Item 15. Exhibits and Financial Statement Schedules.

| DOCUMENTS FILED AS PART OF THIS REPORT: |

| |

Index to Financial

Statements:

|

| |

|

(i) |

Report of Independent Registered Public Accounting Firm (PCAOB ID: 130)

|

| |

|

(ii) |

Consolidated Balance Sheets as of May 31, 2022 and 2021

|

| |

|

(iii) |

Consolidated Statements of Income for the years ended May 31, 2022 and 2021 |

| |

|

(iv) |

Consolidated Statements of Stockholders' Equity for the years ended May 31, 2022 and 2021

|

| |

|

(v) |

Consolidated Statements of Cash Flows for the years ended May 31, 2022 and 2021

|

| |

|

(vi) |

Notes to Consolidated Financial Statements - May 31, 2022 and 2021 |

| EXHIBITS: |

| |

3 |

Articles of incorporation

and by-laws

|

| |

|

(i) |

Restated Certificate

of Incorporation incorporated by reference to Exhibit (3)(i) of Annual Report on Form 10-K, dated August 24, 1983.

|

| |

|

(ii) |

Amendment to Certificate

of Incorporation incorporated by reference to Exhibit (3)(iv) to Form 8 [Amendment to Application or Report], dated September 24, 1993.

|

| |

|

(iii) |

Amendment to Certificate

of Incorporation eliminating and re-designating the Series A Junior Preferred Stock and creating 5,000 Series 2008 Junior Participating

Preferred Stock, at $.05 par value, as filed by the Secretary of State of the State of New York on September 16, 2008, and incorporated

by reference to Exhibit (3)(i) of Form 8-K, dated as of September 15, 2008 and filed September 18, 2008.

|

| |

|

(iv) |

Certificate of Change

incorporated by reference to Exhibit (3)(i) to Quarterly Report on Form 10-QSB for the period ending November 30, 2002.

|

| |

|

(v) |

By-laws and Proxy

Review Guidelines incorporated by reference to Exhibit (3) to Quarterly Report on Form 10-Q for the period ending February 28, 2015, filed

April 14, 2015.

|

| |

4 |

Instruments defining

rights of security holders, including indentures

|

| |

|

(i) |

Rights Agreement

by and between registrant and Computershare Trust Company, N.A., dated as of September 25, 2018 and letter to shareholders (including

Summary of Rights), dated October 5, 2018, attached as Exhibits 4 and 20, respectively, to Registration Statement on Form 8-A 12G, filed

with the Securities and Exchange Commission on October 5, 2018.

|

| |

|

(ii) |

Description of registrant’s securities incorporated by reference to Exhibit 4(vi) to Annual Report on Form 10-K for the fiscal year ended May 31, 2019, filed August 2, 2019. |

| |

|

|

|

|

|

| |

10 |

Material Contracts

|

| |

|

(i) |

2005 Taylor Devices,

Inc. Stock Option Plan attached as Appendix B to Definitive Proxy Statement, filed with the Securities and Exchange Commission on September

27, 2005.

|

| |

|

(ii) |

2008 Taylor Devices,

Inc. Stock Option Plan attached as Appendix C to Definitive Proxy Statement, filed with the Securities and Exchange Commission on September

26, 2008.

|

| |

|

(iii) |

2012 Taylor Devices,

Inc. Stock Option Plan attached as Appendix C to Definitive Proxy Statement, filed with the Securities and Exchange Commission on September

21, 2012.

|

| |

|

(iv) |

2015 Taylor Devices,

Inc. Stock Option Plan attached as Appendix B to Definitive Proxy Statement, filed with the Securities and Exchange Commission on April

8, 2016.

|

| |

|

(v) |

2018 Taylor Devices,

Inc. Stock Option Plan attached as Appendix B to Definitive Proxy Statement, filed with the Securities and Exchange Commission on September

27, 2018.

|

| |

|

(vi) |

The 2004 Taylor

Devices, Inc. Employee Stock Purchase Plan, incorporated by reference to Exhibit 4.1 to Registration Statement on Form S-8, File No. 333-114085,

filed with the Securities and Exchange Commission on March 31, 2004.

|

| |

|

(vii) |

Post-Effective Amendment

No. 1 to Registration Statement on Form S-8, File No. 333-114085, for the 2004 Taylor Devices, Inc. Employee Stock Purchase Plan, filed

with the Securities and Exchange Commission on August 24, 2006.

|

| |

|

(viii) |

Form of Indemnification

Agreement between registrant and directors and executive officers, attached as Appendix A to Definitive Proxy Statement, filed with the

Securities and Exchange Commission on September 27, 2007.

|

| |

|

(ix) |

Management Bonus

Policy dated as of March 4, 2011 between the Registrant and executive officers, incorporated by reference to Exhibit 10(i) to Quarterly

Report on Form 10-Q for the period ending February 28, 2011.

|

| |

|

(x) |

Negative Pledge

Agreement dated August 30, 2017 by the Registrant in favor of M&T Bank, incorporated by reference to Exhibit 10(xiv) to Quarterly

Report on Form 10-Q for the period ending August 31, 2017..

|

| |

|

(xi) |

Employment Agreement

dated as of June 14, 2018 between the Registrant and Alan R. Klembczyk, incorporated by reference to Exhibit 10(i) to Current Report on

Form 8-K filed June 19, 2018.

|

| |

|

(xii) |

Employment Agreement

dated as of June 14, 2018 between the Registrant and Mark V. McDonough, incorporated by reference to Exhibit 10(ii) to Current Report

on Form 8-K filed June 19, 2018.

|

| |

|

(xiii) |

Employment Agreement

dated as of August 9, 2021 between the Registrant and Timothy J. Sopko, incorporated by reference to Exhibit 10 to Current Report on Form

8-K filed August 13, 2021.

|

| |

11 |

Statement regarding computation of per share earnings |

| |

|

|

| |

|

REG. 228.601(A)(11) Statement regarding computation of per share earnings |

| |

|

|

| |

|

Weighted average of common stock/equivalents outstanding - fiscal year ended May 31, 2022 |

| |

|

|

|

| |

|

|

Weighted average common stock outstanding |

3,497,345 |

| |

|

|

Common shares issuable under stock option plans using treasury stock method |

2,208 |

| |

|

|

Weighted average common stock outstanding assuming dilution |

3,499,553 |

| |

|

|

|

| |

|

|

Net income fiscal year ended May 31, 2022 |

(1) |

$ 2,239,423 |

| |

|

|

Weighted average common stock |

(2) |

3,497,345 |

| |

|

|

Basic income per common share (1) divided by (2) |

$ 0.64 |

| |

|

|

|

| |

|

|

Net income fiscal year ended May 31, 2022 |

(3) |

$ 2,239,423 |

| |

|

|

Weighted average common stock outstanding assuming dilution |

(4) |

3,499,553 |

| |

|

|

Diluted income per common share (3) divided by (4) |

$ 0.64 |

| |

|

|

| |

|

Weighted average of common stock/equivalents outstanding - fiscal year ended May 31, 2021 |

| |

|

|

|

| |

|

|

Weighted average common stock outstanding |

3,490,213 |

| |

|

|

Common shares issuable under stock option plans using treasury stock method |

1,674 |

| |

|

|

Weighted average common stock outstanding assuming dilution |

3,491,887 |

| |

|

|

|

| |

|

|

Net income fiscal year ended May 31, 2021 |

(1) |

$ 1,062,895 |

| |

|

|

Weighted average common stock |

(2) |

3,490,213 |

| |

|

|

Basic income per common share (1) divided by (2) |

$ 0.30 |

| |

|

|

|

| |

|

|

Net income fiscal year ended May 31, 2021 |

(3) |

$ 1,062,895 |

| |

|

|

Weighted average common stock outstanding assuming dilution |

(4) |

3,491,887 |

| |

|

|

Diluted income per common share (3) divided by (4) |

$ 0.30 |

| |

|

|

|

| |

13 |

The Annual Report to Security Holders for the fiscal year ended May 31, 2022, attached to this Annual Report on Form 10-K. |

| |

|

|

|

| |

21 |

Subsidiaries of the registrant |

| |

|

Tayco Realty Corporation is a New York corporation organized on September 8, 1977, owned by the Company. |

| |

23 |

The Consent of Independent Registered Public Accounting Firm precedes the Consolidated Financial Statements. |

| |

31 |

Officer Certifications |

| |

|

(i) |

Rule 13a-14(a) Certification of Chief Executive Officer. |

| |

|

(ii) |

Rule 13a-14(a) Certification of Chief Financial Officer. |

| |

|

|

|

|

|

|

|

|

| |

32 |

Officer Certifications |

| |

|

(i) |

Section 1350 Certification of Chief Executive Officer. |

| |

|

(ii) |

Section 1350 Certification of Chief Financial Officer. |

| |

101 |

Interactive data files pursuant to Rule 405 of Regulation S-T: (i) Consolidated Balance Sheets, (ii) Consolidated Statements of Income, (iii) Consolidated Statements of Stockholders’ Equity, (iv) Consolidated Statements of Cash Flows, and (v) Notes to Consolidated Financial Statements. |

| |

|

101.SCH |

XBRL Taxonomy Extension Schema Document |

| |

|

101.CAL |

XBRL Taxonomy Extension Calculation Linkbase Document |

| |

|

101.DEF |

XBRL Taxonomy Extension Definition Linkbase Document |

| |

|

101.LAB |

XBRL Taxonomy Extension Label Linkbase Document |

| |

|

101.PRE |

XBRL Taxonomy Extension Presentation Linkbase Document |

| |

|

|

|

|

SIGNATURES

Pursuant to the requirements of Section

13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| TAYLOR DEVICES, INC. |

|

| (Registrant) |

|

| By: |

/s/Timothy J. Sopko |

Date: |

August 19, 2022 |

| |

Timothy J. Sopko |

|

|

| |

Chief Executive Officer |

|

|

| |

(Principal Executive Officer) |

|

|

and

| By: |

/s/Mark V. McDonough |

Date: |

August 19, 2022 |

| |

Mark V. McDonough |

|

|

| |

Chief Financial Officer |

|

|

Pursuant to the requirements of the Securities

Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and

on the dates indicated.

| By: |

/s/John Burgess |

By: |

/s/Robert M. Carey |

| |

John Burgess, Director |

|

Robert M. Carey, Director |

| |

August 19, 2022 |

|

August 19, 2022 |

| By: |

/s/F. Eric Armenat |

By: |

/s/Alan R. Klembczyk |

| |

F. Eric Armenat, Director |

|

Alan R. Klembczyk, President and Director |

| |

August 19, 2022 |

|

August 19, 2022 |

[Lumsden & McCormick, LLP Letterhead]

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To The Board of Directors of

Taylor Devices, Inc.

Gentlemen:

We hereby consent

to the incorporation by reference in this Annual Report on Form 10-K (Commission File Number 0-3498) of Taylor Devices, Inc. of our report

dated August 19, 2022 and any reference thereto in the Annual Report to Shareholders for the fiscal year ended May 31, 2022.

We also consent

to such incorporation by reference in Registration Statement Nos. 333-114085, 333-133340, 333-155284, 333-184809, 333-210660, and 333-232121

of Taylor Devices, Inc. on Form S-8 of our report dated August 19, 2022.

/s/Lumsden & McCormick, LLP

Lumsden & McCormick, LLP

Buffalo, New York

August 19, 2022

TAYLOR DEVICES, INC. AND SUBSIDIARY

CONSOLIDATED FINANCIAL STATEMENTS

May 31, 2022

[Lumsden & McCormick, LLP Letterhead]

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

The Board of Directors and Stockholders

Taylor Devices, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance

sheets of Taylor Devices, Inc. and Subsidiary (the Company) as of May 31, 2022 and 2021, and the related consolidated statements of income,

stockholders' equity, and cash flows for the years then ended, and the related notes to the consolidated financial statements (collectively

referred to as the consolidated financial statements). In our opinion, the consolidated financial statements present fairly, in all material

respects, the financial condition of the Company as of May 31, 2022 and 2021, and the results of its operations and its cash flows for

the years then ended in accordance with accounting principles generally accepted in the United States of America.

Basis for Opinion

These consolidated

financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s

consolidated financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight

Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities

laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted

our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable

assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud. The Company

is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits

we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion

on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included

performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud,

and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts

and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant

estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a

reasonable basis for our opinion.

Critical Audit Matters

The critical audit matters communicated below are

matters arising from the current period audit of the consolidated financial statements that were communicated or required to be communicated

to the audit committee and that: (1) relate to accounts or disclosures that are material to the consolidated financial statements and

(2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter

in any way our opinion on the consolidated financial statements, taken as a whole, and we are not, by communicating the critical audit

matters below, providing separate opinions on the critical audit matters or on the accounts or disclosures to which they relate.

Cost Estimates for Long-Term Contracts and Related

Revenue Recognition

Description of the Matter

As more fully described in Note 1 to the consolidated

financial statements, the Company recognizes revenue over time for long-term contracts as goods are produced. The Company uses costs incurred

as the method to determine progress, and revenue is recognized based on costs incurred to date plus an estimate of margin at completion.

The process of estimating margin at completion involves estimating the costs to complete production of goods and comparing those costs

to the estimated final revenue amount. Long-term contracts are inherently uncertain in that revenue is fixed while the estimates of costs

required to complete these contracts are subject to significant variability. Due to the technical performance requirements in many of

these contracts, changes to cost estimates could occur, resulting in higher or lower margins when the contracts are completed.

Given the inherent uncertainty and significant judgments

necessary to estimate future costs at completion, auditing these estimates involved a focused audit effort and a high degree of auditor

judgment.

How We Addressed the Matter in Our Audit

Our auditing procedures related to the cost estimates

for long-term contracts and related revenue recognition included the following, among others:

- We evaluated the appropriateness and consistency of management’s methods

used to develop its estimates.

- We evaluated the reasonableness of judgments made and significant assumptions

used by management relating to key estimates.

- We selected a sample of executed contracts to understand the contract, perform

an independent assessment of the appropriate timing of revenue recognition, and test the mathematical accuracy of revenue recognized based

on costs incurred to date relative to total estimated costs at completion.

- We performed inquiries of the Company’s project managers and others

directly involved with the contracts to evaluate project status and project challenges which may affect total estimated costs to complete.

We also observed the project work site when key estimates related to tangible or physical progress of the project.

- We tested the accuracy and completeness of the data used to develop key estimates,

including material, labor, overhead, and sub-contractor costs.

- We performed retrospective reviews of prior year long-term contracts, comparing

actual performance to estimated performance and the related financial statement impact, when evaluating the thoroughness and precision

of management’s estimation process in previous years.

Valuation of Inventory

Description of the Matter

As of May 31, 2022, the Company’s inventory

balance was approximately $5.9 million, net of a $100,000 allowance for obsolescence, its maintenance and other inventory balance was

approximately $1.1 million, net of an approximate $1.2 million allowance for obsolescence. As discussed in Note 5, maintenance and other

inventory represents certain items that are estimated to have a product life-cycle in excess of twelve months the Company is required

to maintain for service of products sold and items that are generally subject to spontaneous ordering. The Company evaluates its inventory

for obsolescence on an ongoing basis by considering historical usage as well as requirements for future orders.

Given the inherent uncertainty and significant judgments

necessary to estimate potential inventory obsolescence, auditing management’s estimates involved a high degree of auditor judgment.

How We Addressed the Matter in Our Audit

Our auditing procedures related to valuation of inventory

included the following, among others:

- We evaluated the appropriateness and consistency of management’s methods

used to develop its estimates.

- We evaluated the reasonableness of judgments made and significant assumptions

used by management relating to key estimates.

- We inquired of management relative to write-offs of inventory during the year.

- We tested the completeness and accuracy of management’s schedule of

inventory.

- We developed an independent expectation of the obsolescence reserve based

on our knowledge of the Company’s inventory, including analysis of slow-moving items and historical usage and compared it to actual.

- We examined management’s lower of cost or net realizable value analysis

and performed procedures to test its completeness and accuracy.

- We selected a sample of material purchases made during the year to ensure

they were included in inventory at the proper value.

- During our physical inventory observation, we toured the Company’s warehouses

and examined inventory on hand for any indications of obsolescence.

/s/Lumsden & McCormick, LLP

Lumsden & McCormick, LLP

We have served as the Company’s auditor since 1998.

Buffalo, New York

August 19, 2022

| TAYLOR DEVICES, INC. AND SUBSIDIARY | |

| |

|

| | |

| |

|

| Consolidated Balance Sheets | |

| |

|

| | |

| |

|

| May 31, | |

2022 | |

2021 |

| | |

| |

|

| Assets | |

| |

|

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 22,517,038 | | |

$ | 20,581,604 | |

| Short-term investments | |

| 1,097,450 | | |

| 1,097,012 | |

| Accounts and other receivables, net | |

| 4,466,686 | | |

| 4,120,564 | |

| Inventory | |

| 5,854,935 | | |

| 5,835,596 | |

| Prepaid expenses | |

| 468,489 | | |

| 522,747 | |

| Prepaid income taxes | |

| 235,947 | | |

| 454,778 | |

| Costs and estimated earnings in excess of billings | |

| 3,336,474 | | |

| 1,499,604 | |

| Total current assets | |

| 37,977,019 | | |

| 34,111,905 | |

| | |

| | | |

| | |

| Maintenance and other inventory, net | |

| 1,107,309 | | |

| 1,612,839 | |

| Property and equipment, net | |

| 9,854,759 | | |

| 9,816,594 | |

| Cash value of life insurance, net | |

| 205,359 | | |

| 200,538 | |

| Deferred income taxes | |

| 74,615 | | |

| 190,115 | |

| Total assets | |

$ | 49,219,061 | | |

$ | 45,931,991 | |

| Liabilities and Stockholders' Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

| 1,426,830 | | |

| 1,787,325 | |

| Accrued commissions | |

| 84,907 | | |

| 269,064 | |

| Other accrued expenses | |

| 3,329,407 | | |

| 1,715,409 | |

| Billings in excess of costs and estimated earnings | |

| 1,122,763 | | |

| 1,361,985 | |

| Total current liabilities | |

| 5,963,907 | | |

| 5,133,783 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders' Equity: | |

| | | |

| | |

| Common stock, $.025 par value, authorized 8,000,000 shares, issued 4,056,771 and 4,055,275 shares | |

| 101,342 | | |

| 101,305 | |

| Paid-in capital | |

| 10,227,916 | | |

| 10,010,430 | |

| Retained earnings | |

| 35,840,898 | | |

| 33,601,475 | |

| Stockholders’ equity before treasury stock | |

| 46,170,156 | | |

| 43,713,210 | |

| Treasury stock – 558,834 shares at cost | |

| (2,915,002 | ) | |

| (2,915,002 | ) |

| Total stockholders' equity | |

| 43,255,154 | | |

| 40,798,208 | |

| Total liabilities and stockholders’ equity | |

$ | 49,219,061 | | |

$ | 45,931,991 | |

| | |

| | | |

| | |

| See notes to consolidated financial statements. | |

| | | |

| | |

| | |

| | | |

| | |

| TAYLOR DEVICES, INC. AND SUBSIDIARY | |

| |

|

| | |

| |

|

| Consolidated Statements of Income | |

| |

|

| | |

| |

|

| For the years ended May 31, | |

2022 | |

2021 |

| | |

| |

|

| | |

| |

|

| Sales, net | |

$ | 30,866,582 | | |

$ | 22,509,641 | |

| | |

| | | |

| | |

| Cost of goods sold | |

| 22,239,070 | | |

| 19,334,950 | |

| | |

| | | |

| | |

| Gross profit | |

| 8,627,512 | | |

| 3,174,691 | |

| | |

| | | |

| | |

| Selling, general and administrative expenses | |

| 6,154,735 | | |

| 5,526,774 | |

| | |

| | | |

| | |

| Operating income (loss) | |

| 2,472,777 | | |

| (2,352,083 | ) |

| | |

| | | |

| | |

| Other income | |

| | | |

| | |

| Interest, net | |

| 4,543 | | |

| 53,654 | |

| Paycheck Protection Program loan forgiveness | |

| — | | |

| 1,461,500 | |

| Employee Retention Credit | |

| 53,508 | | |

| 1,510,131 | |

| Miscellaneous | |

| 25,595 | | |

| 8,693 | |

| Total other income | |

| 83,646 | | |

| 3,033,978 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Provision for income taxes (benefit) | |

| 317,000 | | |

| (381,000 | ) |

| | |

| | | |

| | |

| Net income | |

$ | 2,239,423 | | |

$ | 1,062,895 | |

| | |

| | | |

| | |

| Basic and diluted earnings per common share | |

$ | 0.64 | | |

$ | 0.30 | |

| | |

| | | |

| | |

| See notes to consolidated financial statements. | |

| | | |

| | |

| | |

| | | |

| | |

| TAYLOR DEVICES, INC. AND SUBSIDIARY | |

| |

|

| | |

| |

|

| Consolidated Statements of Shareholders’ Equity | |

| |

|

| | |

| |

|

| For the years ended May 31, | |

2022 | |

2021 |

| | |

| |

|

| Common Stock | |

| | | |

| | |

| Beginning of period | |

$ | 101,305 | | |

$ | 100,943 | |

| Issuance of shares for employee stock purchase plan | |

| 37 | | |

| 37 | |

| Issuance of shares for employee stock option plan | |

| — | | |

| 325 | |

| End of period | |

| 101,342 | | |

| 101,305 | |

| | |

| | | |

| | |

| Paid-in Capital | |

| | | |

| | |

| Beginning of period | |

| 10,010,430 | | |

| 9,759,063 | |

| Issuance of shares for employee stock purchase plan | |

| 16,208 | | |

| 14,954 | |

| Issuance of shares for employee stock option plan | |

| — | | |

| 82,070 | |

| Stock options issued for services | |

| 201,278 | | |

| 154,343 | |

| End of period | |

| 10,227,916 | | |

| 10,010,430 | |

| | |

| | | |

| | |

| Retained Earnings | |

| | | |

| | |

| Beginning of period | |

| 33,601,475 | | |

| 32,538,580 | |

| Net income | |

| 2,239,423 | | |

| 1,062,895 | |

| End of period | |

| 35,840,898 | | |

| 33,601,475 | |

| | |

| | | |

| | |

| Treasury Stock | |

| | | |

| | |

| Beginning of period | |

| (2,915,002 | ) | |

| (2,861,032 | ) |

| Issuance of shares for employee stock option plan | |

| — | | |

| (53,970 | ) |

| End of period | |

| (2,915,002 | ) | |

| (2,915,002 | ) |

| | |

| | | |

| | |

| Total stockholders' equity | |

$ | 43,255,154 | | |

$ | 40,798,208 | |

| | |

| | | |

| | |

See notes to consolidated financial statements.

| TAYLOR DEVICES, INC. AND SUBSIDIARY | |

| |

|

| | |

| |

|

| Consolidated Statements of Cash Flows | |

| |

|

| | |

| |

|

| For the years ended May 31, | |

2022 | |

2021 |

| | |

| |

|

| Operating activities: | |

| | | |

| | |

| Net income | |

$ | 2,239,423 | | |

$ | 1,062,895 | |

| Adjustments to reconcile net income to net cash flows from operating activities: | |

| | | |

| | |

| Depreciation | |

| 1,347,442 | | |

| 1,212,713 | |

| Stock options issued for services | |

| 201,278 | | |

| 154,343 | |

| Bad debt expense | |

| — | | |

| 134,000 | |

| Gain on disposal of property and equipment | |

| (1,530 | ) | |

| — | |

| Provision for inventory obsolescence | |

| — | | |

| 1,500,000 | |

| Deferred income taxes | |

| 115,500 | | |

| (20,000 | ) |

| Paycheck Protection Program loan forgiveness | |

| — | | |

| (1,461,500 | ) |

| Changes in other current assets and liabilities: | |

| | | |

| | |

| Accounts and other receivables | |

| (346,122 | ) | |

| 1,564,907 | |

| Inventory | |

| 486,191 | | |

| 2,038,052 | |

| Prepaid expenses | |

| 54,258 | | |

| (62,535 | ) |

| Prepaid income taxes | |

| 218,831 | | |

| (404,630 | ) |

| Costs and estimated earnings in excess of billings | |

| (1,836,870 | ) | |

| 254,969 | |

| Accounts payable | |

| (360,495 | ) | |

| 417,150 | |

| Accrued commissions | |

| (184,157 | ) | |

| (36,821 | ) |

| Other accrued expenses | |

| 1,613,998 | | |

| 51,495 | |

| Billings in excess of costs and estimated earnings | |

| (239,222 | ) | |

| 625,119 | |

| Net operating activities | |

| 3,308,525 | | |

| 7,030,157 | |

| | |

| | | |

| | |

| Investing activities: | |

| | | |

| | |

| Acquisition of property and equipment | |

| (1,391,577 | ) | |

| (1,621,817 | ) |

| Proceeds from disposal of property and equipment | |

| 7,500 | | |

| — | |

| Increase in short-term investments | |

| (438 | ) | |

| (25,062 | ) |

| Increase in cash value of life insurance | |

| (4,821 | ) | |

| (4,917 | ) |

| Net investing activities | |

| (1,389,336 | ) | |

| (1,651,796 | ) |

| | |

| | | |

| | |

| Financing activities: | |

| | | |

| | |

| Proceeds from issuance of common stock | |

| 16,245 | | |

| 43,416 | |

| | |

| | | |

| | |

| Net change in cash and cash equivalents | |

| 1,935,434 | | |

| 5,421,777 | |

| | |

| | | |

| | |

| Cash and cash equivalents - beginning | |

| 20,581,604 | | |

| 15,159,827 | |

| Cash and cash equivalents - ending | |

$ | 22,517,038 | | |

$ | 20,581,604 | |

| | |

| | | |

| | |

| See notes to consolidated financial statements. | |

| | | |

| | |

| | |

| | | |

| | |

| TAYLOR DEVICES, INC. AND SUBSIDIARY |

| |

| Notes to Consolidated Financial Statements |

| |

1. Summary of Significant Accounting

Policies:

Nature of Operations:

Taylor Devices, Inc. (the Company) manufactures and

sells a single group of very similar products that have many different applications for customers. These similar products are included

in one of eight categories; namely, Seismic Dampers, Fluidicshoks®, Crane and Industrial Buffers, Self-Adjusting Shock Absorbers,

Liquid Die Springs, Vibration Dampers, Machined Springs and Custom Actuators for use in various types of machinery, equipment and structures,

primarily to customers which are located throughout the United States and several foreign countries. The products are manufactured at

the Company's sole operating facility in the United States where all of the Company's long-lived assets reside. Management does not track

or otherwise account for sales broken down by these categories.

76% of the Company's 2022 revenue was generated from

sales to customers in the United States and 14% was from sales to customers in Asia. Remaining sales were to customers in other countries

in North America, Europe, Australia, and South America.

68% of the Company's 2021 revenue was generated from

sales to customers in the United States and 20% was from sales to customers in Asia. Remaining sales were to customers in other countries

in North America, Europe and South America.

Principles of Consolidation:

The accompanying

consolidated financial statements include the accounts of the Company and its wholly owned subsidiary, Tayco Realty Corporation (Realty).

All inter-company transactions and balances have been eliminated in consolidation.

Subsequent Events:

The Company has evaluated events and transactions

for potential recognition or disclosure in the financial statements through the date the financial statements were issued.

Use of Estimates:

The preparation of financial statements in conformity

with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that

affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

Cash and Cash Equivalents:

The Company includes all highly liquid investments

in money market funds in cash and cash equivalents on the accompanying balance sheets.

Cash and cash equivalents in financial institutions

may exceed insured limits at various times during the year and subject the Company to concentrations of credit risk.

Short-term Investments:

At times, the Company invests excess funds in liquid

interest earning instruments. Short-term investments at May 31, 2022 and May 31, 2021 include “available for sale” corporate

bonds stated at fair value, which approximates cost. The bonds (16) mature on various dates during the period December 2022 to November

2026. Unrealized holding gains and losses would be presented as a separate component of accumulated other comprehensive income, net of

deferred income taxes. Realized gains and losses on the sale of investments are determined using the specific identification method.

The bonds are valued using pricing models maximizing

the use of observable inputs for similar securities. This includes basing value on yields currently available on comparable securities

of issuers with similar credit ratings.

Accounts and Other Receivables:

Accounts and other receivables are stated at an amount

management expects to collect from outstanding balances. Management provides for probable uncollectible accounts through a charge to earnings

and a credit to a valuation allowance based on its assessment of the current status of individual accounts. Balances that are still outstanding

after management has used reasonable collection efforts are written off through a charge to the valuation allowance and a credit to the

receivable.

Inventory:

Inventory is stated at the lower of average cost or

net realizable value. Average cost approximates first-in, first-out cost.

Property and Equipment:

Property and equipment is stated at cost net of accumulated

depreciation. Depreciation is provided primarily using the straight-line method for financial reporting purposes and accelerated methods

for income tax reporting purposes. Maintenance and repairs are charged to operations as incurred; significant improvements are capitalized.

Cash Value of Life Insurance:

Cash value of life insurance is stated at the surrender

value of the contracts.

Revenue Recognition:

Revenue is recognized (generally at fixed prices)

when, or as, the Company transfers control of promised products or services to a customer in an amount that reflects the consideration

to which the Company expects to be entitled in exchange for transferring those products or services.

A performance obligation is a promise in a

contract to transfer a distinct good or service to the customer, and is the unit of account. A contract’s transaction price is allocated

to each distinct performance obligation and recognized as revenue when, or as, the performance obligation is satisfied. The majority of

our contracts have a single performance obligation as the promise to transfer the individual goods or services is not separately identifiable

from other promises in the contracts which are, therefore, not distinct. Promised goods or services that are immaterial in the context

of the contract are not separately assessed as performance obligations.

For contracts with customers in which the Company

satisfies a promise to the customer to provide a product that has no alternative use to the Company and the Company has enforceable rights

to payment for progress completed to date inclusive of profit, the Company satisfies the performance obligation and recognizes revenue

over time (generally less than one year), using costs incurred to date relative to total estimated costs at completion to measure progress

toward satisfying our performance obligations. Incurred cost represents work performed, which corresponds with, and thereby best depicts,

the transfer of control to the customer. Contract costs include labor, material and overhead. Adjustments to cost estimates are made periodically,

and losses expected to be incurred on contracts in progress are charged to operations in the period such losses are determined. Other

sales to customers are recognized upon shipment to the customer based on contract prices and terms. In the year ended May 31, 2022, 60%

of revenue was recorded for contracts in which revenue was recognized over time while 40% was recognized at a point in time. In the year

ended May 31, 2021, 43% of revenue was recorded for contracts in which revenue was recognized over time while 57% was recognized at a

point in time.

Progress payments are typically negotiated

for longer term projects. Payments are otherwise due once performance obligations are complete (generally at shipment and transfer of

title). For financial statement presentation purposes, the Company nets progress billings against the total costs incurred on uncompleted

contracts. The asset, “costs and estimated earnings in excess of billings,” represents revenues recognized in excess of amounts

billed. The liability, “billings in excess of costs and estimated earnings,” represents billings in excess of revenues recognized.

If applicable, the Company recognizes an asset for

the incremental material costs of obtaining a contract with a customer if the Company expects the benefit of those costs to be longer

than one year and the costs are expected to be recovered. As of May 31, 2022 and 2021, the Company does not have material incremental

costs on any open contracts with an original expected duration of greater than one year, and therefore such costs are expensed as incurred.

These incremental costs include, but are not limited to, sales commissions incurred to obtain a contract with a customer.

Shipping and Handling Costs:

Shipping and handling costs on incoming inventory

items are classified as a component of cost of goods sold, while shipping and handling costs on outgoing shipments to customers are classified

as a component of selling, general and administrative expenses. The amounts of these costs classified as a component of selling, general

and administrative expenses were $238,536 and $146,878 for the years ended May 31, 2022 and 2021. Shipping and handling activities that

occur after the customer has obtained control of the product are considered fulfillment activities, not performance obligations.

Research and Development Costs:

Research and development costs are classified as a

component of cost of sales. The amounts of these costs were $1,213,000 and $924,000 for the years ended May 31, 2022 and 2021.

Income Taxes:

The provision for income taxes provides for the tax

effects of transactions reported in the financial statements regardless of when such taxes are payable. Deferred tax assets and liabilities

are recognized for the expected future tax consequences of temporary differences between the tax and financial statement basis of assets

and liabilities. Deferred taxes are based on tax laws currently enacted with tax rates expected to be in effect when the taxes are actually

paid or recovered.

The Company's

practice is to recognize interest related to income tax matters in interest income / expense and to recognize penalties in selling, general

and administrative expenses. The Company did not have any accrued interest or penalties included in its consolidated balance sheets at

May 31, 2022 and 2021. The Company recorded no interest expense or penalties in its consolidated

statements of income during the years ended May 31, 2022 and 2021.

The Company

believes it is no longer subject to examination by federal and state taxing authorities for years prior to May 31, 2019.

Sales Taxes:

Certain jurisdictions impose a sales tax on Company

sales to nonexempt customers. The Company collects these taxes from customers and remits the entire amount as required by the applicable

law. The Company excludes from revenues and expenses the tax collected and remitted.

Stock-Based

Compensation:

The Company measures compensation cost arising from

the grant of share-based payments to employees at fair value and recognizes such cost in income over the period during which the employee

is required to provide service in exchange for the award. The stock-based compensation expense for

the years ended May 31, 2022 and 2021 was $201,278 and $154,343.

New

Accounting Standards:

Any recently issued Accounting Standards Codification

(ASC) guidance has either been implemented or are not significant to the Company.

2. Accounts and Other Receivables:

| | |

2022 | |

2021 |

| Customers | |

$ | 4,292,300 | | |

$ | 3,184,970 | |

| Customers – retention | |

| 190,492 | | |

| 200,956 | |

| Gross accounts receivable | |

| 4,482,792 | | |

| 3,385,926 | |

| Less allowance for doubtful accounts | |

| 16,106 | | |

| 6,781 | |

| Add other receivables | |

| — | | |

| 741,419 | |

| Net accounts receivable | |

$ | 4,466,686 | | |

$ | 4,120,564 | |

Retention receivable from customers represents amounts

invoiced to customers where payments have been partially withheld pending completion of the project. All amounts are expected to be collected

within the next fiscal year.

Other receivable was an amount of Employee Retention

Credit claimed by the Company for the second calendar quarter of 2021 and received in the third calendar quarter of 2021.

3. Inventory:

| | |

2022 | |

2021 |

| Raw materials | |

$ | 488,393 | | |

$ | 503,344 | |

| Work-in-process | |

| 5,166,271 | | |

| 5,076,377 | |

| Finished goods | |

| 300,271 | | |

| 355,875 | |

| Gross inventory | |

| 5,954,935 | | |

| 5,935,596 | |

| Less allowance for obsolescence | |

| 100,000 | | |

| 100,000 | |

| Net inventory | |

$ | 5,854,935 | | |

$ | 5,835,596 | |

4. Costs and Estimated Earnings on Uncompleted Contracts:

| | |

2022 | |

2021 |

| Costs incurred on uncompleted contracts | |

$ | 4,268,608 | | |

$ | 3,372,276 | |

| Estimated earnings | |

| 3,211,392 | | |

| 778,011 | |

| Total costs and estimated earnings | |

| 7,480,000 | | |

| 4,150,287 | |

| Less billings to date | |

| 5,266,289 | | |

| 4,012,668 | |

| Costs and estimated earnings not billed | |

$ | 2,213,711 | | |

$ | 137,619 | |

Amounts are included in the accompanying balance sheets

under the following captions:

| | |

2022 | |

2021 |

| Costs and estimated earnings in excess of billings | |

$ | 3,336,474 | | |

$ | 1,499,604 | |

| Billings in excess of costs and estimated earnings | |

| 1,122,763 | | |

| 1,361,985 | |

| Costs and estimated earnings not billed | |

$ | 2,213,711 | | |

$ | 137,619 | |

The following summarizes the status of Projects in

progress as of May 31, 2022 and 2021:

| | |

2022 | |

2021 |

| Number of Projects in progress | |

| 19 | | |

| 14 | |

| Aggregate percent complete | |

| 47 | % | |

| 32 | % |

| Aggregate amount remaining | |

$ | 7,627,234 | | |

$ | 9,333,701 | |

| Percentage of total value invoiced to customer | |

| 35 | % | |

| 30 | % |

The Company expects to recognize the entire remaining

revenue on all open projects during the May 31, 2023 fiscal year.

Revenue recognized during the years ended May 31,

2022 and 2021 for amounts included in billings in excess of costs and estimated earnings as of the beginning of the year amounted to $1,420,000,

and $736,866.

5. Maintenance and Other Inventory:

| | |

2022 | |

2021 |

| Maintenance and other inventory | |

$ | 2,334,889 | | |

$ | 3,612,000 | |

| Less allowance for obsolescence | |

| 1,227,580 | | |

| 1,999,161 | |

| Maintenance and other inventory, net | |

$ | 1,107,309 | | |

$ | 1,612,839 | |

Maintenance and other inventory represent stock that

is estimated to have a product life-cycle in excess of twelve-months. This stock represents certain items the Company is required to maintain

for service of products sold, and items that are generally subject to spontaneous ordering.

This inventory is particularly sensitive to technical

obsolescence in the near term due to its use in industries characterized by the continuous introduction of new product lines, rapid technological

advances and product obsolescence. Therefore, management of the Company has recorded an allowance for potential inventory obsolescence.

During fiscal 2021, the Company began a thorough review

of the facilities including the flow of inventory through the factory and warehouse areas to determine the most efficient utilization

of available space. This review continued through fiscal 2022. Inventory purchasing practices and stocking levels were also evaluated

and it was determined that a significant portion of the older items would be disposed of while the allowance for potential inventory obsolescence

would be increased as more items are identified for disposal. $772,000 and $1,101,000 of inventory was disposed of during the years ended

May 31, 2022 and 2021. The provision for potential inventory obsolescence was zero and $1,500,000 for the years ended May 31, 2022 and

2021.

6. Property and Equipment:

| | |

2022 | |

2021 |

| Land | |

$ | 195,220 | | |

$ | 195,220 | |

| Buildings and improvements | |

| 9,821,812 | | |

| 9,584,087 | |

| Machinery and equipment | |

| 12,824,696 | | |

| 12,366,569 | |

| Office furniture and equipment | |

| 2,744,400 | | |

| 2,536,688 | |

| Autos and trucks | |

| 24,818 | | |

| 24,818 | |

| Land improvements | |

| 483,929 | | |

| 476,429 | |

| Gross property and equipment | |

| 26,094,875 | | |

| 25,183,811 | |

| Less accumulated depreciation | |

| 16,240,116 | | |

| 15,367,217 | |

| Property and equipment, net | |

$ | 9,854,759 | | |

$ | 9,816,594 | |

Depreciation expense was $1,347,442 and $1,212,713

for the years ended May 31, 2022 and 2021.

The Company has commitments to make capital expenditures

of approximately $1,600,000 as of May 31, 2022.

7. Short-Term Borrowings:

The Company has available a $10,000,000 demand line

of credit from a bank, with interest payable at the Company's option of 30, 60 or 90 day LIBOR rate plus 2.25%. The line is secured by

a negative pledge of the Company's real and personal property. This line of credit is subject to the usual terms and conditions applied

by the bank and subject to renewal annually.

There is no amount outstanding under the line of credit

at May 31, 2022 or May 31, 2021.

The Company uses a cash management facility under

which the bank draws against the available line of credit to cover checks presented for payment on a daily basis. Outstanding checks under

this arrangement totaled $193,478 and $366,209 as of May 31, 2022 and 2021. These amounts are included in accounts payable.

8. Other Accrued Expenses:

| | |

2022 | |

2021 |

| Customer deposits | |

$ | 1,347,709 | | |

$ | 867,652 | |

| Personnel costs | |

| 1,587,271 | | |

| 659,623 | |

| Other | |

| 394,427 | | |

| 188,134 | |

| Total other accrued expenses | |

$ | 3,329,407 | | |

$ | 1,715,409 | |

9. Sales:

The Company manufactures and sells a single group

of very similar products that have many different applications for customers. These similar products are included in one of eight categories;

namely, Seismic Dampers, Fluidicshoks®, Crane and Industrial Buffers, Self-Adjusting Shock Absorbers, Liquid Die Springs, Vibration

Dampers, Machined Springs and Custom Actuators. Management does not track or otherwise account for sales broken down by these categories.

Sales of the Company's products are made to three general groups of customers: industrial, structural and aerospace / defense. A breakdown

of sales to these three general groups of customers is as follows:

| | |

2022 | |

2021 |

| Structural | |

$ | 16,267,162 | | |

$ | 10,137,468 | |

| Aerospace / Defense | |

| 12,440,687 | | |

| 10,183,399 | |

| Industrial | |

| 2,158,733 | | |

| 2,188,774 | |

| Sales, net | |

$ | 30,866,582 | | |

$ | 22,509,641 | |

Sales to a single customer approximated 15% of net

sales for 2022. Sales two customers approximated 21% (11% and 10%, respectively) of net sales for 2021.

10. Income Taxes:

| | |

2022 | |

2021 |

| Current tax provision (benefit): | |

| | | |

| | |

| Federal | |

$ | 200,100 | | |

$ | (361,000 | ) |

| State | |

| 1,400 | | |

| — | |

| Total current tax provision | |

| 201,500 | | |

| (361,000 | ) |

| Deferred tax provision (benefit): | |

| | | |

| | |

| Federal | |

| 115,500 | | |

| (20,000 | ) |

| State | |

| — | | |

| — | |

| Total deferred tax provision | |

| 115,500 | | |

| (20,000 | ) |

| Total tax provision | |

$ | 317,000 | | |

$ | (381,000 | ) |

A reconciliation of provision for income taxes at

the statutory rate to income tax provision at the Company's effective rate is as follows:

| | |

2022 | |

2021 |

| Computed tax provision at the expected statutory rate | |

$ | 536,800 | | |

$ | 143,200 | |

| State income tax - net of Federal tax benefit | |

| 1,100 | | |

| — | |

| Tax effect of permanent differences: | |

| | | |

| | |

| Research tax credits | |

| (275,400 | ) | |

| (218,000 | ) |

| Foreign-derived intangible income deduction | |

| (12,200 | ) | |

| — | |

| PPP loan forgiveness | |

| — | | |

| (306,900 | ) |

| Other permanent differences | |

| 3,100 | | |

| 41,500 | |

| Other | |

| 63,600 | | |

| (40,800 | ) |

| Total tax provision | |

$ | 317,000 | | |

$ | (381,000 | ) |

| Effective income tax rate | |

| 12.4 | % | |

| (55.9 | %) |

Significant components of the Company's deferred tax

assets and liabilities consist of the following:

| | |

2022 | |

2021 |

| Deferred tax assets: | |

| | | |

| | |

| Allowance for doubtful receivables | |

$ | 3,400 | | |

$ | 1,400 | |

| Tax inventory adjustment | |

| 92,200 | | |

| 22,900 | |

| Allowance for obsolete inventory | |

| 278,800 | | |

| 440,800 | |

| Accrued vacation | |

| 84,300 | | |

| 81,400 | |

| Accrued commissions | |

| 7,000 | | |

| 5,900 | |

| Warranty reserve | |

| 48,800 | | |

| 23,900 | |

| R&D tax credit | |

| 84,000 | | |

| — | |

| Stock options issued for services | |

| 277,600 | | |

| 238,500 | |

| Total deferred tax assets | |

| 876,100 | | |

| 814,800 | |

| Deferred tax liabilities: | |

| | | |

| | |

| Excess tax depreciation | |

| (801,485 | ) | |

| (624,685 | ) |

| Net deferred tax assets | |

$ | 74,615 | | |

$ | 190,115 | |

Realization of the deferred tax assets is dependent

on generating sufficient taxable income at the time temporary differences become deductible. The Company provides a valuation allowance

to the extent that deferred tax assets may not be realized. A valuation allowance has not been recorded against the deferred tax assets

since management believes it is more likely than not that the deferred tax assets are recoverable. The Company considers future taxable

income and potential tax planning strategies in assessing the need for a potential valuation allowance. The amount of the deferred tax

assets considered realizable however, could be reduced in the near term if estimates of future taxable income are reduced. The Company

will need to generate approximately $4.2 million in taxable income in future years in order to realize the deferred tax assets recorded

as of May 31, 2022 of $876,100.

The Company and its subsidiary file consolidated

Federal and State income tax returns. As of May 31, 2022, the Company had State investment tax credit carryforwards of approximately

$389,000 expiring through May

31, 2027.

11. Earnings Per Common Share:

Basic earnings per common share is computed by dividing

income available to common stockholders by the weighted-average common shares outstanding for the period. Diluted earnings per common

share reflects the weighted-average common shares outstanding and dilutive potential common shares, such as stock options.

A reconciliation of weighted-average common shares

outstanding to weighted-average common shares outstanding assuming dilution is as follows:

| | |

2022 | |

2021 |

| Average common shares outstanding | |

| 3,497,345 | | |

| 3,490,213 | |

| Common shares issuable under stock option plans | |

| 2,208 | | |

| 1,674 | |

| Average common shares outstanding assuming dilution | |

| 3,499,553 | | |

| 3,491,887 | |

12. Related Party Transactions:

The Company had no related party transactions for

the years ended May 31, 2022 and 2021.

13. Employee Stock Purchase Plan:

In March 2004, the Company reserved 295,000 shares

of common stock for issuance pursuant to a non-qualified employee stock purchase plan. Participation in the employee stock purchase plan

is voluntary for all eligible employees of the Company. Purchase of common shares can be made by employee contributions through payroll

deductions. At the end of each calendar quarter, the employee contributions will be applied to the purchase of common shares using a share

value equal to the mean between the closing bid and ask prices of the stock on that date. These shares are distributed to the employees

at the end of each calendar quarter or upon withdrawal from the plan. During the years ended May 31, 2022 and 2021, 1,496 ($9.90 to $11.83

price per share) and 1,470 ($9.20 to $11.40 price per share) common shares, respectively, were issued to employees. As of May 31, 2022,

217,287 shares were reserved for further issue.

14. Stock Option Plans:

In 2018, the Company adopted a stock option plan which

permits the Company to grant both incentive stock options and non-qualified stock options. The incentive stock options qualify for preferential

treatment under the Internal Revenue Code. Under this plan, 160,000 shares of common stock have been reserved for grant to key employees

and directors of the Company and 136,250 shares have been granted as of May 31, 2022. Under the plan, the option price may not be less

than the fair market value of the stock at the time the options are granted. Options vest immediately and expire ten years from the date

of grant.

Using the Black-Scholes option pricing model, the

weighted average estimated fair value of each option granted under the plan was $3.02 during 2022 and $3.27 during 2021. The pricing model

uses the assumptions noted in the following table. Expected volatility is based on the historical volatility of the Company's stock. The

risk-free interest rate for periods within the contractual life of the option is based on the U.S. Treasury yield curve in effect at the

time of the grant. The expected life of options granted is derived from previous history of stock exercises from the grant date and represents

the period of time that options granted are expected to be outstanding. The Company uses historical data to estimate option exercise and

employee termination assumptions under the valuation model. The Company has never paid dividends on its common stock and does not anticipate

doing so in the foreseeable future.

| | |

2022 | |

2021 |

| Risk-free interest rate | |

| 2.59 | % | |

| 2.31 | % |

| Expected life in years | |

| 4.0 years | | |

| 4.0 years | |

| Expected volatility | |

| 31 | % | |

| 33 | % |

| Expected dividend yield | |

| 0 | % | |

| 0 | % |

The following is a summary of stock option activity:

| | |

Shares | |

Weighted Average Exercise Price | |

Intrinsic Value |

| Outstanding - May 31, 2020 | |

| 252,250 | | |

$ | 11.52 | | |

$ | 209,835 | |

| Options granted | |

| 47,250 | | |

$ | 11.26 | | |

| | |

| Less: options exercised | |

| 13,000 | | |

$ | 6.34 | | |

| | |

| Less: options expired | |

| 18,750 | | |

$ | 13.31 | | |

| | |

| Outstanding - May 31, 2021 | |

| 267,750 | | |

$ | 11.60 | | |

$ | 271,426 | |

| Options granted | |

| 66,750 | | |

$ | 10.69 | | |

| | |

| Less: options expired | |

| 51,500 | | |

| — | | |

| | |

| Outstanding - May 31, 2022 | |

| 283,000 | | |

$ | 11.43 | | |

$ | 28,248 | |

We calculated intrinsic value for those options that

had an exercise price lower than the market price of our common shares as of the balance sheet dates. The aggregate intrinsic value of

outstanding options as of the end of each fiscal year is calculated as the difference between the exercise price of the underlying options

and the market price of our common shares for the options that were in-the-money at that date (29,250 at May 31, 2022 and 137,750 at May

31, 2021.) The Company's closing stock price was $9.30 and $11.85 as of May 31, 2022 and 2021. As of May 31, 2022, there are 23,750 options

available for future grants under the 2018 stock option plan. No options were exercised in the fiscal year ended May 31, 2022. $28,425

was received from the exercise of share options during the fiscal year ended May 31, 2021.

The following table summarizes information about stock

options outstanding at May 31, 2022:

| Outstanding and Exercisable | |

| | | |

| | | |

| | |

| Range of Exercise Prices | |

| Number of Options | | |

| Weighted Average Remaining Years of Contractual Life | | |

| Weighted Average Exercise Price | |

| $ 7.01-$ 8.00 | |

| 10,000 | | |

| 0.9 | | |

$ | 7.74 | |

| $ 8.01-$ 9.00 | |

| 19,250 | | |

| 1.5 | | |

$ | 8.64 | |

| $ 9.01-$10.00 | |

| 55,000 | | |

| 9.0 | | |

$ | 9.67 | |

| $10.01-$11.00 | |

| 26,500 | | |

| 7.3 | | |

$ | 10.14 | |

| $11.01-$12.00 | |

| 112,250 | | |

| 7.8 | | |

$ | 11.72 | |

| $12.01-$13.00 | |

| 28,750 | | |

| 3.9 | | |

$ | 12.39 | |

| $13.01-$14.00 | |

| 10,000 | | |

| 4.9 | | |

$ | 13.80 | |

| $16.01-$17.00 | |

| 10,000 | | |

| 3.9 | | |

$ | 16.40 | |

| $19.01-$20.00 | |

| 11,250 | | |

| 4.2 | | |

$ | 19.26 | |

| $ 7.01-$20.00 | |

| 283,000 | | |

| 6.5 | | |

$ | 11.43 | |

| | |

| | | |

| | | |

| | |

The following table summarizes information about stock

options outstanding at May 31, 2021:

| Outstanding and Exercisable | |

| | | |

| | | |

| | |

| Range of Exercise Prices | |

| Number of Options | | |

| Weighted Average Remaining Years of Contractual Life | | |

| Weighted Average Exercise Price | |

| $ 7.01-$ 8.00 | |

| 15,000 | | |

| 1.6 | | |

$ | 7.74 | |

| $ 8.01-$ 9.00 | |

| 24,250 | | |

| 2.1 | | |

$ | 8.71 | |

| $ 9.01-$10.00 | |

| 30,000 | | |

| 7.6 | | |

$ | 9.85 | |

| $10.01-$11.00 | |

| 32,250 | | |

| 7.2 | | |

$ | 10.17 | |

| $11.01-$12.00 | |

| 91,250 | | |

| 7.4 | | |

$ | 11.71 | |

| $12.01-$13.00 | |

| 33,750 | | |

| 4.3 | | |

$ | 12.36 | |

| $13.01-$14.00 | |

| 15,000 | | |

| 4.2 | | |

$ | 13.80 | |

| $16.01-$17.00 | |

| 15,000 | | |

| 3.6 | | |

$ | 16.40 | |

| $19.01-$20.00 | |

| 11,250 | | |

| 5.2 | | |

$ | 19.26 | |

| $ 7.01-$20.00 | |

| 267,750 | | |

| 5.7 | | |

$ | 11.60 | |

| | |

| | | |

| | | |

| | |

15. Preferred Stock:

The Company has 2,000,000 authorized but unissued

shares of preferred stock which may be issued in series. The shares of each series shall have such rights, preferences, and limitations

as shall be fixed by the Board of Directors.

16. Treasury Stock:

Treasury shares are 558,834 at both May 31, 2022 and

2021.

17. Retirement Plan:

The Company maintains a retirement plan for essentially

all employees pursuant to Section 401(k) of the Internal Revenue Code. The Company matches a percentage of employee voluntary salary deferrals

subject to limitations. The Company may also make discretionary contributions as determined annually by the Company's Board of Directors.

The amount expensed under the plan was $313,269 and $288,470 for the years ended May 31, 2022 and 2021.

18. Fair Value of Financial Instruments:

The carrying amounts of cash and cash equivalents,

accounts receivable, accounts payable, and accrued liabilities approximate fair value because of the short maturity of these instruments.

The fair values of short-term investments were determined

as described in Note 1.

19. Cash Flows Information:

| | |

2022 | |

2021 |

| | |

| |

|

| Interest paid | |

| none | | |

| none | |

| | |

| | | |

| | |

| Income taxes paid | |

| none | | |

$ | 43,630 | |

20. Risks and Uncertainties:

On January 31, 2020, the United States Secretary of

Health and Human Services (HHS) declared a public health emergency related to the global spread of coronavirus COVID-19, and a pandemic

was declared by the World Health Organization in February 2020. Efforts to fight the widespread disease included limiting or closing many

businesses and resulted in a severe disruption of operations for many organizations. Financial markets also fluctuated significantly during

this time. The extent of the impact of COVID-19 on the Company’s operational and financial performance was significant in fiscal

2021. The use of vaccinations world-wide have apparently slowed spread of the disease, the extent of the impact of COVID-19 on the Company’s

operational and financial performance in fiscal 2022 was minimal. The effect on the Company’s operational and financial performance

in fiscal 2023 is not expected to be significant however it will depend on further developments, including the duration and spread of

the outbreak, impact on customers, employees, and vendors, all of which cannot be predicted.

As a result of the pandemic described above, the Company

applied for, and received, financial assistance from the U.S. federal government as part of the CARES Act and the Consolidated Appropriations

Act of 2021 (CAA) including: a.) $1,461,500 of income due to the forgiveness of the PPP loan by the SBA (all in fiscal 2021), and b.)

$1,563,639 of Employee Retention Credit income ($53,508 in fiscal 2022 and $1,510,131 in fiscal 2021). These amounts are included in Other

income on the Consolidated Statements of Income.

21. Legal Proceedings:

There are no legal proceedings except for routine

litigation incidental to the business.

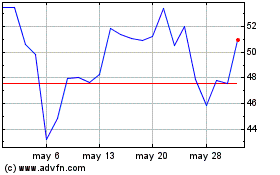

Taylor Devices (NASDAQ:TAYD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Taylor Devices (NASDAQ:TAYD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024