Quest Resource Holding Corporation Reports Second Quarter 2024 Financial Results

08 Agosto 2024 - 3:00PM

Quest Resource Holding Corporation (Nasdaq: QRHC)

(“Quest” or the “Company”), a national leader in

environmental waste and recycling services, today announced

financial results for the second quarter ended June 30, 2024.

“I am incredibly proud of the positive reaction

and feedback we have received from clients we are onboarding, one

of which has already committed to expanding our engagement with

additional services. It is great to see that

investments in our platform to ensure seamless implementation

combined with outstanding client service are resulting in

significant value add for our clients. We believe we continue to

differentiate Quest from the competition and are further

solidifying our position as the waste and recycling services

provider of choice,” said S. Ray Hatch, President and Chief

Executive Officer of Quest.

“We saw strong revenue growth with existing and

new clients, which was offset by lower-than-expected production

volumes at one of our largest clients due to soft conditions in

their end market. After some client-related delays, implementations

from all new client wins are now well underway. With the steady

ramp of new clients, expanded engagements from existing clients,

and new client wins from a growing pipeline, we remain on track for

double digit gross profit dollar and adjusted EBITDA growth during

2024, 2025 and beyond.”

Second Quarter 2024

Highlights

- Revenue was $73.1 million, a 1.8%

decrease compared with the second quarter of 2023.

- Gross profit was $13.5 million,

which was flat compared with the second quarter of 2023.

- Gross margin was 18.5% of revenue

compared with 18.1% for the second quarter of 2023.

- GAAP net loss was $(1.5) million,

compared with GAAP net loss of $(0.9) million during the second

quarter of 2023.

- GAAP net loss per basic and diluted

share attributable to common stockholders was $(0.07), compared

with $(0.04) for the second quarter of 2023.

- Adjusted EBITDA was $5.1 million,

compared with $5.0 million during the second quarter of 2023.

- Adjusted net income per diluted

share was $0.03, compared with adjusted net income of $0.07 per

diluted share during the second quarter of 2023.

Year-to-Date 2024 Highlights (June 30,

2024)

- Revenue was $145.8 million, a 1.9%

decrease compared with the same period of 2023.

- Gross profit was $27.6 million,

a 5.5% increase compared with the same period of 2023.

- Gross margin was 18.9% of revenue

compared with 17.6% during the same period of 2023.

- GAAP net loss was $(2.2) million,

compared with GAAP net loss of $(2.9) million during the same

period of 2023.

- GAAP net loss per basic and diluted

share attributable to common stockholders was $(0.11), compared

with $(0.15) during the same period of 2023.

- Year-to-date Adjusted EBITDA was

$10.3 million, a 13.7% increase compared to $9.0 million during the

same period of 2023.

- Adjusted net income per diluted

share was $0.10, compared with $0.10 per diluted share during the

same period of 2023.

Recent Highlights

- Onboarded and began ramping seven

new clients to date, a first for the Company.

- Signed three expansion agreements

with existing clients, each of which is expected to incrementally

produce seven figures in annual revenue.

- As previously announced, secured a

new client in the grocery vertical that is expected to produce

eight figures of annual revenue.

- Expanded efficiency initiatives.

Our automated accounts payable processing module, enhanced by

artificial intelligence, is now processing about three quarters of

vendors through this platform to drive highly efficient zero touch

initiative.

- Promoted Perry Moss to the newly

created position of Chief Revenue Officer.

- Added to the Russell 2000® and

Russell 3000® Indexes as part of the Russell indexes annual

reconstitution.

Second Quarter 2024 Earnings Conference

Call and Webcast

Quest will host a conference call on Thursday,

August 8, 2024, at 5:00 PM ET, to review the financial results for

the second quarter ended June 30, 2024. To participate, dial

1-800-717-1738 or 1-646-307-1865. The conference call, which may

include forward-looking statements, is also being webcast and is

available via the investor relations section of Quest’s website at

https://investors.qrhc.com/investors. A replay of the webcast will

be archived on Quest’s investor relations website for 90 days.

About Quest Resource Holding

Corporation

Quest is a national provider of waste and

recycling services that enable larger businesses to excel in

achieving their environmental and sustainability goals and

responsibilities. Quest delivers focused expertise across multiple

industry sectors to build single-source, client-specific solutions

that generate quantifiable business and sustainability results.

Addressing a wide variety of waste streams and recyclables, Quest

provides information and data that tracks and reports the

environmental results of Quest’s services, gives actionable data to

improve business operations, and enables Quest’s clients to excel

in their business and sustainability responsibilities. For more

information, visit www.qrhc.com.

Reconciliation of U.S. GAAP to Non-GAAP

Financial Measures

In this press release, non-GAAP financial

measures, “Adjusted EBITDA” and “Adjusted Net Income” are

presented. From time-to-time, Quest considers and uses these

supplemental measures of operating performance in order to provide

an improved understanding of underlying performance trends. Quest

believes it is useful to review, as applicable, both (1) GAAP

measures that include (i) depreciation and amortization, (ii)

interest expense, (iii) stock-based compensation expense, (iv)

income tax expense, and (v) certain other adjustments, and (2)

non-GAAP measures that exclude such items. Quest presents these

non-GAAP measures because it considers it an important supplemental

measure of Quest’s performance. Quest’s definition of these

adjusted financial measures may differ from similarly named

measures used by others. Quest believes these measures facilitate

operating performance comparisons from period to period by

eliminating potential differences caused by the existence and

timing of certain expense items that would not otherwise be

apparent on a GAAP basis. These non-GAAP measures have limitations

as an analytical tool and should not be considered in isolation or

as a substitute for the Company’s GAAP measures. (See attached

tables “Reconciliation of Net Loss to Adjusted EBITDA” and

“Adjusted Net Income Per Share”).

Safe Harbor Statement

This press release contains forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended, which provides a “safe harbor”

for such statements in certain circumstances. The forward-looking

statements include, but are not limited to, our belief that we are

differentiating ourselves from the competition and further

solidifying our position as the waste and recycling services

provider of choice, and our expectation that we remain on track for

double digit gross profit dollar and adjusted EBITDA growth during

2024, 2025 and beyond. Actual events or results could differ

materially from those discussed in the forward-looking statements

as a result of various factors, including, but not limited to,

competition in the environmental services industry, the impact of

the current economic environment, the spread of major epidemics

(including Coronavirus) and other related uncertainties such as

government-imposed travel restrictions, interruptions to supply

chains, commodity price fluctuations, extended shut down of

businesses, and other factors discussed in greater detail in our

filings with the Securities and Exchange Commission (“SEC”),

including in our Annual Report on Form 10-K for the year ended

December 31, 2023. You are cautioned not to place undue reliance on

such statements and to consult our SEC filings for additional risks

and uncertainties that may apply to our business and the ownership

of our securities. Our forward-looking statements are presented as

of the date made, and we disclaim any duty to update such

statements unless required by law to do so.

Investor Relations Contact:

Three Part Advisors, LLCJoe Noyons

817.778.8424

Financial Tables Follow

| |

|

|

Quest Resource Holding Corporation and

SubsidiariesSTATEMENTS OF OPERATIONS

(Unaudited)(In thousands, except per share amounts) |

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 30, |

|

June 30, |

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Revenue |

|

$ |

73,145 |

|

|

$ |

74,497 |

|

|

$ |

145,796 |

|

|

$ |

148,611 |

|

| Cost of revenue |

|

|

59,613 |

|

|

|

60,992 |

|

|

|

118,228 |

|

|

|

122,476 |

|

| Gross profit |

|

|

13,532 |

|

|

|

13,505 |

|

|

|

27,568 |

|

|

|

26,135 |

|

|

Selling, general, and administrative |

|

|

9,386 |

|

|

|

9,213 |

|

|

|

19,184 |

|

|

|

18,630 |

|

|

Depreciation and amortization |

|

|

2,364 |

|

|

|

2,452 |

|

|

|

4,726 |

|

|

|

4,877 |

|

| Total operating expenses |

|

|

11,750 |

|

|

|

11,665 |

|

|

|

23,910 |

|

|

|

23,507 |

|

| Operating income |

|

|

1,782 |

|

|

|

1,840 |

|

|

|

3,658 |

|

|

|

2,628 |

|

|

Interest expense |

|

|

(2,612 |

) |

|

|

(2,556 |

) |

|

|

(5,084 |

) |

|

|

(4,999 |

) |

| Loss before taxes |

|

|

(830 |

) |

|

|

(716 |

) |

|

|

(1,426 |

) |

|

|

(2,371 |

) |

| Income tax expense |

|

|

684 |

|

|

|

171 |

|

|

|

743 |

|

|

|

540 |

|

| Net loss |

|

$ |

(1,514 |

) |

|

$ |

(887 |

) |

|

$ |

(2,169 |

) |

|

$ |

(2,911 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss applicable to common

stockholders |

|

$ |

(1,514 |

) |

|

$ |

(887 |

) |

|

$ |

(2,169 |

) |

|

$ |

(2,911 |

) |

| Net loss per common

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.07 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.11 |

) |

|

$ |

(0.15 |

) |

|

Diluted |

|

$ |

(0.07 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.11 |

) |

|

$ |

(0.15 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of

common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

20,507 |

|

|

|

19,962 |

|

|

|

20,446 |

|

|

|

19,947 |

|

|

Diluted |

|

|

20,507 |

|

|

|

19,962 |

|

|

|

20,446 |

|

|

|

19,947 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

RECONCILIATION OF NET LOSS TO ADJUSTED

EBITDA(Unaudited)(In thousands) |

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 30, |

|

June 30, |

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Net loss |

|

$ |

(1,514 |

) |

|

$ |

(887 |

) |

|

$ |

(2,169 |

) |

|

$ |

(2,911 |

) |

| Depreciation and

amortization |

|

|

2,605 |

|

|

|

2,539 |

|

|

|

5,101 |

|

|

|

5,048 |

|

| Interest expense |

|

|

2,612 |

|

|

|

2,556 |

|

|

|

5,084 |

|

|

|

4,999 |

|

| Stock-based compensation

expense |

|

|

363 |

|

|

|

363 |

|

|

|

720 |

|

|

|

661 |

|

| Acquisition, integration, and

related costs |

|

|

19 |

|

|

|

174 |

|

|

|

61 |

|

|

|

652 |

|

| Other adjustments |

|

|

370 |

|

|

|

117 |

|

|

|

719 |

|

|

|

31 |

|

| Income tax expense |

|

|

684 |

|

|

|

171 |

|

|

|

743 |

|

|

|

540 |

|

| Adjusted EBITDA |

|

$ |

5,139 |

|

|

$ |

5,033 |

|

|

$ |

10,259 |

|

|

$ |

9,020 |

|

| |

|

ADJUSTED NET INCOME PER SHARE(Unaudited)(In

thousands) |

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 30, |

|

June 30, |

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Reported net loss (1) |

|

$ |

(1,514 |

) |

|

$ |

(887 |

) |

|

$ |

(2,169 |

) |

|

$ |

(2,911 |

) |

| Amortization of intangibles

(2) |

|

|

2,221 |

|

|

|

2,223 |

|

|

|

4,441 |

|

|

|

4,444 |

|

| Acquisition, integration, and

related costs (3) |

|

|

19 |

|

|

|

174 |

|

|

|

61 |

|

|

|

652 |

|

| Other adjustments (4) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(76 |

) |

| Adjusted net income |

|

$ |

726 |

|

|

$ |

1,510 |

|

|

$ |

2,333 |

|

|

$ |

2,109 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings

(loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reported net loss |

|

$ |

(0.07 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.11 |

) |

|

$ |

(0.15 |

) |

| Adjusted net income |

|

$ |

0.03 |

|

|

$ |

0.07 |

|

|

$ |

0.10 |

|

|

$ |

0.10 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of

common shares outstanding: Diluted (5) |

|

|

22,974 |

|

|

|

22,037 |

|

|

|

22,777 |

|

|

|

22,101 |

|

(1) Applicable to common

stockholders (2) Reflects the

elimination of non-cash amortization of acquisition-related

intangible assets (3) Reflects

the add back of acquisition/integration related transaction

costs (4) Reflects adjustments

to earn-out fair value

(5) Reflects adjustment for dilution when adjusted

net income is positive

| |

|

BALANCE SHEETS(In thousands, except per share

amounts) |

| |

| |

|

June 30, |

|

December 31, |

|

|

|

2024 |

|

2023 |

| |

|

|

(Unaudited) |

|

|

|

|

ASSETS |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

958 |

|

|

$ |

324 |

|

| Accounts receivable, less

allowance for doubtful accounts of $1,888 and $1,582 as of

June 30, 2024 and December 31, 2023, respectively |

|

|

62,461 |

|

|

|

58,147 |

|

| Prepaid expenses and other

current assets |

|

|

2,575 |

|

|

|

2,142 |

|

|

Total current assets |

|

|

65,994 |

|

|

|

60,613 |

|

| |

|

|

|

|

|

|

| Goodwill |

|

|

85,828 |

|

|

|

85,828 |

|

| Intangible assets, net |

|

|

22,091 |

|

|

|

26,052 |

|

| Property and equipment, net,

and other assets |

|

|

7,839 |

|

|

|

4,626 |

|

|

Total assets |

|

$ |

181,752 |

|

|

$ |

177,119 |

|

| |

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

| Accounts payable and accrued

liabilities |

|

$ |

41,426 |

|

|

$ |

41,296 |

|

| Other current liabilities |

|

|

1,766 |

|

|

|

2,470 |

|

| Current portion of notes

payable |

|

|

1,159 |

|

|

|

1,159 |

|

|

Total current liabilities |

|

|

44,351 |

|

|

|

44,925 |

|

| |

|

|

|

|

|

|

| Notes payable, net |

|

|

70,749 |

|

|

|

64,638 |

|

| Other long-term

liabilities |

|

|

1,057 |

|

|

|

1,275 |

|

|

Total liabilities |

|

|

116,157 |

|

|

|

110,838 |

|

| |

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

| Preferred stock, $0.001 par

value, 10,000 shares authorized, no shares issued and

outstanding as of June 30, 2024 and December 31, 2023 |

|

|

— |

|

|

|

— |

|

| Common stock, $0.001 par

value, 200,000 shares authorized, 20,357 and 20,161 shares

issued and outstanding as of June 30, 2024 and December 31,

2023, respectively |

|

|

20 |

|

|

|

20 |

|

| Additional paid-in

capital |

|

|

177,793 |

|

|

|

176,309 |

|

| Accumulated deficit |

|

|

(112,218 |

) |

|

|

(110,048 |

) |

|

Total stockholders’ equity |

|

|

65,595 |

|

|

|

66,281 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

181,752 |

|

|

$ |

177,119 |

|

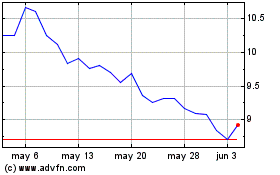

Quest Resource (NASDAQ:QRHC)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Quest Resource (NASDAQ:QRHC)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024