UMB will have approximately $66 billion in

assets, elevating it to the top 4% of publicly traded U.S.

banks

UMB Financial Corporation (Nasdaq: UMBF) and Heartland Financial

USA, Inc. (Nasdaq: HTLF) are pleased to share that the necessary

regulatory approvals from the Office of the Comptroller of the

Currency and the Board of Governors of the Federal Reserve System

have been received to complete the previously announced acquisition

of HTLF. These approvals follow shareholder approvals for both

companies.

“Receiving regulatory approvals is another milestone in

completing this historic acquisition,” said Mariner Kemper,

chairman and chief executive officer of UMB Financial Corporation.

“We remain extremely excited about this momentous expansion of our

core services and capabilities, which will benefit both UMB and

HTLF customers. As we’ve previously shared, HTLF’s like-minded

culture and customer approach are an ideal fit for our business

model, our credit and risk profiles, and our associates, customers

and communities.”

The acquisition is expected to close on or around Jan. 31,

2025.

“We’re pleased this step in the process has been completed,”

said Bruce K. Lee, president and chief executive officer of HTLF.

“Our complementary strengths ensure we’ll continue delivering the

best products, services and expertise to our customers.”

Upon closing, UMB will have approximately $66 billion in assets

(based on assets as of Sept. 30, 2024), elevating it to the top 4%

of the 599 publicly traded banks in the U.S. The transaction will

increase UMB’s private wealth management AUM/AUA by 31% and nearly

doubles its retail deposit base. It will also expand UMB’s presence

from eight to 13 states.

UMB is deeply invested in the communities in which it does

business, providing support through products, services, and

investments as well as corporate and associate giving. UMB is

committed to being a strong financial steward and is finalizing its

Community Benefits Agreement, which will detail how it will provide

support throughout its newly expanded footprint. Specific details

will be shared upon close or when the plan is finalized.

Finally, five HTLF board members will join the UMB Financial

Corporation Board of Directors after final approval by the UMBF

Board at acquisition close: John Schmidt, Bradley (Brad) Henderson,

Jennifer (Jenny) Hopkins, Margaret Lazo and Susan Murphy. With

these additions, the UMBF Board will grow to 16 board members.

“We’re excited to add these extremely talented individuals to

our Board and look forward to working with them in 2025 and

beyond,” Kemper said.

John Schmidt has served as the independent Chairman of

the HTLF Board since March 15, 2022. He has been the senior vice

president and chief financial officer (CFO) of A.Y. McDonald

Industries since 2013 and was named corporate secretary in

2014.

Brad Henderson is the chief executive officer of P33, a

nonprofit organization focused on inclusively driving Chicago’s

global technology leadership, where he has served since July

2019.

Jenny Hopkins has been a managing partner at Crescendo

Capital, a private investment firm for early-stage companies, since

2007.

Margaret Lazo is a senior operating consultant at

Cerberus Capital Management, a global private equity firm, where

she is engaged in human capital initiatives across its portfolio

companies.

Susan Murphy has served as the chairperson of the HTLF

Audit Committee since April 5, 2022. She has been a Principal at

The Grace Alliance, LLC in Denver since 2005, which assists

individuals and families in developing and maintaining financial

strategies for the future.

The transaction closure is still subject to satisfaction or

waiver of the remaining customary closing conditions.

About UMB:

UMB Financial Corporation (Nasdaq: UMBF) is a financial services

company headquartered in Kansas City, Missouri. UMB offers

commercial banking, which includes comprehensive deposit, lending

and investment services, personal banking, which includes wealth

management and financial planning services, and institutional

banking, which includes asset servicing, corporate trust solutions,

investment banking, and healthcare services. UMB operates branches

throughout Missouri, Illinois, Colorado, Kansas, Oklahoma,

Nebraska, Arizona and Texas. As the company’s reach continues to

grow, it also serves business clients nationwide and institutional

clients in several countries. For more information, visit UMB.com,

UMB Blog, UMB Facebook and UMB LinkedIn.

About HTLF

Heartland Financial USA, Inc., is a Denver, Colorado-based bank

holding company operating under the brand name HTLF, with assets of

$18.27 billion as of September 30, 2024. HTLF's banks serve

customers in the West, Southwest and Midwest regions. HTLF is

committed to serving the banking needs of privately owned

businesses, their owners, executives and employees. Our core

commercial business is supported by a strong retail banking

operation, in addition to a diversified line of financial services

including treasury management, wealth management and investments.

Additional information is available at www.htlf.com.

Cautionary Note Regarding Forward-Looking Statements

This joint press release contains “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Rule 175 promulgated thereunder, and Section 21E of

the Securities Exchange Act of 1934, as amended, and Rule 3b-6

promulgated thereunder, which statements involve inherent risks and

uncertainties. Any statements about UMB’s, HTLF’s or the combined

company’s plans, objectives, expectations, strategies, beliefs, or

future performance or events constitute forward-looking statements.

Such statements are generally identified as those that include

words or phrases such as “believes,” “expects,” “anticipates,”

“plans,” “trend,” “objective,” “continue,” or similar expressions

or future or conditional verbs such as “will,” “would,” “should,”

“could,” “might,” “may,” or similar expressions. Forward-looking

statements involve known and unknown risks, uncertainties,

assumptions, estimates, and other important factors that change

over time and could cause actual results to differ materially from

any results, performance, or events expressed or implied by such

forward-looking statements. Such forward-looking statements include

but are not limited to statements about the benefits of the

previously announced business combination transaction between UMB

and HTLF (the “Transaction”), including future financial and

operating results, the combined company’s plans, objectives,

expectations and intentions, and other statements that are not

historical facts.

These forward-looking statements are subject to risks and

uncertainties that may cause actual results to differ materially

from those projected. In addition to factors previously disclosed

in UMB’s and HTLF’s reports filed with the United States Securities

and Exchange Commission (the “SEC”), the following factors, among

others, could cause actual results to differ materially from

forward-looking statements or historical performance: the

occurrence of any event, change, or other circumstance that could

give rise to the right of one or both of the parties to terminate

the definitive merger agreement between UMB and HTLF; the outcome

of any legal proceedings that may be instituted against UMB or

HTLF; the possibility that the Transaction does not close when

expected or at all because the remaining conditions to closing are

not satisfied on a timely basis or at all; the risk that the

benefits from the Transaction may not be fully realized or may take

longer to realize than expected, including as a result of changes

in, or problems arising from, general economic and market

conditions, interest and exchange rates, monetary policy, laws and

regulations and their enforcement, and the degree of competition in

the geographic and business areas in which UMB and HTLF operate;

the ability to promptly and effectively integrate the businesses of

UMB and HTLF; the possibility that the Transaction may be more

expensive to complete than anticipated, including as a result of

unexpected factors or events; reputational risk and potential

adverse reactions of UMB’s or HTLF’s customers, employees or other

business partners, including those resulting from the announcement

or completion of the Transaction; the dilution caused by UMB’s

issuance of additional shares of its capital stock in connection

with the Transaction; and the diversion of management’s attention

and time from ongoing business operations and opportunities on

merger-related matters.

These factors are not necessarily all of the factors that could

cause UMB’s, HTLF’s or the combined company’s actual results,

performance, or achievements to differ materially from those

expressed in or implied by any of the forward-looking statements.

Other factors, including unknown or unpredictable factors, also

could harm UMB’s, HTLF’s or the combined company’s results.

All forward-looking statements attributable to UMB, HTLF, or the

combined company, or persons acting on UMB’s or HTLF’s behalf, are

expressly qualified in their entirety by the cautionary statements

set forth above. Forward-looking statements speak only as of the

date they are made and UMB and HTLF do not undertake or assume any

obligation to update publicly any of these statements to reflect

actual results, new information or future events, changes in

assumptions, or changes in other factors affecting forward-looking

statements, except to the extent required by applicable law. If UMB

or HTLF update one or more forward-looking statements, no inference

should be drawn that UMB or HTLF will make additional updates with

respect to those or other forward-looking statements. Further

information regarding UMB, HTLF and factors which could affect the

forward-looking statements contained herein can be found in UMB’s

Annual Report on Form 10-K for the fiscal year ended December 31,

2023 (and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/0000101382/000095017024018456/umbf-20231231.htm)

and its subsequent Quarterly Reports on Form 10-Q, Current Reports

on Form 8-K, and its other filings with the SEC, in HTLF’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2023

(and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/920112/000092011224000026/htlf-20231231.htm),

and its subsequent Quarterly Reports on Form 10-Q, Current Reports

on Form 8-K and its other filings with the SEC, and the risks

described in UMB’s definitive joint proxy statement/prospectus

related to the Transaction, which was filed with the SEC on July 5,

2024 (and which is available at

https://www.sec.gov/Archives/edgar/data/101382/000119312524175612/d771152d424b3.htm).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250110166743/en/

UMB Media Contact: Stephanie Hague Stephanie.Hague@umb.com

816.729.1027

HTLF Media Contact: Ryan Lund rlund@htlf.com 952.746.0439

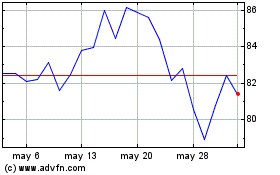

UMB Financial (NASDAQ:UMBF)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

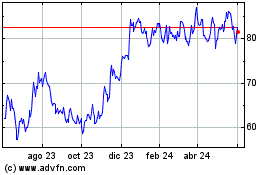

UMB Financial (NASDAQ:UMBF)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025