Nuwellis Announces Pricing of $916,000 Registered Direct Offering Priced At-The-Market Under Nasdaq Rules

23 Agosto 2024 - 8:00AM

Nuwellis, Inc. (Nasdaq: NUWE) (“Nuwellis” or the “Company”), a

medical technology company focused on transforming the lives of

people with fluid overload, today announced that it has entered

into a definitive securities purchase agreement with certain

institutional investors for the purchase and sale of 496,901 shares

of the Company’s common stock at a price of $1.8450 per share of

common stock in a registered direct offering priced at-the-market

under Nasdaq rules.

In addition, in a concurrent private placement,

the Company will issue to the investors warrants to purchase up to

496,901 shares of common stock. The warrants have an exercise price

of $1.72 per share, will be exercisable immediately following the

date of issuance and will have a term of five years from the date

of effectiveness of the registration statement for the purposes of

registering the shares of common stock underlying the warrants.

The closing of the registered direct offering

and the concurrent private placement is expected to occur on or

about August 26, 2024, subject to the satisfaction of customary

closing conditions.

Ladenburg Thalmann & Co. Inc. is acting as exclusive

placement agent for the offerings.

The gross proceeds to Nuwellis from the

registered direct offering and the concurrent private placement,

before deducting the placement agent fees and other offering

expenses payable by the Company, are expected to be approximately

$916,000. Nuwellis intends to use the net proceeds from the

offerings for working capital and for general corporate

purposes.

The securities described above (excluding the

warrants and the shares of common stock underlying the

warrants) are being offered pursuant to a shelf registration

statement on Form S-3 (File No. 333-280647), which was declared

effective by the United States Securities and Exchange Commission

(“SEC”) on July 9, 2024. The registered direct offering is being

made only by means of a prospectus, including a prospectus

supplement, which is part of the effective registration statement,

that will be filed with the SEC. Electronic copies of the final

prospectus supplement and accompanying prospectus may be obtained,

when available, on the SEC’s website

at http://www.sec.gov or by contacting Ladenburg Thalmann

& Co. Inc., Prospectus Department, 640 Fifth Avenue, 4th Floor,

New York, New York 10019 or by email at

prospectus@ladenburg.com.

The warrants described above are being offered

in a private placement under Section 4(a)(2) of the Securities Act

of 1933, as amended (the “Act”), and Regulation D promulgated

thereunder and, along with the shares of common stock underlying

such warrants, have not been registered under the Act, or

applicable state securities laws. Accordingly, the warrants and the

underlying shares of common stock may not be offered or sold in the

United States except pursuant to an effective registration

statement or an applicable exemption from the registration

requirements of the Act and such applicable state securities

laws.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy any of the

securities described therein, nor shall there be any sales of these

securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful prior to registration or qualification under

the securities laws of such jurisdiction.

About Nuwellis

Nuwellis is a medical technology company

dedicated to transforming the lives of patients suffering from

fluid overload through science, collaboration, and innovation. The

Company is focused on commercializing the Aquadex

SmartFlow® system for ultrafiltration therapy. Nuwellis is

headquartered in Minneapolis, with a wholly owned subsidiary in

Ireland.

About the Aquadex SmartFlow®

System

The Aquadex SmartFlow system delivers clinically

proven therapy using a simple, flexible, and smart method of

removing excess fluid from patients suffering from hypervolemia

(fluid overload). The Aquadex SmartFlow system is indicated for

temporary (up to 8 hours) or extended (longer than 8 hours in

patients who require hospitalization) use in adult and pediatric

patients weighing 20 kg or more whose fluid overload is

unresponsive to medical management, including diuretics. All

treatments must be administered by a health care provider, within

an outpatient or inpatient clinical setting, under physician

prescription, both having received training in extracorporeal

therapies.

Forward-Looking Statements

Certain statements in this release may be

considered forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements in this press release include, without limitation,

statements with respect to the completion of the offerings, the

satisfaction of customary closing conditions related to the

offerings and the intended use of proceeds from the offerings.

Forward-looking statements are predictions, projections and other

statements about future events that are based on current

expectations and assumptions and, as a result, are subject to risks

and uncertainties. Many factors could cause actual future events to

differ materially from the forward-looking statements in this

release, including, without limitation, uncertainties related to

market conditions, the satisfaction of customary closing conditions

related to the offerings, those risks associated with our ability

to execute on our commercialization strategy, the possibility that

we may be unable to raise sufficient funds necessary for our

anticipated operations, our post-market clinical data collection

activities, benefits of our products to patients, our expectations

with respect to product development and commercialization efforts,

our ability to increase market and physician acceptance of our

products, potentially competitive product offerings, intellectual

property protection, our ability to integrate acquired businesses,

our expectations regarding anticipated synergies with and benefits

from acquired businesses, and other risks and uncertainties

described in our filings with the SEC. Forward-looking statements

speak only as of the date when made. Nuwellis does not assume any

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

CONTACTS

INVESTORS:Robert ScottChief Financial Officer,

Nuwellis, Inc.ir@nuwellis.com

Vivian CervantesGilmartin Group

LLCvivian.cervantes@gilmartinir.com

Source: Nuwellis, Inc.

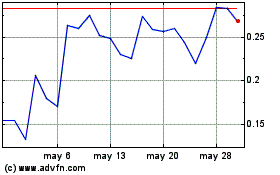

Newellis (NASDAQ:NUWE)

Gráfica de Acción Histórica

De Dic 2024 a Dic 2024

Newellis (NASDAQ:NUWE)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024