false

0000798287

0000798287

2024-10-31

2024-10-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities

Exchange Act of 1934

Date of report (Date of earliest event

reported): October

31, 2024

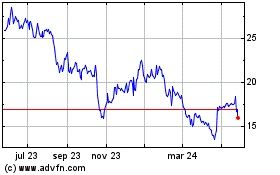

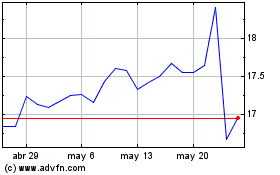

PAM TRANSPORTATION SERVICES, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

0-15057 |

|

71-0633135 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

297 West Henri De Tonti, Tontitown, Arkansas

72770

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including

area code: (479) 361-9111

| |

N/A |

|

| |

(Former name or former address, if changed since last report) |

|

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13c-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $.01 par value |

PTSI |

NASDAQ Global Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers. |

At the 2024 Annual Meeting of Shareholders of

P.A.M. Transportation Services, Inc. (the “Company”), held on October 31, 2024 (the “Annual Meeting”), the Company’s

shareholders approved the P.A.M. Transportation Services, Inc. 2024 Equity Incentive Plan (the “Plan”). Under the Plan, the

Company may grant future awards of stock options, restricted shares, stock appreciation rights, restricted stock units, performance shares,

performance units and unrestricted shares to the Company’s employees, officers, directors, consultants or advisors. The Plan includes

a reserve of 1,600,000 shares authorized for issuance under the plan, subject to adjustment in connection with changes in capitalization

and reorganization and change in control events. A description of the material terms of the Plan is contained under the heading “Proposal

Two – Approval of the Company’s 2024 Equity Incentive Plan” in the Company’s definitive proxy statement for the

2024 Annual Meeting of Shareholders filed with the Securities and Exchange Commission on September 20, 2024. A copy of the Plan is filed

as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

| Item 5.07 | Submission of Matters to a Vote of Security Holders. |

At the Annual Meeting, nine directors were elected

to serve as the Board of Directors until the next Annual Meeting of Shareholders, the P.A.M. Transportation Services, Inc. 2024 Equity

Incentive Plan was approved, the redomestication of the Company to the state of Nevada by conversion was approved, the increase in authorized

shares of the Company’s common stock was approved and the appointment of Grant Thornton LLP as the Company’s independent registered

public accounting firm for the calendar year 2024 was ratified by the Company’s shareholders. Final vote tabulations are indicated

below:

| (1) | Election of nine director nominees to serve until the date of the next Annual Meeting of Shareholders: |

| |

Votes For |

|

Votes Withheld |

|

Broker Non-Votes |

| Michael D. Bishop |

19,850,666 |

|

656,637 |

|

697,702 |

| Frederick P. Calderone |

17,470,406 |

|

3,036,897 |

|

697,702 |

| W. Scott Davis |

19,655,166 |

|

852,137 |

|

697,702 |

| Edwin J. Lukas |

17,500,890 |

|

3,006,413 |

|

697,702 |

| Franklin H. McLarty |

19,850,243 |

|

657,060 |

|

697,702 |

| H. Pete Montaño |

19,837,363 |

|

669,940 |

|

697,702 |

| Matthew J. Moroun |

17,447,827 |

|

3,059,476 |

|

697,702 |

| Matthew T. Moroun |

16,805,774 |

|

3,701,529 |

|

697,702 |

| Joseph A. Vitiritto |

16,919,579 |

|

3,587,724 |

|

697,702 |

| (2) | Proposal to approve the P.A.M. Transportation Services, Inc. 2024 Equity Incentive Plan: |

| Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

| 20,349,766 |

|

156,503 |

|

1,034 |

|

697,702 |

| |

|

|

|

|

|

|

| (3) | Proposal to approve the redomestication of the Company to the State of Nevada by Conversion: |

| Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

| 16,603,272 |

|

3,903,227 |

|

804 |

|

697,702 |

| |

|

|

|

|

|

|

| (4) | Proposal to approve the increase in authorized shares of the Company’s common stock: |

| Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

| 17,048,501 |

|

3,457,832 |

|

970 |

|

697,702 |

| |

|

|

|

|

|

|

| (5) | Proposal to ratify Grant Thornton LLP as the Company’s independent registered public accounting

firm for 2024: |

| Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

| 21,091,428 |

|

113,458 |

|

119 |

|

0 |

| |

|

|

|

|

|

|

No additional business or other matters came before

the meeting or any adjournment thereof.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

P.A.M. TRANSPORTATION SERVICES, INC. |

| |

|

(Registrant) |

| |

|

|

| Date: November

5, 2024 |

By: |

/s/ Lance

K. Stewart |

| |

|

Lance K. Stewart

Vice President of Finance, Chief

Financial Officer, and Treasurer |

Exhibit 10.1

P.A.M. TRANSPORTATION SERVICES,

INC.

2024 EQUITY INCENTIVE PLAN

| 1. | Purposes of the Plan. The purposes of this Plan are (a) to attract and retain

the best available personnel to ensure the Company’s success and accomplish the Company’s goals; (b) to incentivize Employees,

Directors and Consultants with long-term equity-based compensation to align their interests with the Company’s shareholders, and

(c) to promote the success of the Company’s business. The Plan permits the grant of Incentive Stock Options, Nonstatutory Stock

Options, Restricted Stock, Restricted Stock Units, Stock Appreciation Rights, Performance Units, Performance Shares and unrestricted Common

Stock. |

| 2. | Definitions. As used herein, the following definitions will apply: |

a.

“Administrator” means the Board or the Committee of the Board that will be administering the Plan, in accordance with

Section 4 of the Plan.

b.

“Affiliate” means, at the time of determination, any Parent, Subsidiary, or Predecessor of the Company.

c.

“Applicable Laws” means the requirements relating to the administration of equity-based awards under U.S. state corporate

laws, U.S. federal and state securities laws, the Code, any stock exchange or quotation system on which the Common Stock is listed or

quoted and the applicable laws of any foreign country or jurisdiction where Awards are, or will be, granted under the Plan.

d.

“Award” means, individually or collectively, a grant under the Plan of Options, Stock Appreciation Rights, Restricted

Stock, Restricted Stock Units, Performance Units, Performance Shares or unrestricted Common Stock.

e.

“Award Agreement” means the written or electronic agreement setting forth the terms and provisions applicable to each

Award granted under the Plan. Award Agreement is subject to the terms and conditions of the Plan.

f.

“Beneficial Owner” means the definition given in Rule 13d-3 and Rule 13d-5 of the Exchange Act.

g.

“Board” means the Board of Directors of the Company.

h.

“Change in Control” except as may otherwise be provided in an Award Agreement, means the occurrence of any of the following:

i.

The consummation of a merger or consolidation of the Company with or into another entity or any other corporate reorganization, if the

Company’s shareholders immediately prior to such merger, consolidation or reorganization cease to directly or indirectly own immediately

after such merger, consolidation or reorganization at least a majority of the combined voting power of the continuing or surviving entity’s

securities outstanding immediately after such merger, consolidation or other reorganization; provided that any Person who (1) was a Beneficial

Owner of the voting securities of the Company immediately prior to such merger or consolidation, and (2) is a Beneficial Owner of more

than twenty percent (20%) of the securities of the Company immediately after such merger or consolidation, and (3) is not a Moroun Family

Shareholder or any group in which a Moroun Family Shareholder is a member, shall be excluded from the list of “the Company’s

shareholders immediately prior to such merger, consolidation or reorganization” for purposes of the preceding calculation;

ii.

The consummation of the sale, transfer or other disposition of all or substantially all of the Company’s assets (other than (x)

to a corporation or other entity of which at least a majority of its combined voting power is owned directly or indirectly by the Company

or by one or more Moroun Family Shareholders, (y) to a corporation or other entity owned directly or indirectly by the shareholders of

the Company in substantially the same proportions as their ownership of the common stock of the Company or (z) to a continuing or surviving

entity described in Section 2(h)(i) in connection with a merger, consolidation or corporate reorganization which does not result in a

Change in Control under Section 2(h)(i));

iii.

The consummation of any transaction as a result of which any Person or group (other than a Moroun Family Shareholder or any group in which

any a Moroun Family Shareholder is a member) becomes the Beneficial Owner, directly or indirectly, of securities of the Company representing

at least fifty percent (50%) of the total voting power represented by the Company’s then outstanding voting securities. For purposes

of this subparagraph (iii), the term “Person” shall exclude: (1) a trustee or other fiduciary holding securities under an

employee benefit plan of the Company or an Affiliate of the Company; (2) a corporation or other entity owned directly or indirectly by

the shareholders of the Company in substantially the same proportions as their ownership of the common stock of the Company; (3) the Company;

(4) a corporation or other entity of which at least a majority of its combined voting power is owned directly or indirectly by the Company;

and (5) a trustee or receiver appointed for the purpose of a complete winding up, liquidation or dissolution of the Company. A transaction

shall not constitute a Change in Control if its sole purpose is to change the state of the Company’s incorporation or to create

a holding company that will be owned in substantially the same proportions by the persons who held the Company’s securities immediately

before such transactions.

iv.

The definition of “Change in Control,” and all other terms and provisions of the Plan, shall be interpreted at all times in

such a manner as to comply with Section 409A of the Code, meaning that no additional income tax is imposed on the Participant pursuant

to Section 409A(1)(a) of the Code. Notwithstanding the foregoing subparagraphs (i) through (iii) above, to the extent necessary to comply

with Section 409A of the Code with respect to the payment of “nonqualified deferred compensation” (as defined for purposes

of Section 409A of the Code), “Change in Control” shall be limited to a “change in control event” as defined under

Section 409A of the Code.

i.

“Code” means the Internal Revenue Code of 1986, as amended. Reference to a specific section of the Code or regulation

thereunder shall include such section or regulation, any valid regulation promulgated under such section, and any comparable provision

of any future legislation or regulation amending, supplementing or superseding such section or regulation.

j.

“Committee” means a committee of Directors or of other individuals satisfying Applicable Laws appointed by the Board

in accordance with Section 4 hereof. In the absence of such appointment, the Board shall serve as the Committee.

k.

“Common Stock” means the common stock of the Company.

l.

“Company” means P.A.M. Transportation Services, Inc., a Delaware corporation, or any successor thereto.

m.

“Consultant” means any person, including an advisor, engaged by the Company or an Affiliate to render services to such

entity (as the terms consultant and advisor are defined and interpreted for purposes of Form S-8 under the Securities Act of 1933, as

amended, or any successor form).

n.

“Director” means a member of the Board.

o.

“Disability” means total and permanent disability as defined in Section 22(e)(3) of the Code, provided that in the

case of Awards other than Incentive Stock Options, the Administrator in its discretion may determine whether a permanent and total disability

exists in accordance with uniform and non-discriminatory standards adopted by the Administrator from time to time.

p.

“Effective Date” means the date the Plan is approved by shareholders of the Company.

q.

“Employee” means any person, including Officers and Directors, employed by the Company or any Parent or Subsidiary

of the Company. Neither service as a Director nor payment of a director’s fee by the Company will be sufficient to constitute “employment”

by the Company.

r.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

s.

“Fair Market Value” means, as of any date, the value of Common Stock determined as follows:

i.

If the Common Stock is listed on any established stock exchange or a national market system, including without limitation the New York

Stock Exchange, the Nasdaq Global Select Market, the Nasdaq Global Market or the Nasdaq Capital Market of The Nasdaq Stock Market, its

Fair Market Value will be the closing sales price for such stock (or the closing bid, if no sales were reported) as quoted on such exchange

or system on the day of determination, as reported in The Wall Street Journal or such other source as the Administrator deems reliable;

ii.

If the Common Stock is regularly quoted by a recognized securities dealer but selling prices are not reported, the Fair Market Value of

a Share will be the mean between the high bid and low asked prices for the Common Stock on the day of determination, as reported in The

Wall Street Journal or such other source as the Administrator deems reliable; or

iii.

In the absence of an established market for the Common Stock, the Fair Market Value will be determined in good faith by the Administrator

in compliance with Applicable Laws, including Sections 409A and 422 of the Code.

t.

“Fiscal Year” means the fiscal year of the Company.

u.

“Incentive Stock Option” means an Option that is designated by the Committee as an incentive stock option within the

meaning of Section 422 of the Code and the regulations promulgated thereunder.

v.

“Inside Director” means a Director who is an Employee.

w.

“Moroun Family Shareholder” means Matthew T. Moroun, Matthew J. Moroun, their immediate family members (as defined

in Rule 16a-1(e)) and any trust established for the benefit of any such Person who constitutes the Beneficial Owner of the subject shares

for purposes of Rule 16a-1(a)(1) or Rule 16a-1(a)(2).

x.

“Nonstatutory Stock Option” means an Option that by its terms does not qualify or is not intended to qualify as an

Incentive Stock Option.

y.

“Officer” means a person who is an officer of the Company within the meaning of Section 16 of the Exchange Act and

the rules and regulations promulgated thereunder.

z.

“Option” means a stock option granted pursuant to the Plan.

aa.

“Outside Director” means a Director who is not an Employee.

bb.

“Parent” means any corporation (other than the Company) in an unbroken chain of corporations ending with the Company

if each of the corporations other than the Company owns stock possessing fifty percent (50%) or more of the total combined voting power

of all classes of stock in one of the other corporations in such chain. A corporation that attains the status of a Parent after the adoption

of the Plan shall be considered a Parent commencing as of such date.

cc.

“Participant” means the holder of an outstanding Award.

dd.

“Performance Goal” means a performance goal established by the Administrator pursuant to Section 10(c) of the Plan.

ee.

“Performance Share” means an Award denominated in Shares which may be earned in whole or in part upon attainment of

one or more Performance Goals or other vesting criteria as the Administrator may determine pursuant to Section 10.

ff.

“Performance Unit” means an Award which may be earned in whole or in part upon attainment of one or more Performance

Goals or other vesting criteria as the Administrator may determine and which may be settled for cash, Shares or other securities or a

combination of the foregoing pursuant to Section 10.

gg.“Period

of Restriction” means the period during which the transfer of Shares of Restricted Stock are subject to restrictions and, therefore,

the Shares are subject to a substantial risk of forfeiture. Such restrictions may be based on the passage of time, the achievement of

target levels of performance, or the occurrence of other events as determined by the Administrator.

hh.“Person”

has the meaning set forth in Section 13(d) and 14(d) of the Exchange Act.

ii.“Plan”

means this 2024 Equity Incentive Plan.

jj.“Predecessor”

means a corporation that was a party to a transaction described in Section 424(a) of the Code (or which would be so described if a substitution

or assumption under Section 424(a) of the Code had occurred) with the Company, or a corporation which is a Parent or Subsidiary of the

Company, or a predecessor of any such corporation.

kk.“Restricted

Stock” means Shares issued pursuant to a Restricted Stock award under Section 7 of the Plan.

ll.“Restricted

Stock Unit” means a bookkeeping entry representing an amount equal to the Fair Market Value of one Share, granted pursuant to

Section 8. Each Restricted Stock Unit represents an unfunded and unsecured obligation of the Company.

mm.“Rule

16a-1(e)” means Rule 16a-1(e) of the Exchange Act or any successor to Rule 16a-1(e), as in effect when discretion is being exercised

with respect to the Plan.

nn.“Rule

16b-3” means Rule 16b-3 of the Exchange Act or any successor to Rule 16b-3, as in effect when discretion is being exercised

with respect to the Plan.

oo.“Section

16(b)” means Section 16(b) of the Exchange Act.

pp.“Service

Provider” means an Employee, Director or Consultant.

qq.“Share”

means a share of the Common Stock, as adjusted in accordance with Section 13 of the Plan.

rr.“Stock

Appreciation Right” means an Award, granted alone or in connection with an Option, that pursuant to Section 9 is designated

as a Stock Appreciation Right.

ss.“Subsidiary”

means any entity (other than the Company) in an unbroken chain of entities beginning with the Company if each entity other than the last

entity in the unbroken chain owns an equity ownership interest possessing fifty percent (50%) or more of the total combined voting power

of all classes of stock, membership interests or other equity ownership interests in one of the other entities in such chain. An entity

that attains the status of a Subsidiary after the adoption of the Plan shall be considered a Subsidiary commencing as of such date.

| 3. | Stock Subject to the Plan. |

a.

Stock Subject to the Plan. Subject to the provisions of Section 14 of the Plan, the maximum aggregate number of Shares that

may be issued under the Plan is 1,600,000 Shares (the “Share Reserve”). The Shares may be authorized, but unissued,

or reacquired Common Stock. The maximum number of Shares that may be issued upon the exercise of Incentive Stock Options is 1,600,000.

b.

Lapsed Awards. To the extent an Award expires, is surrendered or becomes unexercisable without having been exercised or, with respect

to Restricted Stock, Restricted Stock Units, Performance Units or Performance Shares, is forfeited to the Company due to failure to vest,

the unpurchased Shares (or for Awards other than Options or Stock Appreciation Rights the canceled, forfeited, terminated or unissued

Shares), which were subject thereto will become available for future grant or sale under the Plan (unless the Plan has terminated). With

respect to stock-settled Stock Appreciation Rights, the total number of shares of Common Stock subject to such Stock Appreciation Rights

(and not the net number of shares of Common Stock actually issued pursuant to such Stock Appreciation Rights) will cease to be available

under the Plan. Shares subject to an Award under the Plan may not again be made available for issuance under the Plan if such Shares

are (x) Shares that were subject to an Option or a stock-settled Stock Appreciation Right and were not issued upon the net settlement

or net exercise of such Option or Stock Appreciation Right, or (y) Shares delivered to or withheld by the Company to pay the exercise

price or the withholding taxes under Options, Stock Appreciation Rights or other Awards. To the extent an Award under the Plan is paid

out in cash rather than Shares, such cash payment will not result in reducing the number of Shares available for issuance under the Plan.

In addition, shares of Common Stock repurchased by the Company with the proceeds of the exercise

prices for any Options may not be reissued under the Plan.

c.

Substitute Awards. In connection with a merger or consolidation of an entity with the Company or the acquisition by the Company

of property or stock of an entity, the Board may grant Awards in substitution for any options or other stock or stock-based awards granted

by such entity or an affiliate thereof (“Substitute Awards”). The terms and conditions of such Substitute Awards shall

be set forth in an Award Agreement and shall, except as may be inconsistent with any provision of the Plan, to the extent practicable

provide the recipient with benefits (including economic value) substantially similar to those provided to the recipient under the existing

award which such Substitute Award is intended to replace. Substitute Awards shall not count against the overall share limit set forth

in the Plan, except as may be required by reason of Section 422 and related provisions of the Code but shall be available under the Plan

by virtue of the Company’s assumption of the plan or arrangement of the acquired company or business.

d.

Prior Plan. Following the approval of the Plan by the shareholders of the Company, no new awards may be granted under the Company’s

2014 Amended and Restated Stock Option and Incentive Plan (the “2014 Plan”). Awards outstanding under the 2014 Plan

shall remain in full force and effect under the 2014 Plan according to its terms.

| 4. | Administration of the Plan. |

i.

Multiple Administrative Bodies. Different Committees with respect to different groups of Service Providers may administer the Plan.

ii.

Rule 16b-3. To the extent desirable to qualify transactions hereunder as exempt under Rule 16b-3, the transactions contemplated

hereunder will be structured to satisfy the requirements for exemption under Rule 16b-3.

iii.

Other Administration. Other than as provided above, the Plan will be administered by (A) the Board or (B) a Committee, which committee

will be constituted to satisfy Applicable Laws.

b.

Powers of the Administrator. Subject to the provisions of the Plan, the Administrator will have the authority, in its discretion:

i.

to determine the Fair Market Value;

ii.

to select the Service Providers to whom Awards may be granted hereunder;

iii.

to determine the number of Shares to be covered by each Award granted hereunder;

iv.

to approve forms of Award Agreements for use under the Plan;

v.

to determine the terms and conditions, not inconsistent with the terms of the Plan, of any Award granted hereunder. Such terms and conditions

include, but are not limited to, the exercise price, the time or times when Awards may vest and be exercised (which may be based on performance

criteria), any vesting acceleration or waiver of forfeiture restrictions, and any restriction or limitation regarding any Award or the

Shares relating thereto, based in each case on such factors as the Administrator may determine;

vi.

to construe and interpret the terms and provisions of the Plan and Award Agreements executed pursuant to the Plan;

vii.

to prescribe, amend and rescind rules and regulations relating to the Plan, including rules and regulations established for the purpose

of satisfying applicable foreign laws, for qualifying for favorable tax treatment under applicable foreign laws or facilitating compliance

with foreign laws; and sub-plans may be created for any of these purposes;

viii.

to modify or amend each Award (subject to Section 19 of the Plan), including but not limited to the discretionary authority to extend

the post-termination exercisability period of Awards and to extend the maximum term of an Option (subject to Section 6(a) and Section

6(b) of the Plan);

ix.

to allow Participants to satisfy withholding or other tax obligations in such manner as prescribed in Section 15 of the Plan;

x.

to authorize any person to execute on behalf of the Company any instrument required to effect the grant of an Award previously granted

by the Administrator; and

xi.

to make all other determinations deemed necessary or advisable for administering the Plan.

c.

Effect of Administrator’s Decision. The Administrator’s decisions, determinations and interpretations will be final

and binding on all Participants and any other holders of Awards.

d.

No Option or Stock Appreciation Right Repricing Without Shareholder Approval. Except as provided in Section 14(a) hereof relating

to certain anti-dilution adjustments, unless the approval of the holders of a majority of the Shares that are present in person or by

proxy and entitled to vote at any annual or special meeting of the Company’s shareholders is obtained, (i) Options and Stock Appreciation

Rights issued under the Plan shall not be amended to lower their exercise price, (ii) Options and Stock Appreciation Rights issued under

the Plan will not be exchanged for other Options or Stock Appreciation Rights with lower exercise prices, (iii) Options and Stock Appreciation

Rights issued under the Plan with an exercise price in excess of the Fair Market Value of the underlying Shares will not be exchanged

for cash or other property, and (iv) no other action shall be taken with respect to Options or Stock Appreciation Rights that would be

treated as a repricing under the rules of the principal stock exchange or market system on which the Shares are listed.

e.

Delegation by the Board. Subject to any requirements of Applicable Law, the Board may delegate to one or more officers of the Company

the power to grant Awards (subject to any limitations under the Plan) to Employees of the Company and to exercise such other powers under

the Plan as the Board may determine, provided that the Board shall fix the terms of Awards to be granted by such officers, the maximum

number of shares subject to Awards that the officers may grant, and the time period in which such Awards may be granted; and provided

further, that no officer shall be authorized to grant Awards to any “executive officer” of the Company (as defined by Rule

3b-7 under the Exchange Act) or to any Officer of the Company.

| 5. | Award Eligibility and Limitations. |

a.

Award Eligibility. Nonstatutory Stock Options, Stock Appreciation Rights, Restricted Stock, Restricted Stock Units, Performance

Shares, Performance Units and unrestricted Common Stock may be granted to Service Providers. Incentive Stock Options may be granted only

to Employees.

b.

Limit on Awards to Outside Directors. The aggregate value of all compensation granted or paid, as applicable, to any individual

for service as an Outside Director with respect to any fiscal year, including Awards granted and cash fees paid by the Company to such

Outside Director, will not exceed seven hundred and fifty thousand dollars ($750,000) in total value, calculating the value of any Awards

based on the grant date fair value of such Awards for financial reporting purposes. The Board may make an exception to the applicable

limit in this Section 5(b) for any Outside Director in extraordinary circumstances, as the Board may determine in its discretion, provided

that any Outside Director who is granted or paid such additional compensation may not participate in the decision to grant or pay such

additional compensation.

c.

Rights Under the Plan. No Person shall have any rights as a shareholder with respect to any shares of Common Stock covered by or

relating to any Award until the date of the issuance of such shares on the books and records of the Company. Except as otherwise expressly

provided in Section 14 hereof, no adjustment of any Award shall be made for dividends or other rights for which the record date occurs

prior to the date of such issuance. Nothing in this Section 5(c) is intended, or should be construed, to limit authority of the Administrator

to cause the Company to make payments based on the dividends that would be payable with respect to any share of Common Stock if it were

issued or outstanding, or from granting rights related to such dividends.

a.

Limitations. Each Option will be designated in the Award Agreement as either an Incentive Stock Option or a Nonstatutory Stock

Option. However, notwithstanding such designation, to the extent that the aggregate Fair Market Value of the Shares with respect to which

Incentive Stock Options are exercisable for the first time by the Participant during any calendar year (under all plans of the Company

and any Parent or Subsidiary) exceeds one hundred thousand dollars ($100,000), such Options will be treated as Nonstatutory Stock Options.

For purposes of this Section 6(a), Incentive Stock Options will be taken into account in the order in which they were granted. The Fair

Market Value of the Shares will be determined as of the time the Option with respect to such Shares is granted. With respect to the Committee’s

authority in Section 4(b)(viii), if, at the time of any such extension, the exercise price per Share of the Option is less than the Fair

Market Value of a Share, the extension shall, unless otherwise determined by the Committee, be limited to the earlier of (1) the maximum

term of the Option as set by its original terms, or (2) ten (10) years from the grant date. Unless otherwise determined by the Committee,

any extension of the term of an Option pursuant to Section 4(b)(viii) shall comply with Code Section 409A to the extent necessary to avoid

taxation thereunder.

b.

Term of Option. The term of each Option will be stated in the Award Agreement and will be ten (10) years from the date of grant

or such shorter term as may be provided in the Award Agreement. Moreover, in the case of an Incentive Stock Option granted to a Participant

who, at the time the Incentive Stock Option is granted, owns stock possessing more than ten percent (10%) of the total combined voting

power of all classes of stock of the Company or any Parent or Subsidiary, the term of the Incentive Stock Option will be five (5) years

from the date of grant or such shorter term as may be provided in the Award Agreement.

c.

Option Exercise Price and Consideration.

i.

Exercise Price. The per share exercise price for the Shares to be issued pursuant to exercise of an Option will be determined by

the Administrator, subject to the following:

| 1. | In the case of an Incentive Stock Option, |

| a. | granted to an Employee who, at the time the Incentive Stock Option is granted, owns

stock possessing more than ten percent (10%) of the total combined voting power of all classes of stock of the Company or any Parent or

Subsidiary, the per Share exercise price will be no less than one hundred ten percent (110%) of the Fair Market Value per Share on the

date of grant; and |

| b. | granted to any Employee other than an Employee described in paragraph (a) immediately

above, the per Share exercise price will be no less than one hundred percent (100%) of the Fair Market Value per Share on the date of

grant. |

| 2. | In the case of a Nonstatutory Stock Option, the per Share exercise price will be no

less than one hundred percent (100%) of the Fair Market Value per Share on the date of grant. |

ii.

Waiting Period and Exercise Dates. At the time an Option is granted, the Administrator will fix the period within which the Option

may be exercised and will determine any conditions that must be satisfied before the Option may be exercised.

iii.

Form of Consideration. The Administrator will determine the acceptable form of consideration for exercising an Option, including

the method of payment. In the case of an Incentive Stock Option, the Administrator will determine the acceptable form of consideration

at the time of grant. Such consideration for both types of Options may consist entirely of: (1) cash; (2) check; (3) other Shares, provided

that (A) such Shares have a Fair Market Value on the date of surrender equal to the aggregate exercise price of the Shares as to which

such Option will be exercised, (B) such Shares are not subject to any repurchase, forfeiture, unfulfilled vesting or other similar requirements,

and (C) accepting such Shares will not result in any adverse accounting consequences to the Company, as the Administrator determines in

its sole discretion; (4) consideration received by the Company under a broker-assisted (or other) cashless exercise program (whether through

a broker or otherwise) implemented by the Company in connection with the Plan; (5) for Nonstatutory Stock Options, by net exercise; (6)

such other consideration and method of payment for the issuance of Shares to the extent permitted by Applicable Laws; or (7) any combination

of the foregoing methods of payment.

d.

Exercise of Option.

i.

Procedure for Exercise; Rights as a Shareholder. Any Option granted hereunder will be exercisable according to the terms of the

Plan and at such times and under such conditions as determined by the Administrator and set forth in the Award Agreement. An Option may

not be exercised for a fraction of a Share.

An Option will

be deemed exercised when the Company receives: (i) a notice of exercise (in such form as the Administrator may specify from time to time)

from the person entitled to exercise the Option, and (ii) full payment for the Shares with respect to which the Option is exercised (together

with applicable withholding taxes). Full payment may consist of any consideration and method of payment authorized by the Administrator

and permitted by the Award Agreement and the Plan. Shares issued upon exercise of an Option will be issued in the name of the Participant

or, if requested by the Participant, in the name of the Participant and his or her spouse. Until the Shares are issued (as evidenced by

the appropriate entry on the books of the Company or of a duly authorized transfer agent of the Company), no right to vote or receive

dividends or any other rights as a shareholder will exist with respect to the Shares subject to an Option, notwithstanding the exercise

of the Option. The Company will issue (or cause to be issued) such Shares promptly after the Option is exercised. No adjustment will be

made for a dividend or other right for which the record date is prior to the date the Shares are issued, except as provided in Section

14 of the Plan.

ii.

Termination of Relationship as a Service Provider. If a Participant ceases to be a Service Provider, other than upon the Participant’s

termination as the result of the Participant’s death or Disability, the Participant may exercise his or her Option within such period

of time as is specified in the Award Agreement to the extent that the Option is vested on the date of termination (but in no event later

than the expiration of the term of such Option as set forth in the Award Agreement). In the absence of a specified time in the Award Agreement,

the Option must be exercised, if at all, prior to the first to occur of the following, whichever shall be applicable: (A) the date that

is three (3) months following the Participant’s termination; (B) the expiration of the term of the Option as set forth in the applicable

Award Agreement; or (C) the tenth (10th) anniversary of the grant date. Unless otherwise provided by the Administrator, if

on the date of termination the Participant is not vested as to his or her entire Option, the Shares covered by the unvested portion of

the Option will revert to the Plan. If after termination the Participant does not exercise his or her Option within the time specified

by the Administrator, the Option will terminate, and the Shares covered by such Option will revert to the Plan. If the Participant dies

following the date of the Participant’s termination and prior to the earlier of the date specified in subclauses (A), (B) and (C)

of this paragraph, then the Option shall be exercisable until the earlier to occur of the following: (X) the first anniversary following

the Participant’s termination; (Y) the expiration of the term of the Option as set forth in the applicable Award Agreement; or (Z)

the tenth (10th) anniversary of the grant date.

iii.

Disability of Participant. If a Participant ceases to be a Service Provider as a result of the Participant’s Disability,

the Participant may exercise his or her Option within such period of time as is specified in the Award Agreement to the extent the Option

is vested on the date of termination (but in no event later than the expiration of the term of such Option as set forth in the Award Agreement).

In the absence of a specified time in the Award Agreement, the Option will remain exercisable for twelve (12) months following the Participant’s

termination. Unless otherwise provided by the Administrator, if on the date of termination the Participant is not vested as to his or

her entire Option, the Shares covered by the unvested portion of the Option will revert to the Plan. If after termination the Participant

does not exercise his or her Option within the time specified herein, the Option will terminate, and the Shares covered by such Option

will revert to the Plan.

iv.

Death of Participant. If a Participant dies while a Service Provider, the Option may be exercised following the Participant’s

death within such period of time as is specified in the Award Agreement to the extent that the Option is vested on the date of death (but

in no event may the Option be exercised later than the expiration of the term of such Option as set forth in the Award Agreement), by

the Participant’s designated beneficiary, provided such beneficiary has been designated prior to Participant’s death in a

form acceptable to the Administrator. If no such beneficiary has been designated by the Participant, then such Option may be exercised

by the personal representative of the Participant’s estate or by the person(s) to whom the Option is transferred pursuant to the

Participant’s will or in accordance with the laws of descent and distribution. In the absence of a specified time in the Award Agreement,

the Option will remain exercisable for twelve (12) months following Participant’s death. Unless otherwise provided by the Administrator,

if at the time of death Participant is not vested as to his or her entire Option, the Shares covered by the unvested portion of the Option

will immediately revert to the Plan. If the Option is not so exercised within the time specified herein, the Option will terminate, and

the Shares covered by such Option will revert to the Plan.

a.

Grant of Restricted Stock. Subject to the terms and provisions of the Plan, the Administrator, at any time and from time to time,

may grant Shares of Restricted Stock to Service Providers in such amounts as the Administrator, in its sole discretion, will determine.

b.

Restricted Stock Agreement. Each Award of Restricted Stock will be evidenced by an Award Agreement that will specify the Period

of Restriction, the number of Shares granted, and such other terms and conditions as the Administrator, in its sole discretion, will determine.

Unless the Administrator determines otherwise, the Company as escrow agent will hold Shares of Restricted Stock until the restrictions

on such Shares have lapsed.

c.

Transferability. Except as provided in this Section 7 or the Award Agreement, Shares of Restricted Stock may not be sold, transferred,

pledged, assigned, or otherwise alienated or hypothecated until the end of the applicable Period of Restriction.

d.

Other Restrictions. The Administrator, in its sole discretion, may impose such other restrictions on Shares of Restricted Stock

as it may deem advisable or appropriate. Unless provided otherwise in an Award Agreement, the Participant shall have no right to vote

or to receive dividends or other distributions with respect to shares of Restricted Stock that have not vested.

e.

Removal of Restrictions. Except as otherwise provided in this Section 7, Shares of Restricted Stock covered by each Restricted

Stock grant made under the Plan will be released from escrow as soon as practicable after the last day of the Period of Restriction or

at such other time as the Administrator may determine. The Administrator, in its discretion, may accelerate the time at which any restrictions

will lapse or be removed.

f.

Return of Restricted Stock to Company. On the date set forth in the Award Agreement, the Restricted Stock for which restrictions

have not lapsed will revert to the Company and again will become available for grant under the Plan.

| 8. | Restricted Stock Units. |

a.

Grant. Subject to the terms and conditions of the Plan, Restricted Stock Units may be granted at any time and from time to time

as determined by the Administrator. After the Administrator determines that it will grant Restricted Stock Units under the Plan, it will

advise the Participant in an Award Agreement of the terms, conditions, and restrictions related to the grant, including the number of

Restricted Stock Units.

b.

Vesting Criteria and Other Terms. The Administrator will set vesting criteria in its discretion, which, depending on the extent

to which the criteria are met, will determine the number of Restricted Stock Units that will be paid out to the Participant. The Administrator

may set vesting criteria based upon the achievement of Company-wide, business unit, or individual goals (including, but not limited to,

continued employment), or any other basis (including the passage of time) determined by the Administrator in its discretion.

c.

Restricted Stock Unit Agreement. Each Award of Restricted Stock Units will be evidenced by an Award Agreement that will specify

the number of Restricted Stock Units granted, the vesting criteria, and such other terms and conditions as the Administrator, in its sole

discretion, will determine.

d.

Earning Restricted Stock Units. Upon meeting the applicable vesting criteria, the Participant will be entitled to receive a payout

as determined by the Administrator. Notwithstanding the foregoing, at any time after the grant of Restricted Stock Units, the Administrator,

in its sole discretion, may reduce or waive any vesting criteria that must be met to receive a payout.

e.

Dividend Equivalents on Unvested Restricted Stock Units. The Award Agreement for Restricted Stock Units may provide a Participant

with the right to receive an amount equal to any dividends or other distributions declared and paid on an equal number of outstanding

Shares (“Dividend Equivalents”). Dividend Equivalents may be settled in cash and/or Shares, shall be subject to the

same restrictions on transfer and forfeiture provisions as the Restricted Stock Units with respect to which paid, and shall not be settled

prior to vesting of the Restricted Stock Units with respect to which paid. No interest will be paid on Dividend Equivalents.

f.

Form and Timing of Payment. Payment of earned Restricted Stock Units will be made upon the date determined by the Administrator

and set forth in the Award Agreement. The Administrator, in its sole discretion, may settle earned Restricted Stock Units in cash, Shares,

or a combination of both.

g.

Cancellation. On the date set forth in the Award Agreement, all unearned Restricted Stock Units will be forfeited to the Company.

| 9. | Stock Appreciation Rights. |

a.

Grant of Stock Appreciation Rights. Subject to the terms and conditions of the Plan, a Stock Appreciation Right may be granted

to Service Providers at any time and from time to time as will be determined by the Administrator, in its sole discretion.

b.

Number of Shares. Subject to the terms and conditions of the Plan, the Administrator will have complete discretion to determine

the number of Stock Appreciation Rights granted to any Service Provider.

c.

Exercise Price and Other Terms. The per share exercise price for the Shares underlying an Award of Stock Appreciation Right will

be determined by the Administrator and will be no less than one hundred percent (100%) of the Fair Market Value per Share on the date

of grant. Otherwise, the Administrator, subject to the provisions of the Plan, will have complete discretion to determine the terms and

conditions of Stock Appreciation Rights granted under the Plan.

d.

Stock Appreciation Right Agreement. Each Stock Appreciation Right grant will be evidenced by an Award Agreement that will specify

the number of Shares underlying the Award, the exercise price, the term of the Stock Appreciation Right, the conditions of exercise, and

such other terms and conditions as the Administrator, in its sole discretion, will determine.

e.

Expiration of Stock Appreciation Rights. A Stock Appreciation Right granted under the Plan will expire upon the date determined

by the Administrator, in its sole discretion, and set forth in the Award Agreement. Notwithstanding the foregoing, the rules of Section

6(b) relating to the maximum term and Section 6(d) relating to exercise also will apply to Stock Appreciation Rights.

f.

Payment of Stock Appreciation Right Amount. Upon exercise of a Stock Appreciation Right, a Participant will be entitled to receive

payment from the Company in an amount determined by multiplying:

i.

The difference between the Fair Market Value of a Share on the date of exercise over the exercise price; multiplied by

ii.

The number of Shares with respect to which the Stock Appreciation Right is exercised.

At the discretion of the Administrator,

the payment upon a Stock Appreciation Right exercise may be in cash, in Shares of equivalent value, or in some combination thereof.

| 10. | Performance Units and Performance Shares. |

a.

Grant. Subject to the terms and conditions of the Plan, Performance Units and Performance Shares may be granted to Service Providers

at any time and from time to time, as will be determined by the Administrator, in its sole discretion, and the Administrator will have

complete discretion in determining the number of Performance Units and Performance Shares granted to each Participant.

b.

Value. Subject to the terms and conditions of the Plan, each Performance Unit will have an initial value that is established by

the Administrator on or before the date of grant and each Performance Share will have an initial value equal to the Fair Market Value

of a Share on the date of grant.

c.

Performance Objectives and Other Terms. The Administrator will set Performance Goals or other vesting provisions (including,

without limitation, continued status as a Service Provider) in its discretion which, depending on the extent to which they are met, will

determine the number or value of Performance Units or Performance Shares that will be paid out to the Service Provider. The time period

during which the performance objectives or other vesting provisions must be met will be called the “Performance Period.”

Each Award will be evidenced by an Award Agreement that will specify the Performance Period, and such other terms and conditions as the

Administrator, in its sole discretion, may determine.

d.

Measurement of Performance Goals. Performance Goals shall be established by the Administrator on the basis of targets to be attained

with respect to one or more measures of business or financial performance (each, a “Performance Measure”), subject

to the following:

i.

Performance Measures. For each Performance Period, the Administrator shall establish the Performance Measures, if any, and any

particulars, components and adjustments relating thereto, applicable to each Participant. The Performance Measures, if any, will be based

upon the achievement of a specified percentage or level in one or more discretionary or non-discretionary factors preestablished by the

Administrator. Performance Measures may be one or more of the following or based on such other performance criteria as the Administrator

may deem appropriate, and may be determined pursuant to generally accepted accounting principles (“GAAP”), non-GAAP

or other basis, in each case as determined by the Committee: (i) total revenue; (ii) fuel surcharge revenue; (iii) revenue, excluding

fuel surcharge; (iv) operating income; (v) operating ratio; (vi) income or earnings before taxes, interest, depreciation and/or amortization;

(vii) income or earnings from continuing operations; (viii) effective tax rates; (ix) cash taxes; (x) net income; (xi) pre-tax income

or after-tax income; (xii) operating expenses, or any component expense thereof; (xiii) financing or capital transactions; (xiv) gross

margin; (xv) operating margin or profit margin; (xvi) capital expenditures, cost targets, and expense management; (xvii) total assets;

(xviii) return on assets (gross or net), return on investment, return on capital, or return on shareholder equity; (xix) cash flow, free

cash flow, cash flow return on investment (discounted or otherwise), net cash provided by operations, or cash flow in excess of cost of

capital; (xx) stock price or total shareholder return; (xxi) earnings or book value per share (basic or diluted); (xxii) economic value

created; (xxiii) pre-tax profit or after-tax profit; (xxiv) freight rates or any other customer pricing measure; (xxv) customer growth,

retention or diversification; (xxvi) goals relating to divestitures, joint ventures, mergers, acquisitions and similar transactions; (xxvii)

changes in revenue equipment counts or utilization; (xxviii) goals relating to human capital management, including but not limited to

driver or other employee recruiting, retention or turnover, results from employee surveys, employee safety, employee accident and/or injury

rates, headcount, performance management, or completion of employee training initiatives; (xxix) goals relating to transportation safety

measures, ratings, incidents or initiatives; (xxx) goals related to equipment maintenance; and (xxxi) key regulatory objectives. The Administrator

may specify that such Performance Measures shall be adjusted to exclude any one or more of (a) extraordinary items, (b) gains or losses

on the dispositions of assets, (c) the cumulative effects of changes in accounting principles, (d) the writedown of any asset, (e) unusual

and/or infrequent events impacting Company performance, and (f) any other events affecting the Company, as determined by the Administrator.

ii.

Administrator Discretion on Performance Measures. As determined in the discretion of the Administrator, the Performance Measures

for any Performance Period may (a) differ from Participant to Participant and from Award to Award, (b) be based on the performance of

the Company as a whole or the performance of a specific Participant or one or more subsidiaries, divisions, departments, regions, locations,

segments, functions or business units of the Company, (c) be measured on a per share, per truck, trailer or other revenue equipment unit,

per mile, per lane, per customer, per employee, and/or other objective or subjective basis, (d) be measured on a pre-tax or after-tax

basis, and (e) be measured on an absolute basis or in relative terms (including, but not limited to, the passage of time and/or against

other companies, financial metrics and/or an index). Without limiting the foregoing, the Administrator shall adjust any performance criteria,

Performance Measures or other feature of an Award that relates to or is wholly or partially based on the number of, or the value of, any

stock of the Company, to reflect any stock dividend or split, repurchase, recapitalization, combination, or exchange of shares or other

similar changes in such stock, and may take into account other factors (including subjective factors).

e.

Earning of Performance Units/Shares. After the applicable Performance Period has ended, the holder of Performance Units/Shares

will be entitled to receive a payout of the number of Performance Units/Shares earned by the Participant over the Performance Period,

to be determined as a function of the extent to which the corresponding Performance Goals or other vesting provisions have been achieved.

Notwithstanding any provision of the Plan, the Administrator may adjust downwards the cash or number of Shares payable pursuant to such

an award if it determines, in its sole discretion, that such adjustment is appropriate.

f.

Form and Timing of Payment of Performance Units/Shares. Payment of earned Performance Units/Shares will be made upon the time set

forth in the applicable Award Agreement. The Administrator, in its sole discretion, may pay earned Performance Units/Shares in the form

of cash, in Shares (which have an aggregate Fair Market Value equal to the value of the earned Performance Units/Shares at the close of

the applicable Performance Period) or in a combination thereof.

g.

No Dividends on Unvested Performance Units/Shares. Notwithstanding any provision of this Plan to the contrary, dividends and dividend

equivalents shall not be paid with respect to unvested Performance Units/Shares prior to the time of vesting of the underlying Performance

Units/Shares, or portion thereof, with respect to which the dividend or dividend equivalent is accrued.

h.

Cancellation of Performance Units/Shares. On the date set forth in the Award Agreement, all unearned or unvested Performance Units/Shares

will be forfeited to the Company, and again will be available for grant under the Plan.

| 11. | Unrestricted Stock. The Committee may cause the Company to grant unrestricted

shares of Common Stock to Participants at such time or times, in such amounts and for such reasons as the Committee, in its sole discretion,

shall determine. Unrestricted Common Stock shall immediately vest and shall not be subject to any Period of Restriction. Except as required

by Applicable Laws, no payment shall be required for shares of unrestricted Common Stock. The Company shall issue, in the name of each

Participant to whom unrestricted Shares have been granted, the total number of Shares granted to the Participant as soon as reasonably

practicable after the date of grant or on such later date as the Committee shall determine at the time of grant. |

| 12. | Leaves of Absence; Transfer Between Locations. Unless the Administrator provides

otherwise, vesting of Awards granted hereunder will be suspended during any unpaid leave of absence unless contrary to Applicable Law.

A Participant will not cease to be an Employee in the case of (i) any leave of absence approved by the Participant’s employer or

(ii) transfers between locations of the Company or between the Company, its Parent, or any Subsidiary. For purposes of Incentive Stock

Options, no such leave may exceed three (3) months, unless reemployment upon expiration of such leave is guaranteed by statute or contract.

If such leave exceeds three (3) months and reemployment upon expiration of a leave of absence approved

by the Participant’s employer is not so guaranteed, the employment relationship shall be deemed to have terminated on the first

day immediately following such three (3)-month period, and such Incentive Stock Option held by the Participant shall cease to be treated

as an Incentive Stock Option and shall be treated for tax purposes as a Nonstatutory Stock Option on the first (1st) day

immediately following a three (3)-month period from the date the employment relationship is deemed terminated. |

| 13. | Transferability of Awards. Unless determined otherwise by the Administrator,

an Award may not be sold, pledged, assigned, hypothecated, transferred, or disposed of in any manner other than by will or beneficiary

designation or by the laws of descent or distribution and may be exercised, during the lifetime of the Participant, only by the Participant.

If the Administrator makes an Award transferable, such Award will contain such additional terms and conditions as the Administrator deems

appropriate. |

| 14. | Adjustments; Dissolution or Liquidation; Merger or Change in Control. |

a.

Adjustments. In the event of a stock split, reverse stock split, stock dividend, combination, consolidation, recapitalization

(including a recapitalization through a large nonrecurring cash dividend) or reclassification of the Shares, subdivision of the Shares,

a rights offering, a reorganization, merger, spin-off, split-up, repurchase, or exchange of Common Stock or other securities of the Company

or other significant corporate transaction, or other change affecting the Common Stock occurs, the Administrator, in order to prevent

dilution or enlargement of the benefits or potential benefits intended to be made available under the Plan, will, in such manner as it

may deem equitable, adjust the number, kind and class of securities that may be delivered under the Plan and/or the number, class, kind

and price of securities covered by each outstanding Award, the numerical Share limits and Share counting provisions in Section 3 of the

Plan. Notwithstanding the forgoing, all adjustments under this Section 14 are intended to be made in a manner that does not result in

taxation under Code Section 409A.

b.

Dissolution or Liquidation. In the event of the proposed winding up, dissolution or liquidation of the Company, the Administrator

will notify each Participant as soon as practicable prior to the effective date of such proposed transaction. To the extent it has not

been previously exercised, an Award will terminate immediately prior to the consummation of such proposed action.

c.

Change in Control. Except as set forth in an Award Agreement, to the extent the successor corporation in a merger or Change in

Control does not assume or substitute for outstanding Awards under the Plan, the Participant will fully vest in and have the right to

exercise all of his or her outstanding Options and Stock Appreciation Rights, including Shares as to which such Awards would not otherwise

be vested or exercisable, all restrictions on Restricted Stock and Restricted Stock Units will lapse, and, with respect to Awards with

performance-based vesting, all Performance Goals or other vesting criteria will be deemed achieved at one hundred percent (100%) of target

levels and all other terms and conditions met. In addition, if an Option or Stock Appreciation Right is not assumed or substituted in

the event of a Change in Control, the Administrator will notify the Participant in writing or electronically that the Option or Stock

Appreciation Right will be exercisable for a period of time determined by the Administrator in its sole discretion, and the Option or

Stock Appreciation Right will terminate upon the expiration of such period.

For the purposes

of this subsection (c), an Award will be considered assumed if, following the Change in Control, the Award confers the right to purchase

or receive, for each Share subject to the Award immediately prior to the Change in Control, the consideration (whether stock, cash, or

other securities or property) received in the Change in Control by holders of Common Stock for each Share held on the effective date of

the transaction (and if holders were offered a choice of consideration, the type of consideration chosen by the holders of a majority

of the outstanding Shares); provided, however, that if such consideration received in the Change in Control is not solely common stock

of the successor corporation or its Parent, the Administrator may, with the consent of the successor corporation, provide for the consideration

to be received upon the exercise of an Option or Stock Appreciation Right or upon the payout of a Restricted Stock Unit, Performance Unit

or Performance Share, for each Share subject to such Award, to be solely common stock of the successor corporation or its Parent equal

in fair market value to the per share consideration received by holders of Common Stock in the Change in Control.

Notwithstanding

anything in this Section 14(c) to the contrary, an Award that vests, is earned or paid-out upon the satisfaction of one or more Performance

Goals will not be considered assumed if the Company or its successor modifies any of such Performance Goals without the Participant’s

consent; provided, however, a modification to such Performance Goals only to reflect the successor corporation’s post-Change in

Control corporate structure will not be deemed to invalidate an otherwise valid Award assumption.

a.

Withholding Requirements. Prior to the delivery of any Shares or cash pursuant to an Award (or exercise thereof) or prior to any

time the Award or Shares are subject to taxation, the Company and/or the Participant’s employer will have the power and the right

to deduct or withhold, or require a Participant to remit to the Company, an amount sufficient to satisfy federal, state, local, foreign

or other taxes (including the Participant’s FICA obligation or social insurance contributions) required to be withheld with respect

to such Award (or exercise thereof).

b.

Withholding Arrangements. The Administrator, in its sole discretion and pursuant to such procedures as it may specify from time

to time, may permit a Participant to satisfy such tax withholding obligation, in whole or in part by (without limitation) (a) paying cash,

(b) electing to have the Company withhold otherwise deliverable cash or Shares having a Fair Market Value equal to all or part of the

Participant’s estimated federal, state, local, foreign or other tax obligations with respect to such Award (or exercise thereof),

or (c) delivering to the Company already-owned Shares having a Fair Market Value equal to all or part of such estimated tax obligations

with respect to such Award (or exercise thereof). Except as otherwise determined by the Administrator, the Fair Market Value of the Shares

to be withheld or delivered will be determined as of the date that the taxes are required to be withheld.

c.

Compliance With Code Section 409A. Awards are intended to be designed and operated in such a manner that they are either exempt

from the application of, or comply with, the requirements of Code Section 409A such that the grant, payment, settlement or deferral will

not be subject to the additional tax or interest applicable under Code Section 409A. The Plan and each Award Agreement under the Plan

is intended to meet the requirements of Code Section 409A (or an exemption therefrom) and will be construed and interpreted in accordance

with such intent. To the extent that an Award or payment, or the settlement or deferral thereof, is subject to Code Section 409A, it is

intended that the Award will be granted, paid, settled or deferred in a manner that will meet the requirements of Code Section 409A (or

an exemption therefrom), such that the grant, payment, settlement or deferral will not be subject to the additional tax or interest applicable

under Code Section 409A. Except as provided in an individual Award Agreement initially or by amendment, if and to the extent (i) any portion

of any payment, compensation or other benefit provided to a Participant pursuant to the Plan in connection with his or her employment

termination constitutes “nonqualified deferred compensation” within the meaning of Code Section 409A and (ii) the Participant

is a specified employee as defined in Code Section 409A(a)(2)(B)(i), in each case as determined by the Company in accordance with its

procedures, by which determinations the Participant (through accepting the Award) agrees that he or she is bound, such portion of the

payment, compensation or other benefit shall not be paid before the day that is six months plus one day after the date of “separation

from service” (as determined under Code Section 409A) (the “New Payment Date”), except as Code Section 409A may

then permit. The aggregate of any payments that otherwise would have been paid to the Participant during the period between the date of

separation from service and the New Payment Date shall be paid to the Participant in a lump sum on such New Payment Date, and any remaining

payments will be paid on their original schedule. In no event will the Company be responsible for or reimburse a Participant for any taxes

or other penalties incurred as a result of the application of Code Section 409A.

| 16. | No Effect on Employment or Service. Neither the Plan nor any Award will confer

upon a Participant any right with respect to continuing the Participant’s relationship as a Service Provider with the Company, or

(if different) the Participant’s employer, nor will they interfere in any way with the Participant’s right or the Participant’s

employer’s right to terminate such relationship at any time, with or without cause, to the extent permitted by Applicable Laws. |

| 17. | Clawback Policy. All Awards granted under the Plan will be subject to recoupment

in accordance with any clawback policy adopted by the Company or that the Company is required to adopt pursuant to the listing standards

of any national securities exchange or association on which the Company’s securities are listed or as is otherwise required by Applicable

Laws. In addition, the Board may impose such other clawback, recovery or recoupment provisions in an Award Agreement as the Board determines

necessary or appropriate. |

| 18. | Date of Grant. The date of grant of an Award will be, for all purposes, the

date on which the Administrator makes the determination to grant such Award, or such other later date as is determined by the Administrator.

Notice of the determination will be provided to each Participant within a reasonable time after the date of such grant. |

| 19. | Term of Plan. The Plan will continue in effect for a term of ten (10) years

from the date the Plan is adopted by the Board, unless terminated earlier under Section 20 of the Plan. |

| 20. | Amendment and Termination of the Plan. |

a.

Amendment and Termination. The Committee may at any time amend, alter, suspend or terminate the Plan or any Award Agreement, subject

to the provisions of this Section 20.

b.

Shareholder Approval. The Company will obtain shareholder approval of any Plan amendment to the extent necessary and desirable

to comply with Applicable Laws or as required pursuant to Section 4(d) of the Plan.

c.

Effect of Amendment or Termination. No amendment, alteration, suspension or termination of the Plan or any Award Agreement will

impair the rights of any Participant, unless mutually agreed otherwise between the Participant and the Administrator, which agreement

must be in writing and signed by the Participant and the Company. Termination of the Plan will not affect the Administrator’s ability

to exercise the powers granted to it hereunder with respect to Awards granted under the Plan prior to the date of such termination.

| 21. | Indemnification. In addition to such other rights of indemnification

as they may have as Directors or members of the Committee, and to the extent allowed by Applicable Laws, the Administrator shall be indemnified

by the Company against the reasonable expenses, including attorneys’ fees, actually incurred in connection with any action, suit

or proceeding or in connection with any appeal therein, to which the Administrator may be party by reason of any action taken or failure

to act under or in connection with the Plan or any Award granted under the Plan, and against all amounts paid by the Administrator

in settlement thereof (provided, however, that the settlement has been approved by the Company, which approval shall not be unreasonably

withheld) or paid by the Administrator in satisfaction of a judgment in any such action, suit or proceeding, except in relation to matters

as to which it shall be adjudged in such action, suit or proceeding that such Administrator did not act in good faith and in a manner

which such person reasonably believed to be in the best interests of the Company, or in the case of a criminal proceeding, had no reason

to believe that the conduct complained of was unlawful; provided further, however, that within sixty (60) days after the institution

of any such action, suit or proceeding, such Administrator shall, in writing, offer the Company the opportunity at its own expense to

handle and defend such action, suit or proceeding. |

| 22. | Conditions Upon Issuance of Shares. |

a.

Legal Compliance. Shares will not be issued pursuant to the exercise of an Award unless the exercise of such Award and the issuance

and delivery of such Shares will comply with Applicable Laws and will be further subject to the approval of counsel for the Company with

respect to such compliance.

b.

Investment Representations. As a condition to the exercise of an Award, the Company may require the person exercising such Award

to represent and warrant at the time of any such exercise that the Shares are being purchased only for investment and without any present

intention to sell or distribute such Shares if, in the opinion of counsel for the Company, such a representation is required.

c.

Inability to Obtain Authority. The inability of the Company to obtain authority from any regulatory body having jurisdiction, which

authority is deemed by the Company’s counsel to be necessary to the lawful issuance and sale of any Shares hereunder, will relieve

the Company of any liability in respect of the failure to issue or sell such Shares as to which such requisite authority will not have

been obtained.

d.

Governing Law. The Plan and all Awards hereunder shall be construed in accordance with and governed by the laws of the State of

Delaware, but without regard to its conflict of law provisions.

Adopted by the Board of Directors

on February 15, 2024, and approved by the Company’s shareholders on October 31, 2024.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |