As filed with the United States Securities and Exchange Commission on December

9, 2024

Registration

No. 333-282993

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

F-1

(Amendment No. 2)

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

MAINZ

BIOMED N.V.

(Exact name of registrant as specified in its charter)

| The

Netherlands |

|

8731 |

|

Not

Applicable |

(State or other jurisdiction

of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

Mainz

Biomed N.V.

Robert Koch Strasse 50

55129 Mainz

Germany

Telephone: 0049 6131 5542860

(Address

of principal executive offices, including zip code, and telephone number, including area code)

Vcorp

Services, LLC

25 Robert Pitt Drive, Suite 204

Monsey, NY 10952

Telephone:

(Name,

address, including zip code, and telephone number, including area code, of agent of service)

Copies

to:

William Rosenstadt,

Esq.

Mengyi “Jason” Ye, Esq.

Tim Dockery, Esq.

Ortoli Rosenstadt LLP

366 Madison Avenue

New York, New York 10022

Telephone: (212) 588-0022 |

|

M.

Ali Panjwani, Esq.

Pryor

Cashman LLP

7

Times Square, New York

New

York 10036-6569

Telephone: (212) 421-4100 |

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933,

check the following box and list the Securities Act registration statement number of the earlier effective registration statement for

the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check

the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check

the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company ☒

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective

on such date as the United States Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

We are filing this Amendment No. 2 (the “Amendment”)

to our Registration Statement on Form F-1 (Registration No. 333-282993) (the “Registration Statement”) as an exhibit-only

filing to file Exhibit 5.1, and to amend and restate the list of exhibits set forth in Item 8 of Part II of the Registration

Statement. No changes have been made to Part I or Part II of the Registration Statement other than this explanatory note as

well as revised versions of the cover page and Item 8 of Part II of the Registration Statement. This Amendment does not contain

a copy of the preliminary prospectus included in Amendment No. 1 to the Registration Statement, nor is it intended to amend or delete

any part of the preliminary prospectus.

PART II

INFORMATION

NOT REQUIRED IN PROSPECTUS

ITEM

6: INDEMNIFICATION OF DIRECTORS AND OFFICERS

Under

Dutch law, members of the board of directors may be liable to the registrant for damages in the event of improper or negligent performance

of their duties. They may be jointly and severally liable for damages to the registrant and third parties for infringement of our Articles

of Association or certain provisions of the Dutch Civil Code. In certain circumstances, they may also incur additional specific civil

and criminal liabilities.

Pursuant

to the registrant’s articles of association, to the fullest extent permitted by Dutch law, the following shall be reimbursed to

the indemnified officers:

| (a) | the

costs of conducting a defense against claims, also including claims by the Company and its

group companies, as a consequence of any acts or omissions in the fulfilment of their duties

or any other duties currently or previously performed by them at the company’s request; |

| (b) | any

damages or financial penalties payable by them as a result of any such acts or omissions; |

| (c) | any

amounts payable by them under settlement agreements entered into by them in connection with

any such acts or omissions; |

| (d) | the

costs of appearing in other legal proceedings in which they are involved as directors or

former directors, with the exception of proceedings primarily aimed at pursuing a claim on

their own behalf; |

| (e) | any

taxes payable by them as a result of any reimbursements in accordance with the articles of

association. |

An

indemnitee shall not be entitled to reimbursement if and to the extent that:

| (a) | it

has been adjudicated by a Dutch court or, in the case of arbitration, an arbitrator, in a

final and conclusive decision that the act or omission of the Indemnitee may be characterized

as intentional, deliberately reckless or grossly negligent conduct, unless Dutch law provides

otherwise or this would, in view of the circumstances of the case, be unacceptable according

to standards of reasonableness and fairness; or |

| (b) | the

costs or financial loss of the Indemnitee are covered by an insurance and the insurer has

paid out the costs or financial loss. |

The

description of indemnity herein is merely a summary of the provisions in the registrant’s articles of association described above,

and such description shall not limit or alter the mentioned provisions in the articles of association or other indemnification agreements.

Prior

to the public offering of the securities being registered by this registration statement, we intend to enter into a directors’

and officers’ liability insurance policy to cover the liability of members of the board of directors and members.

The

placement agency agreement the registrant will enter into in connection with the offering being registered hereby provides that the placement

agent will indemnify, under certain conditions, the registrant’s board of directors and its officers against certain liabilities

arising in connection with this offering.

ITEM

7. RECENT SALES OF UNREGISTERED SECURITIES

In

the past three years, we have issued and sold the securities described below without registering the securities under the Securities

Act. None of these transactions involved the placement agent fees or any public offering. We believe that each of the following issuances

was exempt from registration under the Securities Act in reliance on Regulation S promulgated under the Securities Act regarding

sales by an issuer in offshore transactions, Regulation D under the Securities Act, Rule 701 under the Securities Act or pursuant

to Section 4(a)(2) of the Securities Act regarding transactions not involving a public offering.

During calendar 2022, 20,537 ordinary

shares were issued upon the exercise of warrants that were issued in 2021 at an exercise price of $120 per share.

During calendar 2022, 1,825 ordinary

shares were issued to consultants for services rendered, valued at an average price of $496.80 per share.

During calendar 2023, 7,645 ordinary

shares were issued on the exercise of warrants that were issued in 2021 at an exercise price of $120 per share.

On June 28, 2023, 1,361 ordinary

shares were issued as a commitment fee related to a pre-paid advance Agreement entered into as of the same date, valued at $183.60 per

share.

On February 15, 2023, 7,500 ordinary

shares were issued under an intellectual property asset purchase agreement, valued at $274 per share.

During calendar 2023, 3,570 ordinary

shares were issued to consultants for services rendered, valued at an average price of $153.60 per share.

On September 3, 2023, 30,000 ordinary

shares issued to a consultant for services rendered, valued at an average price of $14 per share

In October 2024, 191,013 ordinary

shares were issued for the conversion of debt valued at $1,734,345 for an average price of $9.08 per share.

From November 1, 2024 to the date

hereof, 46,149 ordinary shares were issued for the conversion of debt valued at $373,622 for an average price of $8.10 per share.

ITEM

8. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

The

following exhibits are filed with this registration statement:

| 1.1 |

Form of Placement Agency Agreement between the Company and Maxim Group LLC** |

| 2.1 |

Description of Securities registered under Section 12 of the Exchange Act** |

| 3.1 |

Unofficial English translation of Deed of Conversion** |

| 3.2 |

Unofficial English translation of Deed of Amendment, dated July 19, 2024** |

| 3.3 |

Unofficial English translation of Articles of Association, dated December 3, 2024** |

| 4.1 |

Share Certificate—Ordinary Shares** |

| 4.2 |

Form of Pre-Funded Warrant** |

| 4.3 |

Form of Class A Ordinary Share Purchase Warrant** |

| 4.4 |

Form of Class B Ordinary Share Purchase Warrant** |

| 5.1 |

Opinion

of CMS Derks Star Busmann N.V.* |

| 5.2 |

Opinion of Ortoli Rosenstadt LLP** |

| 10.1 |

Management Services Agreement, dated July 1, 2020, between the Company and Guido Baechler** |

| 10.2 |

Amendment to Management Services Agreement, dated October 2021, between Guido Baechler and the Company** |

| 10.3 |

Amendment to Management Services Agreement, dated October 2024, between Guido Baechler and the Company** |

| 10.4 |

Consulting Agreement, dated July 16, 2021, between the Company and William Caragol** |

| 10.5 |

Amendment to Consultant Agreement, dated October 2021, between William Caragol and the Company** |

| 10.6 |

Amendment to Consultant Agreement, dated October 2024, between William Caragol and the Company** |

| 10.7 |

Form of Silent Partnership Agreements** |

| 10.8 |

Mainz Biomed N.V. 2021 Omnibus Incentive Plan** |

| 10.9 |

Mainz Biomed N.V. Amended and Restated 2022 Omnibus Incentive Plan** |

| 10.10 |

Technology Rights Agreement, dated January 4, 2022, between the Company and Socpra Sciences Santé Et Humaines S.E.C. ** |

| 10.11 |

Employment Contract with William Caragol, dated April 29, 2022** |

| 10.12 |

Intellectual Property Asset Purchase Agreement, dated February 15, 2023, with Uni Targeting Research AS** |

| 10.13 |

Assignment Agreement, dated February 15, 2023, with SOCPRA Sciences Santé et Humaines S.E.C. ** |

| 10.14 |

Mainz Biomed USA, Inc. Carve-Out Plan** |

| 10.15 |

Pre-Paid Advance Agreement (the “PPA”), dated June 28, 2023, between the Company and YA II PN, Ltd.** |

| 10.16 |

Form of Promissory Note to be issued under the PPA**

|

| 10.17 |

Supplemental Agreement to PPA, dated April 18, 2024** |

| 10.18 |

Second Supplemental Agreement to PPA, dated October 8, 2024** |

| 10.19 |

Amendment Agreement, dated December 6, 2024, between the Company and YA II PN, Ltd.** |

| 10.20 |

Form of Securities Purchase Agreement** |

| 10.21 |

Form of Lock-Up Agreement** |

| 10.22 |

Form of Warrant Agent Agreement** |

| 11.1 |

Insider Trading Policy** |

| 11.2 |

Code of Ethics and Business Conduct** |

| 23.1 |

Consent of Reliant CPA PC** |

| 23.2 |

Consent of CMS Derks Star Busmann N.V. (contained in Exhibit 5.1)* |

| 23.3 |

Consent of Ortoli Rosenstadt LLP (contained in Exhibit 5.2)** |

| 24.1 |

Power of Attorney (included

on signature page to the initial filing of this registration statement). |

| 97.1 |

Executive Compensation Clawback Policy** |

| 107 |

Filing Fee Table** |

| + |

Certain confidential portions of this exhibit were omitted by means of marking such portions with asterisks because

the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed. |

ITEM

9. UNDERTAKINGS

The

undersigned Registrant hereby undertakes:

| (1) | To

file, during any period in which offers or sales of securities are being made, a post-effective

amendment to this registration statement to: |

| (i) | Include

any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |

| (ii) | Reflect

in the prospectus any facts or events arising after the effective date of the registration

statement (or the most recent post-effective amendment thereof) which, individually or in

the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities

offered (if the total dollar value of securities offered would not exceed that which was

registered) and any deviation from the low or high end of the estimated maximum offering

range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if,

in the aggregate, the changes in volume and price represent no more than 20% change in the

maximum aggregate offering price set forth in the “Calculation of Registration Fee”

table in the effective registration statement; and |

| (iii) | Include

any material information with respect to the plan of distribution not previously disclosed

in the registration statement or any material change to such information in the registration

statement. |

| (2) | That,

for the purpose of determining any liability under the Securities Act of 1933,

each such post- effective amendment shall be deemed to be a new registration statement relating

to the securities offered therein, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof. |

| (3) | To

remove from registration by means of a post-effective amendment any of the securities being

registered which remain unsold at the termination of the offering. |

| (4) | To

file a post-effective amendment to the registration statement to include any financial statements

required by Item 8.A. of Form 20-F at the start of any delayed offering or throughout

a continuous offering. Financial statements and information otherwise required by Section 10(a)(3) of

the Act need not be furnished, provided that the Registrant includes in the prospectus, by

means of a post- effective amendment, financial statements required pursuant to this paragraph

(4) and other information necessary to ensure that all other information in the prospectus

is at least as current as the date of those financial statements. Notwithstanding the foregoing,

with respect to registration statements on Form F-3, a post-effective amendment need

not be filed to include financial statements and information required by Section 10(a)(3) of

the Act or Rule 3-19 of Regulation S- X if such financial statements and information

are contained in periodic reports filed with or furnished to the Commission by the Registrant

pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934

that are incorporated by reference in the Form F-3. |

| (5) | Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may

be permitted to directors, officers and controlling persons of the registrant pursuant to

the provisions described herein, or otherwise, the registrant has been advised that in the

opinion of the Securities and Exchange Commission such indemnification is against public

policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim

for indemnification against such liabilities (other than the payment by the registrant of

expenses incurred or paid by a director, officer or controlling person of the registrant

in the successful defense of any action, suit or proceeding) is asserted by such director,

officer or controlling person in connection with the securities being registered, the registrant

will, unless in the opinion of its counsel the matter has been settled by controlling precedent,

submit to a court of appropriate jurisdiction the question whether such indemnification by

it is against public policy as expressed in the Act and will be governed by the final adjudication

of such issue. |

| (6) | Each

prospectus filed pursuant to Rule 424(b) as part of a registration statement relating

to an offering, other than registration statements relying on Rule 430B or other than

prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included

in the registration statement as of the date it is first used after effectiveness. Provided,

however, that no statement made in a registration statement or prospectus that is part of

the registration statement or made in a document incorporated or deemed incorporated by reference

into the registration statement or prospectus that is part of the registration statement

will, as to a purchaser with a time of contract of sale prior to such first use, supersede

or modify any statement that was made in the registration statement or prospectus that was

part of the registration statement or made in any such document immediately prior to such

date of first use. |

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe it meets

all of the requirements for filing on Form F-1 and has duly caused this Registration Statement to be signed on its behalf by the

undersigned, thereunto duly authorized on December 9, 2024.

| |

MAINZ BIOMED

N.V. |

| |

(Registrant) |

| |

|

| |

By: |

/s/

Guido Baechler |

| |

|

Guido Baechler, Chief Executive Officer

(Principal Executive Officer) |

Pursuant

to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in

the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Guido Baechler |

|

Chief Executive Officer (Principal Executive Officer), |

|

December 9, 2024 |

| Guido Baechler |

|

Executive Director |

|

|

| |

|

|

|

|

| /s/ William Caragol |

|

Chief Financial Officer (Principal Financial Officer and |

|

December 9, 2024 |

| William Caragol |

|

Principal Accounting Officer) |

|

|

| |

|

|

|

|

| /s/ Dr. Heiner Dreismann* |

|

Director |

|

December 9, 2024 |

| Dr. Heiner Dreismann |

|

|

|

|

| |

|

|

|

|

| /s/ Gregory Tibbits* |

|

Director |

|

December 9, 2024 |

| Gregory Tibbits |

|

|

|

|

| |

|

|

|

|

| /s/ Hans Hekland* |

|

Director |

|

December 9, 2024 |

| Hans Hekland |

|

|

|

|

* Pursuant to power of attorney

SIGNATURE

OF AUTHORIZED REPRESENTATIVE IN THE UNITED STATES

Pursuant

to the Securities Act of 1933, the undersigned, the duly authorized representative in the United States of Mainz Biomed

N.V., has signed this registration statement or amendment thereto in New York, New York, on December 9, 2024.

| |

Ortoli Rosenstadt

LLP |

| |

|

| |

By: |

/s/

William S. Rosenstadt |

| |

Name: |

William S. Rosenstadt |

| |

Title: |

Managing Partner |

II-6

Exhibit 5.1

Dear Madam/Sir,

| Mainz Biomed N.V. |

CMS Derks Star Busmann N.V. |

| Robert Koch Strasse 50 |

Atrium | Parnassusweg 737 |

| 55129

Mainz |

NL-1077 DG Amsterdam

P.O. Box 94700 |

| GERMANY |

NL-1090 GS Amsterdam |

|

|

|

Bank account (Stichting Derdengelden) |

| |

Iban: NL31 RABO 0103 3545 49 |

| |

Swift/bic: RABONL2U |

| |

|

| |

T +31 20 301 63 01 |

| |

F +31 20 301 63 05 |

| |

I cms.law |

Subject: Mainz Biomed N.V. / Legal opinion

9 December 2024

We have acted as Dutch legal

counsel to Mainz Biomed N.V. of Amsterdam, the Netherlands (the “Company”), in respect of certain matters of Dutch law

in connection with an offering of;

| (i) | up to 1,147,776 ordinary units, each consisting of one ordinary share in the capital of the Company with

a nominal value of EUR 0.40 (a “Ordinary Share”), one Class A warrant to purchase one Ordinary Share, and one Series

B warrant to purchase one Ordinary Share (the “Ordinary Units”), |

| (ii) | up to 1,147,776 pre-funded units, each consisting of one pre-funded warrant to purchase one Ordinary Share,

one Class A warrant to purchase one Ordinary Share, and one Series B warrant to purchase one Ordinary Share (the “Pre-Funded Units”), |

| (iii) | up to 3,443,328 Ordinary Shares underlying the Class A warrants, the Class B warrants, and the pre-funded

warrants, |

(collectively referred to as

the “Offering”). Up to 4,591,104 Ordinary Shares are being offered in connection with the Offering (the “Registration

Shares”). The Ordinary Units, Pre-Funded Units and Registration Shares are being offered pursuant to a registration statement

on form F-1 (the “Registration Statement”) and a prospectus (the “Prospectus”) filed by the Company

on 9 December 2024.

All

services are rendered under an agreement of instruction with CMS Derks Star Busmann N.V., with registered office in Amsterdam, the Netherlands.

This agreement is subject to the General Conditions of CMS Derks Star Busmann N.V., which have been filed with the registrar of the District

Court Amsterdam, the Netherlands, under no. 84/2020 and which contain a limitation of liability. These terms have been published on the

website cms.law and will be provided upon request. CMS Derks Star Busmann N.V. is a company with limited liability under the laws of

the Netherlands and is registered in the Netherlands with the trade register under no. 30201194 and in Belgium with the RPR Brussels

under no. 0877.478.727. The VAT number of CMS Derks Star Busmann N.V. for the Netherlands is NL8140.16.479.B01 and for Belgium BE 0877.478.727.

CMS

Derks Star Busmann is a member of CMS, the organisation of European law firms. In certain circumstances, CMS is used as a brand or business

name of, or to refer to, some or all of the member firms or their offices. Further information can be found at www.cms.law.

CMS

offices and associated offices: Aberdeen, Algiers, Amsterdam, Antwerp, Barcelona, Beijing, Belgrade, Berlin, Bogotá, Bratislava,

Bristol, Brussels, Bucharest, Budapest, Casablanca, Cologne, Dubai, Duesseldorf, Edinburgh, Frankfurt, Funchal, Geneva, Glasgow, Hamburg,

Hong Kong, Istanbul, Johannesburg, Kyiv, Leipzig, Lima, Lisbon, Ljubljana, London, Luanda, Luxembourg, Lyon, Madrid, Manchester, Mexico

City, Milan, Mombasa, Monaco, Moscow, Munich, Muscat, Nairobi, Paris, Podgorica, Poznan, Prague, Reading, Rio de Janeiro, Riyadh, Rome,

Santiago de Chile, Sarajevo, Seville, Shanghai, Sheffield, Singapore, Skopje, Sofia, Strasbourg, Stuttgart, Tirana, Utrecht, Vienna,

Warsaw, Zagreb and Zurich.

For the purpose of this legal

opinion, we have examined and relied solely upon the following documents:

| (a) | an electronically received copy of an extract relative to the Company, dated 9 December 2024 (the “Extract”)

from the trade register (handelsregister) of the Dutch Chamber of Commerce (Kamer van Koophandel) (the “Trade Register”); |

| (b) | an official copy (afschrift) of the notarial deed of incorporation (akte van oprichting)

of the Company, dated 8 March 2021 (the “Deed of Incorporation”), containing the articles of association of the Company

before the execution of the Deed of Conversion; |

| (c) | an official copy of a notarial deed of conversion dated 9 November 2021 (the “Deed of Conversion”); |

| (d) | an official copy of the notarial deed of amendment of the articles of association of the Company, dated

3 December 2024 (the “Deed of Amendment”), containing the articles of association of the Company as of such date (the

“Articles of Association”); |

| (e) | a written resolution of the board (bestuur) of the Company, dated 9 December 2024 (the “Board

Resolution”); |

| (f) | a written resolution of the general meeting (algemene vergadering) of the Company, dated 1 November

2021 (the “Shareholder Resolution”); and |

| (g) | an electronically received copy of the Registration Statement and Prospectus forwarded to us on 9 December

2024. |

We do not express any opinion

in respect of the Class A warrants, the Class B warrants, the pre-funded warrants, the Registration Statement or the Prospectus.

In connection with such examination

and for the purpose of the legal opinion expressed herein, we have assumed:

| (i) | that at the time of the issuance of the Registration Shares, the Company’s authorized capital will

be sufficient to allow for the issuance; |

| (ii) | that the Registration Shares will be offered, subscribed for, issued and accepted by the investors in

accordance with all applicable laws (including for the avoidance of doubt, Dutch law); |

| (iii) | that the Class A warrants, the Class B warrants, and the pre-funded warrants will be validly entered into

and exercised by each party thereto; |

| (iv) | that the Registration Shares will be validly paid up at the time of the issuances; |

| (v) | that the Registration Shares will be issued in the form and manner prescribed by the articles of association

at the time of the issuances; |

| (vi) | that the Company will duly sign a deed of issue to implement each issuance of Registration Shares; |

| (vii) | each signature on each document is the original or electronic (as relevant) signature of the relevant

stated person; |

| (viii) | the genuineness of all signatures on all original documents of the persons purported to have signed the

same; |

| (ix) | the conformity to their originals of all documents submitted or transmitted to us in the form of photocopies,

electronically or otherwise, and the authenticity and completeness of such originals; |

| (x) | that the Shareholder Resolution and the Board Resolution have been validly signed and that the resolutions

reflected therein will be in full force and effect at the time of the issuance of the Registration Shares and that none of these resolutions

will be withdrawn or restated and that no resolutions have been or will be adopted to amend the contents of these resolutions; |

| (xi) | that the Deed of Incorporation, the Deed of Conversion and the Deed of Amendment are valid notarial deeds

(notariële aktes), that the content thereof is correct and complete, it being hereby confirmed that on the face of the Deed

of Incorporation, the Deed of Conversion and the Deed of Amendment it does not appear that the deeds are not a valid notarial deed; |

| (xii) | that the Articles of Association are in full force and effect at the date hereof, it being hereby |

confirmed that on

the face of the Articles of Association and the Extract it does not appear that the Articles of Association are not in full force and

effect as at the date hereof;

| (xiii) | any and all authorisations and consents of, or other filings with or notifications to, any public authority

or other relevant body or person in or of any jurisdiction which may be required (other than under Dutch law) in respect of the issuance

of the Registration Shares have been or will be duly obtained or made, as the case may be; |

| (xiv) | that no petition has been presented to nor order made by a court for the bankruptcy (faillissement)

of the Company and that no resolution has been adopted concerning a statutory merger (juridische fusie) or division (splitsing)

involving the Company as disappearing entity, or a voluntary liquidation (ontbinding) of the Company; |

| (xv) | that the information contained in the Extract truly and correctly reflects the position of the Company

as mentioned therein; |

| (xvi) | that, at the time of the issuances of the Registration Shares, the Company, and the investors are: |

| (a) | not included on the consolidated list of persons, groups and entities subject to EU financial sanctions; |

| (b) | not subject to the restrictive measures deriving from Council Regulation (EU) 2022/262 and Council Decision

(CFSP) 2022/264, issued by the Council of the |

European Union on

23 February 2022, in view of Russia’s actions destabilising the situation in Ukraine;

| (c) | not subject to the restrictive measures deriving from Council Regulation (EU) 2022/334 and Council Decision

(CFSP) 2022/335, issued by the Council of the |

European Union on

28 February 2022, in view of Russia’s actions destabilising the situation in Ukraine;

| (d) | not subject to the restrictive measures deriving from Council Regulation (EU) 2022/428 and Council Decision

(CFSP) 2022/430, issued by the Council of the |

European Union on

15 March 2022, in view of Russia’s actions destabilising the situation in Ukraine; and

| (e) | not subject to any other restrictive measures issued by the Council of the European Union, in view of

Russia’s actions destabilising the situation in Ukraine; |

| (xvii) | that, at the date hereof, the directors of the Company are not subject to a director’s disqualification

(civielrechtelijk bestuursverbod) under Dutch law, which assumption is supported by the confirmation of the directors in the Board

Resolution; and |

| (xviii) | that the Company has not been dissolved (ontbonden), merged (gefuseerd) involving the Company

as disappearing entity, demerged (gesplitst), converted (omgezet), granted a suspension of payments (surséance

verleend), subjected to emergency regulations (noodregeling) as provided for in the Financial Supervision Act (Wet op het

Financieel Toezicht), declared bankrupt (failliet verklaard), subjected to any other insolvency proceedings listed in Annex

A of Regulation (EU) 2015/848 of the European Parliament and of the Council of 20 May 2015 on insolvency proceedings (recast), as amended

by Regulation (EU) 2021/2260 of the European Parliament and of the Council of 15 December 2021 amending Regulation (EU) 2015/848 on insolvency

proceedings to replace its Annexes A and B, listed on the list referred to in article 2 (3) of Council Regulation (EC) No 2580/2001 of

27 December 2001, listed in Annex I to Council Regulation (EC) No 881/2002 of 27 May 2002 or listed and marked with an asterisk in the

Annex to Council Common Position 2001/931 of 27 December 2001 relating to measures to combat terrorism, as amended from time to time,

and no trustee (curator), administrator (bewindvoerder) or similar officer has been appointed in respect of the Company

or any of its respective assets. |

We express no opinion as to

any law other than the laws of the Netherlands in force at the date hereof as applied and interpreted according to present duly published

case law of the Dutch courts. No opinion is rendered with respect to any matters of fact, anti-trust law, market abuse, equal treatment

of shareholders, financial assistance, tax law or the laws of the European Communities, to the extent not or not fully implemented in

the laws of the Netherlands.

In this legal opinion, Dutch

legal concepts are expressed in English terms and not in their original Dutch terms. Where indicated in italics, Dutch equivalents of

these English terms have been given for the purpose of clarification. The Dutch concepts may not be identical to the concepts described

by the same English terms as they exist under the laws of other jurisdictions. Terms and expressions of law and of legal concepts as used

in this legal opinion have the meaning attributed to them under the laws of the Netherlands and this legal opinion should be read and

understood accordingly.

This legal opinion is strictly

limited to the matters stated herein and may not be read as extending by implication to any matter not specifically referred to. Nothing

in this legal opinion should be taken as expressing an opinion in respect of the factual accuracy of any representations or warranties,

or other information, contained in any document, referred to herein or examined in connection with this legal opinion, except as expressly

stated otherwise. For the purpose hereof, we have assumed such accuracy.

Based upon the foregoing (including,

without limitation, the documents and the assumptions set out above) and subject to the qualifications set out below and any facts, circumstances,

events or documents not disclosed to us in the course of our examination referred to above, we are, at the date hereof, of the opinion

that:

When issued, the Registration

Shares will have been validly issued, fully paid and will be nonassessable.

The opinion expressed above

is subject to the following qualifications:

| (A) | The opinion expressed above may be affected or limited by any applicable bankruptcy, insolvency, fraudulent

conveyance (actio pauliana), reorganization, suspension of payment and other or similar laws now or hereafter in effect, relating

to or affecting the enforcement or protection of creditors’ rights. |

| (B) | A power of attorney (volmacht) or mandate (lastgeving) granted or issued by the Company

will terminate by force of law and without any notice being required upon bankruptcy of the Company and will become ineffective upon a

suspension of payments (surséance van betaling) being granted to the Company. |

| (C) | A court applying the laws of the Netherlands may: (i) at the request of any party to an agreement change

the effect of an arrangement or dissolve it in whole or in part in the event of unforeseen circumstances (onvoorziene omstandigheden)

of such nature that do not, according the standards of reasonableness and fairness, justify the other party to expect the agreement to

be maintained unchanged; (ii) limit any claim for damages or penalties on the basis that such claim is deemed excessive by the court;

and (iii) refuse to give effect to any provisions for the payment of expenses in respect of the costs of enforcement (actual or attempted)

or unsuccessful litigation brought before such court or tribunal or where such court or tribunal has itself made an order for costs. |

| (D) | The opinion expressed above may be limited or affected by: |

| (i) | claims based on tort (onrechtmatige daad); |

| (ii) | in relation to the issuance of the Registration Shares, including but not limited to an issuance below

market value, the rules of force majeure (niet toerekenbare tekortkoming), reasonableness and fairness (redelijkheid en billijkheid),

suspension (opschorting), dissolution (ontbinding), unforeseen circumstances (onvoorziene omstandigheden) and vitiated

consent (i.e., duress (bedreiging), fraud (bedrog), abuse of circumstances (misbruik van omstandigheden) and error

(dwaling)) or a difference of intention (wil) and declaration (verklaring). |

| (E) | If a party is controlled by or otherwise connected with a person, organization or country that is currently

the subject of sanctions by the United Nations, the European Community or the Netherlands, implemented, effective or sanctioned in the

Netherlands under the Sanctions Act 1977 (Sanctiewet 1977), the Economic Offences Act (Wet op de economische delicten) or

the Financial Supervision Act (Wet op het Financieel Toezicht) or is otherwise the target of any such sanctions, the obligations

of the Company to that party may be unenforceable, void or otherwise affected. |

| (F) | The term “non-assessable” has no equivalent legal term under Dutch law and for the purpose

of this opinion, “non-assessable” means that a holder of a Registration Share will not by reason of merely being such a holder,

be subject to assessment or calls by the Company or its creditors for further payment on such Registration Share. |

This opinion is rendered to

you for the sole purpose of the filing of this opinion as an exhibit to the Registration Statement to be submitted by the Company on the

date hereof, to which filing we consent under the express condition that:

| (i) | we do not admit that we are within the category of persons whose consent is required within Section 7

of the Securities Act of 1933; |

| (ii) | any issues of interpretation or liability arising under this legal opinion will be governed exclusively

by the laws of the Netherlands and be brought exclusively before a Dutch court; |

| (i) | this legal opinion is subject to acceptance of the limitation

of liability as mentioned on the first page of this letter. Subject to its terms, our insurance policy provides for a maximum insured

amount of EUR 100,000,000; |

| (iii) | we do not assume any obligation to notify or to inform you of any developments subsequent to the date

hereof that might render its contents untrue or inaccurate in whole or in part at such time; and |

| (iv) | this legal opinion is strictly limited to the matters set forth herein and no opinion may be inferred

or implied beyond our opinion expressly stated herein. |

Yours faithfully,

/s/ CMS Derks Star Busmann N.V.

Page

6

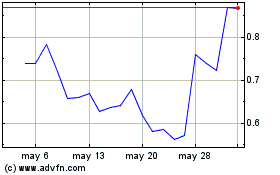

Mainz BioMed NV (NASDAQ:MYNZ)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Mainz BioMed NV (NASDAQ:MYNZ)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024