UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

Neo-Concept International Group Holdings Limited

(Name of Issuer)

Ordinary shares, par value $0.0000625 per share

(Title of Class of Securities)

Ordinary Shares: G6421C 104

(CUSIP Number)

Eva Yuk Yin Siu

10/F, Seaview Centre

No.139-141 Hoi Bun Road

Kwun Tong

Kowloon, Hong Kong

(852) 2798-8639

Asset Empire International Limited

Splendid Vibe Limited

Neo-concept (BVI) Limited

Ample Excellence Limited

Coastal Building, Wickham’s Cay II, P.

O. Box 2221

Road Town, Tortola, VG1110

British Virgin Islands

(852) 2798-8639

VIAPC 1 Limited

190 Elgin Avenue, George Town

Grand Cayman, KY1-9008

Cayman Islands

(852) 3852 0000

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications)

April 1, 2024

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box: ☐

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies

are to be sent.

| * |

This statement on Schedule 13D constitutes an initial Schedule 13D filing on behalf of each of Eva Yuk Yin Siu, Asset Empire International Limited, a British Virgin Islands Company (“Asset Empire”), Splendid Vibe Limited, a British Virgin Islands company (“Splendid Vibe”), Neo-concept (BVI) Limited, a British Virgin Islands company (“Neo-concept (BVI)”), Ample Excellence Limited, a British Virgin Islands company (“Ample Excellence”), and VIAPC 1 Limited, a Cayman Islands company (“VIAPC 1”), with respect to the Ordinary Shares (the “Ordinary Shares”), par value of $0.0000625 per share (“Ordinary Shares”), of Neo-Concept International Group Holdings Limited, a Cayman Islands company (the “Issuer”). |

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| 1. |

Names of Reporting Persons.

Eva Yuk Yin Siu |

| 2. |

Check the Appropriate Box if a Member of a Group

(See Instructions)

(a) ☐

(b) ☒ |

| 3. |

SEC Use Only

|

| 4. |

Source of Funds (See Instructions)

OO |

| 5. |

Check if Disclosure of Legal Proceedings Is Required

Pursuant to Items 2(d) or 2(e) ☐

|

| 6. |

Citizenship or Place of Organization

Chinese (HKSAR) |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

14,526,355 (1) |

| 8. |

Shared Voting Power

|

| 9. |

Sole Dispositive Power

14,526,355 (1) |

| 10. |

Shared Dispositive Power

|

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting

Person

14,526,355 |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes

Certain Shares (See Instructions) ☐

|

| 13. |

Percent of Class Represented by Amount in Row

(11)

71.5%(2) |

| 14. |

Type of Reporting Person (See Instructions)

IN |

| (1) | Ms.

Eva Yuk Yin Siu, the chairlady of the Board, Chief Executive Officer, and a Director of the Company, owns the entire issued share capital

of Asset Empire International Limited. Asset Empire International Limited, a company incorporated in the BVI with limited liability,

holds 87.71% of the issued shares of Splendid Vibe Limited. Splendid Vibe Limited, a company incorporated in the BVI with limited liability,

owns the entire issued share capital of Ample Excellence Limited and Neo-Concept (BVI) Limited. |

| (2) | Percentage

is calculated based on 20,320,000 ordinary shares issued and outstanding as of April 1, 2024, calculated by adding (i) the 18,000,000

Ordinary Shares outstanding as of November 1, 2023, as reported by the Company in its Registration Statement on Form F-1, filed on November

1, 2023, (ii) the 2,320,000 Ordinary Shares the Company sold in its initial public offering as disclosed in the Company’s Current

Report on Form 6-K filed on April 26, 2024. |

| 1. |

Names of Reporting Persons.

Asset Empire International Limited |

| 2. |

Check the Appropriate Box if a Member of a Group

(See Instructions)

(a) ☐

(b) ☒ |

| 3. |

SEC Use Only

|

| 4. |

Source of Funds (See Instructions)

OO |

| 5. |

Check if Disclosure of Legal Proceedings Is Required

Pursuant to Items 2(d) or 2(e) ☐

|

| 6. |

Citizenship or Place of Organization

British Virgin Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

14,526,355 (1) |

| 8. |

Shared Voting Power

|

| 9. |

Sole Dispositive Power

14,526,355 (1) |

| 10. |

Shared Dispositive Power

|

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting

Person

14,526,355 |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes

Certain Shares (See Instructions) ☐

|

| 13. |

Percent of Class Represented by Amount in Row

(11)

71.5%(2) |

| 14. |

Type of Reporting Person (See Instructions)

CO |

| (1) | Ms.

Eva Yuk Yin Siu, the chairlady of the Board, Chief Executive Officer, and a Director of the Company, owns the entire issued share capital

of Asset Empire International Limited. Asset Empire International Limited, a company incorporated in the BVI with limited liability,

holds 87.71% of the issued shares of Splendid Vibe Limited. Splendid Vibe Limited, a company incorporated in the BVI with limited liability,

owns the entire issued share capital of Ample Excellence Limited and Neo-Concept (BVI) Limited. |

| (2) | Percentage

is calculated based on 20,320,000 ordinary shares issued and outstanding as of April 1, 2024, calculated by adding (i) the 18,000,000

Ordinary Shares outstanding as of November 1, 2023, as reported by the Company in its Registration Statement on Form F-1, filed on November

1, 2023, (ii) the 2,320,000 Ordinary Shares the Company sold in its initial public offering as disclosed in the Company’s Current

Report on Form 6-K filed on April 26, 2024. |

| 1. |

Names of Reporting Persons.

Splendid Vibe Limited |

| 2. |

Check the Appropriate Box if a Member of a Group

(See Instructions)

(a) ☐

(b) ☒ |

| 3. |

SEC Use Only

|

| 4. |

Source of Funds (See Instructions)

OO |

| 5. |

Check if Disclosure of Legal Proceedings Is Required

Pursuant to Items 2(d) or 2(e) ☐

|

| 6. |

Citizenship or Place of Organization

British Virgin Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

16,561,800(1) |

| 8. |

Shared Voting Power

|

| 9. |

Sole Dispositive Power

16,561,800 (1) |

| 10. |

Shared Dispositive Power

|

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting

Person

16,561,800 |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes

Certain Shares (See Instructions) ☐

|

| 13. |

Percent of Class Represented by Amount in Row

(11)

81.5%(3) |

| 14. |

Type of Reporting Person (See Instructions)

CO |

| (1) |

Ms. Eva Yuk Yin Siu, the chairlady of the Board, Chief Executive Officer, and a Director of the Company, owns the entire issued share capital of Asset Empire International Limited. Asset Empire International Limited, a company incorporated in the BVI with limited liability, holds 87.71% of the issued shares of Splendid Vibe Limited. Splendid Vibe Limited, a company incorporated in the BVI with limited liability, owns the entire issued share capital of Ample Excellence Limited and Neo-Concept (BVI) Limited. |

| |

| (3) |

Percentage is calculated based on 20,320,000 ordinary shares issued and outstanding as of April 1, 2024, calculated by adding (i) the 18,000,000 Ordinary Shares outstanding as of November 1, 2023, as reported by the Company in its Registration Statement on Form F-1, filed on November 1, 2023, (ii) the 2,320,000 Ordinary Shares the Company sold in its initial public offering as disclosed in the Company’s Current Report on Form 6-K filed on April 26, 2024. |

| 1. |

Names of Reporting Persons.

Neo-concept (BVI) Limited |

| 2. |

Check the Appropriate Box if a Member of a Group

(See Instructions)

(a) ☐

(b) ☒ |

| 3. |

SEC Use Only

|

| 4. |

Source of Funds (See Instructions)

OO |

| 5. |

Check if Disclosure of Legal Proceedings Is Required

Pursuant to Items 2(d) or 2(e) ☐

|

| 6. |

Citizenship or Place of Organization

British Virgin Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

14,761,800 (1) |

| 8. |

Shared Voting Power

|

| 9. |

Sole Dispositive Power

14,761,800 (1) |

| 10. |

Shared Dispositive Power

|

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting

Person

14,761,800 |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes

Certain Shares (See Instructions) ☐

|

| 13. |

Percent of Class Represented by Amount in Row

(11)

72.6.0%(2) |

| 14. |

Type of Reporting Person (See Instructions)

CO |

| (1) | Neo-Concept

(BVI) Limited, a company incorporated in the BVI with limited liability, 72.6% of the issued Shares of the Company |

| (2) | Percentage

is calculated based on 20,320,000 ordinary shares issued and outstanding as of April 1, 2024, calculated by adding (i) the 18,000,000

Ordinary Shares outstanding as of November 1, 2023, as reported by the Company in its Registration Statement on Form F-1, filed on November

1, 2023, (ii) the 2,320,000 Ordinary Shares the Company sold in its initial public offering as disclosed in the Company’s Current

Report on Form 6-K filed on April 26, 2024. |

| 1. |

Names of Reporting Persons.

Ample Excellence Limited |

| 2. |

Check the Appropriate Box if a Member of a Group

(See Instructions)

(a) ☐

(b) ☒ |

| 3. |

SEC Use Only

|

| 4. |

Source of Funds (See Instructions)

|

| 5. |

Check if Disclosure of Legal Proceedings Is Required

Pursuant to Items 2(d) or 2(e) ☐

|

| 6. |

Citizenship or Place of Organization

British Virgin Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

1,800,000(1) |

| 8. |

Shared Voting Power

|

| 9. |

Sole Dispositive Power

1,800,000 (1) |

| 10. |

Shared Dispositive Power

|

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting

Person

1,800,000 |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes

Certain Shares (See Instructions) ☐

|

| 13. |

Percent of Class Represented by Amount in Row

(11)

8.9%(2) |

| 14. |

Type of Reporting Person (See Instructions)

CO |

| (1) | Ample

Excellence Limited, a company incorporated in the BVI with limited liability, owns 8.9% of the issued Shares of the Company. |

| (2) | Percentage

is calculated based on 20,320,000 ordinary shares issued and outstanding as of April 1, 2024, calculated by adding (i) the 18,000,000

Ordinary Shares outstanding as of November 1, 2023, as reported by the Company in its Registration Statement on Form F-1, filed on November

1, 2023, (ii) the 2,320,000 Ordinary Shares the Company sold in its initial public offering as disclosed in the Company’s Current

Report on Form 6-K filed on April 26, 2024. |

| 1. |

Names of Reporting Persons.

VIAPC 1 Limited |

| 2. |

Check the Appropriate Box if a Member of a Group

(See Instructions)

(a) ☐

(b) ☒ |

| 3. |

SEC Use Only

|

| 4. |

Source of Funds (See Instructions)

|

| 5. |

Check if Disclosure of Legal Proceedings Is Required

Pursuant to Items 2(d) or 2(e) ☐

|

| 6. |

Citizenship or Place of Organization

Cayman Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7. |

Sole Voting Power

1,642,930 (1) |

| 8. |

Shared Voting Power

|

| 9. |

Sole Dispositive Power

1,642,930 (1) |

| 10. |

Shared Dispositive Power

|

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting

Person

1,642,930 |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes

Certain Shares (See Instructions) ☐

|

| 13. |

Percent of Class Represented by Amount in Row

(11)

8.1%(2) |

| 14. |

Type of Reporting Person (See Instructions)

CO |

| (1) | VIAPC 1 Limited, a company

incorporated in the Cayman Islands with limited liability, beneficially owns 8.1% of the issued Shares of the Company, through its

ownership of 130 preference shares of Splendid Vibe Limited, a company incorporated in the BVI with limited liability, which owns

the entire issued share capital of Ample Excellence Limited and Neo-Concept (BVI) Limited. |

| (2) | Percentage

is calculated based on 20,320,000 ordinary shares issued and outstanding as of April 1, 2024, calculated by adding (i) the 18,000,000

Ordinary Shares outstanding as of November 1, 2023, as reported by the Company in its Registration Statement on Form F-1, filed on November

1, 2023, (ii) the 2,320,000 Ordinary Shares the Company sold in its initial public offering as disclosed in the Company’s Current

Report on Form 6-K filed on April 26, 2024. |

Item 1. Security and Issuer.

This statement of beneficial ownership on Schedule

13D (this “Statement”) relates to the ordinary shares (the “Ordinary Shares”) of Neo-Concept International Group

Holdings Limited. (the “Issuer”). The principal executive offices of the Issuer are located at 10/F, Seaview Centre, No.139-141

Hoi Bun Road, Kwun Tong, Kowloon, Hong Kong. The Ordinary Shares are listed on the Nasdaq Capital Market under the symbol “NCI.”

Item 2. Identity and Background.

Eva Yuk Yin Siu, Asset Empire, Splendid Vibe Neo-concept

(BVI), Ample Excellence and VIAPC 1, are collectively referred to herein as “Reporting Persons,” and each, a “Reporting

Person.” This Schedule 13D is being filed jointly by the Reporting Persons pursuant to Rule 13d-1(k) promulgated by the SEC under

Section 13 of the Act. The agreement among the Reporting Persons relating to the joint filing is attached hereto as Exhibit 99.1. Information

with respect to each of the Reporting Persons is given solely by such Reporting Person, and no Reporting Person assumes responsibility

for the accuracy or completeness of the information concerning the other Reporting Persons, except as otherwise provided in Rule 13d-1(k).

Ms. Eva Yuk Yin Siu, the chairlady of the Board,

Chief Executive Officer, and a Director of the Company, owns the entire issued share capital of Asset Empire International Limited. Asset

Empire International Limited, a company incorporated in the BVI with limited liability, holds 87.71% of the issued shares of Splendid

Vibe Limited. Splendid Vibe Limited, a company incorporated in the BVI with limited liability, owns the entire issued share capital of

Ample Excellence Limited and Neo-Concept (BVI) Limited.

Neo-Concept (BVI) Limited, a company incorporated

in the BVI with limited liability, 72.6% of the issued Shares of the Company.

Ample Excellence Limited, a company incorporated

in the BVI with limited liability, owns 8.9% of the issued Shares of the Company.

The business address of Ms. Eva Yuk Yin Siu,

is 10/F, Seaview Centre, No.139-141 Hoi Bun Road, Kwun Tong, Kowloon, Hong Kong. The registered office address of Asset Empire,

Splendid Vibe, Neo-concept (BVI) Limited and Ample Excellence is listed is Coastal Building, Wickham’s Cay II, P. O. Box 2221,

Road Town, Tortola, VG1110, British Virgin Islands. VIAPC 1 Limited’s registered office address is at 190 Elgin Avenue, George

Town, Grand Cayman, KY1-9008, Cayman Islands.

During the last five years, none of the Reporting

Persons nor, to the best knowledge of the applicable Reporting Persons, any of their respective directors or executive officers, has been:

(i) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (ii) a party to a civil proceeding of

a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree

or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or

finding any violation with respect to such laws.

Item 3. Source and Amount of Funds or Other

Consideration.

Ms. Eva Yuk Yin Siu, the chairlady of the Board,

Chief Executive Officer, and a Director of the Company, owns the entire issued share capital of Asset Empire International Limited. Asset

Empire International Limited, a company incorporated in the BVI with limited liability, holds 87.71% of the issued shares of Splendid

Vibe Limited. Splendid Vibe Limited, a company incorporated in the BVI with limited liability, owns the entire issued share capital of

Ample Excellence Limited and Neo-Concept (BVI) Limited.

VIAPC 1 Limited, a company incorporated in the

Cayman Islands with limited liability, beneficially owns 1,642,930 of the issued Shares of the Company, through its ownership of 130 preference

shares of Splendid Vibe Limited, a company incorporated in the BVI with limited liability, which owns the entire issued share

capital of Ample Excellence Limited and Neo-Concept (BVI) Limited.

Neo-Concept (BVI), a company incorporated in the

BVI with limited liability, was allotted 1,000,000 Ordinary Shares on October 29, 2021 for $nil consideration. On February 16, 2022, the

Issuer allotted an additional 10,250,000 Ordinary Shares for a consideration of US$1,025.00 to Neo-Concept (BVI). Subsequently, on March

8, 2022, Neo-Concept (BVI) transferred 561,375 Ordinary Shares and 337,500 Ordinary Shares to Au Lai Ming and Chan Kim Sun, respectively,

for a consideration of HK$4,990,000.00 and HK$3,000,000, respectively. On March 8, 2022, Neo-Concept (BVI) transferred 1,125,00 shares

to Ample Excellence for $nil consideration, and subsequently held 9,226,125 Ordinary Shares of the Issuer. On July 14, 2023, following

a share subdivision by the Issuer, Neo-Concept (BVI) held 14,761,800 Ordinary Shares of the Issuer.

Ample Excellence, a company incorporated in the

BVI with limited liability, received 1,125,000 Ordinary Shares of the Issuer from Neo-Concept (BVI) for $Nil consideration on March 8,

2022. On July 14, 2023, following a share subdivision by the Issuer, Ample Excellence held 1,800,000 Ordinary Shares of the Issuer.

Item 4. Purpose of Transaction.

The Reporting Persons do not have any present

plans or proposals that relate to or would result in any of the actions described in subparagraphs (a) through (j) of Item 4 of Schedule

13D, although, subject to the agreements described herein, the Reporting Person, at any time, and from time to time, may review, reconsider

and change their position and/or change their purpose and/or develop such plans and may seek to influence management of the Issuer or

the Board of Directors with respect to the business and affairs of the Issuer and may from time to time consider pursuing or proposing

such matters with advisors, the Issuer, or other persons.

Item 5. Interest in Securities of the Issuer.

| |

(a) - (b) |

The responses of the Reporting Persons with respect to Rows 11 and 13 on the cover pages of this Statement that relate to the aggregate number and percentage of Ordinary Shares (including, but not limited to, footnotes to such information) are incorporated herein by reference. |

| |

|

|

| |

|

The responses of the Reporting Persons with respect to Rows 7, 8, 9, and 10 of the cover pages of this Statement that relate to the number of Ordinary Shares as to which the Reporting Persons referenced in Item 2 above has sole or shared power to vote or to direct the vote of and sole or shared power to dispose of or to direct the disposition of (including, but not limited to, footnotes to such information) are incorporated herein by reference. |

| |

|

|

| |

(c) |

Except as set forth in this Statement, the Reporting Persons have not, to the best of their knowledge, engaged in any transaction with respect to the Issuer’s Ordinary Shares during the sixty days prior to the date of filing this Statement. |

| |

|

|

| |

(d) |

Except as described in Item 3, no person other than the Reporting Persons are known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the shares of the Issuer’s Ordinary Shares beneficially owned by the Reporting Person as reported in this Statement. |

| |

|

|

| |

(e) |

Not applicable. |

Item 6. Contracts, Arrangements, Understandings

or Relationships With Respect to Securities of the Issuer.

Lock-Up Agreement

In connection with the initial

public offering of the Issuer, on April 22, 2024, the Reporting Persons respectively entered into lock-up agreements, (together, the “Lock-up

Agreements”), pursuant to which the Reporting Persons each agreed that, with respect to their respective shareholding of the Company,

in aggregate 13,871,570 Ordinary Shares, not to transfer any of such shares for a period of six months after the date of the final prospectus.

References to and descriptions

of the Lock-up Agreements herein are qualified in their entirety by reference to the Form of Lock-up Agreement filed as Exhibit 2 to this

Statement and incorporated herein by reference.

Except as described herein,

there are no contracts, arrangements, understandings or relationships (legal or otherwise) between such Reporting Person and any other

person with respect to any securities of the Issuer.

Item 7. Material to be Filed as Exhibits.

SIGNATURE

After reasonable inquiry and

to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| Date: May 7, 2024 |

|

|

| |

Neo-Concept International Group Holdings Limited |

| |

|

|

| |

By: |

/s/ Eva Yuk Yin Siu |

| |

Name: |

Eva Yuk Yin Siu |

| |

Title: |

Chief Executive Officer,

Chairlady of the Board and Director |

10

Exhibit 1

Joint Filing Agreement

In accordance with Rule 13d-1(k) under the Securities

Exchange Act of 1934, as amended, the undersigned agree that only one statement containing the information required by Schedule 13D and

any further amendments thereto needs to be filed with respect to the beneficial ownership by each of the undersigned of the ordinary shares

of Neo-Concept International Group Holdings Limited, a Cayman Islands company, and further agree that this Joint Filing Agreement be included

as an exhibit to the Schedule 13D, provided that, as contemplated by Section 13d-1(k)(1)(ii), no person shall be responsible for the completeness

or accuracy of the information concerning any other person making the filing, unless such person knows or has reason to believe that such

information is inaccurate. This Agreement as to Joint Filing may be executed in any number of counterparts, all of which taken together

shall constitute one and the same instrument.

[Remainder of this page has been left intentionally

blank.]

Signature Page

IN WITNESS WHEREOF, the undersigned hereby execute this Agreement as

of May 7, 2024.

| |

Eva Yuk Yin Siu |

| |

|

| |

/s/ Eva Yuk Yin Siu |

| |

Eva Yuk Yin Siu |

| |

|

| |

Asset Empire International Limited |

| |

|

| |

/s/ Eva Yuk Yin Siu |

| |

Eva Yuk Yin Siu |

| |

Director |

| |

|

| |

Splendid Vibe Limited |

| |

|

| |

/s/ Eva Yuk Yin Siu |

| |

Eva Yuk Yin Siu |

| |

Director |

| |

|

| |

Neo-concept (BVI) Limited |

| |

|

| |

/s/ Eva Yuk Yin Siu |

| |

Eva Yuk Yin Siu |

| |

Director |

| |

|

| |

Ample Excellence Limited |

| |

|

| |

/s/ Eva Yuk Yin Siu |

| |

Eva Yuk Yin Siu |

| |

Director |

Exhibit 2

Lock-Up Agreement

[ ], 2024

Revere Securities LLC

650 Fifth Avenue, 35th Floor

New York, NY 10022

Ladies and Gentlemen:

This Lock-Up Agreement (this

“Agreement”) is being delivered to Revere Securities LLC (the “Representative”) in connection with

the proposed Underwriting Agreement (the “Underwriting Agreement”) between Neo-Concept International Group Holdings

Limited, a Cayman Islands company (the “Company”), and the Representative, relating to the proposed public offering

(the “Offering”) of ordinary shares, par value US$0.0000625 per share (the “Ordinary Shares”), of

the Company.

In order to induce the Underwriters

(as defined in the Underwriting Agreement) to continue their efforts in connection with the Offering, and in light of the benefits that

the Offering will confer upon the undersigned in its capacity as a shareholder and/or an officer, director or employee of the Company,

and for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the undersigned agrees with the

Representative that, during the period beginning on and including the date of this Agreement through and including the date that is 180

days from the date of this Agreement (the “Lock-Up Period”), the undersigned will not, without the prior written consent

of the Representative, directly or indirectly, (i) offer, sell, assign, transfer, pledge, contract to sell, or otherwise dispose of, or

announce the intention to otherwise dispose of, any Ordinary Shares now owned or hereafter acquired by the undersigned or with respect

to which the undersigned has or hereafter acquires the power of disposition (including, without limitation, Ordinary Shares which may

be deemed to be beneficially owned by the undersigned in accordance with the rules and regulations promulgated under the Securities Act

of 1933, as amended, and as the same may be amended or supplemented on or after the date hereof from time to time (the “Securities

Act”)) (such shares, the “Beneficially Owned Shares”) or securities convertible into or exercisable or exchangeable

for Ordinary Shares, (ii) enter into any swap, hedge or similar agreement or arrangement that transfers in whole or in part, the economic

risk of ownership of the Beneficially Owned Shares or securities convertible into or exercisable or exchangeable for Ordinary Shares,

whether now owned or hereafter acquired by the undersigned or with respect to which the undersigned has or hereafter acquires the power

of disposition, or (iii) engage in any short selling of the Ordinary Shares.

The restrictions set forth in the immediately

preceding paragraph shall not apply to:

(1) if the undersigned is

a natural person, any transfers made by the undersigned (a) as a bona fide gift to any member of the immediate family (as defined below)

of the undersigned or to a trust the beneficiaries of which are exclusively the undersigned or members of the undersigned’s immediate

family, (b) by will or intestate succession upon the death of the undersigned, (c) as a bona fide gift to a charity or educational institution,

(d) any transfer pursuant to a qualified domestic relations order or in connection with a divorce; or (e) if the undersigned is or was

an officer, director or employee of the Company, to the Company pursuant to the Company’s right of repurchase upon termination of

the undersigned’s service with the Company;

(2) if the undersigned is

a corporation, partnership, limited liability company or other business entity, any transfers to any shareholder, partner or member of,

or owner of a similar equity interest in, the undersigned, as the case may be, if, in any such case, such transfer is not for value;

(3) if the undersigned is

a corporation, partnership, limited liability company or other business entity, any transfer made by the undersigned (a) in connection

with the sale or other bona fide transfer in a single transaction of all or substantially all of the undersigned’s share capital,

partnership interests, membership interests or other similar equity interests, as the case may be, or all or substantially all of the

undersigned’s assets, in any such case not undertaken for the purpose of avoiding the restrictions imposed by this Agreement or

(b) to another corporation, partnership, limited liability company or other business entity so long as the transferee is an affiliate

(as defined below) of the undersigned and such transfer is not for value;

(4) (a) exercises of stock

options or equity awards granted pursuant to an equity incentive or other plan or warrants to purchase Ordinary Shares or other securities

(including by cashless exercise to the extent permitted by the instruments representing such stock options or warrants so long as such

cashless exercise is effected solely by the surrender of outstanding stock options or warrants to the Company and the Company’s

cancellation of all or a portion thereof to pay the exercise price), provided that in any such case the securities issued upon exercise

shall remain subject to the provisions of this Agreement (as defined below); (b) transfers of Ordinary Shares or other securities to the

Company in connection with the vesting or exercise of any equity awards granted pursuant to an equity incentive or other plan and held

by the undersigned to the extent, but only to the extent, as may be necessary to satisfy tax withholding obligations pursuant to the Company’s

equity incentive or other plans;

(5) the exercise by the undersigned

of any warrant(s) issued by the Company prior to the date of this Agreement, including any exercise effected by the delivery of shares

of Ordinary Shares of the Company held by the undersigned; provided, that, the Ordinary Shares received upon such exercise shall remain

subject to the restrictions provided for in this Agreement;

(6) the occurrence after the

date hereof of any of (a) an acquisition by an individual or legal entity or “group” (as described in Rule 13d-5(b)(1) promulgated

under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) of effective control (whether through legal

or beneficial ownership of share capital of the Company, by contract or otherwise) of 100% of the voting securities of the Company, (b)

the Company merges into or consolidates with any other entity, or any entity merges into or consolidates with the Company, (c) the Company

sells or transfers all or substantially all of its assets to another person, or (d) provided, that, the Ordinary Shares received upon

any of the events set forth in clauses (a) through (c) above shall remain subject to the restrictions provided for in this Agreement;

(7) the Offering;

(8) transfers consented to,

in writing by the Representative;

(9) transactions relating

to Ordinary Shares acquired in open market transactions after the completion of the Offering; provided that, no filing by any party under

the Exchange Act or other public announcement shall be required or shall be voluntarily made in connection with such transactions;

provided however, that

in the case of any transfer described in clauses (1), (2) or (3) above, it shall be a condition to the transfer that the transferee executes

and delivers to the Representative, acting on behalf of the Underwriters, not later than one business day prior to such transfer, a written

agreement, in substantially the form of this Agreement (it being understood that any references to “immediate family” in the

agreement executed by such transferee shall expressly refer only to the immediate family of the undersigned and not to the immediate family

of the transferee) and otherwise satisfactory in form and substance to the Representative.

In addition, the restrictions

set forth herein shall not prevent the undersigned from entering into a sales plan pursuant to Rule 10b5-1 under the Exchange Act after

the date hereof, provided that (i) a copy of such plan is provided to the Representative promptly upon entering into the same and

(ii) no sales or transfers may be made under such plan until the Lock-Up Period ends or this Agreement is terminated in accordance with

its terms. For purposes of this paragraph, “immediate family” shall mean a spouse, child, grandchild or other lineal descendant

(including by adoption), father, mother, brother or sister of the undersigned; and “affiliate” shall have the meaning set

forth in Rule 405 under the Securities Act.

If (i) during the last 17

days of the Lock-Up Period, the Company issues an earnings release or material news or a material event relating to the Company occurs,

or (ii) prior to the expiration of the Lock-Up Period, the Company announces that it will release earnings results or becomes aware that

material news or a material event will occur during the 16-day period beginning on the last day of the Lock-Up Period, the restrictions

imposed by this Agreement shall continue to apply until the expiration of the 18-day period beginning on the issuance of the earnings

release or the occurrence of such material news or material event, as applicable, unless the Representative waives, in writing, such extension.

If the undersigned is an officer

or director of the Company, the Representative agrees that, at least three business days before the effective date of any release or waiver

of the foregoing restrictions in connection with a transfer of Ordinary Shares, the Representative will notify the Company of the impending

release or waiver. Any release or waiver granted by the Representative hereunder to any such officer or director shall only be effective

two business days after the publication date of such press release; provided, that such press release is not a condition to the release

of the aforementioned lock-up provisions due to the expiration of the Lock-Up Period. The provisions of this paragraph will also not apply

if (a) the release or waiver is effected solely to permit a transfer not for consideration and (b) the transferee has agreed in writing

to be bound by the same terms described in this Agreement to the extent and for the duration that such terms remain in effect at the time

of such transfer.

In furtherance of the foregoing,

(1) the undersigned also agrees and consents to the entry of stop transfer instructions with any duly appointed transfer agent for the

registration or transfer of the securities described herein against the transfer of any such securities except in compliance with the

foregoing restrictions, and (2) the Company, and any duly appointed transfer agent for the registration or transfer of the securities

described herein, are hereby authorized to decline to make any transfer of securities if such transfer would constitute a violation or

breach of this Agreement.

The undersigned hereby represents

and warrants that the undersigned has full power and authority to enter into this Agreement and that this Agreement has been duly authorized

(if the undersigned is not a natural person), executed and delivered by the undersigned and is a valid and binding agreement of the undersigned.

This Agreement and all authority herein conferred are irrevocable and shall survive the death or incapacity of the undersigned (if a natural

person) and shall be binding upon the heirs, personal representatives, successors and assigns of the undersigned for the term of the Lock-Up

Period.

This Agreement shall automatically

terminate upon the earliest to occur, if any, of (1) either the Representative, on the one hand, or the Company, on the other hand, advising

the other in writing, they have determined not to proceed with the Offering, (2) termination of the Underwriting Agreement before the

sale of Ordinary Shares, or (3) the withdrawal of the Registration Statement

This Agreement shall be governed

by and construed in accordance with the internal laws of the State of New York, without regard to the conflict of laws principles thereof.

[Signature Page Follows]

| |

Very truly yours, |

| |

|

|

| |

|

| |

(Name - Please Print) |

| |

|

|

| |

|

| |

(Signature) |

| |

|

|

| |

|

| |

(Name of Signatory, in the case of entities - Please Print) |

| |

|

|

| |

|

| |

(Title of Signatory, in the case of entities - Please Print) |

| |

|

|

| |

Address: |

|

| |

|

| |

|

|

| |

# of Ordinary Shares Held by Signatory: |

|

4

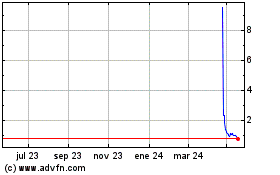

Neo Concept (NASDAQ:NCI)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

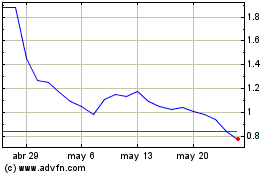

Neo Concept (NASDAQ:NCI)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024