UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16

OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of November 2024

Commission File Number: 001-35126

VNET Group, Inc.

Guanjie Building, Southeast 1st Floor

10# Jiuxianqiao East Road

Chaoyang District

Beijing 100016

The People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x Form 40-F ¨

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

VNET Group, Inc. |

| |

|

|

| |

By: |

/s/ Qiyu Wang |

| |

Name: |

Qiyu Wang |

| |

Title: |

Chief Financial Officer |

| |

|

|

| Date: November 20, 2024 |

|

|

EXHIBIT INDEX

Exhibit 99.1

VNET Reports Unaudited Third Quarter 2024 Financial

Results

BEIJING,

November 20, 2024 /PRNewswire/ -- VNET Group, Inc. (Nasdaq: VNET) (“VNET” or the “Company”),

a leading carrier- and cloud-neutral internet data center services provider in China, today announced its unaudited financial results

for the third quarter ended September 30, 2024.

“We achieved strong third quarter results

mainly driven by our wholesale IDC business,” said Josh Sheng Chen, Founder, Executive Chairperson and interim Chief Executive

Officer of VNET. “Our wholesale IDC business maintained its strong growth momentum as we capitalized on rising AI-driven demand.

We also continued attracting high-quality customers during the third quarter, with six new order wins totaling 84MW. Notably, we won

a new wholesale order from an Internet customer for 32MW at our Huailai IDC Campus, one of our green computing clusters in Hebei province.

Moving forward, we will continue to develop our high-performance data centers and green business, providing reliable, premium IDC services

to meet market demand. Propelling VNET’s high-quality, sustainable development remains our priority as we strive to deliver value

to all of our stakeholders.”

Qiyu

Wang, Chief Financial Officer of VNET, commented, “In the third quarter, we remained focused on high-quality revenue businesses

with high margins. Our total net revenues increased by 12.4% year over year to RMB2.12 billion, mainly driven by remarkable wholesale

revenue growth of 86.4% year over year. Our adjusted EBITDA also grew by 17.1% year over year to RMB594.8 million in the third

quarter of 2024. We previously reported adjusted EBITDA for the third quarter of 2023 at RMB507.9 million. Such figure included VAT surplus

deduction benefit of RMB13.3 million, which is now considered non-continuable due to the termination of preferential tax policies since

January 1, 2024 (the “Discontinued VAT Benefits”). The year-over-year growth in adjusted EBITDA would be 20.2% if the

Discontinued VAT Benefits were excluded from the adjusted EBITDA calculation for the same period last year. We also aim to enter a definitive

agreement with one of China’s leading insurance companies by the end of 2024 to form a pre-REITs fund. The fund will feature the

first and second phases of our Taicang IDC Campus as the underlying assets, with us retaining approximately a 51% interest in the fund.

This will further strengthen our cash reserves and support our sustainable development. Looking ahead, we will continue strengthening

our core capabilities and capitalizing on AI-driven opportunities to create long-term shareholder value.”

Third Quarter 2024 Financial Highlights

| · | Total

net revenues increased by 12.4% to RMB2.12 billion (US$302.2 million) from RMB1.89 billion

in the same period of 2023. |

| · | Net

revenues from the IDC business1

increased by 18.4% to RMB1.50 billion (US$213.5 million) from RMB1.27 billion

in the same period of 2023. |

| · | Net

revenues from the wholesale IDC business (“wholesale revenues”) increased by

86.4% to RMB523.0 million (US$74.5 million) from RMB280.6 million in the same period of 2023. |

| · | Net

revenues from the retail IDC business (“retail revenues”) decreased slightly

by 1.0% to RMB975.5 million (US$139.0 million) from RMB984.9 million in the same period of

2023. |

| · | Net

revenues from the non-IDC business2

increased by 0.2% to RMB622.3 million (US$88.7 million) from RMB621.4 million

in the same period of 2023. |

| · | Adjusted

cash gross profit (non-GAAP) increased by 16.6% to RMB860.7 million (US$122.6 million) from

RMB738.4 million in the same period of 2023. Adjusted cash gross margin (non-GAAP) was 40.6%,

compared with 39.1% in the same period of 2023. |

| · | Adjusted

EBITDA (non-GAAP) increased by 17.1% to RMB594.8 million (US$84.8 million) from RMB507.9

million in the same period of 2023. Such figure in the third quarter of 2023 included Discontinued

VAT Benefits of RMB13.3 million. The year-over-year growth in adjusted EBITDA would be 20.2%

if the Discontinued VAT Benefits were excluded from the adjusted EBITDA calculation for the

same period last year. Adjusted EBITDA margin (non-GAAP) was 28.0%, compared with 26.9% in

the same period of 2023. |

| · | Net

income increased by RMB372.0 million and RMB260.3 million to RMB332.2 million (US$47.3 million)

in the third quarter, compared with a net loss of RMB39.9 million in the same period of 2023

and a net income of RMB71.8 million in the second quarter of 2024, respectively. |

1

IDC business refers to managed hosting services, consisting of the wholesale IDC business and the retail IDC business. Beginning

in the first quarter of 2024, our IDC business was subdivided into wholesale IDC business and retail IDC business according to the nature

and scale of our data center projects. Prior to 2024, the subdivision was based on customer contract types.

2

Non-IDC business consists of cloud services and VPN services.

Third Quarter 2024 Operational Highlights

Wholesale IDC Business3

| · | Capacity

in service was 358MW as of September 30, 2024, compared with 332MW as of June 30,

2024, and 290MW as of September 30, 2023. Capacity under construction was 297MW as of

September 30, 2024. |

| · | Capacity

utilized by customers reached 279MW as of September 30, 2024, compared with 252MW as

of June 30, 2024, and 161MW as of September 30, 2023. The sequential increase during

the third quarter of 2024 was 27MW, which was mainly contributed by the E-JS Campus 02 C

data center and the N-OR06 data center. |

| · | Utilization

rate4

of wholesale capacity was 78.0% as of September 30, 2024, compared with 75.9% as of

June 30, 2024, and 55.4% as of September 30, 2023. |

| · | Utilization

rate of mature wholesale capacity5

was 95.6% as of September 30, 2024, compared with 94.9% as of June 30,

2024, and 94.4% as of September 30, 2023. |

| · | Utilization

rate of ramp-up wholesale capacity6

was 46.4% as of September 30, 2024, compared with 45.7% as of June 30,

2024, and 18.4% as of September 30, 2023. |

| · | Total

capacity committed7

was 352MW as of September 30, 2024, compared with 326MW as of June 30,

2024, and 236MW as of September 30, 2023. |

| · | Commitment

rate8

for capacity in service was 98.2% as of September 30, 2024, compared with 98.1% as of

June 30, 2024, and 81.3% as of September 30, 2023. |

| · | Total

capacity pre-committed9

was 262MW and pre-commitment rate10

for capacity under construction was 88.4% as of September 30, 2024. |

Retail IDC Business11

| · | Capacity

in service was 52,250 cabinets as of September 30, 2024, compared with 52,177 cabinets

as of June 30, 2024, and 52,200 cabinets as of September 30, 2023. |

| · | Capacity

utilized by customers reached 32,950 cabinets as of September 30, 2024, compared with

33,253 cabinets as of June 30, 2024, and 33,845 cabinets as of September 30, 2023. |

| · | Utilization

rate of retail capacity was 63.1% as of September 30, 2024, compared with 63.7% as of

June 30, 2024, and 64.8% as of September 30, 2023. |

| · | Utilization

rate of mature retail capacity12

was 69.5% as of September 30, 2024, compared with 72.5% as of June 30,

2024, and 73.1% as of September 30, 2023. |

3

For wholesale IDC business, certain projects hosted in our E-JS02 data center with an aggregate of 27MW capacity were excluded

and are expected to be continuously excluded from in-service wholesale due to pending commercial discussion with the client. Such projects

were included as in-service wholesale from the first quarter of 2021 to the fourth quarter of 2023, given that such projects had been

delivered to the client based on the terms of the MOU.

4

Utilization rate is calculated by dividing capacity utilized by customers by the capacity in service.

5

Mature wholesale capacity refers to wholesale data centers in which utilization rate is at or above 80%.

6

Ramp-up wholesale capacity refers to wholesale data centers in which utilization rate is below 80%.

7

Total capacity committed is the capacity committed to customers pursuant to customer agreements remaining in effect.

8

Commitment rate is calculated by total capacity committed divided by total capacity in service.

9

Total capacity pre-committed is the capacity under construction which is pre-committed to customers pursuant to customer

agreements remaining in effect.

10

Pre-commitment rate is calculated by total capacity pre-committed divided by total capacity under construction.

11

For retail IDC business, since the first quarter of 2024, we have excluded a certain number of reserved cabinets from the

capacity in service. Reserved cabinets refer to those that have not been utilized on a large scale, those that are planned to be closed,

or those that are planned to be further upgraded. As of September 30, 2023, June 30, 2024, and September 30, 2024, 4,426, 4,150, and

4,150 reserved cabinets, respectively, were excluded from the calculation of utilization rate of retail IDC business capacity.

12

Mature retail capacity refers to retail data centers that came into service prior to the past 24 months.

| · | Utilization

rate of ramp-up retail capacity13

was 16.8% as of September 30, 2024, compared with 12.7% as of June 30,

2024, and 18.7% as of September 30, 2023. |

| · | Monthly

recurring revenue (MRR) per retail cabinet was RMB8,788 in the third quarter of 2024, compared

with RMB8,753 in the second quarter of 2024 and RMB8,845 in the third quarter of 2023. |

Third Quarter 2024 Financial Results

TOTAL

NET REVENUES: Total net revenues in the third quarter of 2024 were RMB2.12 billion (US$302.2 million), representing an increase

of 12.4% from RMB1.89 billion in the same period of 2023. The year-over-year increase was mainly driven by the continued growth of our

wholesale IDC business.

Net

revenues from IDC business increased by 18.4% to RMB1.50 billion (US$213.5 million) from RMB1.27 billion in the same period

of 2023. The year-over-year increase was mainly driven by an increase in wholesale revenues.

| · | Wholesale

revenues increased by 86.4% to RMB523.0 million (US$74.5 million) from RMB280.6 million

in the same period of 2023. |

| · | Retail

revenues decreased to RMB975.5 million (US$139.0 million) from RMB984.9 million in

the same period of 2023. |

Net

revenues from non-IDC business increased by 0.2% to RMB622.3 million (US$88.7 million) from RMB621.4 million in the same

period of 2023.

GROSS

PROFIT: Gross profit in the third quarter of 2024 was RMB491.7 million (US$70.1 million), representing an increase of 60.4%

from RMB306.5 million in the same period of 2023. Gross margin in the third quarter of 2024 was 23.2%, compared with 16.2% in the same

period of 2023. The year-over-year increase was primarily attributable to a reduction in depreciation expense due to the change in the

estimated useful lives of property and equipment starting from January 1, 2024.

ADJUSTED

CASH GROSS PROFIT (non-GAAP), which excludes depreciation, amortization, and share-based compensation expenses, was RMB860.7

million (US$122.6 million) in the third quarter of 2024, compared with RMB738.4 million in the same period of 2023. Adjusted cash gross

margin (non-GAAP) in the third quarter of 2024 was 40.6%, compared with 39.1% in the same period of 2023.

OPERATING

EXPENSES: Total operating expenses in the third quarter of 2024 were RMB300.3 million (US$42.8 million), compared with RMB274.3

million in the same period of 2023.

Sales

and marketing expenses were RMB60.7 million (US$8.7 million) in the third quarter of 2024, compared with RMB64.1 million

in the same period of 2023.

Research

and development expenses were RMB53.1 million (US$7.6 million) in the third quarter of 2024, compared with RMB80.7 million

in the same period of 2023.

General

and administrative expenses were RMB132.5 million (US$18.9 million) in the third quarter of 2024, compared with RMB137.9

million in the same period of 2023.

ADJUSTED

OPERATING EXPENSES (non-GAAP), which exclude share-based compensation expenses, were RMB293.6 million (US$41.8 million) in

the third quarter of 2024, compared with RMB264.8 million in the same period of 2023. As a percentage of total net revenues, adjusted

operating expenses (non-GAAP) in the third quarter of 2024 were 13.8%, compared with 14.0% in the same period of 2023.

ADJUSTED

EBITDA (non-GAAP): Adjusted EBITDA in the third quarter of 2024 was RMB594.8 million (US$84.8 million), representing an increase

of 17.1% from RMB507.9 million in the same period of 2023. Such figure in the third quarter of 2023 included Discontinued VAT Benefits

of RMB13.3 million. The year-over-year growth in adjusted EBITDA would be 20.2% if the Discontinued VAT Benefits were excluded from the

adjusted EBITDA calculation for the same period last year). Adjusted EBITDA margin (non-GAAP) in the third quarter of 2024 was 28.0%,

compared with 26.9% in the same period of 2023.

13

Ramp-up retail capacity refers to retail data centers that came into service within the past 24 months, or mature retail data

centers that have undergone improvements within the past 24 months.

NET

INCOME/LOSS ATTRIBUTABLE TO VNET GROUP, INC.: Net income attributable to VNET Group, Inc. in the third quarter of

2024 was RMB317.6 million (US$45.3 million), compared with a net loss attributable to VNET Group, Inc. of RMB50.5 million in the

same period of 2023. The year-over-year increase was mainly due to a gain in debt extinguishment.

EARNINGS

PER SHARE: Basic and diluted earnings per share in the third quarter of 2024 were RMB0.20 (US$0.03) and RMB0.05 (US$0.01),

respectively, which represents the equivalent to RMB1.20 (US$0.18) and RMB0.30 (US$0.06) per American depositary share (“ADS”).

Each ADS represents six Class A ordinary shares. Diluted earnings per share is calculated using adjusted net income attributable

to ordinary shareholders divided by the weighted average number of diluted shares outstanding.

LIQUIDITY:

As of September 30, 2024, the aggregate amount of the Company’s cash and cash equivalents, restricted cash and

short-term investments was RMB2.10 billion (US$298.9 million).

Total

short-term debt consisting of short-term bank borrowings and the current portion of long-term borrowings was RMB1.87 billion (US$266.4

million). Total long-term debt was RMB8.88 billion (US$1.26 billion), comprised of long-term borrowings of RMB7.08 billion (US$1.0 billion)

and convertible promissory notes of RMB1.79 billion (US$255.6 million).

Net

cash generated from operating activities in the third quarter of 2024 was RMB760.4 million (US$108.4 million), compared with RMB454.3

million in the same period of 2023. During the third quarter of 2024, the Company obtained new debt financing, refinancing facilities

and other financings of RMB0.95 billion (US$134.7 million).

Recent Development

The Company plans to sign a definitive agreement

by the end of 2024 on a pre-REITs project with one of China's leading insurance companies, under which the Company will form a pre-REITs

fund (the "Fund") to feature the first and second phases of our Taicang IDC Campus as the underlying assets with approximately

210MW total IT capacity and RMB5.74 billion estimated value.

The Company is expected to own approximately

51% interest in the Fund and sell the remaining 49% interest to the insurance company, the consideration of which would be approximately

RMB1.15 billion, calculated based on the assets and liabilities of the fund at the establishment date.

After the completion of this transaction, VNET

intends to consolidate the Fund for financial reporting purpose, while operating the Taicang IDC project to offer stable and premium

infrastructure services. The financial results of the Fund’s underlying assets are expected to be consolidated into the Company’s

financial statement.

Business Outlook

The Company increased its full year 2024 guidance

for total net revenues and adjusted EBITDA. Specifically, the Company now expects total net revenues for 2024 to be between RMB8,000

million to RMB8,100 million, representing year-over-year growth of 7.9% to 9.3%, and adjusted EBITDA (non-GAAP) to be in the range of

RMB2,280 million to RMB2,300 million, representing year-over-year growth of 11.8% to 12.8%. Such figure in the third quarter of 2023

adjusted EBITDA included Discontinued VAT Benefits of RMB13.3 million. The year-over-year growth in adjusted EBITDA would be 16.4% to

17.4% if the Discontinued VAT Benefits were excluded from the adjusted EBITDA calculation for the same period last year.

The forecast reflects the Company’s current

and preliminary views on the market and its operational conditions and is subject to change.

Conference Call

The Company’s management will host an earnings

conference call at 8:00 PM U.S. Eastern Time on Wednesday, November 20, 2024, or 9:00 AM Beijing Time on Thursday, November 21,

2024.

For participants who wish to join the call, please

access the links provided below to complete the online registration process.

English line:

https://s1.c-conf.com/diamondpass/10043189-1ej64l.html

Chinese line (listen-only mode):

https://s1.c-conf.com/diamondpass/10043190-a2lrfs.html

Participants can choose between the English and

Chinese options for pre-registration above. Please note that the Chinese option will be in listen-only mode. Upon registration, each

participant will receive an email containing details for the conference call, including dial-in numbers, a conference call passcode and

a unique access PIN, which will be used to join the conference call.

Additionally,

a live and archived webcast of the conference call will be available on the Company's investor relations website at http://ir.vnet.com.

A replay of the conference call will be accessible

through November 28, 2024, by dialing the following numbers:

US/Canada: 1 855 883 1031

| Mainland China: |

400 1209 216 |

| Hong Kong, China: |

800 930 639 |

| International: |

+61 7 3107 6325 |

| Reply PIN (English line): |

10043189 |

| Reply PIN (Chinese line): |

10043190 |

Non-GAAP Disclosure

In evaluating its business, VNET considers and

uses the following non-GAAP measures defined as non-GAAP financial measures by the U.S. Securities and Exchange Commission as a supplemental

measure to review and assess its operating performance: adjusted cash gross profit, adjusted cash gross margin, adjusted operating expenses,

adjusted EBITDA and adjusted EBITDA margin. The presentation of these non-GAAP financial measures is not intended to be considered in

isolation or as a substitute for the financial information prepared and presented in accordance with U.S. GAAP. For more information

on these non-GAAP financial measures, please see the table captioned “Reconciliations of GAAP and non-GAAP results” set forth

at the end of this press release.

The non-GAAP financial measures are provided

as additional information to help investors compare business trends among different reporting periods on a consistent basis and to enhance

investors’ overall understanding of the Company’s current financial performance and prospects for the future. These non-GAAP

financial measures should be considered in addition to results prepared in accordance with U.S. GAAP, but should not be considered a

substitute for, or superior to, U.S. GAAP results. In addition, the Company’s calculation of the non-GAAP financial measures may

be different from the calculation used by other companies, and therefore comparability may be limited.

Exchange Rate

This announcement contains translations of certain

RMB amounts into U.S. dollars (“USD”) at specified rates solely for the convenience of the reader. Unless otherwise stated,

all translations from RMB to USD were made at the rate of RMB7.0176 to US$1.00, the noon buying rate in effect on September 30,

2024, in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the RMB or USD amounts referred

could be converted into USD or RMB, as the case may be, at any particular rate or at all. For analytical presentation, all percentages

are calculated using the numbers presented in the financial statements contained in this earnings release.

Statement Regarding Unaudited Condensed Financial

Information

The unaudited financial information set forth

above is preliminary and subject to potential adjustments. Adjustments to the consolidated financial statements may be identified when

audit work has been performed for the Company’s year-end audit, which could result in significant differences from this preliminary

unaudited condensed financial information.

About VNET

VNET Group, Inc. is a leading carrier- and

cloud-neutral internet data center services provider in China. VNET provides hosting and related services, including IDC services, cloud

services, and business VPN services to improve the reliability, security, and speed of its customers’ internet infrastructure.

Customers may locate their servers and equipment in VNET’s data centers and connect to China’s internet backbone. VNET operates

in more than 30 cities throughout China, servicing a diversified and loyal base of over 7,500 hosting and related enterprise customers

that span numerous industries ranging from internet companies to government entities and blue-chip enterprises to small- to mid-sized

enterprises.

Safe Harbor Statement

This

announcement contains forward-looking statements. These forward-looking statements are made under the "safe harbor" provisions

of the U.S. Private Securities Litigation Reform Act of 1995. These statements can be identified by terminology such as "will,"

"expects," "anticipates," "future," "intends," "plans," "target," "believes,"

"estimates" and similar statements. Among other things, quotations from management in this announcement as well as VNET's strategic

and operational plans, including the plan to sign a definitive agreement on a pre-REITs project, contain forward-looking statements.

VNET may also make written or oral forward-looking statements in its reports filed with, or furnished to, the U.S. Securities and Exchange

Commission, in its annual reports to shareholders, in press releases and other written materials and in oral statements made by its officers,

directors or employees to third parties. Statements that are not historical facts, including statements about VNET's beliefs and expectations,

are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause

actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following:

VNET's goals and strategies; VNET's liquidity conditions; VNET's expansion plans; the expected growth of the data center services market;

expectations regarding demand for, and market acceptance of, VNET's services; VNET's expectations regarding keeping and strengthening

its relationships with customers; VNET's plans to invest in research and development to enhance its solution and service offerings; and

general economic and business conditions in the regions where VNET provides solutions and services. Further information regarding these

and other risks is included in VNET's reports filed with, or furnished to, the U.S. Securities and Exchange Commission. All information

provided in this press release is as of the date of this press release, and VNET undertakes no duty to update such information, except

as required under applicable law.

Investor Relations Contact:

Xinyuan Liu

Tel: +86 10 8456 2121

Email:

ir@vnet.com

VNET

GROUP, INC.

CONSOLIDATED

BALANCE SHEETS

(Amount in thousands of Renminbi (“RMB”) and US dollars (“US$”))

| | |

As of | | |

As of | |

| | |

December 31, 2023 | | |

September 30, 2024 | |

| | |

RMB | | |

RMB | | |

US$ | |

| Assets | |

| | | |

| | | |

| | |

| Current assets: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 2,243,537 | | |

| 1,524,819 | | |

| 217,285 | |

| Restricted cash | |

| 2,854,568 | | |

| 556,266 | | |

| 79,267 | |

| Accounts and notes receivable, net | |

| 1,715,975 | | |

| 1,861,828 | | |

| 265,308 | |

| Short-term Investments | |

| 356,820 | | |

| 15,879 | | |

| 2,263 | |

| Prepaid expenses and other current assets | |

| 2,375,341 | | |

| 2,665,924 | | |

| 379,891 | |

| Amounts due from related parties | |

| 277,237 | | |

| 317,619 | | |

| 45,260 | |

| Total current assets | |

| 9,823,478 | | |

| 6,942,335 | | |

| 989,274 | |

| | |

| | | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | | |

| | |

| Property and equipment, net | |

| 13,024,393 | | |

| 15,153,253 | | |

| 2,159,321 | |

| Intangible assets, net | |

| 1,383,406 | | |

| 1,347,751 | | |

| 192,053 | |

| Land use rights, net | |

| 602,503 | | |

| 588,846 | | |

| 83,910 | |

| Operating lease right-of-use assets, net | |

| 4,012,329 | | |

| 4,412,834 | | |

| 628,824 | |

| Restricted cash | |

| 882 | | |

| 882 | | |

| 126 | |

| Deferred tax assets, net | |

| 247,644 | | |

| 309,390 | | |

| 44,088 | |

| Long-term investments, net | |

| 757,949 | | |

| 798,638 | | |

| 113,805 | |

| Other non-current assets | |

| 533,319 | | |

| 371,501 | | |

| 52,938 | |

| Total non-current assets | |

| 20,562,425 | | |

| 22,983,095 | | |

| 3,275,065 | |

| Total assets | |

| 30,385,903 | | |

| 29,925,430 | | |

| 4,264,339 | |

| | |

| | | |

| | | |

| | |

| Liabilities and Shareholders' Equity | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Short-term bank borrowings | |

| 30,000 | | |

| 552,270 | | |

| 78,698 | |

| Accounts and notes payable | |

| 696,177 | | |

| 728,361 | | |

| 103,791 | |

| Accrued expenses and other payables | |

| 2,783,102 | | |

| 2,527,584 | | |

| 360,178 | |

| Advances from customers | |

| 1,605,247 | | |

| 1,752,935 | | |

| 249,791 | |

| Deferred revenue | |

| 95,477 | | |

| 87,354 | | |

| 12,448 | |

| Income taxes payable | |

| 35,197 | | |

| 51,554 | | |

| 7,346 | |

| Amounts due to related parties | |

| 356,080 | | |

| 354,903 | | |

| 50,573 | |

| Current portion of long-term borrowings | |

| 723,325 | | |

| 1,317,343 | | |

| 187,720 | |

| Current portion of finance lease liabilities | |

| 115,806 | | |

| 107,785 | | |

| 15,359 | |

| Current portion of deferred government grants | |

| 8,062 | | |

| 8,538 | | |

| 1,217 | |

| Current portion of operating lease liabilities | |

| 780,164 | | |

| 874,957 | | |

| 124,680 | |

| Convertible promissory notes | |

| 4,208,495 | | |

| - | | |

| - | |

| Total current liabilities | |

| 11,437,132 | | |

| 8,363,584 | | |

| 1,191,801 | |

| | |

| | | |

| | | |

| | |

| Non-current liabilities: | |

| | | |

| | | |

| | |

| Long-term borrowings | |

| 5,113,521 | | |

| 7,082,026 | | |

| 1,009,181 | |

| Convertible promissory notes | |

| 1,769,946 | | |

| 1,793,894 | | |

| 255,628 | |

| Non-current portion of finance lease liabilities | |

| 1,159,525 | | |

| 1,169,573 | | |

| 166,663 | |

| Unrecognized tax benefits | |

| 98,457 | | |

| 98,457 | | |

| 14,030 | |

| Deferred tax liabilities | |

| 688,362 | | |

| 703,390 | | |

| 100,232 | |

| Deferred government grants | |

| 145,112 | | |

| 265,941 | | |

| 37,896 | |

| Non-current portion of operating lease liabilities | |

| 3,270,759 | | |

| 3,587,701 | | |

| 511,243 | |

| Derivative liability | |

| 188,706 | | |

| - | | |

| - | |

| Total non-current liabilities | |

| 12,434,388 | | |

| 14,700,982 | | |

| 2,094,873 | |

| | |

| | | |

| | | |

| | |

| Shareholders' equity | |

| | | |

| | | |

| | |

| Ordinary shares | |

| 107 | | |

| 109 | | |

| 16 | |

| Additional paid-in capital | |

| 17,291,312 | | |

| 17,256,955 | | |

| 2,459,096 | |

| Accumulated other comprehensive loss | |

| (14,343 | ) | |

| (16,088 | ) | |

| (2,293 | ) |

| Statutory reserves | |

| 80,615 | | |

| 94,276 | | |

| 13,434 | |

| Accumulated deficit | |

| (11,016,323 | ) | |

| (10,835,688 | ) | |

| (1,544,073 | ) |

| Treasury stock | |

| (326,953 | ) | |

| (163,073 | ) | |

| (23,238 | ) |

| Total VNET Group, Inc. shareholders’ equity | |

| 6,014,415 | | |

| 6,336,491 | | |

| 902,942 | |

| Noncontrolling interest | |

| 499,968 | | |

| 524,373 | | |

| 74,723 | |

| Total shareholders' equity | |

| 6,514,383 | | |

| 6,860,864 | | |

| 977,665 | |

| Total liabilities and shareholders' equity | |

| 30,385,903 | | |

| 29,925,430 | | |

| 4,264,339 | |

VNET GROUP, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Amount in thousands of Renminbi (“RMB”) and

US dollars (“US$”) except for number of shares and per share data)

| | |

Three months

ended | | |

Nine months

ended | |

| | |

September

30, 2023 | | |

June 30, 2024 | | |

September

30, 2024 | | |

September

30, 2023 | | |

September

30, 2024 | |

| | |

RMB | | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Net revenues | |

| 1,886,924 | | |

| 1,993,760 | | |

| 2,120,794 | | |

| 302,211 | | |

| 5,514,450 | | |

| 6,012,680 | | |

| 856,800 | |

| Cost of revenues | |

| (1,580,446 | ) | |

| (1,568,865 | ) | |

| (1,629,111 | ) | |

| (232,146 | ) | |

| (4,512,843 | ) | |

| (4,685,381 | ) | |

| (667,661 | ) |

| Gross profit | |

| 306,478 | | |

| 424,895 | | |

| 491,683 | | |

| 70,065 | | |

| 1,001,607 | | |

| 1,327,299 | | |

| 189,139 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating income (expenses) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating income | |

| 26,706 | | |

| - | | |

| 11,767 | | |

| 1,677 | | |

| 73,980 | | |

| 15,716 | | |

| 2,240 | |

| Sales and marketing expenses | |

| (64,077 | ) | |

| (58,225 | ) | |

| (60,700 | ) | |

| (8,650 | ) | |

| (192,921 | ) | |

| (190,668 | ) | |

| (27,170 | ) |

| Research and development expenses | |

| (80,673 | ) | |

| (61,998 | ) | |

| (53,127 | ) | |

| (7,571 | ) | |

| (241,549 | ) | |

| (190,514 | ) | |

| (27,148 | ) |

| General and administrative expenses | |

| (137,931 | ) | |

| (107,297 | ) | |

| (132,482 | ) | |

| (18,879 | ) | |

| (393,395 | ) | |

| (466,076 | ) | |

| (66,415 | ) |

| Allowance for doubtful debt | |

| (18,316 | ) | |

| (2,753 | ) | |

| (65,731 | ) | |

| (9,367 | ) | |

| (7,034 | ) | |

| (63,309 | ) | |

| (9,021 | ) |

| Total operating expenses | |

| (274,291 | ) | |

| (230,273 | ) | |

| (300,273 | ) | |

| (42,790 | ) | |

| (760,919 | ) | |

| (894,851 | ) | |

| (127,514 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating profit | |

| 32,187 | | |

| 194,622 | | |

| 191,410 | | |

| 27,275 | | |

| 240,688 | | |

| 432,448 | | |

| 61,625 | |

| Interest income | |

| 12,887 | | |

| 5,449 | | |

| 4,218 | | |

| 601 | | |

| 28,606 | | |

| 21,796 | | |

| 3,106 | |

| Interest expense | |

| (91,800 | ) | |

| (92,172 | ) | |

| (93,996 | ) | |

| (13,394 | ) | |

| (233,295 | ) | |

| (323,850 | ) | |

| (46,148 | ) |

| Impairment of long-term investments | |

| (11,115 | ) | |

| - | | |

| - | | |

| - | | |

| (11,115 | ) | |

| - | | |

| - | |

| Other income | |

| 7,536 | | |

| 30,475 | | |

| 15,584 | | |

| 2,221 | | |

| 22,892 | | |

| 50,873 | | |

| 7,249 | |

| Other expenses | |

| (10,975 | ) | |

| (6,900 | ) | |

| (8,783 | ) | |

| (1,252 | ) | |

| (14,887 | ) | |

| (17,105 | ) | |

| (2,437 | ) |

| Changes in the fair value of

financial liabilities | |

| 266 | | |

| 712 | | |

| (7,107 | ) | |

| (1,013 | ) | |

| 21,718 | | |

| (2,537 | ) | |

| (362 | ) |

| Gain on debt extinguishment | |

| - | | |

| - | | |

| 246,175 | | |

| 35,080 | | |

| - | | |

| 246,175 | | |

| 35,080 | |

| Foreign exchange gain (loss) | |

| 24,606 | | |

| (4,387 | ) | |

| 14,833 | | |

| 2,114 | | |

| (168,391 | ) | |

| (17,915 | ) | |

| (2,553 | ) |

| (Loss) income before income

taxes and gain from equity method investments | |

| (36,408 | ) | |

| 127,799 | | |

| 362,334 | | |

| 51,632 | | |

| (113,784 | ) | |

| 389,885 | | |

| 55,560 | |

| Income tax expenses | |

| (6,317 | ) | |

| (59,149 | ) | |

| (31,149 | ) | |

| (4,439 | ) | |

| (63,748 | ) | |

| (151,682 | ) | |

| (21,615 | ) |

| Gain from equity method investments | |

| 2,842 | | |

| 3,199 | | |

| 965 | | |

| 138 | | |

| 3,651 | | |

| 6,770 | | |

| 965 | |

| Net (loss) income | |

| (39,883 | ) | |

| 71,849 | | |

| 332,150 | | |

| 47,331 | | |

| (173,881 | ) | |

| 244,973 | | |

| 34,910 | |

| Net income attributable to noncontrolling

interest | |

| (10,579 | ) | |

| (8,174 | ) | |

| (14,524 | ) | |

| (2,070 | ) | |

| (27,167 | ) | |

| (50,677 | ) | |

| (7,221 | ) |

| Net (loss) income attributable

to the VNET Group, Inc. | |

| (50,462 | ) | |

| 63,675 | | |

| 317,626 | | |

| 45,261 | | |

| (201,048 | ) | |

| 194,296 | | |

| 27,689 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| (Loss) earnings per share | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| (0.06 | ) | |

| 0.04 | | |

| 0.20 | | |

| 0.03 | | |

| (0.23 | ) | |

| 0.12 | | |

| 0.02 | |

| Diluted | |

| (0.06 | ) | |

| 0.04 | | |

| 0.05 | | |

| 0.01 | | |

| (0.24 | ) | |

| (0.02 | ) | |

| (0.00 | ) |

| Shares used in (loss) earnings

per share computation | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic* | |

| 889,058,872 | | |

| 1,594,662,099 | | |

| 1,602,860,426 | | |

| 1,602,860,426 | | |

| 888,724,901 | | |

| 1,588,659,647 | | |

| 1,588,659,647 | |

| Diluted* | |

| 889,058,872 | | |

| 1,595,517,338 | | |

| 1,740,565,086 | | |

| 1,740,565,086 | | |

| 899,884,241 | | |

| 1,725,023,283 | | |

| 1,725,023,283 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| (Loss) earnings per ADS (6 ordinary

shares equal to 1 ADS) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| (0.36 | ) | |

| 0.24 | | |

| 1.20 | | |

| 0.18 | | |

| (1.38 | ) | |

| 0.72 | | |

| 0.12 | |

| Diluted | |

| (0.36 | ) | |

| 0.24 | | |

| 0.30 | | |

| 0.06 | | |

| (1.44 | ) | |

| (0.12 | ) | |

| (0.02 | ) |

* Shares used in (loss) earnings per share/ADS computation were computed under weighted average method.

VNET GROUP, INC.

RECONCILIATIONS OF GAAP AND NON-GAAP RESULTS

(Amount in thousands of Renminbi (“RMB”) and US dollars

(“US$”))

| | |

Three months

ended | | |

Nine months

ended | |

| | |

September

30, 2023 | | |

June 30, 2024 | | |

September

30, 2024 | | |

September

30, 2023 | | |

September

30, 2024 | |

| | |

RMB | | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Gross profit | |

| 306,478 | | |

| 424,895 | | |

| 491,683 | | |

| 70,065 | | |

| 1,001,607 | | |

| 1,327,299 | | |

| 189,139 | |

| Plus: depreciation and amortization | |

| 431,933 | | |

| 364,616 | | |

| 368,764 | | |

| 52,548 | | |

| 1,233,983 | | |

| 1,085,984 | | |

| 154,751 | |

| Plus: share-based compensation

expenses | |

| - | | |

| (2,190 | ) | |

| 234 | | |

| 33 | | |

| - | | |

| 234 | | |

| 33 | |

| Adjusted cash gross profit | |

| 738,411 | | |

| 787,321 | | |

| 860,681 | | |

| 122,646 | | |

| 2,235,590 | | |

| 2,413,517 | | |

| 343,923 | |

| Adjusted cash gross

margin | |

| 39.1 | % | |

| 39.5 | % | |

| 40.6 | % | |

| 40.6 | % | |

| 40.5 | % | |

| 40.1 | % | |

| 40.1 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| (274,291 | ) | |

| (230,273 | ) | |

| (300,273 | ) | |

| (42,790 | ) | |

| (760,919 | ) | |

| (894,851 | ) | |

| (127,514 | ) |

| Plus: share-based compensation

expenses | |

| 9,475 | | |

| (12,962 | ) | |

| 6,709 | | |

| 956 | | |

| 25,817 | | |

| 105,428 | | |

| 15,023 | |

| Adjusted operating expenses | |

| (264,816 | )* | |

| (243,235 | ) | |

| (293,564 | ) | |

| (41,834 | ) | |

| (735,102 | ) | |

| (789,423 | ) | |

| (112,491 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating profit | |

| 32,187 | * | |

| 194,622 | | |

| 191,410 | | |

| 27,275 | | |

| 240,688 | | |

| 432,448 | | |

| 61,625 | |

| Plus: depreciation and amortization | |

| 466,285 | | |

| 394,334 | | |

| 396,428 | | |

| 56,491 | | |

| 1,332,649 | | |

| 1,170,313 | | |

| 166,768 | |

| Plus: share-based compensation

expenses | |

| 9,475 | | |

| (15,152 | ) | |

| 6,943 | | |

| 989 | | |

| 25,817 | | |

| 105,662 | | |

| 15,057 | |

| Adjusted EBITDA | |

| 507,947 | * | |

| 573,804 | | |

| 594,781 | | |

| 84,755 | | |

| 1,599,154 | | |

| 1,708,423 | | |

| 243,450 | |

| Adjusted EBITDA margin | |

| 26.9 | % | |

| 28.8 | % | |

| 28.0 | % | |

| 28.0 | % | |

| 29.0 | % | |

| 28.4 | % | |

| 28.4 | % |

* Included VAT surplus deduction benefit of RMB13.3 million, which is now considered non-continuable due to the termination of preferential tax policies since January 1, 2024.

VNET GROUP, INC.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(Amount in thousands of Renminbi (“RMB”) and

US dollars (“US$”))

| | |

Three months ended | |

| | |

September 30, 2023 | | |

June 30, 2024 | | |

September 30, 2024 | |

| | |

RMB | | |

RMB | | |

RMB | | |

US$ | |

| CASH FLOWS FROM OPERATING ACTIVITIES | |

| | | |

| | | |

| | | |

| | |

| Net (loss) income | |

| (39,883 | ) | |

| 71,849 | | |

| 332,150 | | |

| 47,331 | |

| Adjustments to reconcile net (loss) income to net cash generated from operating activities: | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization | |

| 461,603 | | |

| 388,711 | | |

| 393,719 | | |

| 56,105 | |

| Share-based compensation expenses | |

| 9,475 | | |

| (15,152 | ) | |

| 6,943 | | |

| 989 | |

| Others | |

| 130,633 | | |

| 101,890 | | |

| (107,550 | ) | |

| (15,326 | ) |

| Changes in operating assets and liabilities | |

| | | |

| | | |

| | | |

| | |

| Accounts and notes receivable | |

| (70,896 | ) | |

| 142,469 | | |

| (138,968 | ) | |

| (19,803 | ) |

| Prepaid expenses and other current assets | |

| (48,380 | ) | |

| (79,893 | ) | |

| 116,055 | | |

| 16,538 | |

| Accounts and notes payable | |

| 21,763 | | |

| (47,018 | ) | |

| 8,463 | | |

| 1,206 | |

| Accrued expenses and other payables | |

| (54,577 | ) | |

| (61,463 | ) | |

| 65,481 | | |

| 9,329 | |

| Deferred revenue | |

| 36,008 | | |

| (14,000 | ) | |

| 2,300 | | |

| 328 | |

| Advances from customers | |

| 124,816 | | |

| (63,305 | ) | |

| 222,083 | | |

| 31,647 | |

| Others | |

| (116,249 | ) | |

| (18,884 | ) | |

| (140,310 | ) | |

| (19,994 | ) |

| Net cash generated from operating activities | |

| 454,313 | | |

| 405,204 | | |

| 760,366 | | |

| 108,350 | |

| | |

| | | |

| | | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES | |

| | | |

| | | |

| | | |

| | |

| Purchases of property and equipment | |

| (946,444 | ) | |

| (998,489 | ) | |

| (1,426,892 | ) | |

| (203,330 | ) |

| Purchases of intangible assets | |

| (18,228 | ) | |

| (7,594 | ) | |

| (33,806 | ) | |

| (4,817 | ) |

| Proceeds from (payments for) investments | |

| 144,516 | | |

| (138,224 | ) | |

| 92,426 | | |

| 13,171 | |

| Proceeds from other investing activities | |

| 70,010 | | |

| 117,209 | | |

| 31,762 | | |

| 4,526 | |

| Net cash used in investing activities | |

| (750,146 | ) | |

| (1,027,098 | ) | |

| (1,336,510 | ) | |

| (190,450 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | |

| | | |

| | | |

| | | |

| | |

| Proceeds from bank borrowings | |

| 756,101 | | |

| 690,848 | | |

| 745,534 | | |

| 106,238 | |

| Repayments of bank borrowings | |

| (78,050 | ) | |

| (533,324 | ) | |

| (129,893 | ) | |

| (18,510 | ) |

| Repayments of 2025 Convertible Notes | |

| (148,842 | ) | |

| - | | |

| - | | |

| - | |

| Payments for finance leases | |

| (30,366 | ) | |

| (9,586 | ) | |

| (27,669 | ) | |

| (3,943 | ) |

| Proceeds from (payments for) other financing activities | |

| 216,711 | | |

| 516,493 | | |

| (59,645 | ) | |

| (8,499 | ) |

| Net cash generated from financing activities | |

| 715,554 | | |

| 664,431 | | |

| 528,327 | | |

| 75,286 | |

| | |

| | | |

| | | |

| | | |

| | |

| Effect of foreign exchange rate changes on cash, cash equivalents and restricted cash | |

| (12,476 | ) | |

| 3,370 | | |

| (6,049 | ) | |

| (862 | ) |

| Net increase (decrease) in cash, cash equivalents and restricted cash | |

| 407,245 | | |

| 45,907 | | |

| (53,866 | ) | |

| (7,676 | ) |

| Cash, cash equivalents and restricted cash at beginning of period | |

| 2,616,969 | | |

| 2,089,926 | | |

| 2,135,833 | | |

| 304,354 | |

| Cash, cash equivalents and restricted cash at end of period | |

| 3,024,214 | | |

| 2,135,833 | | |

| 2,081,967 | | |

| 296,678 | |

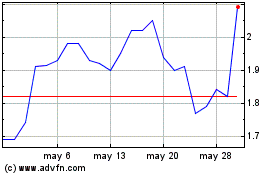

VNET (NASDAQ:VNET)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

VNET (NASDAQ:VNET)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024