0001275158false00012751582023-12-212023-12-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15 (d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): December 21, 2023

NOODLES & COMPANY

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| Delaware | 001-35987 | 84-1303469 |

| (State or Other Jurisdiction of | (Commission File Number) | (I.R.S. Employer |

| Incorporation) | | Identification No.) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 520 Zang Street, Suite D | | | | | | | | | | | | | | | |

| | | Broomfield, | CO | | | | | | | | | | | | | | | 80021 |

| | | (Address of principal executive offices) | | | | | | | | | | | | | | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (720) 214-1900

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock | NDLS | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry Into a Material Definitive Agreement.

On December 21, 2023, Noodles & Company (the “Company”) amended its Amended and Restated Credit Agreement, dated as of July 27, 2022 (as further amended, restated, extended, supplemented, modified and otherwise in effect from time to time, the “Credit Agreement”), by and among the Company, as Borrower (as defined in the Credit Agreement), each other Loan Party (as defined in the Credit Agreement) party thereto, each lender from time to time party thereto, and U.S. Bank National Association, as Administrative Agent, L/C Issuer and Swing Line Lender (each as defined in the Credit Agreement), by entering into that certain First Amendment to Amended and Restated Credit Agreement (the “Amendment”), by and among the Company, the other Loan Parties signatory thereto, the lenders signatory thereto and U.S. Bank National Association, as the Administrative Agent, L/C Issuer and Swing Line Lender.

Among the modifications, the Amendment: (i) increased applicable rate ranges (A) with respect to SOFR loans, from 1.50% - 2.50% per annum to 1.75% - 3.00% per annum and (B) with respect to base rate loans, from 0.50% - 1.50% per annum to 0.75% - 2.00% per annum, in each case as determined by the Consolidated Total Lease Adjusted Leverage Ratio (as defined in the Credit Agreement), (ii) amended the Consolidated Fixed Charge Coverage Ratio (as defined in the Credit Agreement) in order to limit the deduction of capital expenditures to “Non-Growth Capital Expenditures”, (iii) added a defined term for “Non-Growth Capital Expenditures” (along with certain related definitions), (iv) added a new capital expenditures covenant governing entry into new lease agreements and (v) increased the Consolidated Total Lease Adjusted Leverage Ratio (as defined in the Credit Agreement) to be no greater than (x) 4.50 to 1.00 for the period beginning on the last day of the fiscal quarter ending January 2, 2024 until and including the last day of the fiscal quarter ending December 30, 2025 and (y) 4.25 to 1.00 for the period beginning on the last day of the fiscal quarter ending March 31, 2026 until and including the last day of the fiscal quarter ending September 29, 2026.

A copy of the Amendment is attached hereto as Exhibit 10.1 and is incorporated by reference into this Item 1.01 in its entirety. The description of the Amendment is a summary only and is qualified in its entirety by the terms of the Amendment.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The discussion of the Amendment in Item 1.01 of this Current Report on Form 8-K is incorporated by reference in this Item 2.03 in its entirety.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | | | | |

Exhibit No. | | Description |

| 10.1 | | | |

| 104 | | Cover Page Interactive Data File. The cover page XBRL tags are embedded within the Inline XBRL document. | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | Noodles & Company |

| | |

| By: | /s/ MIKE HYNES |

| Name: | Mike Hynes |

| Title: | Chief Financial Officer |

DATED: December 26, 2023

FIRST AMENDMENT

TO

AMENDED AND RESTATED CREDIT AGREEMENT

This FIRST AMENDMENT TO AMENDED AND RESTATED CREDIT AGREEMENT dated as of December 21, 2023 (this “Amendment”) is by and among (a) NOODLES & COMPANY (the “Borrower”), (b) each of the Guarantors (as defined in the Credit Agreement referred to below) signatory hereto, (c) U.S. BANK NATIONAL ASSOCIATION, as administrative agent (in such capacity, the “Administrative Agent”), L/C Issuer and Swing Line Lender (each such term defined in the Credit Agreement referred to below) and (d) the lenders signatory hereto and amends that certain Amended and Restated Credit Agreement, dated as of July 27, 2022 (as further amended, restated, extended, supplemented, modified and otherwise in effect from time to time, the “Credit Agreement”), by and among the Borrower, the other Loan Parties (as defined in the Credit Agreement) party thereto, the Lenders (as defined in the Credit Agreement) party thereto, the Administrative Agent, and U.S. Bank National Association, as L/C Issuer and Swing Line Lender. Capitalized terms used herein without definition shall have the meanings assigned to such terms in the Credit Agreement.

WHEREAS, the Borrower and the Guarantors desire, among other things, to modify certain terms and conditions of the Credit Agreement as set forth in this Amendment; and

WHEREAS, the Administrative Agent and the Lenders have agreed to amend certain provisions of the Credit Agreement as provided more fully herein below.

NOW THEREFORE, in consideration of the mutual agreements contained in the Credit Agreement and herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

§1. Amendments to the Credit Agreement.

§1.1 Amendment to Section 1.01. Section 1.01 of the Credit Agreement is hereby amended by deleting the defined term “Accelerated Step-Down Election”.

§1.2 Amendment to Section 1.01. Section 1.01 of the Credit Agreement is hereby amended by restating the below definitions in their entirety as follows:

“Applicable Rate” means, applicable percentage per annum set forth below for each Type of Loan (and for the Letter of Credit Fees and Commitment Fees) determined by reference to the Consolidated Total Lease Adjusted Leverage Ratio as set forth in the most recent Compliance Certificate received by the Administrative Agent pursuant to Section 6.02(a):

| | | | | | | | | | | | | | |

Pricing Level | Consolidated Total Lease Adjusted Leverage Ratio | SOFR Rate Loans and Letter of Credit Fees | Base Rate Loans | Commitment Fee |

1 | <2.50x 1.00 | 1.75% | 0.75% | 0.20% |

2 | >2.50:1.00 but <3.00:1.00 | 2.00% | 1.00% | 0.20% |

3 | >3.00:1.00 but <3.50:1.00 | 2.25% | 1.25% | 0.25% |

4 | >3.50:1.00 but <4.00:1.00 | 2.50% | 1.50% | 0.30% |

5 | >4.00:1.00 | 3.00% | 2.00% | 0.35% |

Any increase or decrease in the Applicable Rate resulting from a change in the Consolidated Total Lease Adjusted Leverage Ratio shall become effective as of the first Business Day immediately following the date a Compliance Certificate is delivered pursuant to Section 6.02(a); provided, however, that if a Compliance Certificate is not delivered when due in accordance with such Section, then, Pricing Level 5 shall apply as of the first Business Day after the date on which such Compliance Certificate was required to have been delivered and shall remain in effect until the date on which such Compliance Certificate is delivered.

Notwithstanding anything to the contrary contained in this definition, from the First Amendment Effective Date until the date on which the Compliance Certificate for the Fiscal Quarter ending on July 2, 2024 is delivered pursuant to Section 6.02(a) the Applicable Rate shall be deemed to be Pricing Level 5.

Notwithstanding anything to the contrary contained in this definition, the determination of the Applicable Rate for any period shall be subject to the provisions of Sections 2.08(b) and 2.10.

“Consolidated Fixed Charge Coverage Ratio” means, at any date of determination, the ratio of (a) (i) Consolidated EBITDAR for the most recently completed Measurement Period less (ii) Non-Growth Capital Expenditures paid in cash during such Measurement Period less (iii) the aggregate amount of Federal, state, local and foreign income taxes paid in cash during such Measurement Period less (iv) Restricted Payments to redeem, retire or repurchase Equity Interests or any dividend or distribution with respect to the Equity Interest of Borrower (other than the Specified Share Repurchase) to (b) the sum of (i) Consolidated Interest Charges paid in cash, (ii) the aggregate principal amount of all regularly scheduled principal payments or redemptions or similar acquisitions for value of outstanding debt for borrowed money, but excluding any such payments to the extent refinanced through the incurrence of additional Indebtedness otherwise expressly permitted under Section 7.02 and any such payments under Section 2.05(c) and (iii) Consolidated Cash Rental Expense, in each case, of or by the Borrower and its Subsidiaries for the most recently completed Measurement Period; provided that if any Permitted Acquisition shall have been consummated during such Measurement Period, the Consolidated Fixed Charge Coverage Ratio shall be calculated on a Pro Forma Basis.

“Specified Share Repurchase” means the open-market repurchase by Borrower of approximately $5,000,000 of Borrower’s Equity Interest consisting of common stock during the fiscal quarter ended October 3, 2023.

§1.3 Amendment to Section 1.01. Section 1.01 of the Credit Agreement is hereby amended by adding the following new definitions in the appropriate alphabetical order:

“Digital Menu Project” means the cost and expenses directly related to the purchase and installation of restaurant digital menu boards as specifically discussed by Borrower and approved by Administrative Agent in December 2023.

“First Amendment Effective Date” means December 21, 2023.

“Growth Capital Expenditures” means (i) Capital Expenditures for the acquisition, leasing, construction or opening of new restaurants or remodeling of restaurants for increased restaurant capacity, (ii) Capital Expenditures in connection with a Permitted Acquisition, and (iii) such other Capital Expenditures as requested by Borrower and approved by Administrative Agent in its sole discretion. For the avoidance of doubt, Capital Expenditures made in connection with the Digital Menu Project shall be deemed to be Growth Capital Expenditures.

“Non-Growth Capital Expenditures” means all Capital Expenditures which are not Growth Capital Expenditures.

§1.4 Amendment to Section 7.06. Section 7.06 of the Credit Agreement is hereby amended by amending and restating clause (f) of such section in its entirety as follows:

(f) [Reserved].

§1.5 Amendment to Section 7.11. Section 7.11 of the Credit Agreement is hereby amended by amending and restating clause (a) of such section in its entirety as follows:

(a) Consolidated Total Lease Adjusted Leverage Ratio. Permit the Consolidated Total Lease Adjusted Leverage Ratio as of the end of any Measurement Period to be greater than the applicable ratio set forth below opposite such Measurement Period:

| | | | | |

Measurement Period End Date | Maximum Consolidated Total Lease Adjusted Leverage Ratio |

| the last day of the third Fiscal Quarter of Fiscal Year 2022 (September 27, 2022) | 4.50 to 1.00 |

| the last day of the fourth Fiscal Quarter of Fiscal Year 2022 (January 3, 2023) | 4.50 to 1.00 |

| the last day of the first Fiscal Quarter of Fiscal Year 2023 (April 4, 2023) and the last day of each Fiscal Quarter thereafter until and including the last day of the third Fiscal Quarter of Fiscal Year 2023 (October 3, 2023) | 4.00 to 1.00 |

| | | | | |

| the last day of the fourth Fiscal Quarter of Fiscal Year 2023 (January 2, 2024) and the last day of each Fiscal Quarter thereafter until and including the last day of the fourth Fiscal Quarter of Fiscal Year 2025 (December 30, 2025) | 4.50 to 1.00 |

| the last day of the first Fiscal Quarter of Fiscal Year 2026 (March 31, 2026) and the last day of each Fiscal Quarter thereafter until and including the last day of the third Fiscal Quarter of Fiscal Year 2026 (September 29, 2026) | 4.25 to 1.00 |

| the last day of the fourth Fiscal Quarter of Fiscal Year 2026 (December 29, 2026) and the last day of each Fiscal Quarter ending thereafter | 4.00 to 1.00 |

§1.6 Amendment to Section 7.12. Section 7.12 of the Credit Agreement is hereby amended in its entirety as follows:

“7.12 Growth Capital Expenditures. As of the First Amendment Effective Date and thereafter, enter into, commit to enter into or otherwise be bound by more than two (2) new lease agreements (or similar agreement, including but not limited to, agreements to acquire any fee sites), if the Consolidated Total Lease Adjusted Leverage Ratio (calculated on a pro forma basis) as of the time a Loan Party enters into, commits to enter into, or is otherwise bound by such new lease agreement is not at least twenty-five (25) basis points lower than the covenant level required pursuant to Section 7.11(a) for the most recently ended Measurement Period (such period, the “Restricted Lease Period”). The foregoing Consolidated Total Lease Adjusted Leverage Ratio restriction shall not apply to the extent the Consolidated Total Lease Adjusted Leverage Ratio required pursuant to Section 7.11(a) for the most recently ended Measurement Period is 4.00 to 1.00 or less. For the avoidance of doubt, the foregoing restrictions shall not apply to any lease agreements (or similar agreements, including but not limited to, agreements to acquire any fee sites) entered into or existing prior to the First Amendment Effective Date (including extensions, renewals or other modifications to such lease agreements). Borrower shall promptly notify Administrative Agent upon Borrower or its Subsidiaries entering into any new lease agreements during the Restricted Lease Period.

§1.7 Amendment to Section 11.01. The introductory paragraph to Section 11.01 of the Credit Agreement is hereby amended in its entirety as follows:

11.01 Amendments, Etc. Except with respect to an Incremental Term Loan Amendment as provided in Section 2.16 or in connection with an increase in the Aggregate Commitment under Section 2.16 or in connection with an inability to determine a Term SOFR Rate under Section 3.03 (which, in each case, shall be governed by such Section), no amendment or waiver of any provision of this Agreement or any other Loan Document, and no consent to any departure by the Borrower or any other Loan Party therefrom, shall be effective unless in writing signed by the Required Lenders and the Borrower or the applicable Loan Party, as the case may be, and acknowledged by the Administrative Agent, and each such waiver or consent shall be effective only in the specific instance and for the specific purpose for which given; provided, however, that no such amendment, waiver or consent shall:

§2. Affirmation and Acknowledgment. Each Loan Party hereby ratifies and confirms all of its Obligations to the Lenders and the Administrative Agent, and the Borrower hereby affirms its absolute and unconditional promise to pay to the Lenders the Loans, the other Obligations, and all other amounts due under the Credit Agreement as amended hereby. Each Loan Party hereby ratifies and reaffirms the validity and enforceability of all of the Liens and security interests heretofore granted and pledged by such Loan Party pursuant to the Loan Documents to the Administrative Agent, on behalf and for the benefit of the Secured Parties, as collateral security for the Obligations, and acknowledges that all of such Liens and security interests, and all Collateral heretofore granted, pledged or otherwise created as security for the Obligations continues to be and remains collateral security for the Obligations. Each of the Guarantors party to the Guaranty hereby acknowledges and consents to this Amendment and agrees that the Guaranty and all other Loan Documents to which each of the Guarantors are a party remain in full force and effect, and each of the Guarantors confirms and ratifies all of its Obligations thereunder.

§3. Representations and Warranties. Each Loan Party hereby represents and warrants to the Lenders and the Administrative Agent as follows:

(a) The execution, delivery and performance by each Loan Party of this Amendment and the performance by such Loan Party of its obligations and agreements under this Amendment and the Credit Agreement, as amended hereby, have been duly authorized by all necessary corporate or other organizational action, and do not and will not (i) contravene the terms of any of such Loan Party’s Organization Documents, (ii) conflict with or result in any breach or contravention of, or the creation of any Lien under, or require any payment to be made under (A) any material Contractual Obligation (other than the creation of Liens under the Loan Documents) to which such Loan Party is a party or affecting such Loan Party or the properties of such Loan Party or any of its Subsidiaries or (B) any order, injunction, writ or decree of any Governmental Authority or any arbitral award to which such Loan Party or its property is subject; or (iii) violate any Law, except to the extent that any such violation, either individually or in the aggregate, could not reasonably be expected to have a Material Adverse Effect.

(b) This Amendment has been duly executed and delivered by such Loan Party. Each of this Amendment and the Credit Agreement, as amended hereby, constitutes a legal, valid and binding obligation of such Loan Party, enforceable against such Loan Party in accordance with their respective terms except as enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium or similar laws affecting the enforcement of creditors’ rights generally and by general equitable principles, whether enforcement is sought by a proceeding in equity or at law.

(c) No approval, consent, exemption, authorization, or other action by, or notice to, or filing with, any Governmental Authority is required in connection with the execution, delivery or performance by such Loan Party of this Amendment or the Credit Agreement as amended hereby.

(d) The representations and warranties of such Loan Party contained in Article V of the Credit Agreement or in any other Loan Document are true and correct in all material respects on and as of the date hereof, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they shall be true and correct as of such earlier date, and except that the representations and warranties contained in Sections 5.05(a) and 5.05(b) of the Credit Agreement shall be deemed to refer to the most recent statements furnished pursuant to Sections 6.01(a) and 6.01(b) of the Credit Agreement, respectively.

(e) As of the date hereof, after giving effect to this Amendment, there exists no Default or Event of Default.

§4. Conditions. This Amendment shall become effective on the date when each of the following conditions precedent have been satisfied (the “First Amendment Effective Date”):

(a) This Amendment shall have been duly executed and delivered by each Loan Party, the Administrative Agent and the Lenders.

(b) The Administrative Agent shall have received a certificate signed by a Responsible Officer of the Borrower certifying (i) that the conditions specified in this Section 4 have been satisfied, (ii) that there has been no event or circumstance since December 31, 2022 that has had or could be reasonably expected to have, either individually or in the aggregate, a Material Adverse Effect and (iii) that there have been no changes to the Organizational Documents of the Loan Parties delivered to the Administrative Agent on the Closing Date.

(c) The representations and warranties set forth in Section 3 hereof shall be true and correct.

(d) All fees and expenses due and owing to the Administrative Agent and the Lenders and required to be paid on or before the First Amendment Effective Date pursuant to that certain First Amendment to Amended and Restated Credit Agreement Fee Letter dated as of December 21, 2023 by and between the Administrative Agent and the Borrower, shall have been paid (or shall be paid concurrently with the closing of this Amendment).

(e) The Administrative Agent shall have been reimbursed for all reasonable and documented fees and out-of-pocket charges and other expenses incurred in connection with this Amendment, including, without limitation, the reasonable fees and disbursements of counsel for the Administrative Agent, to the extent documented and delivered to the Borrower prior to the date hereof (for the avoidance of doubt, a summary statement of such fees, charges and disbursements shall be sufficient documentation for the obligations set forth in this Section 4(g); provided that supporting documentation for such summary statement is provided promptly thereafter).

§5. Miscellaneous Provisions.

§5.1 Except as expressly amended or otherwise modified by this Amendment, the Credit Agreement and all documents, instruments and agreements related thereto, including, but not limited to the other Loan Documents, are hereby ratified and confirmed in all respects and shall continue in full force and effect. No amendment, consent or waiver herein granted or agreement herein made shall extend beyond the terms expressly set forth herein for such amendment, consent, waiver or agreement, as the case may be, nor shall anything contained herein be deemed to imply any willingness of the Administrative Agent or the Lenders to agree to, or otherwise prejudice any rights of the Administrative Agent or the Lenders with respect to, any similar amendments, consents, waivers or agreements that may be requested for any future period, and this Amendment shall not be construed as a waiver of any other provision of the Loan Documents or to permit the Borrower or any other Loan Party to take any other action which is prohibited by the terms of the Credit Agreement and the other Loan Documents. The Credit Agreement and this Amendment shall be read and construed as a single agreement. All references in the Credit

Agreement, or any related agreement or instrument, to the Credit Agreement shall hereafter refer to the Credit Agreement, as amended hereby. This Amendment shall constitute a Loan Document.

§5.2 THIS AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAW OF THE STATE OF NEW YORK WITHOUT REGARD TO CONFLICT OF LAWS PRINCIPLES THEREOF (OTHER THAN SECTIONS 5-1401 AND 5-1402 OF THE NEW YORK GENERAL OBLIGATIONS LAW).

§5.3 THE BORROWER AND EACH OTHER LOAN PARTY IRREVOCABLY AND UNCONDITIONALLY AGREES THAT IT WILL NOT COMMENCE ANY ACTION, LITIGATION OR PROCEEDING OF ANY KIND OR DESCRIPTION, WHETHER IN LAW OR EQUITY, WHETHER IN CONTRACT OR IN TORT OR OTHERWISE, AGAINST THE ADMINISTRATIVE AGENT, ANY LENDER, THE L/C ISSUER, OR ANY RELATED PARTY OF THE FOREGOING IN ANY WAY RELATING TO THIS AMENDMENT OR ANY OTHER LOAN DOCUMENT OR THE TRANSACTIONS RELATING HERETO OR THERETO, IN ANY FORUM OTHER THAN THE COURTS OF THE STATE OF NEW YORK SITTING IN NEW YORK COUNTY AND OF THE UNITED STATES DISTRICT COURT OF THE SOUTHERN DISTRICT OF NEW YORK, AND ANY APPELLATE COURT FROM ANY THEREOF, AND EACH OF THE PARTIES HERETO IRREVOCABLY AND UNCONDITIONALLY SUBMITS TO THE JURISDICTION OF SUCH COURTS AND AGREES THAT ALL CLAIMS IN RESPECT OF ANY SUCH ACTION, LITIGATION OR PROCEEDING MAY BE HEARD AND DETERMINED IN SUCH NEW YORK STATE COURT OR, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, IN SUCH FEDERAL COURT. EACH OF THE PARTIES HERETO AGREES THAT A FINAL JUDGMENT IN ANY SUCH ACTION, LITIGATION OR PROCEEDING SHALL BE CONCLUSIVE AND MAY BE ENFORCED IN OTHER JURISDICTIONS BY SUIT ON THE JUDGMENT OR IN ANY OTHER MANNER PROVIDED BY LAW. NOTHING IN THIS AMENDMENT OR IN ANY OTHER LOAN DOCUMENT SHALL AFFECT ANY RIGHT THAT THE ADMINISTRATIVE AGENT, ANY LENDER OR THE L/C ISSUER MAY OTHERWISE HAVE TO BRING ANY ACTION OR PROCEEDING RELATING TO THIS AMENDMENT OR ANY OTHER LOAN DOCUMENT AGAINST THE BORROWER OR ANY OTHER LOAN PARTY OR ITS PROPERTIES IN THE COURTS OF ANY JURISDICTION.

§5.4 This Amendment may be executed in counterparts (and by different parties hereto in different counterparts), each of which shall constitute an original, but all of which when taken together shall constitute a single contract. Delivery of an executed counterpart of a signature page of this Amendment by telecopy or other electronic imaging means shall be effective as delivery of a manually executed counterpart of this Amendment.

§5.5 The Borrower hereby agrees to pay to the Administrative Agent, on demand by the Administrative Agent, all reasonable and documented out-of-pocket costs and expenses incurred or sustained by the Administrative Agent in connection with the preparation of this Amendment (including legal fees).

§5.6 The provisions of this Amendment are solely for the benefit of the Loan Parties, the Administrative Agent and the Lenders and no other Person shall have rights as a third party beneficiary of any of such provisions.

[THE REMAINDER OF THIS PAGE IS INTENTIONALLY BLANK.]

IN WITNESS WHEREOF, the parties hereto have executed this Amendment as of the date first written above.

| | | | | | | | |

| NOODLES & COMPANY, | |

| a Delaware corporation | |

| | |

| By: | /s/ MELISSA HEIDMAN | |

| Name: | Melissa M. Heidman | |

| Title: | Secretary | |

| | | | | | | | |

| TNSC, INC., | |

| a Colorado corporation | |

| | |

| By: | /s/ MELISSA HEIDMAN | |

| Name: | Melissa M. Heidman | |

| Title: | President | |

| | | | | | | | |

| THE NOODLES SHOP, CO. - COLORADO, INC., | |

| a Colorado corporation | |

| | |

| By: | /s/ MELISSA HEIDMAN | |

| Name: | Melissa M. Heidman | |

| Title: | President | |

| | | | | | | | |

| THE NOODLES SHOP, CO. - WISCONSIN, INC., | |

| a Wisconsin corporation | |

| | |

| By: | /s/ MELISSA HEIDMAN | |

| Name: | Melissa M. Heidman | |

| Title: | President | |

| | | | | | | | |

| THE NOODLES SHOP, CO. - ILLINOIS, INC., |

| an Illinois corporation | |

| | |

| By: | /s/ MELISSA HEIDMAN | |

| Name: | Melissa M. Heidman | |

| Title: | President | |

| | | | | | | | |

| THE NOODLES SHOP, CO. - VIRGINIA, INC., |

| a Virginia corporation | |

| | |

| By: | /s/ MELISSA HEIDMAN | |

| Name: | Melissa M. Heidman | |

| Title: | President | |

| | | | | | | | |

| THE NOODLES SHOP, CO. - KANSAS, LLC, |

| a Kansas limited liability company | |

| | |

| By: TNSC, Inc. | |

| its Member | |

| | |

| By: | /s/ MELISSA HEIDMAN | |

| Name: | Melissa M. Heidman | |

| Title: | President | |

| | | | | | | | |

| THE NOODLES SHOP, CO. - DELAWARE, INC., | |

| a Delaware corporation | |

| | |

| By: | /s/ MELISSA HEIDMAN | |

| Name: | Melissa M. Heidman | |

| Title: | President | |

| | | | | | | | |

| U.S. BANK NATIONAL ASSOCIATION, |

| as a Lender, Administrative Agent, L/C Issuer |

| and Swing Line Lender |

| | |

| By: | /s/Courtney A. Boltz | |

| Name: | Courtney A. Boltz | |

| Title: | Vice President | |

| | | | | | | | |

| CADENCE BANK, | |

| as a Lender | |

| | |

| By: | /s/ HENRY LOONG | |

| Name: | Henry Loong | |

| Title: | Vice President | |

| | | | | | | | |

| THE HUNTINGTON NATIONAL BANK, | |

| as a Lender | |

| | |

| By: | /s/ KEVIN CONTAT | |

| Name: | Kevin Contat | |

| Title: | Senior Vice President | |

| | | | | | | | |

| FIRST HORIZON BANK, | |

| as a Lender | |

| | |

| By: | /s/ LORRAE MATTIX | |

| Name: | Lorrae Mattix | |

| Title: | Its Authorized Signatory | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

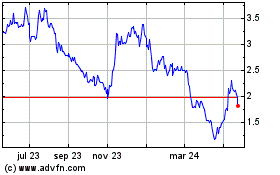

Noodles (NASDAQ:NDLS)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

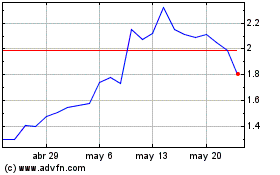

Noodles (NASDAQ:NDLS)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024