Marqeta Expands Partnership with Lydia to Power New European Digital Bank Sumeria

04 Junio 2024 - 1:00AM

Business Wire

Sumeria marks a new chapter for Lydia, creating

a highly customized digital banking experience for customers across

Europe

Marqeta (NASDAQ: MQ), the global modern card issuing platform

that enables embedded finance solutions for the world’s innovators,

today announced it is powering the new digital banking application

Sumeria, launched recently by French payments leader Lydia

Solutions (the company behind the Lydia app). Sumeria has unveiled

new digital banking capabilities including a remunerated current

account, and plans to expand quickly throughout Europe, thanks to

the scale and global reach of Marqeta’s card processing platform.

Marqeta’s platform has had great adoption across Europe, and the

company announced today it saw an 86% jump in European total

processing volume from Q1 2023 to Q1 2024.

Marqeta began partnering with Lydia Solutions in 2019 to power

its peer-to-peer payments app, and has helped it scale to serve 8

million users throughout France, Belgium, Spain and Portugal.

Sumeria aims to simplify banking with its easily accessible app

designed to mimic the ease of use and intuitiveness of beloved

consumer brands. Marqeta’s platform enables these dynamic

capabilities, ensuring security and compliance while issuing

tokenized, virtual and physical cards for Sumeria customers that

provide detailed, real-time views into their accounts and

transactions.

“We’re proud to partner with Sumeria to help them create

customized banking experiences for their customers and continue to

expand their offering into new markets across Europe,” said Marcin

Glogowski, SVP, Managing Director Europe and UK CEO at Marqeta.

“Lydia has cultivated a completely unique and refreshing experience

with its peer-to-peer payments app, and this same attention to

detail and ease of use will translate well into the banking

world.”

Sumeria will offer an online account with 4% interest on cash

balances for the first three months, and also incorporates stock

trading, savings accounts and loans. Sumeria plans to invest over

€100 million into the business and hire 400 people over the next

three years. Sumeria plans to enable users in different European

countries to keep the same bank account if they move to another

country they support, instead of opening a new local bank account

in each country. Eurostat estimates that on average, over 1.5

million citizens migrate from one EU member country to another on

an annual basis. Sumeria will help these citizens simplify their

moves.

“Even though many traditional banks now have digital offerings,

they’re still not the personalized, digital-first experiences that

people are seeking from their banking partners,” said Cyril Ciche,

CEO at Lydia. “Marqeta has enabled us to challenge the norms of

traditional banking and payments and create more flexible and

streamlined experiences for our cardholders. We needed a partner

that could help us scale and launch in new countries to help meet

our ambitious goals for Sumeria – Marqeta has been a tremendous

partner in our journey so far, and we’re excited to continue our

work together in this new endeavor.”

About Marqeta (NASDAQ: MQ)

Marqeta’s modern card issuing platform empowers its customers to

create customized and innovative payment cards and embedded finance

offerings. Marqeta’s platform, powered by open APIs, gives its

customers the ability to build more configurable and flexible

payment experiences, accelerating product development and

democratizing access to card issuing technology. Its modern

architecture provides instant access to highly scalable,

cloud-based payment infrastructure that enables customers to launch

and manage their own card programs, issue cards and authorize and

settle transactions. Marqeta is headquartered in Oakland,

California and is certified to operate in more than 40 countries

globally. For more information, visit www.marqeta.com, Twitter and

LinkedIn.

Forward-Looking Statements

This press release contains "forward-looking statements" within

the meaning of the "safe harbor" provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements expressed or implied in this press release include, but

are not limited to, quotations and statements relating to changing

consumer preferences; increasing consumer adoption of certain

digital payment methods, products, and solutions; which payment,

banking, and financial services products and solutions may succeed;

technological and market trends; Marqeta’s business and growth;

Marqeta’s products and services; and statements made by Marqeta’s

senior leadership. Actual results may differ materially from the

expectations contained in these statements due to risks and

uncertainties, including, but not limited to, the following: any

factors creating issues with changes in domestic and international

business, market, financial, political and legal conditions; and

those risks and uncertainties included in the “Risk Factors”

disclosed in Marqeta's Annual Report on Form 10-K, as may be

updated from time to time in Marqeta’s periodic filings with the

SEC, available at www.sec.gov and Marqeta’s website at

http://investors.marqeta.com. The forward-looking statements in

this press release are based on information available to Marqeta as

of the date hereof. Marqeta disclaims any obligation to update any

forward-looking statements, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240603376328/en/

Media: James Robinson 530-913-0844 jrobinson@marqeta.com

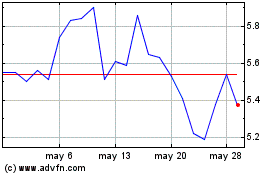

Marqeta (NASDAQ:MQ)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

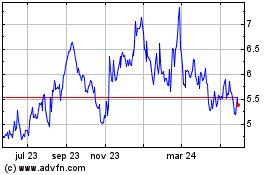

Marqeta (NASDAQ:MQ)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025