0001831363false00018313632024-11-122024-11-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 12, 2024 |

Terns Pharmaceuticals, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39926 |

98-1448275 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1065 East Hillsdale Blvd. Suite 100 |

|

Foster City, California |

|

94404 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (650) 525-5535 |

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.0001 par value per share |

|

TERN |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 12, 2024, Terns Pharmaceuticals, Inc. issued a press release announcing its financial results for the quarter ended September 30, 2024. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in Item 2.02 and Item 9.01 (including Exhibit 99.1) of this Current Report on Form 8-K is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

TERNS PHARMACEUTICALS, INC. |

|

|

|

Date: November 12, 2024 |

By: |

/s/ Elona Kogan |

|

|

Elona Kogan |

|

|

Chief Legal Officer |

Exhibit 99.1

Terns Pharmaceuticals Reports Third Quarter 2024 Financial Results and Corporate Updates

Interim data from initial dose escalation cohorts of Phase 1 CARDINAL trial evaluating TERN-701 (allosteric BCR-ABL tyrosine kinase inhibitor) in chronic myeloid leukemia (CML) expected in early December 2024

Plans to initiate Phase 2 clinical trial for TERN-601 in obesity in early 2Q25 with initial 12-week data expected in 2H25

Cash, cash equivalents and marketable securities of $372.8 million, including $172.7 million equity raise in September, expected to provide runway into 2028

FOSTER CITY, Calif., November 12, 2024 (GLOBE NEWSWIRE) -- Terns Pharmaceuticals, Inc. (“Terns” or the “Company”) (Nasdaq: TERN), a clinical-stage biopharmaceutical company developing a portfolio of small-molecule product candidates to address serious diseases, including oncology and obesity, today reported financial results for the third quarter ended September 30, 2024, and provided corporate updates.

“Our progress in the third quarter was highlighted by the compelling topline results from our Phase 1 study of TERN-601, which demonstrated class-leading potential as a differentiated, once-daily, oral GLP-1R agonist for the treatment of obesity and supports its rapid advancement into Phase 2 studies,” stated Amy Burroughs, chief executive officer of Terns. “We are looking forward to sharing interim dose escalation data from the Phase 1 CARDINAL trial of TERN-701 as a treatment for chronic myeloid leukemia (CML) and expect this early look at safety, tolerability and signals of efficacy to reinforce its potential as a best-in-class allosteric for the treatment of CML. Importantly, our successful equity raise underscores the strong support for our promising pipeline of differentiated small molecules, funds Terns through multiple catalysts across our clinical development programs and extends our cash runway into 2028.”

Recent Pipeline Developments and Anticipated Milestones

TERN-701: Oral, allosteric BCR-ABL tyrosine kinase inhibitor (TKI) for chronic myeloid leukemia (CML)

•Interim data from initial dose escalation cohorts in Terns’ ongoing Phase 1 CARDINAL study of TERN-701 in CML expected in early December 2024

oCARDINAL is a global, multicenter, open-label, two-part Phase 1 clinical trial to evaluate the safety, pharmacokinetics (PK) and efficacy of TERN-701 in patients with previously treated CML

oThe Company expects to share interim dose escalation data from the CARDINAL study, including safety, tolerability and early signals of efficacy

•In August, Terns hosted a TERN-701 webinar event focused on interpreting early datasets in CML

TERN-601: Oral, small-molecule glucagon-like peptide-1 (GLP-1) receptor agonist for obesity

•Terns plans to initiate a Phase 2 clinical trial in early second quarter of 2025 with initial 12-week data expected in the second half of 2025

oThe trial will begin with a 12-week portion to optimize dose titration and inform subsequent cohorts

•In September, Terns announced positive safety and 28-day weight loss data from the Phase 1 first-in-human clinical trial of TERN-601 in obese and overweight participants

oThe results showed TERN-601 was well tolerated and demonstrated dose-dependent, statistically significant mean weight loss up to 5.5% (4.9% placebo adjusted) over 28 days

o67% of study participants lost 5% or more of their baseline body weight at the highest dose of 740 mg once-daily (QD)

oTERN-601 exhibited distinct properties for an oral GLP-1R agonist

▪Low solubility and high gut permeability allowed for prolonged absorption and sustained target coverage and a flat PK curve, while high drug levels in the gut wall may lead to robust GLP-1R activation in the gut triggering satiety centers in the brain

▪Low free fraction in circulation, combined with the flat PK curve, may contribute to TERN-601's tolerability profile at higher target doses than other oral GLP-1R agonists

oTERN-601 was well-tolerated with no treatment-related dose interruptions, reductions, or discontinuations even with rapid dose titration

TERN-501: Oral, thyroid hormone receptor-beta (THR-β) agonist

•In June, Terns presented new preclinical data at the American Diabetes Association (ADA) 84th Scientific Sessions supporting TERN-501 in combination with a GLP-1 receptor agonist for obesity

oPreclinical findings demonstrated TERN-501 in combination with semaglutide significantly enhanced weight loss and showed proportionally greater loss of fat mass relative to lean mass compared to semaglutide alone

oSupports the potential for TERN-501 as a combination partner for injectable and oral GLP-1 agonists for use in obesity and other metabolic disorders

oThe full poster is available on Terns’ scientific publications website

•Terns continues to evaluate opportunities for TERN-501 in metabolic diseases

TERN-800 Series: Oral, small-molecule glucose-dependent insulinotropic polypeptide receptor (GIPR) agonist

•Discovery efforts are ongoing for small molecule GIPR modulators for obesity, which have the potential for combination with GLP-1 receptor agonists, such as TERN-601

•Terns is prioritizing its discovery efforts on nominating a GIPR antagonist development candidate based on in-house discoveries and growing scientific rationale supporting the potential of GLP-1 agonist/GIPR antagonist combinations for obesity

Corporate Updates

•In September, Terns completed an upsized public offering of 14,064,048 shares of its common stock and 2,380,952 pre-funded warrants, generating gross proceeds of approximately $172.7 million before deducting underwriting discounts and commissions and other offering expenses, which extends the Company’s cash runway into 2028

•In July, Terns appointed Elona Kogan as Chief Legal Officer

Third Quarter 2024 Financial Results

Cash Position: As of September 30, 2024, cash, cash equivalents and marketable securities were $372.8 million, as compared with $263.4 million as of December 31, 2023. Based on its current operating plan, Terns expects these funds will be sufficient to support its planned operating expenses into 2028.

Research and Development (R&D) Expenses: R&D expenses were $15.2 million for the quarter ended September 30, 2024, as compared with $14.8 million for the quarter ended September 30, 2023.

General and Administrative (G&A) Expenses: G&A expenses were $9.8 million for the quarter ended September 30, 2024, as compared with $18.4 million for the quarter ended September 30, 2023.

Net Loss: Net loss was $21.9 million for the quarter ended September 30, 2024, as compared with $29.8 million for the quarter ended September 30, 2023.

Financial Tables

Terns Pharmaceuticals, Inc.

Condensed Consolidated Statements of Operations

(Unaudited; in thousands except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

15,169 |

|

|

$ |

14,831 |

|

|

$ |

52,108 |

|

|

$ |

46,038 |

|

General and administrative |

|

|

9,770 |

|

|

|

18,353 |

|

|

|

23,814 |

|

|

|

32,462 |

|

Total operating expenses |

|

|

24,939 |

|

|

|

33,184 |

|

|

|

75,922 |

|

|

|

78,500 |

|

Loss from operations |

|

|

(24,939 |

) |

|

|

(33,184 |

) |

|

|

(75,922 |

) |

|

|

(78,500 |

) |

Interest income |

|

|

3,088 |

|

|

|

3,480 |

|

|

|

9,146 |

|

|

|

9,568 |

|

Other expense, net |

|

|

(32 |

) |

|

|

(5 |

) |

|

|

(58 |

) |

|

|

(69 |

) |

Loss before income taxes |

|

|

(21,883 |

) |

|

|

(29,709 |

) |

|

|

(66,834 |

) |

|

|

(69,001 |

) |

Income tax expense |

|

|

(62 |

) |

|

|

(58 |

) |

|

|

(220 |

) |

|

|

(190 |

) |

Net loss |

|

$ |

(21,945 |

) |

|

$ |

(29,767 |

) |

|

$ |

(67,054 |

) |

|

$ |

(69,191 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share, basic and diluted |

|

$ |

(0.28 |

) |

|

$ |

(0.42 |

) |

|

$ |

(0.89 |

) |

|

$ |

(0.98 |

) |

Weighted average common stock outstanding, basic and diluted |

|

|

77,819,658 |

|

|

|

71,530,180 |

|

|

|

75,567,851 |

|

|

|

70,897,320 |

|

Terns Pharmaceuticals, Inc.

Selected Balance Sheet Data

(Unaudited; in thousands)

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

Cash, cash equivalents and marketable securities |

|

$ |

372,777 |

|

|

$ |

263,440 |

|

Total assets |

|

|

378,233 |

|

|

|

268,517 |

|

Total liabilities |

|

|

13,763 |

|

|

|

13,150 |

|

Total stockholders’ equity |

|

|

364,470 |

|

|

|

255,367 |

|

About Terns Pharmaceuticals

Terns Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company developing a portfolio of small-molecule product candidates to address serious diseases, including oncology and obesity. Terns’ pipeline contains three clinical stage development programs including an allosteric BCR-ABL inhibitor, a small-molecule GLP-1 receptor agonist, a THR-β agonist, and a preclinical GIPR modulator discovery effort, prioritizing a GIPR antagonist nomination candidate. For more information, please visit: www.ternspharma.com.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements about the Company within the meaning of the federal securities laws, including those related to expectations, timing and potential results of the clinical trials and other development activities of the Company and its partners; the potential indications to be targeted by the Company with its small-molecule product candidates; the therapeutic potential of the Company’s small-molecule product candidates; the potential for the mechanisms of action of the Company’s product candidates to be therapeutic targets for their targeted indications; the potential utility and progress of the Company’s product candidates in their targeted indications, including the clinical utility of the data from and the endpoints used in the Company’s clinical trials; the Company’s clinical development plans and activities, including the results of any interactions with regulatory authorities on its programs; the Company’s expectations regarding the profile of its product candidates, including efficacy, tolerability, safety, metabolic stability and pharmacokinetic profile and potential differentiation as compared to other products or product candidates; the Company’s plans for and ability to continue to execute on its current development strategy, including potential combinations involving multiple product candidates; the Company’s plans and expectations around the addition of key personnel; and the Company’s expectations with regard to its cash runway and sufficiency of its cash resources. All statements other than statements of historical facts contained in this press release, including statements regarding the Company’s strategy, future financial condition, future operations, future trial results, projected costs, prospects, plans, objectives of management and expected market growth, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “design,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “positioned,” “potential,” “predict,” “seek,” “should,” “target,” “will,” “would” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology. The Company has based these forward-looking statements largely on its current expectations, estimates, forecasts and projections about future events and financial trends that it believes may affect its financial condition, results of operations, business strategy and financial needs. In light of the significant uncertainties in these forward-looking statements, you should not rely upon forward-looking statements as predictions of future events. These statements are subject to risks and uncertainties that could cause the actual results and the implementation of the Company’s plans to vary materially, including the risks associated with the initiation, cost, timing, progress, results and utility of the Company’s current and future research and development activities and preclinical studies and clinical trials. These risks are not exhaustive. For a detailed discussion of the risk factors that could affect the Company’s actual results, please refer to the risk factors identified in the Company’s SEC reports, including but not limited to its Annual Report on Form 10-K for the year ended December 31, 2023. Except as required by law, the Company undertakes no obligation to update publicly any forward-looking statements for any reason.

Contacts for Terns

Investors

Justin Ng

investors@ternspharma.com

Media

Jenna Urban

Berry & Company Public Relations

media@ternspharma.com

v3.24.3

Document And Entity Information

|

Nov. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 12, 2024

|

| Entity Registrant Name |

Terns Pharmaceuticals, Inc.

|

| Entity Central Index Key |

0001831363

|

| Entity Emerging Growth Company |

true

|

| Entity File Number |

001-39926

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

98-1448275

|

| Entity Address, Address Line One |

1065 East Hillsdale Blvd.

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Foster City

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94404

|

| City Area Code |

(650)

|

| Local Phone Number |

525-5535

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

TERN

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

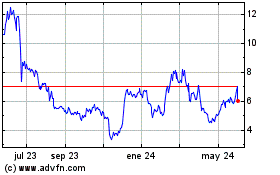

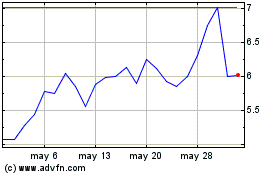

Terns Pharmaceuticals (NASDAQ:TERN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Terns Pharmaceuticals (NASDAQ:TERN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024