- Total revenue growth of 15% year over year

- Cloud ARR exceeds $2 billion

- Company reiterates full-year total revenue guidance and raises

EPS guidance

- Record high operating margin driving operating cash flow of

$159 million

NICE (NASDAQ: NICE) today announced results for the third

quarter ended September 30, 2024, as compared to the corresponding

period of the previous year.

Third Quarter 2024 Financial Highlights

GAAP

Non-GAAP

Total revenue was $690.0 million

and increased 15%

Total revenue was $690.0 million

and increased 15%

Cloud revenue was $500.1 million

and increased 24%

Cloud revenue was $500.1 million

and increased 24%

Operating income was $141.4

million and increased 24%

Operating income was $220.8

million and increased 20%

Operating margin was 20.5%

compared to 18.9% last year

Operating margin was 32.0%

compared to 30.6% last year

Diluted EPS was $1.86 and

increased 34%

Diluted EPS was $2.88 and

increased 27%

Operating cash flow was $159.0

million and increased 32%

“We are pleased to report another stellar quarter in which our

financial performance and continued innovation are redefining our

competitive edge, propelling us far ahead of the industry and

solidifying NICE as the go-to partner for enterprises across the

globe,” said Barak Eilam, CEO of NICE. “Total revenue of $690

million increased 15% compared to the same period last year, and

robust profitability, marked by a 140-basis point increase in

non-GAAP operating margin to a record 32%, an impressive 27% leap

in non-GAAP EPS to $2.88, and another exceptional quarter of

operating cash flow of $159 million, are setting new industry

benchmarks.”

Mr. Eilam continued, “We owe these great results to the power of

our cutting-edge AI innovation, where we delivered an outstanding

quarter and an acceleration in deal signings and bookings for our

CXone AI offerings, including Copilot, Autopilot and Autosummary.

Our strength in AI-powered automated customer service and our

market leading CXone platform, are reshaping the industry landscape

as we continue to displace multiple on-premises and cloud customer

service solution providers.”

GAAP Financial Highlights for the Third

Quarter Ended September 30:

Revenues: Third quarter 2024 total revenues increased 15%

to $690.0 million compared to $601.3 million for the third quarter

of 2023.

Gross Profit: Third quarter 2024 gross profit was $460.3

million compared to $410.4 million for the third quarter of 2023.

Third quarter 2024 gross margin was 66.7% compared to 68.2% for the

third quarter of 2023.

Operating Income: Third quarter 2024 operating income

increased 24% to $141.4 million compared to $113.6 million for the

third quarter of 2023. Third quarter 2024 operating margin was

20.5% compared to 18.9% for the third quarter of 2023.

Net Income: Third quarter 2024 net income increased 31%

to $120.9 million compared to $92.4 million for the third quarter

of 2023. Third quarter 2024 net income margin was 17.5% compared to

15.4% for the third quarter of 2023.

Fully Diluted Earnings Per Share: Fully diluted earnings

per share for the third quarter of 2024 increased 34% to $1.86

compared to $1.39 in the third quarter of 2023.

Cash Flow and Cash Balance: Third quarter 2024 operating

cash flow was $159.0 million. In the third quarter 2024, $86.4

million was used for share repurchases. As of September 30, 2024,

total cash and cash equivalents, and short-term investments were

$1,526.7 million. Our debt was $458.4 million, resulting in net

cash and investments of $1,068.3 million.

Non-GAAP Financial Highlights for the

Third Quarter Ended September 30:

Revenues: Third quarter 2024 total revenues increased 15%

to $690.0 million compared to $601.3 million for the third quarter

of 2023.

Gross Profit: Third quarter 2024 gross profit was $490.3

million compared to $434.4 million for the third quarter of 2023.

Third quarter 2024 gross margin was 71.1% compared to 72.2% for the

third quarter of 2023.

Operating Income: Third quarter 2024 operating income

increased 20% to $220.8 million compared to $183.9 million for the

third quarter of 2023. Third quarter 2024 operating margin was

32.0% compared to 30.6% for the third quarter of 2023.

Net Income: Third quarter 2024 net income increased 24%

to $186.9 million compared to $150.6 million for the third quarter

of 2023. Third quarter 2024 net income margin was 27.1% compared to

25.0% for the third quarter of 2023.

Fully Diluted Earnings Per Share: Fully diluted earnings

per share for the third quarter of 2024 increased 27% to $2.88

compared to $2.27 in the third quarter of 2023.

Full-Year 2024 Guidance:

The Company is reiterating its full-year 2024 non-GAAP total

revenues to be in an expected range of $2,715 million to $2,735

million, representing 15% growth at the midpoint compared to

full-year 2023.

The Company increased full-year 2024 non-GAAP fully diluted

earnings per share which are expected to be in a range of $10.95 to

$11.15, representing 26% growth at the midpoint compared to

full-year 2023.

Quarterly Results Conference Call

NICE management will host its earnings conference call today,

November 14, 2024, at 8:30 AM ET, 13:30 GMT, 15:30 Israel, to

discuss the results and the company's outlook. A live webcast and

replay will be available on the Investor Relations page of the

Company’s website. To access, please register by clicking here:

https://www.nice.com/investor-relations/upcoming-event.

Explanation of Non-GAAP measures Non-GAAP financial

measures are included in this press release. Non-GAAP financial

measures consist of GAAP financial measures adjusted to exclude

share-based compensation, amortization of acquired intangible

assets, acquisition related and other expenses, amortization of

discount on debt and loss from extinguishment of debt and the tax

effect of the Non-GAAP adjustments.

The Company believes that these Non-GAAP financial measures,

used in conjunction with the corresponding GAAP measures, provide

investors with useful supplemental information about the financial

performance of our business. We believe Non-GAAP financial measures

are useful to investors as a measure of the ongoing performance of

our business. Our management regularly uses our supplemental

Non-GAAP financial measures internally to understand, manage and

evaluate our business and to make financial, strategic and

operating decisions. These Non-GAAP measures are among the primary

factors management uses in planning for and forecasting future

periods. Our Non-GAAP financial measures are not meant to be

considered in isolation or as a substitute for comparable GAAP

measures and should be read only in conjunction with our

consolidated financial statements prepared in accordance with GAAP.

These Non-GAAP financial measures may differ materially from the

Non-GAAP financial measures used by other companies. Reconciliation

between results on a GAAP and Non-GAAP basis is provided in a table

immediately following the Consolidated Statements of Income. The

Company provides guidance only on a Non-GAAP basis. A

reconciliation of guidance from a GAAP to Non-GAAP basis is not

available due to the unpredictability and uncertainty associated

with future events that would be reported in GAAP results and would

require adjustments between GAAP and Non-GAAP financial measures,

including the impact of future possible business acquisitions.

Accordingly, a reconciliation of the guidance based on Non-GAAP

financial measures to corresponding GAAP financial measures for

future periods is not available without unreasonable effort.

About NICE With NICE (Nasdaq: NICE), it’s never been

easier for organizations of all sizes around the globe to create

extraordinary customer experiences while meeting key business

metrics. Featuring the world’s #1 cloud native customer experience

platform, CXone, NICE is a worldwide leader in AI-powered

self-service and agent-assisted CX software for the contact center

– and beyond. Over 25,000 organizations in more than 150 countries,

including over 85 of the Fortune 100 companies, partner with NICE

to transform - and elevate - every customer interaction.

www.nice.com

Trademark Note: NICE and the NICE logo are trademarks or

registered trademarks of NICE. All other marks are trademarks of

their respective owners. For a full list of NICE' marks, please

see: http://www.nice.com/nice-trademarks.

Forward-Looking Statements This press release contains

forward-looking statements as that term is defined in the Private

Securities Litigation Reform Act of 1995. In some cases,

forward-looking statements may be identified by words such as

“believe”, “expect”, “seek”, “may”, “will”, “intend”, “should”,

“project”, “anticipate”, “plan”, and similar expressions.

Forward-looking statements are based on the current beliefs,

expectations and assumptions of the Company’s management regarding

the future of the Company’s business, performance, future plans and

strategies, projections, anticipated events and trends, the

economic environment, and other future conditions. Examples of

forward-looking statements include guidance regarding the Company’s

revenue and earnings and the growth of our cloud, analytics and

artificial intelligence business.

Forward looking statements are inherently subject to significant

uncertainties, contingencies, and risks, including, economic,

competitive and other factors, which are difficult to predict and

many of which are beyond the control of management. The Company

cautions that these statements are not guarantees of future

performance, and investors should not place undue reliance on them.

There are or will be important known and unknown factors and

uncertainties that could cause actual results to differ materially

from those expressed or implied in the forward-looking statements.

These factors, include, but are not limited to, risks associated

with changes in economic and business conditions, competition,

successful execution of the Company’s growth strategy, success and

growth of the Company’s cloud Software-as-a-Service business,

difficulties in making additional acquisitions or effectively

integrating acquired operations, products, technologies and

personnel, the Company’s dependency on third-party cloud computing

platform providers, hosting facilities and service partners,

rapidly changing technology, cyber security attacks or other

security breaches against the Company, privacy concerns and

legislation impacting the Company’s business, changes in currency

exchange rates and interest rates, the effects of additional tax

liabilities resulting from our global operations, the effect of

unexpected events or geo-political conditions, such as the impact

of conflicts in the Middle East, that may disrupt our business and

the global economy and various other factors and uncertainties

discussed in our filings with the U.S. Securities and Exchange

Commission (the “SEC”).

You are encouraged to carefully review the section entitled

“Risk Factors” in our latest Annual Report on Form 20-F and our

other filings with the SEC for additional information regarding

these and other factors and uncertainties that could affect our

future performance. The forward-looking statements contained in

this press release speak only as of the date hereof, and the

Company undertakes no obligation to update or revise them, whether

as a result of new information, future developments or otherwise,

except as required by law.

NICE LTD. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

U.S. dollars in thousands

September 30,

December 31,

2024

2023

Unaudited

Audited

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

666,734

$

511,795

Short-term investments

859,955

896,044

Trade receivables

629,850

585,154

Debt hedge option

-

121,922

Prepaid expenses and other current

assets

213,560

197,967

Total current assets

2,370,099

2,312,882

LONG-TERM ASSETS:

Property and equipment, net

187,447

174,414

Deferred tax assets

222,268

178,971

Other intangible assets, net

246,037

305,501

Operating lease right-of-use assets

96,743

104,565

Goodwill

1,853,115

1,821,969

Prepaid expenses and other long-term

assets

212,904

219,332

Total long-term assets

2,818,514

2,804,752

TOTAL ASSETS

$

5,188,613

$

5,117,634

LIABILITIES AND SHAREHOLDERS'

EQUITY

CURRENT LIABILITIES:

Trade payables

$

71,349

$

66,036

Deferred revenues and advances from

customers

333,968

302,649

Current maturities of operating leases

13,065

13,747

Debt

458,360

209,229

Accrued expenses and other liabilities

548,048

528,660

Total current liabilities

1,424,790

1,120,321

LONG-TERM LIABILITIES:

Deferred revenues and advances from

customers

55,223

52,458

Operating leases

95,206

102,909

Deferred tax liabilities

9,887

8,596

Debt

-

457,081

Other long-term liabilities

23,261

21,769

Total long-term liabilities

183,577

642,813

SHAREHOLDERS' EQUITY

Nice Ltd's equity

3,567,727

3,341,132

Non-controlling interests

12,519

13,368

Total shareholders' equity

3,580,246

3,354,500

TOTAL LIABILITIES AND SHAREHOLDERS'

EQUITY

$

5,188,613

$

5,117,634

NICE LTD. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

INCOME

U.S. dollars in thousands (except per

share amounts)

Quarter ended

Year to date

September 30,

September 30,

2024

2023

2024

2023

Unaudited

Unaudited

Unaudited

Unaudited

Revenue:

Cloud

$

500,114

$

403,324

$

1,450,213

$

1,152,839

Services

149,857

160,220

446,381

479,022

Product

39,992

37,800

117,078

122,455

Total revenue

689,963

601,344

2,013,672

1,754,316

Cost of revenue:

Cloud

178,923

140,564

519,603

407,144

Services

44,652

45,292

137,401

140,216

Product

6,111

5,130

20,134

19,935

Total cost of revenue

229,686

190,986

677,138

567,295

Gross profit

460,277

410,358

1,336,534

1,187,021

Operating expenses:

Research and development, net

91,500

84,848

265,854

241,589

Selling and marketing

152,778

144,171

465,438

444,614

General and administrative

74,620

67,713

213,600

188,256

Total operating expenses

318,898

296,732

944,892

874,459

Operating income

141,379

113,626

391,642

312,562

Financial and other income, net

(12,280)

(7,037)

(41,934)

(25,108)

Income before tax

153,659

120,663

433,576

337,670

Taxes on income

32,738

28,310

90,497

81,021

Net income

$

120,921

$

92,353

$

343,079

$

256,649

Earnings per share:

Basic

$

1.91

$

1.46

$

5.41

$

4.03

Diluted

$

1.86

$

1.39

$

5.22

$

3.86

Weighted average shares outstanding:

Basic

63,397

63,422

63,403

63,693

Diluted

64,838

66,223

65,741

66,438

NICE LTD. AND SUBSIDIARIES

CONSOLIDATED CASH FLOW

STATEMENTS

U.S. dollars in thousands

Quarter ended

Year to date

September 30,

September 30,

2024

2023

2024

2023

Unaudited

Unaudited

Unaudited

Unaudited

Operating

Activities

Net income

$

120,921

$

92,353

$

343,079

$

256,649

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

52,964

42,269

156,244

126,148

Share-based compensation

47,252

46,213

133,882

130,488

Amortization of premium and discount and

accrued interest on marketable securities

(3,398)

998

(6,726)

2,044

Deferred taxes, net

(27,542)

(13,915)

(38,949)

(30,787)

Changes in operating assets and

liabilities:

Trade Receivables, net

(41,462)

(25,807)

(40,032)

(17,720)

Prepaid expenses and other current

assets

17,164

(315)

27,665

(22,361)

Operating lease right-of-use assets

3,273

3,182

9,926

8,685

Trade payables

(2,293)

11,632

4,646

784

Accrued expenses and other current

liabilities

22,149

20,835

(21,555)

(28,691)

Deferred revenue

(28,094)

(54,485)

22,187

(39,662)

Operating lease liabilities

(2,748)

(4,140)

(10,524)

(11,541)

Amortization of discount on long-term

debt

430

1,166

1,404

3,449

Loss from extinguishment of debt

-

-

-

37

Other

345

624

1,872

3,412

Net cash provided by operating

activities

158,961

120,610

583,119

380,934

Investing

Activities

Purchase of property and equipment

(10,419)

(5,507)

(27,395)

(23,126)

Purchase of Investments

(138,219)

(9,284)

(575,332)

(200,643)

Proceeds from sales of marketable

investments

60,125

134,486

628,246

307,038

Capitalization of internal use software

costs

(16,812)

(12,479)

(47,986)

(41,106)

Payments for business acquisitions, net of

cash acquired

(44,507)

(18,405)

(44,507)

(18,405)

Net cash provided by (used in) investing

activities

(149,832)

88,811

(66,974)

23,758

Financing

Activities

Proceeds from issuance of shares upon

exercise of options

28

43

2,340

1,767

Purchase of treasury shares

(86,437)

(89,506)

(274,040)

(219,417)

Dividends paid to noncontrolling

interest

-

-

(2,681)

(1,480)

Repayment of debt

-

(23)

(87,435)

(1,557)

Net cash used in financing activities

(86,409)

(89,486)

(361,816)

(220,687)

Effect of exchange rates on cash and cash

equivalents

4,508

(2,824)

1,260

(1,111)

Net change in cash, cash equivalents and

restricted cash

(72,772)

117,111

155,589

182,894

Cash, cash equivalents and restricted

cash, beginning of period

$

741,675

$

598,879

$

513,314

$

533,096

Cash, cash equivalents and restricted

cash, end of period

$

668,903

$

715,990

$

668,903

$

715,990

Reconciliation of cash, cash equivalents

and restricted cash reported in the consolidated balance sheet:

Cash and cash equivalents

$

666,734

$

713,090

$

666,734

$

713,090

Restricted cash included in other current

assets

$

2,169

$

2,900

$

2,169

$

2,900

Total cash, cash equivalents and

restricted cash shown in the statement of cash flows

$

668,903

$

715,990

$

668,903

$

715,990

NICE LTD. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP

RESULTS

U.S. dollars in thousands (except per

share amounts)

Quarter ended

Year to date

September 30,

September 30,

2024

2023

2024

2023

GAAP revenues

$

689,963

$

601,344

$

2,013,672

$

1,754,316

Non-GAAP revenues

$

689,963

$

601,344

$

2,013,672

$

1,754,316

GAAP cost of revenue

$

229,686

$

190,986

$

677,138

$

567,295

Amortization of acquired intangible assets

on cost of cloud

(24,278)

(18,967)

(73,778)

(57,732)

Amortization of acquired intangible assets

on cost of product

-

(260)

(410)

(766)

Cost of cloud revenue adjustment (1,2)

(3,175)

(2,160)

(9,029)

(6,360)

Cost of services revenue adjustment

(1)

(2,511)

(3,016)

(7,506)

(8,764)

Cost of product revenue adjustment (1)

(30)

384

(90)

106

Non-GAAP cost of revenue

$

199,692

$

166,967

$

586,325

$

493,779

GAAP gross profit

$

460,277

$

410,358

$

1,336,534

$

1,187,021

Gross profit adjustments

29,994

24,019

90,813

73,516

Non-GAAP gross profit

$

490,271

$

434,377

$

1,427,347

$

1,260,537

GAAP operating expenses

$

318,898

$

296,732

$

944,892

$

874,459

Research and development (1,2)

(6,734)

(8,224)

(22,361)

(24,405)

Sales and marketing (1,2)

(14,944)

(12,376)

(42,326)

(36,533)

General and administrative (1,2)

(22,154)

(22,348)

(59,414)

(57,703)

Amortization of acquired intangible

assets

(5,613)

(3,308)

(15,824)

(12,251)

Valuation adjustment on acquired deferred

commission

1

30

24

106

Non-GAAP operating expenses

$

269,454

$

250,506

$

804,991

$

743,673

GAAP financial and other income, net

$

(12,280)

$

(7,037)

$

(41,934)

$

(25,108)

Amortization of discount and loss of

extinguishment on debt

(430)

(1,166)

(1,404)

(3,486)

Change in fair value of contingent

consideration

(36)

(239)

(115)

(817)

Non-GAAP financial and other income,

net

$

(12,746)

$

(8,442)

$

(43,453)

$

(29,411)

GAAP taxes on income

$

32,738

$

28,310

$

90,497

$

81,021

Tax adjustments re non-GAAP

adjustments

13,886

13,372

42,665

37,473

Non-GAAP taxes on income

$

46,624

$

41,682

$

133,162

$

118,494

GAAP net income

$

120,921

$

92,353

$

343,079

$

256,649

Amortization of acquired intangible

assets

29,891

22,535

90,012

70,749

Valuation adjustment on acquired deferred

commission

(1)

(30)

(24)

(106)

Share-based compensation (1)

48,731

47,287

137,997

133,206

Acquisition related and other expenses

(2)

817

453

2,729

453

Amortization of discount and loss of

extinguishment on debt

430

1,166

1,404

3,486

Change in fair value of contingent

consideration

36

239

115

817

Tax adjustments re non-GAAP

adjustments

(13,886)

(13,372)

(42,665)

(37,473)

Non-GAAP net income

$

186,939

$

150,631

$

532,647

$

427,781

GAAP diluted earnings per share

$

1.86

$

1.39

$

5.22

$

3.86

Non-GAAP diluted earnings per share

$

2.88

$

2.27

$

8.10

$

6.44

Shares used in computing GAAP diluted

earnings per share

64,838

66,223

65,741

66,438

Shares used in computing non-GAAP diluted

earnings per share

64,838

66,223

65,741

66,438

NICE LTD. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP

RESULTS (continued)

U.S. dollars in thousands

(1)

Share-based

compensation

Quarter ended

Year to date

September 30,

September 30,

2024

2023

2024

2023

Cost of cloud revenue

$

3,175

$

2,160

$

8,967

$

6,360

Cost of services revenue

2,511

3,016

7,506

8,764

Cost of product revenue

30

(384)

90

(106)

Research and development

6,734

8,224

22,031

24,405

Sales and marketing

14,937

12,351

41,676

36,508

General and administrative

21,344

21,920

57,727

57,275

$

48,731

$

47,287

$

137,997

$

133,206

(2)

Acquisition

related and other expenses

Quarter ended

Year to date

September 30,

September 30,

2024

2023

2024

2023

Cost of cloud revenue

$

-

$

-

$

62

$

-

Research and development

-

-

330

-

Sales and marketing

7

25

650

25

General and administrative

810

428

1,687

428

$

817

$

453

$

2,729

$

453

NICE LTD. AND SUBSIDIARIES

RECONCILIATION OF GAAP NET INCOME TO

NON-GAAP EBITDA

U.S. dollars in thousands

Quarter ended

Year to date

September 30,

September 30,

2024

2023

2024

2023

Unaudited

Unaudited

Unaudited

Unaudited

GAAP net income

$

120,921

$

92,353

$

343,079

$

256,649

Non-GAAP adjustments:

Depreciation and amortization

52,964

42,269

156,244

126,148

Share-based compensation

47,252

46,213

133,882

130,488

Financial and other income, net

(12,280)

(7,037)

(41,934)

(25,108)

Acquisition related and other expenses

817

453

2,729

453

Valuation adjustment on acquired deferred

commission

(1)

(30)

(24)

(106)

Taxes on income

32,738

28,310

90,497

81,021

Non-GAAP EBITDA

$

242,411

$

202,531

$

684,473

$

569,545

NICE LTD. AND SUBSIDIARIES

NON-GAAP RECONCILIATION - FREE CASH

FLOW FROM CONTINUING OPERATIONS

U.S. dollars in thousands

Quarter ended

Year to date

September 30,

September 30,

2024

2023

2024

2023

Unaudited

Unaudited

Unaudited

Unaudited

Net cash provided by operating

activities

$

158,961

$

120,610

$

583,119

$

380,934

Purchase of property and equipment

(10,419)

(5,507)

(27,395)

(23,126)

Capitalization of internal use software costs

(16,812)

(12,479)

(47,986)

(41,106)

Free Cash Flow (a)

$

131,730

$

102,624

$

507,738

$

316,702

(a) Free cash flow from continuing operations is defined as

operating cash flows from continuing operations less capital

expenditures of the continuing operations and less capitalization

of internal use software costs.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114018044/en/

Investor Relations Contact Marty Cohen, +1 551 256 5354,

ir@nice.com, ET Omri Arens, +972 3 763-0127, ir@nice.com, CET

Corporate Media Contact Christopher Irwin-Dudek, +1 201

561 4442, media@nice.com, ET

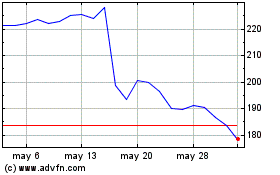

NICE (NASDAQ:NICE)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

NICE (NASDAQ:NICE)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024