NewAmsterdam Pharma Company N.V. (Nasdaq: NAMS or “NewAmsterdam” or

the “Company”), a late-stage, clinical biopharmaceutical company

developing oral, non-statin medicines for patients at risk of

cardiovascular disease (“CVD”) with elevated low-density

lipoprotein cholesterol (“LDL-C”), for whom existing therapies are

not sufficiently effective or well-tolerated, today announced

financial results for the three and nine months ended

September 30, 2024.

“We are pleased to report another strong quarter, which was

marked by continued execution across our ongoing Phase 3 clinical

trials. We are excited to announce that due to faster than expected

enrollment in our pivotal Phase 3 TANDEM trial evaluating a

fixed-dose combination (“FDC”) of obicetrapib and ezetimibe, we now

expect to release topline data in the fourth quarter of 2024,” said

Michael Davidson, M.D., Chief Executive Officer of NewAmsterdam.

“Additionally, we remain on track to announce topline data from our

Phase 3 BROADWAY study by year end and continue to advance our

9,500-patient PREVAIL cardiovascular outcomes trial.”

“We believe there is a substantial opportunity to address the

unmet needs across cardiovascular disease, one of the leading

causes of mortality worldwide. With our recently secured

composition of matter patent granting exclusivity through 2043 in

the United States, cash which we believe is sufficient to fund our

pivotal Phase 3 readouts, and an experienced leadership team at the

helm, we are well-positioned to drive our mission forward. We

remain focused on our clinical execution and, if approved,

ultimately commercializing obicetrapib to transform patient care

for the millions of people living with hyperlipidemia,” continued

Dr. Davidson.

Clinical Development Updates

NewAmsterdam is developing obicetrapib, an oral, low-dose and

once-daily cholesteryl ester transfer protein (“CETP”) inhibitor,

as the preferred LDL-C lowering therapy to be used in patients at

risk of CVD for whom existing therapies are not sufficiently

effective or well-tolerated.

- Due to faster than expected patient enrollment in the pivotal

Phase 3 TANDEM trial evaluating the obicetrapib and ezetimibe FDC,

in patients with heterozygous familial hypercholesterolemia

(“HeFH”) and/or atherosclerotic cardiovascular disease (“ASCVD”) or

ASCVD risk equivalents, the Company expects to announce topline

data in the fourth quarter of 2024.

Upcoming Potential Milestones

NewAmsterdam’s global, pivotal Phase 3 clinical development

program consists of four studies in over 12,250 patients, three for

obicetrapib monotherapy and one for a FDC of obicetrapib and

ezetimibe. NewAmsterdam currently expects to achieve the following

upcoming milestones:

- Announce additional safety and efficacy data from the Phase 3

BROOKLYN trial for obicetrapib monotherapy at the upcoming 2024 AHA

Scientific Sessions taking place November 16 – 18 in Chicago,

Illinois.

- Announce topline data from the Phase 3 BROADWAY trial for

obicetrapib monotherapy in the fourth quarter of 2024. BROADWAY is

evaluating obicetrapib in adult patients with HeFH and/or

established ASCVD, whose LDL-C is not adequately controlled,

despite being on maximally tolerated lipid-lowering therapy.

- Announce topline data from the Phase 3 TANDEM trial evaluating

a FDC of obicetrapib and ezetimibe in the fourth quarter of

2024.

Third Quarter Financial Results

- Cash Position: As of September 30, 2024,

NewAmsterdam recorded cash of $422.7 million, compared to $340.5

million as of December 31, 2023. The increase in cash is primarily

driven by the proceeds of the follow-on offering conducted earlier

this year, the achievement of a clinical development milestone and

warrant exercises partially offset by cash outflows related to

research and development costs as the Company continues development

of obicetrapib and increased spending on selling, general and

administrative expenses to support the Company’s growing

organization.

- Revenue: NewAmsterdam recognized $29.1 million

in revenue for the three months ended September 30, 2024,

compared to $2.9 million in the same period in 2023. This increase

is primarily due to the achievement of a clinical development

milestone from Menarini during the current period.

- Research and Development (“R&D”) Expenses:

R&D expenses were $35.7 million for the three months ended

September 30, 2024, compared to $43.4 million for the same

period in 2023. This decrease was primarily due to a decrease in

clinical expenses related to clinical trials which are completed or

nearing completion.

- Selling, General and Administrative (“SG&A”)

Expenses: SG&A expenses were $18.4 million in three

months ended September 30, 2024, compared to $9.1 million for

the same period in 2023. This increase was primarily due to an

increase in personnel costs related to expansion of the team to

support the growth of the organization and investments in

capabilities to support the Company’s planned commercial launch of

obicetrapib, if approved.

- Net loss: Net loss for the three months ended

September 30, 2024 was $16.6 million compared to net loss of

$47.1 million for the same period in 2023. The individual

components of the change are described above.

About Obicetrapib

Obicetrapib is a novel, oral, low-dose CETP inhibitor that

NewAmsterdam is developing to overcome the limitations of current

LDL-lowering treatments. In each of the Company’s Phase 2 trials,

ROSE2, TULIP, ROSE, and OCEAN, as well as the Company’s Phase 3

BROOKLYN trial, evaluating obicetrapib as monotherapy or

combination therapy, the Company observed statistically significant

LDL-lowering combined with a side effect profile similar to that of

placebo. The Company is conducting an additional Phase 3 pivotal

trial BROADWAY, to evaluate obicetrapib as a monotherapy used as an

adjunct to maximally tolerated lipid-lowering therapies to provide

additional LDL-lowering for CVD patients, and TANDEM, to evaluate

obicetrapib and ezetimibe as a fixed-dose combination. The Company

began enrolling patients in BROADWAY in January 2022 and in TANDEM

in March 2024; completing enrollment of BROADWAY in July 2023, and

TANDEM in July 2024. The Company also commenced the Phase 3 PREVAIL

cardiovascular outcomes trial in March 2022, which is designed to

assess the potential of obicetrapib to reduce occurrences of major

adverse cardiovascular events, including cardiovascular death,

non-fatal myocardial infarction, non-fatal stroke and non-elective

coronary revascularization. NewAmsterdam completed enrollment of

PREVAIL in April 2024 and randomized over 9,500 patients.

Commercialization rights of obicetrapib in Europe, either as a

monotherapy or as part of a fixed dose combination with ezetimibe,

for cardiovascular diseases have been exclusively granted to the

Menarini Group, an Italy-based, leading international

pharmaceutical and diagnostics company.

About NewAmsterdam

NewAmsterdam Pharma (Nasdaq: NAMS) is a late-stage

biopharmaceutical company whose mission is to improve patient care

in populations with metabolic diseases where currently approved

therapies have not been adequate or well tolerated. We seek to fill

a significant unmet need for a safe, well-tolerated and convenient

LDL-lowering therapy. In multiple phase 3 studies, NewAmsterdam is

investigating obicetrapib, an oral, low-dose and once-daily CETP

inhibitor, alone or as a fixed-dose combination with ezetimibe, as

LDL-C lowering therapies to be used as an adjunct to statin therapy

for patients at risk of CVD with elevated LDL-C, for whom existing

therapies are not sufficiently effective or well tolerated.

Forward-Looking Statements

Certain statements included in this document that are not

historical facts are forward-looking statements for purposes of the

safe harbor provisions under the United States Private Securities

Litigation Reform Act of 1995. Forward-looking statements generally

are accompanied by words such as “believe,” “may,” “will,”

“estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,”

“would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,”

“outlook” and similar expressions that predict or indicate future

events or trends or that are not statements of historical matters.

These forward-looking statements include, but are not limited to,

statements regarding the Company’s intellectual property and its

ability to enforce, and sufficiency of, its patents, the

Company’s business and strategic plans, the Company’s commercial

opportunity, the therapeutic and curative potential of the

Company’s product candidate, the Company’s clinical trials and the

timing for enrolling patients, the timing and forums for announcing

data, the achievement and timing of regulatory approvals, and plans

for commercialization. These statements are based on various

assumptions, whether or not identified in this document, and on the

current expectations of the Company’s management and are not

predictions of actual performance. These forward-looking statements

are provided for illustrative purposes only and are not intended to

serve as and must not be relied on as a guarantee, an assurance, a

prediction, or a definitive statement of fact or probability.

Actual events and circumstances are difficult or impossible to

predict and may differ from assumptions. Many actual events and

circumstances are beyond the control of the Company. These

forward-looking statements are subject to a number of risks and

uncertainties, including changes in domestic and foreign business,

market, financial, political, and legal conditions; risks related

to the approval of the Company’s product candidate and the timing

of expected regulatory and business milestones, including potential

commercialization; ability to negotiate definitive contractual

arrangements with potential customers; the impact of competitive

product candidates; ability to obtain sufficient supply of

materials; global economic and political conditions, including the

Russia-Ukraine and Israel-Hamas conflict; the effects of

competition on the Company’s future business; and those factors

described in the Company’s public filings with the Securities

Exchange Commission. Additional risks related to the Company’s

business include, but are not limited to: uncertainty regarding

outcomes of the Company’s ongoing clinical trials, particularly as

they relate to regulatory review and potential approval for its

product candidate; risks associated with the Company’s efforts to

commercialize a product candidate; the Company’s ability to

negotiate and enter into definitive agreements on favorable terms,

if at all; the impact of competing product candidates on the

Company’s business; intellectual property related claims; the

Company’s ability to attract and retain qualified personnel;

ability to continue to source the raw materials for its product

candidate. If any of these risks materialize or the Company’s

assumptions prove incorrect, actual results could differ materially

from the results implied by these forward-looking statements. There

may be additional risks that the Company does not presently know or

that the Company currently believes are immaterial that could also

cause actual results to differ from those contained in the

forward-looking statements. In addition, forward-looking statements

reflect the Company’s expectations, plans, or forecasts of future

events and views as of the date of this document and are qualified

in their entirety by reference to the cautionary statements herein.

The Company anticipates that subsequent events and developments may

cause the Company’s assessments to change. These forward-looking

statements should not be relied upon as representing the Company’s

assessment as of any date subsequent to the date of this

communication. Accordingly, undue reliance should not be placed

upon the forward-looking statements. Neither the Company nor any of

its affiliates undertakes any obligation to update these

forward-looking statements, except as may be required by law.

Company ContactMatthew PhilippeP:

1-917-882-7512matthew.philippe@newamsterdampharma.com

Media ContactSpectrum Science on behalf of

NewAmsterdamBryan BlatsteinP:

1-917-714-2609bblatstein@spectrumscience.com

Investor ContactPrecision AQ on behalf of

NewAmsterdamAustin MurtaghP:

1-212-698-8696austin.murtagh@precisionaq.com

Financial Tables

|

NewAmsterdam Pharma Company N.V. |

|

Condensed Consolidated Balance Sheets |

|

(Unaudited) |

| |

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

| (In thousands of USD) |

|

|

|

|

|

|

Assets |

|

| Current assets: |

|

|

|

|

|

|

Cash |

422,729 |

|

|

340,450 |

|

|

Prepayments and other receivables |

15,145 |

|

|

6,341 |

|

|

Total current assets |

437,874 |

|

|

346,791 |

|

| Property, plant and equipment,

net |

231 |

|

|

46 |

|

| Operating right of use

asset |

493 |

|

|

55 |

|

| Intangible assets |

593 |

|

|

170 |

|

| Long term prepaid

expenses |

- |

|

|

35 |

|

|

Total assets |

439,191 |

|

|

347,097 |

|

| Liabilities and

Shareholders' Equity |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable |

7,039 |

|

|

16,923 |

|

|

Accrued expenses and other current liabilities |

10,580 |

|

|

11,398 |

|

|

Deferred revenue, current |

4,495 |

|

|

8,942 |

|

|

Lease liability, current |

240 |

|

|

60 |

|

|

Derivative warrant liabilities |

18,901 |

|

|

12,574 |

|

|

Total current liabilities |

41,255 |

|

|

49,897 |

|

| Deferred revenue, net of

current portion |

- |

|

|

1,019 |

|

| Lease liability, net of

current portion |

266 |

|

|

- |

|

| Derivative earnout

liability |

18,808 |

|

|

7,788 |

|

|

Total liabilities |

60,329 |

|

|

58,704 |

|

| Commitments and contingencies

(Note 10) |

|

|

|

|

|

| Shareholders' Equity

(deficit): |

|

|

|

|

|

|

Ordinary shares, €0.12 par value; 400,000,000 shares authorized;

92,165,605 and 82,469,768 shares issued and outstanding as at

September 30, 2024 and December 31, 2023, respectively |

11,435 |

|

|

10,173 |

|

|

Additional paid-in capital |

829,399 |

|

|

590,771 |

|

|

Accumulated loss |

(466,394 |

) |

|

(316,973 |

) |

|

Accumulated other comprehensive income |

4,422 |

|

|

4,422 |

|

|

Total shareholders' equity |

378,862 |

|

|

288,393 |

|

| Total liabilities and

shareholders' equity |

439,191 |

|

|

347,097 |

|

|

NewAmsterdam Pharma Company N.V. |

|

Condensed Consolidated Statements of Operations and

Comprehensive Income (Loss) |

|

(Unaudited) |

| |

| |

For the three months ended September 30, |

|

|

For the nine months ended September 30, |

|

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| (In thousands of USD, except

share and per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

29,111 |

|

|

|

2,941 |

|

|

|

32,791 |

|

|

|

13,287 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development expenses |

|

35,702 |

|

|

|

43,371 |

|

|

|

116,511 |

|

|

|

118,132 |

|

|

Selling, general and administrative expenses |

|

18,412 |

|

|

|

9,128 |

|

|

|

49,340 |

|

|

|

27,048 |

|

|

Total operating expenses |

|

54,114 |

|

|

|

52,499 |

|

|

|

165,851 |

|

|

|

145,180 |

|

| Operating loss |

|

(25,003 |

) |

|

|

(49,558 |

) |

|

|

(133,060 |

) |

|

|

(131,893 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

4,443 |

|

|

|

3,059 |

|

|

|

12,396 |

|

|

|

8,615 |

|

|

Fair value change – earnout and warrants |

|

(770 |

) |

|

|

2,521 |

|

|

|

(30,028 |

) |

|

|

(4,004 |

) |

|

Foreign exchange gains/(losses) |

|

4,682 |

|

|

|

(3,155 |

) |

|

|

1,270 |

|

|

|

(160 |

) |

| Loss before tax |

|

(16,648 |

) |

|

|

(47,133 |

) |

|

|

(149,422 |

) |

|

|

(127,442 |

) |

|

Income tax expense |

|

(1 |

) |

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

| Loss and comprehensive loss

for the period |

|

(16,647 |

) |

|

|

(47,133 |

) |

|

|

(149,421 |

) |

|

|

(127,442 |

) |

| Net loss per ordinary

share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per ordinary share |

$ |

(0.18 |

) |

|

$ |

(0.57 |

) |

|

$ |

(1.61 |

) |

|

$ |

(1.55 |

) |

|

Basic and diluted weighted average number of ordinary shares

outstanding |

|

94,754,140 |

|

|

|

82,466,584 |

|

|

|

92,666,874 |

|

|

|

82,058,225 |

|

|

NewAmsterdam Pharma Company N.V. |

|

Condensed Consolidated Statements of Shareholders' Equity

(Deficit) |

|

(Unaudited) |

| |

|

(In thousands of USD, except share amounts) |

Shares |

|

|

Amount |

|

|

Additional Paid-In Capital |

|

|

Accumulated Loss |

|

|

Cumulative Translation Adjustments |

|

|

Total Shareholders' Equity |

|

| Balance at

December 31, 2022 |

81,559,780 |

|

|

10,055 |

|

|

555,625 |

|

|

(140,036 |

) |

|

4,422 |

|

|

430,066 |

|

|

Exercise of warrants |

208,032 |

|

|

27 |

|

|

2,671 |

|

|

— |

|

|

— |

|

|

2,698 |

|

|

Share-based compensation |

— |

|

|

— |

|

|

7,663 |

|

|

— |

|

|

— |

|

|

7,663 |

|

|

Total loss and comprehensive loss for the period |

— |

|

|

— |

|

|

— |

|

|

(42,018 |

) |

|

— |

|

|

(42,018 |

) |

| As at March 31,

2023 |

81,767,812 |

|

|

10,082 |

|

|

565,959 |

|

|

(182,054 |

) |

|

4,422 |

|

|

398,409 |

|

|

Exercise of warrants |

541,609 |

|

|

70 |

|

|

7,444 |

|

|

— |

|

|

— |

|

|

7,514 |

|

|

Exercise of stock options |

14,910 |

|

|

2 |

|

|

103 |

|

|

— |

|

|

— |

|

|

105 |

|

|

Share-based compensation |

— |

|

|

— |

|

|

5,606 |

|

|

— |

|

|

— |

|

|

5,606 |

|

|

Total loss and comprehensive loss for the period |

— |

|

|

— |

|

|

— |

|

|

(38,291 |

) |

|

— |

|

|

(38,291 |

) |

| As at June 30,

2023 |

82,324,331 |

|

|

10,154 |

|

|

579,112 |

|

|

(220,345 |

) |

|

4,422 |

|

|

373,343 |

|

|

Exercise of warrants |

100 |

|

|

0 |

|

|

1 |

|

|

— |

|

|

— |

|

|

1 |

|

|

Exercise of stock options |

145,337 |

|

|

19 |

|

|

166 |

|

|

— |

|

|

— |

|

|

185 |

|

|

Share-based compensation |

— |

|

|

— |

|

|

5,439 |

|

|

— |

|

|

— |

|

|

5,439 |

|

|

Total loss and comprehensive loss for the period |

— |

|

|

— |

|

|

— |

|

|

(47,133 |

) |

|

— |

|

|

(47,133 |

) |

| As at

September 30, 2023 |

82,469,768 |

|

|

10,173 |

|

|

584,718 |

|

|

(267,478 |

) |

|

4,422 |

|

|

331,835 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at

December 31, 2023 |

82,469,768 |

|

|

10,173 |

|

|

590,771 |

|

|

(316,973 |

) |

|

4,422 |

|

|

288,393 |

|

|

Issuance of Ordinary Shares and Pre-Funded Warrants, net of

issuance costs |

5,871,909 |

|

|

759 |

|

|

189,207 |

|

|

— |

|

|

— |

|

|

189,966 |

|

|

Exercise of warrants |

926,698 |

|

|

121 |

|

|

19,674 |

|

|

— |

|

|

— |

|

|

19,795 |

|

|

Exercise of stock options |

452,461 |

|

|

60 |

|

|

(609 |

) |

|

— |

|

|

— |

|

|

(549 |

) |

|

Share-based compensation |

— |

|

|

— |

|

|

7,965 |

|

|

— |

|

|

— |

|

|

7,965 |

|

|

Total loss and comprehensive loss for the period |

— |

|

|

— |

|

|

— |

|

|

(93,767 |

) |

|

— |

|

|

(93,767 |

) |

| As at March 31,

2024 |

89,720,836 |

|

|

11,113 |

|

|

807,008 |

|

|

(410,740 |

) |

|

4,422 |

|

|

411,803 |

|

|

Exercise of warrants |

294,521 |

|

|

38 |

|

|

6,268 |

|

|

— |

|

|

— |

|

|

6,306 |

|

|

Share-based compensation |

— |

|

|

— |

|

|

8,337 |

|

|

— |

|

|

— |

|

|

8,337 |

|

|

Total loss and comprehensive loss for the period |

— |

|

|

— |

|

|

— |

|

|

(39,007 |

) |

|

— |

|

|

(39,007 |

) |

| As at June 30,

2024 |

90,015,357 |

|

|

11,151 |

|

|

821,613 |

|

|

(449,747 |

) |

|

4,422 |

|

|

387,439 |

|

|

Exercise of Pre-Funded Warrants |

2,105,248 |

|

|

279 |

|

|

(279 |

) |

|

— |

|

|

— |

|

|

— |

|

|

Exercise of stock options |

45,000 |

|

|

5 |

|

|

53 |

|

|

— |

|

|

— |

|

|

58 |

|

|

Share-based compensation |

— |

|

|

— |

|

|

8,012 |

|

|

— |

|

|

— |

|

|

8,012 |

|

|

Total loss and comprehensive loss for the period |

— |

|

|

— |

|

|

— |

|

|

(16,647 |

) |

|

— |

|

|

(16,647 |

) |

| As at

September 30, 2024 |

92,165,605 |

|

|

11,435 |

|

|

829,399 |

|

|

(466,394 |

) |

|

4,422 |

|

|

378,862 |

|

|

NewAmsterdam Pharma Company N.V. |

|

Condensed Consolidated Statements of Cash

Flows |

|

(Unaudited) |

| |

| |

For the nine months ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

| (In thousands of USD) |

|

|

|

|

|

| Operating

activities: |

|

|

|

|

|

| Loss for the period |

(149,421 |

) |

|

(127,442 |

) |

| Non-cash adjustments to

reconcile loss before tax to net cash flows: |

|

|

|

|

|

|

Depreciation and amortization |

62 |

|

|

36 |

|

|

Non-cash rent expense |

8 |

|

|

5 |

|

|

Fair value change - derivative earnout and warrants |

30,028 |

|

|

4,004 |

|

|

Foreign exchange (gains)/losses |

(1,270 |

) |

|

160 |

|

|

Share-based compensation |

24,204 |

|

|

18,566 |

|

| Changes in working

capital: |

|

|

|

|

|

|

Changes in prepayments (current and non-current) and other

receivables |

(8,769 |

) |

|

988 |

|

|

Changes in accounts payable |

(9,751 |

) |

|

(7,824 |

) |

|

Changes in accrued expenses and other current liabilities |

(708 |

) |

|

11,266 |

|

|

Changes in deferred revenue |

(5,466 |

) |

|

(7,903 |

) |

| Net cash (used

in)/provided by operating activities |

(121,083 |

) |

|

(108,144 |

) |

| Investing

activities: |

|

|

|

|

|

|

Purchase of property, plant and equipment, including internal use

software |

(669 |

) |

|

(21 |

) |

| Net cash used in

investing activities |

(669 |

) |

|

(21 |

) |

| Financing

activities: |

|

|

|

|

|

|

Proceeds from offering of Ordinary Shares and Pre-Funded

Warrants |

190,481 |

|

|

— |

|

|

Transaction costs on issue of Ordinary Shares and Pre-Funded

Warrants |

(515 |

) |

|

— |

|

|

Proceeds from exercise of warrants |

13,421 |

|

|

8,622 |

|

|

Proceeds from exercise of options |

498 |

|

|

290 |

|

|

Payment of withholding taxes related to net share settlement of

exercised options |

(989 |

) |

|

— |

|

| Net cash provided by

financing activities |

202,896 |

|

|

8,912 |

|

| Net change in cash |

81,144 |

|

|

(99,253 |

) |

| Foreign exchange

differences |

1,135 |

|

|

(168 |

) |

| Cash at the beginning of the

period |

340,450 |

|

|

467,728 |

|

| Cash at the end of the

period |

422,729 |

|

|

368,307 |

|

| Noncash financing and

investing activities |

|

|

|

|

|

|

Right-of-use assets obtained in exchange for new operating lease

liabilities |

562 |

|

|

— |

|

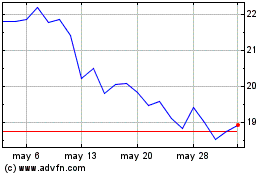

NewAmsterdam Pharma Comp... (NASDAQ:NAMS)

Gráfica de Acción Histórica

De Mar 2025 a Abr 2025

NewAmsterdam Pharma Comp... (NASDAQ:NAMS)

Gráfica de Acción Histórica

De Abr 2024 a Abr 2025