Tourmaline Bio Announces the Promotion of Ryan Robinson to Chief Financial Officer

27 Junio 2024 - 7:05AM

Tourmaline Bio, Inc. (Tourmaline) (NASDAQ: TRML), a late-stage

clinical biotechnology company developing transformative medicines

to dramatically improve the lives of patients with life-altering

immune and inflammatory diseases, today announced the promotion of

Ryan Robinson, CPA, to Chief Financial Officer and Treasurer,

effective June 25, 2024. Mr. Robinson most recently held the role

of Vice President, Finance and Controller at Tourmaline, in

addition to serving as Tourmaline’s Interim Chief Financial Officer

and Treasurer since October 2023.

“Ryan has been instrumental in Tourmaline’s

rapid growth over the last year, building a top-flight finance

organization and executing on our reverse merger in October 2023,

through which we became a public company, as well as our $172.5

million follow-on public offering in January 2024,” said Sandeep

Kulkarni, MD, Co-Founder and Chief Executive Officer of Tourmaline.

“Ryan’s financial acumen, collaborative working style, and

disciplined approach to capital deployment are a strong complement

to Tourmaline’s mission as we continue to realize the ‘pipelines in

a product’ potential of TOUR006.”

“I am honored to take on the role of Chief

Financial Officer at Tourmaline, where I have been privileged to

work alongside world-class colleagues since joining last summer,”

said Mr. Robinson. “I look forward to continuing our work to bring

potentially standard-of-care changing medicines to millions of

patients worldwide, where significant unmet medical need persists

in both immune disorders and cardiovascular disease.”

Mr. Robinson has nearly 15 years of finance and

operations experience within the biotechnology industry. Before

joining Tourmaline, Mr. Robinson served as Vice President of

Finance and Treasurer at Korro Bio, a publicly-traded company

focused on RNA editing. Prior to Korro Bio, Mr. Robinson served as

the Corporate Controller for Jounce Therapeutics, a publicly-traded

immunotherapy company. Mr. Robinson also worked at Merrimack

Pharmaceuticals, a publicly-traded biopharmaceuticals company,

where he oversaw the financial and operational aspects of the

commercial launch of ONIVYDE® for the treatment of metastatic

pancreatic cancer. Mr. Robinson began his career in the audit

practice of Ernst & Young, where he served a variety of public

and private life sciences companies at all stages of clinical

development.

Mr. Robinson earned a B.S. in Management and an

M.S. in Accounting from Boston College, and he is licensed as a

Certified Public Accountant.

About Tourmaline Bio:

Tourmaline is a late-stage clinical

biotechnology company driven by its mission to develop

transformative medicines that dramatically improve the lives of

patients with life-altering immune and inflammatory diseases.

Tourmaline’s lead asset is TOUR006.

Cautionary Note Regarding

Forward-Looking Statements:

Any statements contained in this press release

that do not describe historical facts may constitute

forward-looking statements as that term is defined in the Private

Securities Litigation Reform Act of 1995. These statements may be

identified by words and phrases such as “believe,” “designed to,”

“expect,” “may,” “plan,” “potential,” “will” and similar

expressions, and are based on Tourmaline’s current beliefs and

expectations. These forward-looking statements include, but are not

limited to, expectations regarding the development and potential

therapeutic benefits of TOUR006, including the belief of TOUR006

being a pipelines in a product opportunity, seeking to address both

cardiovascular diseases and autoimmune disorders; the potential of

TOUR006 to be a standard-of-care changing medicine; and patient

population and market opportunities. These statements involve risks

and uncertainties that could cause actual results to differ

materially from those reflected in such statements. Risks and

uncertainties that may cause actual results to differ materially

include uncertainties inherent in the development of therapeutic

product candidates, such as the risk that any one or more of

Tourmaline’s current or future product candidates will not be

successfully developed or commercialized; the risk of delay or

cessation of any planned clinical trials of Tourmaline’s current or

future product candidates; the risk that prior results, such as

signals of safety, activity or durability of effect, observed from

preclinical trials, will not be replicated or will not continue in

ongoing or future studies or clinical trials involving Tourmaline’s

current or future product candidates; the risk that Tourmaline’s

current or future product candidates or procedures in connection

with the administration thereof will not have the safety or

efficacy profile that Tourmaline anticipates; risks regarding the

accuracy of Tourmaline’s estimates of expenses, capital

requirements and needs for additional financing; changes in

expected or existing competition; changes in the regulatory

environment; the uncertainties and timing of the regulatory

approval process; unexpected litigation or other disputes; the

impacts of macroeconomic conditions Tourmaline’s business, clinical

trials and financial position; and other risks and uncertainties

that are described in Tourmaline’s Quarterly Report on Form 10-Q

filed with the U.S. Securities and Exchange

Commission (“SEC”) on May 13, 2024 and other filings

that Tourmaline makes with the SEC from time to time. Any

forward-looking statements speak only as of the date of this press

release and are based on information available to Tourmaline as of

the date hereof, and Tourmaline assumes no obligation to, and does

not intend to, update any forward-looking statements, whether as a

result of new information, future events or otherwise.

Media Contact:Scient PR Sarah

Mishek SMishek@ScientPR.com

Investor Contact:Meru

AdvisorsLee M. Sternlstern@meruadvisors.com

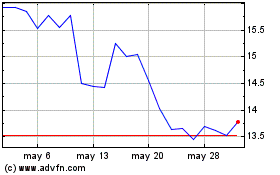

Tourmaline Bio (NASDAQ:TRML)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Tourmaline Bio (NASDAQ:TRML)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024