false000175942500017594252024-05-082024-05-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________________________

FORM 8-K

__________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 8, 2024

__________________________________________

Mirum Pharmaceuticals, Inc.

(Exact name of Registrant as Specified in Its Charter)

__________________________________________

| | | | | | | | |

| Delaware | 001-38981 | 83-1281555 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

950 Tower Lane Suite 1050 | | |

Foster City, California | | 94404 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code:650 667-4085

N/A

(Former Name or Former Address, if Changed Since Last Report)

__________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.0001 per share | | MIRM

| | Nasdaq Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 8, 2024, Mirum Pharmaceuticals, Inc. (the “Company”) issued a press release providing a corporate update and announcing its financial results for the quarter ended March 31, 2024. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| Mirum Pharmaceuticals, Inc. |

| | |

| Date: May 8, 2024 | By: | /s/ Christopher Peetz |

| | Christopher Peetz |

| | Chief Executive Officer |

Exhibit 99.1

Mirum Pharmaceuticals Reports First Quarter 2024 Financial Results and Provides Business Update

•First quarter 2024 total revenue of $69.2 million, on track to achieve full-year guidance of $310 to $320 million

•FDA approval of LIVMARLI for cholestatic pruritus in PFIC patients achieved in March

•Volixibat VISTAS and VANTAGE interim analyses scheduled for June of 2024

•Cash balance of $302.8 million as of March 31, 2024

•Conference call to provide business updates today, May 8 at 1:30 p.m. PT/4:30 p.m. ET

FOSTER CITY, Calif. – May 8, 2024 - Mirum Pharmaceuticals, Inc. (Nasdaq: MIRM) today reported financial results for first quarter 2024 and provided a business update.

“In the first quarter, we made great progress across a number of our strategic objectives that support both the near- and long-term growth of Mirum while maintaining a strong financial position,” said Chris Peetz, chief executive officer at Mirum. “Our commercial business is performing well, and we saw continued growth in demand for LIVMARLI globally putting us on track for our total revenue guidance target for the year. The FDA’s approval of LIVMARLI for cholestatic pruritus in patients with PFIC was also an important step in bringing our high impact medicines to the rare disease patient community. We look forward to continuing this momentum with our upcoming NDA submission for CHENODAL in CTX, and important interim analyses in our PSC and PBC studies in June.”

Commercial: Continued demand growth and reiterate full year guidance of $310-$320 million

•First quarter 2024 global product sales, net of $68.9 million grew 137% compared to first quarter 2023.

•LIVMARLI first quarter net sales were $42.8 million, representing 47% growth compared to first quarter 2023.

•LIVMARLI approved in the US for treatment of cholestatic pruritus in patients with PFIC.

•First quarter 2024 CHOLBAM and CHENODAL net sales were $26.1 million.

Regulatory and Pipeline: H1 Milestones on track

•Interim analyses for volixibat in PSC (VISTAS study) and in PBC (VANTAGE study) expected in June of 2024.

•New Drug Application (NDA) submission for CHENODAL in CTX on track for first half 2024.

•PFIC CHMP approval recommendation anticipated in the first half of 2024.

Corporate and Financial: Strong balance sheet

•Total revenue for the quarter ended March 31, 2024, was $69.2 million compared to $31.6 million for the quarter ended March 31, 2023.

•Total operating expenses were $95.7 million for the quarter ended March 31, 2024, compared to $58.7 million for the quarter ended March 31, 2023. Total operating expense included $17.1 million of non-cash stock-based compensation and depreciation and amortization expense for the quarter ended March 31, 2024, compared to $9.9 million for the quarter ended March 31, 2023.

•As of March 31, 2024, Mirum had cash and cash equivalents of $302.8 million compared to $286.3 million as of December 31, 2023.

Business Update Conference Call

Mirum will host a conference call today, May 8, 2024, at 1:30 p.m. PT/4:30 p.m. ET, to provide business updates. Join the call using the following details:

Conference Call Details:

U.S./Toll-Free: +1 833 470 1428

International: +1 404 975 4839

Passcode: 479107

You may also access the call via webcast by visiting the Events & Presentations section on Mirum’s website. A replay of this webcast will be available for 30 days.

About LIVMARLI® (maralixibat) oral solution

LIVMARLI® (maralixibat) oral solution is an orally administered, once-daily, ileal bile acid transporter (IBAT) inhibitor approved by the U.S. Food and Drug Administration for the treatment of cholestatic pruritus in patients with Alagille syndrome (ALGS) three months of age and older and progressive familial intrahepatic cholestasis (PFIC) five years of age and older.

LIVMARLI is also the only approved IBAT inhibitor approved by the European Commission for the treatment of cholestatic pruritus in patients with ALGS two months and older, and by Health Canada for the treatment of cholestatic pruritus in ALGS. For more information for U.S. residents, please visit LIVMARLI.com.

Mirum has also submitted LIVMARLI for approval in Europe in PFIC for patients two months of age and older.

LIVMARLI has received Breakthrough Therapy designation for ALGS and PFIC type 2 and orphan designation for ALGS and PFIC. To learn more about ongoing clinical trials with LIVMARLI, please visit Mirum’s clinical trials section on the company’s website.

IMPORTANT SAFETY INFORMATION

Limitation of Use: LIVMARLI is not for use in PFIC type 2 patients who have a severe defect in the bile salt export pump (BSEP) protein.

LIVMARLI can cause side effects, including:

Liver injury. Changes in certain liver tests are common in patients with Alagille syndrome and PFIC but can worsen during treatment. These changes may be a sign of liver injury. In PFIC, this can be serious or may lead to liver transplant or death. Your healthcare provider should do blood tests and physical exams before starting and during treatment to check your liver function. Tell your healthcare provider right away if you get any signs or symptoms of liver problems, including nausea or vomiting, skin or the white part of the eye turns yellow, dark or brown urine, pain on the right side of the stomach (abdomen), bloating in your stomach area, loss of appetite or bleeding or bruising more easily than normal.

Stomach and intestinal (gastrointestinal) problems. LIVMARLI can cause stomach and intestinal problems, including diarrhea and stomach pain. Your healthcare provider may advise you to monitor for new or worsening stomach problems including stomach pain, diarrhea, blood in your stool or vomiting. Tell your healthcare provider right away if you have any of these symptoms more often or more severely than normal for you.

A condition called Fat Soluble Vitamin (FSV) Deficiency caused by low levels of certain vitamins (vitamin A, D, E, and K) stored in body fat is common in patients with Alagille syndrome and PFIC but may worsen during treatment. Your healthcare provider should do blood tests before starting and during treatment and may monitor for bone fractures and bleeding which have been reported as common side effects.

US Prescribing Information

EU SmPC

Canadian Product Monograph

About Volixibat

Volixibat is an oral, minimally absorbed agent designed to selectively inhibit the ileal bile acid transporter (IBAT). Volixibat may offer a novel approach in the treatment of adult cholestatic diseases by blocking the recycling of bile acids, through inhibition of IBAT, thereby reducing bile acids systemically and in the liver. Phase 1 and Phase 2 studies of volixibat demonstrated on-target fecal bile acid excretion, a pharmacodynamic marker of ASBT inhibition, in addition to decreases in LDL cholesterol and increases in 7αC4 which are markers of bile acid synthesis. Volixibat has been evaluated in more than 400 individuals across multiple clinical trials. The most common adverse events reported were mild to moderate gastrointestinal events observed in the volixibat groups.

Volixibat is currently being evaluated in Phase 2b studies for primary sclerosing cholangitis (VISTAS study), and primary biliary cholangitis (VANTAGE study).

About CHOLBAM® (cholic acid) capsules

The FDA approved CHOLBAM® (cholic acid) capsules in March 2015, the first FDA-approved treatment for pediatric and adult patients with bile acid synthesis disorders due to single enzyme defects, and for adjunctive treatment of patients with peroxisome biogenesis disorder-Zellweger spectrum disorder. The effectiveness of CHOLBAM® has been

demonstrated in clinical trials for bile acid synthesis disorders and the adjunctive treatment of peroxisomal disorders. An estimated 200 to 300 patients are current candidates for therapy.

CHOLBAM® (cholic acid) Indication

CHOLBAM is a bile acid indicated for

•Treatment of bile acid synthesis disorders due to single enzyme defects.

•Adjunctive treatment of peroxisomal disorders, including Zellweger spectrum disorders, in patients who exhibit manifestations of liver disease, steatorrhea, or complications from decreased fat-soluble vitamin absorption.

LIMITATIONS OF USE

The safety and effectiveness of CHOLBAM on extrahepatic manifestations of bile acid synthesis disorders due to single enzyme defects or peroxisomal disorders, including Zellweger spectrum disorders, have not been established.

IMPORTANT SAFETY INFORMATION

WARNINGS AND PRECAUTIONS – Exacerbation of liver impairment

Monitor liver function and discontinue CHOLBAM in patients who develop worsening of liver function while on treatment.

Concurrent elevations of serum gamma glutamyltransferase (GGT) and alanine aminotransferase (ALT) may indicate CHOLBAM overdose.

Discontinue treatment with CHOLBAM at any time if there are clinical or laboratory indicators of worsening liver function or cholestasis.

ADVERSE REACTIONS

The most common adverse reactions (≥1%) are diarrhea, reflux esophagitis, malaise, jaundice, skin lesion, nausea, abdominal pain, intestinal polyp, urinary tract infection, and peripheral neuropathy.

Please see full Prescribing Information for additional Important Safety Information.

About CHENODAL® (chenodiol) tablets

CHENODAL® is a synthetic oral form of chenodeoxycholic acid (CDCA), a naturally occurring primary bile acid synthesized from cholesterol in the liver. The FDA approved CHENODAL for the treatment of people with radiolucent stones in the gallbladder. In 2010, CHENODAL was granted orphan drug designation for the treatment of cerebrotendinous xanthomatosis (CTX), a rare autosomal recessive lipid storage disease.

While CHENODAL® is not currently approved for CTX, it received a medical necessity determination in the U.S. by the FDA and has been used as the standard of care for more than three decades. A Phase 3 clinical trial for this indication has recently been completed and based on the positive results, a New Drug Application (NDA) submission for CHENODAL in CTX planned in first half 2024. We believe the prevalent patient population in the United States with CTX exceeds 1,000.

About Mirum Pharmaceuticals, Inc.

Mirum Pharmaceuticals, Inc. is a biopharmaceutical company dedicated to transforming the treatment of rare diseases affecting children and adults. Mirum has three approved medications: LIVMARLI® (maralixibat) oral solution, CHOLBAM® (cholic acid) capsules, and CHENODAL® (chenodiol) tablets.

LIVMARLI, an IBAT inhibitor, is approved for the treatment of two rare liver diseases affecting children and adults. It is approved for the treatment of cholestatic pruritus in patients with Alagille syndrome in the U.S. (three months and older), in Europe (two months and older), and in other regions globally. It is also approved in the U.S. in cholestatic pruritus in PFIC patients five years of age and older. Mirum has submitted for approval in Europe for the treatment of PFIC in patients two months of age and older. CHOLBAM is FDA-approved for the treatment of bile acid synthesis disorders due to single enzyme deficiencies and adjunctive treatment of peroxisomal disorders in patients who show signs or symptoms or liver disease. CHENODAL has received medical necessity recognition by the FDA to treat patients with cerebrotendinous xanthomatosis (CTX).

Mirum’s late-stage pipeline includes two investigational treatments for debilitating liver diseases. Volixibat, an IBAT inhibitor, is being evaluated in two potentially registrational studies including the Phase 2b VISTAS study for primary sclerosing cholangitis and Phase 2b VANTAGE study for primary biliary cholangitis. Lastly, CHENODAL, has been evaluated in a Phase 3 clinical study, RESTORE, to treat patients with CTX, with positive topline results reported in 2023.

To learn more about Mirum, visit mirumpharma.com and follow Mirum on Facebook, LinkedIn, Instagram and Twitter (X).

Forward-Looking Statements

Statements contained in this press release regarding matters that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include statements regarding, among other things, progress across Mirum’s strategic objectives, its near- and long-term growth, the strength of its financial position, the performance of its commercial business, growth in demand for LIVMARLI, achievement of full-year revenue guidance, the results, conduct and progress of Mirum’s ongoing and planned studies for its product candidates, the timing and results of interim analyses of Mirum’s ongoing studies and the regulatory approval path for its product candidates globally. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Words such as “expected,” “forecasts,” “forward,” “planned,” “poised,”, “positioned” “potential”, “will” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based upon Mirum’s current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, which include, without limitation, risks and uncertainties associated with Mirum’s business in general, the impact of geopolitical and macroeconomic events, and the other risks described in Mirum’s Annual Report on Form 10-K for the year ended December 31, 2023 and subsequent filings with the Securities and Exchange Commission. All forward-looking statements contained in this press release speak only as of the date on which they were made and are based on management’s assumptions and estimates as of such date. Mirum undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as required by law

Mirum Pharmaceuticals, Inc.

Condensed Consolidated Statement of Operations Data

(in thousands, except share and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, | |

| | 2024 | | 2023 | |

| Revenue: | | | | | |

| Product sales, net | | $ | 68,917 | | | $ | 29,098 | | |

| License and other revenue | | 305 | | | 2,500 | | |

| Total revenue | | 69,222 | | | 31,598 | | |

| Operating expenses: | | | | | |

| Cost of sales (1) | | 17,830 | | | 4,979 | | |

| Research and development | | 32,222 | | | 23,548 | | |

| Selling, general and administrative | | 45,638 | | | 30,219 | | |

| Total operating expenses (2) | | 95,690 | | | 58,746 | | |

| Loss from operations | | (26,468) | | | (27,148) | | |

| Other income (expense): | | | | | |

| Interest income | | 3,633 | | | 2,272 | | |

| Interest expense | | (3,577) | | | (4,242) | | |

| Other income (expense), net | | 1,757 | | | (811) | | |

| Net loss before provision for income taxes | | (24,655) | | | (29,929) | | |

| Provision for income taxes | | 624 | | | 201 | | |

| Net loss | | (25,279) | | | (30,130) | | |

| | | | | |

| Net loss per share, basic and diluted | | $ | (0.54) | | | $ | (0.80) | | |

| Weighted-average shares of common stock outstanding, basic and diluted | | 46,927,550 | | 37,675,306 | |

| | | | | |

| | | | | |

| (1) Amounts include intangible amortization expense as follows: | | | | | |

| | | | | |

| Intangible amortization | | $ | 5,402 | | | $ | 1,259 | | |

| | | | | |

| (2) Amounts include stock-based compensation expense as follows: | | | | | |

| | | | | |

| Research and development | | $ | 3,861 | | | $ | 2,715 | | |

| Selling, general and administrative | | 7,589 | | | 5,846 | | |

| Total stock-based compensation | | $ | 11,450 | | | $ | 8,561 | | |

Mirum Pharmaceuticals, Inc.

Condensed Consolidated Balance Sheet Data

(Unaudited)

| | | | | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 | |

| | | | |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | $ | 302,843 | | | $ | 286,326 | | |

| Accounts receivable | 54,999 | | | 67,968 | | |

| Inventory | 21,606 | | | 22,312 | | |

| Prepaid expenses and other current assets | 10,017 | | | 10,935 | | |

| Total current assets | 389,465 | | | 387,541 | | |

| Intangible assets, net | 257,443 | | | 252,925 | | |

| Other noncurrent assets | 5,054 | | | 6,155 | | |

| Total assets | $ | 651,962 | | | $ | 646,621 | | |

| Liabilities and Stockholders’ Equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | $ | 15,983 | | | $ | 7,416 | | |

| Accrued expenses | 89,568 | | | 78,544 | | |

| Operating lease liabilities | 358 | | | 1,104 | | |

| Total current liabilities | 105,909 | | | 87,064 | | |

| Operating lease liabilities, noncurrent | 328 | | | 617 | | |

| Convertible notes payable, net | 306,835 | | | 306,421 | | |

| Other liabilities | 4,287 | | | 3,849 | | |

| Total liabilities | 417,359 | | | 397,951 | | |

| Commitments and contingencies | | | | |

| Stockholders’ equity: | | | | |

| Preferred stock | — | | | — | | |

| Common stock | 5 | | | 5 | | |

| Additional paid-in capital | 816,129 | | | 803,260 | | |

| Accumulated deficit | (581,518) | | | (556,239) | | |

| Accumulated other comprehensive (loss) income | (13) | | | 1,644 | | |

| Total stockholders’ equity | 234,603 | | | 248,670 | | |

| Total liabilities and stockholders’ equity | $ | 651,962 | | | $ | 646,621 | | |

Contacts

Investor Contact:

Andrew McKibben

ir@mirumpharma.com

Media Contact:

Erin Murphy

media@mirumpharma.com

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

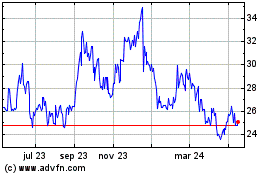

Mirum Pharmaceuticals (NASDAQ:MIRM)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

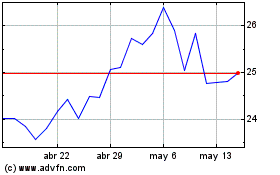

Mirum Pharmaceuticals (NASDAQ:MIRM)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024