UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

FOR ANNUAL REPORTS OF EMPLOYEE STOCK

PURCHASE, SAVINGS AND SIMILAR PLANS

PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

| | | | | |

| x | ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

OR

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to ____________

Commission file number: 0-12247

A. Full title of the plan and the address of the plan, if different from that of the issue named below:

Savings Plan for the Subsidiaries of Southside Bancshares, Inc.

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

Southside Bancshares, Inc.

1201 S. Beckham Avenue

Tyler, TX 75701

SAVINGS PLAN FOR THE

SUBSIDIARIES OF SOUTHSIDE BANCSHARES, INC.

Table of Contents

| | | | | |

| Page |

| |

| Financial Statements: | |

| |

| |

| |

| Supplemental Schedule | |

| |

| Other Information | |

| |

| |

| |

| |

Report of Independent Registered Public Accounting Firm

To the Plan Participants and the Plan Administrator of the Savings Plan for the Subsidiaries of Southside Bancshares, Inc.

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits (modified cash basis) of the Savings Plan for the Subsidiaries of Southside Bancshares, Inc. (the Plan) as of December 31, 2022 and 2021, and the related statements of changes in net assets available for benefits (modified cash basis) for the years then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits (modified cash basis) of the Plan at December 31, 2022 and 2021, and the changes in its net assets available for benefits (modified cash basis) for the years then ended, in accordance with the modified cash basis of accounting described in Note 2.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Schedules Required by ERISA

The accompanying supplemental schedule (modified cash basis) of assets (held at end of year) at December 31, 2022 (referred to as the “supplemental schedule”), has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The information in the supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the information, we evaluated whether such information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Ernst & Young LLP

We have served as the Plan’s auditor since 2014.

Dallas, Texas

June 28, 2023

Savings Plan for the Subsidiaries of Southside Bancshares, Inc. | 1

SAVINGS PLAN FOR THE

SUBSIDIARIES OF SOUTHSIDE BANCSHARES, INC.

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

(MODIFIED CASH BASIS)

| | | | | | | | | | | |

| December 31, 2022 | | December 31, 2021 |

| ASSETS | | | |

| | | |

| | | |

| Investments: | | | |

| Investments, at fair value | $ | 49,209,204 | | | $ | 56,622,830 | |

| Fully benefit responsive investment, at contract value | 1,387,120 | | | 1,311,329 | |

| Total investments | 50,596,324 | | | 57,934,159 | |

| Receivables: | | | |

| Notes receivable from participants | 1,096,973 | | | 867,024 | |

| | | |

| Net assets available for benefits | $ | 51,693,297 | | | $ | 58,801,183 | |

| | | |

See Accompanying Notes to Financial Statements.

Savings Plan for the Subsidiaries of Southside Bancshares, Inc. | 2

SAVINGS PLAN FOR THE

SUBSIDIARIES OF SOUTHSIDE BANCSHARES, INC.

STATEMENTS OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

(MODIFIED CASH BASIS)

| | | | | | | | | | | |

| Years Ended December 31, |

| 2022 | | 2021 |

| ADDITIONS: | | | |

| Investment income (loss): | | | |

| Net (depreciation) appreciation in fair value of investments | $ | (10,053,185) | | | $ | 7,599,677 | |

| Dividend and interest income | 280,450 | | | 515,062 | |

| | | |

| Total investment (loss) income | (9,772,735) | | | 8,114,739 | |

| Interest income on notes receivable from participants | 37,159 | | | 36,985 | |

| Contributions: | | | |

| Participant | 4,546,038 | | | 4,008,862 | |

| Employer | 1,946,451 | | | 1,921,532 | |

| Rollovers | 500,570 | | | 226,195 | |

| Total contributions | 6,993,059 | | | 6,156,589 | |

| Total additions, net of investment loss | (2,742,517) | | | 14,308,313 | |

| | | |

| DEDUCTIONS: | | | |

| Benefits paid to participants | 4,263,306 | | | 4,109,642 | |

| | | |

| Administrative expenses | 102,063 | | | 22,525 | |

| Total deductions | 4,365,369 | | | 4,132,167 | |

| Net (decrease) increase | (7,107,886) | | | 10,176,146 | |

| | | |

| NET ASSETS AVAILABLE FOR BENEFITS: | | | |

| Beginning of year | 58,801,183 | | | 48,625,037 | |

| End of year | $ | 51,693,297 | | | $ | 58,801,183 | |

| | | |

See Accompanying Notes to Financial Statements.

Savings Plan for the Subsidiaries of Southside Bancshares, Inc. | 3

SAVINGS PLAN FOR THE

SUBSIDIARIES OF SOUTHSIDE BANCSHARES, INC.

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2022 AND 2021

NOTE 1 - DESCRIPTION OF PLAN

General and Administrative

The Savings Plan for the Subsidiaries of Southside Bancshares, Inc. (the “Plan”) is a defined contribution 401(k) profit sharing plan for eligible employees of Southside Bancshares, Inc. and Subsidiaries (the “Company” or “Employer”). The Plan is administered by Southside Bancshares, Inc. (“Plan Administrator”), which is also the Plan Sponsor. Principal Financial Group provides certain plan administrative and support services such as compliance testing, processing distribution/loan requests, and enrollment and transaction processing and serves as the trustee and custodian.

The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). Participants should refer to the plan document and summary plan description for a more complete description of the Plan’s provisions, copies of which may be obtained from the Plan Sponsor.

Eligibility

Eligible employees may participate in the Plan after they have worked at least 30 days with the Company or a predecessor employer.

Union employees, leased employees, independent contractors (even if later determined to be an employee), non-resident aliens and any security officers hired on or after April 30, 2003 who are also employed on a full-time basis by any federal, state, county or local law enforcement agency shall be excluded from participation in the Plan.

Contributions

A participant may elect to make salary deferral contributions of their eligible compensation subject to certain maximum limitations imposed by the Internal Revenue Code (the “Code”). These elective deferral contributions may consist of both pre-tax and Roth 401(k) contributions; however, the combination of pre-tax and Roth contributions were limited to $20,500 for 2022 and $19,500 for 2021.

Participants aged 50 and over by the end of the plan year are permitted to make annual catch-up contributions. The catch-up contribution limit was $6,500 for 2022 and 2021, making the total elective deferral limitation $27,000 for 2022 and $26,000 for 2021.

On January 1 of each year and on the plan entry date for each new participant that has met the eligibility criteria, an automatic enrollment at a 5% deferral rate will be applied to all participant accounts that have not made an election to defer. Those who had previously elected not to defer or designated a zero-deferral percentage will also be automatically enrolled each January 1, unless the participant affirmatively elects to not defer prior to each January 1. If a participant does not choose a different deferral percentage other than the automatic 5%, the deferral percentage will also be automatically increased each first day of each succeeding plan year by 1% up to a maximum deferral percentage of 10%.

The Company has an option to provide discretionary contributions equal to a matching percentage which the Company, from time to time, deems advisable. The Company’s matching percentage is 100% for the first 3% of the employee’s salary deferral and 50% for the next 2% of the employee’s salary deferral. In applying the matching percentage, only salary deferrals up to 5% of a participant’s eligible compensation will be used. To receive the Company’s discretionary matching contribution for a Plan year, if any, the participant must have made match-eligible contributions during the Plan year, completed 1,000 hours or more of service during the Plan year and must be employed by the Company on the last day of the Plan year (unless the participant terminated due to death or disability, or after attainment of normal retirement age).

Savings Plan for the Subsidiaries of Southside Bancshares, Inc. | 4

Table of Contents

SAVINGS PLAN FOR THE

SUBSIDIARIES OF SOUTHSIDE BANCSHARES, INC.

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2022 AND 2021

Rollover Contributions

A rollover contribution is an amount received from another plan or IRA. Under certain circumstances, participants may roll over an amount from another plan to this Plan. This amount comes from contributions made because of past participation in another plan. A rollover is only allowed in cash. A rollover may include an outstanding loan balance, if the participant were affected by a business event that results in a change of employer. A direct rollover may come from other qualified plans, tax sheltered annuity plans and governmental 457 plans. A participant rollover that was originally paid to the participant may come from other qualified plans, tax sheltered annuity plans, governmental 457 plans and traditional IRAs.

Vesting

Participants are immediately vested in their salary deferral contributions including Roth 401(k) contributions and any rollover contributions plus actual earnings thereon. Vesting service means the sum of a participant’s periods of service. The cumulative periods of service begin when the participant starts working for the Company and/or a predecessor employer and ends on the earlier of the date the participant stops working for the Company or the date the participant is absent from work for one year. Any Plan year in which a participant was not an employee of the Company for less than a full year or is absent from work less than one year will count as a period of service for vesting purposes.

Vesting in the Company matching contributions is based upon periods of service as indicated below:

| | | | | | | | |

| Periods of Service | | % Vested |

| Less than 2 | | 0% |

| 2 | | 20% |

| 3 | | 40% |

| 4 | | 60% |

| 5 | | 80% |

| 6 or more | | 100% |

A participant also becomes 100% vested in all accounts upon attaining age 55 while employed by the Company. A participant’s account is also fully vested if the participant dies or becomes disabled while employed by the Company.

Participant Accounts

Each participant’s account is credited with the participant’s contribution, the Company’s matching contributions (if eligible), and the net earnings or losses from the investment activities of the participant’s account, reduced for any withdrawals and fees associated with notes receivables. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

Forfeited Accounts

Upon termination of employment, participants forfeit their nonvested benefits. These forfeitures generally may serve to pay the Plan’s administrative expenses and to reduce future Employer contributions. In certain circumstances, if a participant is rehired, the participant shall have the right to repay to the Plan the portion of the participant’s account which may have been previously distributed. In the event the participant repays the entire distribution received from the Plan, the Company shall restore the nonvested portion of the participant’s account. During 2022, forfeitures reduced Plan expenses by $75,708. During 2021, forfeitures did not reduce Plan expenses. Forfeitures were used to reduce employer contributions for the 2022 and 2021 Plan years by $23,619 and $83,648, respectively. Unallocated forfeited balances as of December 31, 2022 and 2021 were $126,799 and $187,237, respectively.

Participant Investment Options

Participants are permitted to invest employee and employer contributions among only those investment alternatives made available under the Plan. Participants may not invest more than 20% of their account in employer stock. Participants are permitted to invest rollover contributions into investment alternatives made available under the Plan except for employer

Savings Plan for the Subsidiaries of Southside Bancshares, Inc. | 5

Table of Contents

SAVINGS PLAN FOR THE

SUBSIDIARIES OF SOUTHSIDE BANCSHARES, INC.

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2022 AND 2021

company stock. Participants may elect to terminate their elective deferrals at any time. Modifications to participants’ deferral amounts are effective at the beginning of the next payroll period. Participants may change their investment options via phone or online access to Principal Financial Group in accordance with applicable procedures established by the Plan Administrator.

Participant Loans

Participants may borrow from their accounts a minimum of $1,000 up to a maximum equal to the lesser of $50,000 (reduced by the highest outstanding loan balance from the Plan during the one-year period ending on the day before the new loan is made), or the greater of 50% of their vested account balance or $10,000, reduced by any outstanding loan balance on the date the new loan is made. The maximum repayment term of any loan is 5 years. Loan transactions are treated as a transfer to (from) the investment funds from (to) the Participants Loan account. Loans are secured by the balance in the participants’ accounts and bear interest at the rate commensurate with the Wall Street base rate at the date of issuance as determined by Principal Financial Group. A participant may not have more than one loan outstanding at any point in time. Principal and interest are paid ratably through payroll deductions over not more than 5 years.

In-service Withdrawals

Participants may be eligible for financial hardship withdrawals to pay medical expenses, the purchase of a residence, expenses of post-secondary higher education or other eligible expenses. Hardship withdrawals are allowed for participants incurring an immediate and heavy financial need, as defined by the Plan. Hardship withdrawals are strictly regulated by the Internal Revenue Service (“IRS”) and a participant must exhaust all available loan options and available distributions prior to requesting a hardship withdrawal. The amount withdrawn, which may include all or a portion of rollover contributions, cannot exceed the amount of the hardship. Participants may also withdraw any or all of the participant’s vested account if the participant is at least 59 ½ and has not yet terminated employment with the Company. Participants may withdraw any or all of the account of rollover contributions at any time.

Payment of Benefits

Upon separation of service with the Company, a participant whose vested account balance is equal to or less than $5,000 but more than $1,000 will receive a mandatory distribution paid directly to an eligible retirement plan unless the participant elects to receive an immediate lump-sum distribution equal to their vested account balance. For vested account balances that are $1,000 or less, an immediate lump-sum distribution of the vested account balance will be paid to the participant. For vested account balances greater than $5,000, a participant is eligible for a distribution paid directly to an eligible retirement plan, a single lump-sum payment, fixed period or fixed amount installment payments over a period of time or partial payments. Cash and employer securities are forms of payment available under the Plan.

Administrative Expenses

Some Plan administrative expenses are paid by the Company. Expenses relating to purchases, sales or transfers of the Plan’s investments are charged to the particular investment fund to which the expenses relate. Fees related to the administration of participants’ notes receivable and distributions are charged directly to the participants.

Plan Termination

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. In the event the Plan terminates, affected participants will become 100% vested in their accounts.

Savings Plan for the Subsidiaries of Southside Bancshares, Inc. | 6

Table of Contents

SAVINGS PLAN FOR THE

SUBSIDIARIES OF SOUTHSIDE BANCSHARES, INC.

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2022 AND 2021

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting

The financial statements of the Plan have been prepared on the modified cash basis of accounting, which is a comprehensive basis of accounting other than U.S. generally accepted accounting principles. The modified cash basis of accounting is an acceptable alternative method of reporting under regulations issued by the Department of Labor. The carrying values of the Plan’s investments have been adjusted to fair value as stated below with the exception of the fully benefit responsive investment, which is carried at contract value. All other transactions are recorded on the cash basis.

Use of Estimates

The preparation of financial statements in conformity with the modified cash basis of accounting requires management to make estimates that affect amounts reported in the financial statements and accompanying notes and supplemental schedule. Actual results could differ from those estimates.

Payment of Benefits

Benefits are recorded when paid.

Investment Valuation and Income Recognition

Investments held by the Plan are stated at fair value except for fully benefit responsive investments which are stated at contract value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). See Note 3 for further discussion and disclosures related to fair value measurements.

An investment contract that meets the fully benefit responsive investment contract criteria is reported at contract value. Contract value is the relevant measure for a fully benefit responsive investment contract, because this is the amount to be received by participants if they were to initiate permitted transactions under the terms of the Plan. Contract value represents contributions made under the contract, plus earnings, less participant withdrawals and administrative expenses. This contract is a guaranteed general-account backed group annuity contract. An employer-level liquidation or employer initiated transfer of the plan’s interest in these contracts is subject to either a 12-month advance notice or a 5% surrender charge, whichever the plan fiduciary chooses. A 5% surrender charge will also apply if the cumulative percentage of participant transfers exceeds 20% of the Plan’s interest in the contract during the 12-month period immediately preceding the employer-level surrender of the plan’s interest in the contract. The occurrence of these events is not probable of occurring.

The Plan Administrator is responsible for determining the Plan’s valuation policies and analyzing information provided by the investment custodians and issuers, which are used to determine the investment value of the Plan’s investments.

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the cash basis. Dividends are recorded on the payment date. Net appreciation or depreciation in the fair value of investments includes the Plan’s gains and losses on investments bought and sold, as well as held during the year.

Notes Receivable from Participants

Notes receivable from participants represent participant loans that are recorded at their unpaid principal balance. Interest income on notes receivable from participants is recorded when it is received. Related fees are recorded as administrative expense and are recorded when they are paid. No allowance for credit losses was recorded as of December 31, 2022 or 2021. If a participant ceases to make loan repayments and the Plan Administrator deems the participant loan to be a distribution, the participant loan balance is reduced and a benefit payment is recorded.

Savings Plan for the Subsidiaries of Southside Bancshares, Inc. | 7

Table of Contents

SAVINGS PLAN FOR THE

SUBSIDIARIES OF SOUTHSIDE BANCSHARES, INC.

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2022 AND 2021

NOTE 3 - FAIR VALUE MEASUREMENTS

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., an exit price). The fair value hierarchy prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets and liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

Level 1 – Valuations based on unadjusted quoted prices in active markets that are accessible to the reporting entity at the measurement date for identical assets and liabilities.

Level 2 – Valuations based on inputs other than quoted prices in active markets for identical assets and liabilities that are observable either directly or indirectly for substantially the full term of the asset or liability. Level 2 inputs might include the following:

•quoted prices for similar assets and liabilities in active markets;

•quoted prices for identical or similar assets or liabilities in markets that are not active;

•inputs other than quoted prices that are observable for the asset or liability (e.g., interest rates, volatilities, prepayment speeds, credit risks, etc.); or

•inputs that are derived principally from or corroborated by observable market data by correlation or other means.

Level 3 – Valuations based on unobservable inputs for the asset or liability (i.e., supported by little or no market activity). Level 3 inputs include management’s own assumption about the assumptions that market participants would use in pricing the asset or liability (including assumptions about risk).

The level in the fair value hierarchy within which the fair value measurement is classified is determined based on the lowest level input that is significant to the fair value measure in its entirety. There were no transfers between any levels of the fair value hierarchy during the years ended December 31, 2022 or 2021.

Following is a description of the valuation techniques and inputs used for each major class of assets measured at fair value by the Plan.

Southside Bancshares, Inc. Common Stock: Fair value measurement of common stock is based upon the closing price reported on the active market on which the individual securities are traded and is classified in Level 1 of the fair value hierarchy.

Mutual Funds and Money Market Funds: Mutual fund and Money Market fund net asset values (“NAVs”) are quoted in an active market and are classified in Level 1 of the fair value hierarchy.

Pooled Separate Accounts: Investments in pooled separate accounts are valued at the fair value per share (unit) based upon the number of shares held by the Plan at year end as reported by the fund managers and are classified in Level 1 in the fair value hierarchy. The Plan considers the fair value per share (unit) to be a readily determinable fair value which is disclosed and used as the basis for current transactions.

Collective Investment Trusts: Investments in collective investment trusts are valued at the fair value per share (unit) as determined by using estimated fair value of the underlying assets held in the fund as reported by the investment manager of the trust. The Plan considers the fair value per share (unit) to be a readily determinable fair value which is disclosed and used as the basis for current transactions.

Savings Plan for the Subsidiaries of Southside Bancshares, Inc. | 8

Table of Contents

SAVINGS PLAN FOR THE

SUBSIDIARIES OF SOUTHSIDE BANCSHARES, INC.

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2022 AND 2021

Investments measured at fair value on a recurring basis which are held directly by the Plan are summarized below:

| | | | | | | | | | | | | | | | | | | | | | | |

| |

| December 31, 2022 | Level 1 | | Level 2 | | Level 3 | | Total |

| Investments at fair value: | | | | | | | |

Mutual Funds | $ | 4,739,876 | | | $ | — | | | $ | — | | | $ | 4,739,876 | |

Southside Bancshares, Inc. Common Stock | 4,416,687 | | | — | | | — | | | 4,416,687 | |

| Collective Investment Trusts | 31,610,152 | | | — | | | — | | | 31,610,152 | |

| Pooled Separate Accounts | 8,442,489 | | | — | | | — | | | 8,442,489 | |

Total investments at fair value | $ | 49,209,204 | | | $ | — | | | $ | — | | | $ | 49,209,204 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| |

| December 31, 2021 | Level 1 | | Level 2 | | Level 3 | | Total |

| Investments at fair value: | | | | | | | |

Mutual Funds | $ | 4,931,859 | | | $ | — | | | $ | — | | | $ | 4,931,859 | |

Southside Bancshares, Inc. Common Stock | 4,839,752 | | | — | | | — | | | 4,839,752 | |

| Collective Investment Trusts | 37,171,076 | | | — | | | — | | | 37,171,076 | |

| Pooled Separate Accounts | 9,680,143 | | | — | | | — | | | 9,680,143 | |

Total investments at fair value | $ | 56,622,830 | | | $ | — | | | $ | — | | | $ | 56,622,830 | |

NOTE 4 - TAX STATUS

The Plan document was restated effective March 15, 2022 and is based on a non-standardized pre-approved profit sharing plan sponsored by Principal Life Insurance Company. The underlying pre-approved plan has received an opinion letter from the IRS dated June 30, 2020, stating that the written form of the underlying pre-approved document is qualified under Section 401 of the Code. Any employer adopting this form of the plan will be considered to have a plan qualified under Section 401 of the Code, and therefore, the related trust is tax-exempt. Once qualified, the Plan is required to operate in conformity with the Code to maintain its qualified status. The Plan Administrator believes the Plan is being operated in compliance with the applicable requirements of the Code and, therefore, believes the Plan is qualified and the related trust is tax-exempt.

Accounting principles generally accepted in the United States require Plan management to evaluate tax positions taken by the Plan and recognize a tax liability if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. The Plan Administrator has analyzed the tax positions taken by the Plan and has concluded that there are no uncertain positions taken or expected to be taken. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

NOTE 5 - RELATED-PARTY TRANSACTIONS

Shares of the Company’s common stock held by the Plan are managed by the Principal Financial Group as trustee and custodian for the Plan. The investments in Southside Bancshares, Inc. common stock at December 31, 2022 and 2021, included 122,720 and 115,728 shares, respectively, with fair values of $4,416,687 and $4,839,752, respectively. The Company pays administrative fees to Principal Financial Group. These transactions qualify as party-in-interest transactions as do note receivables from participants; however, they are exempt from the prohibited transaction rules under ERISA.

Savings Plan for the Subsidiaries of Southside Bancshares, Inc. | 9

Table of Contents

SAVINGS PLAN FOR THE

SUBSIDIARIES OF SOUTHSIDE BANCSHARES, INC.

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2022 AND 2021

NOTE 6 - RISK AND UNCERTAINTIES

The Plan invests in various investment securities. Investment securities are exposed to various risks such as interest rate, market volatility and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statement of net assets available for benefits (modified cash basis).

NOTE 7 - RECONCILIATION OF FINANCIAL STATEMENTS TO FORM 5500

The following is a reconciliation of net assets available for benefits reflected by the accompanying financial statements to Schedule H of Form 5500 at December 31:

| | | | | | | | | | | |

| 2022 | | 2021 |

| Net assets available for benefits - financial statements | $ | 51,693,297 | | | $ | 58,801,183 | |

| Employer match receivable | 2,037,815 | | | 1,946,451 | |

| Employee contribution receivable | 142,244 | | | 142,071 | |

| Net assets available for benefits - Form 5500 | $ | 53,873,356 | | | $ | 60,889,705 | |

| | | |

The following is a reconciliation of the net decrease in the net assets available for benefits per the financial statements to net loss on Schedule H of Form 5500 for the year ended December 31, 2022:

| | | | | | | | |

| Net decrease in the net assets available for benefits | | $ | (7,107,886) | |

| Current year employer match receivable | | 2,037,815 | |

| Prior year employer match receivable | | (1,946,451) | |

| Current year employee contribution receivable | | 142,244 | |

| Prior year employee contribution receivable | | (142,071) | |

| Net loss per the Form 5500 | | $ | (7,016,349) | |

Savings Plan for the Subsidiaries of Southside Bancshares, Inc. | 10

SAVINGS PLAN FOR THE

SUBSIDIARIES OF SOUTHSIDE BANCSHARES, INC.

PLAN No. 002 EIN 75-1848732

SCHEDULE H, Line 4i - SCHEDULE (MODIFIED CASH BASIS) OF ASSETS (HELD AT END OF YEAR)

DECEMBER 31, 2022

| | | | | | | | | | | | | | | | | |

| Description of investment including maturity date, number of shares or units, rate of interest, collateral and par or maturity value | |

| Identity of issue, sponsor, borrower, lessor, or similar party | Current Value |

| | | | | |

| Mutual Funds | | | | | |

| The American Funds | American Funds New Perspective R6 Fund | | 9,616 | | shares | $ | 455,019 | |

| The American Funds | American Funds New World R6 | | 2,615 | | shares | 173,588 | |

| Eagle Financial Services, Inc. | Carillon Eagle Mid Cap Growth R6 Fund | | 8,157 | | shares | 590,273 | |

| Franklin Templeton Investments | Franklin Small Cap Growth R6 Fund | | 27,514 | | shares | 507,364 | |

| JP Morgan Funds | JP Morgan U.S. Research Enhanced Equity R6 Fund | | 18,449 | | shares | 538,349 | |

| | | | | |

| Vanguard Group | Vanguard Total Bond Market Index Admiral Fund | | 1,229 | | shares | 11,654 | |

| Vanguard Group | Vanguard Fed Money Market Investment Fund | | 2,463,629 | | shares | 2,463,629 | |

| Common Stock | | | | | |

| * Southside Bancshares, Inc. | Southside Bancshares, Inc. | | 122,720 | | shares | 4,416,687 | |

| Collective Investment Trusts | | | | | |

| * Principal Global Investors Trust Company | Principal Lifetime Hybrid Income Fund Z | | 6,891 | | shares | 126,786 | |

| * Principal Global Investors Trust Company | Principal Lifetime Hybrid 2010 Fund Z | | 66,798 | | shares | 1,555,047 | |

| * Principal Global Investors Trust Company | Principal Lifetime Hybrid 2015 Fund Z | | 53,712 | | shares | 1,377,701 | |

| * Principal Global Investors Trust Company | Principal Lifetime Hybrid 2020 Fund Z | | 92,126 | | shares | 2,607,178 | |

| * Principal Global Investors Trust Company | Principal Lifetime Hybrid 2025 Fund Z | | 100,616 | | shares | 3,080,871 | |

| * Principal Global Investors Trust Company | Principal Lifetime Hybrid 2030 Fund Z | | 152,068 | | shares | 4,937,665 | |

| * Principal Global Investors Trust Company | Principal Lifetime Hybrid 2035 Fund Z | | 70,666 | | shares | 2,431,615 | |

| * Principal Global Investors Trust Company | Principal Lifetime Hybrid 2040 Fund Z | | 100,532 | | shares | 3,610,088 | |

| * Principal Global Investors Trust Company | Principal Lifetime Hybrid 2045 Fund Z | | 144,258 | | shares | 5,380,824 | |

| * Principal Global Investors Trust Company | Principal Lifetime Hybrid 2050 Fund Z | | 86,177 | | shares | 3,253,174 | |

| * Principal Global Investors Trust Company | Principal Lifetime Hybrid 2055 Fund Z | | 41,187 | | shares | 1,583,647 | |

| * Principal Global Investors Trust Company | Principal Lifetime Hybrid 2060 Fund Z | | 73,755 | | shares | 1,365,937 | |

| * Principal Global Investors Trust Company | Principal Lifetime Hybrid 2065 Fund Z | | 23,262 | | shares | 299,619 | |

| Pooled Separate Accounts | | | | | |

| * Principal Life Insurance Company | Principal Diversified International Separate Account Z | | 2,500 | | shares | 261,510 | |

| * Principal Life Insurance Company | Principal Diversified Income Separate Account Z | | 1,258 | | shares | 17,694 | |

| * Principal Life Insurance Company | Principal Global Real Estate Securities Separate Account Z | | 2,293 | | shares | 33,278 | |

| * Principal Life Insurance Company | Principal Equity Income Separate Account Z | | 27,291 | | shares | 1,301,900 | |

| * Principal Life Insurance Company | Principal Core Fixed Income Separate Account Z | | 39,359 | | shares | 651,635 | |

| * Principal Life Insurance Company | Principal LargeCap Growth I Separate Account Z | | 54,045 | | shares | 2,457,723 | |

| * Principal Life Insurance Company | Principal LargeCap S&P 500 Index Separate Account Z | | 9,117 | | shares | 1,916,154 | |

| * Principal Life Insurance Company | Principal MidCap S&P 400 Index Separate Account Z | | 5,618 | | shares | 463,953 | |

| * Principal Life Insurance Company | Principal MidCap Value I Separate Account Z | | 4,605 | | shares | 326,603 | |

| * Principal Life Insurance Company | Principal Real Estate Securities Separate Account Z | | 5,901 | | shares | 424,047 | |

| * Principal Life Insurance Company | Principal SmallCap S&P 600 Index Separate Account Z | | 4,414 | | shares | 369,238 | |

| * Principal Life Insurance Company | Principal SmallCap Value II Separate Account Z | | 5,147 | | shares | 218,754 | |

| Investment Contract | | | | | |

| * Principal Life Insurance Company | Principal Fixed Income Guaranteed Option | | 94,573 | | shares | 1,387,120 | |

| Notes Receivable | | | | | |

| * Participant loans | Varying maturity dates with interest rates of 3.25% to 7.00% | 1,096,973 | |

| Total | | | | | $ | 51,693,297 | |

* Principal Financial Group, including associated funds and accounts, participants and the Company are parties-in-interest.

| | | |

Savings Plan for the Subsidiaries of Southside Bancshares, Inc. | 11

Exhibit Index

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Incorporated by Reference |

| Exhibit Number | | Exhibit Description | | Filed Herewith | | Exhibit | | Form | | Filing Date | | File No. |

| (23) | | Consents of Experts and Counsel | | | | | | | | | | |

| 23 | | | | X | | | | | | | | |

Savings Plan for the Subsidiaries of Southside Bancshares, Inc. | 12

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | Savings Plan for the Subsidiaries of Southside Bancshares, Inc. |

| | |

| DATE: | June 28, 2023 | BY: | /s/ Julie N. Shamburger |

| | | Julie N. Shamburger |

| | | Chief Financial Officer |

| | | (Principal Financial and Accounting Officer) |

| | | Southside Bancshares, Inc. |

Savings Plan for the Subsidiaries of Southside Bancshares, Inc. | 13

EXHIBIT-23

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statement (Form S-8 No. 333-199439) pertaining to the Savings Plan for the Subsidiaries of Southside Bancshares, Inc. of our report dated June 28, 2023, with respect to the financial statements and schedule of the Savings Plan for the Subsidiaries of Southside Bancshares, Inc. included in this Annual Report (Form 11-K) for the year ended December 31, 2022.

/s/ Ernst & Young LLP

Dallas, Texas

June 28, 2023

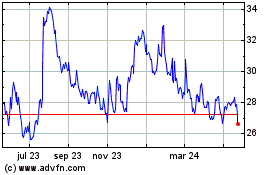

Southside Bancshares (NASDAQ:SBSI)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

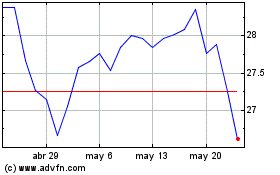

Southside Bancshares (NASDAQ:SBSI)

Gráfica de Acción Histórica

De May 2023 a May 2024