SIMMONS FIRST NATIONAL CORP false 0000090498 0000090498 2024-01-23 2024-01-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) January 23, 2024

SIMMONS FIRST NATIONAL CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Arkansas |

|

0-6253 |

|

71-0407808 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 501 Main Street, Pine Bluff, Arkansas |

|

71601 |

| (Address of principal executive offices) |

|

(Zip Code) |

(870) 541-1000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on

which registered |

| Common stock, par value $0.01 per share |

|

SFNC |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition. |

On January 24, 2024, Simmons First National Corporation (“Company”) issued a press release, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information provided pursuant to this Item 2.02, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (“Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933 (“Securities Act”) or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 7.01 |

Regulation FD Disclosure. |

On January 24, 2024, the Company issued an investor presentation, a copy of which is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

The information provided pursuant to this Item 7.01, including Exhibit 99.2, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

On January 23, 2024, the board of directors of the Company authorized a new stock repurchase program (“Program”) under which the Company may repurchase up to $175,000,000 of its Class A common stock (“Common Stock”) currently issued and outstanding. The Program will be executed in accordance with Rule 10b-18 under the Exchange Act, and will terminate on January 31, 2026 (unless terminated sooner). The new Program replaces the Company’s existing stock repurchase program, which was announced on January 27, 2022. Under the Program, the Company may repurchase shares of its Common Stock through open market and privately negotiated transactions or otherwise (including pursuant to a trading plan in accordance with Exchange Act Rule 10b5-1). The timing, pricing, and amount of any repurchases under the Program will be determined by the Company’s management at its discretion based on a variety of factors, including, but not limited to, trading volume and market price of the Common Stock, corporate considerations, the Company’s working capital and investment requirements, general market and economic conditions, and legal requirements. The Program does not obligate the Company to repurchase any Common Stock and may be modified, discontinued, or suspended at any time without prior notice.

| Item 9.01 |

Financial Statements and Exhibits |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

SIMMONS FIRST NATIONAL CORPORATION |

|

|

|

|

|

|

|

|

|

|

/s/ James M. Brogdon |

| Date: January 24, 2024 |

|

|

|

|

|

James M. Brogdon, President |

Exhibit 99.1

January 24, 2024

Simmons First National Corporation Reports Fourth Quarter 2023 Results

Board of Directors authorizes new $175 million share repurchase program and

approves a 5 percent increase in the quarterly cash dividend

Bob Fehlman, Simmons’ Chief Executive Officer, commented on fourth quarter 2023 results:

Overall, we were encouraged by the underlying trends experienced during the quarter, as

well as the strategic decision we made to selectively sell certain lower yielding bonds in our securities portfolio given advantageous market conditions. Both net interest income and net interest margin were up on a linked quarter basis, reflecting

our focus on maintaining strong loan and deposit pricing discipline. Equally important, deposit growth was driven by an increase in customer deposits – primarily money market and savings accounts.

A strong risk profile has always been a key attribute of Simmons and our results for the quarter continue

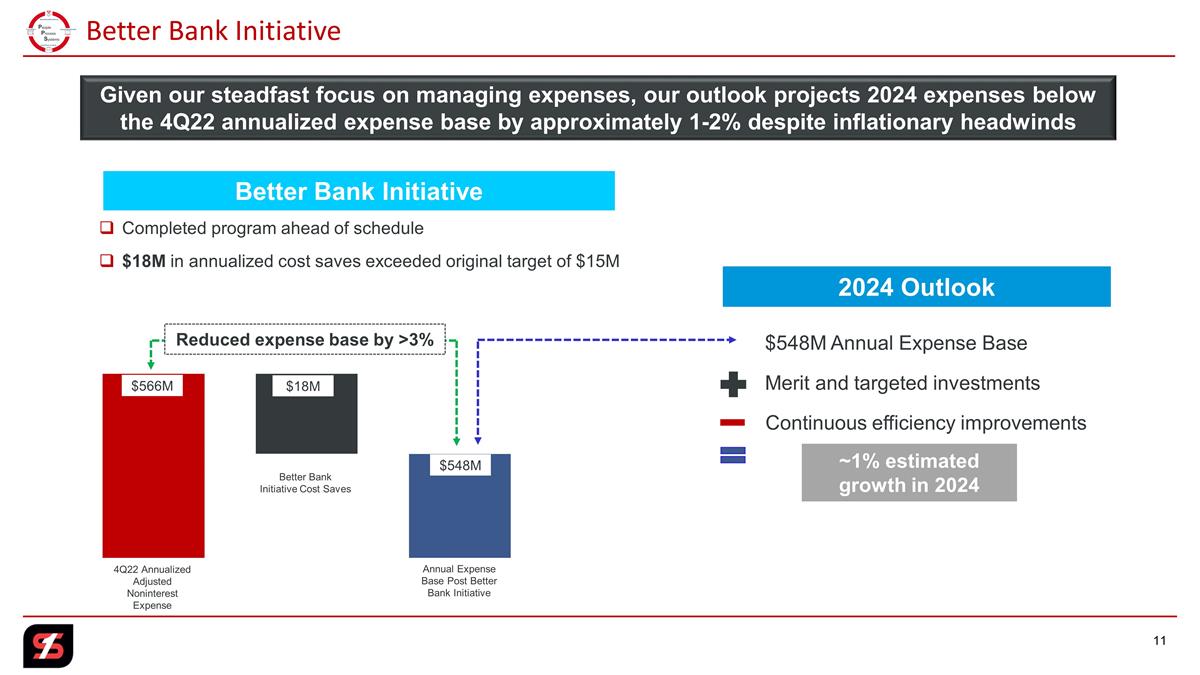

to bear this out. Net charge-offs for the quarter were 11 basis points and our allowance for credit losses on loans to total loans ended the quarter at 1.34 percent as provision expense exceeded net charge-offs. Expense growth, other than the

impact of a FDIC special assessment, was also well contained and reflected the success of our Better Bank Initiative.

As we enter 2024 against a backdrop of economic uncertainty, we believe certain

strategic actions we have taken this past year position us well to take advantage of opportunities and meet the challenges ahead.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCIAL HIGHLIGHTS |

|

4Q23 |

|

|

3Q23 |

|

|

4Q22 |

|

|

|

|

|

|

4Q 23 Highlights |

| BALANCE SHEET (in

millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

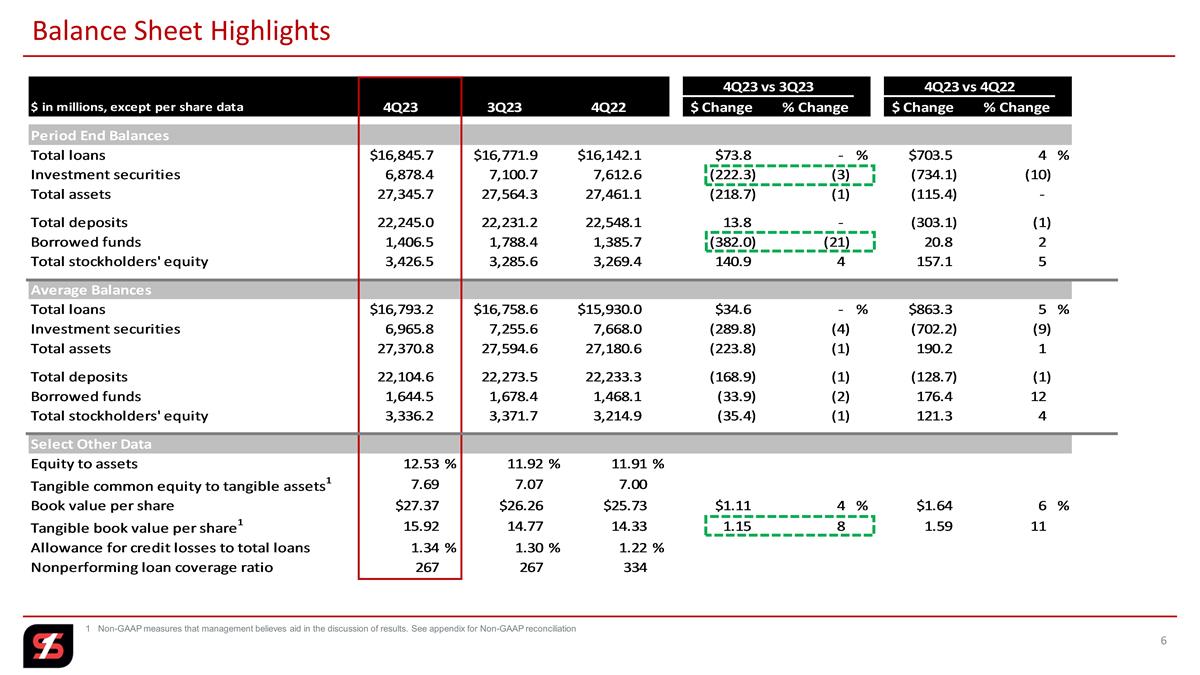

Comparisons reflect 4Q23 vs 3Q23

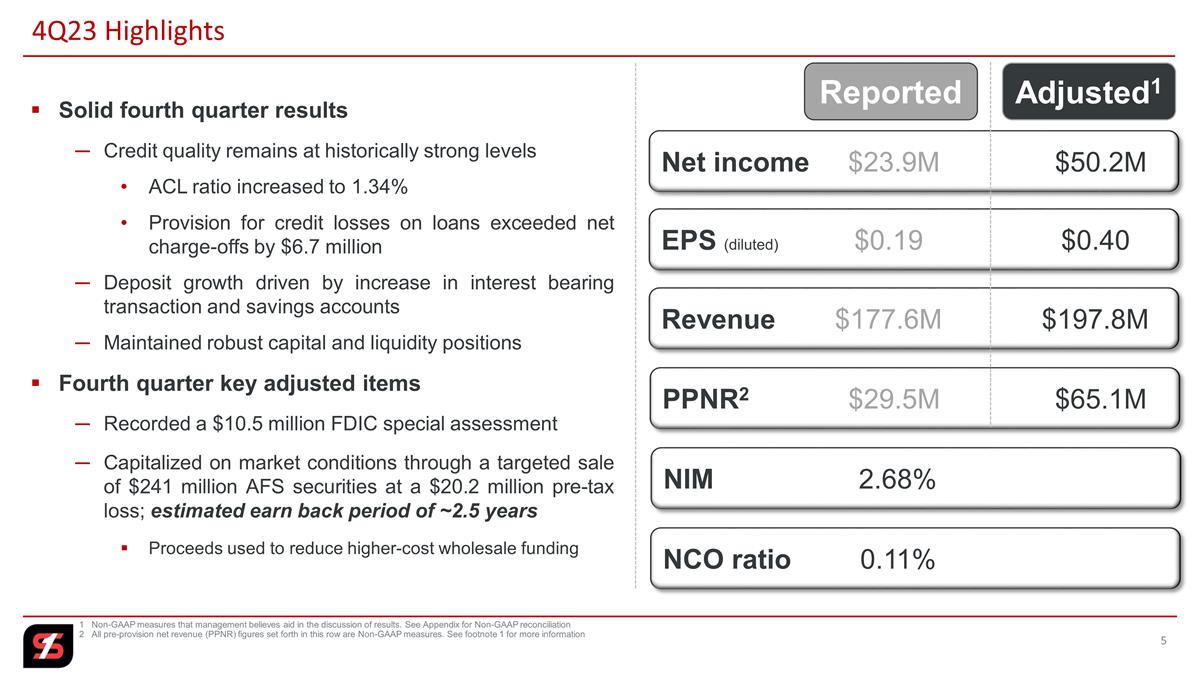

• Net income of $23.9 million and diluted EPS of $0.19

• Adjusted earnings1 of $50.2 million and adjusted diluted EPS1 of $0.40

• Net interest income up 1%; Net interest margin 2.68%, up 7

bps

• Total revenue of $177.6 million; Adjusted total revenue1 of $197.8 million. PPNR1 of $29.5 million; Adjusted PPNR1 of $65.1 million

• NCO 11 bps in 4Q23; NCO 12 bps for the full-year 2023

• Provision for credit losses on loans exceeded net charge-offs

in the quarter by $6.7 million

• ACL ratio ends the quarter at 1.34%; NPA to total assets

ratio at 0.33%, relatively unchanged

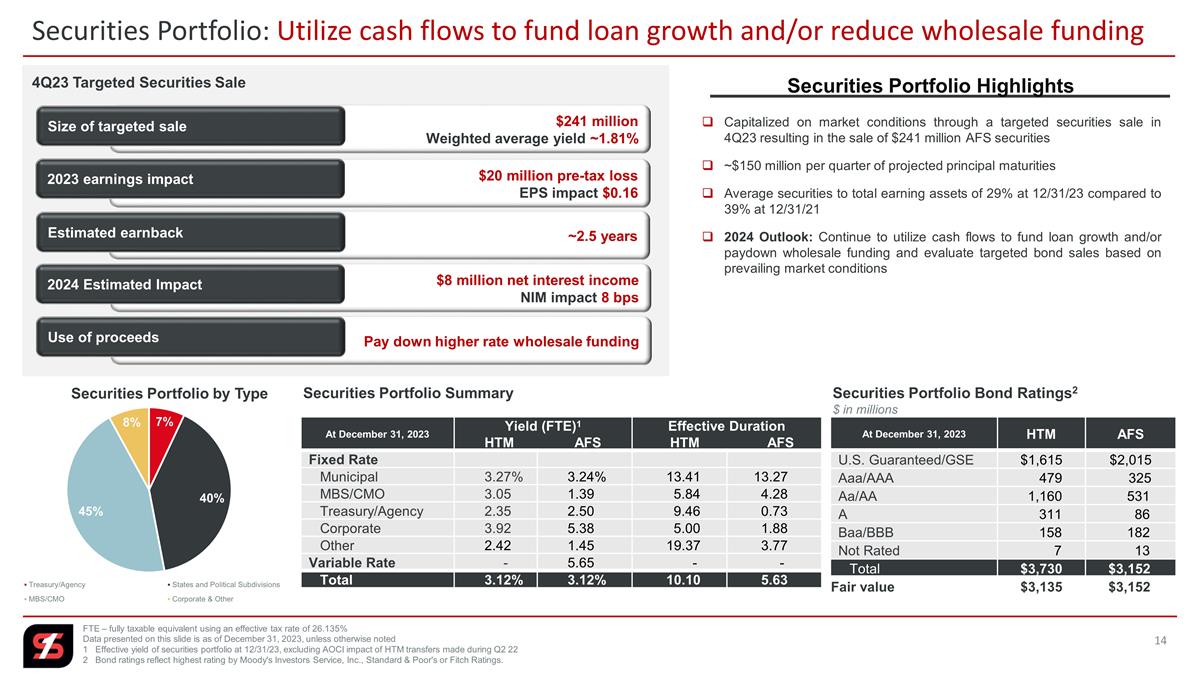

• Sold $241 million of AFS securities; Proceeds used to

paydown higher rate wholesale funding; Earn back period estimated at ~2.5 years

• Book value per share up 4% and TBVPS1 up 8%

• EA ratio 12.53%; TCE ratio1 up 62 bps to 7.69% |

| Total loans |

|

$ |

16,846 |

|

|

$ |

16,772 |

|

|

$ |

16,142 |

|

|

|

| Total investment securities |

|

|

6,878 |

|

|

|

7,101 |

|

|

|

7,613 |

|

|

|

| Total deposits |

|

|

22,245 |

|

|

|

22,231 |

|

|

|

22,548 |

|

|

|

| Total assets |

|

|

27,346 |

|

|

|

27,564 |

|

|

|

27,461 |

|

|

|

| Total shareholders’ equity |

|

|

3,426 |

|

|

|

3,286 |

|

|

|

3,269 |

|

|

|

| ASSET QUALITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net charge-off ratio (NCO ratio) |

|

|

0.11 |

% |

|

|

0.28 |

% |

|

|

0.13 |

% |

|

|

| Nonperforming loan ratio |

|

|

0.50 |

|

|

|

0.49 |

|

|

|

0.37 |

|

|

|

| Nonperforming assets to total assets |

|

|

0.33 |

|

|

|

0.32 |

|

|

|

0.23 |

|

|

|

| Allowance for credit losses to total loans |

|

|

1.34 |

|

|

|

1.30 |

|

|

|

1.22 |

|

|

|

| Nonperforming loan coverage ratio |

|

|

267 |

|

|

|

267 |

|

|

|

334 |

|

|

|

| PERFORMANCE MEASURES (in

millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

$ |

177.6 |

|

|

$ |

196.2 |

|

|

$ |

237.7 |

|

|

|

| Adjusted total revenue1 |

|

|

197.8 |

|

|

|

196.2 |

|

|

|

233.7 |

|

|

|

| Pre-provision net revenue1 (PPNR) |

|

|

29.5 |

|

|

|

64.2 |

|

|

|

95.1 |

|

|

|

| Adjusted pre-provision net revenue1 |

|

|

65.1 |

|

|

|

66.3 |

|

|

|

92.2 |

|

|

|

| Provision for credit losses |

|

|

10.0 |

|

|

|

7.7 |

|

|

|

- |

|

|

|

| PER SHARE

DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings |

|

$ |

0.19 |

|

|

$ |

0.37 |

|

|

$ |

0.65 |

|

|

|

| Adjusted diluted earnings1 |

|

|

0.40 |

|

|

|

0.39 |

|

|

|

0.64 |

|

|

|

| Book value |

|

|

27.37 |

|

|

|

26.26 |

|

|

|

25.73 |

|

|

|

| Tangible book value1 (TBVPS) |

|

|

15.92 |

|

|

|

14.77 |

|

|

|

14.33 |

|

|

|

| CAPITAL RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity to assets (EA ratio) |

|

|

12.53 |

% |

|

|

11.92 |

% |

|

|

11.91 |

% |

|

|

| Tangible common equity (TCE) ratio1 |

|

|

7.69 |

|

|

|

7.07 |

|

|

|

7.00 |

|

|

|

| Common equity tier 1 (CET1) ratio |

|

|

12.11 |

|

|

|

12.02 |

|

|

|

11.90 |

|

|

|

| Total risk-based capital ratio |

|

|

14.39 |

|

|

|

14.27 |

|

|

|

14.22 |

|

|

|

| LIQUIDITY ($ in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

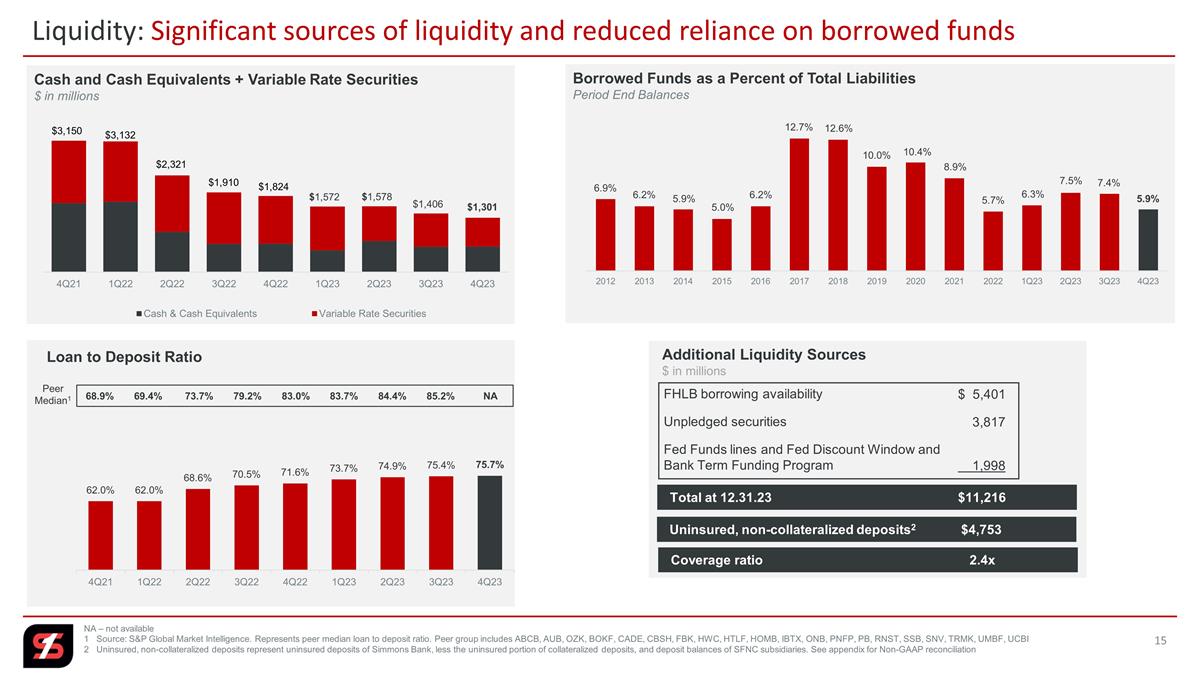

| Loan to deposit ratio |

|

|

75.73 |

% |

|

|

75.44 |

% |

|

|

71.59 |

% |

|

|

| Borrowed funds to total liabilities |

|

|

5.88 |

|

|

|

7.37 |

|

|

|

5.73 |

|

|

|

| Uninsured, non-collateralized deposits (UCD) |

|

$ |

4,753 |

|

|

$ |

4,631 |

|

|

$ |

5,626 |

|

|

|

| Additional liquidity sources |

|

|

11,216 |

|

|

|

11,447 |

|

|

|

10,604 |

|

|

|

| Coverage ratio of UCD |

|

|

2.4x |

|

|

|

2.5x |

|

|

|

1.9x |

|

|

|

Simmons First National Corporation (NASDAQ: SFNC) (Simmons or Company) today

reported net income of $23.9 million for the fourth quarter of 2023, compared to $47.2 million in the third quarter of 2023 and $83.3 million in the fourth quarter of 2022. Diluted earnings per share were $0.19 for the fourth quarter

of 2023, compared to $0.37 per share in the third quarter of 2023 and $0.65 per share in the fourth quarter of 2022. Adjusted earnings1 for the fourth quarter of 2023 were $50.2 million,

compared to $48.8 million in the third quarter of 2023 and $81.1 million in the fourth quarter of 2022. Adjusted diluted earnings per share1 for the fourth quarter of 2023 were $0.40,

compared to $0.39 in the third quarter of 2023 and $0.64 in the fourth quarter of 2022.

During the fourth quarter of 2023, we executed

a strategic decision to sell approximately $241 million of low yield available-for-sale (AFS) investment securities, resulting in a

pre-tax loss of approximately $20.2 million. The proceeds from the sale were used to pay off higher rate wholesale fundings, including both brokered deposits and FHLB advances. The earn back period of

this initiative is estimated at approximately 2.5 years. In addition, during the quarter we also recorded $10.5 million of noninterest expense for a FDIC special assessment levied to support the Deposit Insurance Fund following the failure of

certain banks in 2023. The table below summarizes the impact of these items, along with the impact of other items, consisting primarily of branch right sizing and early retirement program, and they are also described in further detail in the

“Reconciliation of Non-GAAP Financial Measures” tables contained in this press release.

Impact of

Certain Items on Earnings and Diluted EPS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ in millions, except per share data |

|

Q4 23 |

|

|

Q3 23 |

|

|

Q4 22 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

23.9 |

|

|

$ |

47.2 |

|

|

$ |

83.3 |

|

|

|

|

|

|

|

|

|

|

| Loss on sale of AFS investment securities |

|

|

20.2 |

|

|

|

- |

|

|

|

0.1 |

|

|

|

|

|

| FDIC special assessment |

|

|

10.5 |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

| Branch right sizing, net |

|

|

3.9 |

|

|

|

0.5 |

|

|

|

1.1 |

|

|

|

|

|

| Early retirement program |

|

|

1.0 |

|

|

|

1.6 |

|

|

|

- |

|

|

|

|

|

| Gain on insurance settlement |

|

|

- |

|

|

|

- |

|

|

|

(4.1 |

) |

|

|

|

|

|

|

|

|

|

| Total pre-tax impact |

|

|

35.6 |

|

|

|

2.1 |

|

|

|

(2.9 |

) |

|

|

|

|

| Tax effect2 |

|

|

(9.3 |

) |

|

|

(0.5 |

) |

|

|

0.7 |

|

|

|

|

|

|

|

|

|

|

| Total impact on earnings |

|

|

26.3 |

|

|

|

1.6 |

|

|

|

(2.2 |

) |

|

|

|

|

|

|

|

|

|

| Adjusted earnings1 |

|

$ |

50.2 |

|

|

$ |

48.8 |

|

|

$ |

81.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted EPS |

|

$ |

0.19 |

|

|

$ |

0.37 |

|

|

$ |

0.65 |

|

|

|

|

|

|

|

|

|

|

| Loss on sale of AFS investment securities |

|

|

0.16 |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

| FDIC special assessment |

|

|

0.08 |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

| Branch right sizing, net |

|

|

0.03 |

|

|

|

0.01 |

|

|

|

0.01 |

|

|

|

|

|

| Early retirement program |

|

|

0.01 |

|

|

|

0.01 |

|

|

|

- |

|

|

|

|

|

| Gain on insurance settlement |

|

|

- |

|

|

|

- |

|

|

|

(0.03 |

) |

|

|

|

|

|

|

|

|

|

| Total pre-tax impact |

|

|

0.28 |

|

|

|

0.02 |

|

|

|

(0.02 |

) |

|

|

|

|

| Tax effect2 |

|

|

(0.07 |

) |

|

|

— |

|

|

|

0.01 |

|

|

|

|

|

|

|

|

|

|

| Total impact on earnings |

|

|

0.21 |

|

|

|

0.02 |

|

|

|

(0.01 |

) |

|

|

|

|

|

|

|

|

|

| Adjusted Diluted EPS1 |

|

$ |

0.40 |

|

|

$ |

0.39 |

|

|

$ |

0.64 |

|

|

|

|

|

|

|

|

|

|

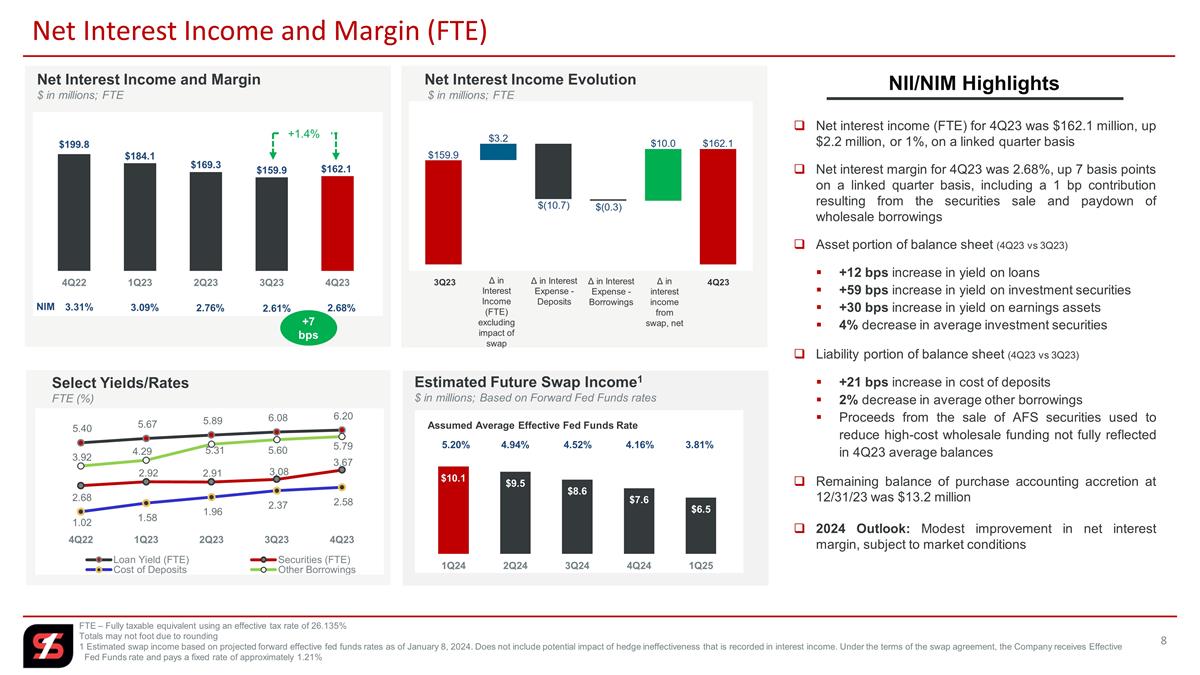

Net Interest Income

Net interest income for the fourth quarter of 2023 totaled $155.6 million, compared to $153.4 million in the third quarter of 2023

and $193.0 million in the fourth quarter of 2022. Interest income totaled $323.5 million in the fourth quarter of 2023, up $13.2 million on a linked quarter basis. Interest expense totaled $167.9 million in the fourth quarter of

2023, up $11.0 million on a linked quarter basis. The increase in net interest income was primarily due to a $5.6 million increase in interest income on loans, coupled with an $8.1 million increase in interest income on investment

securities, offset in part by a $10.7 million increase in interest expense associated with interest bearing deposits. Included in net interest income is accretion recognized on assets acquired, which totaled $1.8 million in the fourth

quarter of 2023, $2.1 million in the third quarter of 2023 and $4.5 million in the fourth quarter of 2022.

The yield on loans on a fully taxable equivalent (FTE) basis for the fourth quarter of

2023 was 6.20 percent, compared to 6.08 percent in the third quarter of 2023 and 5.40 percent in the fourth quarter of 2022. The yield on investment securities on an FTE basis for the fourth quarter of 2023 was 3.67 percent,

compared to 3.08 percent in the third quarter of 2023 and 2.68 percent in the fourth quarter of 2022. Costs of deposits for the fourth quarter of 2023 was 2.58 percent, compared to 2.37 percent in the third quarter of 2023 and

1.02 percent in the fourth quarter of 2022. The net interest margin on an FTE basis for the fourth quarter of 2023 was 2.68 percent, compared to 2.61 percent in the third quarter of 2023 and 3.31 percent in the fourth quarter of

2022.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Select Yield/Rates |

|

Q4 23 |

|

|

Q3 23 |

|

|

Q2 23 |

|

|

Q1 23 |

|

|

Q4 22 |

|

|

|

| Loan yield (FTE)2 |

|

|

6.20 |

% |

|

|

6.08 |

% |

|

|

5.89 |

% |

|

|

5.67 |

% |

|

|

5.40 |

% |

|

|

| Investment securities yield (FTE)2 |

|

|

3.67 |

|

|

|

3.08 |

|

|

|

2.91 |

|

|

|

2.92 |

|

|

|

2.68 |

|

|

|

| Cost of interest bearing deposits |

|

|

3.31 |

|

|

|

3.06 |

|

|

|

2.57 |

|

|

|

2.10 |

|

|

|

1.41 |

|

|

|

| Cost of deposits |

|

|

2.58 |

|

|

|

2.37 |

|

|

|

1.96 |

|

|

|

1.58 |

|

|

|

1.02 |

|

|

|

| Cost of borrowed funds |

|

|

5.79 |

|

|

|

5.60 |

|

|

|

5.31 |

|

|

|

4.29 |

|

|

|

3.92 |

|

|

|

| Net interest spread (FTE)2 |

|

|

1.93 |

|

|

|

1.87 |

|

|

|

2.10 |

|

|

|

2.52 |

|

|

|

2.87 |

|

|

|

| Net interest margin (FTE)2 |

|

|

2.68 |

|

|

|

2.61 |

|

|

|

2.76 |

|

|

|

3.09 |

|

|

|

3.31 |

|

|

|

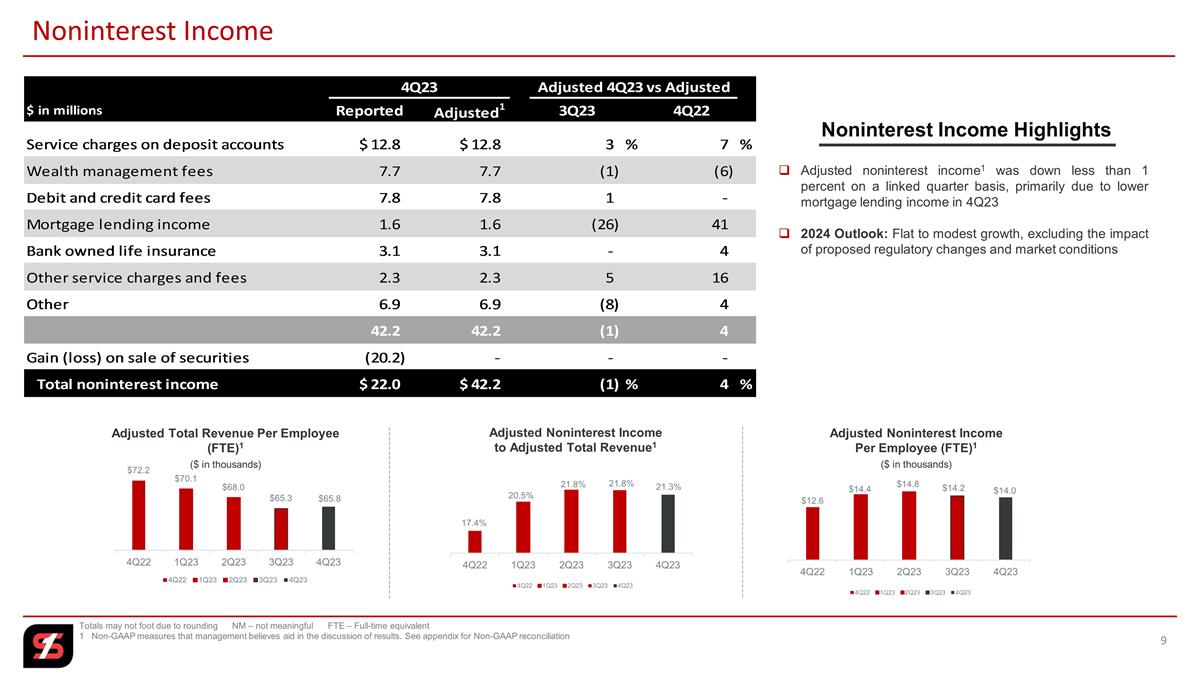

Noninterest Income

Noninterest income for the fourth quarter of 2023 was $22.0 million, compared to $42.8 million in the third quarter of 2023 and

$44.6 million in the fourth quarter of 2022. Included in the fourth quarter of 2023 was a $20.2 million loss on the strategic sale of AFS investment securities. Excluding this item, adjusted noninterest income1 was $42.2 million in the fourth quarter of 2023, compared to $42.8 million in the third quarter of 2023. Adjusted noninterest income1

for the fourth quarter of 2022 was $40.6 million.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest Income

$ in millions |

|

Q4 23 |

|

|

Q3 23 |

|

|

Q2 23 |

|

|

Q1 23 |

|

|

Q4 22 |

|

|

|

| |

| Service charges on deposit accounts |

|

$ |

12.8 |

|

|

$ |

12.4 |

|

|

$ |

12.9 |

|

|

$ |

12.4 |

|

|

|

11.9 |

|

|

|

| Wealth management fees |

|

|

7.7 |

|

|

|

7.7 |

|

|

|

7.4 |

|

|

|

7.4 |

|

|

|

8.2 |

|

|

|

| Debit and credit card fees |

|

|

7.8 |

|

|

|

7.7 |

|

|

|

8.0 |

|

|

|

8.0 |

|

|

|

7.8 |

|

|

|

| Mortgage lending income |

|

|

1.6 |

|

|

|

2.2 |

|

|

|

2.4 |

|

|

|

1.6 |

|

|

|

1.1 |

|

|

|

| Other service charges and fees |

|

|

2.3 |

|

|

|

2.2 |

|

|

|

2.3 |

|

|

|

2.3 |

|

|

|

2.0 |

|

|

|

| Bank owned life insurance |

|

|

3.1 |

|

|

|

3.1 |

|

|

|

2.6 |

|

|

|

3.0 |

|

|

|

3.0 |

|

|

|

| Gain (loss) on sale of securities |

|

|

(20.2 |

) |

|

|

- |

|

|

|

(0.4 |

) |

|

|

- |

|

|

|

(0.1 |

) |

|

|

| Gain on insurance settlement |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

4.1 |

|

|

|

| Other income |

|

|

6.9 |

|

|

|

7.4 |

|

|

|

9.8 |

|

|

|

11.3 |

|

|

|

6.6 |

|

|

|

|

|

|

|

| Total noninterest income |

|

$ |

22.0 |

|

|

$ |

42.8 |

|

|

$ |

45.0 |

|

|

$ |

45.8 |

|

|

$ |

44.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted noninterest income1 |

|

$ |

42.2 |

|

|

$ |

42.8 |

|

|

$ |

45.4 |

|

|

$ |

45.8 |

|

|

$ |

40.6 |

|

|

|

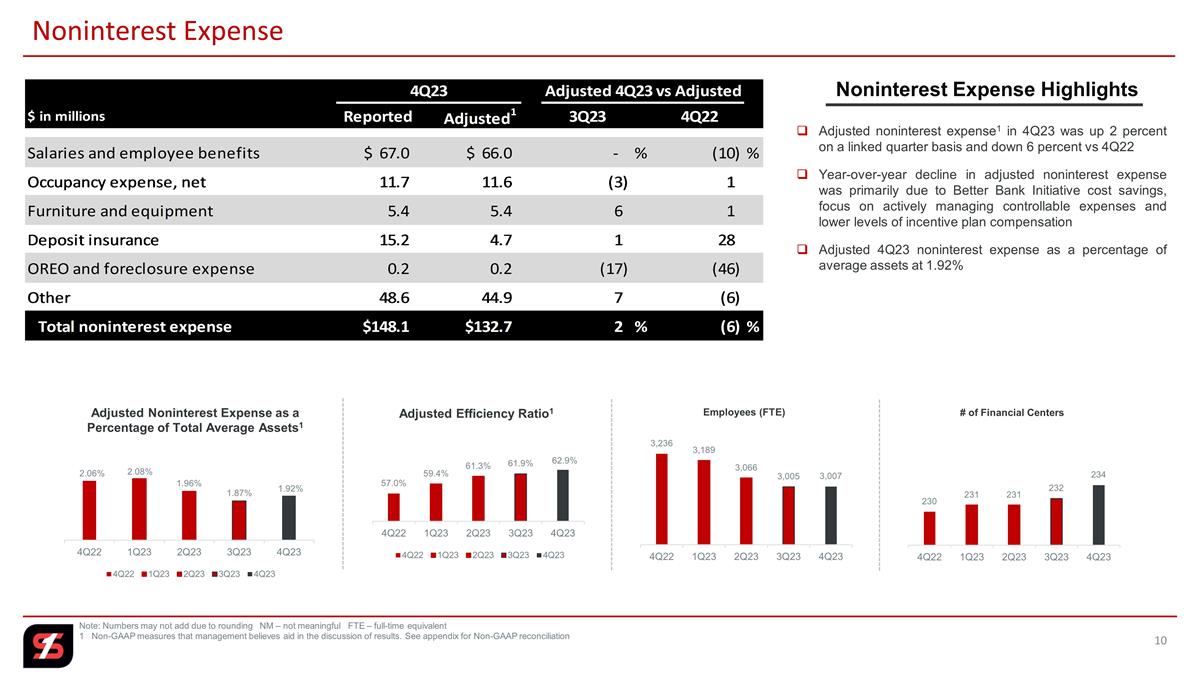

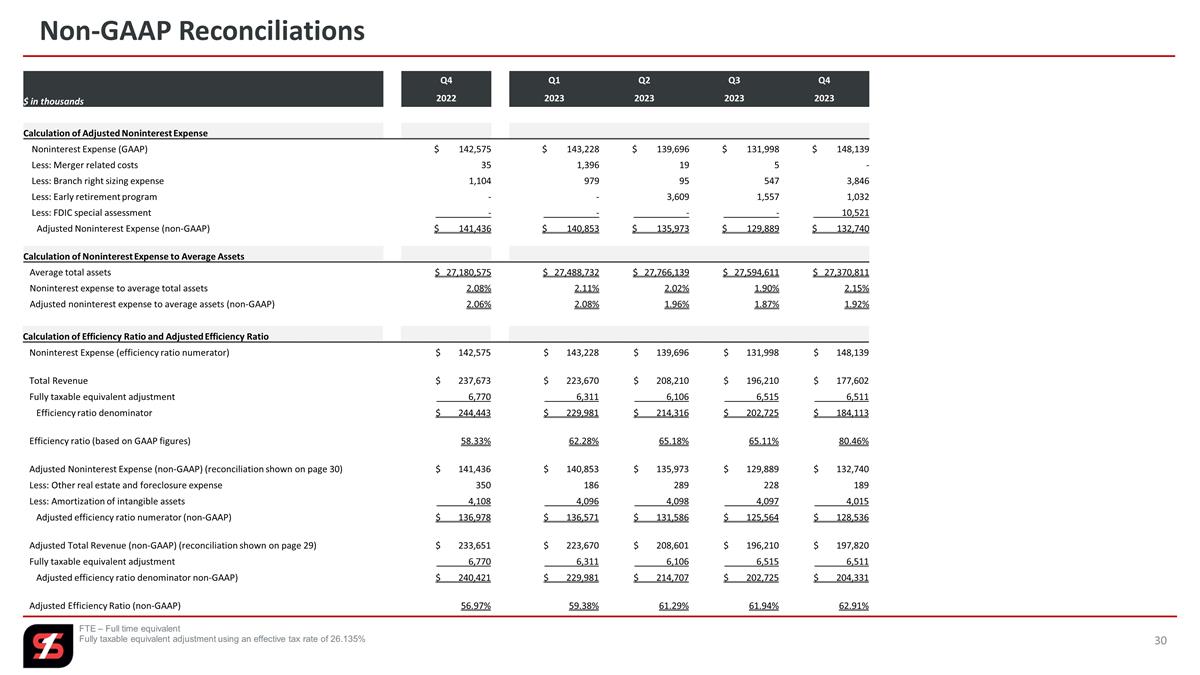

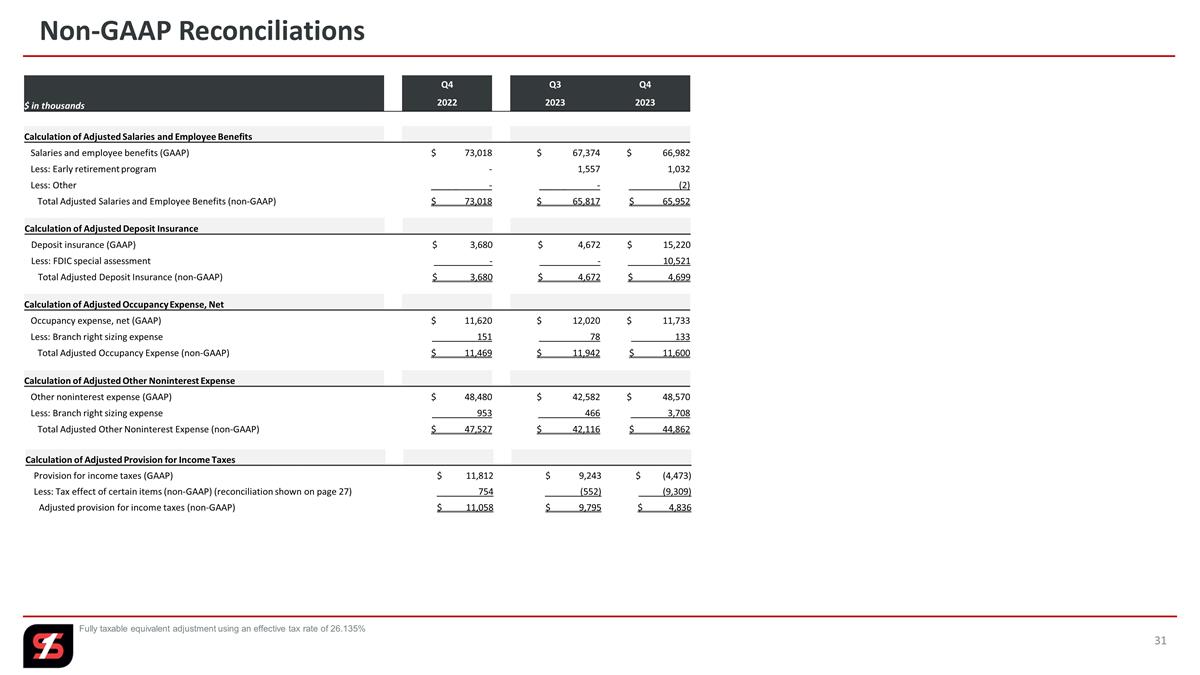

Noninterest Expense

Noninterest expense for the fourth quarter of 2023 was $148.1 million, compared to $132.0 million in the third quarter of 2023 and

$142.6 million in the fourth quarter of 2022. Included in noninterest expense are certain items consisting primarily of early retirement program, branch right sizing and merger related costs, as well as a FDIC special assessment recorded in the

fourth quarter of 2023. These items totaled $15.4 million in the fourth quarter of 2023, $2.1 million in the third quarter of 2023 and $1.1 million in the fourth quarter of 2022. Excluding these items (which are described in the

“Reconciliation of Non-GAAP Financial Measures” tables below), adjusted noninterest expense1 was $132.7 million in the fourth quarter of

2023, $129.9 million in the third quarter of 2023 and $141.4 million in the fourth quarter of 2022. The increase in noninterest expense on a linked quarter basis was primarily the result of the FDIC special assessment, branch right sizing

and early retirement program costs. The increase in adjusted noninterest expense1 on a linked quarter basis was primarily due to sundry items included in other operating expenses.

Provision for income taxes for the fourth quarter of 2023 was $(4.5) million, compared to $9.2 million in the third quarter of 2023 and

$11.8 million in the fourth quarter of 2022. Provision for income taxes in the fourth quarter of 2023 reflected an effective tax rate adjustment based on the level of taxable income primarily due to the FDIC special assessment and loss on sale

of securities.

Noninterest Expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ in millions |

|

Q4 23 |

|

|

Q3 23 |

|

|

Q2 23 |

|

|

Q1 23 |

|

|

Q4 22 |

|

|

|

|

| |

|

| Salaries and employee benefits |

|

$ |

67.0 |

|

|

$ |

67.4 |

|

|

$ |

74.7 |

|

|

$ |

77.0 |

|

|

$ |

73.0 |

|

|

|

|

|

| Occupancy expense, net |

|

|

11.7 |

|

|

|

12.0 |

|

|

|

11.4 |

|

|

|

11.6 |

|

|

|

11.6 |

|

|

|

|

|

| Furniture and equipment |

|

|

5.4 |

|

|

|

5.1 |

|

|

|

5.1 |

|

|

|

5.1 |

|

|

|

5.4 |

|

|

|

|

|

| Deposit insurance |

|

|

4.7 |

|

|

|

4.7 |

|

|

|

5.2 |

|

|

|

4.9 |

|

|

|

3.7 |

|

|

|

|

|

| Other real estate and foreclosure expense |

|

|

0.2 |

|

|

|

0.2 |

|

|

|

0.3 |

|

|

|

0.2 |

|

|

|

0.4 |

|

|

|

|

|

| Merger related costs |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1.4 |

|

|

|

- |

|

|

|

|

|

| FDIC special assessment |

|

|

10.5 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

| Other operating expenses |

|

|

48.6 |

|

|

|

42.6 |

|

|

|

42.9 |

|

|

|

43.1 |

|

|

|

48.5 |

|

|

|

|

|

|

|

|

|

|

| Total noninterest expense |

|

$ |

148.1 |

|

|

$ |

132.0 |

|

|

$ |

139.7 |

|

|

$ |

143.2 |

|

|

$ |

142.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted salaries and employee

benefits1 |

|

$ |

66.0 |

|

|

$ |

65.8 |

|

|

$ |

71.1 |

|

|

$ |

77.0 |

|

|

$ |

73.0 |

|

|

|

|

|

| Adjusted other operating expenses1 |

|

|

44.9 |

|

|

|

42.1 |

|

|

|

43.0 |

|

|

|

42.3 |

|

|

|

47.5 |

|

|

|

|

|

| Adjusted noninterest expense1 |

|

|

132.7 |

|

|

|

129.9 |

|

|

|

136.0 |

|

|

|

140.9 |

|

|

|

141.4 |

|

|

|

|

|

| Efficiency ratio |

|

|

80.46 |

% |

|

|

65.11 |

% |

|

|

65.18 |

% |

|

|

62.28 |

% |

|

|

58.33 |

% |

|

|

|

|

| Adjusted efficiency ratio1 |

|

|

62.91 |

|

|

|

61.94 |

|

|

|

61.29 |

|

|

|

59.38 |

|

|

|

56.97 |

|

|

|

|

|

| Full-time equivalent employees |

|

|

3,007 |

|

|

|

3,005 |

|

|

|

3,066 |

|

|

|

3,189 |

|

|

|

3,236 |

|

|

|

|

|

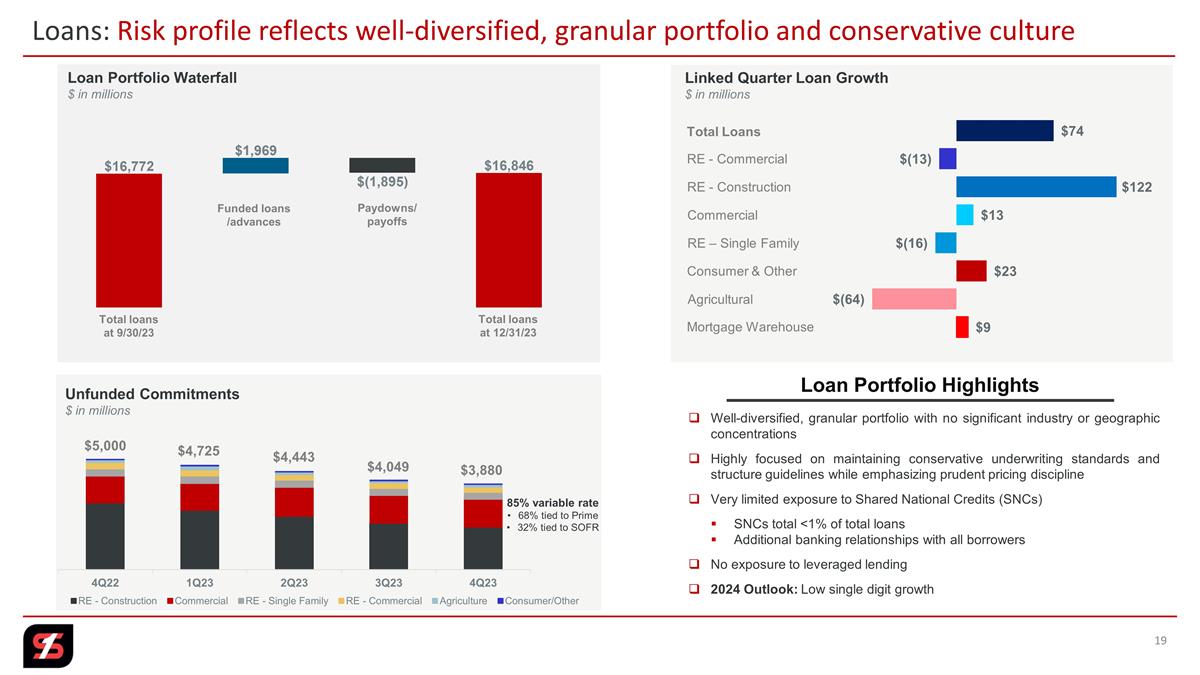

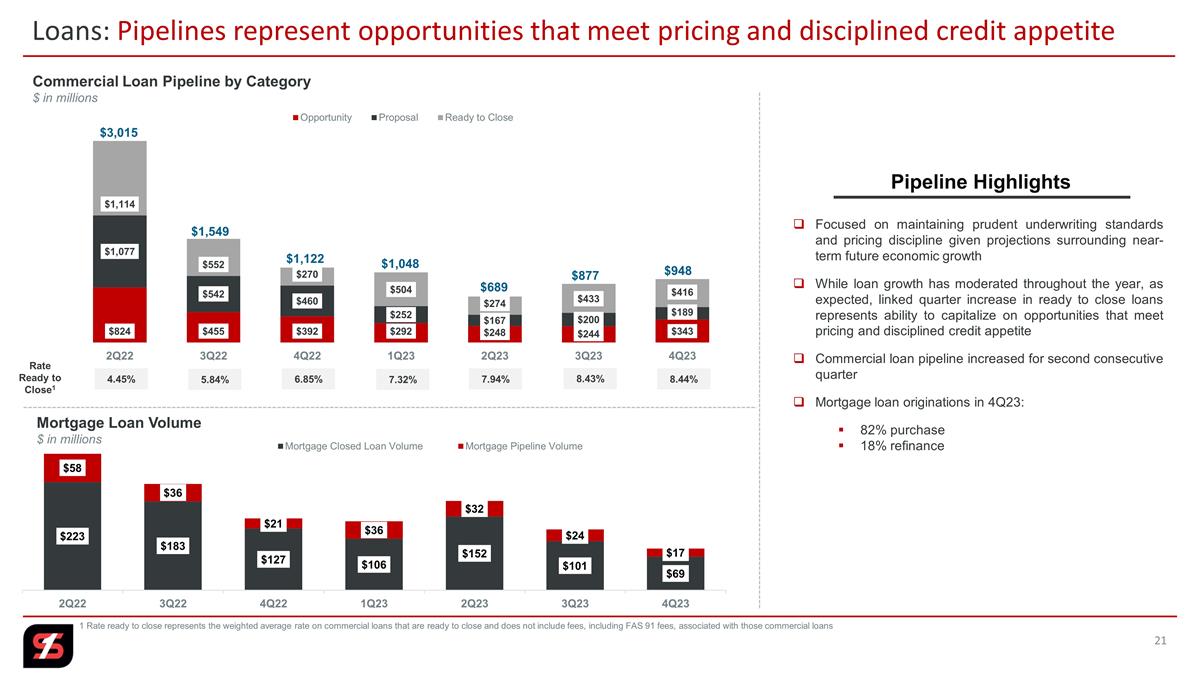

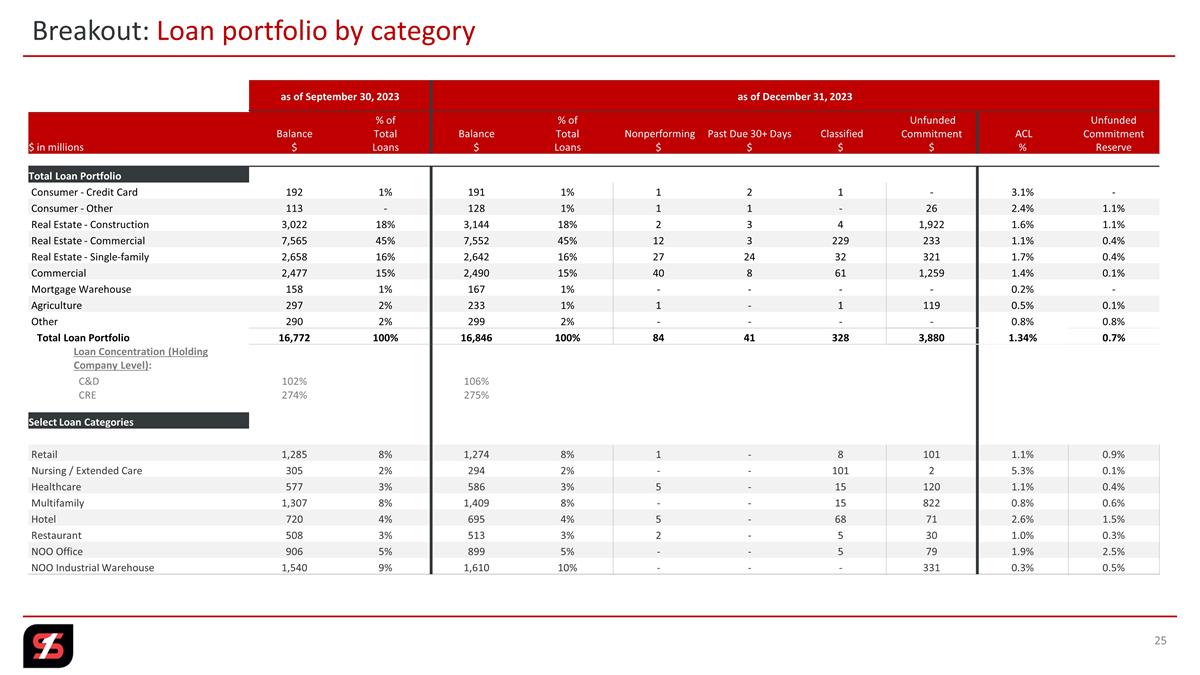

Loans and Unfunded Loan Commitments

Total loans at the end of the fourth quarter of 2023 were $16.8 billion, up $704 million, or 4 percent, compared to

$16.1 billion at the end of the fourth quarter of 2022. Total loans on a linked quarter basis increased $74 million, reflecting moderating demand, as well as our focus on maintaining disciplined pricing strategies and our conservative

underwriting standards given projections surrounding near-term future economic activity and conditions. Unfunded commitments at the end of the fourth quarter of 2023 were $3.9 billion, compared to $4.0 billion at the end of the third

quarter of 2023 and $5.0 billion at the end of the fourth quarter of 2022. At the same time, our commercial loan pipeline experienced measured growth for the second consecutive quarter. Commercial loans ready to close at the end of the fourth

quarter of 2023 were $416 million, and the rate on ready to close commercial loans was 8.44 percent.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans and Unfunded Commitments

$ in millions |

|

Q4 23 |

|

|

Q3 23 |

|

|

Q2 23 |

|

|

Q1 23 |

|

|

Q4 22 |

|

|

|

|

| |

|

| Total loans |

|

$ |

16,846 |

|

|

$ |

16,772 |

|

|

$ |

16,834 |

|

|

$ |

16,555 |

|

|

$ |

16,142 |

|

|

|

|

|

| Unfunded loan commitments |

|

|

3,880 |

|

|

|

4,049 |

|

|

|

4,443 |

|

|

|

4,725 |

|

|

|

5,000 |

|

|

|

|

|

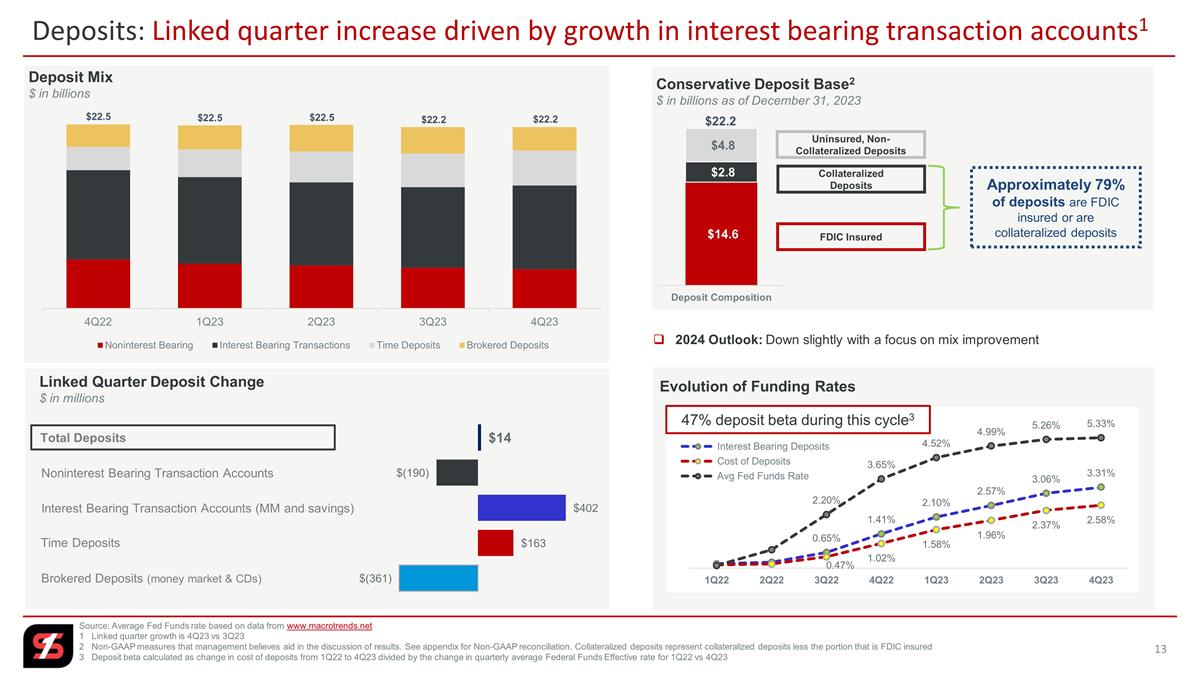

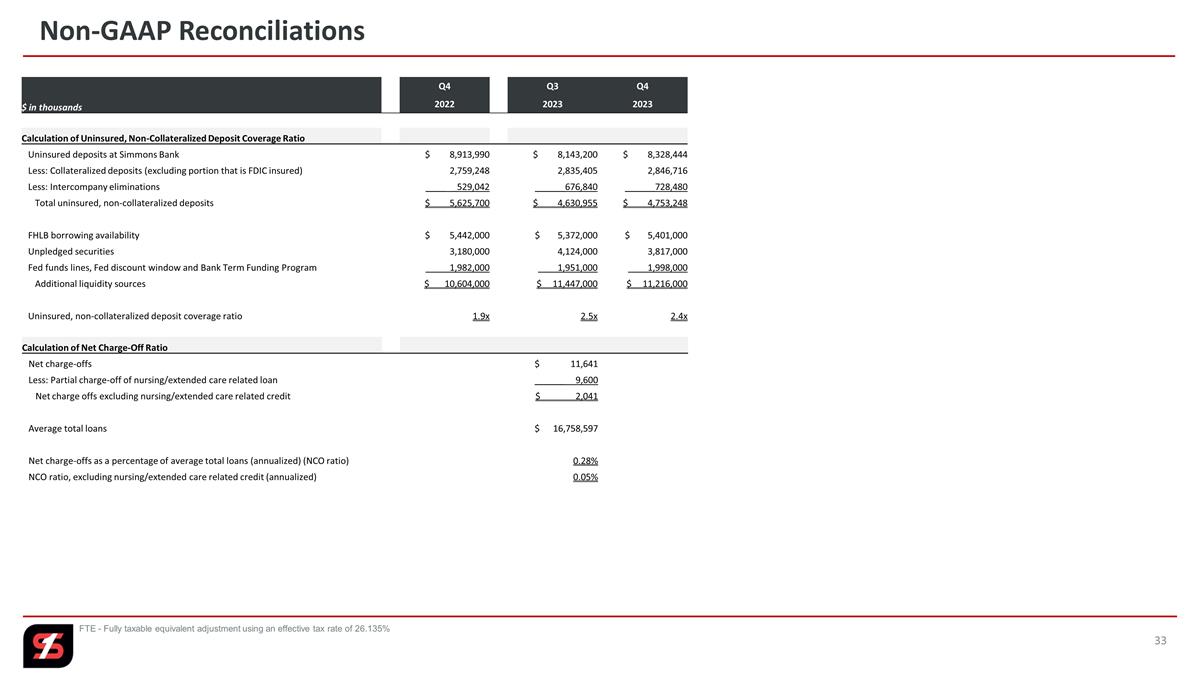

Deposits

Total deposits at the end of the fourth quarter of 2023 were $22.2 billion, compared to $22.5 billion at the end of the fourth

quarter of 2022. On a linked quarter basis, total deposits were up slightly, driven by increased levels of interest bearing transaction accounts (interest bearing checking, money market and savings accounts) and time deposits, offset primarily by a

decrease in brokered deposits. Noninterest bearing deposits totaled $4.8 billion, compared to $5.0 billion at the end of the third quarter of 2023. Interest bearing transaction accounts totaled $10.3 billion at the end of the fourth

quarter of 2023, compared to $9.9 billion at the end of the third quarter of 2023. Time deposits totaled $4.3 billion, compared to $4.1 billion at the end of the third quarter of 2023. Brokered deposits totaled $2.9 billion at

the end of the fourth quarter of 2023, compared to $3.3 billion at the end of the third quarter of 2023. The loan-to-deposit ratio at the end of the fourth quarter

of 2023 was 76 percent, compared to 75 percent at the end of the third quarter of 2023 and 72 percent at the end of the fourth quarter of 2022.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits

$ in millions |

|

Q4 23 |

|

|

Q3 23 |

|

|

Q2 23 |

|

|

Q1 23 |

|

|

Q4 22 |

|

|

|

|

| |

|

| Noninterest bearing deposits |

|

$ |

4,801 |

|

|

$ |

4,991 |

|

|

$ |

5,265 |

|

|

$ |

5,489 |

|

|

$ |

6,017 |

|

|

|

|

|

| Interest bearing transaction accounts |

|

|

10,277 |

|

|

|

9,875 |

|

|

|

10,203 |

|

|

|

10,625 |

|

|

|

10,936 |

|

|

|

|

|

| Time deposits |

|

|

4,266 |

|

|

|

4,103 |

|

|

|

3,784 |

|

|

|

3,385 |

|

|

|

2,849 |

|

|

|

|

|

| Brokered deposits |

|

|

2,901 |

|

|

|

3,262 |

|

|

|

3,237 |

|

|

|

2,953 |

|

|

|

2,746 |

|

|

|

|

|

|

|

|

|

|

| Total deposits |

|

$ |

22,245 |

|

|

$ |

22,231 |

|

|

$ |

22,489 |

|

|

$ |

22,452 |

|

|

$ |

22,548 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest bearing deposits to total deposits |

|

|

22 |

% |

|

|

22 |

% |

|

|

23 |

% |

|

|

24 |

% |

|

|

27 |

% |

|

|

|

|

| Total loans to total deposits |

|

|

76 |

|

|

|

75 |

|

|

|

75 |

|

|

|

74 |

|

|

|

72 |

|

|

|

|

|

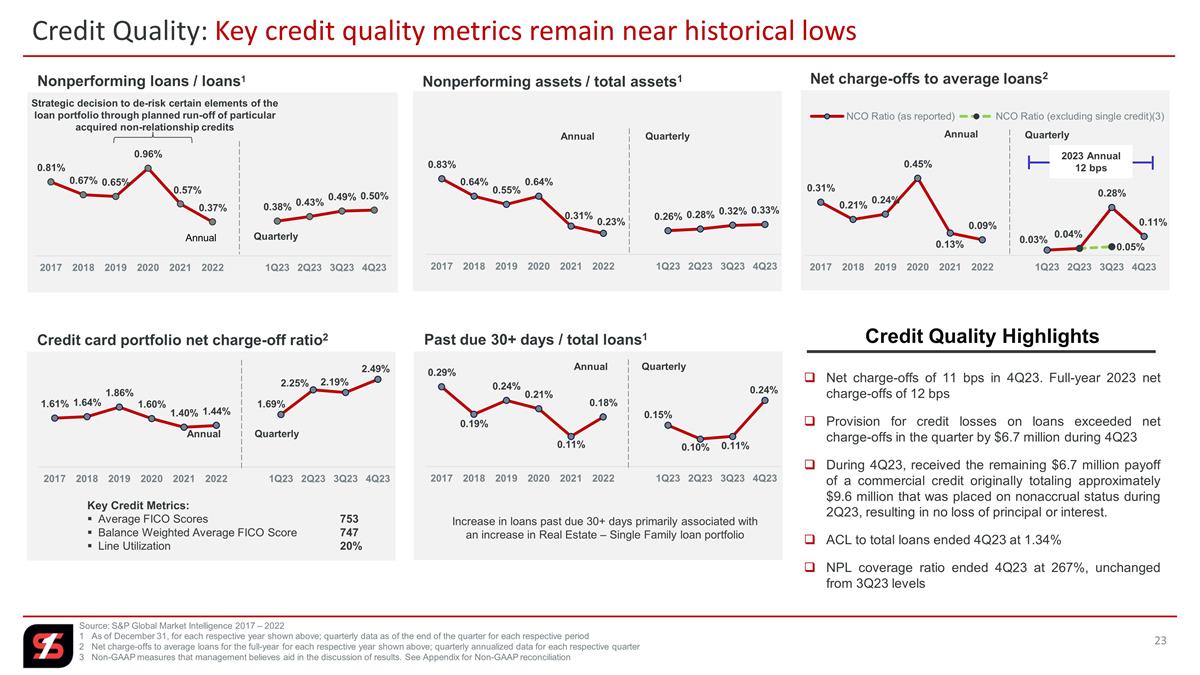

Asset Quality

Total nonperforming loans at the end of the fourth quarter of 2023 were $84.5 million, compared to $81.9 million at the end of the

third quarter of 2023 and $58.9 million at the end of the fourth quarter of 2022. Total nonperforming assets as a percentage of total assets were 0.33 percent at the end of the fourth quarter of 2023, compared to 0.32 percent at the

end of the third quarter of 2023 and 0.23 percent at the end of the fourth quarter of 2022. Activity in the quarter included the remaining $6.7 million payoff of a commercial credit originally totaling approximately $9.6 million that

was placed on nonaccrual status during the second quarter of 2023, thus resulting in no loss of principal or interest to the company. Net charge-offs as a percentage of average loans for the fourth quarter of 2023 were 11 basis points, compared to

28 basis points in the third quarter of 2023 and 13 basis points in the fourth quarter of 2022. For the full-year of 2023, net charge-offs as a percentage of average loans were 12 basis points, compared to 9 basis points for the full-year of 2022.

Provision for credit losses totaled $10.0 million in the fourth quarter of 2023, compared to $7.7 million in the third

quarter of 2023 and less than $1.0 million in the fourth quarter of 2022. Included in provision for credit losses was the recapture of provision expense related to investment securities totaling $1.2 million in both the third quarter and

fourth quarter of 2023. The increase in provision for credit losses on a linked quarter and year-over-year basis reflected in part increased activity in the loan portfolio, as well as changes in macroeconomic conditions and variables. The allowance

for credit losses at the end of the fourth quarter of 2023 was $225.2 million, compared to $218.5 million at the end of the third quarter of 2023 and $197.0 million at the end of the fourth quarter of 2022. The allowance for credit

losses as a percentage of total loans at the end of the fourth quarter of 2023 was 1.34 percent, compared to 1.30 percent at the end of the third quarter of 2023 and 1.22 percent at the end of the fourth quarter of 2022. The

nonperforming loan coverage ratio ended the quarter at 267 percent, and the reserve for unfunded commitments totaled $25.6 million, both unchanged from third quarter 2023 levels.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset Quality

$ in millions |

|

Q4 23 |

|

|

Q3 23 |

|

|

Q2 23 |

|

|

Q1 23 |

|

|

Q4 22 |

|

|

|

|

| |

|

| Allowance for credit losses on loans to total loans |

|

|

1.34 |

% |

|

|

1.30 |

% |

|

|

1.25 |

% |

|

|

1.25 |

% |

|

|

1.22 |

% |

|

|

|

|

| Allowance for credit losses on loans to nonperforming loans |

|

|

267 |

|

|

|

267 |

|

|

|

292 |

|

|

|

324 |

|

|

|

334 |

|

|

|

|

|

| Nonperforming loans to total loans |

|

|

0.50 |

|

|

|

0.49 |

|

|

|

0.43 |

|

|

|

0.38 |

|

|

|

0.37 |

|

|

|

|

|

| Net charge-off ratio (annualized) |

|

|

0.11 |

|

|

|

0.28 |

|

|

|

0.04 |

|

|

|

0.03 |

|

|

|

0.13 |

|

|

|

|

|

| Net charge-off ratio YTD (annualized) |

|

|

0.12 |

|

|

|

0.12 |

|

|

|

0.04 |

|

|

|

0.03 |

|

|

|

0.09 |

|

|

|

|

|

| Total nonperforming loans |

|

|

$84.5 |

|

|

|

$81.9 |

|

|

|

$72.0 |

|

|

|

$63.7 |

|

|

|

$58.9 |

|

|

|

|

|

| Total other nonperforming assets |

|

|

5.8 |

|

|

|

5.2 |

|

|

|

4.9 |

|

|

|

7.7 |

|

|

|

3.6 |

|

|

|

|

|

|

|

|

|

|

| Total nonperforming assets |

|

|

$90.3 |

|

|

|

$87.1 |

|

|

|

$76.9 |

|

|

|

$71.4 |

|

|

|

$62.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reserve for unfunded commitments |

|

|

$25.6 |

|

|

|

$25.6 |

|

|

|

$36.9 |

|

|

|

$41.9 |

|

|

|

$41.9 |

|

|

|

|

|

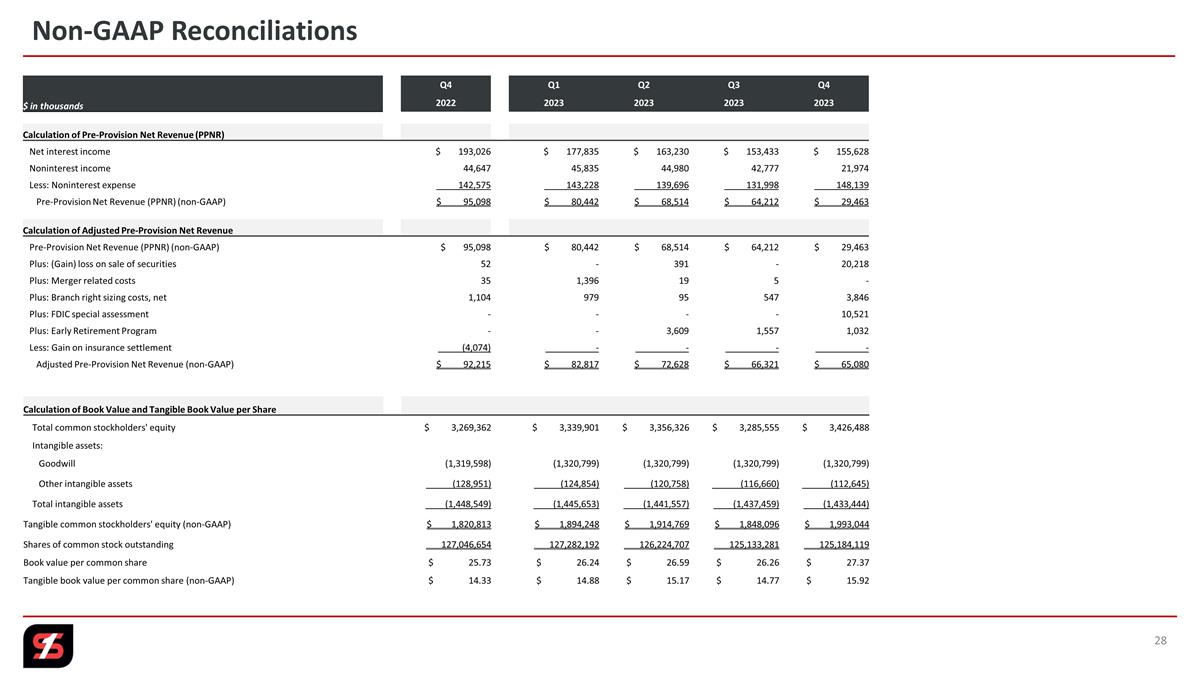

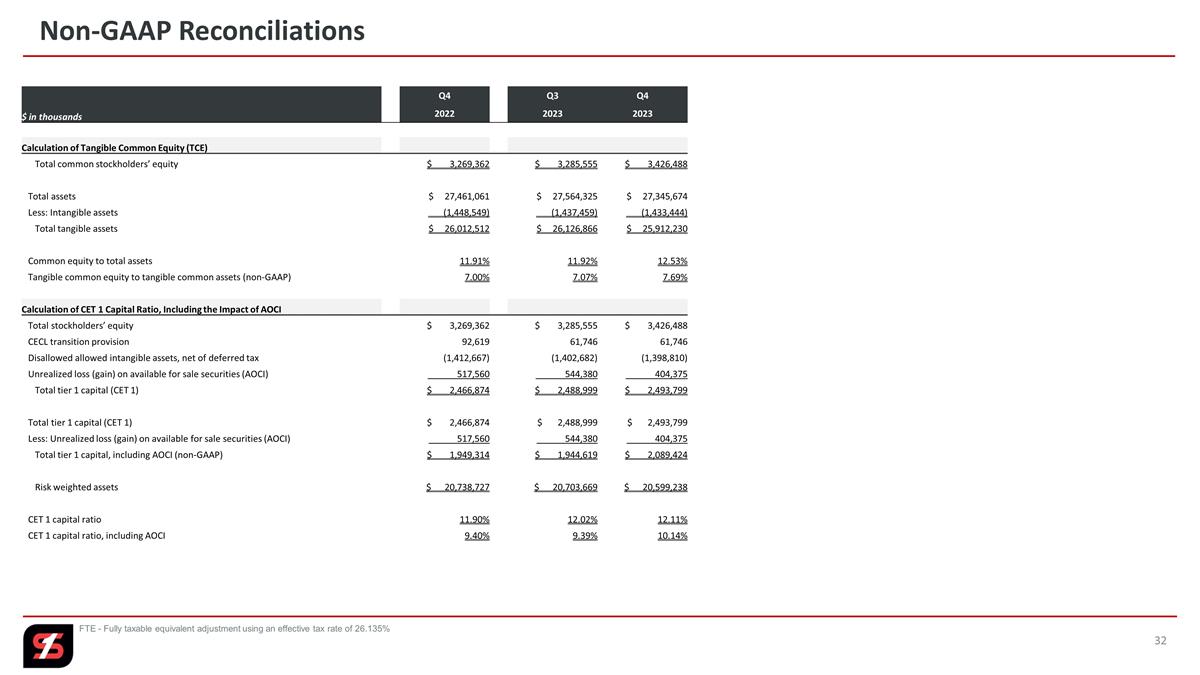

Capital

Total common stockholders’ equity at the end of the fourth quarter of 2023 was $3.4 billion, compared to $3.3 billion at the

end of both the third quarter of 2023 and the fourth quarter of 2022. Book value per share at the end of the fourth quarter of 2023 was $27.37, an increase of $1.11, or 4 percent, compared to $26.26 at the end of the third quarter of 2023 and

an increase of $1.64, or 6 percent, compared to $25.73 at the end of the fourth quarter of 2022. Tangible book value per share1 at the end of the fourth quarter of 2023 was $15.92, an

increase of $1.15, or 8 percent, compared to $14.77 at the end of the third quarter of 2023 and an increase of $1.59, or 11 percent, compared to $14.33 at the end of the fourth quarter of 2022.

Stockholders’ equity as a percentage of total assets at December 31, 2023, was 12.5 percent, compared to 11.9 percent at

September 30, 2023 and at December 31, 2022. Tangible common equity as a percentage of tangible assets1 was 7.7 percent at December 31, 2023, compared to 7.1 percent at

September 30, 2023, and 7.0 percent at December 31, 2022. Simmons continued to maintain a strong regulatory capital position with all regulatory capital ratios significantly exceeding “well capitalized” guidelines.

Share Repurchase Program and Cash Dividend

As a result of the Company’s strong capital position and ability to organically generate capital, the Company’s board of directors

declared a quarterly cash dividend on the Company’s Class A common stock of $0.21 per share, which is payable on April 1, 2024, to shareholders of record as of March 15, 2024. The cash dividend rate represents an increase of

$0.01 per share, or 5 percent, from the dividend paid for the same time period last year.

During the fourth quarter of 2023,

Simmons did not repurchase any shares of its Class A common stock under its 2022 stock repurchase program (2022 Program). With the 2022 Program set to terminate on January 31, 2024, the Company also announced today that its Board of

Directors has authorized a new stock repurchase program (New Program) under which the Company may repurchase up to $175,000,000 of its Class A common stock currently issued and outstanding. The New Program replaces the 2022 Program.

Under the New Program, the Company may repurchase shares of its common stock through open market and privately negotiated transactions or

otherwise. The timing, pricing, and amount of any repurchases under the New Program will be determined by the Company’s management at its discretion based on a variety of factors, including, but not limited to, trading volume and market price

of the Company’s common stock, corporate considerations, the Company’s working capital and investment requirements, general market and economic conditions, and legal requirements. The New Program does not obligate the Company to repurchase

any common stock and may be modified, discontinued, or suspended at any time without prior notice. The Company anticipates funding for the New Program to come from available sources of liquidity, including cash on hand and future cash flow. The New

Program will terminate on January 31, 2026 (unless terminated sooner).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Select Capital Ratios |

|

Q4 23 |

|

|

Q3 23 |

|

|

Q2 23 |

|

|

Q1 23 |

|

|

Q4 22 |

|

|

|

|

| |

|

| Stockholders’ equity to total assets |

|

|

12.5 |

% |

|

|

11.9 |

% |

|

|

12.0 |

% |

|

|

12.1 |

% |

|

|

11.9 |

% |

|

|

|

|

| Tangible common equity to tangible

assets1 |

|

|

7.7 |

|

|

|

7.1 |

|

|

|

7.2 |

|

|

|

7.3 |

|

|

|

7.0 |

|

|

|

|

|

| Common equity tier 1 (CET1) ratio |

|

|

12.1 |

|

|

|

12.0 |

|

|

|

11.9 |

|

|

|

11.9 |

|

|

|

11.9 |

|

|

|

|

|

| Tier 1 leverage ratio |

|

|

9.4 |

|

|

|

9.3 |

|

|

|

9.2 |

|

|

|

9.2 |

|

|

|

9.3 |

|

|

|

|

|

| Tier 1 risk-based capital ratio |

|

|

12.1 |

|

|

|

12.0 |

|

|

|

11.9 |

|

|

|

11.9 |

|

|

|

11.9 |

|

|

|

|

|

| Total risk-based capital ratio |

|

|

14.4 |

|

|

|

14.3 |

|

|

|

14.2 |

|

|

|

14.5 |

|

|

|

14.2 |

|

|

|

|

|

(1) Non-GAAP measurement. See “Non-GAAP

Financial Measures” and “Reconciliation of Non-GAAP Financial Measures” below

(2) FTE – fully taxable equivalent basis using an effective tax rate of 26.135%

Conference Call

Management will

conduct a live conference call to review this information beginning at 9:00 a.m. Central Time today, Wednesday, January 24, 2024. Interested persons can listen to this call by dialing toll-free 1-844-481-2779 (North America only) and asking for the Simmons First National Corporation conference call, conference ID 10185194. In addition, the call will be

available live or in recorded version on Simmons’ website at simmonsbank.com for at least 60 days following the date of

the call.

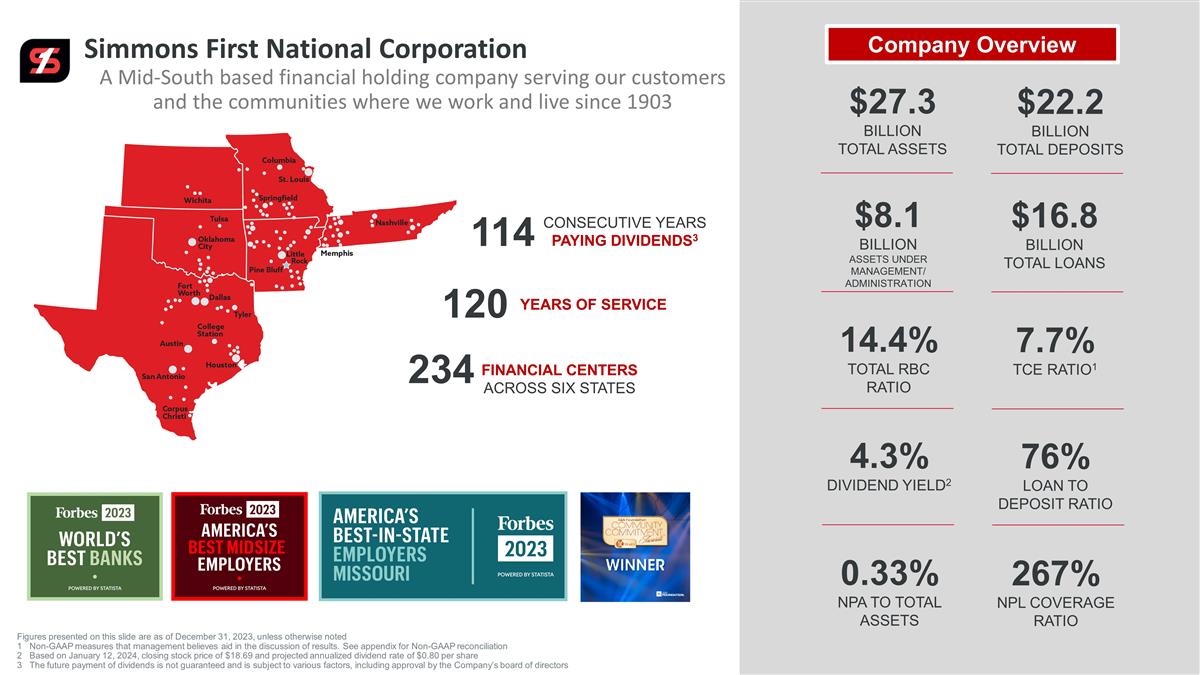

Simmons First National Corporation

Simmons First National Corporation (NASDAQ: SFNC) is a Mid-South based financial holding company that

has paid cash dividends to its shareholders for 115 consecutive years. Its principal subsidiary, Simmons Bank, operates 234 branches in Arkansas, Kansas, Missouri, Oklahoma, Tennessee and Texas. Founded in 1903, Simmons Bank offers comprehensive

financial solutions delivered with a client-centric approach. In 2023, Simmons Bank was recognized by Forbes as one of America’s Best Midsize Employers and among the World’s Best Banks for the fourth consecutive year. In 2022,

Simmons Bank was named to Forbes’ list of “America’s Best Banks” for the second consecutive year. Additional information about Simmons Bank can be found on our website at simmonsbank.com, by following

@Simmons_Bank on X (formerly Twitter) or by visiting our newsroom.

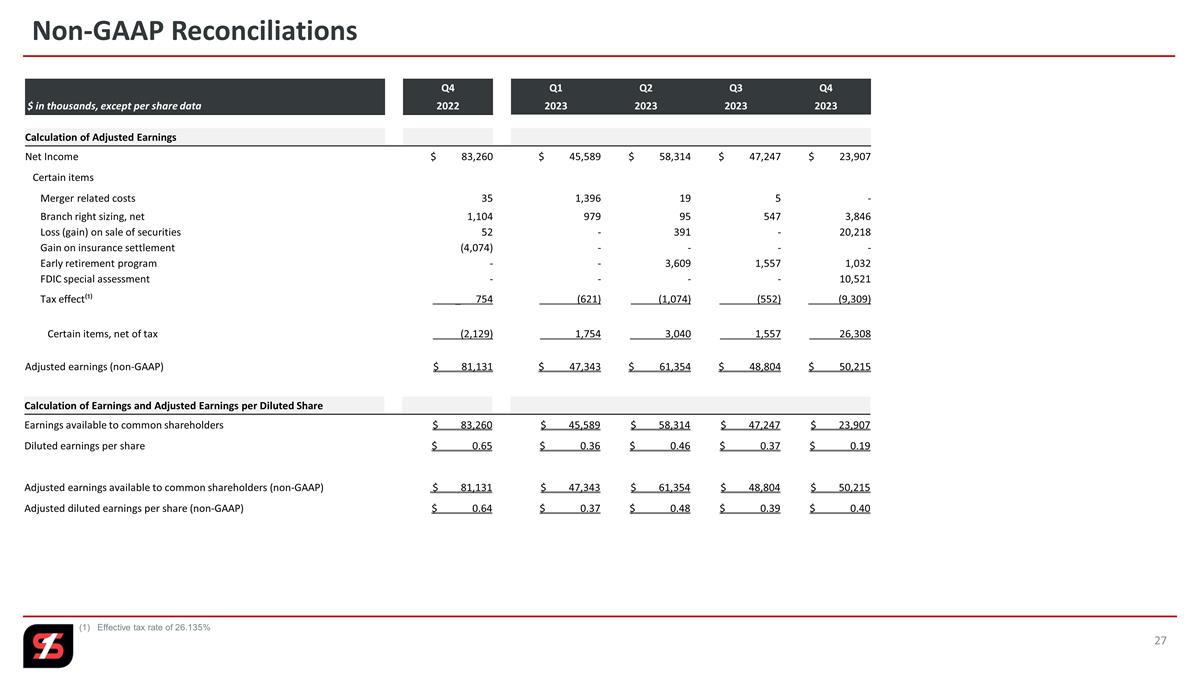

Non-GAAP Financial Measures

This press release contains financial information determined by

methods other than in accordance with U.S. generally accepted accounting principles (GAAP). The Company’s management uses these non-GAAP financial measures in their analysis of the Company’s

performance. These measures adjust GAAP performance measures to, among other things, include the tax benefit associated with revenue items that are tax-exempt, as well as exclude from net income (including on

a per share diluted basis), pre-tax, pre-provision earnings, net charge-offs, income available to common shareholders,

non-interest income, and non-interest expense certain income and expense items attributable to, for example, merger activity (primarily including merger-related expenses

and Day 2 CECL provisions), gains and/or

losses on sale of branches, net branch right-sizing initiatives, loss on redemption of trust preferred securities, gain on sale of intellectual property,

FDIC special assessment charges and gain/loss on the sale of AFS investment securities. The Company has updated its calculation of certain non-GAAP financial measures to exclude the impact of gains or losses

on the sale of AFS investment securities in light of the impact of the Company’s strategic AFS investment securities transactions during the fourth quarter of 2023 and has presented past periods on a comparable basis.

In addition, the Company also presents certain figures based on tangible common stockholders’ equity, tangible assets and tangible book

value, which exclude goodwill and other intangible assets. The Company further presents certain figures that are exclusive of the impact of deposits and/or loans acquired through acquisitions, mortgage warehouse loans, and/or energy loans, or gains

and/or losses on the sale of securities. The Company’s management believes that these non-GAAP financial measures are useful to investors because they, among other things, present the results of the

Company’s ongoing operations without the effect of mergers or other items not central to the Company’s ongoing business, as well as normalize for tax effects and certain other effects. Management, therefore, believes presentations of these

non-GAAP financial measures provide useful supplemental information that is essential to a proper understanding of the operating results of the Company’s ongoing businesses, and management uses these non-GAAP financial measures to assess the performance of the Company’s ongoing businesses as related to prior financial periods. These non-GAAP disclosures should not be

viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in the tables of this release.

Forward-Looking Statements

Certain statements in this press release may not be based on historical facts and should be considered “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements, including, without limitation, statements made in Mr. Fehlman’s quote and estimated earn back periods, may be identified by

reference to future periods or by the use of forward-looking terminology, such as “believe,” “budget,” “expect,” “foresee,” “anticipate,” “intend,” “indicate,” “target,”

“estimate,” “plan,” “project,” “continue,” “contemplate,” “positions,” “prospects,” “predict,” or “potential,” by future conditional verbs such as

“will,” “would,” “should,” “could,” “might” or “may,” or by variations of such words or by similar expressions. These forward-looking statements include, without limitation, statements

relating to Simmons’ future growth, business strategies, lending capacity and lending activity, loan demand, revenue, assets, asset quality, profitability, dividends, net interest margin, non-interest

revenue, share repurchase program, acquisition strategy, digital banking initiatives, the Company’s ability to recruit and retain key employees, the estimated cost savings associated with the Company’s Better Bank Initiative, the adequacy

of the allowance for credit losses, and future economic conditions and interest rates. Any forward-looking statement speaks only as of the date of this press release, and Simmons undertakes no obligation to update these forward-looking statements to

reflect events or circumstances that occur after the date of this press release. By nature, forward-looking statements are based on various assumptions and involve inherent risk and uncertainties. Various factors, including, but not limited to,

changes in economic conditions, changes in credit quality, changes in interest rates and related governmental policies, changes in loan demand, changes in deposit flows, changes in real estate values, changes in the assumptions used in making the

forward-looking statements, changes in the securities markets generally or the price of Simmons’ common stock specifically, changes in information technology affecting the financial industry, and changes in customer behaviors, including

consumer spending, borrowing, and saving habits; general economic and market conditions; market disruptions including pandemics or significant health hazards, severe weather conditions, natural disasters, terrorist activities, financial crises,

political crises, war and other military conflicts (including the ongoing military conflicts between Russia and Ukraine and between Israel and Hamas) or other major events, or the prospect of these events; the soundness of other financial

institutions and indirect exposure related to the closings of Silicon Valley Bank (SVB), Signature Bank and Silvergate Bank and their impact on the broader market through other customers, suppliers and partners (or that the conditions which resulted

in the liquidity concerns with SVB, Signature Bank and Silvergate Bank may also adversely impact, directly or indirectly, other financial institutions and market participants with which the Company has commercial or deposit relationships); increased

inflation; the loss of key employees; increased competition in the markets in which the Company operates; increased unemployment; labor shortages; claims, damages, and fines related to litigation or government actions; changes in accounting

principles relating to loan loss recognition (current expected credit losses); the Company’s ability to manage and successfully integrate its mergers and acquisitions and to fully realize cost savings and other benefits associated with

acquisitions; increased delinquency and foreclosure rates on commercial real estate loans; cyber threats, attacks or events; reliance on third parties for key services; government legislation; and other factors, many of which are beyond the control

of the Company, could cause actual results to differ materially from those projected in or contemplated by the forward-

looking statements. Additional information on factors that might affect the Company’s financial results is included in the Company’s Form 10-K

for the year ended December 31, 2022, the Company’s Form 10-Q for the quarterly period ended March 31, 2023, and other reports that the Company has filed with or furnished to the U.S. Securities

and Exchange Commission (the SEC), all of which are available from the SEC on its website, www.sec.gov. In addition,

there can be no guarantee that the board of directors (Board) of Simmons will approve a quarterly dividend in future quarters, and the timing, payment, and amount of future dividends (if any) is subject to, among other things, the discretion of the

Board and may differ significantly from past dividends.

FOR MORE INFORMATION CONTACT:

Ed Bilek, EVP, Director of Investor and Media Relations

ed.bilek@simmonsbank.com or 205.612.3378 (cell)

|

|

|

| Simmons First National Corporation |

|

SFNC |

| Consolidated End of Period Balance Sheets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the Quarters Ended |

|

Dec 31 |

|

|

Sep 30 |

|

|

Jun 30 |

|

|

Mar 31 |

|

|

Dec 31 |

|

| (Unaudited) |

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

| ($ in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and noninterest bearing balances due from banks |

|

$ |

345,258 |

|

|

$ |

181,822 |

|

|

$ |

181,268 |

|

|

$ |

199,316 |

|

|

$ |

200,616 |

|

| Interest bearing balances due from banks and federal funds sold |

|

|

268,834 |

|

|

|

423,826 |

|

|

|

564,644 |

|

|

|

325,135 |

|

|

|

481,506 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

614,092 |

|

|

|

605,648 |

|

|

|

745,912 |

|

|

|

524,451 |

|

|

|

682,122 |

|

| Interest bearing balances due from banks - time |

|

|

100 |

|

|

|

100 |

|

|

|

545 |

|

|

|

795 |

|

|

|

795 |

|

| Investment securities -

held-to-maturity |

|

|

3,726,288 |

|

|

|

3,742,292 |

|

|

|

3,756,754 |

|

|

|

3,765,483 |

|

|

|

3,759,706 |

|

| Investment securities -

available-for-sale |

|

|

3,152,153 |

|

|

|

3,358,421 |

|

|

|

3,579,758 |

|

|

|

3,755,956 |

|

|

|

3,852,854 |

|

| Mortgage loans held for sale |

|

|

9,373 |

|

|

|

11,690 |

|

|

|

10,342 |

|

|

|

4,244 |

|

|

|

3,486 |

|

| Loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans |

|

|

16,845,670 |

|

|

|

16,771,888 |

|

|

|

16,833,653 |

|

|

|

16,555,098 |

|

|

|

16,142,124 |

|

| Allowance for credit losses on loans |

|

|

(225,231 |

) |

|

|

(218,547 |

) |

|

|

(209,966 |

) |

|

|

(206,557 |

) |

|

|

(196,955 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loans |

|

|

16,620,439 |

|

|

|

16,553,341 |

|

|

|

16,623,687 |

|

|

|

16,348,541 |

|

|

|

15,945,169 |

|

| Premises and equipment |

|

|

570,678 |

|

|

|

567,167 |

|

|

|

562,025 |

|

|

|

564,497 |

|

|

|

548,741 |

|

| Foreclosed assets and other real estate owned |

|

|

4,073 |

|

|

|

3,809 |

|

|

|

3,909 |

|

|

|

2,721 |

|

|

|

2,887 |

|

| Interest receivable |

|

|

122,430 |

|

|

|

110,361 |

|

|

|

103,431 |

|

|

|

98,775 |

|

|

|

102,892 |

|

| Bank owned life insurance |

|

|

500,559 |

|

|

|

497,465 |

|

|

|

494,370 |

|

|

|

493,191 |

|

|

|

491,340 |

|

| Goodwill |

|

|

1,320,799 |

|

|

|

1,320,799 |

|

|

|

1,320,799 |

|

|

|

1,320,799 |

|

|

|

1,319,598 |

|

| Other intangible assets |

|

|

112,645 |

|

|

|

116,660 |

|

|

|

120,758 |

|

|

|

124,854 |

|

|

|

128,951 |

|

| Other assets |

|

|

592,045 |

|

|

|

676,572 |

|

|

|

636,833 |

|

|

|

579,139 |

|

|

|

622,520 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

27,345,674 |

|

|

$ |

27,564,325 |

|

|

$ |

27,959,123 |

|

|

$ |

27,583,446 |

|

|

$ |

27,461,061 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest bearing transaction accounts |

|

$ |

4,800,880 |

|

|

$ |

4,991,034 |

|

|

$ |

5,264,962 |

|

|

$ |

5,489,434 |

|

|

$ |

6,016,651 |

|

| Interest bearing transaction accounts and savings deposits |

|

|

10,997,425 |

|

|

|

10,571,807 |

|

|

|

10,866,078 |

|

|

|

11,283,584 |

|

|

|

11,762,885 |

|

| Time deposits |

|

|

6,446,673 |

|

|

|

6,668,370 |

|

|

|

6,357,682 |

|

|

|

5,678,757 |

|

|

|

4,768,558 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total deposits |

|

|

22,244,978 |

|

|

|

22,231,211 |

|

|

|

22,488,722 |

|

|

|

22,451,775 |

|

|

|

22,548,094 |

|

| Federal funds purchased and securities sold under agreements to repurchase |

|

|

67,969 |

|

|

|

74,482 |

|

|

|

102,586 |

|

|

|

142,862 |

|

|

|

160,403 |

|

| Other borrowings |

|

|

972,366 |

|

|

|

1,347,855 |

|

|

|

1,373,339 |

|

|

|

1,023,826 |

|

|

|

859,296 |

|

| Subordinated notes and debentures |

|

|

366,141 |

|

|

|

366,103 |

|

|

|

366,065 |

|

|

|

366,027 |

|

|

|

365,989 |

|

| Accrued interest and other liabilities |

|

|

267,732 |

|

|

|

259,119 |

|

|

|

272,085 |

|

|

|

259,055 |

|

|

|

257,917 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

23,919,186 |

|

|

|

24,278,770 |

|

|

|

24,602,797 |

|

|

|

24,243,545 |

|

|

|

24,191,699 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock |

|

|

1,252 |

|

|

|

1,251 |

|

|

|

1,262 |

|

|

|

1,273 |

|

|

|

1,270 |

|

| Surplus |

|

|

2,499,930 |

|

|

|

2,497,874 |

|

|

|

2,516,398 |

|

|

|

2,533,589 |

|

|

|

2,530,066 |

|

| Undivided profits |

|

|

1,329,681 |

|

|

|

1,330,810 |

|

|

|

1,308,654 |

|

|

|

1,275,720 |

|

|

|

1,255,586 |

|

| Accumulated other comprehensive (loss) income |

|

|

(404,375 |

) |

|

|

(544,380 |

) |

|

|

(469,988 |

) |

|

|

(470,681 |

) |

|

|

(517,560 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

3,426,488 |

|

|

|

3,285,555 |

|

|

|

3,356,326 |

|

|

|

3,339,901 |

|

|

|

3,269,362 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

27,345,674 |

|

|

$ |

27,564,325 |

|

|

$ |

27,959,123 |

|

|

$ |

27,583,446 |

|

|

$ |

27,461,061 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 1

|

|

|

| Simmons First National Corporation |

|

SFNC |

| Consolidated Statements of Income - Quarter-to-Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the Quarters Ended |

|

Dec 31 |

|

|

Sep 30 |

|

|

Jun 30 |

|

|

Mar 31 |

|

|

Dec 31 |

|

| (Unaudited) |

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

| ($ in thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans (including fees) |

|

$ |

261,505 |

|

|

$ |

255,901 |

|

|

$ |

244,292 |

|

|

$ |

227,498 |

|

|

$ |

216,091 |

|

| Interest bearing balances due from banks and federal funds sold |

|

|

3,115 |

|

|

|

3,569 |

|

|

|

4,023 |

|

|

|

2,783 |

|

|

|

2,593 |

|

| Investment securities |

|

|

58,755 |

|

|

|

50,638 |

|

|

|

48,751 |

|

|

|

48,774 |

|

|

|

45,689 |

|

| Mortgage loans held for sale |

|

|

143 |

|

|

|

178 |

|

|

|

154 |

|

|

|

82 |

|

|

|

152 |

|

| Other loans held for sale |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

59 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL INTEREST INCOME |

|

|

323,518 |

|

|

|

310,286 |

|

|

|

297,220 |

|

|

|

279,137 |

|

|

|

264,584 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Time deposits |

|

|

72,458 |

|

|

|

68,062 |

|

|

|

53,879 |

|

|

|

39,538 |

|

|

|

22,434 |

|

| Other deposits |

|

|

71,412 |

|

|

|

65,095 |

|

|

|

54,485 |

|

|

|

47,990 |

|

|

|

34,615 |

|

| Federal funds purchased and securities sold under agreements to repurchase |

|

|

232 |

|

|

|

277 |

|

|

|

318 |

|

|

|

323 |

|

|

|

449 |

|

| Other borrowings |

|

|

16,607 |

|

|

|

16,450 |

|

|

|

18,612 |

|

|

|

8,848 |

|

|

|

9,263 |

|

| Subordinated notes and debentures |

|

|

7,181 |

|

|

|

6,969 |

|

|

|

6,696 |

|

|

|

4,603 |

|

|

|

4,797 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|