Value Line, Inc., (NASDAQ: VALU) reported results through the third

fiscal quarter ended January 31, 2023. During the nine months ended

January 31, 2023, the Company’s income from operations of

$8,713,000 was 10.6% above income from operations of $7,877,000

during the nine months ended January 31, 2022. For the nine months

ended January 31, 2023, operating expenses decreased 5.6% below

those during the nine months ended January 31, 2022.

Ongoing revenue in the digital-publishing arena

has been supported by record-setting sales results for the

nine-month period on the part of the company’s business-to-business

sales team.

Retained earnings at January 31, 2023, were

$94,588,000, representing an increase of 7.3% over retained

earnings at April 30, 2022. The Company’s liquid assets at January

31, 2023, were $60,777,000, a 4.9% increase from liquid assets at

April 30, 2022. Shareholders’ equity reached $82,226,000 at January

31, 2023, an increase of 3.1% from the shareholders’ equity of

$79,645,000 at April 30, 2022 and reflected $4,487,000 of

repurchases of the company’s shares.

During the nine months ended January 31, 2023,

the Company’s net income of $14,036,000, or $1.48 per share,

compared to net income of $20,015,000, or $2.10 per share, for the

nine months ended January 31, 2022 primarily because last fiscal

year to date results included a gain of $2,331,000 from the

tax-free forgiveness of the SBA’s PPP loan to the Company and

because of a decline of $5,836,000 for the nine months in passive

income from the Company’s investment in EAM Trust as well as a

change in unrealized investment gains/(losses) primarily from

equity securities.

During the three months ended January 31, 2023,

the Company’s income from operations of $2,984,000 was 3.8% above

income from operations of $2,875,000 during the three months ended

January 31, 2022. For the three months ended January 31, 2023,

operating expenses decreased 5.4% below those during the three

months ended January 31, 2022. During the three months ended

January 31, 2023, the Company’s net income of $5,248,000, or $0.55

per share, was 6.5% below net income of $5,614,000, or $0.59 per

share, for the three months ended January 31, 2022 primarily

because of a decline of $1,970,000 for the three months in passive

income from the Company’s investment in EAM Trust offset partly by

an increase in unrealized investment gains primarily from equity

securities.

During the nine months ended January 31, 2023,

there were 9,465,955 average common shares outstanding as compared

to 9,551,418 average common shares outstanding during the nine

months ended January 31, 2022, also reflecting the Company’s

repurchases of shares.

The Company’s quarterly report on Form 10-Q has

been filed with the SEC and is available on the Company’s website

at https://www.valueline.com/About/InvestorRelation.aspx.

Shareholders may receive a printed copy, free of charge upon

request.

Value Line, Inc. is a leading New York based

provider of investment research. The Value Line Investment

Survey is one of the most widely used sources of

independent equity investment research. Value Line also publishes a

range of proprietary investment research in both print and digital

formats including research in the areas of Mutual Funds, ETFs and

Options. Value Line’s acclaimed research also enables the Company

to provide specialized products such as Value Line Select,

Value Line Special Situations, Value Line Select: ETFs, Value Line

Select: Dividend Income & Growth, The New Value Line ETFs

Service, The Value Line M & A Service, The Value Line

Information You Should Know Wealth Newsletter, Value Line Climate

Change Investing Service and certain Value Line

copyrights, distributed under agreements including certain

proprietary ranking system information and other proprietary

information used in third party products. Investment Advisory

services are provided through its substantial non-voting interests

in EULAV Asset Management, the investment advisor to The Value Line

Family of Mutual Funds. Value Line’s products are available to

individual investors by mail, at www.valueline.com or by calling

1-800-VALUELINE or 1-800-825-8354, while institutional-level

services for professional investors, advisers, corporate, academic,

and municipal libraries are offered at www.ValueLinePro.com,

www.ValueLineLibrary.com and by calling 1-800-531-1425.

Cautionary Statement Regarding

Forward-Looking Information

In this report, “Value Line,” “we,” “us,” “our”

refers to Value Line, Inc. and “the Company” refers to Value Line

and its subsidiaries unless the context otherwise requires.

This report contains statements that are

predictive in nature, depend upon or refer to future events or

conditions (including certain projections and business trends)

accompanied by such phrases as “believe”, “estimate”, “expect”,

“anticipate”, “will”, “intend” and other similar or negative

expressions, that are “forward-looking statements” as defined in

the Private Securities Litigation Reform Act of 1995, as amended.

Actual results for the Company may differ materially from those

projected as a result of certain risks and uncertainties, including

but not limited to the following:

- maintaining revenue from

subscriptions for the Company’s digital and print published

products;

- changes in investment trends and

economic conditions, including global financial issues;

- changes in Federal Reserve policies

affecting interest rates and liquidity along with resulting effects

on equity markets;

- stability of the banking system,

including the success of U.S. government policies and actions in

regard to banks with liquidity or capital issues, along with the

associated impact on equity markets;

- continuation of orderly markets for

equities and corporate and governmental debt securities;

- protecting intellectual property

rights in Company methods and trademarks;

- protecting confidential information

including customer confidential or personal information that we may

possess;

- dependence on non-voting revenues

and non-voting profits interests in EULAV Asset Management, a

Delaware statutory trust (“EAM” or “EAM Trust”), which serves as

the investment advisor to the Value Line Funds and engages in

related distribution, marketing and administrative services;

- fluctuations in EAM’s and third

party copyright assets under management due to broadly based

changes in the values of equity and debt securities, redemptions by

investors and other factors;

- possible changes in the valuation

of EAM’s intangible assets from time to time;

- generating future revenues or

collection of receivables from significant customers;

- dependence on key executive and

specialist personnel;

- risks associated with the

outsourcing of certain functions, technical facilities, and

operations, including in some instances outside the U.S.;

- competition in the fields of

publishing, copyright and investment management, along with

associated effects on the level and structure of prices and fees,

and the mix of services delivered;

- the impact of government regulation

on the Company’s and EAM’s businesses;

- availability of free or low cost

investment data through discount brokers or generally over the

internet;

- military conflicts, civil unrest,

and associated travel and supply disruptions and other

effects;

- Russia’s invasion of Ukraine and

the impact on inflation;

- continued availability of generally

dependable energy supplies in the geographic areas in which the

company and certain suppliers operate;

- terrorist attacks, cyber attacks

and natural disasters;

- insufficiency in our business

continuity plans or systems in the event of anticipated or

unpredictable disruption;

- the coronavirus pandemic, which has

drastically affected markets, employment, and other economic

conditions, and may have additional unpredictable impacts on

employees, suppliers, customers, and operations;

- other possible epidemics;

- changes in prices and availability

of materials and other inputs and services, such as freight and

postage, required by the Company;

- other risks and uncertainties,

including but not limited to the risks described in Item 1A, “Risk

Factors” of the Company’s Annual Report on Form 10-K for the year

ended April 30, 2022 and in Part II, Item 1A of this Quarterly

Report on Form 10-Q for the period ended January 31, 2023; and

other risks and uncertainties arising from time to time.

These factors are not necessarily all of the

important factors that could cause actual results to differ

materially from those expressed in any of our forward-looking

statements. Other unknown or unpredictable factors which may

involve external factors over which we may have no control or

changes in our plans, strategies, objectives, expectations or

intentions, which may happen at any time at our discretion, could

also have material adverse effects on future results. Except as

otherwise required by applicable law, we have no duty to update

these statements, and we undertake no obligation to publicly update

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise. In light of these

risks and uncertainties, current plans, anticipated actions, and

future financial conditions and results may differ from those

expressed in any forward-looking information contained herein.

www.valueline.comwww.ValueLinePro.com,

www.ValueLineLibrary.comFacebook | LinkedIn | Twitter Complimentary

Value Line® Reports on Dow 30 Stocks

Contact: Howard A. Brecher

Value Line, Inc.

212-907-1500

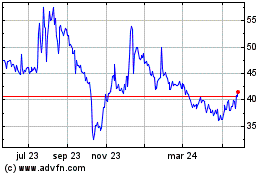

Value Line (NASDAQ:VALU)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

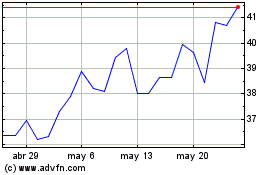

Value Line (NASDAQ:VALU)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024