As

filed with the U.S. Securities and Exchange Commission on November 26, 2024

Registration

No. 333-[●]

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

F-3

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

Starbox

Group Holdings Ltd.

(Exact

name of registrant as specified in its charter)

| Cayman

Islands |

|

Not

Applicable |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

Number) |

VO2-03-07,

Velocity Office 2, Lingkaran SV, Sunway Velocity, 55100

Kuala

Lumpur, Malaysia

+603

2781 9066

(Address

and telephone number of Registrant’s principal executive offices)

Cogency

Global Inc.

122

East 42nd Street, 18th Floor

New

York, NY 10168

800-221-0102

(Name,

address, and telephone number of agent for service)

With

a Copy to:

Ying

Li, Esq.

Lisa

Forcht, Esq.

Hunter

Taubman Fischer & Li LLC

950

Third Avenue, 19th Floor

New

York, NY 10022

212-530-2206

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of the registration statement.

If

only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the

following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company ☒

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

†

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards

Board to its Accounting Standards Codification after April 5, 2012.

The

Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act, or until this registration statement shall become effective on such date as the

U.S. Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is

not complete and may be changed. The securities may not be sold until the registration statement filed with the U.S. Securities and Exchange

Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting any offer to buy these securities

in any jurisdiction where such offer or sale is not permitted.

| PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION |

DATED

NOVEMBER 26, 2024 |

Starbox

Group Holdings Ltd.

20,845,316 Class

A Ordinary Shares Offered by Selling Shareholders

This

prospectus covers the resale by certain selling shareholders described herein (collectively, the “Selling Shareholders”)

of up to an aggregate of 20,845,316 Class A ordinary shares, par value $0.018 per share (the “Class A Ordinary Shares”).

The Selling Shareholders may, from time to time, sell, transfer, or otherwise dispose of any or all of their Class A Ordinary Shares

on any stock exchange, market, or trading facility on which the Class A Ordinary Shares are traded or in private transactions. These

dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price,

at varying prices determined at the time of sale, or at negotiated prices.

We

will not receive any of the proceeds from the sale or other disposition of the Class A Ordinary Shares by the Selling Shareholders, but

we will bear all costs, fees, and expenses in connection with the registration of the Class A Ordinary Shares offered by the Selling

Shareholders. The Selling Shareholders will bear all commissions and discounts, if any, attributable to the sale of the Class A Ordinary

Shares offered for resale through this prospectus. For information regarding the Selling Shareholders and the times and manner in which

they may offer or sell the Class A Ordinary Shares, see “Selling Shareholders” and “Plan of Distribution.”

Our

authorized share capital is $9,990,000 divided into 555,000,000 shares comprised of: (i) 543,875,000 Class

A Ordinary Shares, (ii) 8,000,000 Class B ordinary shares, par value $0.018 per share (“Class B Ordinary Shares”),

and (iii) 3,125,000 preferred shares, par value $0.018 per share (“Preferred Shares”). As of the date of

this prospectus, we have 42,471,204 Class A Ordinary Shares, 800,000 Class B Ordinary Shares, and no Preferred Shares issued

and outstanding, respectively. Holders of Class A Ordinary Shares and Class B Ordinary Shares have the same rights except for voting

and conversion rights. In respect of matters requiring a vote of all shareholders, each holder of Class A Ordinary Shares will be entitled

to one vote per one Class A Ordinary Share and each holder of Class B Ordinary Shares will be entitled to 100 votes per one Class B Ordinary

Share. Class A Ordinary Shares are not convertible into shares of any other class. Class B Ordinary Shares are convertible into Class

A Ordinary Shares at any time after issuance at the option of the holder, and each one Class B Ordinary Share is convertible into 10

Class A Ordinary Shares.

Our

Class A Ordinary Shares are listed on the Nasdaq Capital Market, or “Nasdaq,” under the symbol “STBX.” On November

25, 2024, the last reported sale price of our Class A Ordinary Shares on Nasdaq was $1.19 per share.

We

are a “foreign private issuer” and we are currently an “emerging growth company” under applicable U.S. federal

securities laws and are eligible for reduced public company reporting requirements. Subject to any other conditions as prescribed in

the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), we will no longer be an “emerging growth company,”

as defined in the JOBS Act, from the last day of the fiscal year ending September 30, 2027.

Investing

in our securities involves a high degree of risk. Before making an investment decision, please read the information under the heading

“Risk Factors” beginning on page 8 of this prospectus and risk factors set forth in our most recent annual report

on Form 20-F (the “2023 Annual Report”), in other reports incorporated herein by reference, and in an applicable prospectus

supplement under the heading “Risk Factors.”

Neither

the U.S. Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved

of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2024.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus describes the general manner in which the Selling Shareholders identified in this prospectus may offer from time to time up

to 20,845,316 Class A Ordinary Shares.

You

should rely only on the information contained in this prospectus and the related exhibits, any prospectus supplement or amendment thereto,

and the documents incorporated by reference, or to which we have referred you, before making your investment decision. We have not, and

the Selling Shareholders have not, authorized any other person to provide you with different or additional information. If anyone provides

you with different or inconsistent information, you should not rely on it. This prospectus is not an offer to sell, nor are the Selling

Shareholders seeking an offer to buy, the Class A Ordinary Shares offered by this prospectus in any jurisdiction where the offer or sale

is not permitted. You should assume that the information contained in this prospectus or in any applicable prospectus supplement is accurate

only as of the date on the front cover thereof or the date of the document incorporated by reference, regardless of the time of delivery

of this prospectus or any applicable prospectus supplement or any sales of the Class A Ordinary Shares offered hereby or thereby.

If

necessary, the specific manner in which the Class A Ordinary Shares may be offered and sold will be described in a supplement to this

prospectus, which supplement may also add, update or change any of the information contained in this prospectus. To the extent there

is a conflict between the information contained in this prospectus and any prospectus supplement, you should rely on the information

in such prospectus supplement, provided that if any statement in one of these documents is inconsistent with a statement in another document

having a later date—for example, a document incorporated by reference in this prospectus or any prospectus supplement—the

statement in the document having the later date modifies or supersedes the earlier statement.

Neither

the delivery of this prospectus nor any distribution of the Class A Ordinary Shares pursuant to this prospectus shall, under any circumstances,

create any implication that there has been no change in the information set forth or incorporated by reference into this prospectus or

in our affairs since the date of this prospectus. Our business, financial condition, results of operations, and prospects may have changed

since such date.

COMMONLY

USED DEFINED TERMS

Unless

otherwise indicated or the context requires otherwise, references in this prospectus or in a prospectus supplement to:

| |

● |

“AI” are to

artificial intelligence; |

| |

|

|

| |

● |

“Benefit Pointer”

are to Benefit Pointer Limited, a British Virgin Islands company, which is a wholly owned subsidiary of Starbox International (defined

below); |

| |

|

|

| |

● |

“Carnegie Hill”

are to Carnegie Hill Limited, a company incorporated in Seychelles, which is a wholly owned subsidiary of Irace Technology (defined

below); |

| |

|

|

| |

● |

“Exchange Act”

are to the Securities Exchange Act of 1934; |

| |

|

|

| |

● |

“GETBATS website

and mobile app” are to the GETBATS cash rebate website (www.getbats.com) and the GETBATS app operated by Starbox Technologies

(defined below); |

| |

|

|

| |

● |

“Irace Technology”

are to Irace Technology Limited, a British Virgin Islands company, which is a wholly owned subsidiary of Starbox International (defined

below); |

| |

|

|

| |

● |

“Members” are

to retail shoppers that have registered as a member on the GETBATS website and mobile app; |

| |

|

|

| |

● |

“Merchants”

are to retail merchants (both online and offline) that have registered as a merchant on the GETBATS website and mobile app; |

| |

● |

“One Eighty Ltd”

are to One Eighty Holdings Ltd, a Cayman Islands company and 51% owned by Starbox Global (defined below); |

| |

|

|

| |

● |

“Ordinary Shares”

are to Class A Ordinary Shares and Class B Ordinary Shares; |

| |

|

|

| |

● |

“ProSeeds”

are to ProSeeds Limited, a company incorporated in Seychelles, which is a wholly owned subsidiary of Starbox International; |

| |

● |

“Rainbow

Worldwide” are to Rainbow Worldwide Co., Ltd, a company incorporated in Samoa, which was a wholly owned subsidiary of Irace

Technology before it was dissolved on August 5, 2024; |

| |

|

|

| |

● |

“Securities Act”

are to the Securities Act of 1933, as amended; |

| |

|

|

| |

● |

“SEEBATS website

and mobile app” are to the SEEBATS video streaming website (www.seebats.com) and the SEEBATS app operated by StarboxSB (defined

below); |

| |

|

|

| |

● |

“Share Restructure”

are to the meaning given in the “Prospectus Summary—Overview” section of this prospectus; |

| |

|

|

| |

● |

“Starbox Berhad”

are to Starbox Holdings Berhad, a company limited by shares incorporated under the laws of Malaysia and a wholly owned subsidiary

of Starbox International (defined below); |

| |

|

|

| |

● |

“Starbox Global”

are to Starbox Global Ltd., a British Virgin Islands company and a wholly owned subsidiary of Starbox Group; |

| |

|

|

| |

● |

“Starbox Group”

are to Starbox Group Holdings Ltd., an exempted company limited by shares incorporated under the laws of the Cayman Islands; |

| |

|

|

| |

● |

“Starbox International”

are to Starbox International Ltd., a British Virgin Islands company and a wholly owned subsidiary of Starbox Group; |

| |

|

|

| |

● |

“Starbox Technologies”

are to Starbox Technologies Sdn. Bhd. (formerly known as Starbox Rebates Sdn. Bhd.), a company limited by shares incorporated under

the laws of Malaysia, which is a wholly owned subsidiary of Starbox Berhad; |

| |

|

|

| |

● |

“StarboxSB”

are to StarboxTV Sdn. Bhd., a company limited by shares incorporated under the laws of Malaysia, which is a wholly owned subsidiary

of Starbox Berhad; |

| |

|

|

| |

● |

“Trade Router”

are to Trade Router Ltd., a company incorporated in Seychelles, which is a wholly owned subsidiary of Starbox International ; |

| |

|

|

| |

● |

“U.S. dollars,”

“$,” and “dollars” are to the legal currency of the United States; |

| |

|

|

| |

● |

“VE Services”

are to VE Services Sdn Bhd, a Malaysian Internet payment gateway company and a related-party entity controlled by one of our beneficial

shareholders; and |

| |

|

|

| |

● |

“we,” “us,”

“our,” “our Company,” or the “Company” are to one or more of Starbox Group and its subsidiaries,

as the case may be. |

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, any applicable prospectus supplement, and our SEC filings that are incorporated by reference into this prospectus contain

or incorporate by reference forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the

Exchange Act. All statements other than statements of historical fact are “forward-looking statements,” including any projections

of earnings, revenue or other financial items, any statements of the plans, strategies, and objectives of management for future operations,

any statements concerning proposed new projects or other developments, any statements regarding future economic conditions or performance,

any statements of management’s beliefs, goals, strategies, intentions, and objectives, and any statements of assumptions underlying

any of the foregoing. The words “believe,” “anticipate,” “estimate,” “plan,” “expect,”

“intend,” “may,” “could,” “should,” “potential,” “likely,” “projects,”

“continue,” “will,” and “would” and similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain these identifying words. Forward-looking statements reflect our current

views with respect to future events, are based on assumptions, and are subject to risks and uncertainties. We cannot guarantee that we

actually will achieve the plans, intentions, or expectations expressed in our forward-looking statements and you should not place undue

reliance on these statements. There are a number of important factors that could cause our actual results to differ materially from those

indicated or implied by forward-looking statements. These important factors include those discussed under the heading “Risk Factors”

contained or incorporated by reference in this prospectus and in the applicable prospectus supplement and any free writing prospectus

we may authorize for use in connection with a specific offering. These factors and the other cautionary statements made in this prospectus

should be read as being applicable to all related forward-looking statements whenever they appear in this prospectus. Except as required

by law, we undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future

events, or otherwise.

Prospectus

Summary

Overview

We

are building a cash rebate, advertising, payment solution, and software licensing business ecosystem targeting micro, small, and medium

enterprises that lack the bandwidth to develop an in-house data management system for effective marketing. Through our subsidiaries in

Malaysia, we connect retail merchants with retail shoppers to facilitate transactions through cash rebates offered by retail merchants,

provide advertising services to retail merchant customers (“advertisers”), provide payment solution services to merchants,

and license customized software systems to our clients. Substantially all of our current operations are located in Malaysia.

Our

cash rebate business is the foundation of the business ecosystem we are building. We have cooperated with retail merchants, which have

registered on the GETBATS website and mobile app as Merchants, to offer cash rebates on their products or services, which have attracted

retail shoppers to register on the GETBATS website and mobile app as Members in order to earn cash rebates for shopping online and offline.

As the number of Members grows and sales of the existing Merchants increase, more retail merchants have been willing to cooperate with

us. As of March 31, 2024, the GETBATS website and mobile app had 2,524,635 Members and 842 Merchants. As of September 30, 2023, 2022,

and 2021, the GETBATS website and mobile app had 2,523,802, 2,513,658, and 514,167 Members, respectively, and 841, 820, and 723 Merchants,

respectively. During the six months ended March 31, 2024 and 2023, we facilitated 114,120 and 161,306 transactions through the GETBATS

website and mobile app, respectively. During the fiscal years ended September 30, 2023, 2022, and 2021, we facilitated 264,600, 338,940,

and 295,393 transactions through the GETBATS website and mobile app, respectively. We generate revenue by keeping an agreed-upon portion

of the cash rebates offered by Merchants on the GETBATS website and mobile app.

Making

use of the vast Member and Merchant data we have collected from the GETBATS website and mobile app, we help advertisers design, optimize,

and distribute advertisements through online and digital channels. We primarily distribute advertisements through (i) our SEEBATS website

and mobile app, on which viewers can watch movies and television series for free through over the top streaming, which is a means of

providing television and film content over the Internet at the request and to suit the requirements of the individual consumer, (ii)

our GETBATS website and mobile app to its Members, and (iii) social media, mainly consisting of accounts of influencers and bloggers.

During the six months ended March 31, 2024 and 2023, we served one and 22 advertisers, respectively. During the fiscal years ended September

30, 2023, 2022, and 2021, we served 31, 63, and 25 advertisers, respectively. We generate revenue through service fees charged to the

advertisers.

To

diversify our revenue sources and supplement our cash rebate and digital advertising service businesses, we started to provide payment

solution services to merchants in May 2021 by referring them to VE Services, a Malaysian Internet payment gateway company and a related-party

entity controlled by one of our beneficial shareholders. Pursuant to an appointment letter dated October 1, 2020 with VE Services (the

“Appointment Letter”), we serve as its independent merchant recruitment and onboarding agent and refer merchants to VE Services

for payment processing. We referred 39 and 35 merchants to VE Services during the six months ended March 31, 2024 and 2023, respectively.

We referred 37, 19, and 11 merchants to VE Services during the fiscal years ended September 30, 2023, 2022, and 2021, respectively. We

generate insignificant revenue through commissions from VE Services for our referrals and such revenue has been reported as revenue from

a related party in our consolidated financial statements.

During

the fiscal year ended September 30, 2023, we started our software licensing business. In March 2023 and May 2023, we entered into two

software licensing agreements with two Malaysian companies, respectively. In August 2023, we entered into a software licensing agreement

with a Hong Kong-based company. Pursuant to the software licensing agreements, we granted the licensees access to our data management

system and agreed to help train their staff with respect to the use of the data management system. In July 2023, we entered into a software

licensing agreement with a Philippines-based company, pursuant to which we licensed our AI Rebates Calculation Engine System and agreed

to provide technology support. We generate revenue through license fees and annual technical support and maintenance fees charged to

the clients.

On

June 26, 2023, we acquired 51% ownership of One Eighty Ltd and its subsidiaries, to further expand our business of online and offline

advertisement, including advertisement consultation, design, production, agency services, as well as marketing and promotional campaign

services. We provide brand-building-related consulting services with fixed-priced terms, and our services include market research, advertisement

idea conceptualization, brand positioning proposals, and final proposals and solutions. We provide production services for customers

who already have conceptualized ideas for advertisement or other types of visual or audio content. Our production services range from

photography, video recording, audio recording, script development, and equipment rental, to post-production editing. We also generate

revenue from marketing and promotional campaign services. We assist merchants in the planning, arranging, and execution of seasonal on-the-ground

sales and promotional campaigns, typically located in shopping malls. Our services include providing sales campaign proposals, coordinating

with shopping mall owners for venue rental, assisting merchant clients with rental equipment, advising merchant clients with on-site

layout arrangements and decorations, and providing product display strategies. In addition to these services, we also perform media booking

agency services to sell advertisement lots on behalf of media companies. We generate insignificant revenue from our media booking agency

services.

On

September 7, 2023, One Eighty Ltd incorporated Benefit Pointer in the British Virgin Islands. Benefit Pointer does not have any operations

as of the date of this prospectus.

On

September 7, 2023, Starbox International incorporated Irace Technology in the British Virgin Islands. Irace Technology is engaged in

software development, marketing, and licensing.

At

Starbox Group’s 2024 annual general meeting of the shareholders held on June 27, 2024, the shareholders approved and adopted, among

other resolutions, (1) as an ordinary resolution, the establishment and designation of two new classes of ordinary shares of Starbox

Group, being Class A Ordinary Shares and Class B Ordinary

Shares; and (2) as an ordinary resolution, the redesignation of: (i) the 12,800,000 authorized and issued ordinary shares held

by Nevis International B & T Sdn Bhd (the “Nevis Shares”) as Class B Ordinary Shares; (ii) 161,704,984 of the authorized

and issued ordinary shares, not including the Nevis Shares, as Class A Ordinary Shares; and (iii) 708,495,016 of the authorized but unissued

ordinary shares as Class A Ordinary Shares (items (i) to (iii), together, the “Share Restructure”). Pursuant to the resolutions,

(i) holders of Class A Ordinary Shares and Class B Ordinary Shares have the same rights except for voting and conversion rights; (ii)

in respect of all matters subject to vote at general meetings of the Company, each holder of Class A Ordinary Shares is entitled to one

vote per one Class A Ordinary Share and each holder of Class B Ordinary Shares is entitled to 100 votes per one Class B Ordinary Share;

(iii) Class A Ordinary Shares are not convertible into shares of any other class; and (iv) Class B Ordinary Shares are convertible into

Class A Ordinary Shares at any time after issuance at the option of the holder, and each one Class B Ordinary Share is convertible into

10 Class A Ordinary Shares.

For

the six months ended March 31, 2024, we had total revenue of $4,448,521. Revenue derived from 1) advertising services, 2) software licensing,

3) cash rebate, payment solution services, and media booking, 4) production services, and 5) marketing and promotional campaign services

accounted for approximately 23.68%, 46.74%, 6.29%, 14.67%, and 8.61% of our total revenue for the period, respectively.

For

the six months ended March 31, 2023, we had total revenue of $3,976,190. Revenue derived from advertising services, software licensing,

and cash rebate and payment solutions services accounted for approximately 55.85%, 43.77%, and 0.38% of our total revenue for the period,

respectively.

For

the fiscal year ended September 30, 2023, we had total revenue of $11,740,852 and net income of $2,459,733. Revenue derived from advertising

services, software licensing, cash rebate, payment solution services, media booking, production services, and promotional campaign services

accounted for approximately 45.20%, 48.68%, 0.72%, 3.08%, and 2.32% of our total revenue of the period, respectively.

For

the fiscal year ended September 30, 2022, we had total revenue of $7,194,187 and net income of $3,602,365. Revenue derived from digital

advertising services, cash rebate services, and payment solution services accounted for approximately 99.72%, 0.15%, and 0.13% of our

total revenue for the fiscal year, respectively.

For

the fiscal year ended September 30, 2021, we had total revenue of $3,166,228 and net income of $1,447,650. Revenue derived from digital

advertising services, cash rebate services, and payment solution services accounted for approximately 99.75%, 0.20%, and 0.05% of our

total revenue for the fiscal year, respectively.

The Share Consolidation and the Share Capital

Increase

On October 23, 2024, our shareholders approved

the following corporate actions: (1) (a) each of the 870,200,000 authorized, issued or unissued, Class A ordinary shares were consolidated

on a 16:1 basis to 54,387,500 Class A Ordinary Shares of $0.018 par value each; (b) each of the 12,800,000 authorized Class B ordinary

shares, issued or unissued, were consolidated on a 16:1 basis to 800,000 Class B Ordinary Shares of $0.018 par value each; and (c) each

of the 5,000,000 authorized and unissued preferred shares were consolidated on a 16:1 basis to 312,500 Preferred Shares of $0.018 par

value each ((a) to (c) together, the “Share Consolidation”); and (2) with effect immediately following the Share Consolidation,

the Company’s authorized share capital was increased from (a) $999,000 divided into 55,500,000 shares (immediately after the Share

Consolidation), comprising (i) 54,387,500 Class A ordinary shares of $0.018 par value each, (ii) 800,000 Class B ordinary shares of $0.018

par value each, and (iii) 312,500 preferred shares of $0.018 par value each, to (b) $9,990,000 divided into 555,000,000 shares, comprising

(i) 543,875,000 Class A Ordinary Shares of $0.018 par value each, (ii) 8,000,000 Class B Ordinary Shares of $0.018 par value each, and

(iii) 3,125,000 Preferred Shares of $0.018 par value each (the “Share Capital Increase”). Beginning with the opening of trading

on October 31, 2024, our Class A Ordinary Shares have been trading on a post-Share Consolidation basis on Nasdaq. No fractional shares

were issued in connection with the Share Consolidation. Any fractional shares resulting from the Share Consolidation were rounded up

such that each shareholder received one ordinary share in lieu of the fractional share that would have resulted from the Share Consolidation.

Unless otherwise indicated, all references to

Class A Ordinary Shares, Class B Ordinary Shares, Preferred Shares, share data, per share data, and related information have been retroactively

adjusted, where applicable, in this prospectus to reflect the Share Consolidation as if it had occurred at the beginning of the earlier

period presented.

On November 14, 2024, we received a letter from the Listing Qualifications Department of Nasdaq informing us

that we had regained compliance with the minimum closing bid price required for continued listing on Nasdaq set forth in Nasdaq Listing

Rule 5550(a)(2) (the “Minimum Bid Price Rule”).

Acquisition

Activities

Due

to the constant changes of technology in our industry as well as competition, we constantly adapt and enhance our rebates and digital

advertising systems to meet future needs. Since October 2023, we have embarked on a series of acquisitions of software modules for system

enhancement, creating an immersive cash rebates and digital advertising ecosystem powered by advanced virtual reality and augmented reality

technologies. From October 2023 to the date of this prospectus, we have conducted 18 acquisitions in total. We closed one acquisition

in October 2023, two acquisitions in the first quarter of 2024, three acquisitions in the second quarter of 2024, seven acquisitions

in the third quarter of 2024, and three acquisitions in the fourth quarter of 2024. We have two acquisitions for which we have entered into software

purchase agreements and have not closed such acquisitions as of the date of this prospectus.

Due

to the depressed level of our share price, we found it difficult to raise the appropriate amount of funds required to fund the above-said

systems enhancements. Nevertheless, we were able to negotiate for “all share” payments for the acquisitions. We issued

a total of 38,564,070 Class A Ordinary Shares in connection with the acquisitions.

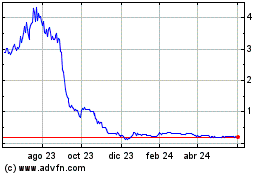

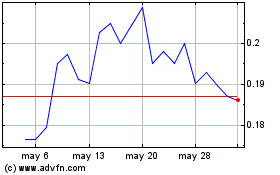

The

fluctuation in the share price of our Class A Ordinary Shares since October 2023 are as follows:

| | |

Highest (US$) | | |

Lowest (US$) | |

| 2023 | |

| | | |

| | |

| October | |

| 18.08 | | |

| 9.60 | |

| November | |

| 10.40 | | |

| 3.34 | |

| December | |

| 7.20 | | |

| 1.55 | |

| | |

| | | |

| | |

| 2024 | |

| | | |

| | |

| January | |

| 6.32 | | |

| 3.04 | |

| February | |

| 6.08 | | |

| 4.35 | |

| March | |

| 5.28 | | |

| 3.38 | |

| April | |

| 4.13 | | |

| 2.91 | |

| May | |

| 3.52 | | |

| 2.57 | |

| June | |

| 3.20 | | |

| 2.60 | |

| July | |

| 3.14 | | |

| 2.43 | |

| August | |

| 2.98 | | |

| 1.94 | |

| September | |

| 2.72 | | |

| 1.92 | |

| October | |

| 3.50 | | |

| 1.40 | |

| | |

| | | |

| | |

| Last reported sale price of Class A Ordinary Shares on Nasdaq on November

25, 2024 | |

| | | |

| 1.19 | |

(Source:

Historical quotes from Nasdaq’s website: Nasdaq.com)

Acquisitions

of ProSeeds, Trade Router, Carnegie Hill, and Rainbow Worldwide

On

October 26, 2023, Starbox Group, as the issuer, and Starbox International, as the purchaser, entered into a share sale agreement with

the three then shareholders of ProSeeds to acquire 100% of the issued and paid-up share capital in ProSeeds. In consideration therefor,

Starbox Group issued to the three then shareholders of ProSeeds an aggregate of 750,000 ordinary shares given the effect of

Share Consolidation, on November 13, 2023, and such ordinary shares were redesignated as Class A Ordinary Shares after the Share

Restructure.

On

January 26, 2024, Starbox Group, as the issuer, and Starbox International, as the purchaser, entered into a share sale agreement with

the four then shareholders of Trade Router acquire 100% of the issued and paid-up share capital in Trade Router. In consideration therefor,

Starbox Group issued to the four then shareholders of Trade Router an aggregate of 500,000 ordinary shares given the effect

of Share Consolidation, on February 19, 2024, and such ordinary shares were redesignated as Class A Ordinary Shares after the Share

Restructure.

On

March 7, 2024, Starbox Group, as the issuer, and Irace Technology, as the purchaser, entered into a share sale agreement with the four

then shareholders of Carnegie Hill to acquire 100% of the issued and paid-up share capital in Carnegie Hill. In consideration therefor,

Starbox Group issued to the four then shareholders of Carnegie Hill an aggregate of 1,125,000 ordinary shares given the effect

of Share Consolidation, on March 22, 2024, and such ordinary shares were redesignated as Class A Ordinary Shares after the Share

Restructure.

On

April 4, 2024, Starbox Group, as the issuer, and Irace Technology, as the purchaser, entered into a share sale agreement with the four

then shareholders of Rainbow Worldwide to acquire 100% of the issued and paid-up share capital in Rainbow Worldwide. In consideration

therefor, Starbox Group issued to the four then shareholders of Rainbow Worldwide an aggregate of 1,125,000 ordinary shares given

the effect of Share Consolidation, on April 19, 2024, and such ordinary shares were redesignated as Class A Ordinary Shares after

the Share Restructure.

ProSeeds,

Trade Router, Carnegie Hill, and Rainbow Worldwide have no operations but own a series of advanced multi-level marketing software, an

Artificial Intelligent Generated Content system, an Advanced Intelligent system, and a Smart Rebate Treasure Hunt augmented reality

system, respectively, and the Company obtained the source code of such software systems. On July 31, 2024, August 7, 2024, and August

6, 2024, ProSeeds, Trade Router, and Carnegie Hill, via their respective registered agents, submitted notices of intended striking off

to the Seychelles Registrar of International Business Companies and are in the process of being struck off as of the date of this prospectus.

On August 5, 2024, as confirmed by the Samoa Register of International and Foreign Companies, Rainbow

Worldwide was struck off the register and was thereupon dissolved.

Loyalty

Engine Software Purchase

On

May 3, 2024, Starbox Group, as the issuer, Irace Technology, as the purchaser, entered into a software purchase agreement with Bella

Bambina Limited (“Bella Bambina”), as the seller, with respect to certain shopping rebate and loyalty software and related

assets (the “Loyalty Engine Software”). Irace Technology acquired all of the rights, title, and interests in the Loyalty

Engine Software. In consideration therefor, Starbox Group issued to the four shareholders of Bella Bambina an aggregate of 1,343,750

ordinary shares given the effect of Share Consolidation, on May 21, 2024, and such ordinary shares were redesignated as Class

A Ordinary Shares after the Share Restructure.

Virtual

Reality Software Purchase

On

May 28, 2024, Starbox Group, as the issuer, Irace Technology, as the purchaser, entered into a software purchase agreement with Raetia

Holdings Limited (“Raetia Holdings”), as the seller, with respect to certain virtual reality software and related assets

(the “Virtual Reality Software”). Irace Technology acquired from Raetia Holdings all of the rights, title, and interests

in the Virtual Reality Software. In consideration therefor, Starbox Group issued to the four shareholders of Raetia Holdings an aggregate

of 1,562,500 ordinary shares given the effect of Share Consolidation, on June 13, 2024, and such ordinary shares were redesignated

as Class A Ordinary Shares after the Share Restructure.

Virtual

Space Rebate Mall Software Purchase

On

June 14, 2024, Starbox Group, as the issuer, Irace Technology, as the purchaser, entered into a software purchase agreement with Bardi

Equity Limited (“Bardi Equity”), as the seller, with respect to certain virtual space rebates mall module software and related

assets (the “Virtual Space Software”). Irace Technology acquired from Bardi Equity all of the rights, title, and interests

in the Virtual Space Software. In consideration therefor, Starbox Group issued to the four shareholders of Bardi Equity an aggregate

of 1,812,500 Class A Ordinary Shares given the effect of Share Consolidation, on July 2, 2024.

Virtual

Events Software Purchase

On

July 2, 2024, Starbox Group, as the issuer, and Irace Technology, as the purchaser, entered into a software purchase agreement with Consolidated

Ideals Limited (“Consolidated Ideals”), as the seller, with respect to certain virtual events module software and related

assets (the “Virtual Events Software”). Irace Technology acquired from Consolidated Ideals all of the rights, title, and

interests in the Virtual Events Software. In consideration therefor, Starbox Group issued to the four shareholders of Consolidated Ideals

an aggregate of 2,031,252 Class A Ordinary Shares given the effect of Share Consolidation,

on July 18, 2024.

VR

Conference Software Purchase

On

July 18, 2024, Starbox Group, as the issuer, and Irace Technology, as the purchaser, entered into a software purchase agreement with

First Premier Holdings Ltd. (“First Premier”), as the seller, with respect to certain virtual reality conference platform

software and related assets (the “VR Conference Software”). Irace Technology acquired from First Premier all of the rights,

title, and interests in the VR Conference Software. In consideration therefor, Starbox Group issued to the four shareholders of First

Premier an aggregate of 2,312,500 Class A Ordinary Shares given the effect of Share Consolidation,

on August 5, 2024.

VS

Immersive Advertisement Software Purchase

On

July 18, 2024, Starbox Group, as the issuer, and Irace Technology, as the purchaser, entered into a software purchase agreement with

Camilla Consulting Ltd. (“Camilla Consulting”), as the seller, with respect to a certain virtual space immersive advertisement

system engine and related assets (the “VS Immersive Advertisement Software”). Irace Technology acquired from Camilla Consulting

all of the rights, title, and interests in the VS Immersive Advertisement Software. In consideration therefor, Starbox Group issued to

the four shareholders of Camilla Consulting an aggregate of 2,031,252 Class A Ordinary Shares given

the effect of Share Consolidation, on August 5, 2024.

Virtual

Interactive Enterprise Showroom Software Purchase

On

August 7, 2024, Starbox Group, as the issuer, and Irace Technology, as the purchaser, entered into a software purchase agreement with

Global Clearing Solutions Limited (“Global Clearing Solutions”), as the seller, with respect to a certain virtual interactive

enterprise showroom system engine and related assets (the “Virtual Interactive Enterprise Showroom Software”). Irace Technology

acquired from Global Clearing Solutions all of the rights, title, and interests in the Virtual Interactive Enterprise Showroom Software.

In consideration therefor, Starbox Group issued to the four shareholders of Global Clearing Solutions an aggregate of 3,125,000

Class A Ordinary Shares given the effect of Share Consolidation, on August 22, 2024.

Virtual

Space Football Software Purchase

On

August 26, 2024, Starbox Group, as the issuer, and Irace Technology, as the purchaser, entered into a software purchase agreement with

Amis et Copins Inc. (“Amis et Copins”), as the seller, with respect to a certain Virtual Space Football System Engine and

related assets (the “Virtual Space Football Software”). Irace Technology acquired from Amis et Copins all of the rights,

title, and interests in the Virtual Space Football Software. In consideration therefor, Starbox Group issued to the four shareholders

of Amis et Copins an aggregate of 3,923,440 Class A Ordinary Shares given the effect

of Share Consolidation, on September 10, 2024.

Virtual

Immersive Sky Park Software Purchase

On

August 26, 2024, Starbox Group, as the issuer, and Irace Technology, as the purchaser, entered into a software purchase agreement with

First Start Company Limited (“First Start”), as the seller, with respect to a certain Virtual Immersive Sky Park System Engine

and related assets (the “Virtual Immersive Sky Park Software”). Irace Technology acquired from First Start all of the rights,

title, and interests in the Virtual Immersive Sky Park Software. In consideration therefor, Starbox Group issued to the four shareholders

of First Start an aggregate of 3,750,000 Class A Ordinary Shares given the effect

of Share Consolidation, on September 10, 2024.

Cyberspace Expo Experience Lounge Software

Purchase

On October 28, 2024, Starbox Group, as the

issuer, and Irace Technology, as the purchaser, entered into a software purchase agreement with Distributed Information Technologies

Limited (“Distributed Information”), as the seller, with respect to a certain Cyberspace Expo Experience Lounge System

and related assets (the “Cyberspace Expo Experience Lounge Software”). Irace Technology acquired from Distributed

Information all of the rights, title, and interests in the Cyberspace Expo Experience Lounge Software. In consideration therefor,

Starbox Group issued to the four shareholders of Distributed Information an aggregate of 4,500,000 Class A Ordinary Shares given

the effect of Share Consolidation, on November 12, 2024.

Immersive Avatar Artistry Lab Software Purchase

On October 28, 2024, Starbox Group, as the issuer,

and Irace Technology, as the purchaser, entered into a software purchase agreement with Helix Holdings Limited (“Helix Holdings”),

as the seller, with respect to a certain Immersive Avatar Artistry Lab System and related assets (the “Immersive Avatar Artistry

Lab Software”). Irace Technology acquired from Helix Holdings all of the rights, title, and interests in the Immersive Avatar Artistry

Lab Software. In consideration therefor, Starbox Group issued to the four shareholders of Helix Holdings an aggregate of 4,296,876 Class

A Ordinary Shares given the effect of Share Consolidation, on November 12, 2024.

Immersive Augmented Video Experience Software

Purchase

On October 29, 2024, Starbox Group, as the issuer,

and Irace Technology, as the purchaser, entered into a software purchase agreement with Honest Designs Limited (“Honest Designs”),

as the seller, with respect to a certain Immersive Augmented Video Experience System Engine and related assets (the “Immersive

Augmented Video Experience Software”). Irace Technology acquired from Honest Designs all of the rights, title, and interests in

the Immersive Augmented Video Experience Software. In consideration therefor, Starbox Group issued to the four shareholders of Honest

Designs an aggregate of 4,375,000 Class A Ordinary Shares given the effect of Share Consolidation, on November 13, 2024.

Web Graphics Library Software Purchase

On November 18, 2024, Starbox Group, as the issuer,

and Irace Technology, as the purchaser, entered into a software purchase agreement with Tech Fellows Limited (“Tech Fellows”),

as the seller, with respect to a certain Web Graphics Library Augmented 3D Framework Module and related assets (the “Web Graphics

Library Software”). Irace Technology agreed to acquire from Tech Fellows all of the rights, title, and interests in the Web Graphics

Library Software. In consideration therefor, Starbox Group agreed to issue to the four shareholders of Tech Fellows an aggregate of 6,000,000

Class A Ordinary Shares on a closing date to be agreed upon among Starbox Group, Irace Technology, and Tech Fellows, subject to the satisfaction

by Tech Fellows of its obligations under the software purchase agreement.

Creative Augmented Billboards Software Purchase

On November 18, 2024, Starbox Group, as the issuer, and Irace Technology,

as the purchaser, entered into a software purchase agreement with Five Points Gang & Company Ltd. (“Five Points Gang”),

as the seller, with respect to a certain Creative Augmented Billboards Module and related assets (the “Creative Augmented Billboards

Software”). Irace Technology agreed to acquire from Five Points Gang all of the rights, title, and interests in the Creative Augmented

Billboards Software. In consideration therefor, Starbox Group agreed to issue to the four shareholders of Five Points Gang an aggregate

of 6,100,000 Class A Ordinary Shares on a closing date to be agreed upon among Starbox Group, Irace Technology, and Five Points Gang,

subject to the satisfaction by Five Points Gang of its obligations under the software purchase agreement.

Corporate

Information

Our

principal executive offices are located at VO2-03-07, Velocity Office 2, Lingkaran SV, Sunway Velocity, 55100 Kuala Lumpur, Malaysia,

and our phone number is +603 2781 9066. We maintain a corporate website at https://www.starboxholdings.com. The information contained

in, or accessible from, our website or any other website does not constitute a part of this prospectus. Our agent for service of process

in the United States is Cogency Global Inc., 122 East 42nd Street, 18th Floor, New York, NY 10168.

RISK

FACTORS

Investing

in our securities involves risks. Before making an investment decision, you should carefully consider the risks discussed below and

described under “Risk Factors” in the applicable prospectus supplement and under the heading “Item 3. Key Information—D.

Risk Factors” in the 2023 Annual Report, which is incorporated in this prospectus by reference, as updated by our subsequent filings

under the Exchange Act that are incorporated herein by reference, together with all of the other information appearing in this prospectus

or incorporated by reference into this prospectus and any applicable prospectus supplement, in light of your particular investment objectives

and financial circumstances. In addition to those risk factors, there may be additional risks and uncertainties of which management is

not aware or focused on or that management deems immaterial. Our business, financial condition, or results of operations could be materially

adversely affected by any of these risks. The trading price of our securities could decline due to any of these risks, and you may lose

all or part of your investment. See sections titled “Incorporation of Documents by Reference” and “Where You Can Find

Additional Information” of this prospectus.

Because

we can issue additional Class A Ordinary Share after the Share Capital Increase, shareholders of our Class A Ordinary Shares may incur

immediate dilution and experience further dilution.

On

October 23, 2024, our shareholders approved, among other resolutions, the Share Consolidation and the Share Capital Increase.

Beginning with the opening of trading on October 31, 2024, our Class A Ordinary Shares have been trading on a post-Share

Consolidation basis on Nasdaq. Upon the completion of the Share Consolidation, each of the 870,200,000 authorized Class A ordinary

shares (including all issued Class A ordinary shares and any unissued Class A ordinary shares) were each be consolidated

on a 16:1 basis, such that the Class A ordinary shares were consolidated from (x) 870,200,000 Class A ordinary shares to

(y) 54,387,500 Class A Ordinary Shares of $0.018 par value each. With effect immediately following the Share Consolidation,

our authorized Class A ordinary shares were increased from 54,387,500 Class A Ordinary Shares of $0.018 par value each

(after the Class A Ordinary Share Consolidation) to 543,875,000 Class A Ordinary Shares of $0.018 par value each. As of the date of this prospectus, 42,471,204 Class A Ordinary Shares are issued and outstanding.

We

believe that any future plans, proposals, or arrangements for issuance of new shares shall be dependent on the Company’s funding

and/or development requirements. Nevertheless, in the foreseeable future, we may issue more shares that result from the proposed increase

in authorized share capital to meet our system enhancement needs. Our board of directors has the authority to cause us to issue additional Class A Ordinary Shares without consent of any of our shareholders. Consequently, shareholders may experience more dilution in

their ownership of our shares in the future. The perceived risk of dilution may cause our shareholders to sell their shares, which may

cause a decline in our share price. Moreover, the perceived risk of dilution and the resulting downward pressure on our share

price could encourage investors to engage in short sales of our shares. By increasing the number of shares offered for sale, material

amounts of short selling could further contribute to progressive price declines in our shares.

Our

acquisition activities may dilute shareholder value, and we may fail to realize all of the anticipated benefits of the acquisitions,

or those benefits may take longer to realize than expected.

In

order to enhance our rebates and digital advertising systems, we have conducted 18 acquisitions of software modules since October

2023 (two of which have not closed as of the date of this prospectus) and issued an aggregate of 38,564,070 Class A Ordinary

Shares in connection with such acquisitions. See “Prospectus Summary—Overview—Acquisition Activities.” The share

issuances resulted in initial tangible book value dilution of 31%, or $0.23 per share.

We

may in the future continue executing transactions of the similar size and frequency. Our management believes that any future plans, proposals,

or arrangements for issuance of new shares shall be dependent on our funding and/or development requirements. Future acquisitions, if

any, may involve cash, debt, or equity securities as transaction consideration. Acquisitions typically involve the payment of a premium

over book and market values, and, therefore, some dilution of our shares’ tangible book value and net income per ordinary

share may occur in connection with any future transaction.

We

believe that there are significant benefits and synergies that may be realized through the acquisitions of the new software modules.

However, the efforts to realize these benefits and synergies will be a complex process and may disrupt our existing operations if not

implemented in a timely and efficient manner. The full benefits of the acquisitions may not be realized as expected or may not be achieved

within the anticipated timeframes, or at all. Failure to achieve the anticipated benefits of the acquisitions could adversely affect

our results of operations or cash flows, cause dilution to the earnings per share, and negatively impact the price of our Class A Ordinary Shares.

We

also may not be able to identify future merger or acquisition targets. We may not be able to successfully integrate the targeted business

or operations with ours after a merger or acquisition. Such failure to execute our long-term business plan likely could negatively impact

results of our operations.

The

sale of our Class A Ordinary Shares could encourage short sales by third parties, which could contribute to the future decline of our

shares price.

As

of the date of this prospectus, we have issued an aggregate of 38,564,070 Class A Ordinary Shares in connection with our acquisitions

since October 2023. In many circumstances, large issuances of equity for companies have the potential to cause a significant downward

pressure on the price of ordinary shares. This is especially the case if the shares being placed into the market exceed the market’s

ability to take up the increased share issuance. Such an event could place further downward pressure on the price of our

Class A Ordinary Shares. Regardless of our activities, the opportunity exists for short sellers and others to contribute to the future

decline of our share price. If there are significant short sales of our Class A Ordinary Shares, the price decline that would result

from our acquisition activities will cause the share price to decline more, which may cause other shareholders of our Class A Ordinary

Shares to sell their shares, thereby contributing to sales of Class A Ordinary Shares in the market. We may continue executing acquisition

transactions of the similar size and frequency, and if there are many more of our Class A Ordinary Shares on the market for sale than

the market will absorb, the price of our Class A Ordinary Shares will likely further decline, which could result in our inability to

meet the Minimum Bid Price Rule.

OFFER

STATISTICS AND EXPECTED TIMETABLE

The

Selling Shareholders may from time to time, offer and sell any or all of their Class A Ordinary Shares covered by this prospectus in

one or more offerings. The Class A Ordinary Shares offered under this prospectus may be offered in amounts, at prices, and on terms to

be determined at the time of sale. We will keep the registration statement of which this prospectus is a part effective until such time

as all of the Class A Ordinary Shares covered by this prospectus have been disposed of pursuant to and in accordance with such registration

statement.

CAPITALIZATION

AND INDEBTEDNESS

The

following table sets forth our total capitalization as of October 31, 2024:

| ● |

on

an actual basis; and |

| |

|

| ● |

on

an as-adjusted basis to give effect to (1) the issuance of 4,500,000 Class A Ordinary Shares in connection with the acquisition

of the Cyberspace Expo Experience Lounge Software on November 12, 2024, (2) the issuance of 4,296,876 Class A

Ordinary Shares in connection with the acquisition of the Immersive Avatar Artistry Lab Software, and (3) the issuance of 4,375,000

Class A Ordinary Shares in connection with the acquisition of the Immersive Augmented Video Experience Software on November

13, 2024. |

The information in this table should be read

in conjunction with the consolidated financial statements for the fiscal years ended September 30, 2023, 2022, and 2021 filed on Form

20-F, and the consolidated unaudited financial statements for the six months ended March 31, 2024 filed on Form 6-K, and other financial

information included in this prospectus, any prospectus supplement or incorporated by reference in this prospectus. Our historical results

do not necessarily indicate our expected results for any future periods.

| | |

October 31, 2024 | |

| | |

Actual (Unaudited) | | |

As-Adjusted (Unaudited) | |

| | |

$ | | | |

| | |

| Shareholders’ Equity: | |

| | | |

| | |

| Preferred shares, $0.018 par value, 3,125,000 shares authorized, no shares issued and outstanding | |

| — | | |

| — | |

| Ordinary Shares, par value $0.018, 551,875,000 shares authorized, 29,892,535 shares

issued and outstanding actual and 43,271,204 shares issued and outstanding, as-adjusted | |

| 538,065 | | |

| 778,882 | |

| Additional paid-in capital | |

| 158,055,714 | | |

| 186,269,871 | |

| Accumulated deficit | |

| (71,978,746 | ) | |

| (100,429,996 | ) |

| Accumulated other comprehensive profit | |

| 3,408,916 | | |

| 3,408,916 | |

| Total Shareholders’ Equity | |

| 90,023,949 | | |

| 90,027,673 | |

| Total Indebtedness | |

| 2,172,739 | | |

| 2,172,739 | |

| Total Capitalization | |

| 143,126,686 | | |

| 143,130,409 | |

USE

OF PROCEEDS

We

will not receive any proceeds from the sale of any of our Class A Ordinary Shares by the Selling Shareholders. We have agreed to pay

all expenses relating to registering the Class A Ordinary Shares covered by this prospectus. The Selling Shareholders will pay any brokerage

commissions and/or similar charges incurred in connection with the sale of the Class A Ordinary Shares covered hereby.

DESCRIPTION

OF SHARE CAPITAL

The

following description of our share capital and provisions of our memorandum and articles of association, as amended from time to time

(which are referred to in this section as our “articles of association”), are summaries and do not purport to be complete.

We

were incorporated as an exempted company limited by shares under the Companies Act (as amended) of the Cayman Islands (the “Cayman

Companies Act”) on September 13, 2021. A Cayman Islands exempted company:

| |

● |

is a company that conducts

its business mainly outside the Cayman Islands; |

| |

|

|

| |

● |

is prohibited from trading

in the Cayman Islands with any person, firm or corporation except in furtherance of the business of the exempted company carried

on outside the Cayman Islands (and for this purpose can effect and conclude contracts in the Cayman Islands and exercise in the Cayman

Islands all of its powers necessary for the carrying on of its business outside the Cayman Islands); |

| |

|

|

| |

● |

does not have to hold an

annual general meeting; |

| |

|

|

| |

● |

does not have to make its

register of members open to inspection by shareholders of that company; |

| |

|

|

| |

● |

may obtain an undertaking

against the imposition of any future taxation; |

| |

|

|

| |

● |

may register by way of

continuation in another jurisdiction and be deregistered in the Cayman Islands; |

| |

|

|

| |

● |

may register as a limited

duration company; and |

| |

|

|

| |

● |

may register as a segregated

portfolio company. |

Ordinary

Shares

As

of the date of this prospectus, we are authorized to issue 543,875,000 Class A Ordinary Shares and 8,000,000 Class B Ordinary

Shares. Holders of Class A Ordinary Shares and Class B Ordinary Shares have the same rights except for voting and conversion rights as

described below.

All

of our issued and outstanding Ordinary Shares are fully paid and non-assessable. Our Ordinary Shares are issued in registered form and

are issued when registered in our register of members. Unless the board of directors determine otherwise, each holder of our Ordinary

Shares will not receive a certificate in respect of such Ordinary Shares. Our shareholders who are non-residents of the Cayman Islands

may freely hold and vote their Ordinary Shares. We may not issue shares or warrants to bearer.

Subject

to the provisions of the Cayman Companies Act and our articles of association regarding redemption and purchase of the shares, the directors

have general and unconditional authority to allot (with or without confirming rights of renunciation), grant options over or otherwise

deal with any unissued shares to such persons, at such times and on such terms and conditions as they may decide. Such authority could

be exercised by the directors to allot shares which carry rights and privileges that are preferential to the rights attaching to Ordinary

Shares. No share may be issued at a discount except in accordance with the provisions of the Cayman Companies Act. The directors may

refuse to accept any application for shares, and may accept any application in whole or in part, for any reason or for no reason.

Preferred

Shares

We

are authorized to issue 3,125,000 Preferred Shares, par value $0.018 per share, and no Preferred Shares are currently issued

and outstanding. The Preferred Shares have the following characteristics:

Conversion.

Each Preferred Share is convertible into one Class A Ordinary Share at any time at the option of the holder thereof. The right to convert

shall be exercisable by the holder of the Preferred Share by delivering a written notice to us that such holder elects to convert a specified

number of Preferred Share into Class A Ordinary Shares. In no event shall Ordinary Shares be convertible into Preferred Shares. In addition,

upon any sale, transfer, assignment, or disposition of any Preferred Share by a holder thereto (“Preferred Shareholder”)

to any person who is not an affiliate of such Preferred Shareholder, or upon a change of control of any Preferred Share to any person

who is not an affiliate of the registered shareholder of such Preferred Share, such Preferred Share shall be automatically and immediately

converted into one Class A Ordinary Share.

Voting.

Each Preferred Share entitles its holder to two votes on all matters subject to vote at general meetings of our Company.

Ranking.

Except for the voting rights and conversion rights, the Ordinary Shares and the Preferred Shares shall rank pari passu with one another

and shall have the same rights, preferences, privileges, and restrictions.

Dividends.

Holders of Preferred Shares are entitled to their pro rata share, based on the number of Preferred Shares in issue, of any dividend paid

on the Preferred Shares.

Listing

Our

Class A Ordinary Shares are listed on the Nasdaq Capital Market under the symbol “STBX.”

Transfer

Agent and Registrar

The

transfer agent and registrar for our Class A Ordinary Shares and Class B Ordinary Shares is Transhare Corporation, at Bayside Center

1, 17755 North U.S. Highway 19, Suite #140, Clearwater, FL 33764.

Dividends

Subject

to the provisions of the Cayman Companies Act and any rights and restrictions attaching to any of our shares:

| |

(a) |

the directors may declare

dividends or distributions out of our funds which are lawfully available for that purpose; and |

| |

(b) |

our shareholders may, by

ordinary resolution, declare dividends but no such dividend shall exceed the amount recommended by the directors. |

The

directors, when paying dividends to shareholders, may make such payment wholly or partly in cash and/or in specie. No dividend shall

bear interest.

Voting

Rights

Subject

to any rights or restrictions as to voting attached to any shares, (i) on a show of hands, every shareholder present in person or by

proxy (or, if a corporation or other non-natural person, by its duly authorized representative or proxy) shall, at a general meeting

of our Company, each have one vote; and (ii) on a poll, every shareholder present in pension or by proxy (or, if a corporation or other

non-natural person, by its duly authorized representative or proxy) shall have one vote for each Class A Ordinary Share, 100 votes for

each Class B Ordinary Share, and two votes for each Preferred Share of which he or the person represented by proxy is the holder.

Conversion

Rights

Class

A Ordinary Shares are not convertible. Class B Ordinary Shares are convertible into Class A Ordinary Shares at any time after issuance

at the option of the holder, and each one Class B Ordinary Share is convertible into 10 Class A Ordinary Shares. Preferred Shares are

convertible, at the option of the holder thereof, into Class A Ordinary Shares on a one-to-one basis.

Modification

of Rights of Shares

Whenever

our capital is divided into different classes of shares, subject to any rights or restrictions for the time being attached to any class

of shares, the rights attaching to any class of shares may only be materially adversely varied with the consent in writing of the holders

of all of the issued shares of that class, or with the sanction of an ordinary resolution passed at a separate meeting of the holders

of the shares of that class.

Subject

to any rights or restrictions for the time being attached to any class of shares, the rights conferred on the holders of the shares of

any class shall not be deemed to be materially adversely varied by, inter alia, the creation, allotment, or issue of further shares

ranking pari passu with or subsequent to them or the redemption or purchase of any shares of any class by us. The rights of the holders

of our shares shall not be deemed to be materially adversely varied by the creation or issue of shares with preferred or other rights,

including, without limitation, the creation of shares with enhanced or weighted voting rights.

Alteration

of Share Capital

Subject

to the Cayman Companies Act, our shareholders may, by ordinary resolution:

| |

(a) |

increase our share capital

by new shares of the amount fixed by that ordinary resolution; |

| |

|

|

| |

(b) |

consolidate and divide

all or any of our share capital into shares of a larger amount than our existing shares; |

| |

|

|

| |

(c) |

sub-divide our shares or

any of them into shares of an amount smaller than that fixed, so, however, that in the sub-division, the proportion between the amount

paid and the amount, if any, unpaid on each reduced share shall be the same as it was in case of the share from which the reduced

share is derived; and |

| |

|

|

| |

(d) |

cancel shares which, at

the date of the passing of that ordinary resolution, have not been taken or agreed to be taken by any person and diminish the amount

of our share capital by the amount of the shares so cancelled. |

Our

shareholders may, by special resolution, reduce our share capital and any capital redemption reserve in any manner authorized by law.

Calls

on Shares and Forfeiture

Subject

to the terms of allotment, the directors may make calls on the shareholders in respect of any monies unpaid on their shares and each

shareholder shall (subject to receiving at least 14 calendar days’ notice specifying the time or times of payment), pay to us the

amount called on his shares. Shareholders registered as the joint holders of a share shall be jointly and severally liable to pay all

calls in respect of the share. If a call remains unpaid after it has become due and payable the person from whom it is due and payable

shall pay interest on the amount unpaid from the day it became due and payable until it is paid at the rate of eight percent per annum.

The directors may, at their discretion, waive payment of the interest wholly or in part.

We

have a first and paramount lien on every share (whether or not fully paid) for all amounts (whether presently payable or not) payable

at a fixed time or called in respect of that share. We also have a first and paramount lien on every share registered in the name of

a person indebted or under liability to us (whether he is the sole registered holder of a share or one of two or more joint holders).

The lien is for all amounts owing to us by the shareholder or the shareholder’s estate (whether or not presently payable). At any

time the directors may declare a share to be wholly or in part exempt from the lien on shares provisions of our articles of association.

Our lien on a share extends to any amount payable in respect of it, including but not limited to dividends.

We

may sell, in such manner as the directors may determine, any share on which we have a lien. However, no sale will be made unless an amount

in respect of which the lien exists is presently payable or until the expiration of 14 calendar days after a notice in writing, demanding

payment of such part of the amount in respect of which the lien exists as is presently payable has been given to the registered holder

of the share, or the persons entitled thereto by reason of his death or bankruptcy.

Unclaimed

Dividend

A

dividend that remains unclaimed after a period of six calendar years from the date of declaration of such dividend may be forfeited by

the board of directors and, if so forfeited, shall revert to the Company.

Forfeiture

or Surrender of Shares

If

a shareholder fails to pay any call or installment of a call in respect of partly paid shares on the day appointed for payment, the directors

may serve a notice on the shareholder requiring payment of the unpaid call or installment, together with any interest which may have

accrued. The notice must name a further day (not earlier than the expiration of 14 calendar days from the date of the notice) on or before

which the payment required by the notice is to be made, and must state that in the event of non-payment at or before the time appointed,

the shares in respect of which the call is made will be liable to be forfeited.

If

the requirements of any such notice are not complied with, the directors may, before the payment required by the notice has been made,

resolve that any share in respect of which that notice has been given be forfeited.

A

forfeited share may be sold or otherwise disposed of on such terms and in such manner as the directors think fit and at any time before

a sale or disposition the forfeiture may be cancelled on such terms as the directors think fit.

A

person whose shares have been forfeited shall cease to be a shareholder in respect of the forfeited shares, but shall, notwithstanding

such forfeiture, remain liable to pay to us all monies which at the date of forfeiture were payable by him to us in respect of the shares

forfeited, but his liability shall cease if and when we receive payment in full of the unpaid amount on the shares forfeited.

A

certificate in writing made by a director that a share has been duly forfeited on a date stated in the certificate shall be conclusive

evidence of the facts in the declaration as against all persons claiming to be entitled to the particular share(s).

The

directors may accept the surrender for no consideration of any fully paid share.

Share

Premium Account

The

directors shall establish a share premium account and shall carry the credit of such account from time to time to a sum equal to the

amount or value of the premium paid on the issue of any share.

Redemption

and Purchase of Own Shares

Subject

to the Cayman Companies Act and our articles of association, we may:

| |

(a) |

issue shares that are to

be redeemed or are liable to be redeemed, at our option or at the option of the shareholder holding those redeemable shares, in the

manner and upon the terms as may be determined, before the issue of those shares, by either the directors or by the shareholders

by special resolution; |

| |

|

|

| |

(b) |

purchase our own shares

(including any redeemable shares) on the terms and in the manner which have been approved by the directors or by the shareholders

by ordinary resolution or are otherwise authorized by our articles of association; and |

| |

|

|

| |

(c) |

make a payment in respect

of the redemption or purchase of our own shares in any manner permitted by the Cayman Companies Act, including out of capital. |

Transfer

of Shares

Provided

that a transfer of Class A Ordinary Shares complies with applicable rules of the Nasdaq Capital Market, a shareholder may transfer Ordinary

Shares to another person by completing an instrument of transfer in a common form or in a form prescribed by Nasdaq or in any other form

approved by the directors, executed:

| |

(a) |

where the Ordinary Shares

are fully paid, by or on behalf of that shareholder; and |

| |

(b) |

where the Ordinary Shares

are nil or partly paid, or if so required by our board of directors, by or on behalf of that shareholder and the transferee and be

accompanied by the share certificate (if any) of the Ordinary Shares to which it relates and such other evidence as our board of

directors may reasonably require to show the right of the transferor to make the transfer. |

The

transferor shall be deemed to remain a shareholder until the name of the transferee is entered in our register of members in respect

of the relevant Ordinary Shares.

Where

the Ordinary Shares in question are not listed on or subject to the rules of the Nasdaq Capital Market, our board of directors may, in

its absolute discretion, decline to register any transfer of any Ordinary Share that has not been fully paid up or is subject to a company

lien. Our board of directors may also decline to register any transfer of such Ordinary Share unless:

| |

(a) |

the instrument of transfer

is lodged with us, accompanied by the certificate for the Ordinary Shares to which it relates and such other evidence as our board

of directors may reasonably require to show the right of the transferor to make the transfer; |

| |

|

|

| |

(b) |

the instrument of transfer

is in respect of only one class of Ordinary Shares; |

| |

|

|

| |

(c) |

the instrument of transfer

is properly stamped, if required; |

| |

|

|

| |

(d) |

any fee related to the

transfer has been paid to us; and |

| |

|

|

| |

(e) |

in the case of a transfer

to joint holders, the number of joint holders to whom the Ordinary Share is to be transferred does not exceed four. |

If

our directors refuse to register a transfer, they are required, within three calendar months after the date on which the instrument of

transfer was lodged, to send to each of the transferor and the transferee notice of such refusal.

The