- Phase 3 RAISE trial interim analysis enrollment target achieved

with Data Monitoring Committee (DMC) review scheduled and topline

results expected in first half of Q2 2024

- Phase 3 TrustTSC trial approximately 85% enrolled with topline

data now expected in first half of Q4 2024

- ZTALMY® (ganaxolone) net product revenue of $6.6 million for Q4

2023 and $19.6 million for the full year ended December 31,

2023

- Full year 2024 U.S. ZTALMY net product revenue guidance of

between $32 and $34 million

- Cash runway projected into Q4 2024 with cash, cash equivalents

and short-term investments of $150.3 million as of December 31,

2023

- Marinus to host conference call today at 4:30 p.m. ET

Marinus Pharmaceuticals, Inc. (Nasdaq: MRNS), a pharmaceutical

company dedicated to the development of innovative therapeutics to

treat seizure disorders, today reported business highlights and

financial results for the fourth quarter and year ended December

31, 2023.

“We are thrilled to announce we have exceeded the enrollment

threshold required to conduct an interim analysis in the Phase 3

RAISE trial in refractory status epilepticus, a life-threatening

condition,” said Scott Braunstein, M.D., Chairman and Chief

Executive Officer of Marinus. “With over 90 patients now randomized

following several months of increasingly strong enrollment trends,

we are on track to announce topline data in the second quarter,

assuming efficacy criteria for the interim analysis are met. We

also remain focused on advancing the Phase 3 TrustTSC trial in

tuberous sclerosis complex and are confident that the new titration

schedule is having the desired effect with the current

discontinuation rate below 7%. We continue to see steady adoption

of ZTALMY in CDKL5 deficiency disorder and are eager to build on

this momentum throughout 2024 as we grow the ZTALMY franchise and

prepare for RSE and TSC data this year.”

ZTALMY®

- ZTALMY® (ganaxolone) oral suspension CV net product revenue of

$6.6 million for the fourth quarter of 2023 and $19.6 million for

the full year ended December 31, 2023

- Continued growth in commercial patients with more than 165

patients active on therapy at the end of 2023

- Full year 2024 projected U.S. ZTALMY net product revenues of

between $32 and $34 million

- Orion Corporation continues to prepare for commercial launches

of ZTALMY in select European countries in 2024

Clinical Pipeline

Status Epilepticus

- Achieved enrollment target required for an interim analysis in

the Phase 3 RAISE trial of intravenous (IV) ganaxolone in

refractory status epilepticus (RSE)

- If pre-defined stopping criteria for the interim analysis are

met, the Company expects to report topline data in the first half

of the second quarter of 2024

- Strong enrollment trends have continued and now expect

approximately 100 patients to be randomized by the conclusion of

the interim analysis; this larger database will support health

economic outcomes

- Targeting submission of a New Drug Application (NDA) to the

U.S. Food and Drug Administration (FDA) in early 2025 with priority

review expected

- Phase 3 RAISE II trial in RSE (for European registration)

underway with enrollment expected to complete in the fourth quarter

of 2025

- Trial design underway with plans to submit a new protocol for

IV ganaxolone in super refractory status epilepticus (SRSE) to the

FDA in the second quarter of 2024

- To date, the Company has received over 25 physician requests

for the use of IV ganaxolone to treat SRSE patients

Ganaxolone development in the RAISE trial is being supported or

in part by the Department of Health and Human Services;

Administration for Strategic Preparedness and Response; Biomedical

Advanced Research and Development Authority (BARDA) under contract

number 75A50120C00159.

Tuberous Sclerosis Complex and Other Rare

Genetic Epilepsies

- Enrollment in the global Phase 3 TrustTSC trial of oral

ganaxolone in tuberous sclerosis complex now at 85% and expected to

be completed in the second quarter of 2024

- Topline data now anticipated in the first half of the fourth

quarter of 2024

- Targeting submission of a supplemental NDA to the FDA in the

first half of 2025 with priority review expected

- Company now anticipates initiating a proof-of-concept study

with oral ganaxolone to treat a range of epileptic

encephalopathies, including Lennox-Gastaut syndrome in late

2024

- IND-enabling studies for a ganaxolone prodrug are expected to

be completed by year-end 2024

General Business and Financial

Update

- Company expects that cash, cash equivalents and short-term

investments of $150.3 million as of December 31, 2023, will be

sufficient to fund the Company’s operating expenses, capital

expenditure requirements and maintain the minimum cash balance of

$15 million required under the Company’s debt facility into the

fourth quarter of 2024.

- For the fiscal year 2024, the Company expects ZTALMY U.S. net

product revenues of between $32 and $34 million.

Financial Results

- Recognized $6.6 million and $19.6 million in net product

revenues for the three and twelve months ended December 31, 2023,

respectively, as compared to $2.3 million and $2.9 million for the

three and twelve months ended December 31, 2022, respectively.

- Recognized $0.6 million and $11.4 million in Biomedical

Advanced Research and Development Authority (BARDA) federal

contract revenue for the three and twelve months ended December 31,

2023, respectively, as compared to $1.8 million and $6.9 million

for the three and twelve months ended December 31, 2022,

respectively.

- Research and development (R&D) expenses were $26.4 million

and $99.4 million for the three and twelve months ended December

31, 2023, respectively, as compared to $21.4 million and $79.9

million, respectively, for the same periods in the prior year; the

increase was due primarily to increased costs associated with our

API onshoring effort, increased TSC and RSE clinical trial

activity, and increased headcount.

- Selling, general and administrative (SG&A) expenses were

$15.4 million and $61.2 million for the three and twelve months

ended December 31, 2023, respectively, as compared to $14.7 million

and $56.8 million, respectively, for the same periods in the prior

year; the primary drivers of the change were annualization of the

U.S. ZTALMY launch costs and increased headcount.

- The Company had net losses of $41.8 million and $141.4 million

for the three and twelve months ended December 31, 2023,

respectively; cash used in operating activities increased to $118.0

million for the twelve months ended December 31, 2023, compared to

$112.9 million for the same period a year ago.

- At December 31, 2023, the Company had cash, cash equivalents

and short-term investments of $150.3 million, compared to cash and

cash equivalents of $240.6 million at December 31, 2022.

- Readers are referred to, and encouraged to read in its

entirety, the Company’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2023, to be filed with the Securities and

Exchange Commission on March 5, 2024, which includes further

details on the Company’s business plans, operations, financial

condition, and results of operations.

Selected Financial Data (in thousands,

except share and per share amounts)

December 31,

2023

(unaudited)

December 31, 2022

ASSETS

Cash and cash equivalents

$

120,572

$

240,551

Short-term investments

29,716

-

Other assets

20,620

18,967

Total assets

$

170,908

$

259,518

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities

$

40,624

$

25,017

Long term debt, net

61,423

71,018

Revenue interest financing payable,

net

33,766

29,857

Other long-term liabilities

18,330

17,626

Total liabilities

154,143

143,518

Total stockholders’ equity

16,765

116,000

Total liabilities and stockholders’

equity

$

170,908

$

259,518

Three Months Ended December

31,

Year Ended December 31

2023

(unaudited)

2022

2023

(unaudited)

2022

Revenue:

Product revenue, net

$

6,551

$

2,317

$

19,561

$

2,872

Federal contract revenue

621

1,847

11,374

6,935

Collaboration revenue

18

2,998

54

15,671

Total revenue

7,190

7,162

30,989

25,478

Expenses:

Research and development

26,382

21,424

99,388

79,912

Selling, general and administrative

15,383

14,658

61,152

56,845

Cost of product revenue

862

142

1,909

190

Cost of collaboration revenue

-

150

25

150

Cost of IP license fee

-

-

-

1,169

Total expenses:

42,627

36,374

162,474

138,266

Loss from operations

(35,437

)

(29,212

)

(131,485

)

(112,788

)

Interest income

1,747

1,744

8,113

2,354

Interest expense

(4,298

)

(3,690

)

(16,895

)

(10,672

)

(Loss) gain from sale of priority review

voucher, net

(4,000

)

-

(4,000

)

107,375

Other income (expense), net

219

(1,517

)

1,324

(2,696

)

Loss before income taxes

(41,769

)

(32,675

)

(142,943

)

(16,427

)

(Provision) benefit for income taxes

-

(1,637

)

1,538

(3,389

)

Net loss applicable to common

shareholders

$

(41,769

)

$

(34,312

)

$

(141,405

)

$

(19,816

)

Per share information:

Net loss per share of common stock—basic

and diluted

$

(0.74

)

$

(0.76

)

$

(2.63

)

$

(0.51

)

Basic and diluted weighted average shares

outstanding

56,688,400

44,973,371

53,746,518

39,072,599

Other comprehensive income (loss)

Unrealized gain (loss) on

available-for-sale securities

51

-

(20

)

-

Total comprehensive loss

$

(41,718

)

(34,312

)

(141,425

)

(19,816

)

Conference Call Information

Tuesday, March 5, 4:30 p.m. ET

Participants may access the conference call via webcast on the

Investor page of Marinus’ website at

ir.marinuspharma.com/events-and-presentations. An archived version

of the call will be available approximately two hours after the

completion of the event on the website.

Telephone Access: Domestic: (888) 550-5280 International: (646)

960-0813 Webcast Registration:

https://events.q4inc.com/attendee/513453609 Conference ID:

2696394

About Marinus Pharmaceuticals

Marinus is a commercial-stage pharmaceutical company dedicated

to the development of innovative therapeutics for seizure

disorders. The Company first introduced FDA-approved prescription

medication ZTALMY® (ganaxolone) oral suspension CV in the U.S. in

2022 and continues to invest in the potential of ganaxolone in IV

and oral formulations to maximize therapeutic reach for adult and

pediatric patients in acute and chronic care settings. For more

information, visit www.marinuspharma.com.

Forward-Looking Statements

To the extent that statements contained in this press release

are not descriptions of historical facts regarding Marinus, they

are forward-looking statements reflecting the current beliefs and

expectations of management made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Words such as "may", "will", "expect", "anticipate", "estimate",

"intend", "believe", and similar expressions (as well as other

words or expressions referencing future events, conditions or

circumstances) are intended to identify forward-looking statements.

Examples of forward-looking statements contained in this press

release include, among others, statements regarding our

commercialization and marketing plans for ZTALMY; our net product

revenue guidance; the potential benefits ZTALMY will provide for

physicians and patients; statements regarding our expected clinical

development plans, enrollment in our clinical trials, regulatory

communications and submissions for ganaxolone, and the timing

thereof; our expected data readouts; our expected cash runway; our

expectations and beliefs regarding the FDA and EMA with respect to

our product candidates; our expectations regarding the development

of new formulations and prodrug candidates; our expectations

regarding our strategic partners; our financial projections; the

potential safety and efficacy of ganaxolone, as well as its

therapeutic potential in a number of indications; and other

statements regarding the company's future operations, financial

performance, financial position, prospects, objectives and other

future event.

Forward-looking statements in this press release involve

substantial risks and uncertainties that could cause our clinical

development programs, future results, performance or achievements

to differ significantly from those expressed or implied by the

forward-looking statements. Such risks and uncertainties include,

among others, the company’s ability to continue as a going concern;

unexpected market acceptance, payor coverage or future

prescriptions and revenue generated by ZTALMY; unexpected actions

by the FDA or other regulatory agencies with respect to our

products; competitive conditions and unexpected adverse events or

patient outcomes from being treated with ZTALMY, uncertainties and

delays relating to the design, enrollment, completion, and results

of clinical trials; unanticipated costs and expenses; the company’s

cash and cash equivalents may not be sufficient to support our

operating plan for as long as anticipated; our ability to comply

with the FDA’s requirement for additional post-marketing studies in

the required time frames; the timing of regulatory filings for our

other product candidates; clinical trial results may not support

regulatory approval or further development in a specified

indication or at all; actions or advice of the FDA or EMA may

affect the design, initiation, timing, continuation and/or progress

of clinical trials or result in the need for additional clinical

trials; the size and growth potential of the markets for the

company’s product candidates, and the company’s ability to service

those markets; our ability to develop new formulations of

ganaxolone or prodrugs; our ability to obtain, maintain, protect

and defend intellectual property for our product candidates; the

potential negative impact of third party patents on our or our

collaborators’ ability to commercialize ganaxolone; delays,

interruptions or failures in the manufacture and supply of our

product candidate; the company’s expectations, projections and

estimates regarding expenses, future revenue, capital requirements,

and the availability of and the need for additional financing; the

company’s ability to obtain additional funding to support its

clinical development and commercial programs; the potential for our

ex-US partners to breach their obligations under their respective

agreements with us or terminate such agreements in accordance with

their respective terms; the risk that drug product quality

requirements may not support continued clinical investigation of

our product candidates and result in delays or termination of such

clinical studies and product approvals; and the availability or

potential availability of alternative products or treatments for

conditions targeted by us that could affect the availability or

commercial potential of our product candidate. This list is not

exhaustive and these and other risks are described in our periodic

reports, including the annual report on Form 10-K, quarterly

reports on Form 10-Q and current reports on Form 8-K, filed with or

furnished to the Securities and Exchange Commission and available

at www.sec.gov. Any forward-looking statements that we make in this

press release speak only as of the date of this press release. We

assume no obligation to update forward-looking statements whether

as a result of new information, future events or otherwise, after

the date of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240305071461/en/

Investors Jim DeNike Senior

Director, Investor Relations Marinus Pharmaceuticals, Inc.

jdenike@marinuspharma.com

Media Molly Cameron Director,

Corporate Communications & Investor Relations Marinus

Pharmaceuticals, Inc. mcameron@marinuspharma.com

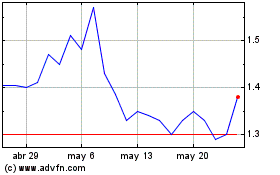

Marinus Pharmaceuticals (NASDAQ:MRNS)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Marinus Pharmaceuticals (NASDAQ:MRNS)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024