false

Q2

--12-31

0001860871

0001860871

2024-01-01

2024-06-30

0001860871

TVGN:CommonStock0.0001ParValuePerShareMember

2024-01-01

2024-06-30

0001860871

TVGN:WarrantsEachExercisableForOneShareOfCommonStockFor11.50PerShareMember

2024-01-01

2024-06-30

0001860871

2024-08-12

0001860871

2024-06-30

0001860871

2023-12-31

0001860871

us-gaap:RelatedPartyMember

2024-06-30

0001860871

us-gaap:RelatedPartyMember

2023-12-31

0001860871

us-gaap:SeriesAPreferredStockMember

2024-06-30

0001860871

2024-04-01

2024-06-30

0001860871

2023-04-01

2023-06-30

0001860871

2023-01-01

2023-06-30

0001860871

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-12-31

0001860871

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-12-31

0001860871

us-gaap:CommonStockMember

2023-12-31

0001860871

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001860871

us-gaap:RetainedEarningsMember

2023-12-31

0001860871

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2024-03-31

0001860871

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2024-03-31

0001860871

us-gaap:CommonStockMember

2024-03-31

0001860871

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0001860871

us-gaap:RetainedEarningsMember

2024-03-31

0001860871

2024-03-31

0001860871

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-12-31

0001860871

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2022-12-31

0001860871

us-gaap:CommonStockMember

2022-12-31

0001860871

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001860871

us-gaap:RetainedEarningsMember

2022-12-31

0001860871

2022-12-31

0001860871

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-03-31

0001860871

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-03-31

0001860871

us-gaap:CommonStockMember

2023-03-31

0001860871

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001860871

us-gaap:RetainedEarningsMember

2023-03-31

0001860871

2023-03-31

0001860871

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2024-01-01

2024-03-31

0001860871

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2024-01-01

2024-03-31

0001860871

us-gaap:CommonStockMember

2024-01-01

2024-03-31

0001860871

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-03-31

0001860871

us-gaap:RetainedEarningsMember

2024-01-01

2024-03-31

0001860871

2024-01-01

2024-03-31

0001860871

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2024-04-01

2024-06-30

0001860871

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2024-04-01

2024-06-30

0001860871

us-gaap:CommonStockMember

2024-04-01

2024-06-30

0001860871

us-gaap:AdditionalPaidInCapitalMember

2024-04-01

2024-06-30

0001860871

us-gaap:RetainedEarningsMember

2024-04-01

2024-06-30

0001860871

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-01-01

2023-03-31

0001860871

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-01-01

2023-03-31

0001860871

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001860871

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001860871

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001860871

2023-01-01

2023-03-31

0001860871

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-04-01

2023-06-30

0001860871

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-04-01

2023-06-30

0001860871

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001860871

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001860871

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001860871

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2024-06-30

0001860871

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2024-06-30

0001860871

us-gaap:CommonStockMember

2024-06-30

0001860871

us-gaap:AdditionalPaidInCapitalMember

2024-06-30

0001860871

us-gaap:RetainedEarningsMember

2024-06-30

0001860871

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-06-30

0001860871

us-gaap:PreferredStockMember

us-gaap:SeriesBPreferredStockMember

2023-06-30

0001860871

us-gaap:CommonStockMember

2023-06-30

0001860871

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001860871

us-gaap:RetainedEarningsMember

2023-06-30

0001860871

2023-06-30

0001860871

us-gaap:CommonStockMember

2024-02-14

0001860871

TVGN:TevogenBioMember

2024-06-30

0001860871

TVGN:SemperParatusMember

2024-06-30

0001860871

TVGN:LoanAgreementMember

us-gaap:SubsequentEventMember

2024-07-31

0001860871

us-gaap:MeasurementInputPriceVolatilityMember

2024-06-30

0001860871

us-gaap:MeasurementInputDiscountRateMember

srt:MinimumMember

2024-06-30

0001860871

us-gaap:MeasurementInputDiscountRateMember

srt:MaximumMember

2024-06-30

0001860871

TVGN:ProbabilityOfFutureLiquidityMember

srt:MinimumMember

2024-06-30

0001860871

TVGN:ProbabilityOfFutureLiquidityMember

srt:MaximumMember

2024-06-30

0001860871

us-gaap:WarrantMember

2024-01-01

2024-06-30

0001860871

us-gaap:CallOptionMember

2024-01-01

2024-06-30

0001860871

us-gaap:SeriesAPreferredStockMember

us-gaap:MeasurementInputPriceVolatilityMember

srt:MinimumMember

2024-06-30

0001860871

us-gaap:SeriesAPreferredStockMember

us-gaap:MeasurementInputPriceVolatilityMember

srt:MaximumMember

2024-06-30

0001860871

us-gaap:SeriesAPreferredStockMember

srt:MinimumMember

2024-06-30

0001860871

us-gaap:SeriesAPreferredStockMember

srt:MaximumMember

2024-06-30

0001860871

us-gaap:SeriesAPreferredStockMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

srt:MinimumMember

2024-06-30

0001860871

us-gaap:SeriesAPreferredStockMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

srt:MaximumMember

2024-06-30

0001860871

us-gaap:SeriesAPreferredStockMember

2024-01-01

2024-06-30

0001860871

TVGN:LoanAgreementMember

2024-06-30

0001860871

us-gaap:MeasurementInputOptionVolatilityMember

2024-06-30

0001860871

us-gaap:MeasurementInputDiscountRateMember

2024-06-30

0001860871

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001860871

us-gaap:FairValueInputsLevel3Member

2024-01-01

2024-06-30

0001860871

us-gaap:FairValueInputsLevel3Member

2024-06-30

0001860871

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001860871

us-gaap:FairValueInputsLevel3Member

2023-01-01

2023-06-30

0001860871

us-gaap:FairValueInputsLevel3Member

2023-06-30

0001860871

us-gaap:FairValueInputsLevel3Member

us-gaap:WarrantMember

2024-02-15

0001860871

us-gaap:FairValueInputsLevel3Member

us-gaap:WarrantMember

2024-02-16

2024-06-30

0001860871

us-gaap:FairValueInputsLevel3Member

us-gaap:WarrantMember

2024-06-30

0001860871

us-gaap:FairValueInputsLevel3Member

us-gaap:CallOptionMember

2024-02-15

0001860871

us-gaap:FairValueInputsLevel3Member

us-gaap:CallOptionMember

2024-02-16

2024-06-30

0001860871

us-gaap:FairValueInputsLevel3Member

us-gaap:CallOptionMember

2024-06-30

0001860871

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2024-06-30

0001860871

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2024-06-30

0001860871

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2024-06-30

0001860871

2024-02-14

0001860871

2024-02-14

2024-02-14

0001860871

TVGN:EarnoutSharesMember

2024-02-14

0001860871

TVGN:TevogenBioCommonStockMember

TVGN:EarnoutSharesMember

2024-06-30

0001860871

TVGN:TevogenBioCommonStockMember

us-gaap:ShareBasedCompensationAwardTrancheOneMember

TVGN:EarnoutSharesMember

2024-06-30

0001860871

TVGN:TevogenBioCommonStockMember

us-gaap:ShareBasedCompensationAwardTrancheTwoMember

TVGN:EarnoutSharesMember

2024-06-30

0001860871

TVGN:TevogenBioCommonStockMember

us-gaap:ShareBasedCompensationAwardTrancheThreeMember

TVGN:EarnoutSharesMember

2024-06-30

0001860871

TVGN:TevogenBioCommonStockMember

us-gaap:ShareBasedCompensationAwardTrancheOneMember

us-gaap:CommonStockMember

2024-06-30

0001860871

TVGN:TevogenBioCommonStockMember

us-gaap:ShareBasedCompensationAwardTrancheTwoMember

us-gaap:CommonStockMember

2024-06-30

0001860871

TVGN:TevogenBioCommonStockMember

us-gaap:ShareBasedCompensationAwardTrancheThreeMember

us-gaap:CommonStockMember

2024-06-30

0001860871

TVGN:LoanAgreementMember

TVGN:ThePatelFamilyLLPMember

us-gaap:UnsecuredDebtMember

2024-06-06

0001860871

TVGN:LoanAgreementMember

TVGN:ThePatelFamilyLLPMember

us-gaap:UnsecuredDebtMember

2024-06-06

2024-06-06

0001860871

TVGN:ThePatelFamilyLLPMember

TVGN:LoanAgreementMember

us-gaap:UnsecuredDebtMember

srt:MaximumMember

2024-06-06

0001860871

TVGN:ThePatelFamilyLLPMember

TVGN:LoanAgreementMember

2024-06-06

2024-06-06

0001860871

TVGN:LoanAgreementMember

TVGN:ThePatelFamilyLLPMember

2024-06-06

0001860871

TVGN:LoanAgreementMember

TVGN:ThePatelFamilyLLPMember

TVGN:AdditionalAmountPurchaseOptionMember

2024-06-06

0001860871

TVGN:PolarMultiStrategyMasterFundMember

2024-06-30

0001860871

TVGN:PolarMultiStrategyMasterFundMember

2024-05-01

2024-05-31

0001860871

TVGN:TwoThousandTwentyFourPlanMember

2024-06-30

0001860871

TVGN:TwoThousandTwentyFourPlanMember

srt:ChiefExecutiveOfficerMember

2024-02-14

2024-02-14

0001860871

TVGN:PerformanceBasedRSUsMember

2024-04-01

2024-06-30

0001860871

TVGN:PerformanceBasedRSUsMember

2024-01-01

2024-06-30

0001860871

us-gaap:SubsequentEventMember

TVGN:PerformanceBasedRSUsMember

2024-07-01

0001860871

us-gaap:RestrictedStockMember

2024-06-30

0001860871

us-gaap:RestrictedStockMember

2024-01-01

2024-06-30

0001860871

TVGN:PerformanceBasedRSUsMember

2024-06-30

0001860871

TVGN:ServiceBasedRestrictedStockMember

2023-12-31

0001860871

TVGN:PerformanceBasedRSUsMember

2023-12-31

0001860871

TVGN:ServiceBasedRestrictedStockMember

2024-01-01

2024-06-30

0001860871

TVGN:ServiceBasedRestrictedStockMember

2024-06-30

0001860871

us-gaap:ResearchAndDevelopmentExpenseMember

2024-04-01

2024-06-30

0001860871

us-gaap:ResearchAndDevelopmentExpenseMember

2024-01-01

2024-06-30

0001860871

us-gaap:GeneralAndAdministrativeExpenseMember

2024-04-01

2024-06-30

0001860871

us-gaap:GeneralAndAdministrativeExpenseMember

2024-01-01

2024-06-30

0001860871

us-gaap:SeriesAPreferredStockMember

2024-03-31

0001860871

us-gaap:SeriesAPreferredStockMember

us-gaap:InvestorMember

2024-03-31

0001860871

us-gaap:SeriesAPreferredStockMember

us-gaap:InvestorMember

2024-03-01

2024-03-31

0001860871

us-gaap:SeriesAPreferredStockMember

2024-03-27

0001860871

TVGN:SeriesAOnePreferredStockMember

us-gaap:InvestorMember

2024-03-26

2024-03-27

0001860871

TVGN:SeriesAOnePreferredStockMember

us-gaap:InvestorMember

2024-03-27

0001860871

TVGN:SeriesAOnePreferredStockMember

us-gaap:InvestorMember

2024-06-30

0001860871

us-gaap:SeriesBPreferredStockMember

2024-03-15

2024-03-15

0001860871

us-gaap:SeriesBPreferredStockMember

2024-06-30

0001860871

TVGN:SemperParatusMember

2021-11-30

0001860871

TVGN:SemperParatusMember

TVGN:PublicWarrantsMember

us-gaap:IPOMember

2021-11-30

0001860871

TVGN:SemperParatusMember

us-gaap:PrivatePlacementMember

2021-11-30

0001860871

TVGN:SemperParatusMember

TVGN:PublicWarrantsMember

2021-11-30

0001860871

TVGN:SemperParatusMember

TVGN:PublicWarrantsMember

2021-11-01

2021-11-30

0001860871

TVGN:SemperParatusMember

TVGN:PublicWarrantsMember

2024-06-30

0001860871

TVGN:SemperParatusMember

us-gaap:PrivatePlacementMember

2024-06-30

0001860871

TVGN:PerformanceBasedRSUsMember

TVGN:WifeOfChiefExecutiveOfficerMember

2023-01-01

2023-01-31

0001860871

TVGN:MehtaphoricConsultingIncMember

2023-01-01

2023-01-31

0001860871

us-gaap:RestrictedStockUnitsRSUMember

2024-01-01

2024-06-30

0001860871

us-gaap:RestrictedStockUnitsRSUMember

2023-01-01

2023-06-30

0001860871

us-gaap:RestrictedStockMember

2024-01-01

2024-06-30

0001860871

us-gaap:RestrictedStockMember

2023-01-01

2023-06-30

0001860871

TVGN:PublicWarrantsMember

2024-01-01

2024-06-30

0001860871

TVGN:PublicWarrantsMember

2023-01-01

2023-06-30

0001860871

TVGN:PrivateWarrantsMember

2024-01-01

2024-06-30

0001860871

TVGN:PrivateWarrantsMember

2023-01-01

2023-06-30

0001860871

us-gaap:ConvertibleDebtSecuritiesMember

2024-01-01

2024-06-30

0001860871

us-gaap:ConvertibleDebtSecuritiesMember

2023-01-01

2023-06-30

0001860871

TVGN:EarnoutSharesMember

2024-01-01

2024-06-30

0001860871

TVGN:EarnoutSharesMember

2023-01-01

2023-06-30

0001860871

us-gaap:RestrictedStockUnitsRSUMember

2024-01-01

2024-06-30

0001860871

us-gaap:SubsequentEventMember

us-gaap:UnsecuredDebtMember

2024-07-15

0001860871

us-gaap:SubsequentEventMember

us-gaap:UnsecuredDebtMember

2024-08-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

TVGN:Segment

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

| ☒ |

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the quarterly period ended June 30, 2024

OR

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from ___________ to ___________

Commission

File Number 001-41002

Tevogen

Bio Holdings Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

98-1597194 |

(State

or other jurisdiction

of incorporation or organization) |

|

(I.R.S.

Employer

Identification No.) |

| |

|

|

15

Independence Boulevard, Suite #410

Warren,

New Jersey |

|

07059 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (877) 838-6436

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value per share |

|

TVGN |

|

The

Nasdaq Stock Market LLC |

| Warrants,

each exercisable for one share of Common Stock for $11.50 per share |

|

TVGNW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| |

|

|

|

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

|

|

| Emerging

growth company |

☒ |

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes☐

No ☒

As

of August 12, 2024, there were 170,646,864 shares of the registrant’s common stock,

par value $0.0001 per share, outstanding.

Table

of Contents

PART

I – FINANCIAL INFORMATION

Item

1. Financial Statements (Unaudited)

Tevogen

Bio Holdings Inc.

UNAUDITED

CONSOLIDATED BALANCE SHEETS

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 1,135,390 | | |

$ | 1,052,397 | |

| Prepaid expenses and other assets | |

| 1,152,554 | | |

| 670,582 | |

| Due from related party | |

| 158,819 | | |

| — | |

| Total current assets | |

| 2,446,763 | | |

| 1,722,979 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 377,547 | | |

| 458,651 | |

| Right-of-use assets - operating leases | |

| 352,673 | | |

| 469,862 | |

| Deferred transaction costs | |

| — | | |

| 2,582,870 | |

| Other assets | |

| 133,276 | | |

| 271,141 | |

| Total assets | |

$ | 3,310,259 | | |

$ | 5,505,503 | |

| | |

| | | |

| | |

| Liabilities and stockholders’ deficit | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 6,666,229 | | |

$ | 3,418,378 | |

| Accrued expenses and other liabilities | |

| 1,776,047 | | |

| 1,096,450 | |

| Operating lease liabilities | |

| 268,672 | | |

| 252,714 | |

| Notes payable | |

| 1,651,000 | | |

| — | |

| Convertible promissory notes | |

| — | | |

| 80,712,000 | |

| Due to related party | |

| 250,000 | | |

| — | |

| Total current liabilities | |

| 10,611,948 | | |

| 85,479,542 | |

| | |

| | | |

| | |

| Convertible promissory notes | |

| — | | |

| 14,220,000 | |

| Operating lease liabilities | |

| 96,809 | | |

| 234,858 | |

| Derivative warrant liabilities | |

| 22,185 | | |

| — | |

| Written call option derivative liabilities | |

| 213,214 | | |

| — | |

| Total liabilities | |

| 10,944,156 | | |

| 99,934,400 | |

| | |

| | | |

| | |

| Stockholders’ deficit | |

| | | |

| | |

| Series A Preferred Stock, $0.0001 par value; 2,000 shares authorized; 500 shares issued and outstanding as of June 30, 2024 | |

| 2,799,990 | | |

| — | |

| Common stock, $0.0001 par value; 800,000,000 shares authorized; 168,826,402 and 119,999,989 shares issued and outstanding at June 30, 2024 and December 31, 2023 | |

| 16,883 | | |

| 12,000 | |

| Additional paid-in capital | |

| 87,605,572 | | |

| 5,216,840 | |

| Accumulated deficit | |

| (98,056,342 | ) | |

| (99,657,737 | ) |

| Total stockholders’ deficit | |

| (7,633,897 | ) | |

| (94,428,897 | ) |

| Total liabilities and stockholders’ deficit | |

$ | 3,310,259 | | |

$ | 5,505,503 | |

See

accompanying notes to the unaudited consolidated financial statements.

TEVOGEN

BIO HOLDINGS INC.

UNAUDITED

CONSOLIDATED STATEMENTS OF OPERATIONS

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

Three months ended June 30, | | |

Six months ended June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

$ | 4,124,450 | | |

$ | 1,031,393 | | |

$ | 24,936,032 | | |

$ | 2,378,566 | |

| General and administrative | |

| 4,474,577 | | |

| 1,153,073 | | |

| 13,179,719 | | |

| 2,130,182 | |

| Total operating expenses | |

| 8,599,027 | | |

| 2,184,466 | | |

| 38,115,751 | | |

| 4,508,748 | |

| Loss from operations | |

| (8,599,027 | ) | |

| (2,184,466 | ) | |

| (38,115,751 | ) | |

| (4,508,748 | ) |

| Interest income (expense), net | |

| 6 | | |

| (299,887 | ) | |

| (155,780 | ) | |

| (588,884 | ) |

| Merger transaction costs | |

| — | | |

| — | | |

| (7,499,353 | ) | |

| — | |

| Change in fair value of warrants | |

| 38,788 | | |

| — | | |

| 6,815 | | |

| — | |

| Change in fair value of convertible promissory notes | |

| — | | |

| (19,700,000 | ) | |

| 48,468,678 | | |

| (47,842,865 | ) |

| Change in fair value of written call option derivative liabilities | |

| (213,214 | ) | |

| — | | |

| (213,214 | ) | |

| — | |

| Loss on issuance of commitment shares | |

| (890,000 | ) | |

| — | | |

| (890,000 | ) | |

| — | |

| Net income (loss) | |

$ | (9,663,447 | ) | |

$ | (22,184,353 | ) | |

$ | 1,601,395 | | |

$ | (52,940,497 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) attributable to common stockholders, basic | |

$ | (6,075,379 | ) | |

$ | (22,184,353 | ) | |

$ | 5,044,907 | | |

$ | (52,940,497 | ) |

| Net loss attributable to common stockholders, diluted | |

$ | (6,075,379 | ) | |

$ | (22,184,353 | ) | |

$ | (43,124,798 | ) | |

$ | (52,940,497 | ) |

| Net income (loss) per share attributable to common stockholders, basic | |

$ | (0.04 | ) | |

$ | (0.18 | ) | |

$ | 0.03 | | |

$ | (0.44 | ) |

| Net loss per share attributable to common stockholders, diluted | |

$ | (0.04 | ) | |

$ | (0.18 | ) | |

$ | (0.29 | ) | |

$ | (0.44 | ) |

| Weighted-average common stock outstanding, basic | |

| 154,167,090 | | |

| 119,999,989 | | |

| 145,655,205 | | |

| 119,999,989 | |

| Weighted-average common stock outstanding, diluted | |

| 154,167,090 | | |

| 119,999,989 | | |

| 148,154,361 | | |

| 119,999,989 | |

See

accompanying notes to the unaudited consolidated financial statements.

Tevogen

Bio Holdings Inc.

UNAUDITED

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ DEFICIT

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

capital | | |

deficit | | |

Total | |

| | |

Series A

Preferred Stock | | |

Series B

Preferred Stock | | |

Common Stock | | |

Additional

paid-in | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

capital | | |

deficit | | |

Total | |

| Balance at January 1, 2024 | |

| — | | |

$ | — | | |

| — | | |

$ | — | | |

| 119,999,989 | | |

$ | 12,000 | | |

$ | 5,216,840 | | |

$ | (99,657,737 | ) | |

$ | (94,428,897 | ) |

| Issuance of Series A preferred stock | |

| 500 | | |

| 2,799,990 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 2,799,990 | |

| Nonrefundable prepaid proceeds towards anticipated Series A-1 preferred stock issuance | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 200,000 | | |

| — | | |

| 200,000 | |

| Issuance of Series B preferred stock | |

| — | | |

| — | | |

| 3,613 | | |

| 3,613,000 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 3,613,000 | |

| Conversion of convertible promissory notes into common stock in connection with

merger | |

| — | | |

| — | | |

| — | | |

| — | | |

| 10,337,419 | | |

| 1,034 | | |

| 46,621,593 | | |

| — | | |

| 46,622,627 | |

| Merger, net of redemptions and transaction costs | |

| — | | |

| — | | |

| — | | |

| — | | |

| 14,778,056 | | |

| 1,478 | | |

| (2,885,459 | ) | |

| — | | |

| (2,883,981 | ) |

| Issuance of restricted common stock | |

| — | | |

| — | | |

| — | | |

| — | | |

| 19,348,954 | | |

| 1,935 | | |

| (1,935 | ) | |

| — | | |

| — | |

| Issuance of common stock for Sponsor advisory service fee | |

| — | | |

| — | | |

| — | | |

| — | | |

| 150,000 | | |

| 15 | | |

| 676,485 | | |

| — | | |

| 676,500 | |

| Stock-based compensation | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 26,333,249 | | |

| — | | |

| 26,333,249 | |

| Net income | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 11,264,842 | | |

| 11,264,842 | |

| Balance at March 31, 2024 | |

| 500 | | |

| 2,799,990 | | |

| 3,613 | | |

| 3,613,000 | | |

| 164,614,418 | | |

| 16,462 | | |

| 76,160,773 | | |

| (88,392,895 | ) | |

| (5,802,670 | ) |

| Issuance of commitment shares in connection with the Loan Agreement | |

| — | | |

| — | | |

| — | | |

| — | | |

| 1,000,000 | | |

| 100 | | |

| 889,900 | | |

| — | | |

| 890,000 | |

| Issuance of common stock in connection with Polar note payable | |

| — | | |

| — | | |

| — | | |

| — | | |

| 1,500,000 | | |

| 150 | | |

| (150 | ) | |

| — | | |

| — | |

| Issuance of common stock in settlement of vested restricted stock units | |

| — | | |

| — | | |

| — | | |

| — | | |

| 1,711,984 | | |

| 171 | | |

| (171 | ) | |

| — | | |

| — | |

| Nonrefundable prepaid proceeds towards anticipated Series A-1 preferred stock issuance | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 2,800,000 | | |

| — | | |

| 2,800,000 | |

| Repurchase of Series B preferred stock | |

| — | | |

| — | | |

| (3,613 | ) | |

| (3,613,000 | ) | |

| — | | |

| — | | |

| 3,613,000 | | |

| — | | |

| — | |

| Stock-based compensation | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 4,142,220 | | |

| — | | |

| 4,142,220 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (9,663,447 | ) | |

| (9,663,447 | ) |

| Balance at June 30, 2024 | |

| 500 | | |

$ | 2,799,990 | | |

| — | | |

$ | — | | |

| 168,826,402 | | |

$ | 16,883 | | |

$ | 87,605,572 | | |

$ | (98,056,342 | ) | |

$ | (7,633,897 | ) |

| | |

Series A Preferred Stock | | |

Series B Preferred Stock | | |

Common Stock | | |

Additional

paid-in | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

capital | | |

deficit | | |

Total | |

| Balance at January 1, 2023 | |

| — | | |

$ | — | | |

| — | | |

$ | — | | |

| 119,999,989 | | |

$ | 12,000 | | |

$ | 5,216,840 | | |

$ | (39,180,057 | ) | |

$ | (33,951,217 | ) |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (30,756,144 | ) | |

| (30,756,144 | ) |

| Balance at March 31, 2023 | |

| — | | |

| — | | |

| — | | |

| — | | |

| 119,999,989 | | |

| 12,000 | | |

| 5,216,840 | | |

| (69,936,201 | ) | |

| (64,707,361 | ) |

| Balance | |

| — | | |

$ | - | | |

| — | | |

| — | | |

| 119,999,989 | | |

$ | 12,000 | | |

$ | 5,216,840 | | |

$ | (69,936,201 | ) | |

$ | (64,707,361 | ) |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (22,184,353 | ) | |

| (22,184,353 | ) |

| Net income (loss) | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (22,184,353 | ) | |

| (22,184,353 | ) |

| Balance at June 30, 2023 | |

| — | | |

$ | — | | |

| — | | |

$ | — | | |

| 119,999,989 | | |

$ | 12,000 | | |

$ | 5,216,840 | | |

$ | (92,120,554 | ) | |

$ | (86,891,714 | ) |

| Balance | |

| — | | |

$ | - | | |

| — | | |

$ | - | | |

| 119,999,989 | | |

$ | 12,000 | | |

$ | 5,216,840 | | |

$ | (92,120,554 | ) | |

$ | (86,891,714 | ) |

See

accompanying notes to the unaudited consolidated financial statements.

Tevogen

Bio Holdings Inc.

UNAUDITED

CONSOLIDATED STATEMENTS OF CASH FLOWS

| | |

2024 | | |

2023 | |

| | |

Six months ended June 30, | |

| | |

2024 | | |

2023 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net income (loss) | |

$ | 1,601,395 | | |

$ | (52,940,497 | ) |

| Adjustments to reconcile net income (loss) to net cash used in operating activities: | |

| | | |

| | |

| Depreciation expense | |

| 81,104 | | |

| 79,471 | |

| Stock-based compensation expense | |

| 30,475,469 | | |

| — | |

| Non-cash interest expense | |

| 159,305 | | |

| 589,135 | |

| Merger transaction costs | |

| 7,099,353 | | |

| — | |

| Change in fair value of convertible promissory notes | |

| (48,468,678 | ) | |

| 47,842,865 | |

| Loss on Series A Preferred Stock issuance | |

| 799,990 | | |

| — | |

| Loss on issuance of commitment shares | |

| 890,000 | | |

| — | |

| Change in fair value of warrants | |

| (6,815 | ) | |

| — | |

| Issuance of written call option | |

| 375,000 | | |

| — | |

| Change in fair value of written call option derivative liabilities | |

| (161,786 | ) | |

| — | |

| Amortization of right-of-use asset | |

| 117,189 | | |

| 104,438 | |

| Change in operating assets and liabilities: | |

| | | |

| | |

| Prepaid expenses and other assets | |

| (479,471 | ) | |

| 144,472 | |

| Other assets | |

| (68,446 | ) | |

| 21,343 | |

| Accounts payable | |

| 3,151,676 | | |

| 372,614 | |

| Accrued expenses and other liabilities | |

| (589,529 | ) | |

| (500,656 | ) |

| Operating lease liabilities | |

| (122,091 | ) | |

| (107,839 | ) |

| Net cash used in operating activities | |

| (5,146,335 | ) | |

| (4,394,654 | ) |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchases of property and equipment | |

| — | | |

| (133,000 | ) |

| Net cash used in investing activities | |

| — | | |

| (133,000 | ) |

| Cash flows from financing activities: | |

| | | |

| | |

| Cash acquired in connection with the reverse recapitalization | |

| 229,328 | | |

| — | |

| Proceeds from issuance of Series A Preferred Stock | |

| 2,000,000 | | |

| — | |

| Nonrefundable prepaid proceeds towards anticipated Series A-1 Preferred Stock Issuance | |

| 3,000,000 | | |

| — | |

| Proceeds from issuance of convertible promissory notes | |

| — | | |

| 2,500,000 | |

| Net cash provided by financing activities | |

| 5,229,328 | | |

| 2,500,000 | |

| Net increase (decrease) in cash | |

| 82,993 | | |

| (2,027,654 | ) |

| Cash – beginning of period | |

| 1,052,397 | | |

| 5,484,265 | |

| Cash – end of period | |

$ | 1,135,390 | | |

$ | 3,456,611 | |

| Supplementary disclosure of noncash investing and financing activities: | |

| | | |

| | |

| de-SPAC transaction fees included in accrued expenses and other liabilities | |

| — | | |

| 276,000 | |

| Conversion of convertible promissory notes into common stock in connection with Merger | |

| 46,622,627 | | |

| — | |

| Repurchase of Series B preferred stock | |

| 3,613,000 | | |

| — | |

| Issuance of common stock for net liabilities upon reverse recapitalization, net of

transaction costs | |

| (3,113,309 | ) | |

| — | |

See

accompanying notes to the unaudited consolidated financial statements.

TEVOGEN

BIO HOLDINGS INC.

NOTES

TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

1. NATURE OF BUSINESS

Tevogen

Bio Holdings Inc., a Delaware corporation (the “Company”), is a clinical-stage specialty immunotherapy company harnessing

the power of CD8+ cytotoxic T lymphocytes to develop off-the-shelf, precision T cell therapies for the treatment of infectious diseases,

cancers, and neurological disorders. The Company’s precision T cell technology platform, ExacTcell, is a set of processes and methodologies

to develop, enrich, and expand single human leukocyte antigen-restricted CTL therapies with proactively selected, precisely defined targets.

The Company has completed a Phase 1 proof-of-concept trial for the first clinical product of ExacTcell, TVGN 489, for the treatment of

ambulatory, high-risk adult COVID-19 patients, and has other product candidates in its pipeline.

On

February 14, 2024 (the “Closing Date”), pursuant to the agreement and plan of merger dated June 28, 2023 (the “Merger

Agreement”), by and among Semper Paratus Acquisition Corporation (“Semper Paratus”), Semper Merger Sub, Inc., a wholly

owned subsidiary of Semper Paratus (“Merger Sub”) SSVK Associates, LLC, (the “Sponsor”) Tevogen Bio Inc (n/k/a

Tevogen Bio Inc.) (“Tevogen Bio”), and Dr. Ryan Saadi in his capacity as seller representative, Merger Sub merged with and

into Tevogen Bio with Tevogen Bio being the surviving company and a wholly owned subsidiary of the Company (the “Merger,”

and together with the other transactions contemplated by the Merger Agreement, the “Business Combination”), and Semper Paratus

was renamed Tevogen Bio Holdings Inc.

In

connection with the closing of the Business Combination (the “Closing”), the then-outstanding shares of common stock of Tevogen

Bio, were converted into shares of the common stock of the Company at an exchange ratio of approximately 4.85 shares of Company common

stock for each share of Tevogen Bio common stock (the “Exchange Ratio”). See Note 4 for more information on the Business

Combination.

As

discussed in Note 4, the Merger was accounted for as a reverse recapitalization under which the historical financial statements of the

Company prior to the Merger are those of Tevogen Bio. All information related to the common stock of Tevogen Bio prior to the Closing

and presented in the consolidated financial statements and notes thereto has been retroactively adjusted to reflect the Exchange Ratio.

Following

the Merger, the former equity holders and holders of convertible promissory notes of Tevogen Bio held 91.0% of the outstanding shares

of common stock of the Company and the former shareholders, creditors, and other contractual counterparties of Semper Paratus held 9.1%

of the Company.

NOTE

2. DEVELOPMENT-STAGE RISKS AND LIQUIDITY

The

Company has generally incurred losses and negative cash flows from operations since inception and had an accumulated deficit of

$98,056,342

as of June 30, 2024. The Company anticipates incurring additional losses until such time, if ever, that it can generate significant

sales from its product candidates currently in development. Management believes that cash of $1,135,390

as of June 30, 2024 and the Loan Agreement entered into in June 2024 (as defined in Note 7), which allows the Company to draw down term

loans of $1,000,000

per month over thirty-six months for a total of $36,000,000, will allow the Company to have adequate cash and financial resources to operate for at least

the next 12 months from the date of issuance of these

unaudited consolidated financial statements. In July 2024, the Company drew $500,000 under the

Loan Agreement. In August 2024, the Company drew an additional $500,000 under the Loan Agreement. The Company does

not plan to initiate a clinical trial until additional funding is received.

Management

is currently evaluating different strategies to obtain the additional funding for future operations for subsequent periods. These

strategies may include but are not limited to private placements of equity and/or debt, licensing and/or marketing arrangements, and

public offerings of equity and/or debt securities. The Company may not be able to obtain financing on acceptable terms, or at all,

and the Company may not be able to enter into strategic alliances or other arrangements on favorable terms, or at all. The terms of

any financing may adversely affect the holdings or the rights of the Company’s stockholders. If the Company is unable to

obtain additional funding, the Company could be required to delay, reduce or eliminate research and development programs, product

portfolio expansion, or future commercialization efforts, which could adversely affect its business prospects.

Operations

since inception have consisted primarily of organizing the Company, securing financing, developing licensed technologies, performing

research, conducting pre-clinical studies and clinical trials, and pursuing the Business Combination. The Company is subject to risks

associated with any specialty biotechnology company that has substantial expenditures for research and development. There can be no assurance

that the Company’s research and development projects will be successful, that products developed will obtain necessary regulatory

approval, or that any approved product will be commercially viable. In addition, the Company operates in an environment of rapid technological

change and is largely dependent on the services of its employees and consultants.

Tevogen

Bio Holdings Inc.

NOTES

TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The

summary of significant accounting policies included in the Company’s annual financial statements that can be found in Exhibit 99.1

of the Company’s Current Report on Form 8-K/A filed with the SEC on April 29, 2024 (the “Form 8-K”), have not materially

changed, except as reflected in the following:

Basis

of Presentation

The

accompanying unaudited consolidated financial statements of the Company are presented in conformity with U.S. Generally Accepted Accounting

Principles (“GAAP”) for interim financial information and pursuant to the rules and regulations of the SEC. Any reference

in these notes to applicable guidance is meant to refer to GAAP as found in the Accounting Standards Codification (“ASC”)

and Accounting Standards Updates (“ASU”) of the Financial Accounting Standards Board (“FASB”). In the opinion

of management, the accompanying unaudited consolidated financial statements include all adjustments, consisting of a normal recurring

nature, (which consist primarily of accruals, estimates, and assumptions that impact the consolidated financial statements) that are

necessary for a fair presentation of the financial position, operating results and cash flows for the periods presented. The accompanying

unaudited consolidated financial statements should be read in conjunction with the financial statements and Management’s Discussion

and Analysis of Financial Condition and Results of Operations of Tevogen Bio filed as Exhibits 99.1 and 99.2 to the Form 8-K. The interim

results for the period presented are not necessarily indicative of the results to be expected for the year ending December 31, 2024,

or for any future interim periods.

Use

of Estimates

In

preparing unaudited consolidated financial statements in conformity with GAAP, management is required to make estimates and assumptions

that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities and the reported amounts

of expenses. Actual results could differ from those estimates. Estimates and assumptions are periodically reviewed, and the effects of

revisions are reflected in the unaudited consolidated financial statements in the period they are determined to be necessary.

Significant

areas that require management’s estimates include the fair value of the common stock and convertible promissory notes prior to

the Merger, the fair value of the Series A Preferred Stock and Series B Preferred Stock, fair value of the purchase options under the

Loan Agreement, stock-based compensation assumptions, the estimated useful lives of property and equipment and accrued research and development

expenses.

Freestanding

and Embedded Common Stock Purchase Options

Equity-linked

purchase options issued in connection with the Loan Agreement (as defined below) are assessed to determine whether they are

freestanding or embedded with the host instrument under ASC 815, Derivatives and Hedging-Contracts in Entity’s Own

Equity (“ASC 815”). Each type of purchase option is then assessed for equity or liability classification under ASC

815. The Company’s embedded and freestanding purchase options were determined to be liability-classified derivative

instruments and are measured at fair value both on the date of issuance and at each subsequent balance sheet date, with changes in

fair value recorded to ‘Change in fair value of written call option derivative liabilities’ within the consolidated

statements of operations and consolidated statements of cash flows.

Concentrations

of Credit Risk

Financial

instruments that potentially subject the Company to significant concentrations of credit risk consist primarily of cash. The Company

maintains deposits in federally insured financial institutions in excess of federally insured limits. The Company has not experienced

any losses in such accounts and believes it is not exposed to significant risk on its cash.

Segment

Reporting

Operating

segments are defined as components of an entity for which discrete financial information is both available and regularly reviewed by

its chief operating decision maker or decision-making group. The Company views its operations and manages its business in one segment.

Tevogen

Bio Holdings Inc.

NOTES

TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

Warrants

As

the result of the Merger, the Company accounts for its warrants originally sold as part of Semper Paratus’s initial public offering

(the “IPO”) in accordance with ASC 815, and considering ASC 480, Distinguishing Liabilities from Equity (“ASC

480”). The assessment considers whether the warrants are freestanding financial instruments and meet the definition of a liability

pursuant to ASC 480 and meet all of the conditions for equity classification under ASC 815, including whether the warrants are indexed

to the Company’s own shares of common stock, among other conditions. This assessment, which requires the use of professional judgment,

is conducted at the time of warrant issuance and as of each subsequent quarterly period end date while the warrants are outstanding.

For issued or modified warrants that meet all of the criteria for equity classification, the warrants are required to be recorded as

a component of additional paid-in capital at the time of issuance. For issued or modified warrants that do not meet all the criteria

for equity classification, the warrants are required to be recorded at their initial fair value on the date of issuance, and each balance

sheet date thereafter until settlement. Changes in the estimated fair value of the warrants are recognized as a non-cash loss on the

consolidated statements of operations. Under these standards, the Company’s private placement warrants sold at the time of the

IPO do not meet the criteria for equity classification and must be recorded as liabilities while the public warrants sold in connection

with the IPO do meet the criteria for equity classification and must be recorded as equity.

Fair

Value Measurements

Certain

assets and liabilities are carried at fair value under GAAP. Fair value is defined as the price that would be received for an asset or

paid to transfer a liability (exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction

between market participants on the measurement date. The Company utilizes valuation techniques that maximize the use of observable inputs

and minimize the use of unobservable inputs to the extent possible. When considering market participant assumptions in fair value measurements,

the following fair value hierarchy distinguishes between observable and unobservable inputs, which are categorized in one of the following

levels:

| Level

1 |

Unadjusted

quoted prices in active markets for identical assets or liabilities; |

| |

|

| Level

2 |

Observable

inputs other than Level 1 prices, such as quoted prices for similar, but not identical, assets or liabilities in active markets;

quoted prices for identical or similar assets or liabilities in markets that are not active; or other inputs that are observable

or can be corroborated by observable market data; |

| |

|

| Level

3 |

Unobservable

inputs in which there is little or no market data available and which require the Company to develop its own assumptions that market

participants would use in pricing an asset or liability. |

Financial

instruments recognized at historical amounts in the balance sheets consist of accounts payable and notes payable. The Company believes

that the carrying value of accounts payable and notes payable approximates their fair values due to the short-term nature of these instruments.

The

Company’s recurring fair value measurements consist of the convertible promissory notes prior to the Merger, for which the Company

elected the fair value option to reduce accounting complexity and private warrants after the Merger. Such fair value measurements are

Level 3 inputs. The following table provides a roll-forward of the aggregate fair values of the Company’s convertible promissory

notes.

SCHEDULE OF FAIR VALUE MEASUREMENT

| Balance at January 1, 2024 | |

$ | 94,932,000 | |

| | |

| - | |

| Accrued interest expense | |

| 159,305 | |

| Change in fair value | |

| (48,468,678 | ) |

| Derecognition upon conversion of convertible promissory notes | |

| (46,622,627 | ) |

| Balance at June 30, 2024 | |

$ | — | |

| | |

| | |

| Balance at January 1, 2023 | |

$ | 39,297,000 | |

| Initial fair value at issuance | |

| 2,500,000 | |

| Accrued interest expense | |

| 589,135 | |

| Change in fair value | |

| 47,842,865 | |

| Balance at June 30, 2023 | |

$ | 90,229,000 | |

The

Company used the probability weighted expected return method valuation methodology to determine the fair value of the convertible

promissory notes prior to the Merger. Significant assumptions and ranges used in determining the fair value of convertible

promissory notes prior to the Merger included volatility (80%),

discount rate (35%

- 36%), and probability of a future liquidity event (85%

- 95%).

The Company used its stock price on the Closing Date to determine the fair value for the conversion derecognition of the convertible

promissory notes on the Closing Date.

There

were no transfers between levels during the six months ended June 30, 2024 and 2023.

Tevogen

Bio Holdings Inc.

NOTES

TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

Upon

the Closing, the Company acquired private warrants the fair value of which decreased by $6,815 between the Closing Date and June 30,

2024. Such fair value measurements are Level 3 inputs. The following table provides a roll-forward of the aggregate fair values of the

warrants.

SCHEDULE OF FAIR VALUES OF WARRANTS

| | |

Derivative

warrant liabilities | |

| Balance at February 15, 2024 | |

$ | — | |

| Initial fair value at issuance | |

| 29,000 | |

| Change in fair value | |

| (6,815 | ) |

| Balance at June 30, 2024 | |

$ | 22,185 | |

In

June 2024, the Company acquired written call options, the fair value of which decreased by $161,786 between the issuance and June 30,

2024. Such fair value measurements are Level 3 inputs. The following table provides a roll-forward of the aggregate fair values of the

written call options.

| | |

Written call option derivative liabilities | |

| Balance at February 15, 2024 | |

$ | — | |

| Initial fair value at issuance | |

| 375,000 | |

| Change in fair value | |

| (161,786 | ) |

| Balance at June 30, 2024 | |

$ | 213,214 | |

The

following table presents information about the Company’s assets and liabilities that are measured at fair value on a recurring

basis at June 30, 2024, and indicates the fair value hierarchy of the valuation inputs the Company utilized to determine such fair value.

SCHEDULE OF ASSETS AND LIABILITIES MEASURED AT FAIR VALUE ON RECURRING BASIS

| | |

Level | | |

Quoted

Prices in

Active

Markets

(Level 1) | | |

Significant

Other

Observable

Inputs

(Level 2) | | |

Significant

Other

Unobservable

Inputs

(Level 3) | |

| Liabilities: | |

| | | |

| | | |

| | | |

| | |

| Derivative warrant liabilities | |

| 3 | | |

$ | — | | |

$ | — | | |

$ | 22,185 | |

| Written call option derivative liabilities | |

| 3 | | |

$ | — | | |

$ | — | | |

$ | 213,214 | |

The

Company’s nonrecurring fair value measurements consist of Series A Preferred Stock. Such fair value measurements are Level 3 inputs.

The Company determined the fair value of Series A Preferred Stock using a Monte Carlo simulation. Key inputs utilized in the Monte Carlo

simulation to estimate fair value of Series A Preferred Stock included a range of volatility between 75% to 85%, a holding period to

a deemed liquidation event, as defined in the Series A Preferred Stock agreement, ranging from 0.5 to 10.0 years, and a risk-free interest

rate between 4.3% and 5.3%. The difference between the cash received of $2,000,000 upon issuance of the Series A Preferred Stock and

its estimated fair value was recognized as general and administrative expense on the consolidated statements of operations.

In June 2024, the Company entered into

a Loan Agreement (the “Loan Agreement”) with The Patel Family, LLP (the “Lender”), a related party of the Company,

providing for an unsecured line of credit facility (the “Facility”) for term loans of up to $36,000,000. The Company used

a Monte Carlo simulation to determine the fair value of the freestanding $14,000,000

purchase option and embedded $36,000,000 purchase

option associated with the Loan Agreement. The Monte Carlo simulation methodology simulates the Company’s future

stock price to estimate if and when the Trailing VWAP (as defined below) will reach $10.00

per share, and discounts the resulting payoff back to each valuation date using a present value factor. Significant assumptions

used in determining the fair value of these options include volatility of 72.5%

and discount rate of 4.94%.

Net

Income (Loss) Per Share

The

Company computes basic net income (loss) per share by dividing net income (loss) by the weighted-average common stock outstanding during

the period. The Company determined that each outstanding share of preferred stock and restricted common stock would participate in earnings

available to common stockholders but would not participate in losses. The Company computes diluted net income (loss) per share by dividing

the net income (loss) by the sum of the weighted-average number of common stock outstanding during the period, plus the potential dilutive

effects, if any, of potentially dilutive securities.

Recently

Issued Accounting Standards

In

August 2020, the FASB issued ASU No. 2020-06, Debt - Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and

Hedging - Contracts in Entity’s Own Equity (Subtopic 815 -40): Accounting for Convertible Instruments and Contracts in an Entity’s

Own Equity (“ASU 2020-06”), which simplifies the accounting for convertible instruments by reducing the number of accounting

models available for convertible debt instruments. ASU 2020-06 also eliminates the treasury stock method to calculate diluted earnings

per share for convertible instruments and requires the use of the if-converted method. Effective January 1, 2024, the Company adopted

ASU 2020-06 and that adoption did not have an impact on its consolidated financial statements and related disclosures.

Tevogen

Bio Holdings Inc.

NOTES

TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

In

November 2023, the FASB issued ASU No. 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures (“ASU

2023-07”). ASU 2023-07 enhances reportable segment disclosures by requiring disclosures such as significant segment expenses, information

on the chief operating decision maker and disclosures for entities with a single reportable segment. Additionally, the amendments enhance

interim disclosure requirements, clarify circumstances in which an entity can disclose multiple segment measures of profit or loss, and

contain other disclosure requirements. ASU 2023-07 is effective for fiscal years beginning after December 15, 2023, and interim periods

within fiscal years beginning after December 15, 2024. The Company does not expect the adoption of ASU 2023-07 to have a material impact

on its consolidated financial statements and related disclosures.

NOTE

4. BUSINESS COMBINATION

On

the Closing Date, the Company completed the Business Combination described in Note 1. The Merger was accounted for as a reverse recapitalization

under GAAP because Tevogen Bio was determined to be the accounting acquirer based upon the terms of the Merger and other factors, including

that following the Merger, former Tevogen Bio (i) equityholders and holders of convertible promissory notes owned approximately 91.0%

of the Company, (ii) directors constituted the majority (six of seven) of the directors of the Company, and (iii) management held all

key positions of management of the Company. Accordingly, the Merger was treated as the equivalent of Tevogen Bio issuing stock to acquire

the net assets of Semper Paratus. As a result of the Merger, the net liabilities of Semper Paratus were recorded at their acquisition-date

fair value in the consolidated financial statements and the reported operating results prior to the Merger are those of Tevogen Bio.

Immediately after the Merger, there were 164,614,418 shares of the Company’s common stock outstanding.

The

following table shows the net liabilities acquired in the Merger:

SCHEDULE

OF NET LIABILITIES ACQUIRED IN MERGER

| | |

February 14, 2024 | |

| Cash | |

$ | 229,328 | |

| Due from Sponsor | |

| 158,819 | |

| Prepaid expenses and other assets | |

| 2,501 | |

| Accounts payable | |

| (96,175 | ) |

| Accrued expenses | |

| (1,269,126 | ) |

| Notes payable | |

| (1,651,000 | ) |

| Derivative warrant liabilities | |

| (29,000 | ) |

| Total net liabilities acquired | |

| (2,654,653 | ) |

| Plus: Merger transaction costs limited to cash acquired | |

| (229,328 | ) |

| Total net liabilities acquired plus transaction costs | |

$ | (2,883,981 | ) |

Total

transaction costs of $7,728,681 were incurred in relation to the Merger through the Closing Date, of which $229,328 were charged directly

to equity to the extent of the cash received from the Merger, with the balance of $7,499,353 charged to Merger transaction costs for

the six months ended June 30, 2024.

Former

holders of Tevogen Bio common stock and the Sponsor are eligible to receive up to an aggregate of 24,500,000 shares of common stock (“Earnout

Shares”) if the volume-weighted average price (the “VWAP”) of the Company’s common stock reaches specified threshold

levels during the three-year period commencing on the Closing Date. Refer to Note 5, Earnout Shares, for further details of the earnout

arrangement.

In

connection with the Merger, the Company issued Series B Preferred Stock to the Sponsor in return for the Sponsor assuming $3,613,000

of liabilities and obligations (“Assumed Liabilities”) of Semper Paratus and Tevogen Bio. The issuance date fair value of

the Series B Preferred Stock was recorded to Merger transaction costs within the consolidated statements of operations. All of the issued

Series B Preferred Stock was repurchased by the Company during the three months ended June 30, 2024 in exchange for the Sponsor being

released from their obligation to repay the Assumed Liabilities. See Note 9 for additional information.

NOTE

5. EARNOUT SHARES

Following

the Closing, former holders of Tevogen Bio common stock may receive up to 20,000,000 Earnout Shares in tranches of 6,666,667, 6,666,667,

and 6,666,666 shares of common stock per tranche, respectively. The first, second, and third tranches are issuable if the VWAP per share

of the Company’s common stock is greater or equal to $15.00, $17.50, and $20.00, respectively, over any twenty trading days within

any thirty consecutive day trading period during the three-year period after the Closing.

Tevogen

Bio Holdings Inc.

NOTES

TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

The

Sponsor received the right to Earnout Shares with the same terms above, except that each of the Sponsor’s three earnout tranches

are for shares of common stock, for an aggregate of shares across the entire Sponsor earnout. The Earnout Shares

are a form of dividend for holders of Tevogen Bio common stock, and the Earnout Shares earnable by the Sponsor are treated as contingent

consideration in a reverse recapitalization. In accordance with ASC 815, the Earnout Shares were considered to be indexed to the Company’s

common stock and are classified within permanent equity.

NOTE

6. ACCRUED EXPENSES AND OTHER LIABILITIES

Accrued

expenses and other liabilities consisted of the following:

SCHEDULE

OF ACCRUED EXPENSES AND OTHER LIABILITIES

| | |

June 30, | | |

December, 31 | |

| | |

2024 | | |

2023 | |

| Professional services | |

$ | 1,387,446 | | |

$ | 976,301 | |

| Other | |

| 388,601 | | |

| 120,149 | |

| Total | |

$ | 1,776,047 | | |

$ | 1,096,450 | |

NOTE

7. DEBT

Loan Agreement

On

June 6, 2024, the Company entered into the Loan Agreement with the Lender, providing for an unsecured line of credit facility for term loans of up

to $36,000,000. Under the Facility, the Company may draw up to $1,000,000 in term loans per calendar month over a draw period of 36 months.

Each term loan draw will have a maturity date of 48 months and will accrue interest at the lower of (i) daily SOFR plus 2.00% and (ii)

7.00%. Interest accrues quarterly and is payable on the three-month anniversary of the draw date. Interest is payable in shares of common

stock at an effective price of $1.50 per share. Principal may be prepaid prior to the maturity date without penalty, and repayments or prepayments may

be made in cash or common stock at the Company’s election. Payments of principal in common stock would be made at an effective

price of the greater of $1.50 per share and the ten-day trailing volume weighted average price per share of the common stock (the “Trailing

VWAP”) as of the trading day prior to payment. As an incentive to enter into the Loan Agreement, the Company issued 1,000,000 shares

of common stock to the Lender during June 2024.

The

Loan Agreement includes a purchase option whereby the Lender has the option to purchase up to $14,000,000 of shares of common stock at

a purchase price equal to 70% of the Trailing VWAP per share (the “$14.0 million Purchase Option”). The $14.0 million Purchase

Option only becomes exercisable once Trailing VWAP reaches $10.00 per share. The $14.0 million Purchase Option was determined to be a freestanding

derivative liability under ASC 815 and is carried at fair value, with changes in fair value recorded to change in fair value of written

call option derivatives liabilities within the consolidated statements of operations.

The

Loan Agreement also includes a purchase option (the “Additional Amount Purchase Option”) that is identical to the $14.0

million Purchase Option, except that the option is exercisable for an amount up to the then-remaining undrawn term loan amount under

the Loan Agreement at the time Trailing VWAP reaches $10.00

per share. The Additional Amount Purchase Option was determined to be an embedded derivative within the written loan commitment that

requires bifurcation under ASC 815, and is carried at fair value with changes in fair value recorded to change in fair value of

written call option derivatives liabilities within the consolidated statements of operations.

The

$14.0 million Purchase Option and the Additional Amount Purchase Option are recorded to written call option derivative liabilities within

the consolidated balance sheet.

The

Loan Agreement is a written loan commitment that is not eligible for the fair value option under ASC 825, Financial

Instruments. However, management intends to elect the fair value option for future draws under this commitment, and therefore

has expensed all issuance costs associated with the Loan Agreement, which are comprised of the fair value of the 1,000,000

shares of common stock issued to the Lender of $890,000, as well as the issuance date fair value of $105,000 and $270,000 for the

$14.0

million Purchase Option and Additional Amount Purchase Option, respectively.

Tevogen

Bio Holdings Inc.

NOTES

TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

Notes

Payable

As

a result of the Merger, the Company assumed notes payable held by Polar Multi-Strategy Master Fund (“Polar”) for which

the proceeds were to be used for working capital purposes by Semper Paratus with an outstanding balance of $1,651,000

on the Closing Date and remain outstanding at June 30, 2024. The notes payable do not

accrue interest. The outstanding balance of the notes was required to be repaid in full within five business days of the Merger, and

the Company is therefore in default of its obligations at June 30, 2024. The notes’ default provisions do not require the

Company to transfer any shares or pay any amounts to Polar. In May 2024, the Company issued 1,500,000

shares of common stock as loan consideration to Polar under a subscription agreement as a result of the Merger.

NOTE

8. STOCK-BASED COMPENSATION

In

connection with the Closing, the Company adopted the Tevogen Bio Holdings Inc. 2024 Omnibus Incentive Plan (the “2024 Plan”)

and no longer grants awards pursuant to the 2020 Equity Incentive Plan (the “2020 Plan”). Each restricted stock unit (“RSU”)

award granted under the 2020 Plan that was outstanding and unvested as of the Closing Date was automatically canceled and converted into

an award under the 2024 Plan with respect to the common stock of the Company (the “Rollover RSUs”). Such Rollover RSUs remain

subject to the same terms and conditions as set forth under the applicable award agreement prior to the Closing.

In

addition to covering the Rollover RSUs, under the 2024 Plan, the Company is authorized to grant awards up to an aggregate 40,000,000

shares of common stock. The 2024 Plan provides for the grant of options, stock appreciation rights, restricted stock, restricted stock

units, and other equity-based awards. As of June 30, 2024, awards for 20,651,046 shares

remained available to be granted under the 2024 Plan.

The

Company has issued RSUs that are subject to either service-based vesting conditions or service-based and performance-based vesting conditions.

Compensation expense for service-based RSUs are recognized on a straight-line basis over the vesting period of the award. Compensation

expense for service-based and performance-based RSUs (“Performance-Based RSUs”) are recognized when the performance condition,

which is based on a liquidity event condition being satisfied, is deemed probable of achievement.

On

the Closing Date, the Company issued an aggregate of 19,348,954 RSUs under the 2024 Plan to the Company’s Chief Executive Officer,

Dr. Ryan Saadi (the “Special RSU Award”). Such RSUs immediately converted into shares of restricted common stock (“Restricted

Stock”), the restrictions on which lapse in four equal annual installments beginning on February 14, 2031 (“Vesting Period”).

Pursuant to the terms of the Special RSU Award, Dr. Saadi will be entitled to vote the Restricted Stock, but the shares may not be sold,

assigned, transferred, pledged, hypothecated, or otherwise encumbered, subject to forfeit. Dr. Saadi will automatically forfeit all unvested

Restricted Stock in the event he departs the Company. The fair value per share for the Special RSU Award was determined to be $4.51 per

share, equivalent to the Company’s stock price on the Closing Date, resulting in a total grant date fair value of $87,263,783.

In accordance with ASC 718, Compensation - Stock Compensation (“ASC 718”), the Company will recognize compensation

expense on a straight-line basis from the Closing Date until the completion of the Vesting Period.

Restricted

Stock and RSU activity was as follows:

SCHEDULE OF RESTRICTED STOCK AND RSU ACTIVITY

| | |

Service-Based Restricted Stock | | |

Performance-Based RSUs | |

| | |

Shares | | |

Weighted

average

grant-date

fair value | | |

Shares | | |

Weighted

average

grant-date

fair value | |

| Nonvested as of January 1, 2024 | |

| — | | |

$ | — | | |

| 10,900,128 | | |

$ | 2.97 | |

| Granted | |

| 19,348,954 | | |

| 4.51 | | |

| — | | |

| — | |

| Vested | |

| — | | |

| — | | |

| (7,174,362 | ) | |

| 2.85 | |

| Forfeited | |

| — | | |

| — | | |

| — | | |

| — | |

| Nonvested as of June 30, 2024 | |

| 19,348,954 | | |

$ | 4.51 | | |

| 3,725,766 | | |

$ | 3.19 | |

As

a result of the Merger, the liquidity event performance condition was achieved and therefore compensation cost of $1,966,603

the three months ended June 30, 2024 and $27,200,090

for the six months ended June 30, 2024 was recognized for the Performance-Based RSUs, of which 1,711,984

shares were issued as of June 30, 2024, and 5,462,378

shares will be issued subsequent to June 30, 2024. There was $83,988,402

of unrecognized compensation cost related to Restricted Stock as of June 30, 2024 which will be expensed over a weighted average

period of 9.6

years. There was $5,138,040

of unrecognized compensation cost related to Performance-Based RSUs as of June 30, 2024, which will be expensed over a weighted

average period of 0.9

years.

Tevogen

Bio Holdings Inc.

NOTES

TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

The

Company recorded stock-based compensation expense in the following expense categories in the accompanying consolidated statements of

operations:

SCHEDULE OF STOCK-BASED COMPENSATION EXPENSE

| | |

Three months ended | | |

Six months ended | |

| | |

June 30,

2024 | | |

June 30,

2024 | |

| Research and development | |

$ | 3,010,944 | | |

$ | 22,746,840 | |

| General and administrative | |

| 1,131,276 | | |

| 7,728,629 | |

| Total | |

$ | 4,142,220 | | |

$ | 30,475,469 | |

No

stock-based compensation expense was recognized during the three or six months ended June 30, 2023.

NOTE

9. STOCKHOLDERS’ DEFICIT

Common

Stock

As

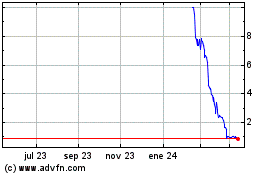

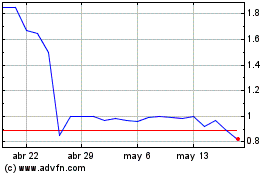

of February 15, 2024, the Company’s common stock and warrants began trading on The Nasdaq Stock Market LLC under the symbols “TVGN”

and “TVGNW”, respectively.

As

of June 30, 2024, the Company had 168,826,402 shares of common stock issued and outstanding. For accounting purposes related to earnings

per share, only shares that are fully vested or are not subject to repurchase are considered issued and outstanding.

Below

is a reconciliation of shares of common stock issued and outstanding:

SCHEDULE OF RECONCILIATION OF SHARES OF COMMON STOCK ISSUED AND OUTSTANDING

| | |

June 30, | |

| | |

2024 | |

| Total shares of common stock legally issued and outstanding | |

| 168,826,402 | |

| Plus: shares to be issued: | |

| | |

| Vested Performance-Based RSUs from satisfaction of liquidity condition upon the Closing (a) | |

| 5,462,378 | |

| Less: Shares subject to future vesting: | |

| | |

| Issuance of restricted common stock subject to forfeiture (b) | |

| (19,348,954 | ) |

| Total shares issued and outstanding | |

| 154,939,826 | |

Prior

to the Merger, Tevogen Bio had outstanding shares of voting and non-voting common stock. Upon the Closing, Tevogen Bio’s common

stockholders received shares of the Company’s common stock in an amount determined by application of the Exchange Ratio, as discussed

in Note 1.

Preferred

Stock

The

Company is authorized to issue up to 20,000,000 shares of preferred stock, par value $0.0001 per share.

Series

A Preferred Stock

In

March 2024, the Company authorized and issued 2,000 and 500 shares, respectively, of Series A Preferred Stock (the “Series A”)

to an investor at a price of $4,000 per share (the “Series A Original Issue Price”), for gross proceeds of $2.0 million.

The Company recorded an expense of $799,990 in its consolidated statements of operations related to issuance of the Series A equal to

the fair value of the Series A when issued of $5,600 per share less the purchase price of $4,000 per share.

Tevogen

Bio Holdings Inc.

NOTES

TO THE UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

Dividends

Holders

of Series A are entitled to receive dividends accruing daily on a cumulative basis payable at a fixed rate of 5% per annum per share

on the Series A Original Issue Price, which rate will automatically increase by 2% every year that the Series A remains outstanding (the

“Series A Accruing Dividends”). These dividends become payable when and if declared by the Company. The Series A Preferred

Stock will also participate on an as-converted basis in any regular or special dividends paid to holders of the common stock.

Liquidation

The

Series A ranks senior to common stock and Series B Preferred Stock (the “Series B”) in liquidation priority. In the event

of a liquidation of the Company, or certain deemed liquidation events, the Series A is redeemable for a price equal to the greater of

the Series A Original Issue Price plus all Series A Accruing Dividends that are unpaid through the redemption date, or such amount that