U.S. Energy Corp. Closes Asset Sale for South Texas Properties

05 Agosto 2024 - 3:30PM

U.S. Energy Corporation (NASDAQ: USEG, “

U.S.

Energy” or the “

Company”) today announced

that the Company has closed the sale (the

“Transaction”) of assets located in South Texas

(the “

South Texas Assets”). The Transaction was

previously announced on July 9, 2024.

HIGHLIGHTS

- All cash

proceeds of approximately $6.5 million.

- Proceeds are

expected to be used to fund development of U.S. Energy’s recently

announced acquisition targeting helium assets (“Recent

Acquisition”) and repay outstanding debt.

- Divested assets

averaged approximately 155 barrels of oil equivalent per day (85%

oil) from January-March 2024, or 13% of U.S. Energy’s total

production over the same period.

- The transaction

closed on July 31, 2024 with an effective date of April 1,

2024.

MANAGEMENT COMMENTARY

"We are pleased to announce the closing of U.S.

Energy's recent transactions, marking the complete divestment of

the Company’s assets in South Texas," stated Ryan Smith, Chief

Executive Officer of U.S. Energy Corp. He continued, "The proceeds

from this sale will be directed towards the development of the

Company's recent acquisition and debt reduction. With the closing

now finalized, U.S. Energy stands in a position of increased

liquidity and enhanced balance sheet strength."

ABOUT U.S. ENERGY CORP.

We are a growth company focused on consolidating

high-quality assets in the United States with the potential to

optimize production and generate free cash flow through low-risk

development while maintaining an attractive shareholder returns

program. We are committed to being a leader in reducing our

carbon footprint in the areas in which we operate. More information

about U.S. Energy Corp. can be found at www.usnrg.com.

INVESTOR RELATIONS CONTACT

Mason McGuireIR@usnrg.com(303) 993-3200www.usnrg.com

FORWARD-LOOKING STATEMENTS

Certain of the matters discussed in this

communication which are not statements of historical fact

constitute forward-looking statements within the meaning of the

federal securities laws, including the Private Securities

Litigation Reform Act of 1995, that involve a number of risks and

uncertainties. Words such as “strategy,” “expects,” “continues,”

“plans,” “anticipates,” “believes,” “would,” “will,” “estimates,”

“intends,” “projects,” “goals,” “targets” and other words of

similar meaning are intended to identify forward-looking statements

but are not the exclusive means of identifying these

statements.

Important factors that may cause actual results

and outcomes to differ materially from those contained in such

forward-looking statements include, without limitation: (1) the

ability of the Company to grow and manage growth profitably and

retain its key employees; (2) the ability of the Company to close

previously announced transactions and the terms of such

transactions; (3) risks associated with the integration of recently

acquired assets; (4) the Company’s ability to comply with the terms

of its senior credit facilities; (5) the ability of the Company to

retain and hire key personnel; (6) the business, economic and

political conditions in the markets in which the Company operates;

(7) the volatility of oil and natural gas prices; (8) the Company’s

success in discovering, estimating, developing and replacing oil

and natural gas reserves; (9) risks of the Company’s operations not

being profitable or generating sufficient cash flow to meet its

obligations; (10) risks relating to the future price of oil,

natural gas and NGLs; (11) risks related to the status and

availability of oil and natural gas gathering, transportation, and

storage facilities; (12) risks related to changes in the legal and

regulatory environment governing the oil and gas industry, and new

or amended environmental legislation and regulatory initiatives;

(13) risks relating to crude oil production quotas or other actions

that might be imposed by the Organization of Petroleum Exporting

Countries and other producing countries; (14) technological

advancements; (15) changing economic, regulatory and political

environments in the markets in which the Company operates; (16)

general domestic and international economic, market and political

conditions, including the military conflict between Russia and

Ukraine and the global response to such conflict; (17) actions of

competitors or regulators; (18) the potential disruption or

interruption of the Company’s operations due to war, accidents,

political events, severe weather, cyber threats, terrorist acts, or

other natural or human causes beyond the Company’s control;

(19) pandemics, governmental responses thereto, economic

downturns and possible recessions caused thereby; (20) inflationary

risks and recent changes in inflation and interest rates, and the

risks of recessions and economic downturns caused thereby or by

efforts to reduce inflation; (21) risks related to military

conflicts in oil producing countries; (22) changes in economic

conditions; limitations in the availability of, and costs of,

supplies, materials, contractors and services that may delay the

drilling or completion of wells or make such wells more expensive;

(23) the amount and timing of future development costs; (24) the

availability and demand for alternative energy sources; (25)

regulatory changes, including those related to carbon dioxide and

greenhouse gas emissions; (26) uncertainties inherent in estimating

quantities of oil and natural gas reserves and projecting future

rates of production and timing of development activities; (27)

risks relating to the lack of capital available on acceptable terms

to finance the Company’s continued growth; (28) the review and

evaluation of potential strategic transactions and their impact on

stockholder value and the process by which the Company engages in

evaluation of strategic transactions; and (29) other risk factors

included from time to time in documents U.S. Energy files with the

Securities and Exchange Commission, including, but not limited to,

its Form 10-Ks, Form 10-Qs and Form 8-Ks. Other important factors

that may cause actual results and outcomes to differ materially

from those contained in the forward-looking statements included in

this communication are described in the Company’s publicly filed

reports, including, but not limited to, the Company’s Annual Report

on Form 10-K for the year ended December 31, 2023 and Quarterly

Report on Form 10-Q for the quarter ended March 31, 2024, and

future annual reports and quarterly reports. These reports and

filings are available at www.sec.gov. Unknown or unpredictable

factors also could have material adverse effects on the Company’s

future results.

The Company cautions that the foregoing list of

important factors is not complete, and does not undertake to update

any forward-looking statements except as required by applicable

law. All subsequent written and oral forward-looking statements

attributable to the Company or any person acting on behalf of the

Company are expressly qualified in their entirety by the cautionary

statements referenced above. Other unknown or unpredictable factors

also could have material adverse effects on the Company’s future

results. The forward-looking statements included in this

communication are made only as of the date hereof. The Company

cannot guarantee future results, levels of activity, performance or

achievements. Accordingly, you should not place undue reliance on

these forward-looking statements. Finally, the Company undertakes

no obligation to update these statements after the date of this

release, except as required by law, and takes no obligation to

update or correct information prepared by third parties that are

not paid for by the Company. If we update one or more

forward-looking statements, no inference should be drawn that we

will make additional updates with respect to those or other

forward-looking statements.

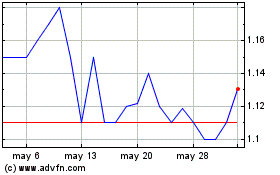

US Energy (NASDAQ:USEG)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

US Energy (NASDAQ:USEG)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024