Filed Pursuant to Rule 424(b)(5)

Registration No. 333-252441

PROSPECTUS SUPPLEMENT

(To Prospectus Dated March 3, 2022)

5,263,158 Common Shares

We are offering 5,263,158

common shares pursuant to this prospectus supplement and the accompanying prospectus. The purchase price of each common share to the purchaser

identified in the securities purchase agreement dated October 30, 2024, by and among us and the purchaser listed on the signature pages

thereto (the “SPA”) is $0.95 per share.

Our common shares are listed

on The Nasdaq Capital Market under the symbol “TLSA.” On October 30, 2024, the last reported price of the common shares on

The Nasdaq Capital Market was $1.18 per share.

Pursuant to the SPA, the purchaser

has the right, in its sole discretion, to purchase an additional 5,263,158 common shares from us for a period of seventy-five (75) days

after the date hereof at the same price per share.

We have engaged Titan Partners

Group LLC, a division of American Capital Partners, LLC, to act as our exclusive placement agent (the “Placement Agent”) in

connection with this offering. The Placement Agent is not purchasing or selling any of the securities offered pursuant to this prospectus

supplement and the accompanying prospectus and the Placement Agent is not required to arrange the purchase or sale of any specific number

of securities or dollar amount and has agreed to use its reasonable best efforts to sell the securities offered by this prospectus supplement

and the accompanying prospectus. We have agreed to pay the Placement Agent certain cash fees set forth in the table below, which assumes

that we sell all of the securities we are offering pursuant to this prospectus supplement and accompanying prospectus, other than those

covered by the purchaser’s option described above. See “Plan of Distribution” beginning on page S-12 of this prospectus

supplement for additional information with respect to the compensation we will pay the Placement Agent.

Investing in the common

shares involves a high degree of risk. Before buying any securities, you should carefully consider the risk factors described in “Risk

Factors” beginning on page S-5 of this prospectus supplement, page 7 of the accompanying prospectus and in the

documents incorporated by reference into this prospectus supplement.

| | |

Per Share | | |

Total | |

| Offering Price | |

$ | 0.95 | | |

$ | 5,000,000 | |

| Placement Agent fees (1) | |

$ | 0.07125 | | |

$ | 375,000 | |

| Proceeds, before expenses, to us | |

$ | 0.87875 | | |

$ | 4,625,000 | |

| (1) |

Consists of a cash fee of 7.5% of the aggregate gross proceeds in this offering. We have also agreed to reimburse the Placement Agent for certain expenses incurred in connection with this offering, See “Plan of Distribution” beginning on page S-12 of this prospectus supplement for additional information with respect to the compensation we will pay the Placement Agent. |

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the securities

offered hereby is expected to be made on or about November 1, 2024, subject to satisfaction of certain customary closing conditions.

Titan Partners Group

a division of American Capital Partners

The date of this prospectus supplement is October

30, 2024

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This prospectus supplement

and the accompanying prospectus are part of a shelf registration statement that we filed with the Securities and Exchange Commission (the

“Commission”) using a “shelf” registration process. This prospectus supplement amends and supplements the information

contained in the prospectus filed as a part of our registration statement on Form F-3 (File No. 333-252441), which was declared effective

as of March 3, 2022 (the “Registration Statement”). This document is in two parts. The first part is the prospectus supplement,

including the documents incorporated by reference, which describes the specific terms of this offering. The second part, the accompanying

prospectus, including the documents incorporated by reference, provides more general information. Generally, when we refer to this prospectus

supplement, we are referring to both parts of this document combined. We urge you to carefully read this prospectus supplement and the

accompanying prospectus, and the documents incorporated by reference herein and therein, before buying any of the securities being offered

under this prospectus supplement. This prospectus supplement may add, update or change information contained in the accompanying prospectus.

To the extent that any statement that we make in this prospectus supplement is inconsistent with statements made in the accompanying prospectus

or any documents incorporated by reference therein filed prior to the date of this prospectus supplement, the statements made in this

prospectus supplement will be deemed to modify or supersede those made in the accompanying prospectus and such documents incorporated

by reference therein.

Before buying any of the common

shares offered hereby, we urge you to carefully read this prospectus supplement and the accompanying prospectus, together with the information

incorporated by reference as described under the heading “Where You Can Find More Information” and “Incorporation of

Documents by Reference.” These documents contain important information that you should consider when making your investment decision.

To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information

contained in any document incorporated by reference in this prospectus that was filed with the SEC before the date of this prospectus

supplement, on the other hand, you should rely on the information in this prospectus supplement, provided that if any statement in one

of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated

by reference in this prospectus supplement—the statement in the document having the later date modifies or supersedes the earlier

statement.

“Tiziana,” the

Tiziana logo and other trademarks or service marks of Tiziana Life Sciences Ltd. appearing in this prospectus supplement are the property

of Tiziana or its subsidiaries. This prospectus supplement contains additional trade names, trademarks and service marks of others, which

are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus supplement

may appear without the ® or TM symbols.

In this prospectus supplement,

except where the context otherwise requires and for purposes of this prospectus supplement only:

| |

● |

“we,” “us,” “our company,” “the Company,” “the registrant,” “our,” “Tiziana” and “Tiziana Life Sciences Ltd.” refer to Tiziana Life Sciences Ltd. and its wholly-owned subsidiaries, Tiziana Therapeutics, Inc., Tiziana Pharma Limited. and Longevia Genomics S.r.l.; |

| |

● |

“shares” refer to our ordinary shares; |

| |

● |

discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding. |

No action is being taken in

any jurisdiction outside the United States to permit a public offering of the common shares or possession or distribution of this prospectus

supplement in that jurisdiction. Persons who come into possession of this prospectus supplement in a jurisdiction outside of the United

States are required to inform themselves about and to observe any restrictions that are applicable to that jurisdiction, as to this offering

and the distribution of this prospectus supplement.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus supplement,

including the documents that we incorporate by reference, contain forward-looking statements within the meaning of Section 27A of the

Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All statements, other than statements

of historical facts, contained in this prospectus supplement, including statements regarding our future results of operations and financial

position, business strategy, prospective products, product approvals, research and development costs, timing and likelihood of success,

plans and objectives of management for future operations, and future results of current and anticipated products, are forward-looking

statements. These statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties

and other factors which may cause our actual results, performance or achievements to be materially different from any future results,

performance or achievements expressed or implied by the forward-looking statements. The words “anticipate,” “assume,”

“believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,”

“goal,” “intend,” “may,” “might,” “objective,” “plan,” “potential,”

“predict,” “project,” “positioned,” “seek,” “should,” “target,”

“will,” “would,” or the negative of these terms or other similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are based on

current expectations, estimates, forecasts and projections about our business and the industry in which we operate and management’s

beliefs and assumptions, are not guarantees of future performance or development and involve known and unknown risks, uncertainties and

other factors.

Actual results or events could

differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. As a result, any or

all of our forward-looking statements in this prospectus supplement may turn out to be inaccurate. We have included important factors

in the cautionary statements included in this prospectus supplement and the documents that we incorporate by reference, particularly in

the sections of this prospectus titled “Risk Factors,” that we believe could cause actual results or events to differ materially

from the forward-looking statements that we make. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking

statements, and you should not place undue reliance on our forward-looking statements. Moreover, we operate in a highly competitive and

rapidly changing environment in which new risks often emerge. It is not possible for our management to predict all risks, nor can we assess

the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statements we may make. Our forward-looking statements do not reflect the potential

impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

You should read this prospectus

supplement, the accompanying prospectus and the documents that we incorporate by reference in this prospectus supplement and have filed

as exhibits to the registration statement of which this prospectus supplement is a part completely and with the understanding that our

actual future results may be materially different from what we expect. The forward-looking statements contained in this prospectus supplement

are made as of the date on the front cover of this prospectus supplement, and we do not assume any obligation to update any forward-looking

statements except as required by applicable law and regulation.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights

information contained elsewhere or incorporated by reference into this prospectus supplement. This summary does not contain all of the

information that you should consider before deciding to invest in our securities. You should read this entire prospectus supplement and

the accompanying prospectus carefully, including the “Risk Factors” section contained in this prospectus supplement, the accompanying

prospectus and our consolidated financial statements and the related notes and the other documents incorporated by reference into this

prospectus supplement and the accompanying prospectus.

Overview

We

are a biotechnology company that specializes in developing transformative therapies for neurodegenerative and lung diseases. Our clinical

pipeline includes drug assets for Secondary Progressive Multiple Sclerosis (SPMS), amyotrophic lateral sclerosis (ALS),

Alzheimer’s disease, and KRAS+ NSCLC. Tiziana is led by a team of highly qualified executives with extensive drug development and

commercialization experience. Our mission is to bring breakthrough therapies to patients with the aim of treating SPMS, ALS, Alzheimer’s

disease, and other CNS indications. Crohn’s Disease, lung diseases and optimizing health outcomes. We are developing transformational

formulation technologies, enabling to switch from traditional routes to alternative routes of immunotherapy to facilitate local site

of action. For example, nasal, oral and inhalation administrations to target neurodegenerative and lung diseases. We believe, if we succeed

in these alternative routes of immunotherapies that has the potential to change the way immunotherapies are currently utilized.

We

employ a lean and virtual research and development, or R&D, model using highly experienced teams of experts for each business function

to maximize value accretion by focusing resources on the drug discovery and development processes.

We

are developing foralumab, for which we in-licensed the intellectual property from Novimmune SA, or Novimmune, in December 2014, as a potential

treatment for neurodegenerative diseases such as SPMS, Crohn’s disease and delayed onset of Type I Diabetes (T1D). On November 10,

2022, we announced a short-term focus on administration of intranasal foralumab for treatment of neurodegenerative diseases, especially

SPMS, based on positive clinical findings of Expanded Access (EA) SPMS patients at Brigham and Women’s Hospital treated with intranasal

foralumab for up to 1 year. As the only fully human engineered human anti-CD3 mAb in clinical development, foralumab has significant potential

advantages such as a shorter treatment duration and reduced immunogenicity. We believe that oral or intranasal administration of foralumab

has the potential to reduce inflammation while minimizing the toxicity and related side effects. To date, foralumab has been studied in

one Phase 1 and two Phase 2a clinical trials conducted by Novimmune in 68 patients dosed by the intravenous route of administration. In

these trials, foralumab was observed to be safe and well-tolerated and produced immunologic effects consistent with potential clinical

benefit while demonstrating mild to moderate infusion related reactions, or IRRs. With completion of the intravenous dosing for Phase

2a trial in Crohn’s Disease, foralumab’s ability to modulate T-cell response enables potential extension into a wide range

of other autoimmune and inflammatory diseases, such as Graft versus Host Disease (GvHD), ulcerative colitis (UC), multiple sclerosis (MS),

T1D, inflammatory bowel disease (IBD), psoriasis (PSA) and rheumatoid arthritis (RA).

On

August 15, 2023, we announced that the FDA cleared the IND application for intranasal foralumab to be studied in Alzheimer’s

disease. The clinical trial will be overseen by Brigham and Women’s Hospital.

On

September 26, 2023, we announced initiation of the Phase 2a multicenter clinical trial for treatment of non-active SPMS patients with

intranasal foralumab. We announced that we held an Investigator’s Meeting with principal

investigators at Brigham and Women’s Hospital to begin site initiation for the clinical trial. In total, six to ten new clinical

trial sites will be recruited.

On

December 19, 2023, we announced “first patient dosed” in our Phase 2a study comparing

two doses of intranasal foralumab and placebo in patients with non-active SPMS. Six investigational centers have been recruited

for this double-blind, placebo-controlled trial, with up to 18 patients per treatment arm. The primary endpoint of the trial will be the

change in microglial activation based on PET scans. Clinical evaluations include the Expanded Disability Status Scale (EDSS), QoL assessments,

and the Modified Fatigue Impact Scale (MFIS), which assess parameters that are essential to a patient’s everyday life. Novel immuno-biomarkers

will be measured also and assessed for predictive relevance. Central review of PET scans and images is an integral component of this study.

On

April 23, 2024, we announced that the FDA had allowed its intranasal foralumab non-active SPMS EA Program to expand from 10 patients to

a total of 30 patients. Up until April 2024, of the 10 participating patients, two patients had been dosed for more than one year and

eight additional patients had been dosed for six months, all without serious side effects. All patients had either stabilized or improved

on treatment with foralumab, and no patients have declined in key clinical measures. Additionally, 70% of these patients had seen a measurable

improvement in fatigue. These data were the first to combine PET imaging with a novel ligand, immune-biomarkers, clinical measures and

comprehensive safety data endpoints in patients receiving long-term intranasal foralumab. Patients not eligible for the Phase 2a trial

may now be considered for this expanded EA Program.

On

May 13, 2024, we announced we had submitted an FDA request to obtain Orphan Drug Designation for

intranasal foralumab for the treatment of non-active SPMS. This request would make foralumab the first therapy for na-SPMS to receive

Orphan Drug Designation. Our request is supported by clinical and non-clinical evidence of foralumab’s effectiveness in na-SPMS.

The prevalence estimates, in part, are supported from the Brigham & Women’s Hospital, Boston, Massachusetts, longitudinal study,

the CLIMB data of which allowed the estimate of na-SPMS in the population. The FDA have requested further information from us with

regards to this request.

On

June 26, 2024, we announced that the FDA had allowed intranasal foralumab to be used under an EA IND in its first patient with moderate

Alzheimer’s disease. Expanded access IND’s provide a pathway for patients to gain access to investigational drugs, biologics,

and medical devices used to diagnose, monitor, or treat patients with serious diseases or conditions for which there are no comparable

or satisfactory therapy options available outside of clinical trial.

Recent Developments

On

July 24, 2024, we announced that the FDA has granted Fast Track designation for our intranasal formulation of foralumab for the treatment

of non-active SPMS.

On

August 19, 2024, we announced that Ivor Elrifi has been appointed as our new Chief Executive Officer. Dr. Elrifi was formerly the global

head of the Patent Group at Cooley since 2014 and before that the global head of Patents at Mintz Levin from 1999 – 2014. He has

counseled companies in various key industries, including pharmaceutical, biotechnology, life sciences and medical device companies, research

institutions, universities, hospitals and governments throughout the world, particularly in the US and Europe. Ivor has guided clients

in developing and implementing intellectual property strategies and in the prosecution, licensing and enforcement of patents. He has extensive

experience in advising clients on strategic transactional work and regularly counsels’ clients with respect to investments, business

development and mergers and acquisitions, including acquisition transactions involving Novartis, Eli Lilly, Biogen and Astellas.

On

September 19, 2024, we announced that the National Institutes of Health, National Institute on Aging has awarded a $4 million grant to

Dr. Howard Wiener as principal investigator at Brigham and Women’s Hospital to be the key research site, to study nasal anti-CD3

for the treatment of Alzheimer’s disease.

On

October 25, 2024, we entered into an Open Market Sale Agreement℠ with Jefferies LLC, relating to the issuance and sale of our common

shares of up to $50,000,000 from time to time through or to Jefferies, acting as sales agent. The offering of our common shares pursuant

to the Sales Agreement will terminate upon the earlier of (i) the sale of all common shares subject to the Sales Agreement and (ii) the

termination of the Sales Agreement as permitted therein.

On

October 30, 2024, we announced positive results demonstrating the anti-inflammatory potential of foralumab in combination with semaglutide,

a GLP-1 agonist marketed by Novo Nordisk under the brand names Ozempic and Wegovy. The data show that the combination of nasal anti-CD3

plus semaglutide improves liver homeostasis and reduces inflammation in models of diet-induced obesity, providing a potential novel approach

to combat obesity-related inflammation, and liver inflammation and dysfunction.

Risks Associated with Our Business

Our business is subject to

numerous risks. You should read these risks before you invest in our securities. In particular, our risks include, but are not limited

to, the following:

| |

● |

We may fail to demonstrate the safety and therapeutic utility of our product candidates to the satisfaction of applicable regulatory authorities, which would prevent or delay regulatory approval and commercialization. |

| |

● |

We depend on enrollment of patients in our clinical trials for our product candidates and may find it difficult to enroll patients in our clinical trials, which could delay or prevent us from proceeding with clinical trials of our product candidates and could materially adversely affect our research and development efforts and business, financial condition and results of operations. |

| |

● |

We have incurred net losses in every year since our inception. We anticipate that we will continue to incur losses for the foreseeable future and may never achieve or maintain profitability. |

| |

● |

We need substantial additional funding to complete the development of our product candidates, which may not be available on acceptable terms, if at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate certain of our product development, research operations or future commercialization efforts, if any. |

| |

● |

We rely, and expect to continue to rely, on third parties to conduct our preclinical studies and clinical trials and for product manufacturing. If these third parties do not successfully carry out their contractual duties or meet expected deadlines, we may not be able to obtain regulatory approval for or commercialize our product candidates. |

| |

● |

Our rights to develop and commercialize our product candidates are subject to the terms and conditions of licenses granted to us by others. If we fail to comply with our obligations under our existing and any future intellectual property licenses with third parties, we could lose license rights that are important to the business. |

| |

● |

If our competitors are able to obtain orphan drug exclusivity for products that constitute the same drug and treat the same indications as our product candidates, we may not be able to have competing products approved by applicable regulatory authorities for a significant period of time. In addition, even if we obtain orphan drug exclusivity for any of our products, such exclusivity may not protect us from competition. |

| |

● |

Healthcare legislative reform measures may have a negative impact on our business and results of operations. |

| |

● |

Our common shares may be delisted from The Nasdaq Capital Market if we fail to comply with continued listing standards. |

| |

● |

Because we are a foreign corporation, you may not have the same rights as a shareholder in a U.S. corporation. |

| |

● |

Claims of U.S. civil liabilities may not be enforceable against us. |

| |

● |

If we are a passive foreign investment company, there could be adverse U.S. federal income tax consequences to U.S. holders. |

Corporate Information

We were originally incorporated

under the laws of England and Wales on February 11, 1998 with the goal of leveraging the expertise of our management team as well

as Dr. Napoleone Ferrara, Dr. Arun Sanyal, Dr. Howard Weiner and Dr. Kevan Herold, and to acquire and exploit certain intellectual property

in biotechnology. We subsequently changed our name to Tiziana Life Sciences plc in April 2014 as a result of the acquisition of Tiziana

Pharma Limited in April 2014. On August 20, 2021 we announced that we had formally commenced a strategic

plan to change our corporate structure by establishing Tiziana Life Sciences Ltd, a Bermuda-incorporated company, to become the ultimate

parent company of the Tiziana Group. The reorganization was performed under a scheme of arrangement under Part 26 of the UK Companies

Act 2006 and became effective on October 20, 2021, at which point all shareholders became shareholders in the new Bermuda company.

Our registered office is located

at Clarendon House, 2 Church Street, Hamilton HM 11, Bermuda and our telephone number is +44 (0) 20 7495 2379. Our website address is

www.tizianalifesciences.com. The reference to our website is an inactive textual reference only and the information contained in,

or that can be accessed through, our website is not a part of this registration statement. Our agent for service of process in the United

States is Tiziana Therapeutics, Inc.

The Offering

| Common shares offered by us |

|

5,263,158 shares |

| |

|

|

| Offering price |

|

$0.95 per share |

| |

|

|

|

Common shares to be outstanding immediately after this offering (1)

|

|

110,659,412 shares. |

| |

|

|

| Use of Proceeds |

|

We intend to use net proceeds from this offering towards (i) our Phase 2a clinical trial for the intra-nasal delivery of foralumab in patients with non-active secondary progressive multiple sclerosis, (ii) expediting the clinical development of foralumab in Alzheimer’s disease, (iii) developing foralumab for other indications, and (iv) for working capital and other general corporate purposes. See “Use of Proceeds” on page S-10. |

| |

|

|

| Nasdaq Capital Market symbol |

|

“TLSA.” |

| |

|

|

| Risk Factors |

|

This investment involves a high degree of risk. See “Risk Factors” beginning on page S-5 of this prospectus supplement, page 7 of the accompanying prospectus as well as the other information included in or incorporated by reference in this prospectus supplement for a discussion of risks you should consider carefully before making an investment decision. |

| (1) |

The number of shares of our common shares that will be outstanding after this offering is based on 105,396,254 common shares outstanding as of October 30, 2024, and excludes as of that date: |

| |

● |

7,733,754 common shares issuable upon the exercise of share options at exercise prices of between $0.50 and $3.72 per common share; |

| |

● |

4,200,000

common shares issuable upon the vesting of restricted stock units (RSU’s); and |

| |

|

|

| |

● |

Up to 5,263,158 common shares that may be issued to the purchaser under

the securities purchase agreement at a price of $0.95 per share until January 13, 2025. |

Unless otherwise indicated,

this prospectus supplement reflects and assumes no exercise of outstanding share options or warrants after October 30, 2024.

RISK FACTORS

An investment in the common

shares involves a high degree of risk. Prior to making a decision about investing in these securities, you should carefully consider the

specific risks, uncertainties and assumptions discussed under the heading “Risk Factors” included in our most recent Annual

Report on Form 20-F, all of which are incorporated herein by reference, and may be amended, supplemented or superseded from time to time

by other reports we file with the SEC in the future. Our business, financial condition or results of operations could be materially adversely

affected by any of these risks which cause you to lose all or part of your investment in the offered securities. Certain statements in

this prospectus supplement, the accompanying prospectus and the documents incorporated by reference into the prospectus supplement are

forward-looking statements. Please also see the section entitled “Cautionary Statement Regarding Forward-Looking Statements.”

Risks Related to the Offering

We may lose our foreign private issuer status

in the future, which would result in significant additional costs and expenses.

In the future, we may lose

our foreign private issuer status if a majority of our shareholders and a majority of our directors or management are US citizens or residents.

If we lose our foreign private issuer status, we will have to mandatorily comply with US federal proxy requirements, and our officers,

directors and principal shareholders will become subject to the short-swing profit disclosure and recovery provisions of Section 16 of

the Exchange Act. We will be required to file periodic reports and registration statements on US domestic issuer forms containing financial

statements prepared in accordance with US generally accepted accounting principles with the SEC, which are more detailed and extensive

than the forms available to a foreign private issuer. In addition, if we lose our status as a foreign private issuer we will become subject

to the Nasdaq corporate governance requirements. As a result, the regulatory and compliance costs to us may be significantly higher if

we cease to qualify as a foreign private issuer.

Our senior management team may invest or

spend the net proceeds of this offering, if any, in ways with which you may not agree or in ways which may not yield a significant return.

Our senior management will

have broad discretion over, and we could spend, the net proceeds from this offering, if any, in ways with which the holders of common

shares may not agree or that do not yield a favorable return, if any. We expect to use our existing cash and cash equivalents and the

net proceeds from this offering, if any, (i) complete our Phase 2a clinical trial for the intra-nasal delivery of foralumab in patients

with non-active secondary progressive multiple sclerosis, (ii) to expedite the clinical development of foralumab in Alzheimer’s

disease, (iii) to develop foralumab for other indications, and (iv) for working capital and other general corporate purposes. We may also

use a portion of the net proceeds from this offering to in-license, acquire or invest in complementary businesses, technologies, products

or assets, however, we have no current commitments or obligations to do so. Furthermore, our senior management will have considerable

discretion in the application of the net proceeds, and you will not have the opportunity, as part of your investment decision, to assess

whether the net proceeds are being used appropriately. The net proceeds may be used for corporate purposes that do not improve our operating

results or enhance the value of our common shares.

We

need substantial additional funding to complete the development of our product candidates, which may not be available on acceptable terms,

if at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate certain of our product development,

research operations or future commercialization efforts, if any.

Our

operations have consumed substantial amounts of cash since inception, and we expect our expenses to increase in connection with our ongoing

activities, particularly as we continue the R&D of, initiate further clinical trials of and seek marketing approval for, our product

candidates. In addition, if we obtain marketing approval for our product candidates, we expect to incur significant expenses related to

product sales, marketing, manufacturing and distribution. Furthermore, we expect to incur additional costs associated with operating as

a public company listed on the Nasdaq in the United States. Our future capital requirements will depend on many factors, including:

| |

● |

the scope, progress, results and costs of laboratory testing, manufacturing, preclinical and clinical development for our current and future product candidates; |

| |

● |

the costs, timing and outcome of regulatory review of our product candidates; |

| |

● |

the extent to which we acquire or in-license and develop other product candidates and technologies; |

| |

● |

our ability to establish and maintain collaborations and license agreements on favorable terms, if at all; |

| |

● |

the costs, timing and outcome of potential future commercialization activities, including manufacturing, marketing, sales and distribution for our product candidates for which we receive marketing approval; |

| |

● |

the costs of developing, maintaining and enforcing our intellectual property rights and defending intellectual property-related claims; and |

| |

● |

the sales price and availability of adequate third-party coverage and reimbursement for our product candidates, if and when approved. |

Developing

product candidates and conducting preclinical studies and clinical trials is a time-consuming, expensive and uncertain process that takes

years to complete, and we may never generate the necessary data or results required to obtain marketing approval and achieve product sales.

In addition, our product candidates, if approved, may not achieve commercial success. Our product revenues, if any, will be derived from

or based on sales of product candidates that may not be commercially available for many years, if at all. Accordingly, we will need to

continue to rely on additional financing to achieve our business objectives. Adequate additional financing may not be available to us

on acceptable terms, if at all. To the extent that additional capital is raised through the issuance of equity or equity-linked securities,

the issuance of those securities could result in substantial dilution for our current shareholders and the terms of any future issuance

may include liquidation or other preferences that adversely affect the rights of our current shareholders. Debt financing, if available,

may involve covenants restricting our operations or our ability to incur additional debt. Any debt or additional equity financing that

we raise may contain terms that are not favorable to us or our shareholders. If we raise additional funds through collaboration and licensing

arrangements with third parties, it may be necessary to relinquish some rights to our technologies or our product candidates or grant

licenses on terms that are not favorable to us. Furthermore, the potential issuance of additional securities in the future, whether equity

or debt, by us, or the possibility of such issuance, may cause the market price of our common shares, to decline and existing shareholders

may not agree with our financing plans or the terms of such financings.

If

we are unable to obtain adequate funding on a timely basis, we may be required to significantly curtail, delay or discontinue our R&D

programs of our product candidates or any future commercialization efforts, be unable to expand our operations or be unable to otherwise

capitalize on our business opportunities, as desired, which could harm our business and potentially cause us to discontinue operations.

You will experience immediate and substantial

dilution in the net tangible book value per share of the common shares you purchase.

Based on an offering price

of $0.95 per share, and a net tangible book value of $1.9 million, or approximately $0.18 per common share, as of June 30, 2024, if you

purchase securities in this offering (excluding up to 5,263,158 common shares that may be issued to the purchaser under the securities

purchase agreement at a price of $0.95 per share until January 13, 2025), you will experience dilution of approximately $0.89 per share

in the net tangible book value of the common shares you purchase representing the difference between our as adjusted pro forma net tangible

book value per share after giving effect to this offering and the offering price per share of our common shares. The exercise of outstanding

stock options and warrants will result in further dilution of your investment.

Our common shares

may be delisted from The Nasdaq Capital Market if we fail to comply with continued listing standards.

If

we fail to meet any of the continued listing standards of The Nasdaq Capital Market, our common shares could be delisted from The Nasdaq

Capital Market. These continued listing standards include specifically enumerated criteria, such as:

| |

● |

a $1.00 minimum closing bid price; |

| |

● |

stockholders’ equity of $2.5 million; |

| |

● |

500,000 shares of publicly-held common stock with a market value of at least $1 million; |

| |

● |

300 round-lot stockholders; and |

| |

● |

compliance with Nasdaq’s corporate governance requirements, as well as additional or more stringent criteria that may be applied in the exercise of Nasdaq’s discretionary authority. |

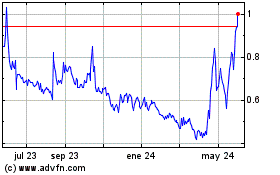

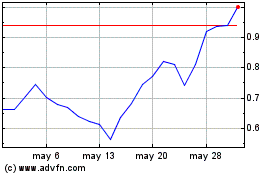

On

June 14, 2022, we received a written notice (the “Notice”) from the Nasdaq Stock Market LLC (“Nasdaq”) notifying

us that were not in compliance with Nasdaq Listing Rule 5550(a)(2) (the “Rule”), as the minimum bid price of the Company’s

common shares has been below $1.00 per share for 30 consecutive business days. On December 13, 2022, Nasdaq notified us that we were eligible

for an additional 180 calendar day period, or until June 12, 2023, to regain compliance.

On

April 21, 2023, we received notice from Nasdaq that we had regained compliance with the minimum bid price requirement for continued listing

on The Nasdaq Capital Market.

On

July 19, 2023, we received Notice from Nasdaq notifying us that were not in compliance with the Rule, as the minimum bid price of the

Company’s common shares has been below $1.00 per share for 30 consecutive business days and that we have until January 16, 2024

to regain compliance. On January 22, 2024, Nasdaq informed us that we were provided an additional 180 calendar day compliance period,

or until July 15, 2024 to demonstrate compliance.

On August 14, 2024, we

announced that Nasdaq informed us that we regained compliance with the minimum bid price requirement for continued listing on The Nasdaq

Capital Market.

If

we fail to comply with Nasdaq’s continued listing standards, we may be delisted and our common shares will trade, if at all, only

on the over-the-counter market, such as the OTC Bulletin Board or OTCQX market, and then only if one or more registered broker-dealer

market makers comply with quotation requirements. In addition, delisting of our common shares could depress our stock price, substantially

limit liquidity of our common shares and materially adversely affect our ability to raise capital on terms acceptable to us, or at all.

Finally, delisting of our common shares could result in our common shares becoming a “penny stock” under the Exchange Act.

The prices of the common shares may be volatile

and fluctuate substantially, which could result in substantial losses for holders of the common shares.

The market prices of the common

shares on The Nasdaq Capital Market may be volatile and fluctuate substantially. The stock market in general and the market for smaller

pharmaceutical and biotechnology companies in particular have experienced extreme volatility that has often been unrelated to the operating

performance of particular companies. As a result of this volatility, holders of the common shares may not be able to sell their common

shares at or above the price at which they were purchased. The market price for the common shares may be influenced by many factors, including:

| |

● |

the success of competitive products or technologies; |

| |

● |

results of clinical trials of foralumab, anti-IL6R mAb (TZLS-501), Milciclib and any other future product candidate that we develop; |

| |

● |

results of clinical trials of product candidates of our competitors; |

| |

● |

changes or developments in laws or regulations applicable to foralumab, anti-IL6R mAb (TZLS-501), Milciclib and any other future product candidates that we develop; |

| |

● |

our entry into, and the success of, any collaboration agreements with third parties; |

| |

● |

developments or disputes concerning patent applications, issued patents or other proprietary rights; |

| |

● |

the recruitment or departure of key personnel; |

| |

● |

the level of expenses related to any of our product candidates or clinical development programs; |

| |

● |

the results of our efforts to discover, develop, acquire or in-license additional product candidates, products or technologies; |

| |

● |

actual or anticipated changes in estimates as to financial results, development timelines or recommendations by securities analysts; |

| |

● |

variations in our financial results or those of companies that are perceived to be similar to us; |

| |

● |

market conditions in the biotechnology and pharmaceutical sectors; |

| |

● |

general economic, industry and market conditions; |

| |

● |

the trading volume of common shares on The Nasdaq Capital Market; and the other factors described in this “Risk Factors” section. |

If securities or industry analysts cease

to publish research reports about us or our industry, or if they adversely change their recommendations regarding our common shares, the

market price for the common shares and trading volume could decline.

The trading market for the

common shares is influenced by research reports that industry or securities analysts publish about us or our industry. If one or more

analysts who cover us downgrade the common shares, the market price for the common shares would likely decline. If one or more of these

analysts ceases coverage of us or fails to regularly publish reports on us, we could lose visibility in the financial markets, which,

in turn, could cause the market price or trading volume for the common shares to decline.

We have no present intention to pay dividends

on our common shares in the foreseeable future and, consequently, your only opportunity to achieve a return on your investment during

that time is if the price of the common shares appreciates.

We have never paid or declared

any cash dividends on our common shares, and we do not anticipate paying any cash dividends on our common shares in the foreseeable future.

We intend to retain all available funds and any future earnings to fund the development and expansion of our business. Under the Companies

Act 1981 of Bermuda, which we refer to in this prospectus as the “Companies Act” we may declare or pay a dividend only if

we have reasonable grounds for believing that we are, or would after the payment be, able to pay our liabilities as they become due and

if the realizable value of our assets would thereby be less than our liabilities. Any declaration of a dividend by our board of directors

will depend on many factors, including our financial condition, results of operations, legal requirements and other factors. Accordingly,

if the price of the common shares falls in the foreseeable future, you will incur a loss on your investment, without the likelihood that

this loss will be offset in part or at all by potential future cash dividends.

We are an “emerging

growth company,” and the reduced disclosure requirements applicable to emerging growth companies may make our common shares less

attractive to investors.

We

are an “emerging growth company” as defined in the SEC’s rules and regulations and we will remain an emerging growth

company until the earlier to occur of (a) the last day of the fiscal year (1) following the fifth anniversary of the completion of this

offering, (2) in which we have total annual gross revenues of at least $1.235 billion or (3) in which we are deemed to be a “large

accelerated filer” under the rules of the SEC, which means the market value of our common shares that are held by non-affiliates

exceeds $700.0 million as of the prior December 31, or (b) the date on which we have issued more than $1.0 billion in non-convertible

debt during the prior three-year period. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions

from certain disclosure requirements that are applicable to other public companies that are not emerging growth companies. These exemptions

include:

| |

● |

not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, or Section 404; |

| |

● |

not being required to comply with any requirement that has or may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

| |

● |

being permitted to provide only two years of audited financial statements in this prospectus, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s discussion and analysis of financial condition and results of operations” disclosure; |

| |

● |

reduced disclosure obligations regarding executive compensation; and |

| |

● |

an exemption from the requirement to seek nonbinding advisory votes on executive compensation or golden parachute arrangements. |

We

may choose to take advantage of some, but not all, of the available exemptions. We have taken advantage of reduced reporting burdens in

this prospectus. In particular, we have not included all of the executive compensation information that would be required if we were not

an emerging growth company. We cannot predict whether investors will find our common shares less attractive if we rely on certain or all

of these exemptions. If some investors find our common shares less attractive as a result, there may be a less active trading market for

our common shares and our common share price may be more volatile.

In

addition, the JOBS Act provides that an emerging growth company may take advantage of an extended transition period for complying with

new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting standards until

those standards would otherwise apply to private companies. We have elected to take advantage of the extended transition period for complying

with new or revised accounting standards and, as a result, our financial statements may not be comparable to companies that comply with

new or revised accounting pronouncements as of public company effective dates.

Even

after we no longer qualify as an emerging growth company, we may still qualify as a “smaller reporting company” if the market

value of our common shares held by non-affiliates is below $250 million (or $700 million if our annual revenue is less than $100 million)

as of June 30 in any given year, which would allow us to take advantage of many of the same exemptions from disclosure requirements, including

reduced disclosure obligations regarding executive compensation in our periodic reports and, when required, our proxy statements.

USE OF PROCEEDS

We expect to receive net proceeds

from this offering of approximately $4.4 million, after deducting the Placement Agent fees and estimated offering expenses payable by

us, excluding the up to 5,263,158 common shares that may be issued to the purchaser under the securities purchase agreement at a price

of $0.95 per share until January 13, 2025.

We currently intend to use

the net proceeds from the sale of the securities offered hereby towards (i) our Phase 2a clinical trial for the intra-nasal delivery of

foralumab in patients with non-active secondary progressive multiple sclerosis, (ii) expediting the clinical development of foralumab

in Alzheimer’s disease, (iii) developing foralumab for other indications, and (iv) for working capital and other general corporate

purposes. We may also use a portion of the net proceeds from this offering to in-license, acquire or invest in complementary businesses,

technologies, products or assets, however, we have no current commitments or obligations to do so.

Management’s plans for

the use of the proceeds of this offering are subject to change due to unforeseen events and opportunities, and the amounts and timing

of our actual expenditures depend on several factors, including our expansion plans and the amount of cash generated or used by our operations.

We cannot specify with certainty the particular uses for the net proceeds to be received upon completion of this offering. Accordingly,

our management will have broad discretion in using the net proceeds of this offering. Pending the use of the net proceeds, we intend to

invest the net proceeds in short-term, investment-grade, interest-bearing instruments.

DILUTION

If you purchase common shares

in this offering, your ownership interest in us will be diluted to the extent of the difference between the public offering price per

common share you will pay in this offering and the pro forma net tangible book value per common share after this offering.

Our historical net tangible

book value as of June 30, 2024, was approximately $1.9 million, corresponding to a net tangible book value of $0.02 per common share,

as of such date. We calculate our historical net tangible book value per share or per common share by taking the amount of our total tangible

assets, subtracting the amount of our total liabilities, and then dividing the difference by the actual total number of common shares

outstanding.

After giving effect to the

sale of 5,263,158 common shares at an offering price of $0.95, and after deducting estimated offering expenses and placement agent fees

payable by us, our as adjusted net tangible book value as of June 30, 2024 would have been would have been $0.89 per common

share. This represents an immediate increase in net tangible book value of $0.06 per common share to existing shareholders and an immediate

dilution of $0.89 per common share to new investors purchasing common shares in this offering. Dilution per common share to new investors

is determined by subtracting the as adjusted net tangible book value per common share after this offering from the public offering price

per common share paid by new investors.

The following table illustrates

this dilution:

| Public offering price per common share | |

| | | |

$ | 0.95 | |

| Net tangible book value per common share as at June 30, 2024 | |

$ | 0.02 | | |

| | |

| Increase in net tangible book value per common share attributable to purchasers purchasing common shares in this offering | |

$ | 0.04 | | |

| | |

| As adjusted net tangible book value per common share | |

| | | |

$ | 0.06 | |

| Dilution per common share to purchasers in this offering | |

| | | |

$ | 0.89 | |

The number of shares of our

common shares that will be outstanding after this offering is based on 105,396,254 common shares outstanding as of June 30, 2024, and

excludes as of that date:

| |

● |

7,733,754 common shares issuable upon the exercise of share options at exercise prices of between $0.50 and $3.72 per common share; |

| |

● |

4,200,000 common shares issuable upon the vesting of RSUs; and |

| |

|

|

| |

● |

Up to 5,263,158 common shares that may be issued to the purchaser under

the securities purchase agreement at a price of $0.95 per share until January 13, 2025.. |

PLAN OF DISTRIBUTION

Titan Partners Group LLC,

a division of American Capital Partners, LLC (“Titan”, or the “Placement Agent”) has agreed to act as our exclusive

placement agent in connection with this offering subject to the terms and conditions of the placement agency agreement dated October 30,

2024. The Placement Agent is not purchasing or selling any of the securities offered by this prospectus supplement, nor is it required

to arrange the purchase or sale of any specific number or dollar amount of securities, but has agreed to use its reasonable best efforts

to arrange for the sale of all of the securities offered hereby. Therefore, we will enter into a securities purchase agreement directly

with an investor in connection with this offering and we may not sell the entire amount of securities offered pursuant to this prospectus

supplement.

We will deliver the securities

being issued to the investor upon receipt of such investor’s funds for the purchase of the securities offered pursuant to this prospectus

supplement. We expect to deliver the initial securities being offered pursuant to this prospectus supplement, on or about November 1,

2024.

We have agreed to indemnify

the Placement Agent against specified liabilities, including liabilities under the Securities Act, and to contribute to payments the Placement

Agent may be required to make in respect thereof.

Fees and Expenses

We have agreed to pay the Placement Agent a fee

based on the aggregate proceeds as set forth in the table below:

| | |

Per Share | | |

Total | |

| Public offering price | |

$ | 0.95 | | |

$ | 5,000,000 | |

| Placement Agent fees(1)

(2) | |

$ | 0.7125 | | |

$ | 375,000 | |

| Proceeds, before expenses, to us | |

$ | 0.87875 | | |

$ | 4,625,000 | |

| (1) |

We have agreed to pay the Placement Agent a cash placement commission equal to 7.5% of the aggregate proceeds from the sale of the common shares sold in this offering. We have also agreed to reimburse the Placement Agent for certain expenses incurred in connection with this offering. |

| |

|

| (2) |

Does not include up to 5,263,158 common shares that may be issued to

the purchaser under the securities purchase agreement at a price of $0.95 per share until January 13, 2025.

|

We have also agreed to a non-accountable

expense allowance in the amount of 1.0% of the gross proceeds from the sale of the securities at closing and reimburse the Placement Agent

at closing for legal and other expenses incurred by them in connection with the offering in an aggregate amount up to $125,000. We estimate

the total expenses payable by us for this offering, excluding the placement agent fees and expenses, will be approximately $125,000.

The Placement Agent may be

deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and any profit

realized on the resale of the shares sold by it while acting as principal might be deemed to be underwriting discounts or commissions

under the Securities Act. As an underwriter, the Placement Agent would be required to comply with the requirements of the Securities Act

and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and Regulation M under the

Exchange Act. These rules and regulations may limit the timing of purchases and sales of shares by the Placement Agent acting as principal.

Under these rules and regulations, the Placement Agent:

| |

● |

may not engage in any stabilization activity in connection with our securities; and |

| |

|

|

| |

● |

may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange Act, until it has completed its participation in the distribution. |

Placement Agent Warrants

Upon the initial closing of

this offering, we have agreed to issue the Placement Agent warrants to purchase up to 157,894 common shares (equal to three percent (3.0%)

of the aggregate number of common shares initially sold in this offering). The Placement Agent warrants will be exercisable at a price

of $1.50 per share. The Placement Agent is entitled to receive additional warrants having the same terms upon any exercise of the purchaser

of its option to purchase up to 5,263,158 common shares under the securities purchase agreement at a price of $0.95 per share until January

13, 2025. The Placement Agent warrants are exercisable at any time and from time to time, in whole or in part, during a period commencing

six (6) months from the date of issuance and expiring on the three-year anniversary of the initial issuance date. The Placement Agent

warrants and the common shares underlying the Placement Agent warrants are being registered pursuant to this prospectus supplement.

Lock-Up Agreements

Pursuant to certain “lock-up”

agreements, our officers and directors have agreed for a period of ninety (90) days after the closing of offering, that they shall not,

offer, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right

or warrant to purchase, lend or hypothecate, pledge or otherwise dispose of (or enter into any transaction which is designed to, or might

reasonably be expected to, result in the disposition (whether by actual disposition or effective economic disposition due to cash settlement

or otherwise) by the holder or any affiliate or any person in privity with the holder or affiliate), directly or indirectly, or establish

or increase a put equivalent position or liquidate or decrease a call equivalent position within the meaning of Section 16 of the Exchange

Act, enter into any swap or other agreement, arrangement, hedge or transaction that transfers to another, in whole or in part, directly

or indirectly, any of the economic consequences of ownership of common shares or any securities convertible into or exercisable or exchangeable

for common shares, whether any transaction is to be settled by delivery of common shares, other securities, in cash or otherwise, or publicly

announce an intention to do any of the foregoing with respect to, any common shares of the Company or securities convertible, exchangeable

or exercisable into, common shares of the Company beneficially owned, held or hereafter acquired.

Transfer Agent and Registrar

A register of holders of the

common shares will be maintained by Conyers Corporate Service (Bermuda) Limited in Bermuda, and a branch register will be maintained in

the United States by Computershare, which will also serve as transfer agent. The transfer agent’s address is Computershare Investor

Services, P.O. Box 43078, Providence, RI 02940-3078.

Listing

Our common shares are listed

on the Nasdaq Capital Market under the trading symbol “TLSA”.

Discretionary Accounts

The Placement Agent does not

intend to confirm sales of the securities offered hereby to any accounts over which it has discretionary authority.

Other Activities and Relationships

The Placement Agent and certain

of its affiliates are full service financial institutions engaged in various activities, which may include securities trading, commercial

and investment banking, financial advisory, investment management, investment research, principal investment, hedging, financing and brokerage

activities. The Placement Agent and certain of its affiliates have, from time to time, performed, and may in the future perform, various

commercial and investment banking and financial advisory services for us and our affiliates, for which they received or will receive customary

fees and expenses.

In the ordinary course of

their various business activities, the Placement Agent and certain of its affiliates may make or hold a broad array of investments and

actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their

own account and for the accounts of their customers, and such investment and securities activities may involve securities and/or instruments

issued by us and our affiliates. If the Placement Agent or its affiliates have a lending relationship with us, they routinely hedge their

credit exposure to us consistent with their customary risk management policies. The Placement Agent and its affiliates may hedge such

exposure by entering into transactions that consist of either the purchase of credit default swaps or the creation of short positions

in our securities or the securities of our affiliates, including potentially the Common Stock offered hereby. Any such short positions

could adversely affect future trading prices of the Common Stock offered hereby. The Placement Agent and certain of its affiliates may

also communicate independent investment recommendations, market color or trading ideas and/or publish or express independent research

views in respect of such securities or instruments and may at any time hold, or recommend to clients that they acquire, long and/or short

positions in such securities and instruments.

LEGAL MATTERS

The validity of the common

shares and certain other matters of Bermuda law will be passed upon for us by Conyers Dill & Pearman Limited, our special Bermuda

counsel and certain matters of U.S. federal law will be passed upon for us by Sheppard, Mullin, Richter & Hampton LLP, New York, New

York. The Placement Agent is being represented in connection with this offering by Loeb & Loeb LLP, New York, New York.

EXPERTS

The consolidated financial

statements of Tiziana Life Sciences Ltd. as of December 31, 2023 and 2022, and for the years then ended, have been incorporated by

reference herein and in the registration statement in reliance on the report of PKF Littlejohn LLP, an independent registered public accounting

firm, appearing elsewhere herein, and upon the authority of said firm as experts in accounting and auditing. The registered business address

of PKF Littlejohn LLP, is 15 Westferry Circus, London E14 4HD, United Kingdom.

The Form 20-F for the fiscal

year ended December 31, 2023 which includes the consolidated financial statements of Tiziana Pharma Limited as of December 31, 2021 and

for the year then ended, together with the report of Forvis Mazars LLP (previously named Mazars LLP), an independent registered public

accounting firm has been incorporated by reference upon the authority of said firm as experts in accounting and auditing. The

registered business address of Forvis Mazars LLP is 30 Old Bailey, London, EC4M 7AU.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus supplement

and the accompanying prospectus form part of a “shelf” registration statement that we filed with the SEC. As permitted

by the SEC’s rules, this prospectus supplement and the accompanying prospectus, do not contain all of the information that is included

in the registration statement. You will find additional information about us in the registration statement. Any statement made in this

prospectus supplement concerning legal documents are not necessarily complete and you should read the documents that are filed as exhibits

to the registration statement or otherwise filed with the SEC for a more complete understanding of the document or matter.

We are subject to the informational

requirements of the Exchange Act. Our Annual Report on Form 20-F for the year ending December 30, 2023 has been filed with the

SEC. We have also filed periodic reports with the SEC on Form 6-K. Such reports and other information filed with the SEC are available

to the public over the Internet at the SEC’s website at http://www.sec.gov.

As a foreign private issuer,

we are exempt under the Exchange Act from, among other things, the rules prescribing the furnishing and content of proxy statements, and

our executive officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions

contained in Section 16 of the Exchange Act. In addition, we are required under the Exchange Act to file periodic reports and financial

statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act.

EXCHANGE CONTROLS

The permission of the Bermuda

Monetary Authority is required, pursuant to the provisions of the Exchange Control Act 1972 and related regulations, for all issuances

and transfers of shares (which includes our common shares) of Bermuda companies to or from a non-resident of Bermuda for exchange control

purposes, other than in cases where the Bermuda Monetary Authority has granted a general permission. The Bermuda Monetary Authority, in

its notice to the public dated June 1, 2005, has granted a general permission for the issue and subsequent transfer of any securities

of a Bermuda company from and/or to a non-resident of Bermuda for exchange control purposes for so long as any “Equity Securities”

of the company (which would include our common shares) are listed on an “Appointed Stock Exchange” (which would include the

Nasdaq). Certain issues and transfers of common shares involving persons deemed resident in Bermuda for exchange control purposes require

the specific consent of the Bermuda Monetary Authority.

ENFORCEMENT OF CIVIL LIABILITIES UNDER UNITED

STATES FEDERAL SECURITIES LAWS

We are a Bermuda exempted

company. As a result, the rights of holders of our common shares will be governed by Bermuda law and our memorandum of association and

bye-laws. The rights of shareholders under Bermuda law may differ from the rights of shareholders of companies incorporated in other jurisdictions.

It may be difficult for investors to enforce in the United States judgments obtained in U.S. courts against us based on the civil liability

provisions of the U.S. securities laws. Our registered office address in Bermuda is Clarendon House, 2 Church Street, Hamilton HM 11,

Bermuda.

We have been advised by our

special Bermuda counsel that there is no treaty in force between the United States and Bermuda providing for the reciprocal recognition

and enforcement of judgments in civil and commercial matters. As a result, whether a U.S. judgment would be enforceable in Bermuda against

us or our directors and officers depends on whether the U.S. court that entered the judgment is recognized by a Bermuda court as having

jurisdiction over us or our directors and officers, as determined by reference to Bermuda conflict of law rules. The courts of Bermuda

would recognize as a valid judgment, a final and conclusive judgment in personam obtained in a U.S. court pursuant to which a sum of money

is payable (other than a sum of money payable in respect of multiple damages, taxes or other charges of a like nature or in respect of

a fine or other penalty). The courts of Bermuda would give a judgment based on such a U.S. judgment as long as (1) the U.S. court had

proper jurisdiction over the parties subject to the judgment; (2) the U.S. court did not contravene the rules of natural justice of Bermuda;

(3) the U.S. judgment was not obtained by fraud; (4) the enforcement of the U.S. judgment would not be contrary to the public policy of

Bermuda; (5) no new admissible evidence relevant to the action is submitted prior to the rendering of the judgment by the courts of Bermuda;

(6) there is due compliance with the correct procedures under the laws of Bermuda; and (7) the U.S. judgment is not inconsistent with

any judgment of the courts of Bermuda in respect of the same matter.

In addition, and irrespective

of jurisdictional issues, the Bermuda courts will not enforce a U.S. federal securities law that is either penal or contrary to Bermuda

public policy. We have been advised that an action brought pursuant to a public or penal law, the purpose of which is the enforcement

of a sanction, power or right at the instance of the state in its sovereign capacity, is unlikely to be entertained by a Bermuda court.

Certain remedies available under the laws of U.S. jurisdictions, including certain remedies under U.S. federal securities laws, would

not be available under Bermuda law or enforceable in a Bermuda court, as they are likely to be contrary to Bermuda public policy. Further,

it may not be possible to pursue direct claims in Bermuda against us or our directors and officers for alleged violations of U.S. federal

securities laws because these laws are unlikely to have extraterritorial effect and do not have force of law in Bermuda. A Bermuda court

may, however, impose civil liability on us or our directors and officers if the facts alleged and proved in the Bermuda proceedings constitute

or give rise to a cause of action under the applicable governing law, not being a foreign public, penal or revenue law.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate

by reference” information into this prospectus supplement, which means that we can disclose important information to you by referring

you to other documents which we have filed or will file with the SEC. The information incorporated by reference is considered a part of

this prospectus supplement and should be read carefully. Certain information in this prospectus supplement supersedes information incorporated

by reference that we filed with the SEC prior to the date of this prospectus supplement. Certain information that we file later with the

SEC will automatically update and supersede the information in this prospectus supplement. Any statement so modified or superseded shall

not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement.

We incorporate by reference

into this prospectus supplement and the registration statement of which it is a part the following documents, including any amendments

to such filings:

| |

● |

our Annual Report on Form 20-F for the fiscal year ended December 31, 2023; |

| |

● |

our Reports on

Form 6-K furnished to the SEC on January

5, 2024 (first submission), January

8, 2024, March 5,

2024, April 11, 2024, April

18, 2024, April 19,

2024, April 22, 2024, April

23, 2024, April 25,

2024, May 13, 2024, May

30, 2024, June 4,

2024, June 6, 2024, June

11, 2024, June 26,

2024, June 28, 2024, July

24, 2024, August 1,

2024, August 14, 2024, August

19, 2024, September 19,

2024 October 18,

2024, October

25, 2024 and October 30,

2024; |

| |

|

|

| |

● |

our Current Report on Form 8-K filed with the SEC on October

21, 2021; and |

| |

● |

the description of our common shares contained in our Registration Statement on Form 8-A filed with the SEC on October 30, 2018, including any amendments or reports filed for the purpose of updating such description. |

We are also incorporating

by reference all subsequent Annual Reports on Form 20-F that we file with the SEC and certain reports on Form 6-K that we furnish

to the SEC after the date of this prospectus supplement (if they state that they are incorporated by reference into this prospectus supplement)

prior to the termination of this offering. In all cases, you should rely on the later information over different information included

in this prospectus supplement or the accompanying prospectus.

Unless expressly incorporated

by reference, nothing in this prospectus supplement shall be deemed to incorporate by reference information furnished to, but not filed

with, the SEC. Copies of all documents incorporated by reference in this prospectus supplement, other than exhibits to those documents

unless such exhibits are specifically incorporated by reference in this prospectus supplement, will be provided at no cost to each person,

including any beneficial owner, who receives a copy of this prospectus supplement on the written or oral request of that person made to:

Tiziana Life Sciences Ltd.

Clarendon House,

2 Church Street,

Hamilton HM 11,

Bermuda

+44 (0) 20 7495 2379

You may also access these

documents on our website, www.tizianalifesciences.com. The information contained on, or that can be accessed through, our website

is not a part of this prospectus supplement. We have included our website address in this prospectus supplement solely as an inactive

textual reference.

You should rely only on information

contained in, or incorporated by reference into, this prospectus supplement. We have not authorized anyone to provide you with information

different from that contained in this prospectus supplement or incorporated by reference in this prospectus supplement. We are not making

offers to sell the securities in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making

such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make such offer or solicitation.

PROSPECTUS

$250,000,000

Common Shares

Warrants

Units

We may offer, issue and sell

from time to time up to $250,000,000, or its equivalent in any other currency, currency units, or composite currency or currencies, of

our common shares, warrants to purchase common shares, and a combination of such securities, separately or as units, in one or more offerings.

This prospectus provides a general description of offerings of these securities that we may undertake.

We refer to our common shares,

warrants, and units collectively as “securities” in this prospectus.

Each time we sell our securities

pursuant to this prospectus, we will provide the specific terms of such offering in a supplement to this prospectus. The prospectus supplement

may also add, update, or change information contained in this prospectus. You should read this prospectus, the accompanying prospectus

supplement, together with the additional information described under the heading “Where You Can Find More Information,” before

you make your investment decision.

We may, from time to time,

offer to sell the securities, through public or private transactions, directly or through underwriters, agents or dealers, on or off The

Nasdaq Global Market, at prevailing market prices or at privately negotiated prices. If any underwriters, agents or dealers are involved

in the sale of any of these securities, the applicable prospectus supplement will set forth the names of the underwriter, agent or dealer

and any applicable fees, commissions or discounts.

Our common shares are listed

on The Nasdaq Global Market under the symbol “TLSA”. On February 24, 2022, the last reported price of our common shares on

The Nasdaq Global Market was $0.62 per share.

We are an “emerging

growth company,” as defined by the Jumpstart Our Business Startups Act of 2012, or JOBS Act, and as such, have elected to comply

with certain reduced public company reporting requirements for this prospectus and future filings.