Form 8-K - Current report

09 Mayo 2024 - 6:10AM

Edgar (US Regulatory)

false 0001142417 0001142417 2024-05-09 2024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 9, 2024

NEXSTAR MEDIA GROUP, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Delaware |

|

000-50478 |

|

23-3083125 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

|

|

| 545 E. John Carpenter Freeway |

|

|

|

|

| Suite 700 |

|

|

|

|

| Irving, Texas |

|

|

|

75062 |

| (Address of Principal Executive Offices) |

|

|

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: 972 373-8800

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

NXST |

|

NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On May 9, 2024, Nexstar Media Group, Inc. issued a press release announcing its financial results for the quarter ended March 31, 2024. A copy of the press release is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

NEXSTAR MEDIA GROUP, INC. |

|

|

|

|

| Date: May 9, 2024 |

|

|

|

By: |

|

/s/ Lee Ann Gliha |

|

|

|

|

Name: |

|

Lee Ann Gliha |

|

|

|

|

|

Title: |

|

Chief Financial Officer |

|

|

|

|

(Principal Financial Officer) |

Exhibit 99.1

FIRST QUARTER 2024 EARNINGS RELEASE May 9, 2024 Q1 Net Revenue Drives Net Income of $167 Million, Adjusted EBITDA of $542 Million and

Adjusted Free Cash Flow of $403 Million All-Time High Quarterly Distribution Revenue Reduced Year-over-Year Quarterly Losses at The CW by $50 Million Quarterly Return of Capital to Shareholders of $168 Million, Reducing Shares Outstanding by 1.7%

“Nexstar is off to a strong start in 2024, delivering the highest first quarter net revenues in the Company’s history and once again outpacing consensus expectations for Adjusted EBITDA and Adjusted Free Cash Flow. As the industry’s

largest local broadcaster with the most-watched broadcast television programming, Nexstar’s value to our distribution and advertising partners is demonstrated by our continued strong financial performance, including all-time quarterly high

distribution revenue. We continue to make progress at The CW, reducing operating losses by $50 million year-over-year and kicking off the 2023/2024 broadcast season by delivering two sequential quarters of primetime audience improvement. Looking

ahead, we remain confident that Nexstar will deliver another strong year of financial results and expect to build momentum through 2024, given the anticipated record-level of political spending this presidential election cycle.” ($ in millions)

Three Months Ended March 31, 2024 2023 % Change Distribution $761 $728 4.5 Advertising 512 517 (1.0) Other 11 12 (8.3) Net Revenue $1,284 $1,257 2.1 Net Income $167 $88 89.8 % Margin(1) 13.0% 7.0% 6.0 Adjusted EBITDA(2) $542 $496 9.3 % Margin(1)

42.2% 39.5% 2.7 Adjusted Free Cash Flow(2) $403 $377 6.9 (1) Net Revenue Income . margin is Net Income as a percentage of Net Revenue. Adjusted EBITDA margin is Adjusted EBITDA as a percentage of Net (2) Definitions release. In and the disclosures

first quarter regarding of 2024, non we - GAAP adjusted financial our definition information of including Adjusted reconciliations EBITDA to add are back included stock at -based the end compensation of the press expense Flow (formerly and

restructuring referred to as expenses Attributable and to Free subtract Cash Flow) out pension to subtract credits out . pension We also credits adjusted and our payments definition for of capitalized Adjusted Free software Cash losses obligations

in The and CW to adjust . The for comparative actual cash prior contributions year disclosures from noncontrolling presented herein interests were in also lieu of recast adjusting to conform for our partners’ with the share current of

presentation.

FIRST QUARTER 2024 EARNINGS RELEASE Announced a 25% increase in the quarterly cash dividend to $1.69 per share of its common stock,

marking the Company’s eleventh consecutive annual dividend increase. Adopted a policy separating the roles of the Company’s Chairperson and Chief Executive Officer, which will take effect after Mr. Sook leaves the Company and the Board.

Received $40 million of gross proceeds from the sale of our ownership interest in Broadcast Music, Inc. (BMI). Entered into a multi-year time brokerage agreement with KAZT-TV in Phoenix, Arizona, the nation’s 11th largest television market, and

added The CW Network affiliation. Successfully completed the transition of all 117 markets to Nexstar’s own national sales organization from third-party representation. Entered into multi-year agreements with Comscore and Nielsen for linear and

cross-platform audience measurement across Nexstar’s local TV, broadcast, network, and digital businesses. Delivered consecutive quarters of primetime ratings growth at The CW in the first two quarters since the launch of the 2023/2024

broadcast season. Announced that The CW’s seven-year NASCAR Xfinity series deal beginning in 2025 will start ahead of schedule, with all 2024 playoff races now scheduled to air exclusively on The CW beginning in September 2024. Achieved our

near-term target of reaching over 50% of U.S. television households with an ATSC 3.0, or NextGen TV, signal from a Nexstar owned or operated station following the Chicago and San Diego market launches. Net Revenue. Record first quarter net revenue

of $1.28 billion, increased by $27 million, or 2.1%, reflecting growth in distribution revenue, partially offset by a slight decline in advertising and other revenue. Approximately 59% of Nexstar’s first quarter revenue was derived from

distribution revenue. Distribution Revenue. First quarter distribution revenue of $761 million was an all-time quarterly high for the company, increasing $33 million, or 4.5%, over the comparable prior year quarter. Distribution revenue growth was

primarily due to distribution contract renewals in 2023 on terms favorable to the Company, annual rate escalators, and the return of our partner stations on one MVPD in January, partially offset by MVPD subscriber attrition. Distribution revenue

includes retransmission revenue, carriage fees, affiliation fees, and spectrum leasing revenue. Advertising Revenue. First quarter advertising revenue of $512 million decreased $5 million, or 1.0%, compared to the prior year quarter reflecting a $36

million year-over-year reduction in core and digital advertising revenue due to ongoing advertising market softness offset, in part, by a $31 million year-over-year increase in election-year political advertising to $39 million. Advertising revenue

includes core television advertising, digital advertising and political advertising revenue. Net Income. First quarter net income of $167 million increased $79 million, or 89.8%, compared to the prior year quarter, reflecting increased revenue,

lower operating expenses driven by reduced amortization of broadcast rights at The CW, and a $40 million gain on the sale of our ownership interest in BMI offset, in part, by increased interest expense. Net Income margin increased to 13.0% from 7.0%

in the comparable prior year period.

FIRST QUARTER 2024 EARNINGS RELEASE Financial Highlights (continued) ï,· Adjusted EBITDA. First quarter Adjusted EBITDA of

$542 million increased $46 million, or 9.3%, compared to the prior year quarter primarily reflecting revenue growth and a $50 million year-over-year reduction in losses at The CW, partially offset by an increase in other operating and

corporate and elimination expenses and a reduction of cash distributions from equity method investments at TV Food Network LLC (“TVFN”) primarily related to lower advertising revenue. Adjusted EBITDA margin improved to 42.2% from 39.5% in

the comparable prior year period. ï,· Adjusted Free Cash Flow. First quarter Adjusted Free Cash Flow of $403 million, increased $26 million, or 6.9%, due primarily to the increase in Adjusted EBITDA offset, in part, by higher

interest expense due to rising interest rates, slightly higher capital expenditures and lower cash contributions from our partners in The CW. Capital Allocation ï,· In the first quarter of 2024, as shown in the table below, the Company

used cash on hand and cash flow from operations to repay $30 million of debt, pay $57 million in dividends, and repurchase 666,574 shares of Nexstar’s common stock at an average price of approximately $166.11 for a total of

$111 million. ($ in millions, shares in thousands) Three Months Ended March 31, 2024 2023 Cash Used For Debt repayment $30 $31 Acquisitions — Stockholder return 168 225 Common stock dividends 57 50 Stock repurchases 111 175 Shares

Outstanding End of period 33,038 35,984 Less: Beginning of period 33,601 36,810 Change in shares outstanding (563) (826) % Change (1.7%) (2.2%)

4 The consolidated debt of Nexstar and Mission Broadcasting, Inc. (“Mission”), an independently owned variable interest

entity, as of March 31, 2024 was $6.81 billion, including senior secured debt of $4.10 billion. The Company calculates its leverage ratios in accordance with the terms of its credit agreements which exclude The CW Network’s operations and cash

balance. As of March 31, 2024, The CW Network had $90 million of cash on its balance sheet. As of March 31, 2024, the Company’s first lien net leverage ratio was 2.21x compared to a covenant of 4.25x and its total net leverage ratio was 3.73x.

The table below summarizes the Company’s unrestricted cash balances and debt obligations (net of financing costs, discounts and/or premiums) as of March 31, 2024 and as of December 31, 2023. ($ in millions) March 31, 2024 December 31, 2023

Unrestricted Cash $237 $135 Revolving Credit Facilities $62 $62 First Lien Term Loans 4,037 4,064 5.625% Senior Unsecured Notes due 2027 1,717 1,717 4.75% Senior Unsecured Notes due 2028 994 994 Total Debt $6,810 $6,837 Nexstar will host a

conference call at 10:00 a.m. ET today. Senior management will discuss the financial results and host a question-and-answer session. The dial in number for the audio conference call is +1 877-407-9208 or +1 201-493-6784, conference ID 13745345

(domestic and international callers). Participants can also listen to a live webcast of the call through the “Events and Presentations” section under “Investor Relations” on Nexstar’s website at nexstar.tv. A webcast replay

will be available for 90 days following the live event at nexstar.tv. nexstar media group, inc. first quarter 2024 earnings release debt, cash and leverage first quarter conference call

FIRST QUARTER 2024 EARNINGS RELEASE Forward-Looking Statements This communication includes forward-looking statements. We have based

these forward-looking statements on our current expectations and projections about future events. Forward-looking statements include information preceded by, followed by, or that includes the words “guidance,” “believes,”

“expects,” “anticipates,” “could,” or similar expressions. For these statements, Nexstar claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act

of 1995. The forward-looking statements contained in this communication, concerning, among other things, future financial performance, including changes in net revenue, operating expenses and cash flow, involve risks and uncertainties, and are

subject to change based on various important factors, including the impact of changes in national and regional economies, the ability to service and refinance our outstanding debt, successful integration of business acquisitions (including

achievement of synergies and cost reductions), pricing fluctuations in local and national advertising, future regulatory actions and conditions in the television stations’ operating areas, competition from others in the broadcast television

markets, volatility in programming costs, the effects of governmental regulation of broadcasting, industry consolidation, technological developments and major world news events. Nexstar undertakes no obligation to update or revise any

forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this communication might not occur. You should not place

undue reliance on these forward-looking statements, which speak only as of the date of this release. For more details on factors that could affect these expectations, please see Nexstar’s other filings with the Securities and Exchange

Commission.

FIRST QUARTER 2024 EARNINGS RELEASE Definitions and Disclosures Regarding Non-GAAP Financial

Information Adjusted EBITDA is calculated as net income, plus or (minus): transaction and other one-time expenses, stock-based compensation expense, depreciation and amortization expense (excluding

amortization of broadcast rights for The CW), (payments) for broadcast rights (excluding broadcast rights payments for The CW), (gain) loss on asset disposal, impairment charges, interest expense, net, (income) loss from equity method investments,

cash distributions from equity method investments, pension and other postretirement plans costs (credit), income tax expense (benefit) and other expense (income). We consider Adjusted EBITDA to be an indicator of our assets’ operating

performance and a measure of our ability to service debt. It is also used by management to identify the cash available for strategic acquisitions and investments, maintain capital assets and fund ongoing operations and working capital needs. We also

believe that Adjusted EBITDA is useful to investors and lenders as a measure of valuation. Adjusted Free Cash Flow is calculated as net income, plus or (minus) transaction and other one-time expenses,

stock-based compensation expense, depreciation and amortization expense (excluding amortization of broadcast rights for The CW), (payments) for broadcast rights (excluding broadcast rights payments for The CW), (gain) loss on asset disposal,

impairment charges, interest expense, net, (income) loss from equity method investments, cash distributions from equity method investments, pension and other postretirement plans costs (credit), income tax expense (benefit) and other expense

(income) minus cash interest expense, capital expenditures, payments for capitalized software obligations and operating cash income tax payments, plus proceeds from disposal of assets and insurance recoveries and cash contribution from

noncontrolling interests. We consider Adjusted Free Cash Flow to be an indicator of our assets’ operating performance. In addition, this measure is useful to investors because it is frequently used by industry analysts, investors and lenders as

a measure of valuation for broadcast companies, although their definitions of free cash flow may differ from our definition. For a reconciliation of these non-GAAP financial measurements to the GAAP financial

results cited in this news announcement, please see the supplemental tables at the end of this release. With respect to our forward-looking guidance, no reconciliation between a non-GAAP measure to the closest

corresponding GAAP measure is included in this release because we are unable to quantify certain amounts that would be required to be included in the GAAP measure without unreasonable efforts. We believe such reconciliations would imply a degree of

precision that would be confusing or misleading to investors. In particular, a reconciliation of forward-looking Adjusted Free Cash Flow to the closest corresponding GAAP measure is not available without unreasonable efforts on a forward-looking

basis due to the high variability, complexity and low visibility with respect to the charges excluded from these non-GAAP measures. For example, the definition of Adjusted Free Cash Flow excludes stock-based

compensation expenses specific to equity compensation awards that are directly impacted by unpredictable fluctuations in our stock price. In addition, the definition of Adjusted Free Cash Flow excludes the impact of

non-recurring or unusual items such as impairment charges, transaction-related costs and gains or losses on sales of assets which are unpredictable. We expect the variability of these items to have a

significant, and potentially unpredictable, impact on our future GAAP financial results.

About Nexstar Media Group, Inc. Nexstar Media Group, Inc. (NASDAQ: NXST) is a leading diversified media company that produces and

distributes engaging local and national news, sports and entertainment content across its television and digital platforms, including more than 310,000 hours of programming produced annually by its business units. Nexstar owns America’s largest

local television broadcasting group comprised of top network affiliates, with over 200 owned or partner stations in 117 U.S. markets reaching 220 million people. Nexstar’s national television properties include The CW, America’s fifth

major broadcast network, NewsNation, America’s fastest-growing national cable news network, popular entertainment multicast networks Antenna TV and REWIND TV, and a 31.3% ownership stake in TV Food Network. The Company’s portfolio of

digital assets, including its local TV station websites, The Hill and NewsNationNow.com, are collectively a Top 10 U.S. digital news and information property. For more information, please visit nexstar.tv. Investor Contacts: Media Contact: Lee Ann

Gliha Gary Weitman EVP and Chief Financial Officer EVP and Chief Communications Officer Nexstar Media Group, Inc. Nexstar Media Group, Inc. 972/373-8800 972/373-8800 or

gweitman@nexstar.tv Joe Jaffoni, Jennifer Neuman JCIR 212/835-8500 or nxst@jcir.com

FIRST QUARTER 2024 EARNINGS RELEASE Nexstar Media Group, Inc. Condensed Consolidated Statements of Operations (in millions, except for

share and per share amounts, unaudited) Three Months Ended March 31, 2024 2023 Net revenue $1,284 $1,257 Operating expenses: Direct operating 548 538 Selling, general and administrative 216 218 Corporate 55 48 Depreciation and amortization 190

249 Total operating expenses 1,009 1,053 Income from operations 275 204 Income from equity method investments, net 19 25 Interest expense, net (114) (107) Pension and other postretirement plans credit, net 7 9 Gain on disposal of an investment

40—Other income (expenses), net 1 (1) Income before income taxes 228 130 Income tax expense (61) (42) Net income 167 88 Net loss attributable to noncontrolling interests 8 23 Net income attributable to Nexstar Media Group, Inc. $175 $111 Net

income per common share attributable to Nexstar Media Group, Inc.: Basic $5.25 $3.03 Diluted $5.16 $2.97 Weighted average number of common shares outstanding: Basic (in thousands) 33,449 36,718 Diluted (in thousands) 34,024 37,448

FIRST QUARTER 2024 EARNINGS RELEASE Nexstar Media Group, Inc. Reconciliation of Adjusted EBITDA and Adjusted Free Cash Flow (Non-GAAP Measure) ($ in millions, unaudited) Three Months Ended March 31, 2024 2023 Net income $167 $88 Add (Less): Transaction and other one-time expenses(1) 1 7

Stock-based compensation expense 18 14 Depreciation and amortization expense(2) 138 142 (Payments) for broadcast rights(2) (19) (27) Interest expense, net 114 107 Income from equity method investments, net (19) (25) Cash distributions from equity

method investments(3) 129 157 Pension and other postretirement plans (credit), net (7) (9) Income tax expense 61 42 Gain on disposal of an investment (40)—Other (1)—Adjusted EBITDA $542 $496 Add (Less): Cash interest expense, net (112)

(104) Capital expenditures (44) (36) Payments for capitalized software obligations (1) (2) Proceeds from disposal of assets and insurance recoveries 1 1 Operating cash income tax payments, net (2) (2) Cash contribution from noncontrolling interests

19 24 Adjusted Free Cash Flow $403 $377 (1) Primarily includes severance, legal and other direct expenses associated with our completed or proposed strategic transactions and/or acquisitions, any fees or other direct expenses associated with

financing transactions, and severance and other direct expenses associated with restructuring activities. (2) Depreciation and amortization expense excludes amounts related to amortization of broadcast rights for The CW (already deducted from

Net Income (loss)). Payments for broadcast rights also excludes amounts related to The CW. By using The CW’s reported amortization of broadcast rights in our definition of Adjusted EBITDA, we match timing of revenues with the expense of the

programming. (3) Distribution received from our investment in TV Food Network LLC during Q1 2023 excludes $69 million, the portion that is related to its accounts receivable securitization program. As our investee stops or reduces the

amount of accounts receivable it sells into the program and our distribution is reduced, we amortize that amount back into our Adjusted EBITDA and Adjusted Free Cash Flow. During Q1 2024, the amount related to the distribution received from TV Food

Network LLC includes $9 million of such amortization.

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

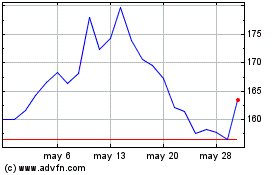

Nexstar Media (NASDAQ:NXST)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Nexstar Media (NASDAQ:NXST)

Gráfica de Acción Histórica

De May 2023 a May 2024