Penns Woods Bancorp, Inc. Announces Stock Repurchase Program

28 Mayo 2024 - 10:26AM

Richard A. Grafmyre, CEO of Penns Woods Bancorp, Inc., (NASDAQ:

PWOD) (“Company”) has announced that the Company’s Board of

Directors has authorized the repurchase of up to 5% of the

outstanding shares of the Company. The repurchase plan is for a

one-year period ending May 31, 2025 and allows for the repurchase

of up to 376,000 shares. The repurchase plan replaces the existing

previously authorized repurchase plan, which expires on May 31,

2024.

Repurchases are authorized to be made by the

Company from time to time at the prevailing market prices on the

open market, in block trades or in privately negotiated

transactions as, in management’s opinion, market conditions

warrant. The repurchase program does not obligate the Company to

purchase any particular number of shares and there can be no

assurances as to the number of shares that will be repurchased

under the program or the timing of any such repurchases. The

program may be suspended, modified, or terminated by the Company at

any time and for any reason.

Penns Woods Bancorp, Inc. is the parent

company of Jersey Shore State Bank, which operates sixteen branch

offices providing financial services in Lycoming, Clinton, Centre,

Montour, Union, and Blair Counties, and Luzerne Bank, which

operates eight branch offices providing financial services in

Luzerne County, and United Insurance Solutions, LLC, which offers

insurance products. Investment and insurance products are

offered through Jersey Shore State Bank’s subsidiary, The M

Group, Inc. D/B/A The Comprehensive Financial Group.

Note: This press release may contain certain

“forward-looking statements” including statements concerning plans,

objectives, future events or performance and assumptions and other

statements, which are statements other than statements of

historical fact. The Company cautions readers that the

following important factors, among others, may have affected and

could in the future affect actual results and could cause actual

results for subsequent periods to differ materially from those

expressed in any forward-looking statement made by or on behalf of

the Company herein: (i) the effect of changes in laws and

regulations, including federal and state banking laws and

regulations, and the associated costs of compliance with such laws

and regulations either currently or in the future as applicable;

(ii) the effect of changes in accounting policies and

practices, as may be adopted by the regulatory agencies as well as

by the Financial Accounting Standards Board, or of changes in the

Company’s organization, compensation and benefit plans;

(iii) the effect on the Company’s competitive position within

its market area of the increasing consolidation within the banking

and financial services industries, including the increased

competition from larger regional and out-of-state banking

organizations as well as non-bank providers of various financial

services; (iv) the effect of changes in interest rates; (v)

the effects of health emergencies, including the spread of

infectious diseases or pandemics; or (vi) the effect of

changes in the business cycle and downturns in the local, regional

or national economies. For a list of other factors which

could affect the Company’s results, see the Company’s filings with

the Securities and Exchange Commission, including

“Item 1A. Risk Factors,” set forth in the Company’s

Annual Report on Form 10-K for the fiscal year ended

December 31, 2023.

Previous press releases and additional

information can be obtained from the Company’s website at

www.pwod.com.

|

Contact: |

Richard A.

Grafmyre, Chief Executive Officer |

|

|

110 Reynolds

Street |

|

|

Williamsport, PA

17702 |

|

|

570-322-1111 |

e-mail: pwod@pwod.com |

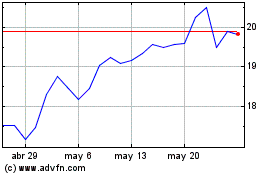

Penns Woods Bancorp (NASDAQ:PWOD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

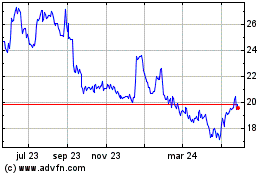

Penns Woods Bancorp (NASDAQ:PWOD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024