Form 11-K - Annual report of employee stock purchase, savings and similar plans

10 Julio 2023 - 10:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 11-K

(Mark One):

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the fiscal year ended December 31, 2022

OR

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

|

For the transition period from ______________ to _______________

Commission file number 000-51338

| A. |

Full title of the plan and the address of the plan, if different from that of the issuer named below:

|

Parke Bank 401(k) Retirement Plan

| B. |

Name of the issuer of the securities held pursuant to the plan and the address of its principal executive

office: |

PARKE BANCORP, INC.

601 DELSEA DRIVE

WASHINGTON TOWNSHIP, NEW JERSEY 08080

REQUIRED INFORMATION

The Parke Bank 401(k) Retirement Plan is subject to the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). In

accordance with Item 4 of the Form 11-K and in lieu of the requirements of Items 1-3, the Plan’s Annual Report of Small Employee Benefit Plan on Form 5500-SF for 2022 is being filed herewith as Exhibit 99.1. Certain personally-identifiable information has been redacted from the Form 5500.

SIGNATURES

The Plan. Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the

employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

PARKE BANK 401(k) RETIREMENT PLAN |

|

|

|

|

| Date: July 10, 2023 |

|

|

|

By: |

|

/s/ John S. Kaufman |

|

|

|

|

|

|

John S. Kaufman |

|

|

|

|

|

|

Plan Administrator |

EXHIBIT 99.1

2022 Form 5500-SF

|

|

|

|

|

|

|

|

|

| Form 5500-SF |

|

|

|

Short

Form Annual Return/Report of Small Employee Benefit Plan This

form is required to be filed under sections 104 and 4065 of the Employee Retirement Income Security Act of 1974 (ERISA), and sections

6057(b) and 6058(a) of the Internal Revenue Code (the Code).

u Complete all entries in accordance with the instructions to the Form 5500-SF. |

|

|

|

OMB Nos. 1210-0110

1210-0089 |

| Department of the Treasury Internal Revenue Service

|

|

|

|

|

|

2022 |

| Department of Labor

Employee Benefits Security Administration |

|

|

|

|

|

This Form is Open to

Public Inspection |

| Pension Benefit Guaranty Corporation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Part I |

|

Annual Report Identification Information |

|

|

|

|

|

|

|

|

|

|

|

| For calendar plan year 2022 or fiscal plan year

beginning |

|

|

|

01/01/2022 |

|

and ending |

|

12/31/2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| A This return/report is for: |

|

☒ |

|

a single-employer plan |

|

☐ |

|

a multiple-employer plan (not multiemployer) (Filers checking this box must attach a list of participating employer information in accordance with the form instructions.) |

|

|

|

|

|

|

|

| B This return/report is |

|

☐ |

|

the first return/report |

|

☐ |

|

the final return/report |

|

|

|

|

|

|

☐ |

|

an amended return/report |

|

☐ |

|

a short plan year return/report (less than 12 months) |

| C Check box if filing under: |

|

☒ |

|

Form 5558 |

|

☐ |

|

automatic extension |

|

☐ |

|

DFVC program |

|

|

☐ |

|

special extension (enter description) |

|

|

|

|

| D If this is a retroactively adopted plan permitted by SECURE Act section 201, check

here. u |

|

☐ |

|

|

|

|

|

| Part II |

|

Basic Plan Information—enter all requested information |

|

|

|

|

|

|

|

|

|

| 1a |

|

Name of plan PARKE BANK 401 (K)

RETIREMENT PLAN |

|

1b |

|

Three-digit

plan number (PN) u |

|

001 |

|

|

|

|

1c |

|

Effective date of plan |

| |

|

|

|

|

|

01/01/2008 |

| 2a |

|

Plan sponsor’s name (employer, if for a single-employer plan)

Mailing address (include room, apt., suite no. and street, or P.O. Box)

City or town, state or province, country, and ZIP or foreign postal code (if foreign, see instructions)

PARKE BANK

601 DELSEA DRIVE

SEWELL

NJ

08080-9325 |

|

2b |

|

Employer Identification Number |

|

|

|

|

(EIN)22-3621091 |

|

|

2c |

|

Sponsor’s telephone number |

|

|

|

|

856-256-2503 |

|

|

2d |

|

Business code (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

522110 |

|

|

| 3a |

|

Plan administrator’s name and address ☒ Same as Plan Sponsor |

|

3b |

|

Administrator’s EIN

|

|

|

|

|

3c |

|

Administrator’s telephone number |

| 4 |

|

If the name and/or EIN of the plan sponsor or the plan name has changed since the last return/report filed for this plan, enter the plan sponsor’s name, EIN, the plan name and the plan

number from the last return/report. |

|

4b |

|

EIN |

| a |

|

Sponsor’s name |

|

4d |

|

PN |

|

|

| c |

|

Plan Name |

|

|

|

|

|

|

| 5a |

|

Total number of participants at the beginning of the plan year |

|

5a |

|

|

|

106 |

| b |

|

Total number of participants at the end of the plan year |

|

5b |

|

|

|

108 |

| c |

|

Number of participants with account balances as of the end of the plan year (only defined contribution plans complete this item) |

|

5c |

|

|

|

108 |

| d(1) |

|

Total number of active participants at the beginning of the plan year |

|

5d(1) |

|

|

|

102 |

| d(2) |

|

Total number of active participants at the end of the plan year |

|

5d(2) |

|

|

|

87 |

| e |

|

Number of participants who terminated employment during the plan year with accrued benefits that were less than 100% vested |

|

5e |

|

|

|

00 |

| Caution: A penalty for the late or incomplete filing of this

return/report will be assessed unless reasonable cause is established. |

| Under penalties of perjury and other penalties set forth in the instructions, I declare that I have

examined this return/report, including, if applicable, a Schedule SB or Schedule MB completed and signed by an enrolled actuary, as well as the electronic version of this return/report, and to the best of my knowledge and belief, it is true,

correct, and complete. |

|

|

|

|

|

|

|

| SIGN

HERE |

|

|

|

06/29/2023 |

|

Plan Sponsor |

| |

Signature of plan administrator |

|

Date |

|

Enter name of individual signing as plan administrator |

| SIGN

HERE |

|

|

|

|

|

|

| |

Signature of employer/plan sponsor |

|

Date |

|

Enter name of individual signing as employer or plan

sponsor |

|

|

|

|

|

|

|

| For Paperwork Reduction Act Notice, see the Instructions for Form 5500-SF. |

|

|

|

Form 5500-SF (2022) |

|

|

|

|

|

|

v.220413 |

|

|

|

|

|

| Form 5500-SF (2022) |

|

Page 2 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| 6a Were all of the plan’s assets

during the plan year invested in eligible assets? (See instructions.) |

|

☒ Yes |

|

☐ No |

|

|

|

| b Are you claiming a waiver

of the annual examination and report of an independent qualified public accountant (IQPA) under 29 CFR 2520.104-46? (See instructions on waiver eligibility and conditions.) |

|

☒ Yes |

|

☐ No |

|

|

|

| If you answered “No” to either line 6a or line 6b, the plan cannot use

Form 5500-SF and must instead use Form 5500. |

|

|

|

|

|

|

| c If the plan is a defined benefit plan, is

it covered under the PBGC insurance program (see ERISA section 4021)? ☐ Yes ☐ No |

|

☐ Not determined |

|

| If “Yes” is checked, enter the My PAA confirmation number from the PBGC premium filing for this plan

year________________. (See instructions.) |

| |

|

|

|

| Part III |

|

Financial Information |

|

|

|

|

|

|

|

| |

|

|

|

|

7 Plan Assets and Liabilities |

|

|

|

(a) Beginning of Year |

|

(b) End of Year |

| |

|

|

|

|

a Total plan assets |

|

7a |

|

9,001,763 |

|

8,205,453 |

| |

|

|

|

|

b Total plan liabilities |

|

7b |

|

0 |

|

0 |

| |

|

|

|

|

c Net plan assets (subtract line 7b from line 7a) |

|

7c |

|

9,001,763 |

|

8,205,453 |

| |

|

|

|

|

8 Income, Expenses, and Transfers for this Plan Year |

|

|

|

(a) Amount |

|

(b) Total |

| |

|

|

|

|

a Contributions received or receivable from: |

|

|

|

|

|

|

| |

|

|

|

|

(1) Employers |

|

8a(1) |

|

237,730 |

|

|

| |

|

|

|

|

(2) Participants |

|

8a(2) |

|

487,053 |

|

|

| |

|

|

|

|

(3) Others (including rollovers) |

|

8a(3) |

|

1,457 |

|

|

| |

|

|

|

|

b Other income (loss) |

|

8b |

|

-1,046,332 |

|

|

| |

|

|

|

|

c Total income (add lines 8a(1), 8a(2), 8a(3), and 8b) |

|

8c |

|

|

|

-320,092 |

| |

|

|

|

|

d Benefits paid (including direct rollovers and insurance premiums to provide

benefits) |

|

8d |

|

475,040 |

|

|

| |

|

|

|

|

e Certain deemed and/or corrective distributions (see instructions) |

|

8e |

|

0 |

|

|

| |

|

|

|

|

f Administrative service providers (salaries, fees, commissions) |

|

8f |

|

1,178 |

|

|

| |

|

|

|

|

g Other expenses |

|

8g |

|

0 |

|

|

| |

|

|

|

|

h Total expenses (add lines 8d, 8e, 8f, and 8g) |

|

8h |

|

|

|

476,218 |

| |

|

|

|

|

i Net income (loss) (subtract line 8h from line 8c) |

|

8i |

|

|

|

-796,310 |

| |

|

|

|

|

j Transfers to (from) the plan (see instructions) |

|

8j |

|

0 |

|

|

|

|

|

|

Part IV |

|

Plan Characteristics |

|

|

|

| 9a |

|

If the plan provides pension benefits, enter the applicable pension feature

codes from the List of Plan Characteristic Codes in the instructions:

2E 2F 2G 2J 2K 2S 2T 3D |

| |

|

| b |

|

If the plan provides welfare benefits, enter the applicable welfare feature codes from the List of Plan Characteristic Codes in the instructions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Part V |

|

Compliance

Questions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 During the plan year: |

|

|

|

|

|

|

Yes |

|

|

|

No |

|

|

Amount |

|

|

|

|

|

| a Was

there a failure to transmit to the plan any participant contributions within the time period described in 29 CFR 2510.3-102? (See instructions and DOL’s Voluntary Fiduciary Correction Program) |

|

|

10a |

|

|

|

|

|

|

|

X |

|

|

|

|

|

|

|

|

|

b Were there any nonexempt transactions with any party-in-interest? (Do not include transactions reported on line 10a.) |

|

|

10b |

|

|

|

|

|

|

|

X |

|

|

|

|

|

|

|

|

|

c Was the plan covered by a fidelity bond? |

|

|

10c |

|

|

|

X |

|

|

|

|

|

|

5,000,000 |

|

|

|

|

|

| d Did

the plan have a loss, whether or not reimbursed by the plan’s fidelity bond, that was caused by fraud or dishonesty? |

|

|

10d |

|

|

|

|

|

|

|

X |

|

|

|

|

|

|

|

|

|

e Were any fees or commissions paid to any brokers, agents, or other persons by an

insurance carrier, insurance service, or other organization that provides some or all of the benefits under the plan? (See instructions.) |

|

|

10e |

|

|

|

X |

|

|

|

|

|

|

22,644 |

|

|

|

|

|

|

f Has the plan failed to provide any benefit when due under the plan? |

|

|

10f |

|

|

|

|

|

|

|

X |

|

|

|

|

|

|

|

|

| g Did

the plan have any participant loans? (If “Yes,” enter amount as of year-end.) |

|

|

10g |

|

|

|

X |

|

|

|

|

|

|

42,898 |

|

|

|

|

|

| h If

this is an individual account plan, was there a blackout period? (See instructions and 29 CFR 2520.101-3.) |

|

|

10h |

|

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

| i If 10h was

answered “Yes,” check the box if you either provided the required notice or one of the exceptions to providing the notice applied under 29 CFR 2520.101-3 |

|

|

10i |

|

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Form 5500-SF (2022) |

|

|

|

Page 3-

|

|

|

|

|

|

|

|

|

|

| Part VI |

|

Pension Funding Compliance |

|

|

|

|

|

|

|

|

|

|

|

| 11 |

|

Is this a defined benefit plan

subject to minimum funding requirements? (If “Yes,” see instructions and complete Schedule SB (Form 5500) and lines 11a and b below.) If this is a defined contribution pension plan, leave line 11 blank and complete line

12 below |

|

☐ Yes ☒ No |

|

|

|

|

|

|

|

|

|

| a |

|

Enter the unpaid minimum required contributions for all years from Schedule SB (Form 5500) line 40 |

|

11a |

|

|

| b |

PBGC missed contribution reporting requirements. If the plan is covered by PBGC and the amount reported

on line 11a is greater than $0, has PBGC been notified as required by ERISA sections 4043(c)(5) and/or 303(k)(4)? Check the applicable box: |

| ☐ |

No. Reporting was waived under 29 CFR 4043.25(c)(2) because contributions equal to or exceeding the unpaid

minimum required contribution were made by the 30th day after the due date. |

| ☐ |

No. The 30-day period referenced in 29 CFR 4043.25(c)(2) has not yet

ended, and the sponsor intends to make a contribution equal to or exceeding the unpaid minimum required contribution by the 30th day after the due date. |

| ☐ |

No. Other. Provide explanation

____________________________________________________________________________________________________ |

|

|

|

|

|

| 12 |

|

Is this a defined contribution plan subject to the minimum funding requirements of section 412 of the Code or section 302 of ERISA? |

|

☐ Yes ☒ No |

| |

|

(If “Yes,” complete line 12a or lines 12b, 12c, 12d, and 12e below, as applicable.) If this is a defined benefit pension plan, leave line 12 blank and complete line 11

above |

| a |

|

If a waiver of the minimum funding standard for a prior year is being amortized in this

plan year, see instructions, and enter the date of the letter ruling granting the waiver Month_____ Day _____ Year ____

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| If you completed line 12a, complete lines 3, 9, and 10 of Schedule MB (Form 5500), and skip to line 13. |

| b |

|

Enter the minimum required contribution for this plan year |

|

12b |

|

|

| c |

|

Enter the amount contributed by the employer to the plan for this plan year |

|

12c |

|

|

| d |

|

Subtract the amount in line 12c from the amount in line 12b. Enter the result (enter a minus sign to the left of a negative amount) |

|

12d |

|

|

| e |

|

Will the minimum funding amount reported on line 12d be met by the funding deadline? |

|

☐ Yes ☐ No ☐

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Part VII |

|

Plan Terminations and Transfers of Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 13a |

|

Has a resolution to terminate the plan been adopted in any plan year? |

|

☐ Yes ☒ No |

| |

|

If “Yes,” enter the amount of any plan assets that reverted to the employer this year |

|

13a |

|

|

| b |

|

Were all the plan assets distributed to participants or beneficiaries, transferred to another plan, or brought under the control of the PBGC? |

|

☐ Yes ☒ No |

| c |

|

If, during this plan year, any assets or liabilities were transferred from this plan to another plan(s), identify the plan(s) to which assets or liabilities were transferred.

(See instructions.) |

|

|

|

|

|

| 13c(1) Name of plan(s): |

|

13c(2) EIN(s) |

|

13c(3) PN(s) |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Form 5558 |

|

Application for Extension of Time |

|

OMB No. 1545-0212 |

| (Rev. September 2018) |

|

To File Certain Employee Plan Returns |

| |

|

|

|

|

|

Department of the Treasury Internal

Revenue Service |

|

u For Privacy Act and Paperwork Reduction Act Notice, see instructions.

u

Go to www.irs.gov/Form5558 for the latest information. |

|

File With IRS Only |

Part I Identification

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| A |

|

Name of filer, plan administrator, or plan sponsor (see instructions) |

|

B |

|

Filer’s identifying number (see instructions) |

|

|

PARKE BANK |

|

|

|

Employer identification number (EIN) (9 digits XX-XXXXXXX) |

|

|

Number, street, and room or suite no. (If a P.O. box, see instructions) |

|

|

|

|

|

|

|

22-3621091 |

|

|

|

|

|

|

601 DELSEA DRIVE |

|

|

|

Social security number (SSN) (9 digits XXX-XX-XXXX) |

|

|

City or town, state, and ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

SEWELL, NJ 08080-9325 |

|

|

|

|

|

|

|

|

|

|

|

|

| C |

|

Plan name |

|

Plan |

|

Plan year ending— |

|

|

|

|

number |

|

MM |

|

DD |

|

YYYY |

|

|

|

|

|

|

|

|

| |

|

PARKE BANK 401(K) RETIREMENT PLAN |

|

0 |

|

0 |

|

1 |

|

12 |

|

31 |

|

2022 |

Part II Extension of Time To File Form 5500 Series, and/or Form 8955-SSA

|

|

|

| 1 |

|

☐ Check this box if you are requesting an extension of time on line 2

to file the first Form 5500 series return/report for the plan listed in Part I, C above. |

|

|

| 2 |

|

I request an extension of time until 10/16/2023 to file Form 5500 series. See instructions. |

|

|

Note: A signature IS NOT required if you are requesting an extension to file Form 5500 series. |

|

|

| 3 |

|

I request an extension of time until 10/16/2023to file Form 8955-SSA. See instructions. |

|

|

Note: A signature IS NOT required if you are requesting an extension to file Form 8955-SSA. |

|

|

|

|

The application is automatically approved to the date shown on line 2 and/or line 3 (above) if (a) the Form 5558 is filed on or before the normal due date of Form 5500 series, and/or Form 8955-SSA for which this extension is requested; and (b) the date on line 2 and/or line 3 (above) is not later than the 15th day of the 3rd month after the normal due

date. |

Part III Extension of Time To File Form 5330 (see instructions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 4 |

|

I request an extension of time until /

/ to file Form 5330. |

|

|

|

|

|

|

|

|

|

|

|

|

You may be approved for up to a 6-month extension to file Form 5330, after the normal due date of Form 5330. |

|

|

|

|

|

|

|

|

|

| a |

|

Enter the Code section(s) imposing the tax |

|

u |

|

a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| b |

|

Enter the payment amount attached |

|

u |

|

b |

|

|

|

|

|

|

|

|

| c |

|

For excise taxes under section 4980 or 4980F of the Code, enter the reversion/amendment date |

|

|

|

u |

|

c |

|

|

| 5 |

|

State in detail why you need the extension: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Under penalties of perjury, I declare that to the best of my knowledge and belief, the statements made on this form are true, correct, and complete, and that I am authorized to

prepare this application. |

|

|

|

| Signature u |

|

Date u |

|

|

| |

|

Cat. No. 12005T |

|

Form 5558 (Rev. 9-2018) |

|

|

|

|

|

| 1019

Form 8955-SSA

Department of the Treasury

Internal Revenue Service |

|

Annual Registration Statement

Identifying Separated Participants With Deferred Vested Benefits

This form is required to be filed under section 6057 of

the Internal Revenue Code. Go to www.irs.gov/Form8955SSA for instructions and the latest

information. |

|

OMB No. 1545-2187 |

| |

This Form Is NOT Open

to Public Inspection |

|

|

|

|

|

|

|

|

|

| PART I Annual Statement Identification Information

|

|

|

| For the plan year beginning 01/01/2022

, and ending 12/31/2022 |

| A |

|

☐ |

|

Check here if plan is a government, church, or other plan that elects to voluntarily file Form 8955-SSA. (See instructions.) |

| B |

|

☐ |

|

Check here if this is an amended registration statement. |

| C |

|

|

|

Check the appropriate box if filing under: |

|

☒ Form 5558 |

|

☐ Automatic extension |

|

|

|

|

|

|

☐ Special extension (enter description)

|

|

|

|

| |

|

| PART II |

|

Basic Plan Information - enter all requested

information |

|

|

|

|

|

|

|

|

|

| 1a Name of plan PARKE BANK 401(K) RETIREMENT PLAN |

|

|

|

|

|

|

|

1b Plan Number (PN)

001 |

| Plan Sponsor Information |

|

|

|

|

|

|

|

|

|

|

|

|

| 2a Plan sponsor’s name

PARKE BANK |

|

|

|

|

|

2b Employer Identification Number (EIN)

22-3621091 |

|

|

|

|

| 2c Trade name (if different from plan sponsor name) |

|

|

|

|

|

2d Plan sponsor’s phone number

856-256-2503 |

| 2e In care of name |

|

|

|

|

|

|

|

|

| 2f Mailing address (room, apt., suite no. and street, or P.O. box)

601 DELSEA DRIVE |

|

|

|

2g City

SEWELL |

|

2h State

NJ |

|

2i ZIP code

08080-9325 |

| 2j Foreign province (or state) |

|

2k Foreign country |

|

2l Foreign postal code |

|

|

|

|

|

| Plan Administrator Information |

|

|

|

|

|

|

|

|

| 3a Plan administrator’s name (if other than plan sponsor)

PARKE BANK |

|

|

|

|

|

3b Employer Identification Number (EIN) 22-3621091 |

|

|

|

|

| 3c In care of name |

|

|

|

|

|

3d Plan administrator’s phone number

856-256-2503 |

|

|

|

|

|

| 3e Mailing address (room, apt., suite no. and street, or P.O. box) |

|

|

|

3f City |

|

3g State |

|

3h ZIP code |

| 601 DELSEA DRIVE |

|

|

|

SEWELL |

|

NJ |

|

08080-9325 |

|

|

|

| 3i Foreign province (or state) |

|

3j Foreign country |

|

3k Foreign postal code |

|

| 4 If the name or EIN of the plan administrator has changed since the last return filed for this plan, enter the name and EIN from the last filed return: |

| Plan administrator’s name |

|

|

|

|

|

EIN |

|

|

|

| 5 If the name or EIN of the plan sponsor has changed since the last

return filed for this plan, enter the name, EIN, and plan number from that return: |

|

|

|

|

|

|

|

|

|

| Plan sponsor’s name |

|

|

|

|

|

EIN |

|

Plan Number (PN) |

|

|

|

|

|

|

|

| 6a |

|

Participants who separated with a deferred vested benefit required to be reported on this Form 8955-SSA |

|

6a |

|

2 |

| b |

|

Participants who separated with a deferred vested benefit voluntarily reported on this Form 8955-SSA in the same year as the separation occurred |

|

6b |

|

0 |

| 7 |

|

Total number of participants reported on lines 6a and 6b |

|

7 |

|

2 |

| 8 |

|

Did the plan administrator provide an individual statement to each participant required to receive a statement? |

|

☒ Yes |

|

☐ No |

|

|

Under penalties of perjury, I declare that I have examined this statement, and to the best of my knowledge and belief, it is true, correct, and

complete. |

|

|

|

|

|

|

|

|

|

| Sign

Here |

|

Signature of plan sponsor |

|

Date signed |

|

Signature of plan administrator |

|

Date signed |

Page 1 of 2

|

|

|

|

|

| For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. |

|

Cat. No. 52729U Form 8955-SSA (2022) |

|

|

|

|

|

|

|

|

|

| 1019 |

|

|

|

|

|

|

|

|

| Form 8955-SSA (2022) |

|

Page 2 of 2 |

|

|

Page 2.1 |

|

| Name of plan PARKE BANK 401(K) RETIREMENT PLAN |

|

Plan Number |

|

EIN |

|

|

|

|

| |

001 |

|

22-3621091 |

|

|

|

|

| PART III Participant Information - enter all requested information |

|

|

|

|

|

|

|

|

|

| 9 Enter one of the following Entry Codes in column (a) for each separated participant with deferred vested benefits who: |

| Code A — has not previously been reported. |

| Code B — has previously been reported under the above plan number, but whose previously reported information requires revisions. |

| Code C — has previously been reported under another plan, but who will be receiving benefits from the plan listed above instead. |

| Code D — has previously been reported under the above plan number, but whose benefits have been paid out

or who is no longer entitled to those deferred vested benefits. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Use with entry code “A”, “B”, “C”, or “D” |

|

Use with entry code “A” or “B” |

|

Entry code “C” only |

| (a)

Entry Code |

|

(b)

Full Social

Security Number

(or “FOREIGN”) |

|

(c) Name of Participant (See instructions.) |

|

Enter code for nature and form of benefit |

|

Amount of vested benefit |

|

(h)

Previous sponsor’s

EIN |

|

(i)

Previous plan

number |

| |

First name |

|

M.I. |

|

Last name |

|

✓ |

|

(d) Type of

annuity |

|

(e) Payment

frequency |

|

(f) Defined

benefit plan —

periodic payment |

|

(g) Defined contribution |

| |

plan — total value |

| |

of account |

| A |

|

XXX-XX-XXXX |

|

XXXX |

|

F |

|

XXXXXX |

|

X |

|

A |

|

A |

|

|

|

226,175 |

|

|

|

|

| A |

|

XXX-XX-XXXX |

|

XXXXX |

|

B |

|

XXXXXX |

|

X |

|

A |

|

A |

|

|

|

2,3567 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 8955-SSA (2022)

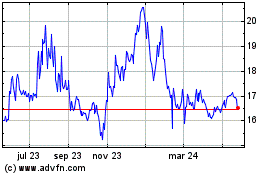

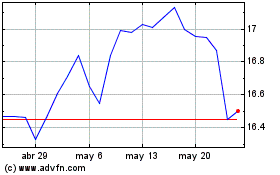

Parke Bancorp (NASDAQ:PKBK)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Parke Bancorp (NASDAQ:PKBK)

Gráfica de Acción Histórica

De May 2023 a May 2024