Filed

Pursuant To General Instruction II.L of Form F-10

Registration

No. 333-272534

PROSPECTUS

SUPPLEMENT

To

the Short Form Base Shelf Prospectus Dated July 20, 2023

| NEW

ISSUE |

AUGUST

29, 2024 |

URANIUM

ROYALTY CORP.

Up

to US$39,000,000

Common

Shares

This

prospectus supplement (the “prospectus supplement”) of Uranium Royalty Corp. (the “Company”), together

with the accompanying short form base shelf prospectus to which this prospectus supplement relates dated July 20, 2023 (the “prospectus”),

qualifies the distribution (the “Offering”) of common shares (the “Offered Shares”) of the Company

having an aggregate sale price of up to US$39,000,000 (or the equivalent in Canadian dollars determined using the daily exchange rate

posted by the Bank of Canada on the date the Offered Shares are sold). See “Plan of Distribution” herein and “Description

of Securities” in the accompanying prospectus.

The

outstanding common shares (the “Common Shares”) of the Company are listed and posted for trading on the Toronto Stock

Exchange (“TSX”) and on the Nasdaq Capital Market (“Nasdaq”) under the symbol “URC”

and “UROY”, respectively. On August 28, 2024, the last trading day before the date of this prospectus supplement,

the closing price of the Common Shares (i) on the TSX was C$2.98 per Common Share, and (ii) on Nasdaq was US$2.20

per Common Share. The Company has received conditional approval from TSX to list the Offered Shares distributed under the Offering,

subject to the Company fulfilling all of the requirements of the TSX. The Company has submitted a Listing of Additional Shares Notification

form for the Offered Shares to Nasdaq.

The

Company has entered into an equity distribution agreement dated August 29, 2024 (the “Distribution Agreement”)

with BMO Nesbitt Burns Inc., Canaccord Genuity Corp., National Bank Financial Inc., Paradigm Capital Inc. and TD Securities Inc.

(the “Canadian Agents”) and BMO Capital Markets Corp., Canaccord Genuity LLC, H.C. Wainwright & Co., LLC,

National Bank of Canada Financial Inc. and TD Securities (USA) LLC (the “U.S. Agents” and, together with the Canadian

Agents, the “Agents”), pursuant to which the Company may distribute up to US$39,000,000 (or the equivalent in Canadian

dollars determined using the daily exchange rate posted by the Bank of Canada on the date the Offered Shares are sold) of Offered Shares

in the Offering from time to time through the Agents, as agents, in accordance with the terms of the Distribution Agreement. See “Plan

of Distribution”. The Offering is being made concurrently in Canada under the terms of this prospectus supplement and in the

United States under the terms of the Company’s registration statement on Form F-10, as amended (File No. 333-272534) (the “Registration

Statement”), filed with the United States Securities and Exchange Commission (the “SEC”) of which this prospectus

supplement forms a part.

Sales

of Offered Shares, if any, under this prospectus supplement will only be made in transactions that are deemed to be “at-the-market

distributions” as defined in National Instrument 44-102 — Shelf Distributions (“NI 44-102”), involving

sales made directly on the TSX, Nasdaq or on any other trading market for the Common Shares in Canada or the United States. The Offered

Shares will be distributed at market prices prevailing at the time of the sale. As a result, prices may vary as between purchasers and

during the period of distribution. The Agents are not required to sell any specific number or dollar amount of Offered Shares but will

use their commercially reasonable efforts to sell the Offered Shares pursuant to the terms and conditions of the Distribution Agreement.

There is no minimum amount of funds that must be raised under the Offering. This means that the Offering may terminate after only

raising a small portion of the offering amount set out above, or none at all. The Canadian Agents are not registered as broker-dealers

in the United States and, accordingly, will only sell Offered Shares on marketplaces in Canada, and the U.S. Agents are not registered

as investment dealers in any Canadian jurisdiction and, accordingly, will only sell Offered Shares on marketplaces in the United States.

See “Plan of Distribution”.

The

Company will pay the Agents a commission for their services in acting as agents in connection with the sale of Offered Shares pursuant

to the Distribution Agreement (the “Commission”). The amount of the Commission shall not exceed 2.50% of the

gross sales price per Offered Share sold; provided that the Company shall not be obligated to pay the Commission on any sale of Offered

Shares that is not possible to settle due to: (i) a suspension or material limitation in trading in securities generally on the TSX or

Nasdaq; (ii) a material disruption in securities settlement or clearance services in the United States or Canada; or (iii) failure by

the applicable Agent to comply with its obligations under the terms of the Distribution Agreement. The Company estimates that the total

expenses that it will incur related to the commencement of the Offering, excluding compensation payable to the Agents under the terms

of the Distribution Agreement, will be approximately C$400,000 (exclusive of taxes and disbursements). The net proceeds to the

Company from the sale of any Offered Shares will be equal to the sales proceeds after payment of the Commission and deduction of any

applicable expenses payable by the Company and any applicable transaction or filing fees imposed by any governmental, regulatory or self-regulatory

organization in connection with such sales. See “Plan of Distribution”.

The

Company is permitted, under the multi-jurisdictional disclosure system adopted by the United States and Canada (“MJDS”),

to prepare this prospectus supplement and the accompanying prospectus in accordance with Canadian disclosure requirements. Purchasers

of the Offered Shares should be aware that such requirements are different from those of the United States. Financial statements incorporated

herein by reference have been prepared in accordance with International Financial Reporting Standards, as issued by the International

Accounting Standards Board (“IFRS”), and such financial statements are reported in Canadian dollars. See “Financial

and Exchange Rate Information” and “Auditor, Transfer Agent and Registrar”.

Purchasers

of the Offered Shares should be aware that the acquisition of the Offered Shares may have tax consequences both in the United States

and in Canada. Such consequences for purchasers who are resident in, or citizens of, the United States or who are resident in Canada

may not be described fully herein. Purchasers of the Offered Shares should read the tax discussion contained in this prospectus supplement

and consult their own tax advisors. See “Certain Canadian Federal Income Tax Considerations” and “Certain

United States Federal Income Tax Considerations”.

The

enforcement by investors of civil liabilities under United States federal securities laws may be affected adversely by the fact that

the Company is incorporated under the laws of Canada, certain of the officers and directors are not residents of the United States, that

some or all of the Agents or experts named in this prospectus supplement and in the accompanying prospectus are not residents of the

United States, and that a substantial portion of the assets of the Company and such persons are located outside the United States. See

“Enforceability of Certain Civil Liabilities”.

NEITHER

THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THE OFFERED SHARES NOR PASSED UPON THE ACCURACY OR ADEQUACY OF

THE PROSPECTUS AND THIS PROSPECTUS SUPPLEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

Investing

in the Offered Shares is highly speculative and involves significant risks that you should consider before purchasing such Offered Shares.

The risks outlined in this prospectus supplement, the accompanying prospectus and in the documents incorporated by reference herein and

therein should all be carefully reviewed and considered by prospective investors in connection with an investment in the Offered Shares.

See “Risk Factors”.

In

connection with the sale of the Offered Shares on our behalf, the Agents may be deemed to be an “underwriter” within the

meaning of Section 2(a)(11) of the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), and

the compensation of the Agents may be deemed to be underwriting commissions or discounts. The Company has agreed to provide indemnification

and contribution to the Agents against certain liabilities, including liabilities under the U.S. Securities Act.

As

sales agents, the Agents will not engage in any transactions to stabilize or maintain the price of the Common Shares. No underwriter

of the at-the-market distribution, and no person or company acting jointly or in concert with an underwriter, may, in connection with

the distribution, enter into any transaction that is intended to stabilize or maintain the market price of the securities or securities

of the same class as the securities distributed under this prospectus supplement and the related prospectus, including selling an aggregate

number or principal amount of securities that would result in the underwriter creating an over-allocation position in the securities.

See “Plan of Distribution”.

The

Company’s head office is located at 1188 West Georgia Street, Suite 1830, Vancouver, British Columbia V6E 4A2, and its registered

and records office is located at 925 West Georgia Street, Suite 1000, Vancouver, British Columbia V6C 3L2.

Investors

should rely only on the information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus.

We have not authorized anyone to provide investors with different information. Information contained on our website shall not be deemed

to be a part of this prospectus supplement (including the accompanying prospectus) or to be incorporated by reference herein or therein

and should not be relied upon by prospective investors for the purpose of determining whether to invest in the Offered Shares. No offer

of the Offered Shares is being made in any jurisdiction where the offer or sale is not permitted. Investors should not assume that the

information contained in this prospectus supplement is accurate as of any date other than the date on the face page of this prospectus

supplement or the date of any documents incorporated by reference herein.

Unless

otherwise indicated, all references in this prospectus supplement and the accompanying prospectus to “US$” are to U.S. dollars,

and references to “C$” or “$” are to Canadian dollars. See “Financial and Exchange Rate Information”.

TABLE

OF CONTENTS

TABLE

OF CONTENTS OF THE SHORT FORM BASE SHELF PROSPECTUS DATED JULY 20, 2023

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document is in two parts. The first part is this prospectus supplement, which describes the specific terms of the Offered Shares and

adds to, and updates, information contained in the accompanying prospectus and the documents incorporated by reference herein and therein.

The second part, the prospectus, gives more general information, some of which may not apply to the Offered Shares. This prospectus supplement

is deemed to be incorporated by reference into the accompanying prospectus solely for the purposes of the Offering constituted by this

prospectus supplement.

The

representations, warranties and covenants made by the Company in any agreement that is filed as an exhibit to any document that is incorporated

by reference herein or in the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in

some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to investors. Moreover, such representations, warranties or covenants were accurate only as of the date when made.

Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of affairs

of the Company.

Investors

should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus.

If the description of the Offered Shares or any other information varies between this prospectus supplement and the accompanying prospectus

(including the documents incorporated by reference herein and therein on the date hereof), the investor should rely on the information

in this prospectus supplement. The Company has not, and the Agents have not, authorized anyone to provide investors with different or

additional information. If anyone provides investors with any different, additional, inconsistent or other information, investors should

not rely on it. This prospectus supplement and the accompanying prospectus contain summaries of certain provisions contained in some

of the documents described herein or therein, but reference is made to the actual documents for complete information. All of the summaries

are qualified in their entirety by the actual documents. Copies of some of these documents have been filed, will be filed or will be

incorporated herein by reference, and investors may obtain copies of those documents as described below in the section entitled “Where

You Can Find More Information”.

Neither

the Company nor the Agents are making an offer to sell or seeking an offer to buy the Offered Shares in any jurisdiction where the offer

or sale is not permitted. Investors should not assume that the information contained in this prospectus supplement, the accompanying

prospectus and the documents incorporated by reference herein and therein is accurate as of any date other than the date on the front

of this prospectus supplement, the accompanying prospectus or the respective dates of the documents incorporated by reference herein

and therein, as applicable, regardless of the time of delivery of this prospectus supplement or of any sale of the Offered Shares pursuant

hereto. The Company’s business, financial condition, results of operations and prospects may have changed since those dates. Information

contained on the Company’s website should not be deemed to be a part of this prospectus supplement, the accompanying prospectus

or incorporated by reference herein and should not be relied upon by prospective investors for the purpose of determining whether to

invest in the Offered Shares.

Market

data and certain industry forecasts used in this prospectus supplement and the accompanying prospectus and the documents incorporated

by reference herein and therein were obtained from market research, publicly available information and industry publications. The Company

believes that these sources are generally reliable, but the accuracy and completeness of this information is not guaranteed. The Company

has not independently verified such information, and we do not make any representation as to the accuracy of such information.

This

prospectus supplement shall not be used by anyone for any purpose other than in connection with the Offering.

Unless

the context otherwise requires, references to “we”, “us”, “our” or similar terms, as well as references

to “URC” or the “Company”, refer to Uranium Royalty Corp. together with its subsidiaries. All other trademarks,

service marks or other tradenames appearing in this prospectus supplement and the accompanying prospectus are the property of their respective

owners.

This

prospectus supplement includes the trademarks, trade names and service marks of the Company, which is protected under applicable intellectual

property laws and are the property of Uranium Royalty Corp., or its subsidiaries. Solely for convenience, trademarks, trade names and

service marks referred to in this prospectus supplement may appear without the ®, ™ or SM symbols, but such references are

not intended to indicate, in any way, that the Company will not assert, to the fullest extent under applicable law, it rights or the

right of the applicable licensor to these trademarks, trade names and service marks. The Company does not intend the use or display of

other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship

with, or endorsement or sponsorship of the Company by, these other parties.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING INFORMATION

This

prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein, contain

“forward-looking information” within the meaning of applicable Canadian securities laws and “forward-looking statements”

within the meaning of securities laws in the United States (collectively, “Forward-Looking Statements”). These statements

relate to the expectations of management about future events, results of operations and the Company’s future performance (both

operational and financial) and business prospects. All statements other than statements of historical fact are Forward-Looking Statements.

The use of any of the words “anticipate”, “plan”, “contemplate”, “continue”, “estimate”,

“expect”, “intend”, “propose”, “might”, “may”, “will”, “shall”,

“project”, “should”, “could”, “would”, “believe”, “predict”,

“forecast”, “target”, “aim”, “pursue”, “potential”, “objective”

and “capable” and the negative of these terms or other similar expressions are generally indicative of Forward-Looking Statements.

These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially

from those anticipated in such Forward-Looking Statements. No assurance can be given that these expectations will prove to be correct

and such Forward-Looking Statements should not be unduly relied on. These statements speak only as of the date hereof. In addition, this

prospectus supplement and the accompanying prospectus may contain Forward-Looking Statements attributed to third party industry sources.

Without limitation, this prospectus supplement contains Forward-Looking Statements pertaining to the following: future sales of Offered

Shares under the Offering; use of proceeds; the ongoing operations of the properties in which the Company holds or may hold uranium interests;

future events or future performance; the impact of general business and economic conditions; future financial capacity, liquidity and

capital resources; anticipated future sources of funds to meet working capital and strategic requirements; future capital expenditures

and contractual commitments; expectations respecting future financial results; expectations with respect to the Company’s financial

position; expectations regarding uranium prices and the impacts of the United States and other governmental policies on uranium demand;

expectations regarding supply and demand for uranium; conditions, trends and practices pertaining to the uranium industry and other industries

in which uranium is used; expectations regarding the Company’s business plans, strategies, growth and results of operations; the

Company’s dividend policy; the financial and operational strength of counterparties; production volumes; mineral resources and

mine life; governmental regulatory regimes with respect to environmental matters; and governmental taxation regimes.

Forward-Looking

Statements are based on a number of material assumptions, including those listed here, which could prove to be significantly incorrect:

market prices of uranium; global economic and financial conditions; demand for uranium; uranium supply; industry conditions; the ongoing

operation of the properties in which the Company holds or may hold uranium interests; future operations and developments on the properties

in which the Company holds or may hold interests; and the accuracy of public statements and disclosure, including future plans and expectations,

made by the owners or operators of the properties underlying the Company’s interests.

Actual

results could differ materially from those anticipated in these Forward-Looking Statements as a result of, among other things, the risk

factors set forth below and included elsewhere in this prospectus supplement and accompanying prospectus, including the following:

| |

● |

limited

or no access to data or the operations underlying the Company’s interests; |

| |

● |

dependence

on third party operators; |

| |

● |

risks

related to political unrest in Kazakhstan, which could negatively impact the Company’s option to purchase uranium from Yellow

Cake plc; |

| |

● |

dependence

on future payments from owners and operators; |

| |

● |

a

majority of the Company’s assets are non-producing; |

| |

● |

royalties,

streams and similar interests may not be honoured by operators of a project; |

| |

● |

defects

in or disputes relating to the existence, validity, enforceability, terms and geographic extent of royalties, streams and similar

interests; |

| |

● |

royalty,

stream and similar interests may be subject to buy-down right provisions or pre-emptive rights; |

| |

● |

project

costs may influence the Company’s future royalty returns; |

| |

● |

risks

faced by owners and operators of the properties underlying the Company’s interests; |

| |

● |

title,

permit or licensing disputes related to any of the properties in which the Company holds or may hold royalties, streams or similar

interests; |

| |

● |

excessive

cost escalation, as well as development, permitting, infrastructure, operating or technical difficulties on any of the properties

underlying the Company’s royalties, streams or similar interests; |

| |

● |

regulations

and political or economic developments in any of the jurisdictions where properties in which the Company holds or may hold royalties,

streams or similar interests are located; |

| |

● |

volatility

in market prices and demand for uranium and the market price of the Company’s other investments, including as a result of geopolitical

factors such as the ongoing conflict in Ukraine and the political unrest in Kazakhstan; |

| |

● |

changes

in general economic, financial, market and business conditions in the industries in which uranium is used; |

| |

● |

risks

related to mineral reserve and mineral resource estimates; |

| |

● |

replacement

of depleted mineral reserve; |

| |

● |

the

public acceptance of nuclear energy in relation to other energy sources; |

| |

● |

alternatives

to and changing demand for uranium; |

| |

● |

the

absence of any public market for uranium; |

| |

● |

changes

in legislation, including permitting and licensing regimes and taxation policies; |

| |

● |

the

effects of the spread of illness or other public health emergencies; |

| |

● |

commodities

price risks, which may affect revenue derived by the Company from its asset portfolio; |

| |

● |

risks

associated with future acquisitions; |

| |

● |

competition

and pricing pressures; |

| |

● |

any

inability of the Company to obtain necessary financing when required on acceptable terms or at all; |

| |

● |

liquidity

in equity investments; |

| |

● |

fluctuations

in the foreign exchange rate; |

| |

● |

any

inability to attract and retain key employees; |

| |

● |

disruptions

to the information technology systems of the Company or third-party service providers; |

| |

● |

litigation; |

| |

● |

risks

associated with First Nations land claims; |

| |

● |

compliance

with laws and regulations relating to environmental, social and governance matters; |

| |

● |

macroeconomic

developments and changes in global general economic, financial, market and business conditions; |

| |

● |

potential

conflicts of interests; |

| |

● |

any

inability to ensure compliance with anti-bribery and anti-corruption laws; |

| |

● |

any

future expansion of the Company’s business activities outside of areas of expertise; |

| |

● |

any

failure to maintain effective internal controls; |

| |

● |

negative

cash flow from operating activities; and |

| |

● |

the

other factors discussed under “Risk Factors” herein, in the accompanying prospectus and in the Company’s

annual information form for the fiscal year ended April 30, 2024, dated July 24, 2024 (the “Annual Information Form”)

incorporated by reference herein. |

Should

one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially

from those described in Forward-Looking Statements. Forward-Looking Statements are based on management’s beliefs, estimates and

opinions on the date the statements are made and the Company undertakes no obligation to update Forward-Looking Statements if these beliefs,

estimates and opinions or other circumstances should change, other than as required by applicable laws. Investors are cautioned against

attributing undue certainty to Forward-Looking Statements.

The

risk factors referenced herein should not be construed as exhaustive. Except as required under applicable laws, the Company undertakes

no obligation to update or revise any Forward-Looking Statements. An investment in the Company is speculative and involves a high degree

of risk due to the nature of our business and the present state of exploration of our projects. Please carefully consider the risk factors

set out herein under “Risk Factors”, in the accompanying prospectus and in the Annual Information Form.

FINANCIAL

AND EXCHANGE RATE INFORMATION

The

Company’s annual consolidated financial statements that are incorporated by reference into this prospectus supplement have been

prepared in accordance with IFRS, as issued by the International Accounting Standards Board, and are reported in Canadian dollars. In

this prospectus supplement, unless otherwise indicated, all dollar amounts and references to “US$” are to United States dollars,

and references to “$” or “C$” are to Canadian dollars.

The

high, low, average and closing exchange rates for United States dollars in terms of the Canadian dollar for each of the indicated periods,

as quoted by the Bank of Canada, were as follows:

| | |

Year

ended April 30 (US$) | |

| | |

2024 | | |

2023 | | |

2022 | |

| High | |

0.7617 | | |

0.7974 | | |

0.8306 | |

| Low | |

0.7207 | | |

0.7217 | | |

0.7727 | |

| Average | |

0.7407 | | |

0.7526 | | |

0.7972 | |

| Closing | |

0.7275 | | |

0.7817 | | |

0.7755 | |

On

August 28, 2024, the daily average exchange rate provided by the Bank of Canada in terms of the Canadian dollar was C$1.00 = US$0.7423.

CAUTIONARY

NOTE TO UNITED STATES INVESTORS

We

are permitted under MJDS to prepare the prospectus and this prospectus supplement in accordance with the disclosure requirements of Canada.

Prospective investors in the United States should be aware that such requirements are different from those of the United States. Financial

statements included or incorporated by reference herein have been prepared in accordance with IFRS and are reported in Canadian dollars.

They may not be comparable to financial statements of United States companies.

This

prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein, as applicable,

have been prepared in accordance with the requirements of Canadian securities laws, which differ from the requirements of United States

securities laws. Unless otherwise indicated, all mineral reserve and resource estimates included in this prospectus supplement and the

accompanying prospectus and in any document incorporated by reference herein and therein have been prepared for or by the current or

former owners and operators of the relevant properties, as and to the extent indicated by them, in accordance with National Instrument

43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining,

Metallurgy and Petroleum (the “CIM”) classification system or the 2012 Edition of the Australasian Code for Reporting

of Exploration Results, Mineral Resources and Ore Reserves (“JORC”) or S-K 1300 (as defined below), as applicable.

In accordance with NI 43-101, the Company uses the terms mineral reserves and resources as they are defined in accordance with the CIM

Definition Standards on Mineral Resources and Reserves as adopted by the CIM (the “CIM Definition Standards”).

The

SEC has adopted mining disclosure rules under sub-part 1300 of SEC S-K – Disclosure by Registrants Engaged in Mining Operations

(“S-K 1300”). As a foreign private issuer that is eligible to file reports with the SEC pursuant to MJDS, the

Company is not required to provide disclosure under S-K 1300 and will continue to provide disclosure under NI 43-101. Under S-K 1300,

the SEC now recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred

mineral resources”. In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable

mineral reserves” to be substantially similar to the corresponding definitions under the CIM Definition Standards, as required

under NI 43-101.

United

States investors are also cautioned that while the SEC will now recognize “measured mineral resources”, “indicated

mineral resources” and “inferred mineral resources”, investors should not assume that any part or all of the mineralization

in these categories will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described

using these terms has a greater amount of uncertainty as to their existence and feasibility than mineralization that has been characterized

as reserves. Accordingly, investors are cautioned not to assume that any “measured mineral resources”, “indicated mineral

resources”, or “inferred mineral resources” that the Company reports are or will be economically or legally mineable.

Further,

“inferred resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally

or economically. In accordance with Canadian rules, estimates of “inferred mineral resources” cannot form the basis of feasibility

or other economic studies, except in limited circumstances where permitted under NI 43-101. In addition, the project stage classifications

utilized by the Company under NI 43-101 do not conform to defined project stages under S-K 1300.

Certain

resource estimates disclosed in this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference

herein and therein, have been prepared in accordance with JORC, which differs from the requirements of NI 43-101 and S-K 1300. Accordingly,

information contained in this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference

herein and therein, may contain descriptions of the projects underlying the interests that differ from similar information made available

by Canadian and United States issuers.

TECHNICAL

AND THIRD-PARTY INFORMATION

This

prospectus supplement and accompanying prospectus, including the documents incorporated by reference therein, includes market information,

industry data and forecasts obtained from independent industry publications, market research and analyst reports, surveys and other publicly

available sources. Although the Company believes these sources to be generally reliable, market and industry data is subject to interpretation

and cannot be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of

the data gathering process and other limitations and uncertainties inherent in any statistical survey. Accordingly, the accuracy and

completeness of this data is not guaranteed. Actual outcomes may vary materially from those forecast in such reports, surveys or publications,

and the prospect for material variation can be expected to increase as the length of the forecast period increases. The Company has not

independently verified any of the data from third party sources referred to herein nor ascertained the underlying assumptions relied

on by such sources.

Except

where otherwise stated, the disclosure herein, and in the documents incorporated by reference in the accompanying prospectus, relating

to properties underlying the Company’s interests is based primarily on information publicly disclosed by the owners or operators

of such properties, as is customary for royalty portfolio companies of this nature. Specifically, as a royalty holder, the Company has

limited, if any, access to the properties subject to its interests. The Company generally relies on publicly available information regarding

these properties and related operations and generally has no ability to independently verify such information, and there can be no assurance

that such third-party information is complete and accurate. In addition, such publicly available information may relate to a larger property

area than that covered by the Company’s interests. Additionally, the Company has received, and may from time to time receive, operating

information from the owners and operators of these properties, which it is not permitted to disclose to the public.

As

of the date of this prospectus supplement, the Company considers its royalty interest in the McArthur River Project and Cigar Lake Project

(each as described in the Annual Information Form), located in Saskatchewan, Canada as its material properties for the purposes of NI

43-101. Information contained in this prospectus supplement or accompanying prospectus or incorporated by reference herein or therein

with respect to each of such projects has been prepared in accordance with the exemption set forth in section 9.2 of NI 43-101.

We

have obtained certain information contained in this prospectus supplement concerning the industries in which we operate from publicly

available information from third party sources. We have not verified the accuracy or completeness of any information contained in such

publicly available information. In addition, we have not determined if any such third party has omitted to disclose any facts, information

or events which may have occurred prior to or subsequent to the date as of which any such information became publicly available or which

may affect the significance or accuracy of any information contained in any such information and summarized herein.

DOCUMENTS

FILED AS PART OF THE REGISTRATION STATEMENT

The

following documents have been, or will be, filed with the SEC as part of the Registration Statement of which this prospectus supplement

forms a part: (1) the Distribution Agreement; (2) the documents listed under “Documents Incorporated by Reference”;

(3) the consent of PricewaterhouseCoopers LLP; (4) the consent of the Company’s Canadian counsel, Sangra Moller LLP; (5) the consent

of the Agents’ Canadian counsel, Gowling WLG (Canada) LLP; (6) powers of attorney from certain of the Company’s directors

and officers (included on the signature page to the Registration Statement); and (7) the consents of the “qualified persons”

referred to in this prospectus supplement under “Interest of Experts”.

DOCUMENTS

INCORPORATED BY REFERENCE

This

prospectus supplement is deemed to be incorporated by reference in the accompanying prospectus solely for the purpose of the distribution

of the Offered Shares. Information has been incorporated by reference in this prospectus supplement and in the accompanying prospectus

from documents filed with the securities commissions or similar authorities in Canada. Copies of the documents incorporated herein

by reference may be obtained on request without charge from Josephine Man, Chief Financial Officer of the Company at 1188 West Georgia

Street, Suite 1830, Vancouver, British Columbia V6E 4A2, (604) 396-8222 or by accessing the disclosure documents available electronically

in Canada on the consolidated electronic filing and data access system of the Canadian Securities Administrators (“SEDAR+”)

at www.sedarplus.ca. Documents filed with, or furnished to, the SEC are available electronically in the United States through the SEC’s

Electronic Data Gathering and Retrieval System (“EDGAR”), at www.sec.gov. The Company’s filings through SEDAR+

and EDGAR are not incorporated by reference in this prospectus supplement except as specifically set forth herein.

The

following documents, filed by the Company with the securities commissions or similar authorities in each of the provinces and territories

of Canada, and filed with, or furnished to, the SEC, are specifically incorporated by reference into, and form an integral part of, this

prospectus supplement:

| |

1) |

the

Annual Information Form; |

| |

|

|

| |

2) |

the

management information circular of the Company regarding the annual general and special meeting of shareholders of the Company to

be held on October 17, 2024, dated August 23, 2024; |

| |

|

|

| |

3) |

the

audited annual consolidated financial statements of the Company as at and for the financial years ended April 30, 2024 and 2023,

together with the notes thereto, and the auditors reports thereon; and |

| |

|

|

| |

4) |

management’s

discussion and analysis of financial condition and results of operations of the Company for the financial year ended April 30, 2024

dated July 24, 2024. |

If

the Company disseminates a news release in respect of previously undisclosed information that, in the Company’s determination,

constitutes a “material fact” (as such term is defined under applicable Canadian securities laws), the Company will identify

such news release as a “designated news release” for the purposes of this prospectus supplement and the accompanying prospectus

in writing on the face page of the version of such news release that the Company files on SEDAR+ (each such news release, a “Designated

News Release”), and each such Designated News Release shall be deemed to be incorporated by reference into this prospectus

supplement and the accompanying prospectus for the purposes of the Offering.

References

to the Company’s website in any documents that are incorporated by reference into the accompanying prospectus, of which this prospectus

supplement forms a part, do not incorporate by reference the information on such website into the accompanying prospectus, of which this

prospectus supplement forms a part, and the Company disclaims any such incorporation by reference. Neither the Company nor the Agents

have provided or otherwise authorized any other person to provide investors with information other than that contained or incorporated

by reference in the accompanying prospectus, of which this prospectus supplement forms a part, and neither the Company nor the Agents

take any responsibility for other information that others may give to investors. If an investor is provided with different or inconsistent

information, he or she should not rely on it.

WHERE

YOU CAN FIND MORE INFORMATION

We

have filed with the SEC the Registration Statement on Form F-10, as amended (File No. 333-272534), under the U.S. Securities Act with

respect to the Offered Shares offered under this prospectus supplement. This prospectus supplement, the accompanying prospectus and the

documents incorporated by reference herein and therein, which form a part of the Registration Statement, do not contain all of the information

set forth in the Registration Statement, certain parts of which are contained in the exhibits to the Registration Statement as permitted

by the rules and regulations of the SEC. Information omitted from this prospectus supplement or the prospectus but contained in the Registration

Statement is available on EDGAR under the Company’s profile at www.sec.gov. Reference is also made to the Registration Statement

and the exhibits thereto for further information with respect to us, the Offering and the Offered Shares. Statements contained in this

prospectus supplement as to the contents of certain documents are not necessarily complete and, in each instance, reference is made to

the copy of the document filed as an exhibit to the Registration Statement. Each such statement is qualified in its entirety by such

reference.

We

are required to file with the various securities commissions or similar authorities in all of the provinces and territories of Canada,

annual and quarterly reports, material change reports and other information. We are also an SEC registrant subject to the informational

requirements of the United States Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”) and, accordingly,

file with, or furnish to, the SEC certain reports and other information. Under MJDS, these reports and other information (including financial

information) may be prepared in accordance with the disclosure requirements of Canada, which differ from those of the United States.

As a foreign private issuer, we are exempt from the rules under the U.S. Exchange Act, prescribing the furnishing and content of proxy

statements, and our officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions

contained in Section 16 of the U.S. Exchange Act.

THE

COMPANY

The

following description of the Company does not contain all of the information about the Company and its assets and business that you should

consider before investing in the Offered Shares. You should carefully read the entire prospectus supplement and the prospectus, including

the section entitled “Risk Factors”, and the Annual Information Form, as well as the documents incorporated by reference

herein and therein before making an investment decision.

The

Company is a uranium royalty company focused on gaining exposure to uranium prices by making strategic investments in uranium interests,

including royalties, streams, debt and equity investments in uranium companies, as well as through holdings of physical uranium. For

further information on the Company and its business activities, see the Annual Information Form, which is incorporated by reference herein.

Acquisition

of Additional Royalty Interest on Churchrock

On

July 31, 2024, pursuant to a royalty purchase agreement dated July 26, 2024, the Company acquired an additional royalty interest on a

portion of the Churchrock uranium project (the “Churchrock Project”). The Churchrock Project is an advanced stage,

in-situ recovery (“ISR”) uranium project owned indirectly by Laramide Resources Ltd. (“Laramide”)

and located in the Grants Mineral Belt of New Mexico, USA, 12 miles northeast of Gallup, New Mexico. Laramide has disclosed that the

Churchrock Project and nearby properties represent one of the largest and highest-grade undeveloped ISR uranium projects in the United

States. The consideration paid by the Company was US$3.5 million in cash.

The

royalty is structured as a gross overriding royalty of 6% “Mine Price”, which anticipates recovery of reasonable and actual

costs to transport the mineral to the final point of sale. The royalty covers the 10 patented mining claims in Section 8 property (640

acres) that comprise New Mexico Mineral Survey 2220 on the Churchrock Project.

Other

than as set forth herein, there have been no material developments in the Company’s business since April 30, 2024.

CONSOLIDATED

CAPITALIZATION

As

a result of the Offering, the shareholder’s equity of the Company will increase by the amount of the net proceeds of the Offering

and the number of issued and outstanding Common Shares will increase by the number of Offered Shares actually distributed under the Offering.

Other

than as set forth above and herein under “Prior Sales”, there have been no material changes in the Company’s

share or loan capital on a consolidated basis since April 30, 2024.

USE

OF PROCEEDS

The

Company intends to use the net proceeds from the Offering, if any, to finance the acquisition of additional royalties, streams, physical

uranium and similar interests and for working capital purposes. The Company has a negative cash flow from operating activities in its

most recently completed financial year, and, if necessary, proceeds may be used to fund negative cash flow from operating activities

in future periods. The Company may, from time to time, issue securities (including equity and debt securities) other than pursuant to

this prospectus supplement.

The

net proceeds from the Offering, if any, are not determinable in light of the nature of the distribution. Sales of Offered Shares, if

any, will be made in transactions that are deemed to be “at-the-market distributions” as defined in NI 44-102, including

sales made by the Agents directly on the TSX, Nasdaq or any other trading market for the Common Shares in Canada or the United States.

Any proceeds that the Company receives will depend on the number of Offered Shares actually sold and the offering price of such Offered

Shares. The net proceeds to the Company of any given distribution of Offered Shares through the Agents in an “at-the-market distribution”

under the Distribution Agreement will represent the gross proceeds of the Offering, after deducting the applicable Commission, any transaction

or filing fees imposed by any governmental, regulatory, or self-regulatory organization in connection with any such sales of Offered

Shares and the expenses of the Offering. The gross proceeds of the Offering will be up to US$39,000,000 (or the equivalent in Canadian

dollars determined using the daily exchange rate posted by the Bank of Canada on the date the Offered Shares are sold). The Agents will

receive the Commission of up to 2.50% of the gross proceeds from the sale of the Offered Shares. Any Commission paid to the Agents

will be paid out of the proceeds from the sale of Offered Shares. There is no minimum amount of funds that must be raised under the Offering.

This means that the Offering may terminate after raising only a portion of the Offering amount set out above, or none at all. See “Plan

of Distribution”.

Although

the Company intends to expend the net proceeds from the Offering as set forth above, there may be circumstances where, for sound business

reasons, a reallocation of funds may be prudent or necessary, and may vary materially from that set forth above. In addition, management

of the Company will have broad discretion with respect to the actual use of the net proceeds from the Offering. See “Risk Factors”.

PLAN

OF DISTRIBUTION

The

Company has entered into the Distribution Agreement with the Agents under which the Company may issue and sell from time to time Offered

Shares having an aggregate sale price of up to US$39,000,000 (or the equivalent in Canadian dollars determined using the daily exchange

rate posted by the Bank of Canada on the date the Offered Shares are sold) in each of the provinces and territories of Canada and in

the United States pursuant to placement notices delivered by the Company to the Agents from time to time in accordance with the terms

of the Distribution Agreement. Sales of Offered Shares, if any, will be made in transactions that are deemed to be “at-the-market

distributions” as defined in NI 44-102, including sales made by the Agents directly on the TSX, Nasdaq or any other trading market

for the Common Shares in Canada or the United States. Subject to the pricing parameters in a placement notice, the Offered Shares will

be distributed at the market prices prevailing at the time of the sale. As a result, prices may vary as between purchasers and during

the period of distribution. The Company cannot predict the number of Offered Shares that it may sell under the Distribution Agreement

on the TSX, Nasdaq or any other trading market for the Common Shares in Canada or the United States, or if any Offered Shares will be

sold.

The

Agents will offer the Offered Shares subject to the terms and conditions of the Distribution Agreement from time to time as agreed upon

by the Company and the Agents. The Company will designate the maximum amount of, and the minimum price at which the Company is willing

to sell, Offered Shares to be sold pursuant to any single placement notice to the applicable Agent or Agents. The Company will identify

in the placement notice which Agent or Agents will effect the placement. Subject to the terms and conditions of the Distribution Agreement,

the Agents will use their commercially reasonable efforts to sell, on the Company’s behalf, all of the Offered Shares requested

to be sold by the Company. Any placement notice delivered to an applicable Agent or Agents shall be effective upon delivery unless and

until (i) the applicable Agent or Agents declines to accept the terms contained in the placement notice or such Agent or Agents does

not promptly confirm the acceptability of such placement notice, (ii) the entire amount of Offered Shares under the placement notice

are sold, (iii) the Company suspends or terminates the placement notice in accordance with the terms of the Distribution Agreement, (iv)

the Company issues a subsequent placement notice with parameters superseding those of the earlier placement notice, or (v) the Distribution

Agreement is terminated in accordance with its terms. No Agent will be required to purchase Offered Shares as principals pursuant to

the Distribution Agreement.

Either

the Company or the Agents may suspend the Offering upon proper notice to the other party. The Company and the Agents each have the right,

by giving written notice as specified in the Distribution Agreement, to terminate the Distribution Agreement in each party’s sole

discretion at any time.

The

Company will pay the Agents the Commission for their services in acting as agents in connection with the sale of Offered Shares pursuant

to the Distribution Agreement. The amount of the Commission will be up to 2.50% of the gross sales price per Offered Share sold,

provided however, that the Company shall not be obligated to pay the Agents any Commission on any sale of Offered Shares that it is not

possible to settle due to (i) a suspension or material limitation in trading in securities generally on the TSX or the Nasdaq, (ii) a

material disruption in securities settlement or clearance services in the United States or Canada, or (iii) failure by the applicable

Agent to comply with its obligations under the terms of the Distribution Agreement. The sales proceeds remaining after payment of the

Commission and after deducting any expenses payable by the Company and any transaction or filing fees imposed by any governmental, regulatory,

or self-regulatory organization in connection with the sales, will equal the net proceeds to the Company from the sale of any such Offered

Shares.

The

applicable Agent or Agents will provide written confirmation to the Company following close of trading on the trading day on which such

Agent has made sales of the Offered Shares under the Distribution Agreement setting forth (i) the number of Offered Shares sold on such

day (including the number of Offered Shares sold on the TSX or Nasdaq), (ii) the average price of the Offered Shares sold on such day

(including the average price of Offered Shares sold on the TSX, Nasdaq or on any other marketplace in Canada or the United States), (iii)

the gross proceeds, (iv) the Commission payable by the Company to the Agents with respect to such sales, and (v) the net proceeds payable

to the Company.

The

Company will disclose the number and average price of the Offered Shares sold under this prospectus supplement, as well as the gross

proceeds, Commission and net proceeds from sales hereunder in the Company’s annual and interim financial statements and related

management’s discussion and analysis, annual information forms and Annual Reports on Form 40-F, filed with the Canadian securities

regulators on www.sedarplus.ca and with the SEC on EDGAR at www.sec.gov, for any quarters or annual periods in which sales of Offered

Shares occur.

Settlement

for sales of Offered Shares will occur on the first trading day on the applicable exchange following the date on which any sales were

made in return for payment of the gross proceeds (less Commission) to the Company. There is no arrangement for funds to be received in

an escrow, trust or similar arrangement. Sales of Offered Shares in the United States will be settled through the facilities of The Depository

Trust Corporation, or by such other means as the Company and the Agents may agree upon, and sales of Offered Shares in Canada will be

settled through the facilities of The Canadian Depository for Securities or by such other means as the Company and the Agents may agree.

The

Canadian Agents are not registered as broker-dealers in the United States and, accordingly, will only sell Offered Shares on marketplaces

in Canada, the U.S. Agents are not registered as investment dealers in any Canadian jurisdiction and, accordingly, will only sell Offered

Shares on marketplaces in the United States.

In

connection with the sales of the Offered Shares on the Company’s behalf, each of the Agents may be deemed to be an “underwriter”

within the meaning of the U.S. Securities Act, and the compensation paid to the Agents may be deemed to be underwriting commissions or

discounts. The Company has agreed in the Distribution Agreement to provide indemnification and contribution to the Agents against certain

liabilities, including liabilities under the U.S. Securities Act and under Canadian securities laws. In addition, the Company has agreed

to pay the reasonable expenses of the Agents in connection with the Offering, pursuant to the terms of the Distribution Agreement.

The

Agents and their affiliates will not engage in any transactions to stabilize or maintain the price of the Common Shares in connection

with any offer or sales of Offered Shares pursuant to the Distribution Agreement. No underwriter of the at-the-market distribution, including

the Agents, and no person or company acting jointly or in concert with an underwriter, may, in connection with the distribution, enter

into any transaction that is intended to stabilize or maintain the market price of the securities or securities of the same class as

the securities distributed under this prospectus supplement and the related prospectus, including selling an aggregate number or principal

amount of securities that would result in the underwriter creating an over-allocation position in the securities.

The

total expenses related to the commencement of the Offering to be paid by the Company, excluding

the Commission payable to the Agents under the Distribution Agreement, are estimated to be

approximately C$400,000.

Pursuant

to the Distribution Agreement, the Offering will terminate upon the earliest of: (i) August 20, 2025; (ii) the issuance and sale of all

of the Offered Shares subject to the Distribution Agreement; and (iii) the termination of the Distribution Agreement as permitted therein.

The

Agents and their affiliates may in the future provide various investment banking, commercial banking and other financial services for

the Company and its affiliates, for which services they may in the future receive customary fees. To the extent required by Regulation

M under the U.S. Exchange Act, the Agents will not engage in any market making activities involving the Common Shares while the Offering

is ongoing under this prospectus supplement.

The

Common Shares are listed on the TSX and Nasdaq. The Company has applied for conditional approval from TSX to list the Offered Shares

distributed under the Offering, subject to the Company fulfilling all of the requirements of the TSX. The Company has applied to list

the Offered Shares distributed under the Offering on Nasdaq.

PRIOR

SALES

The

following table summarizes the issuances by the Company of Common Shares and securities convertible into Common Shares within the 12

months prior to the dates of this prospectus supplement:

| Date

of Issuance | |

Type

of Security | |

Number

of Securities | | |

Issuance

Price /

Exercise Price | |

| | |

| |

| | |

| |

| August

18, 2023 | |

Common

Shares | |

| 300 | | |

$ | 2.00 | (1) |

| August

21, 2023 | |

Stock

Options | |

| 418,800 | | |

| N/A | |

| August

24, 2023 | |

Common

Shares | |

| 587,000 | | |

$ | 2.00 | (1) |

| August

29, 2023 | |

Stock

Options | |

| 32,500 | | |

| N/A | |

| August

30, 2023 | |

Common

Shares | |

| 800 | | |

$ | 2.00 | (1) |

| September

5, 2023 | |

Common

Shares | |

| 28,000 | | |

$ | 2.00 | (1) |

| September

6, 2023 | |

Common

Shares | |

| 181,678 | | |

$ | 2.00 | (1) |

| September

25, 2023 | |

Common

Shares | |

| 227,000 | | |

US$ | 3.13 | (2) |

| September

25, 2023 | |

Common

Shares | |

| 46,800 | | |

$ | 4.22 | (2) |

| September

26, 2023 | |

Common

Shares | |

| 17,610 | | |

US$ | 3.12 | (2) |

| September

26, 2023 | |

Common

Shares | |

| 4,400 | | |

$ | 4.20 | (2) |

| September

28, 2023 | |

Common

Shares | |

| 55,400 | | |

US$ | 3.06 | (2) |

| September

28, 2023 | |

Common

Shares | |

| 19,100 | | |

$ | 4.12 | (2) |

| October

4, 2023 | |

Common

Shares | |

| 270,000 | | |

US$ | 2.86 | (2) |

| October

4, 2023 | |

Common

Shares | |

| 65,000 | | |

$ | 3.92

| (2) |

| October

5, 2023 | |

Common

Shares | |

| 41,900 | | |

$ | 2.00 | (1) |

| October

5, 2023 | |

Common

Shares | |

| 121,400 | | |

US$ | 2.93 | (2) |

| October

5, 2023 | |

Common

Shares | |

| 44,200 | | |

$ | 4.03 | (2) |

| October

6, 2023 | |

Common

Shares | |

| 9,750 | | |

$ | 2.00 | (1) |

| October

10, 2023 | |

Common

Shares | |

| 13,850 | | |

$ | 2.00 | (1) |

| October

11, 2023 | |

Common

Shares | |

| 110,300 | | |

$ | 2.00 | (1) |

| October

17, 2023 | |

Common

Shares | |

| 10,205,000 | | |

US$ | 2.94 | |

| November

8, 2023 | |

Stock

Options | |

| 50,000 | | |

| N/A | |

| November

28, 2023 | |

Common

Shares | |

| 22,600 | | |

$ | 2.00 | (1) |

| November

30, 2023 | |

Common

Shares | |

| 60,000 | | |

$ | 2.00 | (1) |

| December

8, 2023 | |

Common

Shares | |

| 24,000 | | |

$ | 2.00 | (1) |

| December

11, 2023 | |

Common

Shares | |

| 187,600 | | |

$ | 2.00 | (1) |

| December

12, 2023 | |

Common

Shares | |

| 22,500 | | |

$ | 2.00 | (1) |

| January

11, 2024 | |

Common

Shares | |

| 2,520 | | |

$ | 2.00 | (1) |

| January

16, 2024 | |

Common

Shares | |

| 3,000 | | |

$ | 2.00 | (1) |

| January

19, 2024 | |

Common

Shares | |

| 120,000 | | |

$ | 2.00 | (1) |

| January

25, 2024 | |

Common

Shares | |

| 80,000 | | |

$ | 2.00 | (1) |

| January

26, 2024 | |

Common

Shares | |

| 50,000 | | |

$ | 2.00 | (1) |

| January

31, 2024 | |

Common

Shares | |

| 140,000 | | |

$ | 2.00 | (1) |

| February

1, 2024 | |

Common

Shares | |

| 127,200 | | |

$ | 2.00 | (1) |

| February

2, 2024 | |

Common

Shares | |

| 130,000 | | |

$ | 2.00 | (1) |

| February

5, 2024 | |

Common

Shares | |

| 24,200 | | |

$ | 2.00 | (1) |

| February

9, 2024 | |

Common

Shares | |

| 6,724,600 | | |

US$ | 3.40 | |

| February

9, 2024 | |

Common

Shares | |

| 10,000 | | |

$ | 2.00 | (1) |

| February

14, 2024 | |

Common

Shares | |

| 5,000 | | |

$ | 2.00 | (1) |

| February

16, 2024 | |

Common

Shares | |

| 30,240 | | |

$ | 2.00 | (1) |

| February

28, 2024 | |

Common

Shares | |

| 13,000 | | |

$ | 2.00 | (1) |

| March

15, 2024 | |

Common

Shares | |

| 39,133 | | |

$ | 2.00 | (1) |

| March

18, 2024 | |

Common

Shares | |

| 70,933 | | |

$ | 2.00 | (1) |

| March

21, 2024 | |

Common

Shares | |

| 8,368 | | |

$ | 2.00 | (1) |

| April

4, 2024 | |

Common

Shares | |

| 140,000 | | |

$ | 2.00 | (1) |

| April

5, 2024 | |

Common

Shares | |

| 35,000 | | |

$ | 2.00 | (1) |

| April

8, 2024 | |

Common

Shares | |

| 65,000 | | |

$ | 2.00 | (1) |

| April

10, 2024 | |

Common

Shares | |

| 500 | | |

$ | 2.00 | (1) |

| May

31, 2024 | |

Common

Shares | |

| 100,000 | | |

$ | 2.00 | (1) |

| June

19, 2024 | |

Common

Shares | |

| 50,000 | | |

$ | 2.00 | (1) |

| June

24, 2024 | |

Common

Shares | |

| 95,588 | | |

$ | 1.40 | (1) |

| June

28, 2024 | |

Common

Shares | |

| 100,000 | | |

$ | 2.00 | (1) |

| July

8, 2024 | |

Common

Shares | |

| 200,000 | | |

$ | 2.00 | (1) |

| July

12, 2024 | |

Common

Shares | |

| 66,500 | | |

$ | 2.00 | (1) |

| July

15, 2024 | |

Common

Shares | |

| 17,600 | | |

$ | 2.00 | (1) |

| July

16, 2024 | |

Common

Shares | |

| 29,500 | | |

$ | 2.00 | (1) |

| July

17, 2024 | |

Common

Shares | |

| 24,600 | | |

$ | 2.00 | (1) |

| July

18, 2024 | |

Common

Shares | |

| 14,500 | | |

$ | 2.00 | (1) |

| July

19, 2024 | |

Common

Shares | |

| 140,000 | | |

$ | 2.00 | (1) |

| July

24, 2024 | |

Common

Shares | |

| 4,500 | | |

$ | 2.00 | (1) |

| July

25, 2024 | |

Common

Shares | |

| 50,000 | | |

$ | 2.00 | (1) |

| July

29, 2024 | |

Common

Shares | |

| 1,400 | | |

$ | 2.00 | (1) |

| August

2, 2024 | |

Common

Shares | |

| 5,000 | | |

$ | 2.00 | (1) |

| August

8, 2024 | |

Common

Shares | |

| 14,000 | | |

$ | 2.00 | (1) |

| August

14, 2024 | |

Common

Shares | |

| 32,200 | | |

$ | 2.00 | (1) |

| August 19, 2024 | |

Common Shares | |

| 250 | | |

$ | 2.92 | (3) |

August

26, 2024 | |

Common

Shares | |

| 5,000 | | |

$ | 2.00 | (1) |

Notes:

| |

(1) |

Common

Shares issued from the exercise of common share purchase warrants. |

| |

(2) |

Common

Shares issued from distributions under the Company’s “at-the-market” distribution equity program qualified by a

prospectus supplement dated August 8, 2023 to the prospectus, pursuant to an equity distribution agreement dated August 8, 2023 among

the Company and the agents party to such equity distribution agreement. Common Shares sold with an issuance price in “US$”

were sold through the facilities of the Nasdaq. Common Shares sold with an issuance price in “$” were sold through the

facilities of the TSX. |

| |

(3) |

Common Shares issued from the exercise of stock options. |

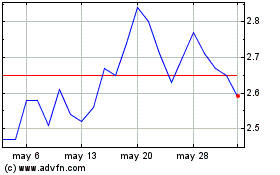

TRADING

PRICE AND VOLUME

The

following table sets forth the monthly high and low sales price and trading volume of the Common Shares in Canada for the 12-month period

before the date of this prospectus supplement:

| | |

Trading

Summary | |

| | |

High ($) | | |

Low ($) | | |

Volume

Traded (#) | |

| 2023 | |

| | | |

| | | |

| | |

| August | |

| 3.44 | | |

| 2.71 | | |

| 1,570,481 | |

| September | |

| 4.26 | | |

| 3.30 | | |

| 2,826,467 | |

| October | |

| 4.38 | | |

| 3.50 | | |

| 4,562,200 | |

| November | |

| 4.33 | | |

| 3.59 | | |

| 3,439,400 | |

| December | |

| 4.06 | | |

| 3.42 | | |

| 2,766,100 | |

| 2024 | |

| | | |

| | | |

| | |

| January | |

| 4.95 | | |

| 3.25 | | |

| 6,483,851 | |

| February | |

| 5.05 | | |

| 3.46 | | |

| 6,287,245 | |

| March | |

| 3.74 | | |

| 3.14 | | |

| 4,135,841 | |

| April | |

| 3.71 | | |

| 3.05 | | |

| 4,149,550 | |

| May | |

| 3.88 | | |

| 3.20 | | |

| 3,241,697 | |

| June | |

| 3.62 | | |

| 3.07 | | |

| 2,502,231 | |

| July | |

| 3.64 | | |

| 3.01 | | |

| 3,000,119 | |

| August

1 - 28 | |

| 3.34 | | |

| 2.75 | | |

| 3,938,418 | |

The

following table provides the monthly high and low sales price and trading volume of the Common Shares on Nasdaq for the 12-month period

before the date of this prospectus supplement:

| | |

Trading

Summary | |

| | |

High (US$) | | |

Low (US$) | | |

Volume

Traded (#) | |

| 2023 | |

| | | |

| | | |

| | |

| August | |

| 2.54 | | |

| 2.02 | | |

| 16,669,320 | |

| September | |

| 3.18 | | |

| 2.42 | | |

| 28,878,133 | |

| October | |

| 3.29 | | |

| 2.54 | | |

| 40,264,900 | |

| November | |

| 3.17 | | |

| 2.61 | | |

| 22,768,500 | |

| December | |

| 3.02 | | |

| 2.56 | | |

| 21,026,500 | |

| 2024 | |

| | | |

| | | |

| | |

| January | |

| 3.72 | | |

| 2.43 | | |

| 42,703,340 | |

| February | |

| 3.76 | | |

| 2.54 | | |

| 42,073,121 | |

| March | |

| 2.76 | | |

| 2.33 | | |

| 31,873,387 | |

| April | |

| 2.78 | | |

| 2.21 | | |

| 27,313,734 | |

| May | |

| 2.86 | | |

| 2.32 | | |

| 22,543,543 | |

| June | |

| 2.66 | | |

| 2.23 | | |

| 17,433,891 | |

| July | |

| 2.68 | | |

| 2.16 | | |

| 24,396,520 | |

| August

1 - 28 | |

| 2.45 | | |

| 1.92 | | |

| 35,702,643 | |

The

Company’s warrants are listed on the TSX under the stock symbol “URC.WT.” The following table provides the monthly

high and low sales price and trading volume of the warrants in Canada for the 12-month period before the date of this prospectus supplement:

| | |

Trading

Summary | |

| | |

High ($) | | |

Low ($) | | |

Volume

Traded (#) | |

| 2023 | |

| | | |

| | | |

| | |

| August | |

| 1.48 | | |

| 0.95 | | |

| 333,798 | |

| September | |

| 2.33 | | |

| 1.37 | | |

| 848,175 | |

| October | |

| 2.38 | | |

| 1.60 | | |

| 573,145 | |

| November | |

| 2.34 | | |

| 1.70 | | |

| 715,312 | |

| December | |

| 1.99 | | |

| 1.51 | | |

| 564,571 | |

| 2024 | |

| | | |

| | | |

| | |

| January | |

| 2.99 | | |

| 1.33 | | |

| 1,434,142 | |

| February | |

| 3.05 | | |

| 1.50 | | |

| 1,474,614 | |

| March | |

| 1.75 | | |

| 1.30 | | |

| 471,915 | |

| April | |

| 1.75 | | |

| 1.12 | | |

| 392,666 | |

| May | |

| 1.87 | | |

| 1.30 | | |

| 435,931 | |

| June | |

| 1.55 | | |

| 1.08 | | |

| 336,543 | |

| July | |

| 1.63 | | |

| 1.01 | | |

| 424,927 | |

| August

1 - 28 | |

| 1.27 | | |

| 0.77 | | |

| 371,202 | |

CERTAIN

CANADIAN FEDERAL INCOME TAX CONSIDERATIONS

In

the opinion of Sangra Moller LLP, Canadian counsel to the Company, and Gowling WLG (Canada) LLP, Canadian counsel to the Agents, the

following is, as of the date hereof, a general summary of the principal Canadian federal income tax considerations under the Income

Tax Act (Canada) and the regulations thereunder (the “Tax Act”) generally applicable to a holder who acquires

Offered Shares as beneficial owner pursuant to the Offering and who, at all relevant times, for the purposes of the Tax Act, deals at

arm’s length with the Company and the Agents, is not affiliated with the Company or the Agents, and will acquire and hold such

Offered Shares as capital property (each, a “Holder”), all within the meaning of the Tax Act. Offered Shares will

generally be considered to be capital property to a Holder unless the Holder acquires or holds the Offered Shares or is deemed to acquire

or hold the Offered Shares in the course of carrying on a business of trading or dealing in securities or has acquired them or deemed

to have acquired them in one or more transactions considered to be an adventure or concern in the nature of trade.

This

summary does not apply to a Holder (a) that is a “financial institution” for purposes of the “mark-to-market property”

rules in the Tax Act; (b) an interest in which is or would constitute a “tax shelter investment” (as defined in the Tax Act);

(c) that is a “specified financial institution” (as defined in the Tax Act); (d) that reports its “Canadian tax results”

(as defined in the Tax Act) in a currency other than Canadian currency; (e) that is exempt from tax under Part I of the Tax Act; (f)

that has entered into, or will enter into, a “synthetic disposition arrangement” or a “derivative forward agreement”

(as those terms are defined in the Tax Act) with respect to the Offered Shares; (g) that receives dividends on the Offered Shares under

or as part of a “dividend rental arrangement” (as defined in the Tax Act), (h) that is a partnership, or (i) that is a corporation

resident in Canada that is or becomes (or does not deal at arm’s length with a corporation resident in Canada for purposes of the

Tax Act that is or becomes), as part of a transaction or event or series of transactions or events that includes the acquisition of Offered

Shares, controlled by a non-resident person or a group of persons comprised of any combination of non-resident corporations, non-resident

individuals or non-resident trusts that do not deal with each other at arm’s length, for the purposes of the “foreign affiliate

dumping” rules in Section 212.3 of the Tax Act. Such Holders should consult their own tax advisors to determine the particular

Canadian federal income tax consequences to them of acquiring Offered Shares pursuant to the Offering.

This

summary does not address the deductibility of interest by a Holder who has borrowed money or otherwise incurred debt in connection with

the acquisition of Offered Shares.

This

summary is based upon the current provisions of the Tax Act in force as of the date hereof, all specific proposals to amend the Tax Act

publicly announced by or on behalf of the Minister of Finance (Canada) prior to the date hereof (the “Tax Proposals”),

the current provisions of the Canada-United States Tax Convention (1980), as amended (the “Canada-U.S. Tax Convention”),

and counsel’s understanding of the current published administrative policies and assessing practices of the Canada Revenue Agency

(the “CRA”) published in writing by it prior to the date hereof. This summary assumes that the Tax Proposals will

be enacted in the form proposed and does not take into account or anticipate any other changes in law, whether by way of judicial, legislative

or governmental decision or action, nor does it take into account provincial, territorial or foreign income tax legislation or considerations,

which may differ from the Canadian federal income tax considerations discussed herein. No assurances can be given that the Tax Proposals

will be enacted as proposed or at all, or that legislative, judicial or administrative changes will not modify or change the statements

expressed herein.

This

summary is not exhaustive of all possible Canadian federal income tax considerations applicable to an investment in Offered Shares. This

summary is of a general nature only and is not intended to be, nor should it be construed to be, legal or tax advice to any particular

Holder. Holders should consult their own tax advisors with respect to the tax consequences applicable to them based on their own particular

circumstances.

Currency

Conversion

Subject

to certain exceptions that are not discussed in this summary, for the purposes of the Tax Act, all amounts relating to the acquisition,

holding or disposition of Offered Shares must be determined in Canadian dollars based on the Bank of Canada rate for the day on which

such amount arose or such other rate as is acceptable to the CRA.

Residents

of Canada

The

following portion of this summary is generally applicable to a Holder who, for the purposes of the Tax Act and any applicable income

tax treaty or convention, is resident or deemed to be resident in Canada at all relevant times (each, a “Resident Holder”)

and this portion of the summary only addresses such Resident Holders. Certain Resident Holders who might not be considered to hold their

Offered Shares as capital property may, in certain circumstances, be entitled to make an irrevocable election pursuant to subsection

39(4) of the Tax Act to have the Offered Shares, and every other “Canadian security” (as defined by the Tax Act) owned by