AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE

SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS

SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT

FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF

AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL

BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. THE COMPANY MAY ELECT TO SATISFY ITS OBLIGATION TO DELIVER A FINAL

OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF THE COMPANY’S SALE TO YOU THAT CONTAINS

THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

PRELIMINARY OFFERING CIRCULAR

DATED OCTOBER 11, 2024

ENERGOUS CORPORATION

Energous Corporation

3590 North First Street, Suite 210

San Jose, CA 95134

408-963-0200

https://energous.com/

BEST EFFORTS OFFERING OF UP TO 5,000,000 UNITS,

EACH COMPRISING 1 SHARE OF SERIES A PREFERRED STOCK AND 3 WARRANTS, EACH TO PURCHASE 1 SHARE OF COMMON STOCK

UP TO 10,000,000 SHARES OF COMMON STOCK INTO

WHICH THE SERIES A PREFERRED STOCK MAY CONVERT AND UP TO 15,000,000 SHARES OF COMMON STOCK, ISSUABLE UPON EXERCISE OF THE INVESTOR

WARRANTS

AGENT WARRANTS FOR THE PURCHASE OF UP TO 150,000

AGENT UNITS

UP TO 150,000 SHARES OF SERIES A PREFERRED STOCK

UNDERLYING AGENT UNITS AND UP TO 300,000 SHARES OF COMMON STOCK INTO WHICH SUCH SERIES A PREFERRED STOCK MAY CONVERT

UP TO 450,000 SHARES OF COMMON STOCK, ISSUABLE

UPON EXERCISE OF THE AGENT UNIT WARRANTS

SEE “SECURITIES BEING OFFERED” AT

PAGE 71

Energous Corporation d/b/a Energous Wireless Power Solutions, which we refer to as “our Company,” “we,” “our”

and “us,” is offering up to 5,000,000 Units. Each Unit consists of one (1) share of Series A Convertible Preferred Stock,

par value $0.00001 per share, which we refer to as the Series A Preferred Stock, and 3 warrants (each a “Warrant”, and collectively

the “Warrants”), each to purchase one (1) share of common stock, $0.00001 par value per share (the “Common Stock”)

of the Company. We will not issue fractional shares. The Units will be sold at an offering price of $1.50 per Unit, for a maximum offering

amount of $7,500,000. This offering circular also relates to the 25,000,000 shares of Common Stock issuable upon conversion of the Series

A Preferred Stock and exercise of the Warrants. The Warrants are exercisable within 36 months from the date of issuance. Two (2) Warrants

will each be exercisable at a price of $1.50 for one (1) share of our Common Stock, subject to adjustment and one (1) Warrant will be

exercisable at a price of $2.00 for one (1) share of our Common Stock, subject to adjustment.

There is a minimum initial investment amount per investor of $750.00

for the Units and any additional purchases must be made in increments of at least $___.

At any time after issuance, each share of our Series A Preferred Stock is convertible into two (2) shares of our Common Stock at the option

of the holder of such Series A Preferred Stock. At any time after issuance upon the occurrence of any of the following events, the Company

shall have a right to direct the mandatory conversion of the Series A Preferred Stock: (a) a change in control, (b) if the price of the

Common Stock closes at or above $1.50 per share for 10 consecutive trading days, or (c) if the Company consummates a firm commitment public

offering of Common Stock for gross proceeds of at least $15 million at an offering price per share equal to or greater than $1.50. The

shares underlying the Series A Preferred Stock will be qualified in this offering (the “Offering”). The Series A Preferred

Stock and the Common Stock differ in other characteristics including voting rights. Up to 10,000,000 shares of Common Stock underlying

the Series A Preferred Stock are being qualified in this Offering. See “Securities Being Offered” beginning on page 71 for

additional details.

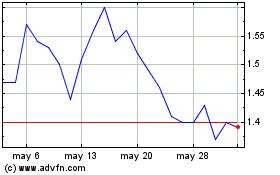

There is no existing public trading market for the Series A Preferred

Stock. Our Common Stock is traded on the Nasdaq Capital Market (which we sometimes refer to as “Nasdaq”) under the symbol

“WATT.” On October 10, 2024, the closing price of our Common Stock as reported on Nasdaq was $0.56 per share.

The offering price of the Units is not related to, nor may it reflect

the market price of the shares of our Common Stock underlying the Warrants after this Offering. Our Series A Preferred Stock and

the Warrants are not currently listed or quoted on any exchange and we do not intend to seek a listing for them. The Units have no stand-alone

rights and will not be certificated or issued as stand-alone securities. The shares of our Series A Preferred Stock and the Warrants

are immediately separable and will be issued separately, but will be purchased together as a Unit in this Offering.

This Offering is being conducted on a “best efforts” basis.

This Offering will terminate at the earlier of the date at which the maximum offering amount has been sold or the date at which the Offering

is earlier terminated by the Company at its sole discretion, and the offering statement on Form 1-A of which this offering circular

forms a part will remain qualified in accordance with Rule 251(d)(3)(i)(F) of Regulation A until the date at which all of the

outstanding Warrants of the Company issued pursuant to this Offering have been exercised for shares of common stock of the Company, which

shares of common stock are qualified under the Form 1-A. At least every 12 months after this Offering has been qualified by the United

States Securities and Exchange Commission (the “Commission”), the Company will file a post-qualification amendment to include

the Company’s then recent financial statements.

Digital Offering, LLC is a broker-dealer registered with the Commission

and a member of the Financial Industry Regulatory Authority, or FINRA, and the Securities Investor Protection Corporation, or SIPC, which

we refer to as the lead selling agent or managing broker-dealer, and is the lead selling agent for this Offering. The lead selling agent

is selling our Units in this Offering on a best-efforts basis and is not required to sell any specific number or dollar amount of Units

offered by this Offering circular, but will use their best efforts to sell such Units.

We may undertake one or more closings on a rolling basis. Until we

complete a closing, the proceeds for this Offering will be kept in an escrow account maintained at Enterprise Bank & Trust (“Escrow

Agent”). At each closing, the proceeds will be distributed to us and the associated Series A Preferred Stock and Warrants will

be issued to the investors. If there are no closings or if funds remain in the escrow account upon termination of this Offering without

any corresponding closing, the funds so deposited for this Offering will be promptly returned to the applicable investors, without deduction

and without interest. See “Plan of Distribution.”

| |

|

Price to

Public(1) |

|

|

Selling Agent

Commissions(2) |

|

|

Proceeds to

issuer(3) |

|

| Per Unit |

|

$ |

1.50 |

|

|

$ |

0.105 |

|

|

$ |

1.395 |

|

| Total Maximum of Units Offering |

|

$ |

7,500,000.00 |

|

|

$ |

525,000.00 |

|

|

$ |

6,975,000.00 |

|

| Preferred Stock Contained in the Units (5,000,000 shares) |

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

| Common Stock Issuable upon Conversion of Series A Preferred Stock (10,000,000 shares) (4) |

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

| Agent Warrants (150,000 Units) (5) |

|

$ |

281,250.00 |

|

|

|

-- |

|

|

$ |

281,250.00 |

|

| Preferred Stock Contained in the Agent Warrants (150,000 shares) |

|

|

-- |

|

|

|

-- |

|

|

|

-- |

|

| Common Stock Issuable upon Exercise of investor Warrants (15,000,000 shares) (6) |

|

$ |

25,000,000.00 |

|

|

|

-- |

|

|

$ |

25,000,000.00 |

|

| Common Stock Issuable upon Exercise of Agent Unit Warrants (450,000 shares) (7) |

|

$ |

750,000.00 |

|

|

|

-- |

|

|

$ |

750,000.00 |

|

| Total Maximum |

|

$ |

33,531,250.00 |

|

|

$ |

525,000.00 |

|

|

$ |

33,006,250.00 |

|

| 1. | Per Unit price represents the offering price for one Unit. |

| |

2. |

The Company has engaged Digital Offering, LLC (“Digital Offering”) to act as lead selling agent to offer the Units to prospective investors in this Offering on a “best efforts” basis, which means that there is no guarantee that any minimum amount will be received by the Company in this Offering. In addition, the lead selling agent may engage one or more sub-agents or selected dealers to assist in its marketing efforts. Digital Offering is not purchasing the Units offered by us and is not required to sell any specific number or dollar amount of Units in this Offering before a closing occurs. The Company will pay a cash commission of 7.00% to Digital Offering on sales of the Units and issue warrants (the “Agent Warrants”) to Digital Offering to purchase that number of Units equal to 3% of the total number of Units sold in this Offering. The Agent Warrants and the securities comprising and underlying the Agent Warrants will not be transferable for a period of six months after the date of Closing of the Offering (in compliance with FINRA Rule 5110(e)(1)) and the Agent Warrants will expire five years after commencement of sales in the Offering. The exercise price for the Agent Warrants will be the amount that is 125% of the offering price, or $1.875 per Unit. The Units issuable upon exercise of the Agent Warrants will include 1 share of Series A Preferred Stock, 2 warrants exercisable at $1.50 per share and 1 warrant exercisable at $2.00 per share (the “Agent Unit Warrants”). Additionally, the Company paid Digital Offering an accountable due diligence fee of $25,000. Finally, the Company shall be responsible for Digital Offering’s reasonable legal costs up to an amount of $85,000. See “Plan of Distribution” on page 36 for details of compensation payable to the lead selling agent in connection with the Offering. |

| 3. | Before deducting expenses of the Offering, which are estimated to be approximately $1,115,000. See the section captioned “Plan of

Distribution” for details regarding the compensation payable in connection with this Offering. This amount represents the gross

proceeds of the Offering to us, before expenses, which will be used as set out in the section captioned “Use of Proceeds to Issuer.” |

| 4. | No additional consideration or placement agent compensation will be paid in connection with the issuance of shares of Common Stock upon

conversion of the Series A Preferred Stock. |

| 5. | The value of the Agent Warrants set forth in the table above is based on the number of shares of Series A Preferred Stock contained in

the Units (150,000 shares) multiplied by the exercise price of $1.875 per warrant. The actual value of the Agent Warrants utilizing an

options pricing model would be different from the amount indicated in the table. |

| |

6. |

No additional compensation will be paid in connection with the issuance of Common Stock upon exercise of the investor Warrants included in the Units offered hereby, nor will any additional commissions be paid on such shares or Warrants. No additional commissions will be paid upon exercise of any Warrants unless the Company determines to engage a placement agent for a separate warrant exercise solicitation offering. |

| 7. | Up to 300,000 of the Agent Unit Warrants will have an exercise price of $1.50 per share and up to 150,000 of the Agent Unit Warrants will

have an exercise price of $2.00 per share. |

Sales of these securities will commence on approximately

[date].

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS

UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS

OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH

THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF

THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED

INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE

YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO www.investor.gov.

This Offering is inherently risky. See “Risk Factors”

on page 36.

The Company is following the format of Part I of Form S-1

pursuant to the general instructions of Part II(a)(1)(ii) of Form 1-A.

TABLE OF CONTENTS

In this offering circular, the term “Energous” or “the

Company” refers to Energous Corporation d/b/a Energous Wireless Power Solutions.

Other than in the table on the cover page, dollar amounts have been

rounded to the closest whole dollar.

This offering circular contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, that are intended to be covered by the “safe harbor” created by those sections. Forward-looking statements, which

are based on certain assumptions and describe our future plans, strategies and expectations, can generally be identified by the use of

forward-looking terms such as “believe,” “expect,” “may,” “will,” “should,”

“could,” “seek,” “intend,” “plan,” “estimate,” “anticipate” or

other comparable terms. All statements other than statements of historical facts included in this offering circular regarding our strategies,

prospects, financial condition, operations, costs, plans and objectives are forward-looking statements. Examples of forward-looking statements

include, among others, statements we make regarding proposed business strategy; market opportunities; regulatory approval; expectations

for current and potential business relationships; expectations for revenues, cash flows and financial performance; payment of future dividends;

use of our at-the-market (“ATM”) offering program; our liquidity position and capital resources; the impact of certain market

risk exposures on our financial condition, results of operations or cash flows; and anticipated results of research and development efforts.

These forward-looking statements are based on our current information and beliefs. Because forward-looking statements relate to the future,

they are subject to inherent uncertainties, risks and changes in circumstances that are unpredictable and many of which are outside of

our control. Actual results may differ materially from what is anticipated, so you should not rely on these forward-looking statements.

Important factors that could cause actual outcomes to differ materially from those indicated in the forward-looking statements include,

among others, the following: our ability to successfully execute our commercialization strategy for our products that have received regulatory

certification; receipt of necessary regulatory approval; our ability to find and maintain development partners; market acceptance of our

technology; competition in our industry; protection of our intellectual property; and other risks and uncertainties described in the Risk

Factors and Management’s Discussion and Analysis of Financial Condition and Results of Operations sections of this offering circular

and our subsequently filed Annual Reports on Form 10-K and our Quarterly Reports on Form 10-Q. We undertake no obligation to

update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information,

future developments or otherwise.

SUMMARY

The Offering

Securities being

offered: |

We are offering on a “best efforts” basis a maximum

of 5,000,000 Units, with each Unit consisting of one share of our Series A Convertible Preferred Stock, $0.00001 par value per share

(the “Series A Preferred Stock”) and three common stock purchase warrants, two to each purchase one share of our common

stock, $0.00001 par value per share (the “Common Stock”) at an exercise price of $1.50 per share and one to purchase one

share of our Common Stock at an exercise price of $2.00 per share, for a total of 5,000,000 shares of our Series A Preferred Stock

(and 10,000,000 shares of Common Stock underlying the shares of Series A Preferred Stock) and warrants to purchase up to an

aggregate of 10,000,000 shares of our Common Stock at an exercise price of $1.50 per share and 5,000,000 shares of our Common Stock

at an exercise price of $2.00 per share, at an offering price of $1.50 per Unit, for a maximum offering amount of $7,500,000.

The 10,000,000 shares of Common Stock underlying the Series A

Preferred Stock and the 15,000,000 shares of Common Stock issuable upon exercise of the Warrants are being qualified in this Offering.

The Units have no stand-alone rights and will not be certificated or

issued as stand-alone securities. The shares of our Series A Preferred Stock and the Warrants are immediately separable and will

be issued separately, but will be purchased together as a unit in this Offering. |

| |

|

| Minimum Initial Investment Amount Per Investor: |

$750, or 500 Units |

|

Terms of Series A Preferred Stock:

|

● |

Ranking - The Series A Preferred Stock ranks, as to dividend rights and rights upon our liquidation, dissolution, or winding up, senior to our Common Stock. The terms of the Series A Preferred Stock will not limit our ability to (i) incur indebtedness or (ii) issue additional equity securities that are equal or junior in rank to the shares of our Series A Preferred Stock as to distribution rights and rights upon our liquidation, dissolution or winding up. |

| |

|

|

| |

● |

Liquidation Preference - The liquidation preference for each share of our Series A Preferred Stock is $1.50. Upon a liquidation, dissolution or winding up of our company, holders of shares of our Series A Preferred Stock will be entitled to receive the liquidation preference with respect to their shares. |

| |

● |

Optional Conversion – At any time each share of our Series A Preferred Stock is convertible into 2 (two) shares of our Common Stock at the option of the holder. |

| |

|

|

| |

● |

Mandatory Conversion -- At any time after issuance upon the occurrence of any of the following events, the Company shall have a right to direct the mandatory conversion of the Series A Preferred Stock: (a) a change in control, (b) if the price of the Common Stock closes at or above $1.50 per share for 10 consecutive trading days, or (c) if the Company consummates a firm commitment public offering of Common Stock for gross proceeds of at least $15 million at an offering price per share equal to or greater than $1.50. |

| |

|

|

| |

● |

Company Call and Stockholder Put Options - Commencing on the fifth anniversary of the initial closing of this

Offering and continuing indefinitely thereafter, we shall have a right to call for redemption the outstanding shares of our Series A

Preferred Stock at a call price equal to the lesser of (i) the original issue price of our Series A Preferred Stock plus a non-compounded

rate of return calculated at 8% per annum, and (ii) 200% of the original issue price of our Series A Preferred Stock, and correspondingly,

each holder of shares of our Series A Preferred Stock shall have a right to put the shares of Series A Preferred Stock held

by such holder back to us at a put price equal to the lesser of (i) the original issue price of our Series A Preferred Stock

plus a non-compounded rate of return calculated at 8% per annum, and (ii) 200% of the original issue purchase price of such shares.

Any redemption of our Series A Preferred Stock shall be subject to any applicable legal and contractual restrictions. |

| |

|

|

| |

● |

Further Issuances - The shares of our Series A Preferred Stock have no maturity date, and we will not be required to redeem shares of our Series A Preferred Stock at any time except as otherwise described above under the caption “Company Call and Stockholder Put Options.” Accordingly, the shares of our Series A Preferred Stock will remain outstanding indefinitely, unless we decide, at our option, to exercise our call right, the holder of the Series A Preferred Stock exercises their put right, or the Series A Preferred Stock is converted into Common Stock. |

| |

● |

Voting Rights - We may not authorize or issue any class or series of equity securities ranking senior to the Series A Preferred Stock as to dividends or distributions upon liquidation (including securities convertible into or exchangeable for any such senior equity securities) or amend our certificate of incorporation (whether by merger, consolidation, or otherwise) to materially and adversely change the terms of the Series A Preferred Stock without the affirmative vote of at least a majority of the votes entitled to be cast on such matter by holders of our outstanding shares of Series A Preferred Stock, voting together as a class. Otherwise, holders of the shares of our Series A Preferred Stock will not have any voting rights. |

| Terms of Warrants: |

|

The Warrants will be exercisable at any time from the date of issuance through the third anniversary of issuance, unless earlier redeemed. Warrants will be exercisable to purchase one share of our Common Stock at an exercise price of $1.50 per share or $2.00 per share, as applicable. |

Summary of Risk Factors

Risks Related to Our Financial Condition

| · | We have no history of generating meaningful product revenue, and we may never achieve or maintain profitability. |

| · | We will need additional financings to achieve our long-term business plans, and there is no guarantee that it will be available on

acceptable terms, or at all. |

| · | We may be adversely affected by the effects of inflation. |

Risks Related to Our Technology and Products

| · | We may not be able to develop all the features we seek to include in our technology. |

| · | We make significant investments in our products and may be unable to demonstrate the commercial feasibility of the full capability

of our technology or achieve profitability. |

| · | Expanding our business operations as we intend will impose new demands on our financial, technical, operational and management resources. |

| · | If products incorporating our technology are launched commercially but do not achieve widespread market acceptance, we will not be

able to generate the revenue necessary to support our business. |

| · | Our products, or the products of our licensing partners, could be susceptible to errors, defects, or unintended performance problems

that could result in lost revenue, liability or delayed or limited market acceptance. |

| · | As products incorporating our technology are launched commercially, we may experience seasonality or other unevenness in our financial

results in consumer markets or a long and variable sales cycle in enterprise markets. |

| · | Future products based on our technology may require the user to purchase additional products to use with existing devices. To the

extent these additional purchases are inconvenient or costly, the adoption of our technology under development or other future products

could be slowed, which would harm our business. |

| · | Laboratory conditions differ from field conditions, which could reduce the effectiveness of our technology under development or other

future products. Failures to move from laboratory to the field effectively would harm our business. |

| · | Safety concerns and legal action by private parties may affect our business. |

| · | Our industry is subject to intense competition and rapid technological change, which may result in technology that is more advanced

or superior to ours. If we do not keep pace with changes in the marketplace and the direction of technological innovation and customer

demands, our technology and products may become less useful or obsolete and our operating results will suffer. |

| · | If the quality of our products does not meet the expectations of our licensing partners or the end users of our licensing partners’

products or regulatory or industry standards, then our sales and operating earnings, and ultimately our reputation, could be negatively

impacted. |

| · | If our products do not effectively interoperate with wireless networks and the wireless devices that integrate them, future sales

of our products could be negatively affected. |

| · | We require third-party components, including components from limited or sole source suppliers, to build our products. The unavailability

of these components could substantially disrupt our ability to manufacture our products and fulfill sales orders. |

| · | Our dependence on commodities and certain components subjects us to cost volatility and potential availability constraints. Our products

rely on the availability of unlicensed RF spectrum and if such spectrum were to become unavailable through overuse or licensing, the performance

of our products could suffer and our revenues from their sales could decrease. Reliance upon a few major customers may adversely affect

our revenue and operating results. If our licensing partners do not effectively manage inventory of their products which integrate our

technology, fail to timely resell such products or overestimate expected future demand, they may reduce purchases in future periods, causing

our revenues and operating results to fluctuate or decline. |

| · | If we are not able to effectively forecast demand or manage our inventory, we may be required to record write-downs for excess or

obsolete inventory. |

Risks Related to Our Intellectual Property and Other Legal Risks

| · | It is difficult and costly to protect our intellectual property and our proprietary technologies, and we may not be able to ensure

their protection. |

| · | We depend upon a combination of patents, trade secrets, copyright and trademark laws to protect our intellectual property and technology. |

| · | We may be subject to patent infringement or other intellectual property lawsuits that could be costly to defend. |

| · | We could become subject to product liability claims, product recalls, and warranty claims that could be expensive, divert management’s

attention and harm our business. |

| · | Our business is subject to data security risks, including security breaches. |

| · | If we are not able to satisfy data protection, security, privacy and other government- and industry-specific requirements or regulations,

our business, results of operations and financial condition could be harmed. |

| · | If we are not able to secure advantageous license agreements for our technology, our business and results of operations will be adversely

affected. |

Risks Related to Regulation of Our Business

| · | Domestic and international regulators may deny approval for our technology, and future legislative or regulatory changes may impair

our business. |

Risks Related to Personnel

| · | We are highly dependent on key members of our executive management team. Our inability to retain these individuals could impede our

business plan and growth strategies, which could have a negative impact on our business and the value of your investment. |

| · | Our success and growth depend on our ability to attract, integrate and retain high-level engineering talent. |

| · | We are subject to risks associated with our utilization of engineering consultants. |

Risks Related to Ownership of Our Common Stock

| · | We are a “smaller reporting company,” and the reduced disclosure requirements applicable to smaller reporting companies

could make our common stock less attractive to investors. |

| · | If we are unable to maintain effective internal control over financial reporting, investors may lose confidence in the accuracy of

our financial reports. |

| · | You might lose all or part of your investment. |

| · | Our stock price is likely to continue to be volatile. |

| · | We have not paid dividends in the past and have no immediate plans to pay dividends. |

| · | We expect to continue to incur significant costs as a result of being a public reporting company and our management will be required

to devote substantial time to meet our compliance obligations. |

| · | We may be subject to securities litigation, which is expensive and could divert management attention. |

| · | Our ability to use Federal net operating loss carry forwards to reduce future tax payments may be limited if our taxable income does

not reach sufficient levels. |

| · | Our charter documents and Delaware law may inhibit a takeover that stockholders consider favorable. |

| · | Our Warrants that are accounted for as liabilities and the changes in value of our Warrants could have a material effect on the market

price of our common stock or our financial results. |

Risks Related to this Offering

| · | This is a fixed price offering and the fixed offering price may not accurately represent the current value of us or our assets at

any particular time. Therefore, the purchase price you pay for our Units may not be supported by the value of our assets at the time of

your purchase. |

| · | We may amend our business policies without stockholder approval. |

| · | Investors in this Offering will suffer immediate and substantial dilution of their investment. |

| · | Our management team will have broad discretion over the use of the net proceeds from our sale of the Units, if any, and you may not

agree with how we use the proceeds and the proceeds may not be invested successfully. |

| · | We may issue additional debt and equity securities, which are senior to our Series A Preferred Stock as to distributions and

in liquidation, which could materially adversely affect the value of the Series A Preferred Stock. |

| · | This Offering is being conducted on a “best efforts” basis without a minimum and we may not be able to execute our growth

strategy if the $7,500,000 maximum is not sold. |

| · | You will not have a vote or influence on the management of our company. |

| · | We may terminate this Offering at any time during the Offering period. |

| |

· |

Investors in this Offering may not be entitled to a jury trial with respect to

claims arising under the subscription agreement, which could result in less favorable outcomes to the plaintiff(s) in any action

under the agreement. |

| |

|

|

| |

· |

Our Amended and Restated Bylaws provide that the Court of Chancery of the State

of Delaware will be the exclusive forum for substantially all disputes between us and our stockholders, which could limit our stockholders’

ability to obtain a favorable judicial forum for disputes with us or our directors, officers or employees. |

| |

|

|

| |

· |

The subscription agreement has a forum selection provision that requires disputes

be resolved in state or federal courts in the State of Delaware, regardless of convenience or cost to you, the investor. |

| |

|

|

| |

· |

Using a credit card to purchase shares may impact the return on your investment

as well as subject you to other risks inherent in this form of payment. |

General Risk Factors

| · | If we fail to comply with the requirements for continued listing on Nasdaq, our common stock will be

subject to delisting. Our ability to publicly or privately sell equity securities and the liquidity

of our common stock could be adversely affected if our common stock is delisted. |

| · | Adverse macroeconomic conditions, natural disasters or reduced technology spending could adversely affect our business, operating

results, and financial condition. |

| · | If securities or industry analysts do not publish research or reports about our business, or publish negative reports about our business,

our stock price and trading volume could decline. |

RISK FACTORS

The Commission requires the Company to identify risks that are specific

to its business and its financial condition. The Company is still subject to all the same risks that all companies in its business, and

all companies in the economy, are exposed to. These include risks relating to economic downturns, political and economic events and technological

developments (such as cyber-attacks and the ability to prevent those attacks). Additionally, earlier-stage companies are inherently more

risky than more developed companies. You should consider general risks as well as specific risks when deciding whether to invest.

Risks Related

to Our Financial Condition

We have

no history of generating meaningful product revenue, and we may never achieve or maintain profitability.

We have a limited

operating history upon which investors may rely in evaluating our business and prospects. We have generated limited revenues to date,

and as of June 30, 2024, we had an accumulated deficit of approximately $393 million. Our ability to generate revenues and achieve

profitability will depend on our ability to execute our business plan, complete the development and approval of our technology, incorporate

the technology into products that customers wish to buy, and, if necessary, secure additional financing. There can be no assurance that

our technology will be adopted widely, that we will ever earn revenues sufficient to support our operations, or that we will ever be profitable.

Furthermore, there can be no assurance that we will be able to raise capital as and when we need it to continue our operations. If we

are unable to raise sufficient additional capital, we may be required to delay, reduce or severely curtail our research and development

or other operations, which could have a material adverse effect on our business, operating results, financial condition, long-term prospects

and ability to continue as a viable business. If we are unable to generate revenues of sufficient scale to cover our costs of doing business,

our losses will continue and we may not achieve profitability, which could negatively impact the value of your investment in our securities.

We will

need additional financings to achieve our long-term business plans, and there is no guarantee that it will be available on acceptable

terms, or at all.

We may not have

sufficient funds to fully implement our long-term business plans. We will need to raise additional capital through new financings, even

if we begin to generate meaningful commercial revenue. For example, new product development for business partners may require considerable

expense in advance of any substantial revenue being earned for such products. Such financings could include equity financing, which may

be dilutive to our current stockholders, and debt financing, which could restrict our operations and ability to borrow from other sources.

In addition, such securities may contain rights, preferences or privileges senior to those of current stockholders. As a result of current

macroeconomic conditions and general global economic uncertainty (including as a result of the remaining effects of the global health

pandemic, regional conflicts around the world, increases in inflation, fluctuating interest rates, disruptions to global supply chains,

recent turmoil in the global banking sector, volatile global financial markets, the potential for government shutdowns and uncertainty

regarding the federal budget and debt ceiling), political change, labor market shortages and other factors, we do not know whether additional

capital will be available when needed, or that, if available, we will be able to obtain additional capital on reasonable terms. If we

are unable to raise additional capital due to the volatile global financial markets, recent turmoil in the global banking sector, general

economic uncertainty or any other factor, we may be required to curtail development of our technology or reduce operations as a result,

or to sell or dispose of assets. Any inability to raise adequate funds on commercially reasonable terms or at all could have a material

adverse effect on our business, results of operations and financial condition, including the possibility that a lack of funds could cause

our business to fail and liquidate with little or no return to investors.

We may

be adversely affected by the effects of inflation.

Inflation has

the potential to adversely affect our liquidity, business, financial condition and results of operations by increasing our overall cost

structure. The U.S. capital markets have experienced and continue to experience extreme volatility and disruption. Inflation rates in

the U.S. have increased significantly since 2022 resulting in federal action to increase interest rates, adversely affecting capital markets

activity. We expect certain inflationary elements to ease, with a moderate increase in 2024. However, the existence of inflation in the

economy has resulted in, and may continue to result in, higher interest rates and capital costs, shipping costs, supply shortages, increased

costs of labor, labor shortages, weakening exchange rates and other similar effects. As a result of inflation, we have and may continue

to experience cost increases, including increases in our supply chain costs. Although we may take measures to mitigate the impact of this

inflation, if these measures are not effective, our business, financial condition, results of operations and liquidity could be materially

adversely affected. Even if such measures are effective, any positive impact on our results of operations could be delayed and not immediately

apparent. Additionally, because we purchase component parts from our suppliers, we may be adversely impacted by their inability to adequately

mitigate inflationary, industry, or economic pressures. Similarly, inflationary pressures may also negatively impact consumer purchasing

power, which could result in reduced demand for our products.

Risks Related

to Our Technology and Products

We may

not be able to develop all the features we seek to include in our technology.

We have developed

commercial products, as well as working prototypes, that utilize our technology. Additional features and performance specifications we

seek to include in our technology have not yet been developed. For example, some customer applications may require specific combinations

of cost, footprint, efficiencies and capabilities at various frequencies, charging power levels and distances. We believe our research

and development efforts will yield additional functionality and capabilities for our products over time. However, there can be no assurance

that we will be successful in achieving all the features we are targeting, and our inability to do so may limit the appeal of our technology

to consumers.

We make

significant investments in our products and may be unable to demonstrate the commercial feasibility of the full capability of our technology

or achieve profitability.

We have developed

both commercial products and working prototypes that use our technology at differing power levels and charging distances, but additional

research and development is required to realize the potential of our technology for applications at increasing power levels and distances

that can be successfully integrated into commercial products. Research and development of new technologies is, by its nature, unpredictable.

We could encounter unanticipated technical problems, the inability to identify products utilizing our technology that will be in demand

with customers, getting our technology designed into those products, designing new products for manufacturability, regulatory hurdles

and achieving acceptable price points for final products. Although we intend to undertake development efforts with commercially reasonable

diligence, there can be no assurance that our available resources will be sufficient to enable us to develop our technology to the extent

needed to create future revenues to sustain our operations.

Our technology

must satisfy customer expectations and be suitable for use in consumer applications. Any delays in developing our technology that arise

from factors of this sort would aggravate our exposure to the risk of having inadequate capital to fund the research and development needed

to complete development of these products. Technical problems leading to delays would cause us to incur additional expenses that would

increase our operating losses. If we experience significant delays in developing our technology and products based on it for use in potential

commercial applications, particularly after incurring significant expenditures, our business may fail, and you could lose all or part

of the value of your investment in the Company.

In addition,

we have made and will continue to make significant investments in the research and development of new and existing technologies and products.

Investments in new technologies and enhancements to our existing technologies are speculative and technological feasibility may not be

achieved. Commercial success depends on many factors including demand for innovative technology, availability of materials and equipment,

selling price the market is willing to bear, competition and effective licensing or product sales. We may not achieve significant revenue

from our product investments for a number of years, if at all. Moreover, new technologies and products may not be profitable, and even

if they are profitable, operating margins for new products may not be as high as the margins we originally anticipated. If we fail to

develop practical and economical commercial products based on our technology, or are unable to achieve profitability in commercializing

those products, our business may fail and you could lose all or part of the value of your investment in our stock.

Expanding

our business operations as we intend will impose new demands on our financial, technical, operational and management resources.

Our ability to

grow our business involves various risks, including the need to invest significant resources in unfamiliar and new markets and the possibility

that we may not realize a return on our investments in the near future or at all. To date we have operated primarily in the research and

development phase of our business. To be successful in commercializing our product offerings, we will need to expand our business operations,

which will require us to incur significant expenses before we generate any material revenue and will impose new demands on our financial,

technical, operational and management resources. For example, if we do not invest in developing and upgrading our technical, administrative,

operating and financial control systems, or if unexpected expansion difficulties arise, including issues relating to our research and

development activities, then retention of experienced scientists, managers and engineers could become more challenging and have a material

adverse effect on our business, results of operations and financial condition.

If products

incorporating our technology are launched commercially but do not achieve widespread market acceptance, we will not be able to generate

the revenue necessary to support our business.

We may successfully

complete the technical development of our products, but still fail to develop a commercially successful product. Market acceptance of

an RF-based charging system as a preferred method for charging electronic devices will be crucial to our success. The following factors,

among others, may affect the level of market acceptance of our products:

| · | the price of products incorporating our technology relative to other products or competing technologies; |

| · | the rate of innovation of competing technologies; |

| · | user perceptions of the convenience, safety, efficiency and benefits of our technology; |

| · | the effectiveness of sales and marketing efforts of our commercialization partners and of our

competitors; |

| · | the support and rate of acceptance of our technology and solutions with our development partners; |

| · | press and blog coverage, social media coverage, and other publicity factors that are not within

our control; and |

| · | regulatory developments and the failure to obtain any required regulatory approvals for the

use of our products or the products of our licensing partners. |

If we are unable

to successfully commercialize, including to achieve or maintain market acceptance of our technology, and if related products do not win

widespread market acceptance, our business will be significantly harmed.

Our products,

or the products of our licensing partners, could be susceptible to errors, defects, or unintended performance problems that could result

in lost revenue, liability or delayed or limited market acceptance.

Despite our quality

assurance testing, our technology may contain undetected defects or errors that may affect the proper use of our products or the products

of our licensing partners’ which incorporate them. Because our products are embedded in other end-use products and rely on stable

transmissions, the performance of our products could unintentionally jeopardize the performance of our licensing partners’ product

performance. Defects or errors in our technology may discourage existing and future partners from using our technology to develop a range

of commercial products. These defects or errors could also result in product liability, service level agreement claims or warranty claims.

Any such defects, errors, or unintended performance problems in our products, and any inability to meet the expectations of our licensing

partners or retail consumers in a timely manner, could adversely impact our sales and result in loss of revenue or market share, failure

to achieve market acceptance, diversion of development resources, injury to our reputation, increased insurance costs and increased service

costs, any of which could materially harm our business.

As products

incorporating our technology are launched commercially, we may experience seasonality or other unevenness in our financial results in

consumer markets or a long and variable sales cycle in enterprise markets.

Our strategy

depends on our customers developing successful commercial products using our technology and selling them into the retail, industrial,

healthcare and smart/home office markets. We need to understand procurement and buying cycles to be successful in licensing our technology.

We anticipate it is possible that demand for our technology may vary in different segments of the consumer electronics market, such as

hearing aids, wearables, toys, watches, accessories, laptops, tablet, mobile phones and gaming systems. Such consumer markets are often

seasonal, with peaks in and around the December holiday season and the August-September back-to-school season. Enterprises and

commercial customers may have annual or other budgeting and buying cycles that could affect us, and, particularly if we are designated

as a capital improvement project, we may have a long or unpredictable sales cycle.

Future

products based on our technology may require the user to purchase additional products to use with existing devices. To the extent these

additional purchases are inconvenient or costly, the adoption of our technology under development or other future products could be slowed,

which would harm our business.

For rechargeable

devices that utilize our receiver technology, the technology may be embedded in a sleeve, case or other enclosure. For example, products

such as remote controls or toys equipped with replaceable AA size or other batteries would need to be outfitted with enhanced batteries

and other hardware enabling the devices to be rechargeable by our system. In each case, an end user would be required to retrofit the

device with a receiver and may be required to upgrade the battery technology used with the device (unless, for example, compatible battery

technology and a receiver are built into the device). These additional steps and expenses may offset the convenience of our products for

users and discourage customers from licensing our technology. Such factors may inhibit adoption of our technology, which could harm our

business. We have not developed an enhanced battery for use in devices with our technology, and our ability to enable use of our technology

with devices that require an enhanced battery will depend on our ability to develop a commercial version of such a battery that could

be manufactured at a reasonable cost. If a commercially practicable enhanced battery of this nature is not developed, our business could

be harmed, and we may need to change our strategy and target markets, which could have a material adverse impact on our financial condition

and results of operations.

Laboratory

conditions differ from field conditions, which could reduce the effectiveness of our technology under development or other future products.

Failures to move from laboratory to the field effectively would harm our business.

When used in

the field, our technology may not perform as expected based on performance under controlled laboratory conditions. For example, in the

case of distance charging, a laboratory configuration of transmission obstructions will be arranged for testing, but in consumer use receivers

may be obstructed in many different and unpredictable ways. These conditions may significantly diminish the power received at the receiver

or the effective range of the transmitter. The failure of products using our technology to meet the expectations of users in the field

could harm our business.

Safety

concerns and legal action by private parties may affect our business.

We believe that

our technology is safe. However, it is possible that we could discover safety issues with our technology or that third-parties may raise

concerns relating to RF-based charging in a similar manner as has occurred with some other wireless technologies as they were put into

residential and commercial use, such as the safety concerns that were raised by some regarding the use of cellular telephones and other

devices to transmit data wirelessly in close proximity to the human body. In addition, while we believe our technology is safe, users

of our technology under development or other future products who suffer from medical ailments may blame the use of products incorporating

our technology for the triggering or worsening of those ailments, as occurred with a small number of users of cellular telephones. A discovery

of safety issues relating to our technology could have a material adverse effect on our business and any legal action against us claiming

that our technology caused harm could be expensive, divert management attention and adversely affect us or cause our business to fail,

whether or not such legal actions were ultimately successful.

Even if they

are not real, perceived safety issues could result in reduced sales, as could safety incidents or reports occurring solely with respect

to the products of our competitors or licensing partners, which could negatively impact attitudes towards our technology and similar technologies.

Any real or perceived safety issues relating to our products, our licensing partners’ products or competing technologies in the

marketplace could negatively affect our business, revenue, and profits.

Our industry

is subject to intense competition and rapid technological change, which may result in technology that is more advanced or superior to

ours. If we do not keep pace with changes in the marketplace and the direction of technological innovation and customer demands, our technology

and products may become less useful or obsolete and our operating results will suffer.

The consumer

electronics industry in general, and the charging segments in particular, are subject to intense competition and rapidly evolving technologies,

evolving regulations and industry standards and frequent introductions of new products and services. If, among other things, our products

are not cost effective, brought to market in a timely manner, compliant with evolving industry standards, accepted in the market or recognized

as meeting our licensing partners’ or retail consumers’ requirements, we could experience a material adverse effect on our

business, financial condition, results of operations and cash flows.

In addition,

because products incorporating our technology are expected to have long development cycles, we must anticipate changes in the marketplace

and the direction of technological innovation and customer demands. To compete successfully, we will need to demonstrate the advantages

of our products and technologies over established alternatives and other emerging methods of power delivery. Traditional wall plug-in

recharging remains an inexpensive alternative to our technology. Directly competing technologies such as inductive charging, magnetic

resonance charging, conductive charging, ultrasound and other yet unidentified solutions may have greater consumer acceptance than the

technology we have developed. Furthermore, some competitors may have greater resources than we have and may be better established in the

market than we are. We cannot be certain which other companies may have already decided to or may in the future choose to enter our markets.

For example, consumer electronics products companies may invest substantial resources in wireless power or other recharging technologies

and may decide to enter our target markets. Successful developments of competitors that result in new approaches for recharging could

reduce the attractiveness of our products and technologies or render them obsolete.

Our future success

will depend in large part on our ability to establish and maintain a competitive position in current and future technologies. Rapid technological

development may render our technology or future products based on our technology obsolete. Many of our competitors have more corporate,

financial, operational, sales and marketing resources than we have, as well as more experience in research and development. We cannot

assure you that our competitors will not develop or market technologies that are more effective, economical or commercially attractive

than our products or that would render our technologies and products obsolete. In addition, we may not have the financial resources, technical

expertise, marketing, distribution or support capabilities to compete successfully in the future.

Our competitive

position also depends on our ability to:

| · | generate widespread awareness, acceptance and adoption by the consumer and enterprise markets

of our technology under development and future products; |

| · | design a product that may be sold at an acceptable price point; |

| · | develop new or enhanced technologies or features that improve the convenience, efficiency, safety

or perceived safety, and productivity of our technology under development and future products; |

| · | properly identify existing and evolving customer needs and deliver new products or product enhancements

to address those needs; |

| · | limit the time required from proof of feasibility to routine production; |

| · | limit the timing and cost of regulatory approvals; |

| · | adapt to evolving regulatory requirements; |

| · | attract and retain qualified personnel; |

| · | protect our inventions with patents or otherwise develop proprietary products and processes;

and |

| · | secure sufficient capital resources to expand both our continued research and development, and

sales and marketing efforts. |

If our technology

does not compete well based on these or other factors, our business could be materially and adversely harmed.

If the

quality of our products does not meet the expectations of our licensing partners or the end users of our licensing partners’ products

or regulatory or industry standards, then our sales and operating earnings, and ultimately our reputation, could be negatively impacted.

Some of the products

we sell, and some of the products our licensing partners sell which integrate our products, may have quality issues resulting from the

design or manufacture of our products, or from the software, hardware or components used in those products. Sometimes, these issues may

be caused by components we purchase from our suppliers. Any such issues identified prior to the shipment of the products may cause delays

in shipping products to customers, or even the cancellation of orders by customers. If quality issues are discovered in our products after

they have been shipped to our customers, we would be required to resolve such issues in a timely manner that is the least disruptive to

our customers. Such pre-shipment and post-shipment quality issues can have legal, financial and reputational ramifications, including:

(i) delays in the recognition of revenue, loss of revenue or future orders, (ii) customer-imposed penalties for failure to meet

contractual requirements, (iii) increased costs associated with repairing or replacing products, and (iv) a negative impact

on our reputation.

In some cases,

if the quality issue affects the product's performance, safety or regulatory compliance, then such a “defective” product may

need to be “stop-shipped” or recalled. Depending on the nature of the quality issue and the number of products in the field,

it could cause us to incur substantial recall or corrective field action costs, in addition to the costs associated with the potential

loss of future orders and the damage to our reputation. In addition, we may be required, under certain customer contracts, to pay damages

for failed performance that might exceed the revenue that we receive from the contracts. Recalls and field actions involving regulatory

non-compliance could also result in fines and additional costs. Recalls and field actions could result in third-party litigation by persons

or companies alleging harm or economic damage as a result of the use of the products. In addition, privacy advocacy groups and other technology

and industry groups have established or may establish various new or different self-regulatory standards that may place additional obligations

on us. Our customers may expect us to meet voluntary certifications or adhere to other standards established by third-parties. If we are

unable to maintain these certifications or meet these standards, it could reduce demand for our products and adversely affect our business.

If our

products do not effectively interoperate with wireless networks and the wireless devices that integrate them, future sales of our products

could be negatively affected.

Our products

are designed to interoperate with wireless networks using Wi-Fi technology and certain wireless devices produced by our licensing partners.

These networks and devices have varied and complex specifications. As a result, we must ensure that our products interoperate effectively

with these existing and planned networks and devices. To meet these requirements, we must continue development and testing efforts that

require significant capital and employee resources. We may not accomplish these development efforts quickly or cost-effectively, or at

all. If our products do not interoperate effectively, orders for our products could be delayed or cancelled, which would harm our revenue,

operating results and reputation, potentially resulting in the loss of existing and potential licensing partners. The failure of our products

to interoperate effectively with wireless devices may result in significant warranty, support and repair costs, divert the attention of

our engineering personnel from our product development efforts and cause significant customer relations problems. In addition, our licensing

partners may require our products to comply with new and rapidly evolving security or other certifications and standards. If our products

are late in achieving or fail to achieve compliance with these certifications and standards, or our competitors first achieve compliance

with these certifications and standards, such end customers may not purchase our products, which would harm our business, operating results,

financial condition and cash flows.

We require

third-party components, including components from limited or sole source suppliers, to build our products. The unavailability of these

components could substantially disrupt our ability to manufacture our products and fulfill sales orders.

We rely on third-party

components to build our products, and we generally rely on our third-party manufacturers to obtain the components necessary for the manufacture

of our products. We use our forecast of expected demand to determine our material requirements. Lead times for materials and components

we order vary significantly, and depend on factors such as the specific supplier, contract terms and demand for a component at a given

time. If forecasts exceed orders, we may have excess and/or obsolete inventory, which could have a material adverse effect on our business,

operating results and financial condition. If orders exceed forecasts, or available supply, we may have inadequate supplies of certain

materials and components, which could have a material adverse effect on our ability to meet customer delivery requirements and to recognize

revenue. If we underestimate our requirements or our third-party suppliers are not able to timely deliver components, our third-party

manufacturers may have inadequate materials and components required to produce our products. This could result in an interruption in the

manufacture of our products, delays in shipments and fulfillment of customer orders, and deferral or loss of revenues.

Our third-party

manufacturers may not be able to secure sufficient components at reasonable prices or of acceptable quality to build our products in a

timely manner, adversely impacting our ability to meet demand for our products. In addition, if our component suppliers cease manufacturing

needed components, we could be required to redesign our products to incorporate components from alternative sources or designs, a process

which could cause significant delays in the manufacture and delivery of our products. Unpredictable price increases for such components

may also occur. The unavailability of these components could substantially disrupt our ability to manufacture our products and fulfill

sales orders.

We currently

depend on a limited number of suppliers for several critical components for our products, and in some instances, we use sole or single

source suppliers for our components to simplify design and fulfillment logistics. Neither we nor our third-party manufacturers carry substantial

inventory of our product components. Many of these components are also widely used in other product types. Shortages are possible and

our ability to predict the availability of such components may be limited. In the event of a shortage or supply interruption from our

component suppliers, we may not be able to develop alternate or second sources in a timely manner, on commercially reasonable terms or

at all, and the development of alternate sources may be time-consuming, difficult and costly. Any resulting failure or delay in shipping

products could result in lost revenues and a material and adverse effect on our operating results. If we are unable to pass component

price increases along to our end customers or maintain stable pricing, our gross margins could be adversely affected and our business,

financial condition, results of operations and prospects could suffer.

Our dependence

on commodities and certain components subjects us to cost volatility and potential availability constraints.

Our profitability

may be materially affected by changes in the market price and availability of certain raw materials and components, some of which are

linked to the commodity markets. The principal raw materials and components used in our products are aluminum, copper, steel, bimetals,

optical fiber, plastics and other polymers, capacitors, memory devices and silicon chips. Prices for some of these materials have experienced

significant volatility as a result of changes in the levels of global demand, supply disruptions, including port, transportation and distribution

delays or interruptions, and other factors. As a result, we have seen a significant increase in costs that has negatively impacted our

results of operations. We have adjusted our prices for our products, but we may have to adjust prices again in the future. Delays in implementing

price increases or a failure to achieve market acceptance of price increases could have a material adverse impact on our results of operations.

Conversely, in an environment of falling commodities prices, we may be unable to sell higher-cost inventory before implementing price

decreases, which could have a material adverse impact on our business, financial condition and results of operations.

Our products

rely on the availability of unlicensed RF spectrum and if such spectrum were to become unavailable through overuse or licensing, the performance

of our products could suffer and our revenues from their sales could decrease.

Our products

are designed to operate in unlicensed RF spectrum, which is used by a wide range of consumer devices and is becoming increasingly crowded.

If such spectrum usage continues to increase through the proliferation of consumer electronics and products competitive with our products,

the resultant higher levels of noise in the bands of operation our products use could decrease the effectiveness of our products, which

could adversely affect our ability to sell our products, including as a result of reduced sales of our licensing partners’ products.

Our business could be further harmed if currently unlicensed RF spectrum becomes licensed in the United States or elsewhere. We and our

licensing partners that use our products in manufacturing their own may be unable to obtain licenses for RF spectrum. Even if the unlicensed

spectrum remains unlicensed, existing and new governmental regulations may require we make changes in our products. The operation of our

products in the United States or elsewhere in a manner not in compliance with local law could result in fines, operational disruption,

or harm to our reputation.

Reliance

upon a few major customers may adversely affect our revenue and operating results.

We rely on a

relatively small number of customers for a significant portion of our revenue. Our top three customers represented approximately 70% of

our revenue for the year ended December 31, 2023. It is possible that we will continue to derive a significant portion of our revenue

from a concentrated group of customers in the future. If, among other things, a major customer fails to pay us or reduces their order

volume, our revenue would be impacted and our operating results and financial condition could be materially harmed. Additionally, if we

were to lose any material customer or our customers were to consolidate or merge with other companies, we may not be able to maintain

product sales at similar volume or pricing levels and such loss or reduced sales volume or pricing could have a material adverse effect

on our business, cash flows and results of operations.

If our

licensing partners do not effectively manage inventory of their products which integrate our technology, fail to timely resell such products

or overestimate expected future demand, they may reduce purchases in future periods, causing our revenues and operating results to fluctuate

or decline.

Our licensing

partners purchase and maintain inventories of their products, which integrate our products, to meet future demand and have only limited

rights to return the products they have purchased from us. If our licensing partners purchase more product from us than is required to

meet demand in a particular period, causing their inventory levels to grow, they may delay or reduce additional future purchases, causing

our quarterly results to fluctuate and adversely impacting our ability to accurately predict future earnings.

If we are

not able to effectively forecast demand or manage our inventory, we may be required to record write-downs for excess or obsolete inventory.

We maintain inventory

of our products and, to a lesser extent, raw materials that we believe are sufficient to allow timely fulfillment of sales, subject to

the impact of supply shortages. Growth in our sales and new product launches may require us to build inventory in the future. Higher levels

of inventory expose us to a greater risk of carrying excess or obsolete inventory, which may in turn lead to write-downs. We may also

record write-downs in connection with the end-of-life for specific products. Decisions to increase or maintain higher inventory levels

are typically based upon uncertain forecasts or other assumptions. Because the markets in which we compete are volatile, competitive and

subject to rapid technology and price changes, if the assumptions on which we base these decisions turn out to be incorrect, our financial

performance could suffer and we could be required to write-off the value of excess products or components inventory. In addition, in order

to manage manufacturing lead times and help ensure adequate component supply, we enter into agreements with suppliers that allow them

to procure inventory based upon criteria as defined by us, such as forecasted demand. We may be liable to purchase excess product or aged

material from our suppliers following reasonable mitigation efforts, resulting in an adverse impact on our cash flows, operating expenses,

results of operation and financial condition.

Risks Related

to Our Intellectual Property and Other Legal Risks

It is difficult

and costly to protect our intellectual property and our proprietary technologies, and we may not be able to ensure their protection.

Our success depends

significantly on our ability to obtain, maintain and protect our proprietary rights to our technologies. Patents and other proprietary

rights provide uncertain protections, and we may be unable to protect our intellectual property. For example, we may be unsuccessful in

defending our patents and other proprietary rights against third party challenges. If we do not have the resources to defend our intellectual

property, the value of our intellectual property and our licensed technology will decline. In addition, some companies that integrate

our technology into their products may have or acquire rights in the technology that limit our business or increase our costs. If we are

not successful in protecting our intellectual property effectively, our financial results may be adversely affected and the price of our

common stock could decline.

We depend

upon a combination of patents, trade secrets, copyright and trademark laws to protect our intellectual property and technology.

We rely on a

combination of patents, trade secrets, copyright and trademark laws in the United States and similar laws in other countries, nondisclosure

agreements, noncompetition covenants and other contractual provisions and technical security measures to protect our intellectual property

rights and proprietary information. However, these protections may not be available in all jurisdictions and may be inadequate to prevent

our competitors or other third-party manufacturers from copying, reverse engineering or otherwise obtaining and using our technology,

proprietary rights or products, which would adversely affect our ability to compete in the market.

Although we are

attempting to obtain patent coverage for our technology where available and where we believe appropriate, there are aspects of the technology

for which patent coverage may never be sought or received. We may not possess the resources to or may not choose to pursue patent protection

outside the United States or any or every country other than the United States where we may eventually decide to sell our future products.

Our ability to prevent others from making or selling duplicate or similar technologies will be impaired in those countries in which we

would have no patent protection. Although we have patent applications on file in the United States and elsewhere, the patents might not

issue, might issue only with limited coverage, or might issue and be subsequently successfully challenged by others and held invalid or

unenforceable.

Similarly, even

if patents are issued based on our applications or future applications, any issued patents may not provide us with any competitive advantages.

There can be no assurance that our competitors will not independently develop technologies that are substantially equivalent or superior

to our technology or design around our proprietary rights. Competitors may be able to design around our patents or develop products that

provide outcomes comparable or superior to ours. Our patents may be held invalid or unenforceable as a result of legal challenges or claims

of prior art by third parties, and others may challenge the inventorship or ownership of our patents and pending patent applications.

In addition, if we secure protection in countries outside the United States, the laws of some foreign countries may not protect our intellectual

property rights to the same extent as do the laws of the United States. In the event a competitor infringes upon our patent or other intellectual

property rights, enforcing those rights may be difficult and time consuming. Even if successful, litigation to enforce our intellectual

property rights or to defend our patents against challenge could be expensive and time consuming and could divert our management’s

attention. We may not have sufficient resources to enforce our intellectual property rights or to defend our patents against a challenge.

Our strategy

is to deploy our technology into the market by licensing patent and other proprietary rights to third parties and customers. Disputes

with our licensees may arise regarding the scope and content of these licenses. Further, our ability to expand into additional fields

with our technologies may be restricted by existing licenses or licenses we may grant to third parties in the future.

The policies

we use to protect our trade secrets might not be effective in preventing misappropriation of our trade secrets by others. In addition,