UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant

to Rule 13a-16 or 15d-16 under

the

Securities Exchange Act of 1934

For the month of November 2023

Commission File Number: 001-35016

TROOPS, Inc.

Unit A, 18/F, 8 Fui Yiu Kok Street,

Tsuen Wan, New Territories,

Hong Kong

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F

x Form 40-F ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

This report is hereby incorporated by reference to the Registration

Statement on Form F-3 (File No. 333-176437) of the Company.

Change of Office Address

On November 14, 2023, the Company moved its principal

office to Unit A, 18/F, 8 Fui Yiu Kok Street, Tsuen Wan, New Territories, Hong Kong. The Company’s telephone remained the same at

+852 2153 3957.

Other Information

Attached hereto as Exhibit 99.1 the Company’s

unaudited financial and operating results for the six months ended June 30, 2023; attached hereto as Exhibit 99.2 are the unaudited

condensed consolidated financial statements of the Company as of June 30, 2023 and for the six months ended June 30, 2023 and

2022.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| |

TROOPS, Inc. |

| |

|

| Date:

November 20, 2023 |

By: |

/s/

Raleigh Siu Lau |

| |

Raleigh Siu Lau |

| |

President and Chief Executive Officer |

Exhibit Index

Exhibit 99.1

TROOPS, Inc. Announces 2023 Unaudited Interim

Financial Results

TROOPS, Inc. (Nasdaq: TROO) ("TROOPS"

or the "Company"), a conglomerate group of various businesses with its headquarters based in Hong Kong. The group is principally

engaged in (a) money lending business in Hong Kong providing mortgage loans to high quality target borrowers (b) property investment

to generate additional rental income and (c) the development, operation and management of an online financial marketplace that provides

one-stop financial technology solutions including API services by leveraging artificial intelligence, big data and blockchain, and cloud

computing (SaaS). The group’s vision is to operate as a conglomerate to build synergy within its own sustainable ecosystem thereby

creating value to its shareholders, today announced its unaudited operating results for the six months ended June 30, 2023.

2023 Interim Results Overview

Revenue

Our sales were $1.83 million for the six months

ended June 30, 2023, which decreased by $0.09 million, or 4.7% from $1.92 million for the same period of 2022. During the six

months ended June 30, 2023, we through 11 Hau Fook Street Limited, Vision Lane Limited and Suns Tower Limited earned property lease

and management income of $0.57 million, compared to income of $0.54 million in 2022. We through Giant Credit Limited and First Asia Finance

Limited earned interest on loans from money lending services of $1.16 million for the six months ended June 30, 2023, compared to

$1.20 million for the same period of 2022. We through Giant Financial Services Limited and Apiguru Pty Limited earned financial technology

solutions and services income of $0.10 million for the six months ended June 30, 2023, compared to $0.18 million for the same period

of 2022.

Below is the summary presenting the Company’s

revenues disaggregated by products and services and timing of revenue recognition:

| | |

For the six months ended

June 30, | |

| Revenue by recognition over time | |

2023 | | |

2022 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| Revenue by recognition over time | |

$ | 1,834 | | |

$ | 1,924 | |

| | |

$ | 1,834 | | |

$ | 1,924 | |

| | |

For the six months ended

June 30, | |

| Revenue by major product line | |

2023 | | |

2022 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| Interest on loans | |

$ | 1,160 | | |

$ | 1,203 | |

| Property lease and management | |

| 573 | | |

| 544 | |

| Financial technology solutions and services | |

| 101 | | |

| 177 | |

| | |

$ | 1,834 | | |

$ | 1,924 | |

Cost of revenues

For the six months ended June 30, 2023, cost of revenues decreased

by $0.15 million, or 9.6%, to $1.42 million from $1.57 million for the six months ended June 30, 2022. The decrease was in line with

the revenue drop.

Gross profit

Our gross profit was $0.41 million for the six months ended June 30,

2023, compared to $0.36 million for the same period of 2022.

General and administrative expenses

General and administrative expenses amounted to

approximately $1.47 million for the six months ended June 30, 2023, $0.29 million or 24.6% higher than $1.18 million for the same

period of previous year. This increase was mainly due to more IT-related expenses of approximately $0.16 million.

General and administrative expenses include system

development fee, staff salary and benefits, legal and professional fees, office expenses, travel expenses, entertainment, IT consultancy

and support services expenses, depreciation, amortization of intangible assets.

Impairment loss of loan and interest receivable

Impairment loss of loan and interest receivable

based on historical experience and an estimate of collectability of the loans receivable and interest receivable. Our provision for loan

losses and interest receivable were $nil and $0.61 million for the six months ended June 30, 2023 and 2022, respectively.

Income tax benefit

Income tax benefit was $0.05 million for the

six months ended June 30, 2023, a decrease of $0.06 million, from income tax benefit of $0.11 million for the same period of

2022. Income tax benefit was related to the deferred tax impact on intangible assets and property and plant.

Our subsidiaries in Hong Kong are subject to Hong

Kong taxation on income derived from their activities conducted in Hong Kong at a rate of 16.5%. Our subsidiary in Australia is subject

to the Australian lower company tax rate of 25.0%. Our PRC entity was subject to the statutory PRC enterprise income tax rate of 25.0%.

Net loss

As a result of the various factors described above,

net loss for the six months ended June 30, 2023 was $1.04 million, as compared to $1.18 million for the same period of 2022.

About TROOPS, Inc.

TROOPS, Inc. is a conglomerate group of various

businesses with its headquarters based in Hong Kong. The group is principally engaged in (a) money lending business in Hong

Kong providing mortgage loans to high quality target borrowers (b) property investment to generate additional rental income and (c) the

development, operation and management of an online financial marketplace that provides one-stop financial technology solutions including

API services by leveraging artificial intelligence, big data and blockchain, and cloud computing (SaaS). The group’s vision is to

operate as a conglomerate to build synergy within its own sustainable ecosystem thereby creating value to its shareholders. For more information

about TROOPS, please visit our investor relations website:

www.troops.co

Safe Harbor and Informational Statement

This announcement contains "forward-looking"

statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of

1934. These statements are made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995.

All statements, other than statements of historical fact, including, without limitation, those with respect to the objectives, plans and

strategies of the Company set forth herein and those preceded by or that include the words "believe," "expect," "anticipate,"

"future," "will," "intend," "plan," "estimate" or similar expressions, are "forward-looking

statements". Forward-looking statements in this release include, without limitation, the effectiveness of the Company's multiple-brand,

multiple channel strategy and the transitioning of its product development and sales focus and to a "light-asset" model. Although

the Company's management believes that such forward-looking statements are reasonable, it cannot guarantee that such expectations are,

or will be, correct. These forward looking statements involve a number of risks and uncertainties, which could cause the Company's future

results to differ materially from those anticipated. These forward-looking statements can change as a result of many possible events or

factors not all of which are known to the Company, which may include, without limitation, our ability to have effective internal control

over financial reporting; our success in designing and distributing products under brands licensed from others; management of sales trend

and client mix; possibility of securing loans and other financing without efficient fixed assets as collaterals; changes in government

policy in China; China's overall economic conditions and local market economic conditions; our ability to expand through strategic acquisitions

and establishment of new locations; compliance with government regulations; legislation or regulatory environments; geopolitical events,

and other events and/or risks outlined in TROOPS 's filings with the U.S. Securities and Exchange Commission, including its annual report

on Form 20-F and other filings. All information provided in this press release and in the attachments is as of the date of the issuance,

and TROOPS does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

Exhibit 99.2

TROOPS, INC.

AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

AS OF

JUNE 30, 2023, AND DECEMBER 31, 2022

(In

thousands of U.S. dollars except share and per share data)

| | |

As of | |

| | |

June 30,

2023 | | |

December 31,

2022 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | |

| |

| CURRENT ASSETS | |

| | | |

| | |

| Cash | |

$ | 3,161 | | |

$ | 2,950 | |

| Loans receivable, net of provision for loan losses of $1,388 and $619, respectively | |

| 7,611 | | |

| 8,380 | |

| Interest receivable | |

| 167 | | |

| 4 | |

| Other receivables, prepayments and deposits, net of provision for credit losses of $3 and $3, respectively | |

| 288 | | |

| 205 | |

| Total current assets | |

| 11,227 | | |

| 11,539 | |

| | |

| | | |

| | |

| Deposits for acquisition of a subsidiary, net of provision for credit losses of $131 and $131, respectively | |

| 4,869 | | |

| 4,869 | |

| Plant and equipment, net | |

| 47,806 | | |

| 48,655 | |

| Operating lease right-of-use assets, net | |

| 15 | | |

| 26 | |

| Intangible assets, net | |

| 31 | | |

| 42 | |

| Long-term loans receivable, net of provision for loan losses of $684 and $1,453, respectively | |

| 6,228 | | |

| 4,170 | |

| Goodwill | |

| 385 | | |

| 385 | |

| Total non-current assets | |

| 59,334 | | |

| 58,147 | |

| | |

| | | |

| | |

| Total assets | |

$ | 70,561 | | |

$ | 69,686 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Short-term loan | |

| 1,282 | | |

| - | |

| Accounts payable | |

| 1 | | |

| 2 | |

| Other payables and accrued liabilities | |

| 2,006 | | |

| 1,258 | |

| Operating lease liability, current | |

| 15 | | |

| 22 | |

| Customer deposits | |

| - | | |

| 88 | |

| Taxes payable | |

| 832 | | |

| 721 | |

| Convertible notes - current | |

| 94 | | |

| 94 | |

| Total current liabilities | |

| 4,230 | | |

| 2,185 | |

| | |

| | | |

| | |

| LONG-TERM LIABILITIES | |

| | | |

| | |

| Operating lease liability, non-current | |

| - | | |

| 4 | |

| Non-current Deferred tax liabilities | |

| 5,167 | | |

| 5,293 | |

| Total non-current liabilities | |

| 5,167 | | |

| 5,297 | |

| | |

| | | |

| | |

| Total liabilities | |

| 9,397 | | |

| 7,482 | |

| | |

| | | |

| | |

| COMMITMENTS AND CONTINGENCIES | |

| - | | |

| - | |

| | |

| | | |

| | |

| SHAREHOLDERS' EQUITY | |

| | | |

| | |

| Preferred stock, $0.001 par value, 1,000,000 shares authorized, nil issued and outstanding as of June 30, 2023 and December 31, 2022 | |

| - | | |

| - | |

| Ordinary shares, $0.004 par value, 500,000,000 shares authorized, 101,597,998 issued and outstanding as of June 30, 2023 and December 31, 2022 | |

| 406 | | |

| 406 | |

| Additional paid-in-capital | |

| 135,674 | | |

| 135,674 | |

| Retained deficit | |

| (74,917 | ) | |

| (73,879 | ) |

| Accumulated other comprehensive income | |

| 1 | | |

| 3 | |

| Total shareholders' equity | |

| 61,164 | | |

| 62,204 | |

| Total liabilities and shareholders' equity | |

$ | 70,561 | | |

$ | 69,686 | |

TROOPS, INC.

AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

FOR THE SIX MONTHS ENDED JUNE 30, 2023 AND

2022

(In

thousands of U.S. dollars except share and per share data)

| | |

2023 | | |

2022 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| REVENUES | |

$ | 1,834 | | |

$ | 1,924 | |

| COST OF REVENUES | |

| 1,424 | | |

| 1,567 | |

| GROSS PROFIT | |

| 410 | | |

| 357 | |

| | |

| | | |

| | |

| OPERATING EXPENSES: | |

| | | |

| | |

| General and administrative expenses | |

| 1,469 | | |

| 1,175 | |

| Impairment loss of loan and interest receivables | |

| - | | |

| 610 | |

| Total operating expenses | |

| 1,469 | | |

| 1,785 | |

| | |

| | | |

| | |

| OPERATING LOSS | |

| (1,059 | ) | |

| (1,428 | ) |

| | |

| | | |

| | |

| OTHER (EXPENSES) INCOME: | |

| | | |

| | |

| Interest income | |

| 7 | | |

| - | |

| Interest expense | |

| (32 | ) | |

| (26 | ) |

| Other income, net | |

| (3 | ) | |

| 163 | |

| Total other income, net | |

| (28 | ) | |

| 137 | |

| | |

| | | |

| | |

| LOSS FROM OPERATIONS BEFORE PROVISION FOR INCOME TAXES | |

| (1,087 | ) | |

| (1,291 | ) |

| INCOME TAX BENEFIT | |

| 49 | | |

| 114 | |

| | |

| | | |

| | |

| NET LOSS | |

$ | (1,038 | ) | |

$ | (1,177 | ) |

| | |

| | | |

| | |

| OTHER COMPREHENSIVE LOSS: | |

| | | |

| | |

| Foreign currency translation adjustment | |

| (2 | ) | |

| (5 | ) |

| COMPREHENSIVE LOSS | |

$ | (1,040 | ) | |

$ | (1,182 | ) |

| | |

| | | |

| | |

| LOSS PER SHARE: | |

| | | |

| | |

| Basic | |

$ | (0.01 | ) | |

$ | (0.01 | ) |

| Diluted | |

$ | (0.01 | ) | |

$ | (0.01 | ) |

| | |

| | | |

| | |

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES: | |

| | | |

| | |

| Basic | |

| 101,597,998 | | |

| 101,597,998 | |

| Diluted | |

| 101,597,998 | | |

| 101,597,998 | |

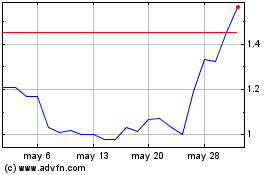

TROOPS (NASDAQ:TROO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

TROOPS (NASDAQ:TROO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025