Tri Counties Bank and Self-Help Enterprises Launch Down Payment Assistance Program in the California Central Valley

18 Octubre 2023 - 11:00AM

Business Wire

Tri Counties Bank announced today a partnership with Self-Help

Enterprises (SHE) to launch a new Down Payment Assistance (DPA)

Program. Tri Counties Bank is funding the program with a $150,000

donation to support low- and moderate-income homebuyers in

Stanislaus, Merced, Madera, Fresno, Tulare and Kern Counties.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20231018455732/en/

Tri Counties Bank awards Self-Help

Enterprises with a $150,000 donation to fund a new Down Payment

Assistance that support low- and moderate-income homebuyers in

Stanislaus, Merced, Madera, Fresno, Tulare and Kern Counties.

(Photo: Business Wire)

The new program is coordinated through SHE and all home

mortgages will be financed through Tri Counties Bank. Qualified

low- and moderate-income borrowers can apply to receive up to 3% of

their future home’s purchase price (up to $10,000) in down-payment

assistance loans. All loans have a term of five years with zero

percent interest and will qualify for forgiveness if terms are

met.

“Tri Counties Bank is pleased to continue partnering with SHE to

provide low-income buyers with the opportunity to achieve the dream

of purchasing their first home,” said Aytom Salomon, Senior Vice

President and Market President of Tri Counties Bank’s Greater

Bakersfield region. “Our goal is to strengthen and grow our

communities, especially those that have been underserved in the

Central Valley area.”

First-time home buyers may also be able to obtain additional

down payment assistance through other programs available through

Tri Counties Bank, including:

- Tri Counties Bank’s Homeownership Access Program

- CalHFA Down Payment Assistance Program

- California Dream For All Shared Appreciation Loan Program

- Workforce Initiative Subsidy for Homeownership (WISH)

First-Time Homebuyer Program

“This partnership with Tri Counties Bank is vital to bringing

home ownership within reach for hard working families in the San

Joaquin Valley,” said Tom Collishaw, CEO of SHE. “Owning a home

continues to be the most important path to economic security in

this country.”

In addition to the DPA Program, Tri Counties Bank and SHE will

be offering two “Understanding Down Payment Assistance” workshops

on October 18 at 5:30 PM and October 21 at 10:30 AM. Workshops will

be hosted at the Annadale Commons Community Center at 1515 E

Annadale Avenue in Fresno. Attendees will learn about the program’s

process and about qualifying for down payment assistance. Space is

limited and spots can be reserved by calling (559) 434-0939.

Interested home buyers can apply for the Down Payment Assistance

Program by calling (559) 802-1640 or by visiting

https://www.selfhelpenterprises.org/.

About Tri Counties Bank

Established in 1975, Tri Counties Bank is a wholly-owned

subsidiary of TriCo Bancshares (NASDAQ: TCBK) headquartered in

Chico, California, with assets of almost $10 billion and nearly 50

years of financial stability. Tri Counties Bank provides a unique

brand of Service With Solutions® for communities throughout

California with a breadth of personal, small business and

commercial banking services, plus an extensive branch network,

access to approximately 40,000 surcharge-free ATMs nationwide, and

advanced mobile and online banking. Tri Counties Bank participates

in the Cities for Financial Empowerment (CFE) Fund’s BankOn program

that seeks to ensure that everyone has access to safe and

affordable financial products and services. Visit

TriCountiesBank.com to learn more. Member FDIC. Equal

Housing Lender. NMLS #458732

About Self-Help Enterprises

Self-Help Enterprises (SHE) is a nationally recognized community

development organization whose mission is to work together with

low-income families to build and sustain healthy homes and

communities. The pioneer and leading provider of mutual self-help

housing in the United States, SHE’s efforts today encompass a range

of endeavors to build better homes and communities for farmworkers

and other hard-working families. Since 1965, SHE has helped more

than 6,500 families to build their own homes, rehabilitated over

6,900 unsafe homes, developed over 2,500 units of affordable rental

housing, and has provided technical assistance for reliable access

to safe drinking water and sanitary sewer infrastructures which has

affected the lives of over 33,000 individuals in 175 small

communities. SHE’s commitment to providing resources and training

for individuals builds the capacity of highly effective leaders in

communities that also promote collaborative solutions for improving

communities. These combined efforts have touched the lives of over

75,000 families, providing security and stability for families and

building more productive communities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231018455732/en/

Megan Sheehan, AVP, Public Relations Manager

megansheehan@tcbk.com (530) 332-2330

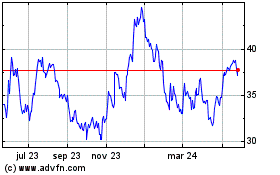

TriCo Bancshares (NASDAQ:TCBK)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

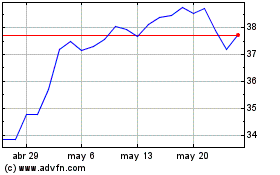

TriCo Bancshares (NASDAQ:TCBK)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024