Q10001762303--12-31falsehttp://avitamedical.com/20240331#ContractualMaturitiesMemberhttp://avitamedical.com/20240331#ContractualMaturitiesMemberhttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#UsefulLifeShorterOfTermOfLeaseOrAssetUtilityMemberhttp://fasb.org/us-gaap/2023#NonqualifiedPlanMemberhttp://fasb.org/us-gaap/2023#NonqualifiedPlanMember0001762303rcel:StedicalScientificIncMemberrcel:PermeadermMember2024-03-310001762303rcel:WarrantLiabilityMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001762303rcel:PatentSevenMember2023-12-310001762303rcel:DeferredCompensationPlansMember2023-12-310001762303us-gaap:RetainedEarningsMember2023-03-310001762303us-gaap:TrademarksMember2024-03-310001762303us-gaap:FairValueInputsLevel3Memberus-gaap:LongTermDebtMember2024-03-310001762303rcel:PermeadermMember2024-01-012024-03-310001762303us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001762303rcel:NonQualifiedDeferredCompensationPlanMembersrt:MinimumMember2024-01-012024-03-310001762303rcel:CommercialSalesMemberrcel:RecellSystemMember2024-01-012024-03-310001762303us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001762303us-gaap:FairValueMeasurementsRecurringMember2024-03-310001762303us-gaap:OtherCurrentLiabilitiesMemberrcel:COSMOTECMember2024-03-310001762303rcel:BlackScholesOptionPricingModelMemberus-gaap:MeasurementInputSharePriceMemberus-gaap:FairValueInputsLevel3Member2024-03-3100017623032022-12-310001762303rcel:ContractLiabilitiesMember2024-03-310001762303us-gaap:LeaseholdImprovementsMember2024-03-310001762303rcel:WarrantLiabilityMemberus-gaap:FairValueInputsLevel3Member2024-01-012024-03-310001762303rcel:DeferredCompensationPlansMember2024-03-3100017623032023-06-012023-06-300001762303us-gaap:USTreasurySecuritiesMember2024-03-3100017623032024-05-060001762303country:AU2024-01-012024-03-310001762303rcel:TrancheTwoMemberrcel:SeniorSecuredCreditFacilityMemberrcel:OrbimedMember2023-10-180001762303rcel:PatentOneMember2023-12-310001762303us-gaap:FairValueInputsLevel3Memberrcel:WarrantLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001762303us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001762303us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001762303us-gaap:FairValueInputsLevel2Memberrcel:NonQualifiedDeferredCompensationPlanLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001762303us-gaap:MeasurementInputExercisePriceMemberrcel:BlackScholesOptionPricingModelMemberus-gaap:FairValueInputsLevel3Member2023-12-310001762303rcel:CommercialSalesMemberrcel:RecellSystemMember2023-01-012023-03-310001762303us-gaap:AdditionalPaidInCapitalMember2023-03-310001762303rcel:AdrsMemberrcel:ShareholdersOfAvitaMedicalMember2024-01-012024-03-310001762303us-gaap:RetainedEarningsMember2023-12-310001762303country:JP2024-01-012024-03-310001762303rcel:SeniorSecuredCreditFacilityMembersrt:MinimumMemberrcel:OrbimedMember2023-10-182023-10-180001762303country:JP2023-01-012023-03-310001762303us-gaap:CommonStockMember2023-12-3100017623032023-01-012023-03-310001762303us-gaap:CustomerConcentrationRiskMemberrcel:CommercialCustomerMemberus-gaap:SalesRevenueNetMember2023-01-012023-03-310001762303us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-12-310001762303us-gaap:FairValueMeasurementsRecurringMemberrcel:CorporateOwnedLifeInsurancePoliciesMember2024-03-310001762303rcel:SeniorSecuredCreditFacilityMemberrcel:OrbimedMember2024-01-012024-03-310001762303rcel:DeferredCompensationPlansMember2024-01-012024-03-310001762303us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310001762303us-gaap:TrademarksMember2023-12-310001762303rcel:CommercialSalesMemberrcel:OtherWoundCareProductsMember2024-01-012024-03-310001762303rcel:PatentFiveMember2024-03-310001762303rcel:PatentTwoMember2023-12-310001762303us-gaap:AdditionalPaidInCapitalMember2023-12-310001762303us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001762303us-gaap:ThreatenedLitigationMember2024-03-310001762303rcel:DeferredCommercialRevenueRecognizedMember2024-01-012024-03-310001762303us-gaap:PerformanceSharesMember2024-01-012024-03-310001762303us-gaap:RetainedEarningsMember2023-01-012023-03-310001762303us-gaap:CashEquivalentsMemberus-gaap:MoneyMarketFundsMember2023-12-310001762303rcel:NonOptionsTenureBasedRestrictedStockUnitsMember2023-12-310001762303rcel:NonQualifiedDeferredCompensationPlanMember2024-01-012024-03-310001762303rcel:BlackScholesOptionPricingModelMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-12-3100017623032023-03-310001762303us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001762303rcel:PatentThreeMember2024-03-310001762303us-gaap:ComputerEquipmentMembersrt:MinimumMember2024-03-3100017623032024-01-310001762303us-gaap:EquipmentMember2024-03-310001762303rcel:NonQualifiedDeferredCompensationPlanLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001762303us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRevenueMultipleMemberrcel:MonteCarloSimulationMember2023-12-310001762303rcel:PatentTenMember2023-12-310001762303country:US2024-01-012024-03-310001762303us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001762303us-gaap:SellingAndMarketingExpenseMember2024-01-012024-03-3100017623032023-12-310001762303us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMemberrcel:MonteCarloSimulationMember2023-12-310001762303rcel:SeniorSecuredCreditFacilityMemberrcel:OrbimedMember2023-10-180001762303rcel:RecellMouldsMember2024-03-3100017623032024-03-310001762303us-gaap:CommonStockMember2022-12-310001762303rcel:PatentNineMember2024-03-310001762303us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001762303rcel:RecellMouldsMember2023-12-310001762303rcel:NonQualifiedDeferredCompensationPlanMemberrcel:DeferredCompensationPlansVestingTrancheTwoMember2024-01-012024-03-310001762303us-gaap:ConstructionInProgressMember2023-12-310001762303us-gaap:EmployeeStockMember2023-12-310001762303us-gaap:CommonStockMember2024-01-012024-03-310001762303rcel:EmployeeStockPurchasePlanMember2024-01-012024-03-310001762303us-gaap:FairValueInputsLevel3Memberus-gaap:LongTermDebtMember2023-12-310001762303us-gaap:FurnitureAndFixturesMember2023-12-310001762303rcel:PatentElevenMember2023-12-310001762303country:US2023-01-012023-03-310001762303rcel:WarrantLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001762303us-gaap:PerformanceSharesMember2023-12-310001762303us-gaap:CashEquivalentsMember2024-03-310001762303us-gaap:CustomerConcentrationRiskMemberrcel:CommercialCustomerMemberus-gaap:SalesRevenueNetMember2024-01-012024-03-310001762303us-gaap:LeaseholdImprovementsMember2023-12-310001762303rcel:ContractLiabilitiesMemberrcel:COSMOTECMember2024-03-310001762303rcel:ContractLiabilitiesMember2023-12-310001762303us-gaap:MeasurementInputExpectedDividendRateMemberrcel:BlackScholesOptionPricingModelMemberus-gaap:FairValueInputsLevel3Member2023-12-310001762303us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001762303rcel:ProductCostMember2023-01-012023-03-310001762303rcel:PatentOneMember2024-03-310001762303us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001762303rcel:CommonStockHeldByNonQualifiedDeferredCompensationPlanMember2022-12-310001762303us-gaap:EmployeeStockOptionMember2023-01-012023-03-310001762303rcel:NonQualifiedDeferredCompensationPlanMember2023-12-310001762303rcel:PatentEightMember2024-03-310001762303us-gaap:RetainedEarningsMember2022-12-310001762303us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-12-310001762303us-gaap:FairValueMeasurementsRecurringMemberus-gaap:LongTermDebtMember2023-12-310001762303us-gaap:AdditionalPaidInCapitalMember2024-03-310001762303us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMemberrcel:MonteCarloSimulationMember2023-12-310001762303us-gaap:CashEquivalentsMember2023-12-310001762303us-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001762303us-gaap:EmployeeStockOptionMember2024-01-012024-03-310001762303us-gaap:ConstructionInProgressMember2024-03-310001762303rcel:COSMOTECMember2024-01-012024-03-310001762303us-gaap:ComputerEquipmentMembersrt:MaximumMember2024-03-310001762303country:GB2023-01-012023-03-310001762303rcel:PatentFiveMember2023-12-310001762303srt:MaximumMemberus-gaap:EquipmentMember2024-03-310001762303us-gaap:FairValueInputsLevel3Memberus-gaap:LongTermDebtMember2023-01-012023-12-310001762303us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberrcel:CorporateOwnedLifeInsurancePoliciesMember2023-12-310001762303rcel:PatentSixMember2023-12-310001762303rcel:PatentSevenMember2024-03-310001762303us-gaap:MeasurementInputExercisePriceMemberrcel:BlackScholesOptionPricingModelMemberus-gaap:FairValueInputsLevel3Member2024-03-310001762303rcel:PatentElevenMember2024-03-310001762303us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRevenueMultipleMemberrcel:MonteCarloSimulationMember2024-03-310001762303rcel:DeferredCompensationPlansVestingTrancheOneMemberrcel:NonQualifiedDeferredCompensationPlanMember2024-01-012024-03-310001762303us-gaap:MeasurementInputExpectedDividendRateMemberrcel:BlackScholesOptionPricingModelMemberus-gaap:FairValueInputsLevel3Member2024-03-310001762303srt:MaximumMemberrcel:SeniorSecuredCreditFacilityMemberrcel:OrbimedMember2023-10-180001762303rcel:NonOptionRestrictedStockUnitsMember2024-01-012024-03-310001762303us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001762303us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001762303rcel:NonQualifiedDeferredCompensationPlanLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001762303us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001762303us-gaap:FairValueMeasurementsRecurringMemberus-gaap:LongTermDebtMember2024-03-310001762303country:GB2024-01-012024-03-310001762303us-gaap:USTreasurySecuritiesMemberus-gaap:CashEquivalentsMember2023-12-310001762303us-gaap:MeasurementInputExpectedTermMemberrcel:BlackScholesOptionPricingModelMemberus-gaap:FairValueInputsLevel3Member2023-12-310001762303us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-03-310001762303us-gaap:OtherCurrentLiabilitiesMemberrcel:COSMOTECMember2023-12-310001762303us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMemberrcel:MonteCarloSimulationMember2024-03-310001762303us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001762303us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-03-310001762303rcel:NonOptionsTenureBasedRestrictedStockUnitsMember2024-03-310001762303us-gaap:CommonStockMember2023-03-310001762303rcel:COSMOTECMember2023-01-012023-03-310001762303rcel:PatentNineMember2023-12-310001762303us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:LongTermDebtMember2024-03-310001762303us-gaap:MeasurementInputExpectedTermMemberrcel:BlackScholesOptionPricingModelMemberus-gaap:FairValueInputsLevel3Member2024-03-310001762303us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberrcel:CorporateOwnedLifeInsurancePoliciesMember2024-03-310001762303us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001762303us-gaap:WarrantMember2024-01-012024-03-310001762303us-gaap:FurnitureAndFixturesMember2024-03-310001762303rcel:NonOptionPerformanceBasedRestrictedStockUnitsMember2024-01-012024-03-310001762303us-gaap:FairValueInputsLevel3Member2024-01-012024-03-310001762303us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-03-310001762303us-gaap:OtherCurrentLiabilitiesMember2024-03-310001762303us-gaap:FairValueInputsLevel3Memberrcel:WarrantLiabilityMember2023-12-310001762303rcel:ServiceOnlyShareOptionsMember2024-01-012024-03-310001762303rcel:NonQualifiedDeferredCompensationPlanMember2023-01-012023-03-310001762303rcel:CommonStockHeldByNonQualifiedDeferredCompensationPlanMember2024-03-310001762303rcel:PatentTwoMember2024-03-310001762303us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001762303us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001762303us-gaap:CommonStockMember2023-01-012023-03-310001762303rcel:ContractLiabilitiesMemberrcel:COSMOTECMember2023-12-310001762303rcel:NonOptionsTenureBasedRestrictedStockUnitsMember2024-01-012024-03-310001762303us-gaap:EmployeeStockMember2024-01-012024-03-310001762303rcel:ServiceOnlyShareOptionsMember2023-12-310001762303us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-03-310001762303rcel:RevenueForRightOfFirstAccessMember2024-01-012024-03-310001762303rcel:CommonStockHeldByNonQualifiedDeferredCompensationPlanMember2023-12-310001762303rcel:BlackScholesOptionPricingModelMemberus-gaap:MeasurementInputSharePriceMemberus-gaap:FairValueInputsLevel3Member2023-12-310001762303rcel:CommercialCustomerMemberus-gaap:AccountsReceivableMember2024-01-012024-03-310001762303rcel:StedicalScientificDistributorAgreementMember2024-01-100001762303rcel:ServiceOnlyShareOptionsMember2024-03-310001762303rcel:CommercialSalesMember2024-01-012024-03-310001762303us-gaap:ComputerEquipmentMember2023-12-310001762303rcel:SeniorSecuredCreditFacilityMembersrt:MinimumMemberrcel:OrbimedMember2023-10-180001762303rcel:DeferredCompensationPlansMember2022-12-310001762303rcel:WarrantLiabilityMemberus-gaap:FairValueInputsLevel3Member2023-01-012023-12-310001762303rcel:WarrantLiabilityMemberus-gaap:FairValueInputsLevel3Member2024-03-310001762303us-gaap:CommonStockMember2024-03-310001762303rcel:EmergencyPreparednessServiceCostMember2023-01-012023-03-310001762303us-gaap:AccountsReceivableMemberrcel:CommercialCustomerMember2023-01-012023-12-310001762303rcel:BlackScholesOptionPricingModelMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputOptionVolatilityMember2024-03-310001762303us-gaap:USTreasurySecuritiesMember2023-12-310001762303us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMemberrcel:CommercialCustomerMember2023-01-012023-12-310001762303us-gaap:FairValueInputsLevel3Memberus-gaap:LongTermDebtMember2024-01-012024-03-310001762303us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001762303rcel:PatentTenMember2024-03-310001762303us-gaap:OtherCurrentLiabilitiesMember2023-12-310001762303us-gaap:FairValueMeasurementsRecurringMember2023-12-310001762303rcel:DeferredCompensationPlansMember2023-01-012023-12-310001762303us-gaap:EmployeeStockMember2024-03-310001762303rcel:CommonStockHeldByNonQualifiedDeferredCompensationPlanMember2023-03-310001762303rcel:CommercialSalesMember2023-01-012023-03-310001762303rcel:SeniorSecuredCreditFacilityMemberrcel:OrbimedMember2023-10-182023-10-180001762303rcel:PatentSixMember2024-03-310001762303us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001762303us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001762303us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001762303us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-03-3100017623032023-01-012023-12-310001762303rcel:PatentEightMember2023-12-310001762303us-gaap:EquipmentMember2023-12-310001762303rcel:CommonStockHeldByNonQualifiedDeferredCompensationPlanMember2024-01-012024-03-310001762303us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001762303rcel:ServicesForEmergencyPreparednessMember2023-01-012023-03-310001762303rcel:WarrantLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001762303rcel:StedicalScientificIncMembersrt:ScenarioForecastMemberrcel:PermeadermMember2024-12-310001762303us-gaap:FairValueMeasurementsRecurringMemberrcel:CorporateOwnedLifeInsurancePoliciesMember2023-12-310001762303us-gaap:ComputerEquipmentMember2024-03-310001762303us-gaap:CashEquivalentsMemberus-gaap:MoneyMarketFundsMember2024-03-310001762303rcel:StedicalScientificIncMemberrcel:PermeadermMember2024-01-012024-03-310001762303us-gaap:MeasurementInputRevenueMultipleMemberrcel:MonteCarloSimulationMember2024-03-310001762303us-gaap:RetainedEarningsMember2024-01-012024-03-310001762303us-gaap:ThreatenedLitigationMember2023-12-310001762303rcel:CommonStockHeldByNonQualifiedDeferredCompensationPlanMember2023-01-012023-03-310001762303rcel:NonOptionPerformanceBasedRestrictedStockUnitsMember2024-03-310001762303us-gaap:EuropeanUnionMember2024-01-012024-03-310001762303us-gaap:PerformanceSharesMember2024-03-310001762303srt:MinimumMemberus-gaap:EquipmentMember2024-03-310001762303us-gaap:RetainedEarningsMember2024-03-3100017623032024-01-012024-03-310001762303us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:LongTermDebtMember2023-12-310001762303country:AU2023-01-012023-03-310001762303rcel:SeniorSecuredCreditFacilityMemberrcel:TrancheOneMemberrcel:OrbimedMember2023-10-180001762303us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001762303rcel:PatentThreeMember2023-12-310001762303srt:MaximumMemberrcel:NonQualifiedDeferredCompensationPlanMember2024-01-012024-03-310001762303us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2024-03-310001762303us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001762303us-gaap:CustomerConcentrationRiskMemberrcel:CommercialCustomerMemberus-gaap:AccountsReceivableMember2024-01-012024-03-310001762303us-gaap:EmployeeStockMember2023-01-012023-03-310001762303us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001762303rcel:BlackScholesOptionPricingModelMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputOptionVolatilityMember2023-12-310001762303rcel:NonQualifiedDeferredCompensationPlanMember2024-03-310001762303us-gaap:FairValueInputsLevel2Memberrcel:NonQualifiedDeferredCompensationPlanLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001762303us-gaap:AdditionalPaidInCapitalMember2022-12-310001762303srt:MaximumMemberrcel:SeniorSecuredCreditFacilityMemberrcel:OrbimedMember2023-10-182023-10-180001762303us-gaap:SellingAndMarketingExpenseMember2023-01-012023-03-310001762303rcel:BlackScholesOptionPricingModelMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMember2024-03-310001762303us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMemberrcel:MonteCarloSimulationMember2024-03-310001762303rcel:SeniorSecuredCreditFacilityMemberrcel:OrbimedMember2024-03-310001762303rcel:NonOptionPerformanceBasedRestrictedStockUnitsMember2023-12-31xbrli:purexbrli:sharesrcel:Iterationrcel:Segmentiso4217:USDutr:Y

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-39059

AVITA MEDICAL, INC.

(Exact name of registrant as specified in its charter)

|

|

Delaware |

85-1021707 |

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

28159 Avenue Stanford

Suite 220

Valencia, CA 91355

(Address of principal executive offices and Zip Code)

Registrant’s telephone number, including area code: (661) 367-9170

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

Common Stock, par value $0.0001 per share |

|

RCEL |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

Accelerated filer |

|

☐ |

|

|

|

|

|

|

Non-accelerated filer |

|

☒ |

Smaller reporting company |

|

☒ |

|

|

|

|

|

|

Emerging growth company |

|

☒ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has selected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares of the registrant’s common stock, par value $0.0001, outstanding as of May 6, 2024 was 25,799,735

TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All statements other than statements of historical facts contained in this Quarterly Report on Form 10-Q, including statements regarding our future revenues; solvency; future industry market conditions; future changes in our capacity and operations; future operating and overhead costs; intellectual property; regulatory and related approvals; the conduct or outcome of pre-clinical or clinical (human) studies; operational and management restructuring activities (including implementation of methodologies and changes in the board of directors); our ability to expand our sales organization to address effectively existing and new markets that we intend to target; future employment and contributions of personnel; tax and rising interest rates; productivity, business process, rationalization, investment, acquisition and acquisition integrations, consulting, operational, tax, financial and capital projects and initiatives; inflationary pressures on the U.S. and global economy; changes in the legal or regulatory environment; and future working capital, costs, revenues, business opportunities, cash flows, margins, earnings and growth. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential”, or “continue” or the negative of these terms or other similar expressions.

The forward-looking statements in this Quarterly Report on Form 10-Q are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition, and results of operations. These forward-looking statements speak only as of the date of this Quarterly Report on Form 10-Q and are subject to a number of important factors that could cause actual results to differ materially from those in the forward-looking statements, including the factors described under the sections in this Quarterly Report on Form 10-Q titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for our management to predict all risk factors and uncertainties.

You should read this Quarterly Report on Form 10-Q and the documents that we reference in this Quarterly Report on Form 10-Q completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

PART I – Financial Information

Item 1. FINANCIAL STATEMENTS

AVITA MEDICAL, INC.

Consolidated Balance Sheets

(In thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

ASSETS |

|

(unaudited) |

|

|

(audited) |

|

Cash and cash equivalents |

|

$ |

16,951 |

|

|

$ |

22,118 |

|

Marketable securities |

|

|

51,232 |

|

|

|

66,939 |

|

Accounts receivable, net |

|

|

7,081 |

|

|

|

7,664 |

|

BARDA receivables |

|

|

28 |

|

|

|

30 |

|

Prepaids and other current assets |

|

|

3,523 |

|

|

|

1,659 |

|

Inventory |

|

|

7,171 |

|

|

|

5,596 |

|

Total current assets |

|

|

85,986 |

|

|

|

104,006 |

|

Plant and equipment, net |

|

|

4,297 |

|

|

|

1,877 |

|

Operating lease right-of-use assets |

|

|

3,275 |

|

|

|

2,440 |

|

Corporate-owned life insurance ("COLI") asset |

|

|

2,880 |

|

|

|

2,475 |

|

Intangible assets, net |

|

|

542 |

|

|

|

487 |

|

Other long-term assets |

|

|

401 |

|

|

|

355 |

|

Total assets |

|

$ |

97,381 |

|

|

$ |

111,640 |

|

LIABILITIES, NON-QUALIFIED DEFERRED COMPENSATION PLAN SHARE AWARDS AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

|

4,477 |

|

|

|

3,793 |

|

Accrued wages and fringe benefits |

|

|

5,803 |

|

|

|

7,972 |

|

Current non-qualified deferred compensation ("NQDC") liability |

|

|

429 |

|

|

|

168 |

|

Other current liabilities |

|

|

1,153 |

|

|

|

1,266 |

|

Total current liabilities |

|

|

11,862 |

|

|

|

13,199 |

|

Long-term debt |

|

|

41,301 |

|

|

|

39,812 |

|

Non-qualified deferred compensation liability |

|

|

3,913 |

|

|

|

3,663 |

|

Contract liabilities |

|

|

349 |

|

|

|

357 |

|

Operating lease liabilities, long term |

|

|

2,532 |

|

|

|

1,702 |

|

Warrant liability |

|

|

4,028 |

|

|

|

3,158 |

|

Total liabilities |

|

|

63,985 |

|

|

|

61,891 |

|

Non-qualified deferred compensation plan share awards |

|

|

827 |

|

|

|

693 |

|

Commitments and contingencies (Note 13) |

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

Common stock, $0.0001 par value per share, 200,000,000 shares authorized, 25,789,051 and 25,682,078, shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively |

|

|

3 |

|

|

|

3 |

|

Preferred stock, $0.0001 par value per share, 10,000,000 shares authorized, no shares issued or outstanding at March 31, 2024 and December 31, 2023 |

|

|

- |

|

|

|

- |

|

Company common stock held by the non-qualified deferred compensation plan |

|

|

(944 |

) |

|

|

(1,130 |

) |

Additional paid-in capital |

|

|

353,205 |

|

|

|

350,039 |

|

Accumulated other comprehensive loss |

|

|

(3,068 |

) |

|

|

(1,887 |

) |

Accumulated deficit |

|

|

(316,627 |

) |

|

|

(297,969 |

) |

Total stockholders' equity |

|

|

32,569 |

|

|

|

49,056 |

|

Total liabilities, non-qualified deferred compensation plan share awards and stockholders' equity |

|

$ |

97,381 |

|

|

$ |

111,640 |

|

|

|

|

|

|

|

|

The accompanying notes form part of the unaudited Consolidated Financial Statements.

AVITA MEDICAL, INC.

Consolidated Statements of Operations

(In thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

Three-Months Ended |

|

|

|

March 31, 2024 |

|

March 31, 2023 |

|

|

|

|

|

|

|

Revenues |

|

$ |

11,104 |

|

$ |

10,550 |

|

Cost of sales |

|

|

(1,513 |

) |

|

(1,667 |

) |

Gross profit |

|

|

9,591 |

|

|

8,883 |

|

BARDA income |

|

|

- |

|

|

627 |

|

Operating expenses: |

|

|

|

|

|

Sales and marketing |

|

|

(12,640 |

) |

|

(6,540 |

) |

General and administrative |

|

|

(8,963 |

) |

|

(8,295 |

) |

Research and development |

|

|

(5,194 |

) |

|

(4,586 |

) |

Total operating expenses |

|

|

(26,797 |

) |

|

(19,421 |

) |

Operating loss |

|

|

(17,206 |

) |

|

(9,911 |

) |

Interest expense |

|

|

(1,356 |

) |

|

(4 |

) |

Other income (expense), net |

|

|

(66 |

) |

|

725 |

|

Loss before income taxes |

|

|

(18,628 |

) |

|

(9,190 |

) |

Income tax expense |

|

|

(30 |

) |

|

(30 |

) |

Net loss |

|

$ |

(18,658 |

) |

$ |

(9,220 |

) |

Net loss per common share: |

|

|

|

|

|

Basic and Diluted |

|

$ |

(0.73 |

) |

$ |

(0.37 |

) |

Weighted-average common shares: |

|

|

|

|

|

Basic and Diluted |

|

|

25,637,783 |

|

|

25,202,088 |

|

The accompanying notes form part of the unaudited Consolidated Financial Statements.

AVITA MEDICAL, INC.

Consolidated Statements of Comprehensive Loss

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three-Months Ended |

|

|

|

March 31, 2024 |

|

|

March 31, 2023 |

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(18,658 |

) |

|

$ |

(9,220 |

) |

Foreign currency translation loss |

|

|

- |

|

|

|

(11 |

) |

Change in fair value due to credit risk on Long-term debt |

|

|

(1,092 |

) |

|

|

- |

|

Net unrealized gain/(loss) on marketable securities, net of tax |

|

|

(89 |

) |

|

|

242 |

|

Comprehensive loss |

|

$ |

(19,839 |

) |

|

$ |

(8,989 |

) |

The accompanying notes form part of the unaudited Consolidated Financial Statements.

AVITA MEDICAL, INC.

Consolidated Statements of Stockholders’ Equity

(In thousands, except shares)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

Amount |

|

Company common stock held by the NQDC Plan |

|

Additional

Paid-in Capital |

|

Accumulated Other

Comprehensive

Gain (Loss) |

|

Accumulated

Deficit |

|

Total

Stockholders'

Equity |

|

Balance at December 31, 2023 |

|

25,682,078 |

|

$ |

3 |

|

$ |

(1,130 |

) |

$ |

350,039 |

|

$ |

(1,887 |

) |

$ |

(297,969 |

) |

$ |

49,056 |

|

Net loss |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(18,658 |

) |

|

(18,658 |

) |

Stock-based compensation |

|

- |

|

|

- |

|

|

- |

|

|

2,585 |

|

|

- |

|

|

- |

|

|

2,585 |

|

Exercise of stock options |

|

106,973 |

|

|

- |

|

|

- |

|

|

631 |

|

|

- |

|

|

- |

|

|

631 |

|

Distribution/diversification of Company common stock held by the NQDC Plan |

|

- |

|

|

- |

|

|

186 |

|

|

78 |

|

|

- |

|

|

- |

|

|

264 |

|

Change in redemption value of share awards in NQDC plan |

|

- |

|

|

- |

|

|

- |

|

|

(128 |

) |

|

- |

|

|

- |

|

|

(128 |

) |

Net unrealized loss on marketable securities |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(89 |

) |

|

- |

|

|

(89 |

) |

Change in fair value due to credit risk on Long-term debt |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(1,092 |

) |

|

- |

|

|

(1,092 |

) |

Balance at March 31, 2024 |

|

25,789,051 |

|

$ |

3 |

|

$ |

(944 |

) |

$ |

353,205 |

|

$ |

(3,068 |

) |

$ |

(316,627 |

) |

$ |

32,569 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

Amount |

|

Company common stock held by the NQDC Plan |

|

Additional

Paid-in Capital |

|

Accumulated Other

Comprehensive

Gain (Loss) |

|

Accumulated

Deficit |

|

Total

Stockholders'

Equity |

|

Balance at December 31, 2022 |

|

25,208,436 |

|

$ |

3 |

|

$ |

(127 |

) |

$ |

339,825 |

|

$ |

7,627 |

|

$ |

(262,588 |

) |

$ |

84,740 |

|

Net loss |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(9,220 |

) |

|

(9,220 |

) |

Stock-based compensation |

|

- |

|

|

- |

|

|

- |

|

|

2,197 |

|

|

- |

|

|

- |

|

|

2,197 |

|

Exercise of stock options |

|

31,675 |

|

|

- |

|

|

- |

|

|

171 |

|

|

- |

|

|

- |

|

|

171 |

|

Company common stock held by the NQDC Plan |

|

87,650 |

|

|

- |

|

|

(765 |

) |

|

765 |

|

|

- |

|

|

- |

|

|

- |

|

Change in redemption value of share awards in NQDC plan |

|

- |

|

|

- |

|

|

- |

|

|

(558 |

) |

|

- |

|

|

- |

|

|

(558 |

) |

Other comprehensive gain |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

231 |

|

|

- |

|

|

231 |

|

Balance at March 31, 2023 |

|

25,327,761 |

|

$ |

3 |

|

$ |

(892 |

) |

$ |

342,400 |

|

$ |

7,858 |

|

$ |

(271,808 |

) |

$ |

77,561 |

|

The accompanying notes form part of the unaudited Consolidated Financial Statements.

AVITA Medical, Inc.

Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three-Months Ended |

|

|

|

March 31, 2024 |

|

|

March 31, 2023 |

|

Cash flow from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(18,658 |

) |

|

$ |

(9,220 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Change in fair value of long-term debt |

|

|

397 |

|

|

|

- |

|

Change in fair value of warrant liability |

|

|

870 |

|

|

|

- |

|

Depreciation and amortization |

|

|

203 |

|

|

|

135 |

|

Stock-based compensation |

|

|

2,591 |

|

|

|

2,640 |

|

Non-cash lease expense |

|

|

214 |

|

|

|

167 |

|

Remeasurement and foreign currency transaction gain |

|

|

- |

|

|

|

(2 |

) |

Excess and obsolete inventory related charges |

|

|

83 |

|

|

|

67 |

|

BARDA deferred costs |

|

|

- |

|

|

|

(64 |

) |

Contract cost amortization |

|

|

- |

|

|

|

85 |

|

Provision for credit losses |

|

|

80 |

|

|

|

172 |

|

Amortization of premium of marketable securities |

|

|

(677 |

) |

|

|

(328 |

) |

Non-cash changes in the fair value of NQDC plan |

|

|

278 |

|

|

|

610 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Trade and other receivables |

|

|

503 |

|

|

|

(1,158 |

) |

BARDA receivables |

|

|

2 |

|

|

|

382 |

|

Prepaids and other current assets |

|

|

(1,864 |

) |

|

|

12 |

|

Inventory |

|

|

(1,659 |

) |

|

|

(754 |

) |

Operating lease liability |

|

|

(224 |

) |

|

|

(156 |

) |

Corporate-owned life insurance ("COLI") asset |

|

|

(215 |

) |

|

|

(526 |

) |

Other long-term assets |

|

|

(46 |

) |

|

|

(109 |

) |

Accounts payable and accrued expenses |

|

|

(763 |

) |

|

|

778 |

|

Accrued wages and fringe benefits |

|

|

(2,170 |

) |

|

|

(2,957 |

) |

Current non-qualified deferred compensation liability |

|

|

473 |

|

|

|

748 |

|

Other current liabilities |

|

|

(109 |

) |

|

|

958 |

|

Non-qualified deferred compensation plan liability |

|

|

(165 |

) |

|

|

(237 |

) |

Contract liabilities |

|

|

(8 |

) |

|

|

(316 |

) |

Net cash used in operations |

|

$ |

(20,864 |

) |

|

$ |

(9,073 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

Purchase of marketable securities |

|

|

(2,904 |

) |

|

|

(5,183 |

) |

Maturities of marketable securities |

|

|

19,200 |

|

|

|

24,271 |

|

Purchase of plant and equipment |

|

|

(1,147 |

) |

|

|

(284 |

) |

Patent filing fees |

|

|

(83 |

) |

|

|

(17 |

) |

Net cash provided by investing activities |

|

$ |

15,066 |

|

|

$ |

18,787 |

|

Cash flow from financing activities: |

|

|

|

|

|

|

Proceeds from exercise of stock options |

|

|

631 |

|

|

|

171 |

|

Net cash provided by financing activities |

|

$ |

631 |

|

|

$ |

171 |

|

Effect of foreign exchange rate on cash and cash equivalents |

|

|

- |

|

|

|

1 |

|

Net increase/(decrease) in cash and cash equivalents |

|

|

(5,167 |

) |

|

|

9,886 |

|

Cash and cash equivalents beginning of the period |

|

$ |

22,118 |

|

|

$ |

18,164 |

|

Cash and cash equivalents end of the period |

|

$ |

16,951 |

|

|

$ |

28,050 |

|

Supplemental Disclosure of Cash Flow Information: |

|

|

|

|

|

|

Income taxes paid during the period |

|

$ |

17 |

|

|

$ |

9 |

|

Interest paid during the period |

|

$ |

1,355 |

|

|

$ |

4 |

|

Non-cash investing activities: |

|

|

|

|

|

|

Plant and equipment purchases not yet paid |

|

$ |

74 |

|

|

$ |

9 |

|

Right-of-use-asset obtained in exchange for lease liabilities |

|

$ |

1,053 |

|

|

$ |

- |

|

|

|

|

|

|

|

|

The accompanying notes form part of the unaudited Consolidated Financial Statements.

AVITA MEDICAL, INC.

Notes to Consolidated Financial Statements

(Unaudited)

1. The Company

Nature of the Business

AVITA Medical, Inc. and its subsidiaries (collectively, “AVITA Medical”, “we”, “our”, “us”, or “Company”) is a commercial-stage regenerative medicine company transforming the standard of care in wound management and skin restoration with innovative devices. At the forefront of the Company's portfolio is its patented and proprietary RECELL®System (“RECELL System” or “RECELL”), approved by the FDA for the treatment of thermal burn wounds and full-thickness skin defects ("FTSD"), and for repigmentation of stable depigmented vitiligo lesions. RECELL harnesses the regenerative properties of a patient’s own skin to create an autologous skin cell suspension, Spray-On Skin™ Cells, delivering a transformative solution at the point of care. This breakthrough technology serves as the catalyst for a new treatment paradigm enabling improved clinical outcomes.

On January 10, 2024, the Company entered into an exclusive multi-year distribution agreement with Stedical Scientific, Inc.

("Stedical") to commercialize PermeaDerm® Biosynthetic Wound Matrix ("PermeaDerm") in the United States (the "Stedical Agreement"). PermeaDerm is cleared by the FDA as a transparent matrix for use in the treatment of a variety of wound types until healing is achieved. Under the terms of the agreement, the Company holds the exclusive rights to market, sell, and distribute PermeaDerm products, including any future enhancements or modifications, within the United States. The initial term is for five years, with the option to renew for an additional five years, contingent upon meeting certain minimum requirements.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited Consolidated Financial Statements of the Company have been prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X of the Securities and Exchange Commission (the “SEC”). Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. In the opinion of management, the Consolidated Financial Statements reflect all adjustments of a normal and recurring nature that are considered necessary for a fair presentation of the results for the interim periods presented. The information included in this quarterly report on Form 10-Q should be read in conjunction with the audited Consolidated Financial Statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year-ended December 31, 2023 filed with the SEC on February 22, 2024 and the Australian Securities Exchange ("ASX") on February 23, 2024 (the “2023 Annual Report").

There have been no changes to the Company’s significant accounting policies as described in the 2023 Annual Report that have had a material impact on the Company’s Consolidated Financial Statements. See the summary of the Company’s significant accounting policies set forth in the notes to its Consolidated Financial Statements included in the 2023 Annual Report.

Principles of Consolidation

The accompanying Consolidated Financial Statements include the accounts of the Company and its wholly owned subsidiaries. All intercompany transactions and balances have been eliminated upon consolidation.

Recent Accounting Pronouncements

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures. The ASU expands public entities’ segment disclosures by requiring disclosure of significant segment expenses that are regularly reviewed by the Chief Operating Decision Maker ("CODM") and included within each reported measure of segment profit or loss, an amount and description of its composition for other segment items, and interim disclosures of a reportable segment’s profit or loss and assets. The ASU also allows, in addition to the measure that is most consistent with GAAP, the disclosure of additional measures of segment profit or loss that are used by the CODM in assessing segment performance and deciding how to allocate resources. All disclosure requirements under ASU 2023-07 are also required for public entities with a single reportable segment. The ASU is effective for the Company’s 2023 Annual Report on Form 10-K for the fiscal year ending December 31, 2025, and subsequent interim periods, with early adoption permitted. The Company is currently evaluating the impact of adopting this ASU on its consolidated financial statements and disclosures.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures. The amendments require (i) enhanced disclosures in connection with an entity's effective tax rate reconciliation and (ii) income taxes paid disaggregated by jurisdiction. The amendments are effective for annual periods beginning after December 15, 2024. The Company is currently evaluating the impact of adopting this ASU on its consolidated financial statements and disclosures.

Use of Estimates

The preparation of the accompanying Consolidated Financial Statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts (including estimate of the average selling price for PermeaDerm sales, allowance for credit losses, reserves for inventory excess and obsolescence, carrying value of long-lived assets, the useful lives of long-lived assets, accounting for marketable securities, income taxes, fair value of the debt, fair value of warrants and stock-based compensation) and related disclosures. Estimates have been prepared on the basis of the current and available information. However, actual results could differ from estimated amounts.

Foreign Currency Translation and Foreign Currency Transactions

The financial position and results of operations of the Company’s operating non-U.S. subsidiaries are generally determined using the respective local currency as the functional currency of that subsidiary. Assets and liabilities of these subsidiaries are translated at the exchange rate in effect at each period end. Income statement accounts are translated at the average rate of exchange prevailing during the period. Adjustments arising from the use of differing exchange rates from period to period are included in Other comprehensive gain (loss) in Stockholders’ Equity. Gains and losses resulting from foreign currency transactions are included in earnings in the Consolidated Statement of Operations. Gains and losses resulting from foreign currency transactions were minimal for the three-months ended March 31, 2024 and 2023.

The Company’s non-operating subsidiaries that use the U.S. dollar as their functional currency remeasure monetary assets and liabilities at exchange rates in effect at the end of each period and nonmonetary assets and liabilities at historical rates. Gains and losses resulting from these remeasurements are included in earnings in the Consolidated Statement of Operations. Gains and losses for remeasurement and foreign currency transactions were minimal during the three-months ended March 31, 2024 and 2023.

Cash and Cash Equivalents

Cash and cash equivalents consist of cash held at deposit institutions and cash equivalents. Cash equivalents consist primarily of money market funds. Cash equivalents also includes short-term highly liquid investments with original maturities of three months or less from the date of purchase. The Company holds cash at deposit institutions in the amount of $4.9 million and $10.7 million as of March 31, 2024 and December 31, 2023, respectively. The Company does not have cash on deposit denominated in foreign currency in foreign institutions as of March 31, 2024. As of December 31, 2023, the Company had $69,000 of cash on deposit denominated in foreign currencies in foreign institutions. As of March 31, 2024 and December 31, 2023, the Company held cash equivalents in the amount of $12.0 million and $11.4 million, respectively.

Concentrations

Financial instruments that potentially subject the Company to concentrations of credit risk consist primarily of cash and cash equivalents, marketable securities, trade receivables and debt and other liabilities. As of March 31, 2024 and December 31, 2023, substantially all the Company’s cash was deposited in accounts at financial institutions, and amounts exceed federally insured limits and are subject to the risk of bank failure.

As of March 31, 2024 and December 31, 2023, no single commercial customer accounted for more than 10% of net accounts receivable or more than 10% of revenues for the three-months ended March 31, 2024 and 2023.

3. Marketable Securities

The following table summarizes the amortized cost and estimated fair values of securities available-for-sale:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of March 31, 2024 |

|

|

|

Amortized

Cost |

|

|

Gross

Unrealized

Holding

Gains |

|

|

Gross

Unrealized

Holding

Losses |

|

|

Carrying

Value |

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

Cash equivalents: |

|

|

|

|

|

|

|

|

|

|

|

|

Money market funds |

|

$ |

12,018 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

12,018 |

|

Total cash equivalents |

|

$ |

12,018 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

12,018 |

|

Current marketable securities: |

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Treasury securities |

|

$ |

51,225 |

|

|

$ |

11 |

|

|

$ |

(4 |

) |

|

$ |

51,232 |

|

Total current marketable securities |

|

$ |

51,225 |

|

|

$ |

11 |

|

|

$ |

(4 |

) |

|

$ |

51,232 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, 2023 |

|

|

|

Amortized

Cost |

|

|

Gross

Unrealized

Holding

Gains |

|

|

Gross

Unrealized

Holding

Losses |

|

|

Carrying

Value |

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

Cash equivalents: |

|

|

|

|

|

|

|

|

|

|

|

|

Money market funds |

|

$ |

8,427 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

8,427 |

|

U.S. Treasury securities |

|

|

2,992 |

|

|

|

- |

|

|

|

- |

|

|

|

2,992 |

|

Total cash equivalents |

|

$ |

11,419 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

11,419 |

|

Current marketable securities: |

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Treasury securities |

|

$ |

65,145 |

|

|

$ |

100 |

|

|

$ |

(3 |

) |

|

$ |

65,242 |

|

U.S. Government agency obligations |

|

|

1,699 |

|

|

|

- |

|

|

|

(2 |

) |

|

|

1,697 |

|

Total current marketable securities |

|

$ |

66,844 |

|

|

$ |

100 |

|

|

$ |

(5 |

) |

|

$ |

66,939 |

|

The maturities of our available-for-sale securities are summarized in the following table using contractual maturities. Actual maturities may differ from contractual maturities due to obligations that are called or prepaid.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of March 31, 2024 |

|

|

As of December 31, 2023 |

|

(in thousands) |

|

Amortized

Cost |

|

|

Carrying

Value |

|

|

Amortized

Cost |

|

|

Carrying

Value |

|

Due in one year or less |

|

$ |

51,225 |

|

|

$ |

51,232 |

|

|

$ |

66,844 |

|

|

$ |

66,939 |

|

Unrealized gains and losses, net of any related tax effects for available-for-sale securities are excluded from earnings and are included in other comprehensive loss and reported as a separate component of stockholders' equity until realized. Realized gains and losses on marketable securities are included in Other income (expense), net, in the accompanying Consolidated Statements of Operations. The Company had net unrealized gains of $7,000 and $95,000 as of March 31, 2024 and December 31, 2023, respectively. The Company did not have sales of investments during the three-months ended March 31, 2024 and 2023 that resulted in realized gains or losses. As of March 31, 2024, and December 31, 2023, the Company did not recognize credit losses. The Company has accrued interest income receivable of $182,000 and $227,000 as of March 31, 2024, and December 31, 2023, respectively, in Prepaids and other current assets.

4. Fair Value Measurements

ASC 820, Fair Value Measurement, the authoritative guidance on fair value measurements establishes a framework with respect to measuring assets and liabilities at fair value on a recurring basis and non-recurring basis. Under the framework, fair value is defined as the exit price, or the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants, as of the measurement date. The framework also establishes a three-tier hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are inputs market participants would use in valuing the asset or liability and are developed based on market data obtained from sources independent of the Company. Unobservable inputs are inputs

that reflect the Company’s assumptions about the factors market participants would use in valuing the asset or liability and are developed based on the best information available in the circumstances. The hierarchy consists of the following three levels:

Level 1: Inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities that the reporting entity can access at the measurement date.

Level 2: Inputs are inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly.

Level 3: Inputs are unobservable inputs for the asset or liability

The following tables present information about the Company’s financial assets measured at fair value on a recurring basis, based on the three-tier fair value hierarchy:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of March 31, 2024 |

|

(in thousands) |

Level 1 |

|

Level 2 |

|

Level 3 |

|

Total |

|

Cash equivalents: |

|

|

|

|

|

|

|

|

Money market funds |

$ |

12,018 |

|

$ |

- |

|

$ |

- |

|

$ |

12,018 |

|

Total cash equivalents |

$ |

12,018 |

|

$ |

- |

|

$ |

- |

|

$ |

12,018 |

|

Current marketable securities: |

|

|

|

|

|

|

|

|

U.S. Treasury securities |

$ |

- |

|

$ |

51,232 |

|

$ |

- |

|

$ |

51,232 |

|

Total current marketable securities |

$ |

- |

|

$ |

51,232 |

|

$ |

- |

|

$ |

51,232 |

|

Total marketable securities and cash equivalents |

$ |

12,018 |

|

$ |

51,232 |

|

$ |

- |

|

$ |

63,250 |

|

Financial liabilities: |

|

|

|

|

|

|

|

|

Long-term debt |

$ |

- |

|

$ |

- |

|

$ |

41,301 |

|

$ |

41,301 |

|

Warrant liability |

|

- |

|

|

- |

|

|

4,028 |

|

$ |

4,028 |

|

Non-qualified deferred compensation plan liability |

|

- |

|

|

4,342 |

|

|

- |

|

$ |

4,342 |

|

Total financial liabilities |

$ |

- |

|

$ |

4,342 |

|

$ |

45,329 |

|

$ |

49,671 |

|

Financial assets: |

|

|

|

|

|

|

|

|

Corporate-owned life insurance policies |

$ |

- |

|

$ |

2,880 |

|

$ |

- |

|

$ |

2,880 |

|

Total financial assets |

$ |

- |

|

$ |

2,880 |

|

$ |

- |

|

$ |

2,880 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, 2023 |

|

(in thousands) |

Level 1 |

|

Level 2 |

|

Level 3 |

|

Total |

|

Cash equivalents: |

|

|

|

|

|

|

|

|

Money market funds |

$ |

8,427 |

|

$ |

- |

|

$ |

- |

|

$ |

8,427 |

|

U.S. Treasury securities |

|

- |

|

|

2,992 |

|

|

- |

|

|

2,992 |

|

Total cash equivalents |

$ |

8,427 |

|

$ |

2,992 |

|

$ |

- |

|

$ |

11,419 |

|

Current marketable securities: |

|

|

|

|

|

|

|

|

U.S. Treasury securities |

$ |

- |

|

$ |

65,242 |

|

$ |

- |

|

$ |

65,242 |

|

U.S. Government agency obligations |

|

- |

|

|

1,697 |

|

|

- |

|

|

1,697 |

|

Total current marketable securities |

$ |

- |

|

$ |

66,939 |

|

$ |

- |

|

$ |

66,939 |

|

Total marketable securities and cash equivalents |

$ |

8,427 |

|

$ |

69,931 |

|

$ |

- |

|

$ |

78,358 |

|

Financial liabilities: |

|

|

|

|

|

|

|

|

Long-term debt |

$ |

- |

|

$ |

- |

|

$ |

39,812 |

|

$ |

39,812 |

|

Warrant liability |

|

- |

|

|

- |

|

|

3,158 |

|

|

3,158 |

|

Non-qualified deferred compensation plan liability |

|

- |

|

|

3,831 |

|

|

- |

|

$ |

3,831 |

|

Total financial liabilities |

$ |

- |

|

$ |

3,831 |

|

$ |

42,970 |

|

$ |

46,801 |

|

Financial assets: |

|

|

|

|

|

|

|

|

Corporate-owned life insurance policies |

$ |

- |

|

$ |

2,475 |

|

$ |

- |

|

$ |

2,475 |

|

Total financial assets |

$ |

- |

|

$ |

2,475 |

|

$ |

- |

|

$ |

2,475 |

|

The following table presents the summary of changes in the fair value of our Level 3 financial instruments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of March 31, 2024 |

|

|

As of December 31, 2023 |

|

|

Long-term debt |

|

|

Warrant liability |

|

|

Long-term debt |

|

|

Warrant liability |

|

Balance beginning of period |

$ |

39,812 |

|

|

$ |

3,158 |

|

|

$ |

- |

|

|

$ |

- |

|

Fair value on issuance date |

|

|

|

|

|

|

|

37,575 |

|

|

|

2,425 |

|

Change in fair value in earnings |

|

397 |

|

|

|

870 |

|

|

|

1,616 |

|

|

|

733 |

|

Change in fair value in other comprehensive loss |

|

1,092 |

|

|

|

- |

|

|

|

621 |

|

|

|

- |

|

Balance end of period, at fair value |

$ |

41,301 |

|

|

$ |

4,028 |

|

|

$ |

39,812 |

|

|

$ |

3,158 |

|

The Company’s Level 1 assets include money market instruments and are valued based upon observable market prices. Level 2 assets consist of U.S Treasury securities and U.S. Government Agency obligations. Level 2 securities are valued based upon observable inputs that include reported trades, broker/dealer quotes, bids and offers. The corporate-owned life insurance contracts are recorded at cash surrender value, which approximates the fair value and is categorized as Level 2. Non-qualified deferred compensation plan liability is measured at fair value based on quoted prices of identical instruments to the investment vehicles selected by the participants and its recorded as Level 2. There were no transfers between fair value measurement levels during the period ended March 31, 2024 and December 31, 2023.

Long-term debt

The fair value of the debt was determined using a Monte Carlo Simulation ("MCS") in order to predict the probability of different outcomes. The valuation was performed based on significant inputs not observable in the market, which represents a Level 3 measurement within the fair value hierarchy. The fair value of the debt is recorded in the Consolidated Balance Sheets. The fair value is estimated by the Company each reporting period and the change in the fair value is recorded in both earnings and other comprehensive income depending on the instrument's inherent credit risk and market risk related to the debt valuation.

As the debt is subject to net revenue requirements, the valuation of the debt was determined using the Monte Carlo Simulation (“MCS”). The underlying metric to be simulated is the projected Trailing Twelve Month (“TTM”) revenues at each quarter end through the maturity date of October 18. 2028. Based on the simulated metric, the different levels of simulated TTM revenues may trigger different discounted cash flow scenarios in which the TTM revenues are lower than the targeted revenues per the Credit Agreement or TTM is equal to or higher than the targeted revenues per the Credit Agreement. The MCS performs 100,000 iterations of various simulated revenues to determine the fair value of the debt.

The below assumptions were used in the Monte Carlo simulation

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

Risk-free interest rate |

|

4.20 |

% |

|

|

3.81 |

% |

Revenue volatility |

|

64.00 |

% |

|

|

64.00 |

% |

Revenue discount rate |

|

16.99 |

% |

|

|

16.58 |

% |

Warrant Liability

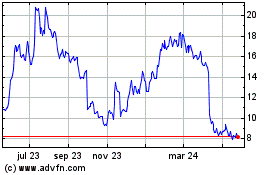

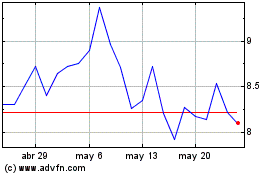

The fair value of the warrant liability is recognized in connection with the Credit Agreement. The fair value of the warrant liability was determined based on significant inputs not observable in the market, which represents a Level 3 measurement within the fair value hierarchy. The fair value of the warrant liability, which is reported within Warrant liabilities on the Consolidated Balance Sheets, is estimated by the Company based on the Black-Scholes option pricing model with the following key inputs:

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

Price of common stock |

$ |

16.03 |

|

|

$ |

13.72 |

|

Expected term |

9.56 years |

|

|

9.81 years |

|

Expected volatility |

|

31.39 |

% |

|

|

31.07 |

% |

Exercise price |

$ |

10.9847 |

|

|

$ |

10.9847 |

|

Risk-free interest rate |

|

4.16 |

% |

|

|

3.84 |

% |

Expected dividends |

|

0.00 |

% |

|

|

0.00 |

% |

5. Revenues

The Company’s revenue consists of sale of the RECELL System to hospitals, treatment centers and distributors. Revenue also includes the sale of PermeaDerm to customers (collectively “commercial customers”). Revenue also includes maintenance fee received from BARDA to ensure first right of access. In the prior year, the Company recorded service revenue for the emergency preparedness services provided to BARDA (collectively "customers"). Services are included in Revenues within the Consolidated Statements of Operations.

Distributor Transactions

For international markets, the Company exclusively partners with third-party distributors (COSMOTEC and PolyMedics Innovation GmbH). Revenue recognition occurs when the distributors obtain control of the product. The terms of sales transactions through distributors are generally consistent with the terms of direct sales to customers and do not contain return rights. These transactions are accounted for in accordance with the Company’s revenue recognition policy described in Note 2 of the Company's Annual Report for the year-ended December 31, 2023.

PermeaDerm Sales

As provided in the Stedical Scientific Distribution Agreement, the Company’s gross margin from the sale of PermeaDerm will be 50% of the average sales price. The Company and Stedical will split the gross revenue from sale of the products evenly through the purchase of products at 50% of Average Sale Price (“ASP”). The Company recognizes revenue when the customer obtains control of promised goods, in an amount that reflects the consideration which the Company expects to be entitled in exchange for those goods.

Remaining Performance Obligations

Revenues from remaining performance obligations are calculated as the dollar value of the remaining performance obligations on executed contracts and relate to COSMOTEC. The estimated revenue expected to be recognized in the future related to performance obligations that are unsatisfied (or partially unsatisfied) pursuant to the Company’s existing customer agreements is $382,000 and $390,000 as of March 31, 2024 and December 31, 2023, respectively. These amounts are split between current and long-term in Other current liabilities and other Contract liabilities, respectively, in the Consolidated Balance Sheets. The Company has $33,000 in Other current liabilities as of March 31, 2024 and December 31, 2023 and $349,000 and $357,000 Contract liabilities as of March 31, 2024 and December 31, 2023, respectively. The Company expects to recognize these amounts as revenue on a straight-line basis over the term of the contract with COSMOTEC.

Contract Assets and Contract Liabilities

Contract assets include amounts related to the Company’s contractual right to consideration for both completed and partially completed performance for which the Company does not have the right to payment. As of March 31, 2024 and December 31, 2023, the Company does not have any contract assets.

Contract liabilities are recorded when the Company receives payment prior to satisfying its obligation to transfer goods to a customer. The Company had $382,000 and $390,000 of total contract liabilities as of March 31, 2024 and December 31, 2023, respectively. As of March 31, 2024 and December 31, 2023, a total of $33,000 was included in Other current liabilities and $349,000 and $357,000, respectively, in Contract liabilities in the Consolidated Balance Sheets. The balance relates to the unsatisfied performance obligation from COSMOTEC. The Company recognized approximately $8,000 of revenue from COSMOTEC for amounts included in the beginning balance of contract liabilities for the three-months ended March 31, 2024 and 2023.

Disaggregated Revenue

The Company disaggregates revenue from contracts with customers into geographical regions, by customer type and by product. As noted in the segment footnote, the Company’s business consists of one reporting segment. A reconciliation of disaggregated revenue by geographical region, customer type and product is provided in Note 12.

6. Long-term debt

On October 18, 2023 (“Closing Date”) the Company entered into a Credit Agreement, by and between the Company, as borrower, and an affiliate of OrbiMed Advisors, LLC as the lender and administrative agent (the “Lender”). The Credit Agreement provides for a five-year senior secured credit facility in an aggregate principal amount of up to $90.0 million, of which (i) $40.0 million