Form 424B5 - Prospectus [Rule 424(b)(5)]

13 Octubre 2023 - 4:18PM

Edgar (US Regulatory)

Filed pursuant to Rule 424(b)(5)

Registration No. 333-258646

Prospectus Supplement

(To the Prospectus dated August 19, 2021)

150,000 Shares of Preferred Stock

375,000 Warrants to purchase an aggregate

of 375,000 Shares of Common Stock

(and 750,000 Shares of Common Stock issuable

upon the conversion of such Preferred Stock and exercise of such Warrants)

___________________

This prospectus supplement updates, supersedes

and amends certain information contained in the prospectus dated August 19, 2021 (the “Base Prospectus”) as supplemented by

the prospectus supplements dated October 13, 2021, September 30, 2022 and May 1, 2023 (the “Prospectus Supplements,” and together

with the Base Prospectus, the “Prospectus”), relating to the registered direct offering of an aggregate of 150,000 shares

of our preferred stock, par value $0.01 per share, or the Preferred Stock, and warrants to purchase up to an aggregate amount of 375,000

shares of common stock (as adjusted for the company’s 20-for-1 reverse stock split effected in January 2023), par value $0.01 per

share, or the Common Stock, with a current exercise price of $0.7785 per share, or the Existing Warrants. The Existing Warrants have been

amended as described below under “Amendments to Existing Warrants.”

This prospectus supplement should be read in

conjunction with the Prospectus, and is qualified by reference to the Prospectus, except to the extent that the information presented

herein supersedes the information contained in the Prospectus. This prospectus supplement is not complete without, and may only be delivered

or used in connection with, the Prospectus, including any amendments or supplements thereto. We may amend or supplement the Prospectus

from time to time by filing amendments or supplements as required. You should read the entire Prospectus and any amendments or supplements

carefully before you make an investment decision.

Our common stock is listed on the NASDAQ Capital Market under

the symbol “OPGN.” On October 12, 2023, the last reported sale price of our common stock on the NASDAQ Capital Market

was $0.92 per share.

Investing in our securities involves a high

degree of risk. See “Risk Factors” in the Original Prospectus and documents incorporated therein by reference for a discussion

of such risk factors, which factors should be read carefully in connection with an investment in our securities.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus

supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

AMENDMENTS TO EXISTING WARRANTS

This Supplement is being filed to disclose the following:

On October 12, 2023, we entered into a warrant

inducement agreement (the “Warrant Inducement Agreement”) with an institutional investor that is the holder of the Existing

Warrants (the “Warrant Inducement Transaction”). Pursuant to the Warrant Inducement Transaction, the investor agreed to exercise

for cash warrants to purchase up to an aggregate of 10,892,728 shares of Common Stock (the “Inducement Warrants”), including

the Existing Warrants, at an exercise price of $0.7785 per share during the period from the date of the Warrant Inducement Agreement until

7:30 a.m., Eastern Time, on October 26, 2023, in exchange for the Company’s agreement to issue new warrants to purchase up to a

number of shares of common stock equal to 100% of the number of shares issued to the investor upon exercise of the Inducement Warrants

(the “New Warrants”). Accordingly, upon exercise of all of the Inducement Warrants, the investor will receive New Warrants

to purchase up to an aggregate of 10,892,728 shares of common stock.

As previously reported, the Existing Warrants

were not exercisable until the receipt of stockholder approval for the exercisability of the Existing Warrants. In order to permit the

exercise of such Existing Warrants pursuant to the rules of the NASDAQ Capital Market, the investor agreed to pay as additional consideration

$0.25 per share of common stock issued upon exercise of the Existing Warrants. The New Warrants will be immediately exercisable upon issuance

at an exercise price of $0.336 per share of Common Stock underlying such New Warrants and will expire on October 16, 2028.

___________________

Prospectus supplement dated October 12, 2023

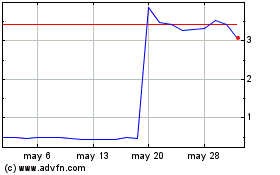

OpGen (NASDAQ:OPGN)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

OpGen (NASDAQ:OPGN)

Gráfica de Acción Histórica

De May 2023 a May 2024