NorthEast Community Bancorp, Inc. (Nasdaq: NECB) (the “Company”),

the parent holding company of NorthEast Community Bank (the

“Bank”), reported net income of $11.4 million, or $0.87 per basic

share and $0.86 per diluted share, for the three months ended March

31, 2024 compared to net income of $11.2 million, or $0.77 per

basic and diluted share, for the three months ended March 31, 2023.

Kenneth A. Martinek, NorthEast Community Bancorp’s Chairman of

the Board and Chief Executive Officer, stated “We are pleased to

report another quarter of strong earnings due to the strong

performance of our loan portfolio. Despite the high interest rate

environment during 2023 that continued into 2024, loan demand

remained strong with originations and outstanding commitments

remaining robust. As has been in the past, construction lending in

high demand-high absorption areas continues to be our focus.”

Highlights for the three months ended March 31, 2024 are as

follows:

- Performance metrics continue to be

strong with a return on average assets ratio of 2.50%, a return on

average equity ratio of 15.88%, and an efficiency ratio of

37.91%.

- Net interest income increased by

$2.1 million, or 9.4%, to $25.0 million for the three months ended

March 31, 2024 compared to the same periods in 2023.

- Our commitments, loans-in-process,

and standby letters of credit outstanding totaled $731.3 million at

March 31, 2024 compared to $719.6 million at December 31,

2023.

Balance Sheet Summary

Total assets increased by $102.8 million, or 5.8%, to $1.9

billion at March 31, 2024, from $1.8 billion at December 31,

2023. The increase in assets was primarily due to an increase in

net loans of $67.8 million and an increase in cash and cash

equivalents of $38.8 million, partially offset by a decrease in

other assets of $3.7 million.

Cash and cash equivalents increased by $38.8 million, or 56.5%,

to $107.4 million at March 31, 2024 from $68.7 million at

December 31, 2023. The increase in cash and cash equivalents was a

result of an increase in deposits of $112.0 million, partially

offset by a decrease in borrowings of $17.0 million, an increase of

$67.8 million in net loans, and stock repurchases of $1.2

million.

Equity securities decreased by $82,000, or 0.5%, to $18.0

million at March 31, 2024 from $18.1 million at December 31, 2023.

The decrease in equity securities was attributable to market

depreciation of $82,000 due to market interest rate volatility

during the three months ended March 31, 2024.

Securities held-to-maturity decreased by $125,000, or 0.8%, to

$15.7 million at March 31, 2024 from $15.9 million at December 31,

2023 due to $128,000 in maturities and pay-downs of various

investment securities, partially offset by a decrease of $3,000 in

the allowance for credit losses for held-to-maturity

securities.

Loans, net of the allowance for credit losses, increased by

$67.8 million, or 4.3%, to $1.6 billion at March 31, 2024 from

$1.6 billion at December 31, 2023. The increase in loans, net

of the allowance for credit losses, was primarily due to loan

originations of $180.5 million during the three months ended March

31, 2024, consisting primarily of $170.9 million in construction

loans with respect to which approximately 34.0% of the funds were

disbursed at loan closings, with the remaining funds to be

disbursed over the terms of the construction loans. In addition,

during the three months ended March 31, 2024, we originated $9.5

million in commercial and industrial loans.

Loan originations during the first quarter of 2024 resulted in a

net increase of $74.5 million in construction loans and $410,000 in

consumer loans. The increase in our loan portfolio was partially

offset by decreases of $2.2 million in commercial and industrial

loans, $2.0 million in non-residential loans, $1.1 million in

mixed-use loans, $981,000 in multi-family loans, and $605,000 in

residential loans, coupled with normal pay-downs and principal

reductions.

The allowance for credit losses related to loans decreased to

$4.9 million as of March 31, 2024 from $5.1 million as of December

31, 2023. The decrease in the allowance for credit losses related

to loans was due to a credit to the provision for credit losses

totaling $145,000 and charge-offs of $21,000.

Premises and equipment decreased by $229,000, or 0.9%, to $25.2

million at March 31, 2024 from $25.5 million at December 31, 2023

primarily due to the depreciation of fixed assets.

Investments in Federal Home Loan Bank stock decreased by

$315,000, or 33.9%, to $614,000 at March 31, 2024 from $929,000 at

December 31, 2023 due primarily to the mandatory redemption of

Federal Home Loan Bank stock in connection with the maturity of

$7.0 million in advances in 2024.

Bank owned life insurance (“BOLI”) increased by $157,000, or

0.6%, to $25.2 million at March 31, 2024 from $25.1 million at

December 31, 2023 due to increases in the BOLI cash value.

Accrued interest receivable increased by $641,000, or 5.2%, to

$13.0 million at March 31, 2024 from $12.3 million at December 31,

2023 due to an increase in the loan portfolio.

Foreclosed real estate was $1.5 million at both March 31, 2024

and December 31, 2023.

Right of use assets — operating decreased by $139,000, or 3.0%,

to $4.4 million at March 31, 2024 from $4.6 million at

December 31, 2023, primarily due to amortization.

Other assets decreased by $3.7 million, or 46.6%, to

$4.3 million at March 31, 2024 from $8.0 million at

December 31, 2023 due to a decrease in tax assets of $3.6 million

and a decrease in suspense accounts of $236,000, partially offset

by an increase of $126,000 in prepaid expenses.

Total deposits increased by $112.0 million, or 8.0%, to

$1.5 billion at March 31, 2024 from $1.4 billion at December

31, 2023. The increase in deposits was primarily due to the Bank

offering competitive interest rates to attract deposits. This

resulted in a shift in deposits whereby certificates of deposit

increased by $90.9 million, or 11.9% and NOW/money market

accounts increased by $60.1 million, or 41.5%, partially offset by

decreases in savings account balances of $27.4 million, or 14.3%,

and non-interest bearing demand deposits of $11.6 million, or

3.9%.

Federal Home Loan Bank advances decreased by $7.0 million, or

50.0%, to $7.0 million at March 31, 2024 from $14.0 million at

December 31, 2023 due to the maturity of borrowings in 2024.

Federal Reserve Bank borrowings decreased by $10.0 million, or

20.0%, to $40.0 million at March 31, 2024 from $50.0 million at

December 31, 2023.

Advance payments by borrowers for taxes and insurance increased

by $326,000, or 16.1%, to $2.3 million at March 31, 2024 from $2.0

million at December 31, 2023 due primarily to remittance of real

estate tax payments from our borrowers.

Lease liability – operating decreased by $128,000, or 2.8%, to

$4.5 million at March 31, 2024 from $4.6 million at December 31,

2023, primarily due to amortization.

Accounts payable and accrued expenses decreased by $2.0 million,

or 14.7%, to $11.6 million at March 31, 2024 from $13.6 million at

December 31, 2023 due primarily to a decrease in accrued expense of

$2.5 million, partially offset by an increase in accounts payable

of $486,000 and deferred compensation of $132,000. The allowance

for credit losses for off-balance sheet commitments was $1.0

million at March 31, 2024 and at December 31, 2023.

Stockholders’ equity increased by $9.6 million, or 3.4% to

$288.9 million at March 31, 2024, from $279.3 million at

December 31, 2023. The increase in stockholders’ equity was due to

net income of $11.4 million for the three months ended March

31, 2024, $444,000 in the amortization of restricted stock and

stock options granted under the Company’s 2022 Equity Incentive

Plan, a reduction of $217,000 in unearned employee stock ownership

plan shares coupled with an increase of $135,000 in earned employee

stock ownership plan shares, an exercise of stock options totaling

$14,000, and $3,000 in other comprehensive income, partially offset

by stock repurchases totaling $1.2 million and dividends paid and

declared of $1.3 million.

Net Interest Income

Net interest income totaled $25.0 million for

the three months ended March 31, 2024, as compared to

$22.8 million for the three months ended March 31, 2023.

The increase in net interest income of $2.2 million, or 9.4%, was

primarily due to an increase in interest income offset by an

increase in interest expense.

The increase in interest income is attributable to increases in

the average balances of loans and interest-bearing deposits,

partially offset by decreases in the average balances of investment

securities and FHLB stock. The increase in interest income is also

attributable to a rising interest rate environment due to the

Federal Reserve’s interest rate increases in 2023.

The increase in market interest rates in 2023 also caused an

increase in our interest expense. As a result, the increase in

interest expense for the three months ended March 31, 2024 was due

to an increase in the cost of funds on our deposits and borrowed

money. The increase in interest expense was also due to an increase

in the average balances on our certificates of deposits, our

interest-bearing demand deposits, and our borrowed money, offset by

a decrease in the average balances on our savings and club

deposits.

Total interest and dividend income increased by $9.6 million, or

33.7%, to $38.1 million for the three months ended March 31, 2024

from $28.5 million for the three months ended March 31, 2023. The

increase in interest and dividend income was due to an increase in

the average balance of interest earning assets of $361.6 million,

or 26.3%, to $1.7 billion for the three months ended March 31, 2024

from $1.4 billion for the three months ended March 31, 2023 and an

increase in the yield on interest earning assets by 49 basis points

from 8.28% for the three months ended March 31, 2023 to 8.77% for

the three months ended March 31, 2024.

Interest expense increased by $7.4 million, or 131.5%, to $13.1

million for the three months ended March 31, 2024 from $5.7 million

for the three months ended March 31, 2023. The increase in interest

expense was due to an increase in the cost of interest bearing

liabilities by 155 basis points from 2.74% for the three months

ended March 31, 2023 to 4.29% for the three months ended March 31,

2024 and an increase in average interest bearing liabilities of

$398.9 million, or 48.2%, to $1.2 billion for the three months

ended March 31, 2024 from $827.0 million for the three months ended

March 31, 2023.

Net interest margin decreased by 88 basis points, or 13.3%, to

5.75% during the three months ended March 31, 2024 compared to

6.63% during the three months ended March 31, 2023. The

decrease in the net interest margin was due to the increase in the

cost of interest-bearing liabilities outpacing the increase in the

yield on interest-earning assets.

Credit Loss Expense

The Company recorded a credit loss expense reduction totaling

$165,000 for the three months ended March 31, 2024 compared to a

credit loss expenses totaling $1,000 for the three months ended

March 31, 2023. The credit loss expense reduction of $165,000 for

the three months ended March 31, 2024 was comprised of a credit

loss expense reduction for loans of $145,000, a credit loss expense

reduction for held-to-maturity investment securities of $3,000, and

a credit loss expense reduction for off-balance sheet commitments

of $17,000. The credit loss expense reduction for loans of $145,000

for the three months ended March 31, 2024 was primarily attributed

to favorable trend in the economy.

We charged-off $21,000 during the three months ended March 31,

2024 as compared to charge-offs of $21,000 during the three months

ended March 31, 2023. The charge-offs of $21,000 during the three

months ended March 31, 2024 and March 31, 2023 were against various

unpaid overdrafts in our demand deposit accounts.

We recorded no recoveries from previously charged-off loans

during the three months ended March 31, 2024 and 2023.

Non-Interest Income

Non-interest income for the three months ended March 31, 2024

was $554,000 compared to non-interest income of $1.1 million for

the three months ended March 31, 2023. The decrease of $561,000, or

50.3%, in total non-interest income was primarily due to an

increase of $307,000 in unrealized gain/loss on equity securities,

a decrease of $145,000 in other loan fees and service charges, and

a decrease of $117,000 in investment advisory fees.

The increase in unrealized gain/loss on equity was due to an

unrealized loss of $82,000 on equity securities during the three

months ended March 31, 2024 compared to an unrealized gain of

$225,000 on equity securities during the three months ended March

31, 2023. The unrealized loss of $82,000 on equity securities

during the three months ended March 31, 2024 was due to market

interest rate volatility during the quarter ended March 31,

2024.

The decrease of $145,000 in other loan fees and service charges

was due to a decrease of $138,000 in other loan fees and loan

servicing fees and a decrease of $7,000 in ATM/debit card/ACH

fees.

The decrease in investment advisory fees was due to the

disposition in January 2024 of the Bank’s assets relating to the

Harbor West Wealth Management Group. Consequently, the Bank no

longer generates investment advisory fees following the completion

of the transaction.

Non-Interest Expense

Non-interest expense increased by $1.5 million, or 18.2%, to

$9.7 million for the three months ended March 31, 2024

from $8.2 million for the three months ended March 31, 2023.

The increase resulted primarily from increases of $809,000 in

salaries and employee benefits, $543,000 in other operating

expense, $122,000 in outside data processing expense, $39,000 in

advertising expense, and $38,000 in occupancy expense, partially

offset by decreases of $51,000 in equipment expense and $10,000 in

real estate owned expense.

Income Taxes

We recorded income tax expense of $4.7 million and $4.5 million

for the three months ended March 31, 2024 and 2023,

respectively. For the three months ended March 31, 2024, we

had approximately $195,000 in tax exempt income, compared to

approximately $182,000 in tax exempt income for the three

months ended March 31, 2023. Our effective income tax rates were

29.0% and 28.7% for the three months ended March 31, 2024 and

2023, respectively.

Asset Quality

Non-performing assets totaled $5.8 million at March 31, 2024 and

December 31, 2023. At March 31, 2024 and December 31, 2023, we had

two non-performing construction loans totaling $4.4 million secured

by the same project located in the Bronx, New York. The other

non-performing assets consisted of one foreclosed property at March

31, 2024 and December 31, 2023. Our ratio of non-performing assets

to total assets remained low at 0.31% at March 31, 2024 as compared

to 0.33% at December 31, 2023.

The Company’s allowance for credit losses related to loans

totaled $4.9 million, or 0.30% of total loans as of March 31, 2024,

compared to $5.1 million, or 0.32% of total loans as of December

31, 2023. Based on a review of the loans that were in the loan

portfolio at March 31, 2024, management believes that the allowance

for credit losses related to loans is maintained at a level that

represents its best estimate of inherent losses in the loan

portfolio that were both probable and reasonably estimable.

In addition, at March 31, 2024, the Company’s allowance for

credit losses related to off-balance sheet commitments totaled $1.0

million and the allowance for credit losses related to

held-to-maturity debt securities totaled $133,000.

Capital

The Company’s total stockholders’ equity to assets ratio was

15.48% as of March 31, 2024. At March 31, 2024, the Company had the

ability to borrow $928.8 million from the Federal Reserve Bank of

New York, $32.1 million from the Federal Home Loan Bank of New York

and $8.0 million from Atlantic Community Bankers Bank.

The Bank’s capital position remains strong relative to current

regulatory requirements and the Bank is considered a

well-capitalized institution under the Prompt Corrective Action

framework. As of March 31, 2024, the Bank had a tier 1 leverage

capital ratio of 14.65% and a total risk-based capital ratio of

13.78%.

The Company completed its first stock repurchase program on

April 14, 2023 whereby the Company repurchased 1,637,794 shares, or

10%, of the Company’s issued and outstanding common stock. The cost

of the stock repurchase program totaled $23.0 million, including

commission cost and Federal excise taxes. Of the total shares

repurchased under this program, 957,275 of such shares were

repurchased during 2023 at a total cost of $13.7 million, including

commission costs and Federal excise taxes.

The Company commenced its second stock repurchase program on May

30, 2023 whereby the Company will repurchase 1,509,218, or 10%, of

the Company’s issued and outstanding common stock. The Company has

repurchased 1,015,980 shares of common stock under its second

repurchase program, at a cost of $16.0 million, including

commission costs and Federal excise taxes, at March 31, 2024.

About NorthEast Community Bancorp

NorthEast Community Bancorp, headquartered at 325 Hamilton

Avenue, White Plains, New York 10601, is the holding company for

NorthEast Community Bank, which conducts business through its

eleven branch offices located in Bronx, New York, Orange, Rockland,

and Sullivan Counties in New York and Essex, Middlesex, and Norfolk

Counties in Massachusetts and three loan production offices located

in New City, New York, White Plains, New York, and Danvers,

Massachusetts. For more information about NorthEast Community

Bancorp and NorthEast Community Bank, please visit

www.necb.com.

Forward Looking Statement

This press release contains certain forward-looking statements.

Forward-looking statements include statements regarding anticipated

future events and can be identified by the fact that they do not

relate strictly to historical or current facts. They often include

words such as “believe,” “expect,” “anticipate,” “estimate,” and

“intend” or future or conditional verbs such as “will,” “would,”

“should,” “could,” or “may.” These statements are based upon the

current beliefs and expectations of the Company’s management and

are subject to significant risks and uncertainties. Actual results

may differ materially from those set forth in the forward-looking

statements as a result of numerous factors. Factors that could

cause actual results to differ materially from expected results

include, but are not limited to, changes in market interest rates,

regional and national economic conditions (including higher

inflation and its impact on regional and national economic

conditions), legislative and regulatory changes, monetary and

fiscal policies of the United States government, including policies

of the United States Treasury and the Federal Reserve Board, the

quality and composition of the loan or investment portfolios,

demand for loan products, decreases in deposit levels necessitating

increased borrowing to fund loans and securities, competition,

demand for financial services in NorthEast Community Bank’s market

area, changes in the real estate market values in NorthEast

Community Bank’s market area, the impact of failures or disruptions

in or breaches of the Company’s operational or security systems,

data or infrastructure, or those of third parties, including as a

result of cyberattacks or campaigns, and changes in relevant

accounting principles and guidelines. Additionally, other risks and

uncertainties may be described in our annual and quarterly reports

filed with the U.S. Securities and Exchange Commission (the “SEC”),

which are available through the SEC’s website located at

www.sec.gov. These risks and uncertainties should be considered in

evaluating any forward-looking statements and undue reliance should

not be placed on such statements. Except as required by applicable

law or regulation, the Company does not undertake, and specifically

disclaims any obligation, to release publicly the result of any

revisions that may be made to any forward-looking statements to

reflect events or circumstances after the date of the statements or

to reflect the occurrence of anticipated or unanticipated

events.

|

CONTACT: |

|

Kenneth A. MartinekChairman and Chief Executive Officer |

|

|

|

|

|

PHONE: |

|

(914) 684-2500 |

|

|

|

|

|

NORTHEAST COMMUNITY

BANCORP, INC.CONSOLIDATED STATEMENTS OF

FINANCIAL CONDITION(Unaudited) |

| |

| |

|

March 31, |

|

December 31, |

| |

|

2024 |

|

2023 |

| |

|

(In thousands, except share |

| |

|

and per share amounts) |

|

ASSETS |

|

|

|

|

|

|

|

Cash and amounts due from depository institutions |

|

$ |

9,940 |

|

|

$ |

13,394 |

|

|

Interest-bearing deposits |

|

|

97,508 |

|

|

|

55,277 |

|

|

Total cash and cash equivalents |

|

|

107,448 |

|

|

|

68,671 |

|

|

Certificates of deposit |

|

|

100 |

|

|

|

100 |

|

|

Equity securities |

|

|

18,020 |

|

|

|

18,102 |

|

|

Securities held-to-maturity ( net of allowance for credit losses of

$133 and $136, respectively ) |

|

|

15,735 |

|

|

|

15,860 |

|

|

Loans receivable |

|

|

1,654,626 |

|

|

|

1,586,721 |

|

|

Deferred loan costs, net |

|

|

(52 |

) |

|

|

176 |

|

|

Allowance for credit losses |

|

|

(4,927 |

) |

|

|

(5,093 |

) |

|

Net loans |

|

|

1,649,647 |

|

|

|

1,581,804 |

|

|

Premises and equipment, net |

|

|

25,223 |

|

|

|

25,452 |

|

|

Investments in restricted stock, at cost |

|

|

614 |

|

|

|

929 |

|

|

Bank owned life insurance |

|

|

25,239 |

|

|

|

25,082 |

|

|

Accrued interest receivable |

|

|

12,952 |

|

|

|

12,311 |

|

|

Real estate owned |

|

|

1,456 |

|

|

|

1,456 |

|

|

Property held for investment |

|

|

1,398 |

|

|

|

1,407 |

|

|

Right of Use Assets – Operating |

|

|

4,427 |

|

|

|

4,566 |

|

|

Right of Use Assets – Financing |

|

|

350 |

|

|

|

351 |

|

|

Other assets |

|

|

4,299 |

|

|

|

8,044 |

|

|

Total assets |

|

$ |

1,866,908 |

|

|

$ |

1,764,135 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

| Liabilities: |

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

Non-interest bearing |

|

$ |

288,589 |

|

|

$ |

300,184 |

|

|

Interest bearing |

|

|

1,223,413 |

|

|

|

1,099,852 |

|

|

Total deposits |

|

|

1,512,002 |

|

|

|

1,400,036 |

|

|

Advance payments by borrowers for taxes and insurance |

|

|

2,346 |

|

|

|

2,020 |

|

|

Borrowings |

|

|

47,000 |

|

|

|

64,000 |

|

|

Lease Liability – Operating |

|

|

4,497 |

|

|

|

4,625 |

|

|

Lease Liability – Financing |

|

|

580 |

|

|

|

571 |

|

|

Accounts payable and accrued expenses |

|

|

11,559 |

|

|

|

13,558 |

|

|

Total liabilities |

|

|

1,577,984 |

|

|

|

1,484,810 |

|

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

Preferred stock, $0.01 par value; 25,000,000 shares authorized;

none issued or outstanding |

|

$ |

— |

|

|

$ |

— |

|

|

Common stock, $0.01 par value; 75,000,000 shares authorized;

14,065,796 shares and 14,144,856 shares outstanding,

respectively |

|

|

141 |

|

|

|

142 |

|

|

Additional paid-in capital |

|

|

109,267 |

|

|

|

109,924 |

|

|

Unearned Employee Stock Ownership Plan (“ESOP”) shares |

|

|

(6,346 |

) |

|

|

(6,563 |

) |

|

Retained earnings |

|

|

185,542 |

|

|

|

175,505 |

|

|

Accumulated other comprehensive gain |

|

|

320 |

|

|

|

317 |

|

|

Total stockholders’ equity |

|

|

288,924 |

|

|

|

279,325 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

1,866,908 |

|

|

$ |

1,764,135 |

|

| |

|

|

|

|

|

|

|

NORTHEAST COMMUNITY

BANCORP, INC.CONSOLIDATED STATEMENTS OF

INCOME(Unaudited) |

| |

| |

|

Quarter Ended March 31, |

| |

|

2024 |

|

2023 |

| |

|

(In thousands, except per share amounts) |

| INTEREST

INCOME: |

|

|

|

|

|

|

|

|

Loans |

|

$ |

36,703 |

|

|

$ |

27,575 |

|

|

Interest-earning deposits |

|

|

1,200 |

|

|

|

703 |

|

|

Securities |

|

|

218 |

|

|

|

233 |

|

|

Total Interest Income |

|

|

38,121 |

|

|

|

28,511 |

|

| INTEREST

EXPENSE: |

|

|

|

|

|

|

|

|

Deposits |

|

|

12,394 |

|

|

|

5,552 |

|

|

Borrowings |

|

|

731 |

|

|

|

112 |

|

|

Financing lease |

|

|

10 |

|

|

|

9 |

|

|

Total Interest Expense |

|

|

13,135 |

|

|

|

5,673 |

|

|

Net Interest Income |

|

|

24,986 |

|

|

|

22,838 |

|

| Provision for credit

loss |

|

|

(165 |

) |

|

|

1 |

|

|

Net Interest Income after Credit Loss Expense |

|

|

25,151 |

|

|

|

22,837 |

|

| NON-INTEREST

INCOME: |

|

|

|

|

|

|

|

|

Other loan fees and service charges |

|

|

462 |

|

|

|

607 |

|

|

Earnings on bank owned life insurance |

|

|

157 |

|

|

|

150 |

|

|

Investment advisory fees |

|

|

- |

|

|

|

117 |

|

|

Realized and unrealized (loss) gain on equity securities |

|

|

(82 |

) |

|

|

225 |

|

|

Other |

|

|

17 |

|

|

|

16 |

|

|

Total Non-Interest Income |

|

|

554 |

|

|

|

1,115 |

|

| NON-INTEREST

EXPENSES: |

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

5,351 |

|

|

|

4,542 |

|

|

Occupancy expense |

|

|

707 |

|

|

|

669 |

|

|

Equipment |

|

|

253 |

|

|

|

304 |

|

|

Outside data processing |

|

|

637 |

|

|

|

515 |

|

|

Advertising |

|

|

88 |

|

|

|

49 |

|

|

Real estate owned expense |

|

|

11 |

|

|

|

21 |

|

|

Other |

|

|

2,634 |

|

|

|

2,091 |

|

|

Total Non-Interest Expenses |

|

|

9,681 |

|

|

|

8,191 |

|

| INCOME BEFORE

PROVISION FOR INCOME TAXES |

|

|

16,024 |

|

|

|

15,761 |

|

| PROVISION FOR INCOME

TAXES |

|

|

4,650 |

|

|

|

4,517 |

|

| NET

INCOME |

|

$ |

11,374 |

|

|

$ |

11,244 |

|

| |

|

|

|

|

|

|

|

|

|

NORTHEAST COMMUNITY

BANCORP, INC.SELECTED CONSOLIDATED FINANCIAL

DATA(Unaudited) |

| |

| |

|

Quarter Ended March 31, |

| |

|

2024 |

|

2023 |

| |

|

(In thousands, except per share amounts) |

| Per share

data: |

|

|

|

|

|

|

|

Earnings per share - basic |

|

$ |

0.87 |

|

|

$ |

0.77 |

|

|

Earnings per share - diluted |

|

|

0.86 |

|

|

|

0.77 |

|

|

Weighted average shares outstanding - basic |

|

|

13,118 |

|

|

|

14,649 |

|

|

Weighted average shares outstanding - diluted |

|

|

13,191 |

|

|

|

14,696 |

|

| Performance

ratios/data: |

|

|

|

|

|

|

|

Return on average total assets |

|

|

2.50 |

% |

|

|

3.10 |

% |

|

Return on average shareholders' equity |

|

|

15.88 |

% |

|

|

16.98 |

% |

|

Net interest income |

|

$ |

24,986 |

|

|

$ |

22,838 |

|

|

Net interest margin |

|

|

5.75 |

% |

|

|

6.63 |

% |

|

Efficiency ratio |

|

|

37.91 |

% |

|

|

34.20 |

% |

|

Net charge-off ratio |

|

|

0.00 |

% |

|

|

0.00 |

% |

|

|

|

|

|

|

|

|

| Loan portfolio

composition: |

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

One-to-four family |

|

$ |

4,647 |

|

|

$ |

5,252 |

|

|

Multi-family |

|

|

197,946 |

|

|

|

198,927 |

|

|

Mixed-use |

|

|

28,500 |

|

|

|

29,643 |

|

|

Total residential real estate |

|

|

231,093 |

|

|

|

233,822 |

|

|

Non-residential real estate |

|

|

19,130 |

|

|

|

21,130 |

|

|

Construction |

|

|

1,293,871 |

|

|

|

1,219,413 |

|

|

Commercial and industrial |

|

|

108,882 |

|

|

|

111,116 |

|

|

Consumer |

|

|

1,650 |

|

|

|

1,240 |

|

|

Gross loans |

|

|

1,654,626 |

|

|

|

1,586,721 |

|

|

Deferred loan (fees) costs, net |

|

|

(52 |

) |

|

|

176 |

|

|

Total loans |

|

$ |

1,654,574 |

|

|

$ |

1,586,897 |

|

| Asset quality

data: |

|

|

|

|

|

|

|

Loans past due over 90 days and still accruing |

|

$ |

- |

|

|

$ |

- |

|

|

Non-accrual loans |

|

|

4,385 |

|

|

|

4,385 |

|

|

OREO property |

|

|

1,456 |

|

|

|

1,456 |

|

| Total non-performing

assets |

|

$ |

5,841 |

|

|

$ |

5,841 |

|

| |

|

|

|

|

|

|

| Allowance for credit losses to

total loans |

|

|

0.30 |

% |

|

|

0.32 |

% |

| Allowance for credit losses to

non-performing loans |

|

|

112.34 |

% |

|

|

116.15 |

% |

| Non-performing loans to total

loans |

|

|

0.27 |

% |

|

|

0.28 |

% |

| Non-performing assets to total

assets |

|

|

0.31 |

% |

|

|

0.33 |

% |

| |

|

|

|

|

|

|

| Bank's Regulatory

Capital ratios: |

|

|

|

|

|

|

|

Total capital to risk-weighted assets |

|

|

13.78 |

% |

|

|

14.11 |

% |

|

Common equity tier 1 capital to risk-weighted assets |

|

|

13.47 |

% |

|

|

13.78 |

% |

|

Tier 1 capital to risk-weighted assets |

|

|

13.47 |

% |

|

|

13.78 |

% |

|

Tier 1 leverage ratio |

|

|

14.65 |

% |

|

|

16.21 |

% |

|

|

|

|

|

|

|

|

|

|

|

NORTHEAST COMMUNITY BANCORP, INC.NET

INTEREST MARGIN ANALYSIS(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended March 31, 2024 |

|

Quarter Ended March 31, 2023 |

| |

|

Average |

|

Interest and |

|

Average |

|

Average |

|

Interest and |

|

Average |

| |

|

Balance |

|

dividend |

|

Yield |

|

Balance |

|

dividend |

|

Yield |

| |

|

(In thousands, except yield/cost

information) |

|

(In thousands, except yield/cost

information) |

|

Loan receivable gross |

|

$ |

1,612,343 |

|

|

$ |

36,703 |

|

|

|

9.11 |

% |

|

$ |

1,269,850 |

|

|

$ |

27,575 |

|

|

|

8.69 |

% |

| Securities |

|

|

33,848 |

|

|

|

197 |

|

|

|

2.33 |

% |

|

|

44,523 |

|

|

|

211 |

|

|

|

1.90 |

% |

| Federal Home Loan Bank

stock |

|

|

842 |

|

|

|

21 |

|

|

|

9.98 |

% |

|

|

1,150 |

|

|

|

22 |

|

|

|

7.65 |

% |

| Other interest-earning

assets |

|

|

91,552 |

|

|

|

1,200 |

|

|

|

5.24 |

% |

|

|

61,484 |

|

|

|

703 |

|

|

|

4.57 |

% |

|

Total interest-earning assets |

|

|

1,738,585 |

|

|

|

38,121 |

|

|

|

8.77 |

% |

|

|

1,377,007 |

|

|

|

28,511 |

|

|

|

8.28 |

% |

| Allowance for credit

losses |

|

|

(5,091 |

) |

|

|

|

|

|

|

|

|

|

(5,459 |

) |

|

|

|

|

|

|

|

| Non-interest-earning

assets |

|

|

88,859 |

|

|

|

|

|

|

|

|

|

|

80,900 |

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

1,822,353 |

|

|

|

|

|

|

|

|

|

$ |

1,452,448 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing demand

deposit |

|

$ |

171,483 |

|

|

$ |

1,817 |

|

|

|

4.24 |

% |

|

$ |

90,199 |

|

|

$ |

428 |

|

|

|

1.90 |

% |

| Savings and club accounts |

|

|

182,771 |

|

|

|

1,202 |

|

|

|

2.63 |

% |

|

|

286,510 |

|

|

|

1,913 |

|

|

|

2.67 |

% |

| Certificates of deposit |

|

|

810,586 |

|

|

|

9,375 |

|

|

|

4.63 |

% |

|

|

431,259 |

|

|

|

3,211 |

|

|

|

2.98 |

% |

|

Total interest-bearing deposits |

|

|

1,164,840 |

|

|

|

12,394 |

|

|

|

4.26 |

% |

|

|

807,968 |

|

|

|

5,552 |

|

|

|

2.75 |

% |

| Borrowed money |

|

|

61,092 |

|

|

|

741 |

|

|

|

4.85 |

% |

|

|

19,056 |

|

|

|

121 |

|

|

|

2.54 |

% |

|

Total interest-bearing liabilities |

|

|

1,225,932 |

|

|

|

13,135 |

|

|

|

4.29 |

% |

|

|

827,024 |

|

|

|

5,673 |

|

|

|

2.74 |

% |

| Non-interest-bearing

demand deposit |

|

|

291,909 |

|

|

|

|

|

|

|

|

|

|

345,298 |

|

|

|

|

|

|

|

|

| Other

non-interest-bearing liabilities |

|

|

18,090 |

|

|

|

|

|

|

|

|

|

|

15,181 |

|

|

|

|

|

|

|

|

|

Total liabilities |

|

|

1,535,931 |

|

|

|

|

|

|

|

|

|

|

1,187,503 |

|

|

|

|

|

|

|

|

| Equity |

|

|

286,422 |

|

|

|

|

|

|

|

|

|

|

264,945 |

|

|

|

|

|

|

|

|

|

Total liabilities and equity |

|

$ |

1,822,353 |

|

|

|

|

|

|

|

|

|

$ |

1,452,448 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income / interest spread |

|

|

|

|

$ |

24,986 |

|

|

|

4.48 |

% |

|

|

|

|

$ |

22,838 |

|

|

|

5.54 |

% |

|

Net interest rate margin |

|

|

|

|

|

|

|

|

|

5.75 |

% |

|

|

|

|

|

|

|

|

|

6.63 |

% |

|

Net interest earning assets |

|

$ |

512,653 |

|

|

|

|

|

|

|

|

|

$ |

549,983 |

|

|

|

|

|

|

|

|

|

Average interest-earning assets to interest-bearing

liabilities |

|

|

141.82 |

% |

|

|

|

|

|

|

|

|

|

166.50 |

% |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

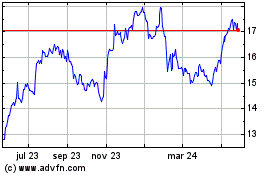

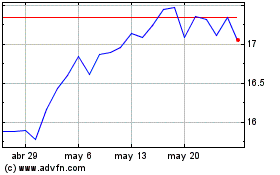

NorthEast Community Banc... (NASDAQ:NECB)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

NorthEast Community Banc... (NASDAQ:NECB)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025