Reading International, Inc. (NASDAQ: RDI) (the “Company”), an

internationally diversified cinema and real estate company with

operations and assets in the United States, Australia, and New

Zealand, today announced its results for the third quarter ended

September 30, 2022.

President and Chief Executive Officer, Ellen Cotter

said, “Our third quarter 2022 global revenue grew 61%

year-over-year to $51.2 million, demonstrating our operational

progress in a post-COVID environment. This progress occurred

despite the headwinds of a soft Hollywood movie slate in August and

September and, with respect to our Australian and New Zealand

operations, an appreciation of the U.S. dollar that has impacted

U.S. based multi-nationals in general. Despite the lackluster film

slate over the last few months, we know our global audiences are

excited about the upcoming holiday theatrical movie season to be

led by Black Panther: Wakanda Forever and Avatar: Way of the Water,

two of Hollywood’s strongest franchises.”

Ms. Cotter continued, “During the third quarter, we

are pleased to have resolved the arbitration regarding an Agreement

to Lease of one of our properties in Wellington New Zealand to a

supermarket, with both parties agreeing that such contract had been

terminated and each party bearing its own costs. This settlement

provides us with the flexibility necessary to create the most

strategic masterplan for our properties and to re-establish our

assets as the key Wellington destination for film, families, and

fun. Located in the creative heart of the cultural capital, our

Wellington assets are poised to benefit from the recent re-launch

of the iconic St. James Theater and the mid-2023 opening of Takina,

the city’s new state-of-the-art convention and exhibition center.

Both of these dynamic venues are directly across the street from

our Reading properties.”

“We further advanced our long-term real estate

strategy in the United States with the substantial completion in

October of the landlord’s work related to the cellar, ground and

second floor retail space of our 44 Union Square property. This

space has now been turned over to our new international retail

tenant for the construction of tenant improvements for its New York

City flagship store. Also, in New York City, Audible, an Amazon

company, extended their annual license of the Minetta Lane Theatre

through the first quarter of 2024.”

Ms. Cotter concluded, “Our ‘two business/three

country’ diversified business structure, together with our

dedicated global executive and employee team, will continue to

serve as the foundation for both our recovery from the devastating

impacts of the COVID-19 pandemic and the evolving complex

macroeconomic environment. As we look ahead to the last quarter of

the year, we remain focused on leveraging our strategic

adaptability, capitalizing on pent up industry demand, and

delivering value for stockholders.”

Key Financial Results – Third Quarter

2022

- Achieved global revenue of $51.2

million, a 61% increase from revenue of $31.8 million for the same

period in 2021.

- Operating loss improved by

approximately 40% to $6.7 million, compared to an operating loss of

$11.0 million for the same period in 2021.

- Net loss attributable to Reading

International, Inc. improved by 49% to $5.2 million in Q3 2022,

compared to a net loss of $10.1 million for the same period in

2021.

- The Australian dollar and New Zealand

dollar average exchange rates weakened against the U.S. dollar by

7.0% and 12.5%, respectively, compared to the same period in the

prior year, which contributed to our loss for the period, and

negatively impacted our overall international financial

results.

Key Financial Results - Nine Months of

2022

- Achieved global revenue of $155.9

million, an 75% increase from $89.1 million for the same period in

2021.

- Operating loss improved by

approximately 46% to $20.1 million, compared to an operating loss

of $37.5 million for the same period in 2021.

- Due to the successful

monetization of our properties in Manukau (New Zealand), Coachella

(California), Auburn (Australia), Royal George theatre (Chicago)

and Invercargill (New Zealand) in the first nine months of 2021,

not replicated in the first nine months of 2022, we reported a

basic loss per share of $1.04 compared to a basic earnings per

share of $1.45 for the first nine months of 2021.

- For the same reason as above, net loss

attributable to Reading International, Inc. was $23.0 million for

the first nine months of 2022, compared to a net income of $31.6

million for the same period in 2021.

- The Australian dollar and New Zealand

dollar average exchange rates weakened against the U.S. dollar by

6.9% and 9.2%, respectively, compared to the same period in the

prior year, which contributed to our loss for the period, and

negatively impacted our overall international financial

results.

Key Cinema Business

Highlights

Despite the quarter’s foreign exchange impacts, our

Q3 2022 cinema segment revenue of $48.4 million improved by 68%

compared to the same period in 2021. Our Q3 2022 cinema segment

operating loss of $2.1 million improved by 58% compared to the same

period in 2021. Cinema segment revenue for the nine months ended

September 30, 2022 of $147.5 million increased by 85% compared

to the same period in 2021. Cinema segment operating loss for the

nine months ended September 30, 2022, improved by 71.4% to a

loss of $5.9 million compared to the same period in 2021.

The operating performance improvement in 2022

compared to 2021 was due to a higher quantity and quality of the

film slate and a greater number of operating days for our cinema

circuit due to fewer government COVID-related closures and the

ability to offer more seats due to relaxation of government

COVID-related spacing mandates. Our variable operating costs

increased, in line with the changes in the operational landscape,

and as a result of increased occupancy expenses related to internal

rent that was abated in 2021.

Now that we have reopened for business, we are once

again focusing on the implementation of our cinema business plan:

the enhancement of our food and beverage offerings, procuring

additional cinema liquor licenses, and refurbishing our older

cinemas with luxury seating (and/or larger screen formats). In the

United States, in November 2021, we reopened our remodeled

Consolidated Theatre at the Kahala Mall in Honolulu and in March

2022 we re-launched our Consolidated Theatre in Kapolei. In

Australia and New Zealand, on December 15, 2021, we opened a new

state-of-the-art five-screen Reading Cinemas in Traralgon,

Victoria. We anticipate adding an eight-screen complex at South

City Square, Brisbane QLD in the second half of 2023. The new

location will operate under the Angelika Film Center brand. Also,

in the second half of 2023, we anticipate adding a five-screen

Reading Cinemas in Busselton, Western Australia. Both new cinema

complexes are part of broader shopping center developments

currently under construction.

Key Real Estate Business

Highlights

Real estate segment revenue for Q3 2022, increased

by 28% to $4.1 million, compared to the same period in 2021. Real

estate segment operating loss for Q3 2022, decreased by $1.3

million, compared to a loss of $1.5 million for the same period in

2021.

Real estate segment revenue for the nine months

ended September 30, 2022, increased by 23% to $12.3 million,

compared to the same period in 2021. Real estate segment operating

loss for the nine months ended September 30, 2022, reduced

$3.8 million, compared to a loss of $3.9 million for the same

period in 2021.

These changes between 2021 and 2022 were

attributable to rental revenue generated from our U.S. Live Theatre

business unit, internal rental income from our Australian and New

Zealand properties that were abated in 2021 and savings in

operating expenses. On July 20, 2021, our Orpheum Theatre in New

York City reopened to the public with the resumption of STOMP,

which was amongst the first New York shows to resume live public

performances. On October 8, 2021, live public performances resumed

at our Minetta Lane Theatre in New York, which continues to be

licensed by Audible, an Amazon company.

Key Balance Sheet, Cash, and Liquidity

Highlights

As of September 30, 2022, our cash and cash

equivalents were $39.6 million. As of September 30, 2022, we

had total gross debt of $219.4 million against total book value

assets of $589.7 million, compared to $236.9 million and $687.7

million, respectively, as of December 31, 2021.

For more information about our borrowings, please

refer to Part I – Financial Information, Item 1 – Notes to

Consolidated Financial Statements-- Note 11 – Borrowings.

Conference Call and Webcast

We plan to post our pre-recorded conference call

and audio webcast on our corporate website on Friday, November 11,

2022, which will feature prepared remarks from Ellen Cotter,

President and Chief Executive Officer; Gilbert Avanes, Executive

Vice President, Chief Financial Officer and Treasurer; and Andrzej

Matyczynski, Executive Vice President - Global Operations.

A pre-recorded question and answer session will

follow our formal remarks. Questions and topics for consideration

should be submitted to InvestorRelations@readingrdi.com by 5:00

p.m. Eastern Time on November 10, 2022. The audio webcast can be

accessed by visiting https://investor.readingrdi.com/financials on

November 11, 2022.

About Reading International,

Inc.

Reading International, Inc. (NASDAQ: RDI), an

internationally diversified cinema and real estate company

operating through various domestic and international subsidiaries,

is a leading entertainment and real estate company, engaging in the

development, ownership, and operation of cinemas and retail and

commercial real estate in the United States, Australia, and New

Zealand.

Reading’s cinema subsidiaries operate under

multiple cinema brands: Reading Cinemas, Angelika Film Centers,

Consolidated Theatres, and the State Cinema by Angelika. Its live

theatres are owned and operated by its Liberty Theaters subsidiary,

under the Orpheum and Minetta Lane names. Its signature property

developments are maintained in special purpose entities and

operated under the names Newmarket Village, Cannon Park, and The

Belmont Common in Australia, Courtenay Central in New Zealand, and

44 Union Square in New York City.

Additional information about Reading can be

obtained from our Company's website: http://www.readingrdi.com.

Cautionary Note Regarding Forward-Looking

Statements

September 30, 2022, respectively.

Forward-looking statements are neither historical

facts nor assurances of future performance. Instead, they are based

only on our current beliefs, expectations, and assumptions

regarding the future of our business, future plans and strategies,

projections, anticipated events and trends, the economy, and other

future conditions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks, and

changes in circumstances that are difficult to predict and many of

which are outside of our control. Our actual results and financial

condition may differ materially from those indicated in the

forward-looking statements. Therefore, you should not rely on any

of these forward-looking statements. Important factors that could

cause our actual results and financial condition to differ

materially from those indicated in the forward-looking statements

include, among others, the adverse impact of the COVID-19 pandemic

and any variant thereof on short-term and/or long-term

entertainment, leisure and discretionary spending habits and

practices of our patrons and on our results from operations,

liquidity, cash flows, financial condition, and access to credit

markets, and those factors discussed throughout Part I, Item 1A –

Risk Factors and Part II, Item 7 – Management's Discussion and

Analysis of Financial Condition and Results of Operations of our

Annual Report on Form 10-K for the year ended December 31,

2021, as well as the risk factors set forth in any other filings

made under the Securities Act of 1934, as amended, including any of

our Quarterly Reports on Form 10-Q, for more information.

Any forward-looking statement made by us in this

Earnings Release is based only on information currently available

to us and speaks only as of the date on which it is made. We

undertake no obligation to publicly update any forward-looking

statement, whether written or oral, that may be made from time to

time, whether as a result of new information, future developments

or otherwise.

Reading International, Inc. and

SubsidiariesUnaudited Consolidated Statements of

Operations(Unaudited; U.S. dollars in thousands, except

per share data)

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Nine Months Ended |

| |

|

September 30, |

|

September 30, |

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

| Cinema |

|

$ |

48,359 |

|

|

$ |

28,751 |

|

|

$ |

147,476 |

|

|

$ |

79,580 |

|

| Real

estate |

|

|

2,837 |

|

|

|

3,052 |

|

|

|

8,432 |

|

|

|

9,562 |

|

|

Total revenue |

|

|

51,196 |

|

|

|

31,803 |

|

|

|

155,908 |

|

|

|

89,142 |

|

|

Costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Cinema |

|

|

(45,308 |

) |

|

|

(29,237 |

) |

|

|

(134,579 |

) |

|

|

(82,485 |

) |

| Real estate |

|

|

(2,352 |

) |

|

|

(2,683 |

) |

|

|

(6,715 |

) |

|

|

(7,902 |

) |

| Depreciation and

amortization |

|

|

(5,010 |

) |

|

|

(5,560 |

) |

|

|

(15,781 |

) |

|

|

(17,011 |

) |

| Impairment expense |

|

|

— |

|

|

|

— |

|

|

|

(1,549 |

) |

|

|

— |

|

| General and

administrative |

|

|

(5,257 |

) |

|

|

(5,274 |

) |

|

|

(17,364 |

) |

|

|

(19,205 |

) |

|

Total costs and expenses |

|

|

(57,927 |

) |

|

|

(42,754 |

) |

|

|

(175,988 |

) |

|

|

(126,603 |

) |

|

Operating income (loss) |

|

|

(6,731 |

) |

|

|

(10,951 |

) |

|

|

(20,080 |

) |

|

|

(37,461 |

) |

| Interest expense, net |

|

|

(3,693 |

) |

|

|

(3,068 |

) |

|

|

(10,242 |

) |

|

|

(10,437 |

) |

| Gain (loss) on sale of

assets |

|

|

(59 |

) |

|

|

2,559 |

|

|

|

(59 |

) |

|

|

92,345 |

|

| Other

income (expense) |

|

|

5,455 |

|

|

|

440 |

|

|

|

8,445 |

|

|

|

2,236 |

|

|

Income (loss) before income tax expense and equity earnings

of unconsolidated joint ventures |

|

|

(5,028 |

) |

|

|

(11,020 |

) |

|

|

(21,936 |

) |

|

|

46,683 |

|

| Equity

earnings of unconsolidated joint ventures |

|

|

61 |

|

|

|

(75 |

) |

|

|

233 |

|

|

|

158 |

|

|

Income (loss) before income taxes |

|

|

(4,967 |

) |

|

|

(11,095 |

) |

|

|

(21,703 |

) |

|

|

46,841 |

|

| Income

tax benefit (expense) |

|

|

(332 |

) |

|

|

895 |

|

|

|

(1,492 |

) |

|

|

(12,380 |

) |

|

Net income (loss) |

|

$ |

(5,299 |

) |

|

$ |

(10,200 |

) |

|

$ |

(23,195 |

) |

|

$ |

34,461 |

|

| Less:

net income (loss) attributable to noncontrolling interests |

|

|

(122 |

) |

|

|

(105 |

) |

|

|

(228 |

) |

|

|

2,889 |

|

|

Net income (loss) attributable to Reading International,

Inc. |

|

$ |

(5,177 |

) |

|

$ |

(10,095 |

) |

|

$ |

(22,967 |

) |

|

$ |

31,572 |

|

|

Basic earnings (loss) per share |

|

$ |

(0.23 |

) |

|

$ |

(0.46 |

) |

|

$ |

(1.04 |

) |

|

$ |

1.45 |

|

|

Diluted earnings (loss) per share |

|

$ |

(0.23 |

) |

|

$ |

(0.46 |

) |

|

$ |

(1.04 |

) |

|

$ |

1.41 |

|

|

Weighted average number of shares outstanding–basic |

|

|

22,043,823 |

|

|

|

21,809,402 |

|

|

|

22,011,755 |

|

|

|

21,792,007 |

|

|

Weighted average number of shares outstanding–diluted |

|

|

22,043,823 |

|

|

|

21,809,402 |

|

|

|

22,011,755 |

|

|

|

22,462,657 |

|

Reading International, Inc. and

SubsidiariesConsolidated Balance

Sheets(U.S. dollars in thousands, except share

information)

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

September 30, |

|

December 31, |

|

|

|

2022 |

|

|

2021 |

|

|

ASSETS |

|

(unaudited) |

|

|

|

| Current

Assets: |

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

39,628 |

|

|

$ |

83,251 |

|

| Restricted cash |

|

|

6,222 |

|

|

|

5,320 |

|

| Receivables |

|

|

4,601 |

|

|

|

5,360 |

|

| Inventories |

|

|

1,355 |

|

|

|

1,408 |

|

| Derivative financial

instruments - current portion |

|

|

1,318 |

|

|

|

96 |

|

| Prepaid and other current

assets |

|

|

5,567 |

|

|

|

4,871 |

|

|

Total current assets |

|

|

58,691 |

|

|

|

100,306 |

|

| Operating property, net |

|

|

281,910 |

|

|

|

306,657 |

|

| Operating lease right-of-use

assets |

|

|

200,396 |

|

|

|

227,367 |

|

| Investment and development

property, net |

|

|

7,853 |

|

|

|

9,570 |

|

| Investment in unconsolidated

joint ventures |

|

|

4,352 |

|

|

|

4,993 |

|

| Goodwill |

|

|

24,131 |

|

|

|

26,758 |

|

| Intangible assets, net |

|

|

2,548 |

|

|

|

3,258 |

|

| Deferred tax asset, net |

|

|

2,316 |

|

|

|

2,220 |

|

| Derivative financial

instruments - non-current portion |

|

|

21 |

|

|

|

112 |

|

| Other

assets |

|

|

7,500 |

|

|

|

6,461 |

|

|

Total assets |

|

$ |

589,718 |

|

|

$ |

687,702 |

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

| Current

Liabilities: |

|

|

|

|

|

|

| Accounts payable and accrued

liabilities |

|

$ |

38,497 |

|

|

$ |

39,678 |

|

| Film rent payable |

|

|

2,803 |

|

|

|

7,053 |

|

| Debt - current portion |

|

|

57,207 |

|

|

|

11,349 |

|

| Subordinated debt - current

portion |

|

|

738 |

|

|

|

711 |

|

| Derivative financial

instruments - current portion |

|

|

— |

|

|

|

181 |

|

| Taxes payable - current |

|

|

2,038 |

|

|

|

10,655 |

|

| Deferred revenue |

|

|

7,958 |

|

|

|

9,996 |

|

| Operating lease liabilities -

current portion |

|

|

22,950 |

|

|

|

23,737 |

|

| Other

current liabilities |

|

|

6,717 |

|

|

|

3,619 |

|

|

Total current liabilities |

|

|

138,908 |

|

|

|

106,979 |

|

| Debt - long-term portion |

|

|

132,345 |

|

|

|

195,198 |

|

| Subordinated debt, net |

|

|

26,894 |

|

|

|

26,728 |

|

| Noncurrent tax

liabilities |

|

|

6,286 |

|

|

|

7,467 |

|

| Operating lease liabilities -

non-current portion |

|

|

200,855 |

|

|

|

223,364 |

|

| Other

liabilities |

|

|

15,196 |

|

|

|

22,906 |

|

|

Total liabilities |

|

$ |

520,484 |

|

|

$ |

582,642 |

|

|

Commitments and contingencies (Note 14) |

|

|

|

|

|

|

| Stockholders’

equity: |

|

|

|

|

|

|

| Class A non-voting common

shares, par value $0.01, 100,000,000 shares authorized, |

|

|

|

|

|

|

|

33,299,344 issued and 20,363,234 outstanding at September 30, 2022

and |

|

|

|

|

|

|

|

33,198,500 issued and 20,262,390 outstanding at December 31,

2021 |

|

|

234 |

|

|

|

233 |

|

| Class B voting common shares,

par value $0.01, 20,000,000 shares authorized and |

|

|

|

|

|

|

|

1,680,590 issued and outstanding at September 30, 2022 and December

31, 2021 |

|

|

17 |

|

|

|

17 |

|

| Nonvoting preferred shares,

par value $0.01, 12,000 shares authorized and no issued |

|

|

|

|

|

|

|

or outstanding shares at September 30, 2022 and December 31,

2021 |

|

|

— |

|

|

|

— |

|

| Additional paid-in

capital |

|

|

153,275 |

|

|

|

151,981 |

|

| Retained

earnings/(deficits) |

|

|

(35,598 |

) |

|

|

(12,632 |

) |

| Treasury shares |

|

|

(40,407 |

) |

|

|

(40,407 |

) |

|

Accumulated other comprehensive income |

|

|

(8,979 |

) |

|

|

4,882 |

|

|

Total Reading International, Inc. stockholders’

equity |

|

|

68,542 |

|

|

|

104,074 |

|

|

Noncontrolling interests |

|

|

693 |

|

|

|

986 |

|

|

Total stockholders’ equity |

|

|

69,235 |

|

|

|

105,060 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

589,719 |

|

|

$ |

687,702 |

|

Reading International, Inc. and

SubsidiariesSegment Results(Unaudited;

U.S. dollars in thousands)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Nine Months Ended |

| |

|

September 30, |

|

% ChangeFavorable/ |

|

September 30, |

|

% ChangeFavorable/ |

|

(Dollars in thousands) |

|

2022 |

|

|

2021 |

|

|

(Unfavorable) |

|

2022 |

|

|

2021 |

|

|

(Unfavorable) |

|

Segment revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cinema |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

$ |

24,676 |

|

|

$ |

16,963 |

|

|

45 |

|

% |

|

$ |

72,532 |

|

|

$ |

33,858 |

|

|

>100 |

% |

|

Australia |

|

|

20,014 |

|

|

|

9,356 |

|

|

>100 |

% |

|

|

63,797 |

|

|

|

37,620 |

|

|

70 |

% |

|

New Zealand |

|

|

3,670 |

|

|

|

2,431 |

|

|

51 |

|

% |

|

|

11,147 |

|

|

|

8,102 |

|

|

38 |

% |

|

Total |

|

$ |

48,360 |

|

|

$ |

28,750 |

|

|

68 |

|

% |

|

$ |

147,476 |

|

|

$ |

79,580 |

|

|

85 |

% |

|

Real estate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

$ |

527 |

|

|

$ |

556 |

|

|

(5 |

) |

% |

|

$ |

1,788 |

|

|

$ |

1,229 |

|

|

45 |

% |

|

Australia |

|

|

3,154 |

|

|

|

2,391 |

|

|

32 |

|

% |

|

|

9,336 |

|

|

|

8,000 |

|

|

17 |

% |

|

New Zealand |

|

|

390 |

|

|

|

230 |

|

|

70 |

|

% |

|

|

1,141 |

|

|

|

718 |

|

|

59 |

% |

|

Total |

|

$ |

4,071 |

|

|

$ |

3,177 |

|

|

28 |

|

% |

|

$ |

12,265 |

|

|

$ |

9,947 |

|

|

23 |

% |

|

Inter-segment elimination |

|

|

(1,232 |

) |

|

|

(125 |

) |

|

(>100) |

% |

|

|

(3,833 |

) |

|

|

(386 |

) |

|

(>100) |

% |

| Total segment

revenue |

|

$ |

51,199 |

|

|

$ |

31,802 |

|

|

61 |

|

% |

|

$ |

155,908 |

|

|

$ |

89,141 |

|

|

75 |

% |

| Segment operating

income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cinema |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

$ |

(3,988 |

) |

|

$ |

(3,274 |

) |

|

(22 |

) |

% |

|

$ |

(12,342 |

) |

|

$ |

(21,582 |

) |

|

43 |

% |

|

Australia |

|

|

1,577 |

|

|

|

(1,682 |

) |

|

>100 |

% |

|

|

5,836 |

|

|

|

566 |

|

|

>100 |

% |

|

New Zealand |

|

|

274 |

|

|

|

(100 |

) |

|

>100 |

% |

|

|

605 |

|

|

|

337 |

|

|

80 |

% |

|

Total |

|

$ |

(2,137 |

) |

|

$ |

(5,056 |

) |

|

58 |

|

% |

|

$ |

(5,901 |

) |

|

$ |

(20,679 |

) |

|

71 |

% |

|

Real estate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

$ |

(1,159 |

) |

|

$ |

(1,439 |

) |

|

19 |

|

% |

|

$ |

(3,273 |

) |

|

$ |

(4,260 |

) |

|

23 |

% |

|

Australia |

|

|

1,351 |

|

|

|

464 |

|

|

>100 |

% |

|

|

4,046 |

|

|

|

1,782 |

|

|

>100 |

% |

|

New Zealand |

|

|

(336 |

) |

|

|

(509 |

) |

|

34 |

|

% |

|

|

(897 |

) |

|

|

(1,430 |

) |

|

37 |

% |

|

Total |

|

$ |

(144 |

) |

|

$ |

(1,484 |

) |

|

90 |

|

% |

|

$ |

(124 |

) |

|

$ |

(3,908 |

) |

|

97 |

% |

| Total segment

operating income (loss) (1) |

|

$ |

(2,281 |

) |

|

$ |

(6,540 |

) |

|

65 |

|

% |

|

$ |

(6,025 |

) |

|

$ |

(24,587 |

) |

|

75 |

% |

(1) Total segment operating

income is a non-GAAP financial measure. See the discussion of

non-GAAP financial measures that follows.

Reading International, Inc. and

SubsidiariesReconciliation of EBITDA and Adjusted

EBITDA to Net Income (Loss)(Unaudited; U.S. dollars in

thousands)

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Nine Months Ended |

| |

|

September 30, |

|

September 30, |

|

(Dollars in thousands) |

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

Net Income (loss) attributable to Reading International, Inc. |

|

$ |

(5,177 |

) |

|

$ |

(10,095 |

) |

|

$ |

(22,967 |

) |

|

$ |

31,572 |

|

Add: Interest expense, net |

|

|

3,693 |

|

|

|

3,068 |

|

|

|

10,242 |

|

|

|

10,437 |

|

Add: Income tax expense (benefit) |

|

|

332 |

|

|

|

(895 |

) |

|

|

1,492 |

|

|

|

12,380 |

|

Add: Depreciation and amortization |

|

|

5,010 |

|

|

|

5,560 |

|

|

|

15,781 |

|

|

|

17,011 |

| EBITDA |

|

$ |

3,858 |

|

|

$ |

(2,362 |

) |

|

$ |

4,548 |

|

|

$ |

71,400 |

| Adjustments for: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal expenses relating to the Derivative litigation, the James J.

Cotter Jr. employment arbitration and other Cotter litigation

matters |

|

|

— |

|

|

|

(2 |

) |

|

|

— |

|

|

|

28 |

| Adjusted

EBITDA |

|

$ |

3,858 |

|

|

$ |

(2,364 |

) |

|

$ |

4,548 |

|

|

$ |

71,428 |

Reading International, Inc. and

SubsidiariesReconciliation of Total Segment

Operating Income (Loss) to Income (Loss) before Income

Taxes(Unaudited; U.S. dollars in thousands)

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Nine Months Ended |

| |

|

September 30, |

|

September 30, |

|

(Dollars in thousands) |

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

Segment operating income (loss) |

|

$ |

(2,283 |

) |

|

$ |

(6,542 |

) |

|

$ |

(6,026 |

) |

|

$ |

(24,587 |

) |

| Unallocated corporate

expense |

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and

amortization expense |

|

|

(258 |

) |

|

|

(300 |

) |

|

|

(804 |

) |

|

|

(917 |

) |

| General and

administrative expense |

|

|

(4,191 |

) |

|

|

(4,109 |

) |

|

|

(13,250 |

) |

|

|

(11,957 |

) |

| Interest

expense, net |

|

|

(3,694 |

) |

|

|

(3,068 |

) |

|

|

(10,242 |

) |

|

|

(10,437 |

) |

| Equity earnings of

unconsolidated joint ventures |

|

|

61 |

|

|

|

(75 |

) |

|

|

233 |

|

|

|

158 |

|

| Gain (loss) on sale of

assets |

|

|

(59 |

) |

|

|

2,559 |

|

|

|

(59 |

) |

|

|

92,345 |

|

| Other income (expense) |

|

|

5,455 |

|

|

|

440 |

|

|

|

8,445 |

|

|

|

2,236 |

|

| Income (loss) before

income tax expense |

|

$ |

(4,969 |

) |

|

$ |

(11,095 |

) |

|

$ |

(21,703 |

) |

|

$ |

46,841 |

|

Non-GAAP Financial Measures

This Earnings Release presents total segment

operating income (loss), EBITDA, and Adjusted EBITDA, which are

important financial measures for our Company, but are not financial

measures defined by U.S. GAAP.

These measures should be reviewed in conjunction

with the relevant U.S. GAAP financial measures and are not

presented as alternative measures of earnings (loss) per share,

cash flows or net income (loss) as determined in accordance with

U.S. GAAP. Total segment operating income (loss) and EBITDA, as we

have calculated them, may not be comparable to similarly titled

measures reported by other companies.

Total segment operating income

(loss) – we evaluate the performance of our business

segments based on segment operating income (loss), and management

uses total segment operating income (loss) as a measure of the

performance of operating businesses separate from non-operating

factors. We believe that information about total segment operating

income (loss) assists investors by allowing them to evaluate

changes in the operating results of our Company’s business separate

from non-operational factors that affect net income (loss), thus

providing separate insight into both operations and the other

factors that affect reported results. EBITDA – We

use EBITDA in the evaluation of our Company’s performance since we

believe that EBITDA provides a useful measure of financial

performance and value. We believe this principally for the

following reasons:

We believe that EBITDA is an accepted industry-wide

comparative measure of financial performance. It is, in our

experience, a measure commonly adopted by analysts and financial

commentators who report upon the cinema exhibition and real estate

industries, and it is also a measure used by financial institutions

in underwriting the creditworthiness of companies in these

industries. Accordingly, our management monitors this calculation

as a method of judging our performance against our peers, market

expectations, and our creditworthiness. It is widely accepted that

analysts, financial commentators, and persons active in the cinema

exhibition and real estate industries typically value enterprises

engaged in these businesses at various multiples of EBITDA.

Accordingly, we find EBITDA valuable as an indicator of the

underlying value of our businesses. We expect that investors may

use EBITDA to judge our ability to generate cash, as a basis of

comparison to other companies engaged in the cinema exhibition and

real estate businesses and as a basis to value our company against

such other companies.

EBITDA is not a measurement of financial

performance under generally accepted accounting principles in the

United States of America and it should not be considered in

isolation or construed as a substitute for net income (loss) or

other operations data or cash flow data prepared in accordance with

generally accepted accounting principles in the United States for

purposes of analyzing our profitability. The exclusion of various

components, such as interest, taxes, depreciation, and

amortization, limits the usefulness of these measures when

assessing our financial performance, as not all funds depicted by

EBITDA are available for management’s discretionary use. For

example, a substantial portion of such funds may be subject to

contractual restrictions and functional requirements to service

debt, to fund necessary capital expenditures, and to meet other

commitments from time to time.

EBITDA also fails to take into account the cost of

interest and taxes. Interest is clearly a real cost that for us is

paid periodically as accrued. Taxes may or may not be a current

cash item but are nevertheless real costs that, in most situations,

must eventually be paid. A company that realizes taxable earnings

in high tax jurisdictions may, ultimately, be less valuable than a

company that realizes the same amount of taxable earnings in a low

tax jurisdiction. EBITDA fails to take into account the cost of

depreciation and amortization and the fact that assets will

eventually wear out and have to be replaced.

Adjusted EBITDA – using the

principles we consistently apply to determine our EBITDA, we

further adjusted the EBITDA for certain items we believe to be

external to our core business and not reflective of our costs of

doing business or results of operation. Specifically, we have

adjusted for (i) legal expenses relating to extraordinary

litigation, and (ii) any other items that can be considered

non-recurring in accordance with the two-year SEC requirement for

determining an item is non-recurring, infrequent or unusual in

nature.

For more information, contact:

Gilbert Avanes – EVP, CFO, and Treasurer

Andrzej Matyczynski – EVP Global Operations

(213) 235-2240

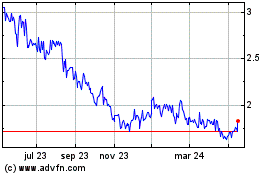

Reading (NASDAQ:RDI)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

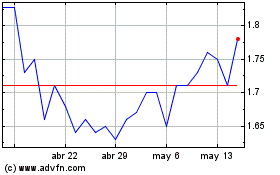

Reading (NASDAQ:RDI)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025