Pyxis Oncology Provides Corporate Update and Reports Financial Results for Second Quarter 2024

14 Agosto 2024 - 3:05PM

Pyxis Oncology, Inc. (Nasdaq: PYXS), a clinical stage company

focused on developing next generation therapeutics to target

difficult-to-treat cancers, today reported financial results for

the second quarter ended June 30, 2024, and provided a corporate

update. The Company ended the second quarter of 2024 with $157.2

million in cash, cash equivalents, restricted cash and short-term

investments, which is expected to provide cash runway into the

second half of 2026 and enable the Company to fund the next phase

of PYX-201 clinical development, which the Company plans to

announce in the fall of 2024.

"I'm thrilled with our team's continued

operational and clinical execution prowess that keeps us on track

to deliver preliminary data from our ongoing Phase 1 trial of

PYX-201, a first-in-concept tumor stroma targeting antibody-drug

conjugate (ADC) against the stromal Extradomain-B Fibronectin

(EDB+FN) target, this fall," said Lara S. Sullivan, M.D., President

and Chief Executive Officer of Pyxis Oncology.

Dr. Sullivan added, "To date, we have dosed 72

subjects in the PYX-201 dose escalation study with a continued

focus on head and neck squamous cell carcinoma (HNSCC), non-small

cell lung cancer (NSCLC), ovarian cancer, soft tissue sarcoma, and

pancreatic ductal adenocarcinoma cancer (PDAC) based on an

assessment of factors including immunohistochemistry target

expression, stromal volume, unmet medical need, and clinical

investigator judgment. PYX-201 safety data observed to date

continues to support go-forward monotherapy and

potential combination clinical development strategies, both of

which we believe could have the potential to provide additional

treatment options to patients with difficult-to treat-cancers.”

Recent Clinical Program Updates

PYX-201

PYX-201, an ADC that uniquely targets EDB+FN

within the tumor stroma, is the Company’s lead clinical program

being evaluated in an ongoing Phase 1 trial in multiple types of

solid tumors.

- To date, 72 subjects have been

dosed with PYX-201 in this Phase 1 trial. Dose escalation and

safety monitoring remain ongoing for the trial.

- The Company

expects to announce preliminary data from the Phase 1 trial of

PYX-201, including efficacy, safety, pharmacokinetics (PK), and

provide an update on future development plans in the fall of

2024.

PYX-106

PYX-106, a fully human Siglec-15-targeting

antibody designed to block suppression of T-cell proliferation and

function, is being evaluated in ongoing Phase 1 clinical studies in

multiple types of solid tumors.

- Dose escalation

of PYX-106 and safety monitoring is ongoing with 33 subjects dosed

to date in the Phase 1 trial.

- The Company

expects to report preliminary data from the Phase 1 trial of

PYX-106, including PK/pharmacodynamic results, by year-end

2024.

Second Quarter 2024 Financial Results

- As of June 30, 2024, Pyxis Oncology

had cash and cash equivalents, including restricted cash and

short-term investments of $157.2 million. The Company believes that

its current cash, cash equivalents, and short-term investments will

be sufficient to fund its operations into the second half of 2026,

including the Company’s current projections for PYX-201's next

phase of clinical development.

- Research and development expenses

were $13.9 million for the quarter ended June 30, 2024, compared to

$11.4 million for the quarter ended June 30, 2023. The

period-over-period increase was primarily due to increased clinical

trial-related expenses, including manufacturing of drug product and

drug substance for our ongoing Phase 1 clinical trials of PYX-201

and PYX-106.

- General and administrative expenses

were $6.1 million for the quarter ended June 30, 2024, compared to

$6.7 million for the quarter ended June 30, 2023. The

period-over-period decline was primarily due to lower professional

and consultant fees.

- Net loss was $17.3 million, or

($0.29) per common share, for the quarter ended June 30, 2024,

compared to $15.9 million, or ($0.41) per common share, for the

quarter ended June 30, 2023. Net losses for the quarters ended June

30, 2024 and 2023 included $2.9 million and $3.7 million,

respectively, related to non-cash stock-based compensation

expense.

- As of August 14, 2024, the

outstanding number of shares of common stock of Pyxis Oncology was

58,942,243.

About Pyxis Oncology, Inc.Pyxis

Oncology, Inc. is a clinical stage company focused on defeating

difficult-to-treat cancers. The company is efficiently building

next generation therapeutics that hold the potential for mono and

combination therapies. PYX-201, an antibody-drug conjugate (ADC)

that uniquely targets EDB+FN within the tumor stroma, and PYX-106,

a fully human Siglec-15-targeting antibody designed to block

suppression of T-cell proliferation and function, are being

evaluated in ongoing Phase 1 clinical studies in multiple types of

solid tumors. Pyxis Oncology’s therapeutic candidates are designed

to directly kill tumor cells and to address the underlying

pathologies created by cancer that enable its uncontrollable

proliferation and immune evasion. Pyxis Oncology’s ADC and

immuno-oncology (IO) programs employ novel and emerging strategies

to target a broad range of solid tumors resistant to current

standards of care. To learn more, visit

www.pyxisoncology.com or follow us

on Twitter and LinkedIn.

Forward-Looking StatementsThis

press release contains forward-looking statements for the purposes

of the safe harbor provisions under The Private Securities

Litigation Reform Act of 1995 and other federal securities laws.

These statements are often identified by the use of words such as

“anticipate,” “believe,” “can,” “continue,” “could,” “estimate,”

“expect,” “intend,” “likely,” “may,” “might,” “objective,”

“ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “to

be,” “will,” “would,” or the negative or plural of these words, or

similar expressions or variations, although not all forward-looking

statements contain these words. We cannot assure you that the

events and circumstances reflected in the forward-looking

statements will be achieved or occur and actual results could

differ materially from those expressed or implied by these

forward-looking statements. Factors that could cause or contribute

to such differences include, but are not limited to, those

identified herein, and those discussed in the section titled “Risk

Factors” set forth in Part II, Item 1A. of the Company’s Quarterly

Report on Form 10-Q filed with SEC on August 14, 2024, and our

other filings, each of which is on file with the Securities and

Exchange Commission. These risks are not exhaustive. New risk

factors emerge from time to time, and it is not possible for our

management to predict all risk factors, nor can we assess the

impact of all factors on our business or the extent to which any

factor, or combination of factors, may cause actual results to

differ materially from those contained in any forward-looking

statements. In addition, statements that “we believe” and similar

statements reflect our beliefs and opinions on the relevant

subject. These statements are based upon information available to

us as of the date hereof and while we believe such information

forms a reasonable basis for such statements, such information may

be limited or incomplete, and our statements should not be read to

indicate that we have conducted an exhaustive inquiry into, or

review of, all potentially available relevant information. These

statements are inherently uncertain, and investors are cautioned

not to unduly rely upon these statements. Except as required by

law, we undertake no obligation to update any forward-looking

statements to reflect events or circumstances after the date of

such statements.

Pyxis Oncology ContactPamela

ConnealyCFO and COOir@pyxisoncology.com

|

|

|

PYXIS ONCOLOGY, INC. |

| |

|

|

|

|

|

|

Condensed Consolidated Statements of Operations and

Comprehensive Loss(In thousands, except share and per

share amounts)(Unaudited) |

| |

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

2024 |

|

|

2023 |

|

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Royalty revenues |

|

$ |

— |

|

|

$ |

— |

|

$ |

8,146 |

|

|

$ |

— |

|

|

Sale of royalty rights |

|

|

— |

|

|

|

— |

|

|

8,000 |

|

|

|

— |

|

|

Total revenues |

|

|

— |

|

|

|

— |

|

|

16,146 |

|

|

|

— |

|

| Costs and operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

|

— |

|

|

|

— |

|

|

475 |

|

|

|

— |

|

|

Research and development |

|

|

13,953 |

|

|

|

11,391 |

|

|

26,982 |

|

|

|

23,292 |

|

|

General and administrative |

|

|

6,079 |

|

|

|

6,730 |

|

|

14,326 |

|

|

|

15,783 |

|

|

Total costs and operating expenses |

|

|

20,032 |

|

|

|

18,121 |

|

|

41,783 |

|

|

|

39,075 |

|

| Loss from operations |

|

|

(20,032 |

) |

|

|

(18,121 |

) |

|

(25,637 |

) |

|

|

(39,075 |

) |

| Other income, net: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and investment income |

|

|

2,023 |

|

|

|

1,656 |

|

|

3,573 |

|

|

|

3,329 |

|

|

Sublease income |

|

|

708 |

|

|

|

564 |

|

|

1,507 |

|

|

|

602 |

|

|

Total other income, net |

|

|

2,731 |

|

|

|

2,220 |

|

|

5,080 |

|

|

|

3,931 |

|

| Net loss |

|

$ |

(17,301 |

) |

|

$ |

(15,901 |

) |

$ |

(20,557 |

) |

|

$ |

(35,144 |

) |

| Net loss per common share -

basic and diluted |

|

$ |

(0.29 |

) |

|

$ |

(0.41 |

) |

$ |

(0.37 |

) |

|

$ |

(0.95 |

) |

| Weighted average shares of

common stock outstanding - basic and diluted |

|

|

60,495,675 |

|

|

|

38,389,123 |

|

|

55,892,479 |

|

|

|

36,878,787 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PYXIS ONCOLOGY, INC. |

|

|

|

|

|

|

|

|

|

Condensed Consolidated Balance Sheets(In

thousands, except per share

amounts)(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

June 30, 2024 |

|

|

December 31, 2023 |

|

| Assets |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

25,074 |

|

|

$ |

9,664 |

|

|

Marketable debt securities, short-term |

|

|

130,650 |

|

|

|

109,634 |

|

|

Restricted cash |

|

|

1,472 |

|

|

|

1,472 |

|

|

Prepaid expenses and other current assets |

|

|

3,842 |

|

|

|

3,834 |

|

|

Total current assets |

|

|

161,038 |

|

|

|

124,604 |

|

| Property and equipment,

net |

|

|

11,069 |

|

|

|

11,872 |

|

| Intangible assets, net |

|

|

23,675 |

|

|

|

24,308 |

|

| Right-of-use asset |

|

|

12,607 |

|

|

|

12,942 |

|

| Total

assets |

|

$ |

208,389 |

|

|

$ |

173,726 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

5,470 |

|

|

$ |

3,896 |

|

|

Accrued expenses and other current liabilities |

|

|

10,089 |

|

|

|

12,971 |

|

|

Lease liabilities, current portion |

|

|

1,338 |

|

|

|

1,232 |

|

|

Deferred revenues |

|

|

— |

|

|

|

7,660 |

|

|

Total current liabilities |

|

|

16,897 |

|

|

|

25,759 |

|

| Operating lease liabilities,

net of current portion |

|

|

19,399 |

|

|

|

20,099 |

|

| Financing lease liabilities,

net of current portion |

|

|

135 |

|

|

|

— |

|

| Deferred tax liability,

net |

|

|

2,164 |

|

|

|

2,164 |

|

|

Total liabilities |

|

|

38,595 |

|

|

|

48,022 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

Preferred stock, par value $0.001 per share |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value per share |

|

|

59 |

|

|

|

45 |

|

|

Additional paid-in capital |

|

|

476,619 |

|

|

|

411,821 |

|

|

Accumulated other comprehensive (loss) income |

|

|

(102 |

) |

|

|

63 |

|

|

Accumulated deficit |

|

|

(306,782 |

) |

|

|

(286,225 |

) |

|

Total stockholders’ equity |

|

|

169,794 |

|

|

|

125,704 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

208,389 |

|

|

$ |

173,726 |

|

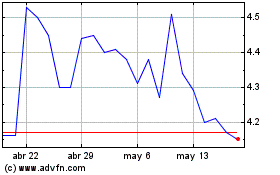

Pyxis Oncology (NASDAQ:PYXS)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Pyxis Oncology (NASDAQ:PYXS)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024