O’Reilly Automotive, Inc. (the “Company” or “O’Reilly”)

(

Nasdaq: ORLY), a leading retailer in the

automotive aftermarket industry, today announced record revenue and

earnings for its third quarter ended September 30, 2024.

3rd

Quarter Financial ResultsBrad Beckham, O’Reilly’s

CEO, commented, “Our comparable store sales increased 1.5% in the

third quarter, as we faced broad-based consumer pressures and a

soft demand environment on both the professional and DIY sides of

our business. While our third quarter results were below our

expectations, we are pleased with our Team’s unwavering dedication

to our customers and their ability to still deliver positive

comparable store sales results in tough conditions, on top of the

robust 8.7% and 7.6% increases we generated in the third quarter

the last two years. We are also pleased to have generated another

strong quarter of sales growth in our professional business, where

we continue to gain market share. We remain very confident in the

strength of the long-term, core drivers of demand in our industry,

as well as our Team’s ability to outpace the market. I would like

to express my appreciation to our over 92,000 Team Members for

their unrelenting hard work and commitment to providing

industry-leading service to our customers.”

Sales for the third quarter ended

September 30, 2024, increased $161 million, or 4%, to

$4.36 billion from $4.20 billion for the same period one year ago.

Gross profit for the third quarter increased 4% to $2.25 billion

(or 51.6% of sales) from $2.16 billion (or 51.4% of sales) for the

same period one year ago. Selling, general and administrative

expenses (“SG&A”) for the third quarter increased 7% to $1.35

billion (or 31.0% of sales) from $1.26 billion (or 30.1% of sales)

for the same period one year ago. Operating income for the third

quarter was $897 million (or 20.5% of sales), which was flat

compared to $897 million (or 21.3% of sales) for the same period

one year ago.

Net income for the third quarter ended

September 30, 2024, increased $16 million, or 2%, to $665

million (or 15.2% of sales) from $650 million (or 15.5% of sales)

for the same period one year ago. Diluted earnings per common share

for the third quarter increased 6% to $11.41 on 58 million shares

versus $10.72 on 61 million shares for the same period one year

ago.

Year-to-Date Financial

ResultsMr. Beckham concluded, “We are tightening our

full-year comparable store sales guidance from a range of 2.0% to

4.0% to a range of 2.0% to 3.0%, to reflect our performance so far

this year and expectations for the remainder of 2024. We remain

very confident in Team O’Reilly and their ability to consistently

execute our proven dual market strategy and gain market share by

relentlessly focusing on providing the highest levels of service in

the industry, supported by best-in-class parts availability.”

Sales for the first nine months of 2024

increased $633 million, or 5%, to $12.61 billion from $11.98

billion for the same period one year ago. Gross profit for the

first nine months of 2024 increased 5% to $6.45 billion (or 51.2%

of sales) from $6.14 billion (or 51.2% of sales) for the same

period one year ago. SG&A for the first nine months of 2024

increased 7% to $3.94 billion (or 31.2% of sales) from $3.67

billion (or 30.6% of sales) for the same period one year ago.

Operating income for the first nine months of 2024 increased 2% to

$2.51 billion (or 19.9% of sales) from $2.47 billion (or 20.6% of

sales) for the same period one year ago.

Net income for the first nine months of 2024

increased $41 million, or 2%, to $1.84 billion (or 14.6% of sales)

from $1.79 billion (or 15.0% of sales) for the same period one year

ago. Diluted earnings per common share for the first nine months of

2024 increased 7% to $31.14 on 59 million shares versus $29.20 on

61 million shares for the same period one year ago.

3rd

Quarter Comparable Store Sales ResultsComparable

store sales are calculated based on the change in sales for U.S.

stores open at least one year and exclude sales of specialty

machinery, sales to independent parts stores, and sales to Team

Members, as well as sales from Leap Day in the nine months ended

September 30, 2024. Online sales for ship-to-home orders

and pick-up-in-store orders for U.S. stores open at least one year

are included in the comparable store sales calculation. Comparable

store sales increased 1.5% for the third quarter ended

September 30, 2024, on top of 8.7% for the same period

one year ago. Comparable store sales increased 2.4% for the nine

months ended September 30, 2024, on top of 9.4% for the

same period one year ago.

Share Repurchase ProgramDuring

the third quarter ended September 30, 2024, the Company

repurchased 0.5 million shares of its common stock, at an average

price per share of $1,084.28, for a total investment of $541

million. During the first nine months of 2024, the Company

repurchased 1.5 million shares of its common stock, at an average

price per share of $1,038.32, for a total investment of $1.60

billion. Excise tax on shares repurchased, assessed at one percent

of the fair market value of shares repurchased, was $16.0 million

for the nine months ended September 30, 2024. Subsequent

to the end of the third quarter and through the date of this

release, the Company repurchased an additional 0.1 million shares

of its common stock, at an average price per share of $1,170.55,

for a total investment of $70 million. The Company has repurchased

a total of 95.7 million shares of its common stock under its share

repurchase program since the inception of the program in January of

2011 and through the date of this release, at an average price of

$259.72, for a total aggregate investment of $24.85 billion. As of

the date of this release, the Company had approximately $898

million remaining under its current share repurchase

authorization.

Updated Full-Year 2024

GuidanceThe table below outlines the Company’s updated

guidance for selected full-year 2024 financial data:

|

|

|

For the Year Ending |

| |

|

December 31, 2024 |

| Net, new store openings |

|

190 to 200 |

| Comparable store sales |

|

2.0% to 3.0% |

| Total revenue |

|

$16.6 billion to $16.8 billion |

| Gross profit as

a percentage of sales |

|

51.0% to 51.5% |

| Operating income as

a percentage of sales |

|

19.4% to 19.9% |

| Effective income tax rate |

|

21.8% |

| Diluted earnings per share

(1) |

|

$40.60 to $41.10 |

| Net cash provided by operating

activities |

|

$2.7 billion to $3.1 billion |

| Capital expenditures |

|

$900 million to $1.0 billion |

| Free cash flow (2) |

|

$1.8 billion to $2.1 billion |

| |

|

|

(1) Weighted-average shares

outstanding, assuming dilution, used in the denominator of this

calculation, includes share repurchases made by the Company through

the date of this release.(2) Free cash flow is a

non-GAAP financial measure. The table below reconciles Free cash

flow guidance to Net cash provided by operating activities

guidance, the most directly comparable GAAP financial measure:

|

|

|

For the Year Ending |

| (in millions) |

|

December 31, 2024 |

| Net cash provided

by operating activities |

|

$ |

2,730 |

|

to |

|

$ |

3,140 |

|

Less: |

Capital expenditures |

|

|

900 |

|

to |

|

|

1,000 |

|

|

Excess tax benefit from

share-based compensation payments |

|

|

30 |

|

to |

|

|

40 |

| Free cash

flow |

|

$ |

1,800 |

|

to |

|

$ |

2,100 |

Non-GAAP InformationThis

release contains certain financial information not derived in

accordance with United States generally accepted accounting

principles (“GAAP”). These items include adjusted debt to earnings

before interest, taxes, depreciation, amortization, share-based

compensation, and rent (“EBITDAR”) and free cash flow. The Company

does not, nor does it suggest investors should, consider such

non-GAAP financial measures in isolation from, or as a substitute

for, GAAP financial information. The Company believes that the

presentation of adjusted debt to EBITDAR and free cash flow provide

meaningful supplemental information to both management and

investors that is indicative of the Company’s core operations. The

Company has included a reconciliation of this additional

information to the most comparable GAAP measure in the table above

and the selected financial information below.

Earnings Conference Call

InformationThe Company will host a conference call on

Thursday, October 24, 2024, at 10:00 a.m. Central Time to discuss

its results as well as future expectations. Investors may listen to

the conference call live on the Company’s website at

www.OReillyAuto.com by clicking on “Investor Relations” and then

“News Room.” Interested analysts are invited to join the call. The

dial-in number for the call is (888) 506-0062 and the conference

call identification number is 560004. A replay of the conference

call will be available on the Company’s website through Thursday,

October 23, 2025.

About O’Reilly Automotive,

Inc.O’Reilly Automotive, Inc. was founded in 1957 by the

O’Reilly family and is one of the largest specialty retailers of

automotive aftermarket parts, tools, supplies, equipment, and

accessories in the United States, serving both the do-it-yourself

and professional service provider markets. Visit the Company’s

website at www.OReillyAuto.com for additional information about

O’Reilly, including access to online shopping and current

promotions, store locations, hours and services, employment

opportunities, and other programs. As of

September 30, 2024, the Company operated 6,291 stores

across 48 U.S. states, Puerto Rico, Mexico, and Canada.

Forward-Looking StatementsThe

Company claims the protection of the safe-harbor for

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. You can identify these

statements by forward-looking words such as “estimate,” “may,”

“could,” “will,” “believe,” “expect,” “would,” “consider,”

“should,” “anticipate,” “project,” “plan,” “intend,” “guidance,”

“target,” or similar words. In addition, statements contained

within this press release that are not historical facts are

forward-looking statements, such as statements discussing, among

other things, expected growth, store development, integration and

expansion strategy, business strategies, future revenues, and

future performance. These forward-looking statements are based on

estimates, projections, beliefs, and assumptions and are not

guarantees of future events and results. Such statements are

subject to risks, uncertainties, and assumptions, including, but

not limited to, the economy in general; inflation; consumer debt

levels; product demand; a public health crisis; the market for auto

parts; competition; weather; tariffs; availability of key products

and supply chain disruptions; business interruptions, including

terrorist activities, war and the threat of war; failure to protect

our brand and reputation; challenges in international markets;

volatility of the market price of our common stock; our increased

debt levels; credit ratings on public debt; damage, failure, or

interruption of information technology systems, including

information security and cyber-attacks; historical growth rate

sustainability; our ability to hire and retain qualified employees;

risks associated with the performance of acquired businesses; and

governmental regulations. Actual results may materially differ from

anticipated results described or implied in these forward-looking

statements. Please refer to the “Risk Factors” section of the

annual report on Form 10-K for the year ended

December 31, 2023, and subsequent Securities and Exchange

Commission filings, for additional factors that could materially

affect the Company’s financial performance. Forward-looking

statements speak only as of the date they were made, and the

Company undertakes no obligation to publicly update any

forward-looking statements, whether as a result of new information,

future events, or otherwise, except as required by applicable

law.

|

|

|

|

For further information contact: |

Investor Relations Contacts |

|

|

Leslie Skorick (417) 874-7142 |

|

|

Eric Bird (417) 868-4259 |

|

|

|

|

|

Media Contact |

|

|

Sonya Cox (417) 829-5709 |

| |

|

O’REILLY AUTOMOTIVE, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE SHEETS(In

thousands, except share data) |

| |

|

|

|

|

|

|

|

|

|

| |

|

September 30, 2024 |

|

September 30, 2023 |

|

December 31, 2023 |

| |

|

(Unaudited) |

|

(Unaudited) |

|

(Note) |

| Assets |

|

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

115,613 |

|

|

$ |

82,664 |

|

|

$ |

279,132 |

|

|

Accounts receivable, net |

|

|

401,950 |

|

|

|

399,654 |

|

|

|

375,049 |

|

|

Amounts receivable from suppliers |

|

|

154,300 |

|

|

|

156,727 |

|

|

|

140,443 |

|

|

Inventory |

|

|

4,913,237 |

|

|

|

4,631,511 |

|

|

|

4,658,367 |

|

|

Other current assets |

|

|

113,187 |

|

|

|

107,156 |

|

|

|

105,311 |

|

|

Total current assets |

|

|

5,698,287 |

|

|

|

5,377,712 |

|

|

|

5,558,302 |

|

| |

|

|

|

|

|

|

|

|

|

| Property and equipment, at

cost |

|

|

8,969,137 |

|

|

|

8,136,342 |

|

|

|

8,312,367 |

|

| Less: accumulated depreciation

and amortization |

|

|

3,532,755 |

|

|

|

3,248,165 |

|

|

|

3,275,387 |

|

|

Net property and equipment |

|

|

5,436,382 |

|

|

|

4,888,177 |

|

|

|

5,036,980 |

|

| |

|

|

|

|

|

|

|

|

|

| Operating lease, right-of-use

assets |

|

|

2,269,929 |

|

|

|

2,213,884 |

|

|

|

2,200,554 |

|

| Goodwill |

|

|

997,226 |

|

|

|

895,399 |

|

|

|

897,696 |

|

| Other assets, net |

|

|

175,698 |

|

|

|

176,666 |

|

|

|

179,463 |

|

| Total assets |

|

$ |

14,577,522 |

|

|

$ |

13,551,838 |

|

|

$ |

13,872,995 |

|

| |

|

|

|

|

|

|

|

|

|

| Liabilities and

shareholders’ deficit |

|

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

6,359,619 |

|

|

$ |

6,199,816 |

|

|

$ |

6,091,700 |

|

|

Self-insurance reserves |

|

|

123,505 |

|

|

|

128,892 |

|

|

|

128,548 |

|

|

Accrued payroll |

|

|

141,361 |

|

|

|

124,040 |

|

|

|

138,122 |

|

|

Accrued benefits and withholdings |

|

|

201,351 |

|

|

|

170,550 |

|

|

|

174,650 |

|

|

Income taxes payable |

|

|

206,776 |

|

|

|

325,693 |

|

|

|

7,860 |

|

|

Current portion of operating lease liabilities |

|

|

408,571 |

|

|

|

385,942 |

|

|

|

389,536 |

|

|

Other current liabilities |

|

|

743,982 |

|

|

|

496,149 |

|

|

|

730,937 |

|

|

Total current liabilities |

|

|

8,185,165 |

|

|

|

7,831,082 |

|

|

|

7,661,353 |

|

| |

|

|

|

|

|

|

|

|

|

| Long-term debt |

|

|

5,359,810 |

|

|

|

5,102,350 |

|

|

|

5,570,125 |

|

| Operating lease liabilities,

less current portion |

|

|

1,938,162 |

|

|

|

1,895,991 |

|

|

|

1,881,344 |

|

| Deferred income taxes |

|

|

325,869 |

|

|

|

282,894 |

|

|

|

295,471 |

|

| Other liabilities |

|

|

207,580 |

|

|

|

199,990 |

|

|

|

203,980 |

|

| |

|

|

|

|

|

|

|

|

|

| Shareholders’ equity

(deficit): |

|

|

|

|

|

|

|

|

|

|

Common stock, $0.01 par value: |

|

|

|

|

|

|

|

|

|

|

Authorized shares – 245,000,000 |

|

|

|

|

|

|

|

|

|

|

Issued and outstanding shares – |

|

|

|

|

|

|

|

|

|

|

57,838,920 as of September 30, 2024, |

|

|

|

|

|

|

|

|

|

|

59,621,138 as of September 30, 2023, and |

|

|

|

|

|

|

|

|

|

|

59,072,792 as of December 31, 2023 |

|

|

578 |

|

|

|

596 |

|

|

|

591 |

|

|

Additional paid-in capital |

|

|

1,449,447 |

|

|

|

1,341,163 |

|

|

|

1,352,275 |

|

|

Retained deficit |

|

|

(2,875,955 |

) |

|

|

(3,132,517 |

) |

|

|

(3,131,532 |

) |

|

Accumulated other comprehensive (loss) income |

|

|

(13,134 |

) |

|

|

30,289 |

|

|

|

39,388 |

|

| Total shareholders’

deficit |

|

|

(1,439,064 |

) |

|

|

(1,760,469 |

) |

|

|

(1,739,278 |

) |

| |

|

|

|

|

|

|

|

|

|

| Total liabilities and

shareholders’ deficit |

|

$ |

14,577,522 |

|

|

$ |

13,551,838 |

|

|

$ |

13,872,995 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Note: The balance sheet at

December 31, 2023, has been derived from the audited

consolidated financial statements at that date but does not include

all of the information and footnotes required by United States

generally accepted accounting principles for complete financial

statements.

| |

|

O’REILLY AUTOMOTIVE, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

INCOME(Unaudited)(In thousands, except per share data) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended |

|

For the Nine Months Ended |

| |

|

September 30, |

|

September 30, |

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Sales |

|

$ |

4,364,437 |

|

|

$ |

4,203,380 |

|

|

$ |

12,612,878 |

|

|

$ |

11,980,235 |

|

| Cost of goods sold, including

warehouse and distribution expenses |

|

|

2,113,212 |

|

|

|

2,042,917 |

|

|

|

6,159,421 |

|

|

|

5,842,861 |

|

| Gross profit |

|

|

2,251,225 |

|

|

|

2,160,463 |

|

|

|

6,453,457 |

|

|

|

6,137,374 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and

administrative expenses |

|

|

1,354,497 |

|

|

|

1,263,241 |

|

|

|

3,940,950 |

|

|

|

3,669,734 |

|

| Operating income |

|

|

896,728 |

|

|

|

897,222 |

|

|

|

2,512,507 |

|

|

|

2,467,640 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(55,166 |

) |

|

|

(51,361 |

) |

|

|

(167,145 |

) |

|

|

(145,520 |

) |

|

Interest income |

|

|

2,055 |

|

|

|

1,292 |

|

|

|

5,239 |

|

|

|

2,920 |

|

|

Other, net |

|

|

4,304 |

|

|

|

(486 |

) |

|

|

9,266 |

|

|

|

8,179 |

|

|

Total other expense |

|

|

(48,807 |

) |

|

|

(50,555 |

) |

|

|

(152,640 |

) |

|

|

(134,421 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income

taxes |

|

|

847,921 |

|

|

|

846,667 |

|

|

|

2,359,867 |

|

|

|

2,333,219 |

|

| Provision for income

taxes |

|

|

182,457 |

|

|

|

196,840 |

|

|

|

524,317 |

|

|

|

539,142 |

|

| Net income |

|

$ |

665,464 |

|

|

$ |

649,827 |

|

|

$ |

1,835,550 |

|

|

$ |

1,794,077 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share-basic: |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share |

|

$ |

11.47 |

|

|

$ |

10.82 |

|

|

$ |

31.34 |

|

|

$ |

29.46 |

|

| Weighted-average common shares

outstanding – basic |

|

|

57,998 |

|

|

|

60,082 |

|

|

|

58,563 |

|

|

|

60,905 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share-assuming

dilution: |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share |

|

$ |

11.41 |

|

|

$ |

10.72 |

|

|

$ |

31.14 |

|

|

$ |

29.20 |

|

| Weighted-average common shares

outstanding – assuming dilution |

|

|

58,335 |

|

|

|

60,590 |

|

|

|

58,942 |

|

|

|

61,445 |

|

| |

|

O’REILLY AUTOMOTIVE, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS(Unaudited) (In thousands) |

| |

|

|

|

|

|

|

| |

|

For the Nine Months Ended |

| |

|

September 30, |

| |

|

2024 |

|

|

2023 |

|

| Operating

activities: |

|

|

|

|

|

|

|

Net income |

|

$ |

1,835,550 |

|

|

$ |

1,794,077 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

|

|

|

Depreciation and amortization of property, equipment and

intangibles |

|

|

339,324 |

|

|

|

296,583 |

|

|

Amortization of debt discount and issuance costs |

|

|

4,870 |

|

|

|

3,597 |

|

|

Deferred income taxes |

|

|

8,536 |

|

|

|

35,982 |

|

|

Share-based compensation programs |

|

|

21,600 |

|

|

|

21,948 |

|

|

Other |

|

|

5,928 |

|

|

|

3,574 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

Accounts receivable |

|

|

(9,175 |

) |

|

|

(58,658 |

) |

|

Inventory |

|

|

(212,491 |

) |

|

|

(263,896 |

) |

|

Accounts payable |

|

|

252,454 |

|

|

|

315,910 |

|

|

Income taxes payable |

|

|

198,780 |

|

|

|

353,366 |

|

|

Other |

|

|

(20,287 |

) |

|

|

15,172 |

|

|

Net cash provided by operating activities |

|

|

2,425,089 |

|

|

|

2,517,655 |

|

| |

|

|

|

|

|

|

| Investing

activities: |

|

|

|

|

|

|

| Purchases of property and

equipment |

|

|

(732,916 |

) |

|

|

(753,958 |

) |

| Proceeds from sale of property

and equipment |

|

|

10,268 |

|

|

|

10,461 |

|

| Investment in tax credit

equity investments |

|

|

— |

|

|

|

(4,150 |

) |

| Other, including acquisitions,

net of cash acquired |

|

|

(160,960 |

) |

|

|

(2,126 |

) |

|

Net cash used in investing activities |

|

|

(883,608 |

) |

|

|

(749,773 |

) |

| |

|

|

|

|

|

|

| Financing

activities: |

|

|

|

|

|

|

| Proceeds from borrowings on

revolving credit facility |

|

|

30,000 |

|

|

|

3,227,000 |

|

| Payments on revolving credit

facility |

|

|

(30,000 |

) |

|

|

(3,227,000 |

) |

| Net (payments) proceeds of

commercial paper |

|

|

(706,850 |

) |

|

|

1,025,075 |

|

| Proceeds from the issuance of

long-term debt |

|

|

498,910 |

|

|

|

— |

|

| Principal payments on

long-term debt |

|

|

— |

|

|

|

(300,000 |

) |

| Payment of debt issuance

costs |

|

|

(3,900 |

) |

|

|

(39 |

) |

| Repurchases of common

stock |

|

|

(1,604,509 |

) |

|

|

(2,590,980 |

) |

| Net proceeds from issuance of

common stock |

|

|

112,825 |

|

|

|

71,604 |

|

| Other |

|

|

(569 |

) |

|

|

(354 |

) |

|

Net cash used in financing activities |

|

|

(1,704,093 |

) |

|

|

(1,794,694 |

) |

| |

|

|

|

|

|

|

| Effect of exchange rate

changes on cash |

|

|

(907 |

) |

|

|

893 |

|

| Net decrease in cash and cash

equivalents |

|

|

(163,519 |

) |

|

|

(25,919 |

) |

| Cash and cash equivalents at

beginning of the period |

|

|

279,132 |

|

|

|

108,583 |

|

| Cash and cash equivalents at

end of the period |

|

$ |

115,613 |

|

|

$ |

82,664 |

|

| |

|

|

|

|

|

|

| Supplemental

disclosures of cash flow information: |

|

|

|

|

|

|

| Income taxes paid |

|

$ |

419,331 |

|

|

$ |

147,128 |

|

| Interest paid, net of

capitalized interest |

|

|

139,228 |

|

|

|

127,085 |

|

| |

|

O’REILLY AUTOMOTIVE, INC. AND SUBSIDIARIESSELECTED

FINANCIAL INFORMATION (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Twelve Months Ended |

|

|

|

September 30, |

| Adjusted

Debt to EBITDAR: |

|

2024 |

|

2023 |

| (In thousands,

except adjusted debt to EBITDAR ratio) |

|

|

|

|

|

|

|

|

| GAAP debt |

|

$ |

5,359,810 |

|

|

$ |

5,102,350 |

|

| Add: |

Letters of credit |

|

|

127,234 |

|

|

|

111,732 |

|

|

|

Unamortized discount and debt

issuance costs |

|

|

30,190 |

|

|

|

27,650 |

|

|

|

Six-times rent expense |

|

|

2,664,996 |

|

|

|

2,507,928 |

|

| Adjusted debt |

|

$ |

8,182,230 |

|

|

$ |

7,749,660 |

|

| |

|

|

|

|

|

|

|

|

| GAAP net

income |

|

$ |

2,388,054 |

|

|

$ |

2,322,649 |

|

| Add: |

Interest expense |

|

|

223,293 |

|

|

|

187,851 |

|

|

|

Provision for income

taxes |

|

|

643,344 |

|

|

|

656,817 |

|

|

|

Depreciation and

amortization |

|

|

451,802 |

|

|

|

396,468 |

|

|

|

Share-based compensation

expense |

|

|

27,163 |

|

|

|

29,493 |

|

|

|

Rent expense (i) |

|

|

444,166 |

|

|

|

417,988 |

|

| EBITDAR |

|

$ |

4,177,822 |

|

|

$ |

4,011,266 |

|

| |

|

|

|

|

|

|

|

|

| Adjusted debt to

EBITDAR |

|

|

1.96 |

|

|

|

1.93 |

|

| |

|

|

|

|

|

|

|

|

(i) The table below outlines the

calculation of Rent expense and reconciles Rent expense to Total

lease cost, per ASC 842, the most directly comparable GAAP

financial measure, for the twelve months ended

September 30, 2024 and 2023 (in thousands):

|

|

|

For the Twelve Months Ended |

|

|

|

September 30, |

|

|

|

2024 |

|

2023 |

| Total lease cost,

per ASC 842 |

|

$ |

530,689 |

|

|

$ |

495,360 |

|

|

Less: |

Variable non-contract operating lease components, related to

property taxes and insurance |

|

|

86,523 |

|

|

|

77,372 |

|

| Rent expense |

|

$ |

444,166 |

|

|

$ |

417,988 |

|

|

|

|

September 30, |

|

|

|

2024 |

|

2023 |

|

Selected Balance Sheet Ratios: |

|

|

|

|

|

|

|

|

|

Inventory turnover (1) |

|

|

1.7 |

|

|

1.7 |

|

Average inventory per store (in thousands) (2) |

|

$ |

781 |

|

$ |

758 |

|

Accounts payable to inventory (3) |

|

|

129.4 |

% |

|

|

133.9 |

% |

| |

|

|

For the Three Months Ended |

|

For the Nine Months Ended |

| |

|

|

September 30, |

|

September 30, |

| |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Reconciliation of Free Cash Flow (in

thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided

by operating activities |

|

$ |

772,015 |

|

|

$ |

866,286 |

|

|

$ |

2,425,089 |

|

|

$ |

2,517,655 |

|

|

Less: |

Capital expenditures |

|

|

258,309 |

|

|

|

293,016 |

|

|

|

732,916 |

|

|

|

753,958 |

|

|

|

Excess tax benefit from

share-based compensation payments |

|

|

13,666 |

|

|

|

8,862 |

|

|

|

35,044 |

|

|

|

27,852 |

|

|

|

Investment in tax credit

equity investments |

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

4,150 |

|

| Free cash

flow |

|

$ |

500,040 |

|

|

$ |

564,407 |

|

|

$ |

1,657,129 |

|

|

$ |

1,731,695 |

|

| |

|

For the Three Months Ended |

|

For the Nine Months Ended |

| |

|

September 30, |

|

September 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Revenue

Disaggregation (in thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales to

do-it-yourself customers |

$ |

2,215,640 |

|

|

$ |

2,206,511 |

|

|

$ |

6,366,670 |

|

|

$ |

6,254,980 |

|

|

Sales to professional service provider customers |

|

|

2,032,376 |

|

|

|

1,914,884 |

|

|

|

5,901,820 |

|

|

|

5,480,212 |

|

| Other sales, sales

adjustments, and sales from the acquired Vast Auto stores |

|

|

116,421 |

|

|

|

81,985 |

|

|

|

344,388 |

|

|

|

245,043 |

|

| Total sales |

|

$ |

4,364,437 |

|

|

$ |

4,203,380 |

|

|

$ |

12,612,878 |

|

|

$ |

11,980,235 |

|

| |

|

For the Three Months Ended |

|

For the Nine Months Ended |

|

For the Twelve Months Ended |

| |

|

September 30, |

|

September 30, |

|

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Store

Count: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Beginning domestic store

count |

|

6,152 |

|

|

6,027 |

|

|

6,095 |

|

|

5,929 |

|

|

6,063 |

|

|

5,910 |

|

| New stores opened |

|

35 |

|

|

36 |

|

|

92 |

|

|

136 |

|

|

125 |

|

|

156 |

|

| Stores closed |

|

— |

|

|

— |

|

|

— |

|

|

(2 |

) |

|

(1 |

) |

|

(3 |

) |

| Ending domestic store

count |

|

6,187 |

|

|

6,063 |

|

|

6,187 |

|

|

6,063 |

|

|

6,187 |

|

|

6,063 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Beginning Mexico store

count |

|

69 |

|

|

44 |

|

|

62 |

|

|

42 |

|

|

48 |

|

|

28 |

|

| New stores opened |

|

9 |

|

|

4 |

|

|

16 |

|

|

6 |

|

|

30 |

|

|

20 |

|

| Ending Mexico store count |

|

78 |

|

|

48 |

|

|

78 |

|

|

48 |

|

|

78 |

|

|

48 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Beginning Canada store

count |

|

23 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Stores acquired |

|

— |

|

|

— |

|

|

23 |

|

|

— |

|

|

23 |

|

|

— |

|

| New stores opened |

|

3 |

|

|

— |

|

|

3 |

|

|

— |

|

|

3 |

|

|

— |

|

| Ending Canada store count |

|

26 |

|

|

— |

|

|

26 |

|

|

— |

|

|

26 |

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total ending store count |

|

6,291 |

|

|

6,111 |

|

|

6,291 |

|

|

6,111 |

|

|

6,291 |

|

|

6,111 |

|

| |

|

For the Three Months Ended |

|

For the Twelve Months Ended |

| |

|

September 30, |

|

September 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Store and Team Member Information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total employment |

|

|

92,709 |

|

|

|

90,910 |

|

|

|

|

|

|

|

|

|

| Square footage (in thousands)

(4) |

|

|

47,949 |

|

|

|

46,258 |

|

|

|

|

|

|

|

|

|

| Sales per weighted-average

square foot (4)(5) |

|

$ |

89.17 |

|

|

$ |

89.99 |

|

|

$ |

340.84 |

|

|

$ |

339.76 |

|

| Sales per weighted-average

store (in thousands) (4)(6) |

|

$ |

689 |

|

|

$ |

683 |

|

|

$ |

2,620 |

|

|

$ |

2,564 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Calculated as cost of goods sold

for the last 12 months divided by average inventory. Average

inventory is calculated as the average of inventory for the

trailing four quarters used in determining the

denominator.(2) Calculated as inventory divided by

store count at the end of the reported period.(3)

Calculated as accounts payable divided by inventory.(4)

Represents O’Reilly’s U.S. and Puerto Rico operations

only.(5) Calculated as sales less jobber sales, divided

by weighted-average square footage. Weighted-average square footage

is determined by weighting store square footage based on the

approximate dates of store openings, acquisitions, expansions, or

closures.(6) Calculated as sales less jobber sales,

divided by weighted-average stores. Weighted-average stores is

determined by weighting stores based on their approximate dates of

openings, acquisitions, or closures.

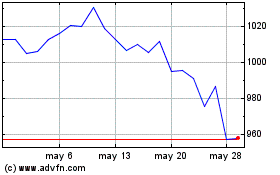

O Reilly Automotive (NASDAQ:ORLY)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

O Reilly Automotive (NASDAQ:ORLY)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024