (including a merger, consolidation, statutory share exchange and, in certain circumstances

specified in the statute, an asset transfer or issuance or reclassification of equity securities) between a New York corporation and

an “interested shareholder” (defined generally as any person who beneficially owns, directly or indirectly, 20% or more of

the voting power of the corporation’s outstanding voting shares) or an affiliate of such an interested shareholder are prohibited

for five years after the most recent date on which the interested shareholder becomes an interested shareholder. Thereafter, any such

business combination must generally be recommended by the board of directors of the corporation and approved by the affirmative vote

of holders of a majority of the outstanding voting stock of the corporation other than shares held by the interested shareholder with

whom (or with whose affiliate) the business combination is to be effected or held by an affiliate or associate of the interested shareholder,

unless, among other conditions, the corporation’s common shareholders receive a minimum price (as described in the NYBCL) for their

shares and the consideration is received in cash or in the same form as previously paid by the interested shareholder for its shares.

A person is not an interested shareholder under the statute if the board of directors approved in advance the transaction by which the

person otherwise would have become an interested shareholder. A corporation’s board of directors may provide that its approval

is subject to compliance, at or after the time of approval, with any terms and conditions determined by the board of directors.

REIT

Qualification

Our

restated certificate of incorporation provides that our board of directors may authorize us to revoke or otherwise terminate our REIT

election, without approval of our shareholders, if it determines that it is no longer in our best interests to continue to qualify to

be taxed as a REIT.

Limitation

on Directors’ Liability and Indemnification of Directors and Officers

The

NYBCL permits a New York corporation to include in its certificate of incorporation a provision limiting the liability of its directors

to the corporation and its shareholders for money damages, except if a judgment or other final adjudication establishes that (i) the

director’s acts were committed in bad faith, (ii) involved intentional misconduct or a knowing violation of law, (iii) he personally

gained a financial profit or other advantage to which he was not legally entitled or (iv) his act involves (A) the declaration of a dividend

that violated section 510 of the NYBCL; (B) the purchase or redemption of our shares in violation of section 513 of the NYBCL; (C) the

distribution of assets to shareholders after dissolution without paying or adequately providing for the payment of all known liabilities;

and (D) the making of loans to a director in violation of section 714 of the NYBCL.

The

NYBCL permits us to indemnify any present or former director or officer, against judgments, fines, settlements and reasonable expenses

including attorney’s fees actually and necessarily incurred as a result of the action or proceeding, including any appeals, if

such director or officer acted, in good faith, for a purpose which he reasonably believed to be in, or not opposed to, the best interests

of the corporation and, in criminal actions or proceedings, in addition, had no reasonable cause to believe that his conduct was unlawful.

In

addition, the NYBCL permits us to advance reasonable expenses to a director or officer upon our receipt of an undertaking by or on behalf

of such officer or director to repay such amount as, and to the extent, such officer or director is ultimately found not to be entitled

to indemnification or, if entitled to indemnification, to the extent the amount advanced exceeds the indemnification to which such officer

or director is entitled.

Our

restated certificate of incorporation and bylaws obligate us, to the fullest extent permitted by New York law in effect from time to

time, to indemnify, pay or reimburse reasonable expenses in advance of final disposition of a proceeding to any present or former director

or officer who is made or threatened to be made a party to, or witness in, a proceeding by reason of his or her service in that capacity

and any individual who, while a member of our board of directors and at our request as a director, officer, employee or agent of another

corporation or of a partnership, joint venture, trust or other enterprise, including service with respect to employee benefit plans,

whether the basis of such a proceeding is alleged action in an official capacity as a director, officer, employee or agent or in any

other capacity while serving as a director, officer, employee or agent, as authorized by:

| |

● |

the

board of directors, acting by a quorum consisting of directors who are not parties to such action or proceeding upon a finding that

the director or officer has met the standard of conduct set forth in the NYBCL; |

| |

|

|

| |

● |

the

board of directors upon the opinion in writing of independent legal counsel that indemnification is proper in the circumstances because

the applicable standard of conduct set forth in such sections has been met by such director or officer; or |

| |

|

|

| |

● |

the

shareholders upon a finding that the director or officer has met the applicable standard of conduct set forth in such sections. |

The

indemnification and payment or reimbursement of expenses provided by the indemnification provisions of our restated certificate of incorporation

and bylaws are not deemed exclusive of or limit in any way other rights to which any person seeking indemnification or payment or reimbursement

of expenses may be or may become entitled under any statute, bylaw, resolution, insurance, agreement, vote of shareholders or disinterested

directors or otherwise.

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling us

pursuant to the foregoing provisions, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities

Act and is therefore unenforceable.

RESTRICTIONS

ON OWNERSHIP OF CAPITAL STOCK

In

order for us to qualify to be taxed as a REIT under the IRC, shares of our capital stock must be owned by 100 or more persons during

at least 335 days of a taxable year of twelve months or during a proportionate part of a shorter taxable year. Also, not more than 50%

of the value of the outstanding shares of our stock (after taking into account options to acquire shares of stock) may be owned, directly

or indirectly, by five or fewer individuals (as defined in the IRC to include certain entities such as private foundations) during the

last half of a taxable year (other than the first year for which an election to be a REIT has been made). To qualify to be taxed as a

REIT, we must satisfy other requirements as well.

Our

restated certificate of incorporation provides that, subject to the exceptions described below, no person or entity may own, or be deemed

to own, beneficially or by virtue of the applicable constructive ownership provisions of the IRC, more than 4.0%, by value or number

of common shares, whichever is more restrictive, of our aggregate outstanding capital stock, or such other percentage determined by our

board of directors. As such, our board of directors, in its sole and absolute discretion, may exempt, prospectively or retroactively,

a particular shareholder from the ownership limits or establish a different limit on ownership, or the Excepted Holder Limit, if it obtains

representations and undertakings from such shareholders as are reasonably necessary for the board of directors to determine that such

shareholder’s beneficial or constructive ownership of our shares will not result in our being “closely held” under

Section 856(h) of the IRC (without regard to whether the ownership interest is held during the last half of a taxable year) or otherwise

failing to qualify to be taxed as a REIT. Any violation or attempted violation of any such representations or undertakings (or other

action which is contrary to the restrictions contained in our restated certificate of incorporation) will result in such shareholder’s

shares being automatically transferred to a charitable trust. As a condition of granting the waiver or establishing the Excepted Holder

Limit, our board of directors may require an opinion of counsel or a ruling from the Internal Revenue Service, or IRS, in either case

in form and substance satisfactory to our board of directors, in its sole discretion, in order to determine or ensure our status as a

REIT. Notwithstanding the receipt of any ruling or opinion, our board of directors may impose such conditions or restrictions as it deems

appropriate in connection with granting such a waiver or establishing an Excepted Holder Limit.

The

ownership limits described above generally do not apply to Assaf Ran, our current chief executive officer, who, as of May 21, 2024, owns

22.8% of our outstanding common shares. In addition, our board of directors may grant such an exemption to such limitations in its sole

discretion, subject to such conditions, representations and undertakings as it may determine.

We

refer to the person or entity that, but for operation of the ownership limits or another restriction on ownership and transfer of shares

as described below, would beneficially own or constructively own shares of our capital stock in violation of such limits or restrictions

and, if appropriate in the context, a person or entity that would have been the record owner of such shares as a “Prohibited Owner.”

The

constructive ownership rules under the IRC are complex and may cause shares owned beneficially or constructively by a group of related

individuals and/or entities to be deemed owned beneficially or constructively by one individual or entity. As a result, even if a shareholder’s

actual ownership does not exceed the share ownership limits described, on a constructive ownership basis such shareholder may exceed

those limits.

In

connection with granting a waiver of the ownership limits or creating an excepted holder limit or at any other time, our board of directors

may from time to time increase or decrease the common share ownership limit, for all other persons, unless, after giving effect to such

increase, five or fewer individuals could beneficially own, in the aggregate, more than 49.9% in value of our outstanding shares or we

would otherwise fail to qualify to be taxed as a REIT. A reduced ownership limit will not apply to any person or entity whose percentage

ownership of our common shares or our shares of all classes and series, as applicable, is, at the effective time of such reduction, in

excess of such decreased ownership limit until such time as such person’s or entity’s percentage ownership of our common

shares or our shares of all classes and series, as applicable, equals or falls below the decreased ownership limit; provided, however,

any further acquisition of our common shares or shares of all other classes or series, as applicable, will violate the decreased ownership

limit.

Thus,

our restated certificate of incorporation prohibits:

| |

● |

any

person from beneficially or constructively owning, applying certain attribution rules of the IRC, shares of our capital stock that

would result in our being “closely held” under Section 856(h) of the IRC (without regard to whether the ownership interest

is held during the last half of a taxable year) or otherwise cause us to fail to qualify to be taxed as a REIT; |

| |

|

|

| |

● |

any

person from transferring shares of our capital stock if the transfer would result in shares of our capital stock being beneficially

owned by fewer than 100 persons (determined under the principles of Section 856(a)(5) of the IRC); and |

| |

|

|

| |

● |

any

person from beneficially or constructively owning shares of our capital stock to the extent such ownership would result in our failing

to qualify as a “domestically controlled qualified investment entity” within the meaning of Section 897(h)(4)(B) of the

IRC. |

Any

person who acquires or attempts or intends to acquire beneficial or constructive ownership of shares of our capital stock that will or

may violate the ownership limits or any of the other restrictions on ownership and transfer of shares of our capital stock described

above, or who would have owned shares of our stock transferred to the trust as described below, must immediately give notice to us of

such event or, in the case of an attempted or proposed transaction, give us at least 15 days’ prior written notice and provide

us with such other information as we may request in order to determine the effect of such transfer on our status as a REIT. The foregoing

restrictions on ownership and transfer of shares of our capital stock will not apply if our board of directors determines that it is

no longer in our best interests to attempt to qualify, or to continue to qualify, to be taxed as a REIT or that compliance with the restrictions

and limits on ownership and transfer of shares of our capital stock described above is no longer required.

If

any transfer of shares of our capital stock would result in shares of our capital stock being beneficially owned by fewer than 100 persons,

the transfer will be null and void and the intended transferee will acquire no rights in the shares. In addition, if any purported transfer

of shares of our capital stock or any other event would otherwise result in any person violating the ownership limits or an excepted

holder limit established by our board of directors, or in our being “closely held” under Section 856(h) of the IRC (without

regard to whether the ownership interest is held during the last half of a taxable year) or otherwise failing to qualify to be taxed

as a REIT or as a “domestically controlled qualified investment entity” within the meaning of Section 897(h)(4)(B) of the

IRC, then that number of shares (rounded up to the nearest whole share) that would cause the violation will be automatically transferred

to, and held by, a trust for the exclusive benefit of one or more charitable organizations selected by us, and the intended transferee

or other prohibited owner will acquire no rights in the shares. The automatic transfer will be effective as of the close of business

on the business day prior to the date of the violating transfer. If the transfer to the trust as described above is not automatically

effective, for any reason, to prevent a violation of the applicable ownership limits or our being “closely held” under Section

856(h) of the IRC (without regard to whether the ownership interest is held during the last half of a taxable year) or our otherwise

failing to qualify to be taxed as a REIT or as a “domestically controlled qualified investment entity,” then the transfer

of the shares will be null and void and the intended transferee will acquire no rights in such shares.

Shares

of our capital stock held in the trust will be issued and outstanding shares. The prohibited owner will not benefit economically from

ownership of any shares of our capital stock held in the trust and will have no rights to distributions and no rights to vote or other

rights attributable to the shares held in the trust. The trustee of the trust will exercise all voting rights and receive all distributions

with respect to shares held in the trust for the exclusive benefit of the charitable beneficiary of the trust. Any dividend or distribution

made before we discover that the shares have been transferred to a trust as described above must be repaid by the recipient to the trustee

upon demand by us. Subject to New York law, effective as of the date that the shares have been transferred to the trust, the trustee

will have the authority to rescind as void any vote cast by a prohibited owner before our discovery that the shares have been transferred

to the trust and to recast the vote in accordance with the desires of the trustee acting for the benefit of the charitable beneficiary

of the trust. However, if we have already taken irreversible corporate action, then the trustee may not rescind and recast the vote.

Shares

of our capital stock transferred to the trustee are deemed offered for sale to us, or our designee, at a price per share equal to the

lesser of (i) the price paid by the prohibited owner for the shares (or, in the case of a devise or gift, the market price at the time

of such devise or gift) and (ii) the market price on the date we, or our designee, accepts such offer. We may reduce the amount so payable

to the prohibited owner by the amount of any dividend or distribution that we made to the prohibited owner before we discovered that

the shares had been automatically transferred to the trust, and we may pay the amount of any such reduction to the trustee for distribution

to the charitable beneficiary. We have the right to accept such offer until the trustee has sold the shares of our capital stock held

in the trust as discussed below. Upon a sale to us, the interest of the charitable beneficiary in the shares sold terminates, and the

trustee must distribute the net proceeds of the sale to the prohibited owner and must distribute any distributions held by the trustee

with respect to such shares to the charitable beneficiary.

If

we do not buy the shares, the trustee must, within 20 days of receiving notice from us of the transfer of shares to the trust, sell the

shares to a person or entity designated by the trustee who could own the shares without violating the ownership limits or the other restrictions

on ownership and transfer of shares of our capital stock. After the sale of the shares, the interest of the charitable beneficiary in

the shares transferred to the trust will terminate and the trustee must distribute to the prohibited owner an amount equal to the lesser

of (i) the price paid by the prohibited owner for the shares (or, if the prohibited owner did not give value for the shares in connection

with the event causing the shares to be held in the trust (for example, in the case of a gift, devise or other such transaction), the

market price of the shares on the day of the event causing the shares to be held in the trust) and (ii) the price per share received

by the Trustee (net of any commissions and other expenses of sale) received by the trust for the shares. The trustee may reduce the amount

payable to the prohibited owner by the amount of any distribution that we paid to the prohibited owner before we discovered that the

shares had been automatically transferred to the trust and that are then owed by the prohibited owner to the trustee as described above.

Any net sales proceeds in excess of the amount payable to the prohibited owner must be paid immediately to the charitable beneficiary.

In addition, if, prior to the discovery by us that shares have been transferred to a trust, such shares are sold by a prohibited owner,

then such shares will be deemed to have been sold on behalf of the trust and, to the extent that the prohibited owner received an amount

for or in respect of such shares that exceeds the amount that such prohibited owner was entitled to receive, such excess amount will

be paid to the trustee upon demand. The prohibited owner has no rights in the shares held by the trustee.

In

addition, if our board of directors determines that a transfer or other event has occurred that would violate the restrictions on ownership

and transfer of shares of our stock described above, our board of directors may take such action as it deems advisable to refuse to give

effect to or to prevent such transfer, including, but not limited to, causing us to redeem the shares, refusing to give effect to the

transfer on our books or instituting proceedings to enjoin the transfer.

Every

owner of 4% or more (or such lower percentage as required by the IRC or the regulations promulgated thereunder) of our capital stock,

within 30 days after the end of each taxable year, must give us written notice stating the shareholder’s name and address, the

number of shares of each class and series of our capital stock that the shareholder beneficially owns and a description of the manner

in which the shares are held. Each such owner must provide to us such additional information as we may request in order to determine

the effect, if any, of the shareholder’s beneficial ownership on our status as a REIT and to ensure compliance with the ownership

limits. In addition, any person or entity that is a beneficial owner or constructive owner of shares of our capital stock and any person

or entity (including the shareholder of record) who is holding shares of our capital stock for a beneficial owner or constructive owner

must, on request, provide to us such information as we may request in order to determine our status as a REIT and to comply with the

requirements of any taxing authority or governmental authority or to determine such compliance and to ensure compliance with the ownership

limits.

Certificates

or other evidence representing shares of our capital stock will bear a legend referring to the restrictions on ownership and transfer

of shares of our capital stock described above.

The

restrictions on ownership and transfer of shares of our stock described above could delay, defer or prevent a transaction or a change

in control, including one that might involve a premium price for our common shares or otherwise be in the best interests of our shareholders.

MATERIAL

UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

This

section summarizes the material United States federal income tax considerations generally applicable to an investment in common shares

or preferred shares of the Company. Supplemental United States federal income tax considerations relevant to the ownership of the other

securities offered by this prospectus may be provided in the prospectus supplement that relates to those securities. The following summary

of material United States federal income tax considerations is based on existing law and is limited to investors who own our shares as

investment assets rather than as inventory or as property used in a trade or business. The summary does not discuss all of the particular

tax considerations that might be relevant to you if you are subject to special rules under federal income tax law, for example if you

are:

| |

● |

a

bank, insurance company, or other financial institution; |

| |

|

|

| |

● |

a

regulated investment company or REIT; |

| |

|

|

| |

● |

a

subchapter S corporation; |

| |

|

|

| |

● |

a

broker, dealer or trader in securities or foreign currencies; |

| |

|

|

| |

● |

a

person who marks-to-market our shares for U.S. federal income tax purposes; |

| |

|

|

| |

● |

a

U.S. shareholder (as defined below) that has a functional currency other than the U.S. dollar; |

| |

|

|

| |

● |

a

person who acquires or owns our shares in connection with employment or other performance of services; |

| |

|

|

| |

● |

a

person subject to alternative minimum tax; |

| |

|

|

| |

● |

a

person who acquires or owns our shares as part of a straddle, hedging transaction, constructive sale transaction, constructive ownership

transaction or conversion transaction, or as part of a “synthetic security” or other integrated financial transaction; |

| |

|

|

| |

● |

a

person who owns 10% or more (by vote or value, directly or constructively under the IRC) of any class of our shares; |

| |

|

|

| |

● |

a

U.S. expatriate; |

| |

|

|

| |

● |

a

non-U.S. shareholder (as defined below) whose investment in our shares is effectively connected with the conduct of a trade or business

in the United States; |

| |

● |

a

nonresident alien individual present in the United States for 183 days or more during an applicable taxable year; |

| |

|

|

| |

● |

a

“qualified shareholder” (as defined in Section 897(k)(3)(A) of the IRC); |

| |

|

|

| |

● |

a

“qualified foreign pension fund” (as defined in Section 897(l)(2) of the IRC) or any entity wholly owned by one or more

qualified foreign pension funds; |

| |

|

|

| |

●

|

a

non-U.S. shareholder that is a passive foreign investment company or controlled foreign corporation; |

| |

|

|

| |

● |

a

person subject to special tax accounting rules as a result of their use of applicable financial statements (within the meaning of

Section 451(b)(3) of the IRC); or |

| |

|

|

| |

● |

except

as specifically described in the following summary, a trust, estate, tax-exempt entity or foreign person. |

The

sections of the IRC that govern the federal income tax qualification and treatment of a REIT and its shareholders are complex. This presentation

is a summary of applicable IRC provisions, related rules and regulations, and administrative and judicial interpretations, all of which

are subject to change, possibly with retroactive effect. Future legislative, judicial or administrative actions or decisions could also

affect the accuracy of statements made in this summary. We have not received a ruling from the IRS with respect to any matter described

in this summary, and we cannot be sure that the IRS or a court will agree with all of the statements made in this summary. The IRS could,

for example, take a different position from that described in this summary with respect to our acquisitions, operations, valuations,

restructurings or other matters, which, if a court agreed, could result in significant tax liabilities for applicable parties. In addition,

this summary is not exhaustive of all possible tax considerations and does not discuss any estate, gift, state, local or foreign tax

considerations. For all these reasons, we urge you and any holder of or prospective acquiror of our shares to consult with a tax advisor

about the federal income tax and other tax consequences of the acquisition, ownership and disposition of our shares. Our intentions and

beliefs described in this summary are based upon our understanding of applicable laws and regulations that are in effect as of the date