The Nasdaq Stock Market® Welcomes Seven New ETPs in the First Quarter of 2017

13 Abril 2017 - 9:00AM

Nasdaq (Nasdaq:NDAQ), the single largest U.S. equity exchange by

market share, announced seven new exchange-traded products (ETP)

listings from five different issuers during the first quarter of

2017. Nasdaq now has a total of 332 products listed from 39 unique

issuers as of March 31, 2017, representing a 38 percent increase in

products versus the first quarter of 2016.

Additionally, Nasdaq announced that Paul Roland, Associate Vice

President at Nasdaq, has been appointed to lead the U.S. ETP

Listings business. He will report to Tal Cohen, Senior Vice

President and Head of North American Equities. Roland continues to

be responsible for product development and market structure

initiatives and will now also help issuers launch, list and trade

products. He has more than 15 years’ experience in the financial

sector with roles at Vanguard, the Philadelphia Stock Exchange --

prior to its acquisition by Nasdaq -- and Bloomberg.

“Paul’s wealth of trading experience coupled with his deep

understanding of the ETP landscape will be a valuable asset as we

continue to grow the team to strengthen existing and build new

issuer relationships in 2017 and beyond,” said Cohen. “Several

innovative ETPs listed on Nasdaq in the quarter and we continue

focusing our efforts on being the exchange of choice and supporting

products of all types.”

First Quarter Nasdaq ETP Listing

Highlights:Nasdaq was selected as the exchange of choice

for seven new ETP launches:

• Active Alts launched an actively managed fund that invests in

companies with large short positions that are subject to a short

squeeze; the fund began trading on March 22:

- Active Alts Contrarian ETF (Nasdaq:SQZZ)

• First Trust launched an actively managed fund that invests in

fixed income securities; the fund began trading February 15:

- First Trust TCW Opportunistic Fixed Income ETF

(Nasdaq:FIXD)

• Gabelli Funds launched a product that invests in domestic

and foreign companies in the food and beverage industries; the fund

began trading February 14:

- Gabelli Food of All Nations NextShares (Nasdaq:FOANC)

• Davis Advisors launched three transparent

actively-managed funds using a fundamental bottom up approach; the

funds began trading January 12:

- Davis Select U.S. Equity ETF (Nasdaq:DUSA)

- Davis Select Financial ETF (Nasdaq:DFNL)

- Davis Select Worldwide ETF (Nasdaq:DWLD)

• ALPS launched a fund designed to capture momentum

investing at both the sector and stock level, that tracks an index

owned and developed by Dorsey, Wright & Associates, a Nasdaq

Company; the fund began trading January 10:

- ALPS Dorsey Wright Sector Momentum ETF (Nasdaq:SWIN)

For issuers who want to learn more about opportunities to list

and grow on The Nasdaq Stock Market®, please visit our website or

email etflistings@nasdaq.com.

About Nasdaq: Nasdaq (Nasdaq:NDAQ) is a leading

provider of trading, clearing, exchange technology, listing,

information and public company services across six continents.

Through its diverse portfolio of solutions, Nasdaq enables clients

to plan, optimize and execute their business vision with

confidence, using proven technologies that provide transparency and

insight for navigating today's global capital markets. As the

creator of the world's first electronic stock market, its

technology powers more than 85 marketplaces in 50 countries, and 1

in 10 of the world's securities transactions. Nasdaq is home to

approximately 3,800 listed companies with a market value of $10.1

trillion and nearly 18,000 corporate clients. To learn more, visit:

business.nasdaq.com.

Cautionary Note Regarding Forward-Looking Statements The matters

described herein contain forward-looking statements that are made

under the Safe Harbor provisions of the Private Securities

Litigation Reform Act of 1995. These statements include, but are

not limited to, statements about Nasdaq and its products and

offerings. We caution that these statements are not guarantees of

future performance. Actual results may differ materially from those

expressed or implied in the forward-looking statements.

Forward-looking statements involve a number of risks, uncertainties

or other factors beyond Nasdaq's control. These factors include,

but are not limited to factors detailed in Nasdaq's annual report

on Form 10-K, and periodic reports filed with the U.S. Securities

and Exchange Commission. We undertake no obligation to release any

revisions to any forward-looking statements.

Nothing contained herein should be construed as investment

advice from Nasdaq or its subsidiaries (collectively, “Nasdaq”),

either on behalf of a particular financial product or an overall

investment strategy. Nasdaq makes no recommendation to buy or sell

any financial product or any representation about the financial

condition of any company or fund. Investors should undertake their

own due diligence and carefully evaluate financial products before

investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY

ADVISED

NDAQG

Nasdaq Media Contact:

Christine Barna

(646) 441-5310

Christine.Barna@nasdaq.com

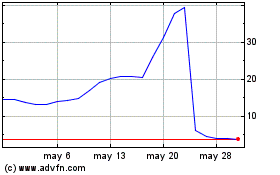

Solowin (NASDAQ:SWIN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

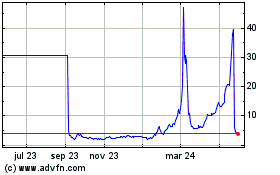

Solowin (NASDAQ:SWIN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024