Solowin Holdings Announces Pricing of Initial Public Offering

06 Septiembre 2023 - 4:30PM

Solowin Holdings (the “Company”), one of the few Chinese

investor-focused and versatile securities brokerage companies based

in Hong Kong, today announced the pricing of its initial public

offering (the "Offering") of 2,000,000 ordinary shares at a public

offering price of US$4.00 per ordinary share. The ordinary shares

are expected to commence trading on the Nasdaq Capital Market on

September 7, 2023 under the ticker symbol “SWIN”.

The Company expects to receive aggregate gross

proceeds of US$8.0 million from this Offering, before deducting

underwriting discounts and other related expenses. In addition, the

Company has granted the underwriters a 45-day option to purchase up

to an additional 300,000 ordinary shares at the public offering

price, less the underwriting discounts. The Offering is expected to

close on September 8, 2023, subject to satisfaction of customary

closing conditions.

EF Hutton, division of Benchmark Investments,

LLC (“EF Hutton”), is acting as sole book-running manager for the

Offering. Bevilacqua PLLC is acting as counsel to the Company, and

Winston & Strawn LLP is acting as counsel to EF Hutton in

connection with the Offering.

Proceeds from the Offering will be used to (i)

fund the expansion of business, including enhancing

the Solomon Pro application; (ii) strengthen investment

advisory business by recruiting additional experienced professional

staff; (iii) fund the increasing HKSFC capital requirements

proportion to the enlarged client base and increase of client

assets, to develop margin financing business; (iv) fund the brand

promotion as well as hiring of additional sales and marketing

personnel; and (v) adopt employee incentive plan and otherwise

improve employees benefits.

A registration statement on Form F-1 relating to

the Offering, as amended, was filed with the Securities and

Exchange Commission (the “SEC”) (File Number: 333-271525) and was

declared effective by the SEC on September 6, 2023. The Offering is

being made only by means of a prospectus, forming a part of the

registration statement. Copies of the final prospectus relating to

the Offering, when available, may be obtained from EF Hutton, Attn:

Syndicate Department, 590 Madison Avenue, 39th Floor, New York, NY

10022, or via email at syndicate@efhuttongroup.com or telephone at

(212) 404-7002. In addition, a copy of the prospectus relating to

the Offering may be obtained via the SEC's website at

www.sec.gov.

Before you invest, you should read the

prospectus and other documents the Company has filed or will file

with the SEC for more complete information about the Company and

the Offering. This press release shall not constitute an offer to

sell, or the solicitation of an offer to buy any of the Company’s

securities, nor shall such securities be offered or sold in the

United States absent registration or an applicable exemption from

registration, nor shall there be any offer, solicitation or sale of

any of the Company’s securities in any state or jurisdiction in

which such offers, solicitations or sales would be unlawful prior

to registration or qualification under the securities laws of such

state or jurisdiction.

About Solowin

Holdings

Solowin Holdings is one of the few Chinese

investor-focused and versatile securities brokerage companies based

in Hong Kong, offering a wide spectrum of products and services

through its advanced and secured one-stop electronic platform.

Licensed with the Hong Kong Securities and Futures Commission for

Type 1/4/6/9, the Company offers a comprehensive range of services,

including securities-related services, investment advisory,

corporate consultancy, and asset management. The Company’s secure

one-stop electronic platform allows investor access to over 10,000

listed securities and their derivative products across major

exchanges including the Hong Kong Stock Exchange (HKSE), New York

Stock Exchange (NYSE), Nasdaq, Shanghai Stock Exchange, and

Shenzhen Stock Exchange. With strong financial and technical

capabilities, the Company has been providing brokerage services to

global Chinese investors and institutional investors in Hong Kong,

and have been recognized and appreciated by users and industry

professionals. For more information, visit the Company’s website at

http://ir.solomonwin.com.hk.

Forward-Looking Statements

Certain statements in this announcement are

forward-looking statements, including, but not limited to, the

Company's proposed Offering. These forward-looking statements

involve known and unknown risks and uncertainties and are based on

the Company’s current expectations and projections about future

events that the Company believes may affect its financial

condition, results of operations, business strategy and financial

needs, including the expectation that the Offering will be

successfully completed. Investors can identify these

forward-looking statements by words or phrases such as “may,”

“will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,”

“plan,” “believe,” “is/are likely to,” “potential,” “continue” or

other similar expressions. The Company undertakes no obligation to

update or revise publicly any forward-looking statements to reflect

subsequent occurring events or circumstances, or changes in its

expectations that arise after the date hereof, except as may be

required by law. These statements are subject to uncertainties and

risks including, but not limited to, the uncertainties related to

market conditions and the completion of the proposed Offering on

the anticipated terms or at all, and other factors discussed in the

“Risk Factors” section of the registration statement filed with the

SEC. Although the Company believes that the expectations expressed

in these forward-looking statements are reasonable, it cannot

assure you that such expectations will turn out to be correct, and

the Company cautions investors that actual results may differ

materially from the anticipated results and encourages investors to

review other factors that may affect its future results in the

Company's registration statement and other filings with the SEC.

Additional factors are discussed in the Company's filings with the

SEC, which are available for review at www.sec.gov.

For investor and media inquiries please

contact:

Solowin

Holdings Investor Relations DepartmentEmail:

ir@solomonwin.com.hk

Ascent Investor Relations

LLCTina XiaoPhone: +1 917-609-0333Email:

tina.xiao@ascent-ir.com

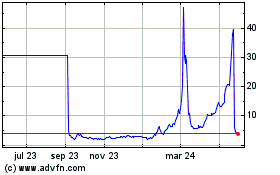

Solowin (NASDAQ:SWIN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

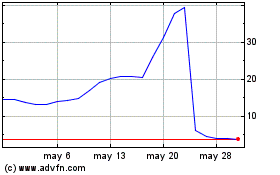

Solowin (NASDAQ:SWIN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024