Provides Preliminary Third Quarter 2024

Results

Kellstrom Aerospace

Expands VSE Aviation’s Presence in Growing Commercial Engine

Aftermarket

VSE Corporation (“VSE” or the “Company”) (NASDAQ: VSEC), a

leading provider of aftermarket distribution and repair services,

announced today that the Company has signed a definitive agreement

to acquire Kellstrom Aerospace Group, Inc. (“Kellstrom”), a

portfolio company of AE Industrial Partners, LP and a diversified

global distributor and service provider supporting the commercial

aerospace engine aftermarket. The transaction is subject to

customary closing conditions, including regulatory review, and is

expected to close in the fourth quarter of 2024.

MANAGEMENT COMMENTARY

"The agreement to acquire Kellstrom represents a significant

milestone for VSE Aviation,” stated John Cuomo, President and CEO

of VSE Corporation. “This acquisition improves our position in the

commercial aviation aftermarket, reinforces our OEM-focused

strategy, expands our aftermarket product and capability offerings,

and broadens our global footprint. The acquisition also

significantly increases our participation in aircraft engine

maintenance events, which represents the largest and

fastest-growing segment of the commercial aftermarket today. Like

VSE, Kellstrom’s core differentiator is its outstanding team

delivering the highest level of service and commercial value to

customers.”

“We are delighted to welcome the Kellstrom team to the VSE

Aviation family later this year,” said Ben Thomas, President of VSE

Aviation. “Kellstrom's portfolio of engine-focused products and MRO

services, coupled with its technical advisory capabilities and

OEM-centric approach, makes this acquisition highly complementary

to VSE Aviation’s business. This acquisition is expected to yield

significant sales and operating synergies, allowing us to leverage

combined strengths, optimize resources, and drive accelerated

growth in the aviation aftermarket.”

“Kellstrom is excited to be joining the VSE team,” said Oscar

Torres, President and CEO of Kellstrom Aerospace. “This combination

is expected to significantly expand the products and services we

offer our customers around the world. We are confident that by

joining forces with VSE Aviation, we will enhance the long-term

value we bring to our customers and supplier partners in the

commercial aerospace aftermarket.”

ACQUISITION OVERVIEW AND STRATEGIC

RATIONALE

Kellstrom is a leading full-service aftermarket solutions

provider of value-added distribution and technical services for the

commercial aerospace engine aftermarket. Differentiated by a highly

technical, high-touch global sales and product line management

organization, Kellstrom supports over 30 OEMs and approximately 800

customers, including airlines, air cargo operators, lessors, OEMs,

and MROs across 75 countries.

Kellstrom is directly aligned with VSE Aviation’s growth

strategy:

- Increases Exposure to Commercial Aerospace Engine

Aftermarket: Kellstrom’s business is focused on the commercial

aerospace engine aftermarket, providing a strong combination of new

customers, distribution products, MRO capabilities, and technical

services that drive growth in the largest and fastest-growing

sector of the aviation aftermarket.

- Aligns with VSE Aviation’s Core OEM-Centric Strategy:

Over 95% of Kellstrom’s distribution revenue is generated from

exclusive, long-standing relationships with world-leading

OEMs.

- Expands International Reach: Approximately 50% of

Kellstrom’s revenue is generated from outside of North America

including the high growth APAC region.

- Presents Significant Synergies with Full Integration

Planned: Kellstrom is strongly aligned with VSE Aviation’s

technical OEM-focused distribution business and provides

complementary product and repair capabilities to the recently

acquired Turbine Controls, Inc. business.

AGREEMENT TERMS AND TIMELINE

- Total consideration of approximately $200 million, comprised of

approximately $185 million in cash and approximately $15 million of

shares of common stock of the Company, subject to working capital

adjustments.

- The transaction is subject to customary closing conditions,

including regulatory review, and is expected to close in the fourth

quarter of 2024.

ACQUISITION FINANCIAL AND INTEGRATION SUMMARY

- Kellstrom generated approximately $175 million of revenue

during the trailing twelve months through August 2024.

- Synergy and Integration

- Expect to generate synergies of approximately $4 million.

- Near-term path to 15%+ Adjusted EBITDA margins(1) for Kellstrom

resulting from integration synergies and business

optimization.

ACQUISITION FINANCING SUMMARY

- The acquisition is expected to be funded by anticipated

proceeds from an equity financing and borrowings under the

Company’s existing credit facility.

- Upon closing of the acquisition and anticipated financings, Pro

Forma Net Leverage Ratio(1) as of 3Q 2024 is expected to be less

than 3.5x.

ADVISORS

Jones Day served as legal counsel and Jefferies, LLC acted as

exclusive financial advisor to VSE Corporation with respect to the

Kellstrom acquisition. Kirkland & Ellis LLP served as legal

counsel and Perella Weinberg Partners served as exclusive financial

advisor to Kellstrom.

PRELIMINARY THIRD QUARTER 2024 FINANCIAL RESULTS (1)

3Q'24 (Preliminary -

unaudited)

Revenue

~$268 to ~$275 million

Operating Income

~$22 to ~$24 million

Adjusted EBITDA(1)

~$31 to ~$34 million

(1) Non-GAAP measure, see additional

information at the end of this release regarding non-GAAP financial

measures

VSE’s 3Q 2024 performance and current aftermarket trends are

expected to support Aviation segment full-year revenue growth above

Company expectations and previously provided guidance, while

impacting the Fleet segment as full-year revenue is anticipated to

decline year-over-year. The Company continues to expect to report

positive free cash flow in the third quarter, followed by an

increase in free cash flow in the fourth quarter.

THIRD QUARTER 2024 EARNINGS CONFERENCE CALL

A conference call will be held Wednesday, November 6, 2024, at

8:30 A.M. ET to review the Company’s financial results, discuss

recent events and conduct a question-and-answer session.

A webcast of the conference call and accompanying presentation

materials will be available in the Investor Relations section of

VSE’s website at https://ir.vsecorp.com. To listen to the live

broadcast, go to the site at least 15 minutes prior to the

scheduled start time to register, download and install any

necessary audio software.

To participate in the live teleconference:

Domestic Live:

(844) 826-3035

International Live:

(412) 317-5195

Audio Webcast:

https://viavid.webcasts.com/starthere.jsp?ei=1690580&tp_key=8747ae1c41

ABOUT VSE CORPORATION

VSE is a leading provider of aftermarket distribution and repair

services. Operating through its two key segments, VSE significantly

enhances the productivity and longevity of its customers'

high-value, business-critical assets. The Aviation segment is a

leading provider of aftermarket parts distribution and maintenance,

repair, and overhaul (MRO) services for components and engine

accessories to commercial, business, and general aviation

operators. The Fleet segment specializes in part distribution,

engineering solutions, and supply chain management services catered

to the medium and heavy-duty fleet market. For more detailed

information, please visit VSE's website at www.vsecorp.com.

FORWARD-LOOKING STATEMENTS

This press release contains statements that, to the extent they

are not recitations of historical fact, constitute “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. All such statements are intended to be covered

by the safe harbor provisions for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995

and this statement is included for purposes of such safe harbor

provisions.

“Forward-looking” statements, as such term is defined by the

Securities and Exchange Commission (the “SEC”) in its rules,

regulations and releases, represent our expectations or beliefs,

including, but not limited to, statements concerning our

operations, economic performance, financial condition, growth and

acquisition strategies, investments and future operational plans.

Without limiting the generality of the foregoing, words such as

“may,” “will,” “expect,” “believe,” “anticipate,” “intend,”

“forecast,” “seek,” “plan,” “predict,” “project,” “could,”

“estimate,” “might,” “continue,” “seeking” or the negative or other

variations thereof or comparable terminology are intended to

identify forward-looking statements.

These statements speak only as of the date of this press release

and we undertake no ongoing obligation, other than that imposed by

law, to update these statements as a result of new information,

future events or otherwise. These statements relate to, among other

things, our intent, belief or current expectations with respect to

the acquisition of Kellstrom, including anticipated financing and

closing timeline related thereto: our future financial condition,

results of operations or prospects; our business and growth

strategies; and our financing plans and forecasts. You are

cautioned that any such forward-looking statements are not

guarantees of future performance and involve significant risks and

uncertainties, certain of which are beyond our control, and that

actual results may differ materially from those contained in or

implied by the forward-looking statements as a result of various

factors, some of which are unknown, including, without

limitation:

- supply chain delays and disruptions;

- risks related to our work on large government programs;

- our ability to consummate, successfully integrate, and achieve

the strategic and other objectives, including any expected

synergies, relating to pending acquisitions, including the

potential acquisition of Kellstrom Aerospace Group, Inc.

(“Kellstrom Aerospace” or “Kellstrom”);

- our ability to successfully integrate and realize the

anticipated benefits of recently acquired businesses, including the

acquisition of the Turbine Controls, LLC business;

- our ability to successfully divest businesses and to transition

facilities in connection therewith;

- risks related to future business conditions resulting in

impairments;

- risks related to the intense competition in our industry;

- risks related to the performance of the aviation

aftermarket;

- global economic and political conditions;

- prolonged periods of inflation and our ability to mitigate the

impact thereof;

- challenges related to workforce management or any failure to

attract or retain a skilled workforce;

- our dependence on third-party package delivery companies;

- compliance with government rules and regulations, including

environmental and pollution risk;

- risks related to technology security and cyber-attacks;

- risks related to our outstanding indebtedness;

- risks related to market volatility in the debt and equity

capital markets;

- risks related to our preliminary financial estimates, which

represent management’s current estimates and are subject to change;

and

- the other factors identified in our reports filed or expected

to be filed with the SEC, including our Annual Report on Form 10-K

for the year ended December 31, 2023 and our Quarterly Reports on

Form 10-Q for the quarterly periods ended March 31, 2024 and June

30, 2024.

You are advised, however, to consult any further disclosures we

make on related subjects in our periodic reports on Forms 10-K,

10-Q or 8-K filed with or furnished to the SEC.

PRELIMINARY RESULTS

Our actual operating results remain subject to the completion of

our quarter-end closing process, which includes review by

management and our audit committee. While carrying out such

procedures, we may identify items that would require us to make

adjustments to the preliminary estimates of our operating results

set forth herein. As a result, our actual operating results could

be outside of the ranges set forth herein and such differences

could be material. The preliminary estimates of our financial

results included herein have been prepared by, and are the

responsibility of, our management. Our independent registered

public accountants have not audited, reviewed or performed any

procedures with respect to such preliminary estimates of our

operating results. The information presented herein should not be

considered a substitute for the financial information we file with

the SEC in our Quarterly Report on Form 10-Q for the third quarter

of 2024. We have no intention or obligation to update the

preliminary estimates of our operating results set forth above

prior to the release of our consolidated financial statements as of

and for the three and nine months ended September 30, 2024.

NON-GAAP MEASURES

In addition to the financial measures prepared in accordance

with U.S. Generally Accepted Accounting Principles (GAAP), this

release also contains non-GAAP financial measures. These measures

provide useful information to investors.

The non-GAAP Financial Information set forth in this document is

not calculated in accordance with GAAP under SEC Regulation G. We

consider EBITDA and Adjusted EBITDA as non-GAAP financial measures

and important indicators of performance and useful metrics for

management and investors to evaluate our business' ongoing

operating performance on a consistent basis across reporting

periods. These non-GAAP financial measures, however, should not be

considered in isolation or as a substitute for performance measures

prepared in accordance with GAAP. Estimated Adjusted EBITDA for the

quarter ended September 30, 2024 represents estimated operating

income before depreciation and amortization expenses and excluding

other non-recurring adjustments.

Additionally, our estimates of Adjusted EBITDA Margin and Pro

Forma Net Leverage Ratio are forward-looking non-GAAP financial

measures based solely on information available to us as of the date

of this press release and may differ materially from our actual

operating results as a result of developments that occur after the

date of this press release. The determination of the amounts that

are excluded from these non-GAAP financial measures is a matter of

management judgment and depends upon, among other factors, the

nature of the underlying expense or income amounts recognized in a

given period. We are unable to present a quantitative

reconciliation of the aforementioned forward-looking non-GAAP

financial measures to their most directly comparable

forward-looking GAAP financial measures because such information is

not available, and management cannot reliably predict all of the

necessary components of such GAAP measures without unreasonable

effort or expense. For the same reasons, we are unable to address

the probable significance of the unavailable information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241015070328/en/

Michael Perlman Vice President of Investor Relations and

Treasury Phone: (954) 547-0480 Email: investors@vsecorp.com

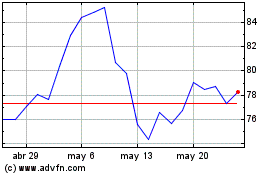

VSE (NASDAQ:VSEC)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

VSE (NASDAQ:VSEC)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025